SocialFi emerged as a promising trend, offering users control over their data and interactions. However, by late 2024, these platforms have struggled to maintain their initial momentum. Despite substantial funding and initial excitement, the once-thriving ecosystems of Farcaster, Lens, and Friend.Tech has become eerily quiet.

1. Farcaster’s Challenges

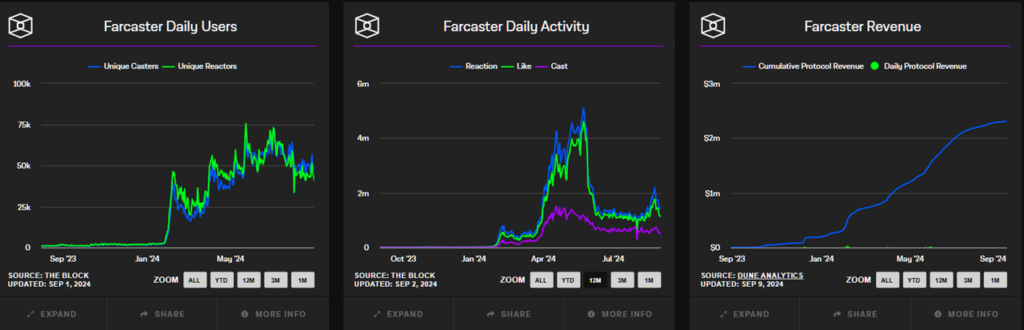

Founded in 2020 by Coinbase alumni Dan Romero and Varun Srinivasan, Farcaster was designed to prioritize censorship resistance and privacy. It raised an impressive $150 million in May 2024, valuing the company at $1 billion. However, user interest has waned significantly. Daily active users (DAUs) dropped from 104,000 in July to 60,000 by September. New user registrations plummeted from 15,000 in February to just 545 by September.

The decline in user activity is attributed to the lack of innovative user experiences. Although Farcaster offered a decentralized alternative to traditional social media, it failed to provide compelling features to draw users away from established platforms like Twitter and Facebook.

2. Lens Protocol’s Struggle

Lens Protocol also faces a similar fate. Despite an early surge in user engagement, with over 37,000 new users in February, numbers dwindled to 142 by September. DAUs fell from 42,281 in July to 8,368.

The platform’s inability to differentiate itself from traditional social media offerings is a core issue, leading to a significant drop in user retention.

3. Friend.Tech’s Rapid Decline

Friend.Tech, launched on the Base network in August 2023, initially generated substantial interest, amassing over $2 million in fees shortly after its launch. However, by September 2024, revenues had collapsed to a mere $71. The development team renounced control of its smart contract, ending future updates or takeovers.

The platform’s token, FRIEND, saw an 80% decrease in value over four months, reflecting diminished user confidence and engagement. Users initially drawn by token incentives have since lost interest, highlighting the unsustainable reliance on airdrops for growth.

4. Insights from Industry Experts

Experts point to several reasons for the decline of SocialFi platforms. Jack Inabinet, a researcher from Bankless, notes that these platforms have not provided a user experience that is both innovative and distinct from existing social media. Instead, they often replicate functionalities of Web2 platforms without significant improvements.

Jerry Lopez, CEO of Philcoin, emphasizes the need for SocialFi projects to offer something more than their traditional counterparts. Without unique features or seamless integration into users’ daily routines, platforms struggle to convert users from established giants.

5. The Broader Market Context

The downturn of SocialFi platforms is indicative of broader challenges within the crypto ecosystem. Despite substantial investments from major firms like Andreessen Horowitz and Paradigm, the rapid decline in user engagement underscores the volatile nature of investor confidence and user interest.

Platforms like Farcaster and Lens, despite their advantages in decentralization and data privacy, have not succeeded in captivating users for the long term. The complexity of blockchain-based applications and unfriendly user interfaces further hinder widespread adoption.

6. Conclusion

The current state of SocialFi reveals the critical need for innovation and user-centric design in emerging technologies. While the promise of decentralized social media remains enticing, platforms must evolve beyond mere replicas of existing services. They must address user experience issues and offer compelling reasons for users to leave traditional social networks.

The Struggle of Farcaster, Lens, and Friend.Tech serves as a cautionary tale for future SocialFi projects. To succeed, they must provide seamless, innovative experiences that integrate effortlessly into users’ lives, ensuring they offer more than just decentralization. Only then can they hope to regain traction and fulfill the promise of a truly decentralized social experience.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.