Donald Trump’s return to the presidency has already sent shockwaves through markets, with U.S. stocks and Bitcoin surging after his election victory. As the “Trump trade” takes center stage, his policy mix of tariffs, tax cuts, and deregulation is poised to reshape the global investment landscape.

Are these market moves just another boom-bust cycle—or is the U.S.’s first crypto-friendly president paving the way for a new digital asset revolution? Dive into our latest research to uncover how investors position themselves for the Trump era.

1. Full-Blown Bull Market: Must-See Charts when Trump Wins

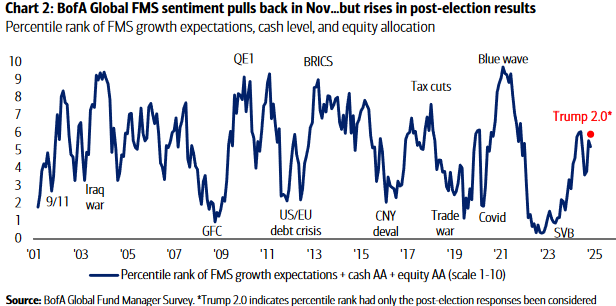

- Post-election, fund managers have turned more bullish, anticipating that tax cuts and deregulation under Trump’s leadership will drive economic growth and corporate profits.

- The S&P 500 surged to new highs following the 2024 election, fueled by the Republican Party’s tax-cut promises. Exposure to U.S. equities reached its highest level since 2013, with the percentage of fund managers overweighting U.S. stocks nearly tripling to 29%, driven by optimism for stronger economic growth.

- There’s strong momentum for the Nasdaq to outperform, but expectations point to the Russell 2000 (small-cap stocks) leading gains through 2025. Retail enthusiasm is growing as stocks enter their strongest seasonal period.

- Small-caps and cyclical stocks have further upside potential, supported by Trump’s protectionist policies. 35% of investors predict small caps will outperform large caps, marking the most bullish outlook for small caps since February 2021.

- A net 23% of investors now expect global growth to strengthen over the next year, up from just 10% in the previous survey.

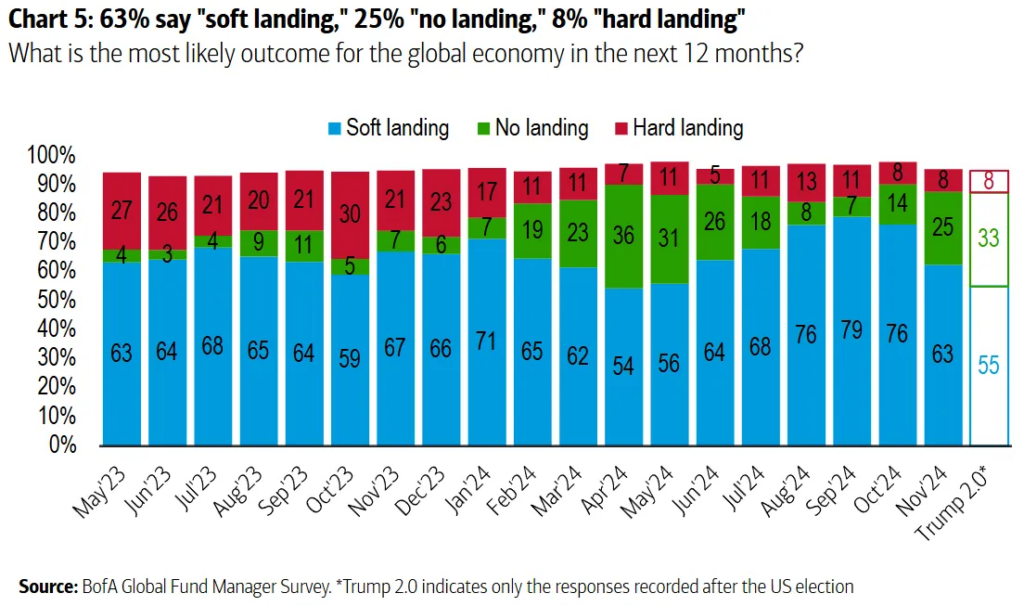

- The share of investors expecting a “soft landing” has dropped to 55%, while the “hard landing” probability remains steady at 8%, signaling positive sentiment. Notably, the “no landing” scenario has surged to its highest level since May 2024.

- Inflation is becoming a top concern, with 32% of investors citing it as their biggest worry (up from 26% in October). This reflects concerns over global central bank easing and potential fiscal stimulus, which could reignite inflation, alongside ongoing geopolitical risks (21% of investors view it as a key risk).

- Nvidia is now seen as the biggest market event in the coming month.

- The “Long Magnificent 7” tech stocks remain the most crowded trade (50% of investors), followed by gold and the U.S. dollar.

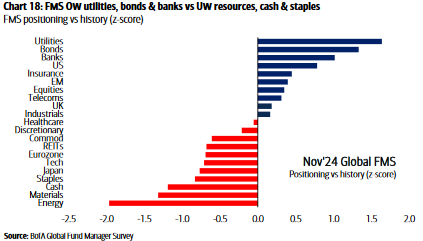

- Investors are rotating out of energy, Japanese equities, consumer discretionary, and telecoms while increasing allocations to banks, cash, and emerging markets (EM), as fiscal and monetary policies are expected to become more supportive in response to Trump’s tariff policies.

- Investors are overweight in utilities, banks, bonds, and U.S. stocks, while underweight in resources, cash, and staples.

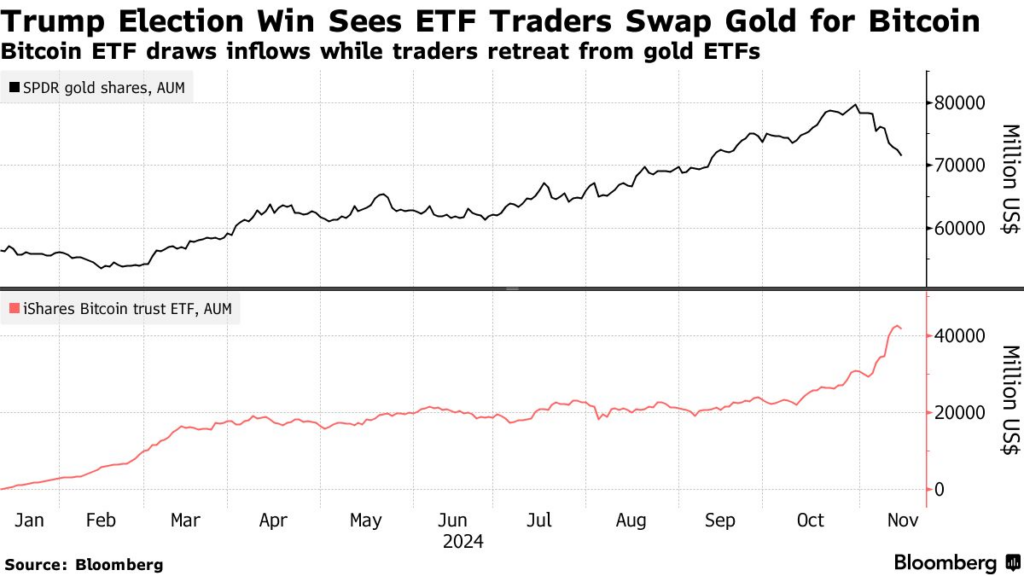

- Gold prices fell after Trump’s victory, as the reduction in U.S. political uncertainty diminished haven demand. This triggered a shift from gold to Bitcoin, fueled by expectations of crypto-friendly policies from the incoming administration.

2. Closing Thoughts

- With Trump’s election and Republican control of Congress, we maintain an underweight position in U.S. Treasuries, anticipating fiscal stimulus and tax cuts to drive economic growth.

- We expect improving financial conditions outside the U.S. in the coming year, making international stocks a key focus for investors as monetary and fiscal policies shift to counter Trump’s tariff strategies.

- Gold and cryptocurrencies remain top hedges against inflation, providing a secure store of value amidst ongoing economic uncertainty.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.