1. Executive Summary

Token Overview

- Ticker: $HYPE

- Current Price: $16,64

- Market Cap: $5.4B

- FDV: $16.3B

- Sector: L1 & Perp Dex

TLDR;

Strong Revenue Growth & Real Profit: Hyperliquid achieves over $12.8M USD in weekly revenue, surpassing even Ethereum. With $63M USD in accumulated revenue in 2024, it’s become one of the most profitable DeFi PERP projects.

Fair Tokenomics, No VC Dump Pressure: 70.2% of $HYPER is allocated to the community, free from major investment fund control, ensuring fair distribution.

Concentrated Liquidity on Hyperliquid → Retains All Trading Fees & Increases Native Demand: By concentrating liquidity, Hyperliquid keeps all trading fees within the platform, driving organic demand.

Sustainable Ecosystem & Deep Liquidity: Robust matching engine technology provides a smooth trading experience akin to CEXs. Liquidity advantage: Market makers from the team that operated Chameleon Trading ensure deep liquidity.

First-Mover Advantage in DeFi Derivatives: Hyperliquid directly competes with dYdX and GMX, but offers a superior user experience and isn’t reliant on Layer 2 solutions. Its hybrid CEX/DEX model attracts both traditional and crypto-native traders.

2. Due Diligence Summary

2.1. Overview

Hyperliquid: A Specialized Layer 1 Blockchain

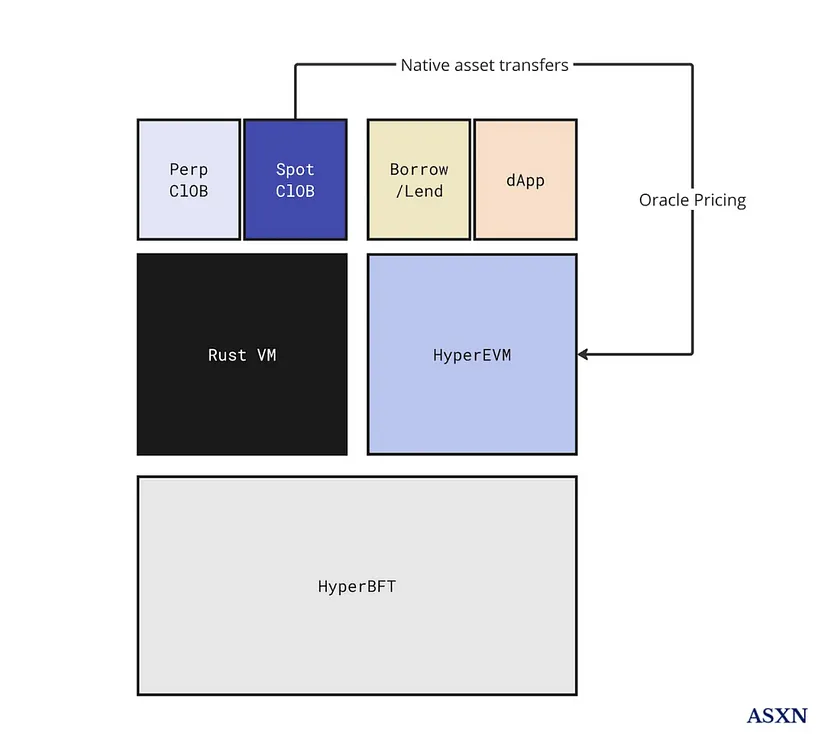

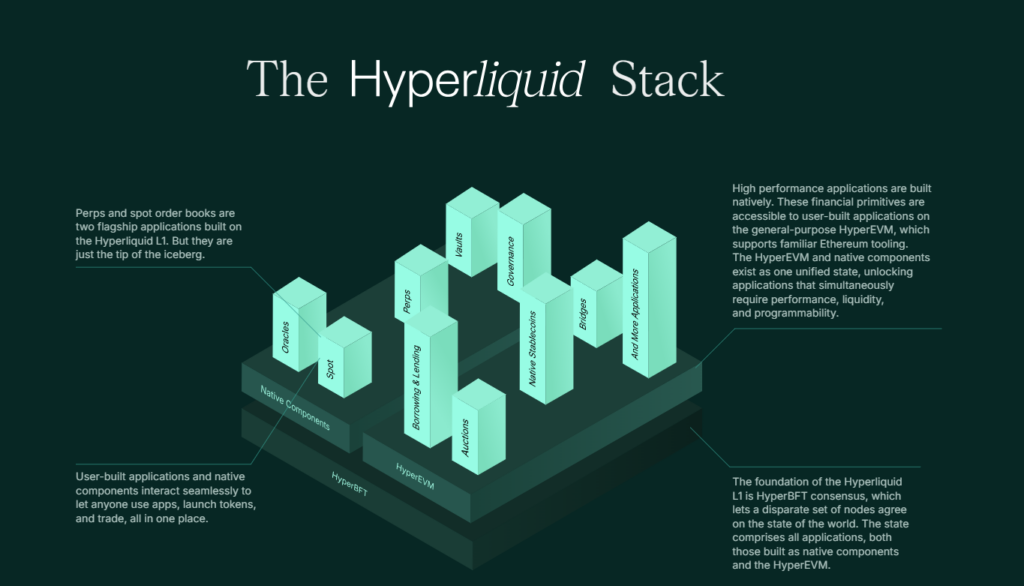

Hyperliquid is a Layer 1 blockchain specifically designed to support on-chain financial applications. It utilizes a custom HyperBFT consensus mechanism to achieve sub-second block times.

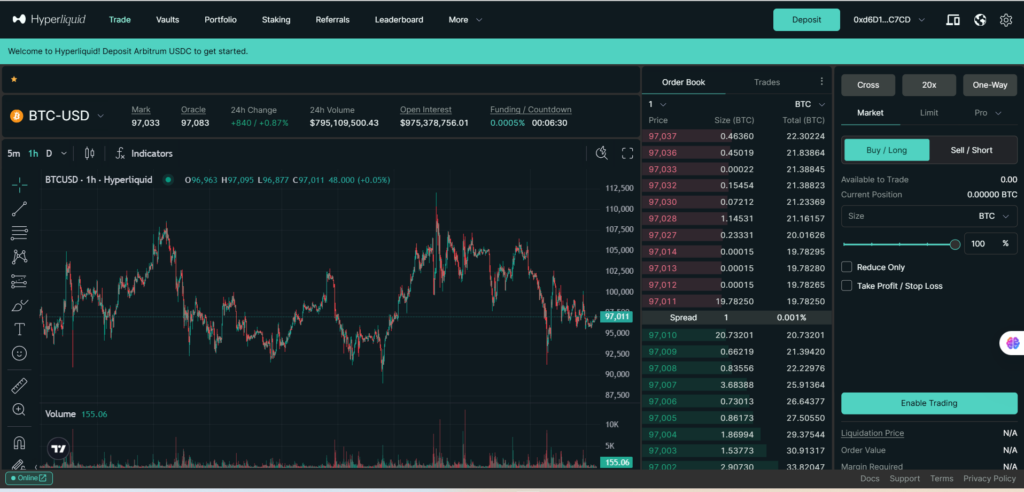

Core Application: Hyperliquid PERP DEX

The primary application on Hyperliquid L1 is the Hyperliquid PERP DEX, a decentralized perpetual exchange offering up to 50x leverage. The platform employs a centralized exchange (CEX)-like order book but operates fully on-chain, ensuring all transactions are transparently verifiable and trackable by users.

User-Friendly Interface & Advanced Order Types

Hyperliquid’s interface mirrors that of traditional CEXs, facilitating easy onboarding and use for traders. It supports a wide range of order types, including Market, Limit, Stop Market, Stop Limit, Scale, and TWAP, catering to diverse user needs.

2.2. Team

Jeff Yan (Co-Founder): Graduated from Harvard University with a degree in Computer Science and Mathematics.

- Hudson River Trading: After graduation, Jeff began his career at Hudson River Trading, a leading high-frequency trading firm in traditional finance, specializing in U.S. equities.

- Chameleon Trading: In 2018, Jeff transitioned to the cryptocurrency space and founded Chameleon Trading, a prominent market-making firm in the crypto industry.

- Hyperliquid: Jeff and his team developed Hyperliquid.

While the core team maintains anonymity, Jeff Yan’s public presence as a co-founder significantly enhances the project’s credibility within the community.

Jeff Yan’s demonstrated expertise in technology, finance, and algorithmic trading, combined with his invaluable experience in market making, provides a significant advantage and fosters an innovative business model for Hyperliquid.

2.3. Business Model – Product

Hyperliquid Blockchain

Hyperchain is a Layer 1 blockchain built on Cosmos, specifically engineered to optimize performance for a dedicated derivatives DEX, rather than supporting general-purpose smart contracts. It boasts a high throughput of up to 100,000 transactions per second (TPS).

EVM Compatibility & Cross-Chain Liquidity

Hyperchain is designed with EVM compatibility, facilitating access to a broader user base and liquidity from various sources. Currently, it supports Arbitrum, with plans to expand compatibility to more chains.

Focus on Transparency & Decentralization

The project prioritizes transparency and decentralization, aiming to address the issues prevalent in many derivatives DEXs that utilize off-chain order books, which can lead to manipulation and a lack of transparency for users.

Hyperliquid Perp DEX

The Perpetual DEX is Hyperliquid Labs’ flagship product, featuring an interface and functionality that closely mirrors those of a centralized exchange (CEX). This design helps users bridge the gap between Web2 and Web3.

It provides a seamless trading experience by categorizing tokens into sectors such as AI, Layer 1, DeFi, and more. Notably, the “Pre-launch” section displays tokens that are not yet listed on any CEX or DEX.

Instead of relying on external oracles, Hyperliquid’s price feed is determined by the network’s validators. This can occasionally lead to short-term price discrepancies, posing a risk to users as some orders may be liquidated.

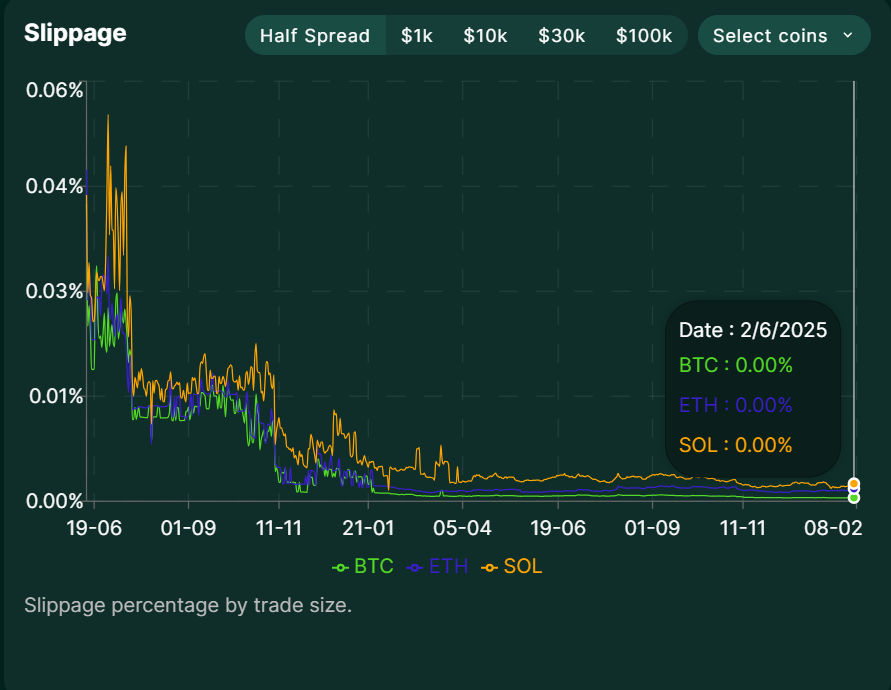

However, with slippage as low as 0.01% – 0.00% for top assets like BTC, ETH, and SOL, Hyperliquid demonstrates exceptionally deep liquidity, rivaling that of centralized exchanges (CEXs).

Fee

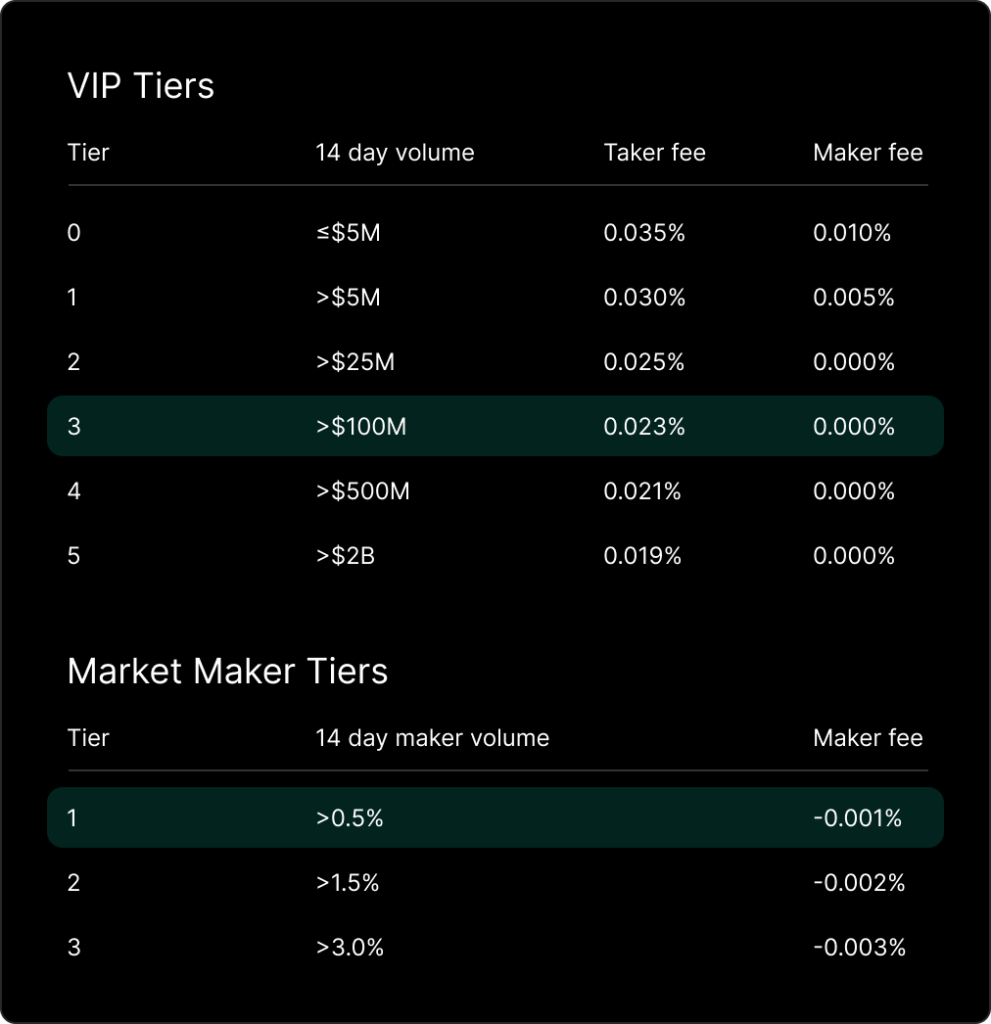

The fee structure on Hyperliquid is based on the trading volume over the past 14 days. There are two main types of trading fees:

- Taker Fee: Charged when an order is executed immediately against an existing order in the order book.

- Maker Fee: Charged when an order is placed but not immediately executed, thus providing liquidity.

Source: Hyperliquid.xyz

Specifically, for Market Makers with Tier 3 status, each successful maker order earns a 0.003% rebate on the trading volume instead of incurring a fee. (This bonus is credited directly to your trading wallet instantly.) This incentivizes major market makers like Wintermute, GSR Markets, and Jump Trading to participate.

The project has created a fair and transparent playing field for everyone by implementing a VIP Tier (user) and Market Maker Tier fee structure, offering more attractive incentives compared to other PERP DEXs to attract liquidity and trading volume to the platform.

Notably, these transaction fees do not go to the development team or investors but are redistributed to the community through the HLP and Assistance Fund (AF, which operates on-chain and can only be used with validator consensus).

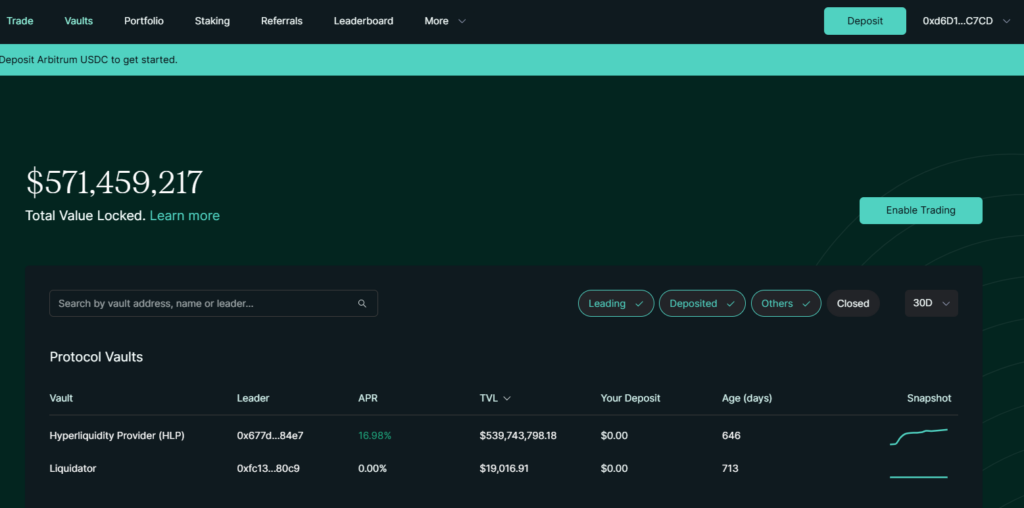

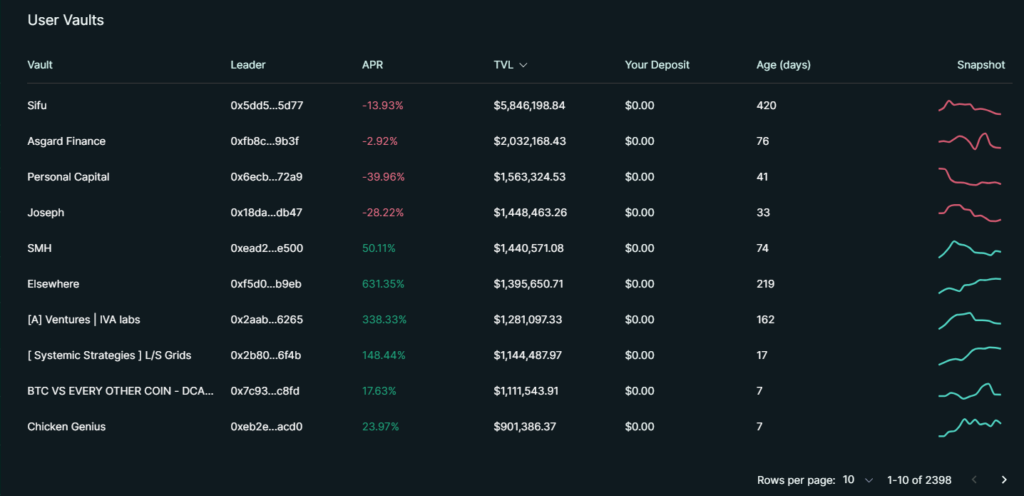

Hyperliquidity Provider (Vault)

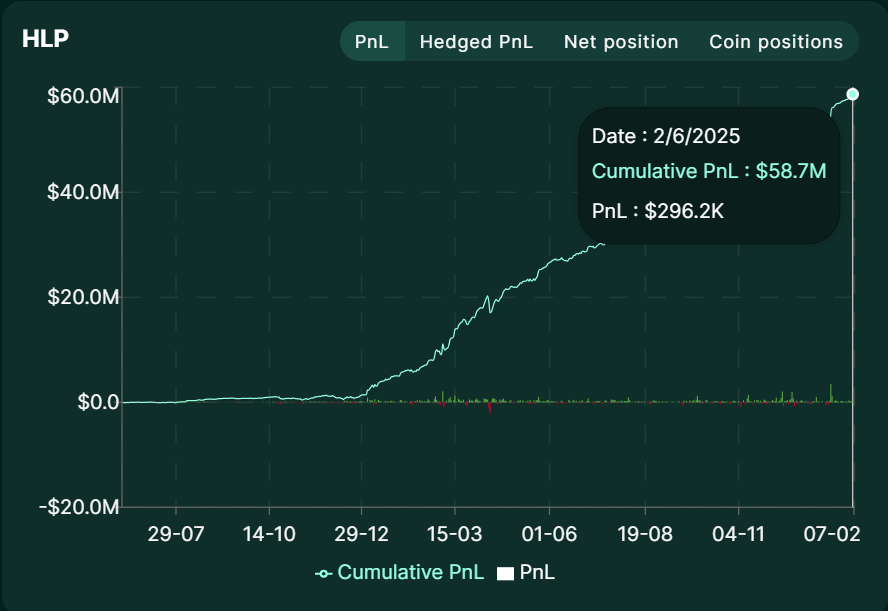

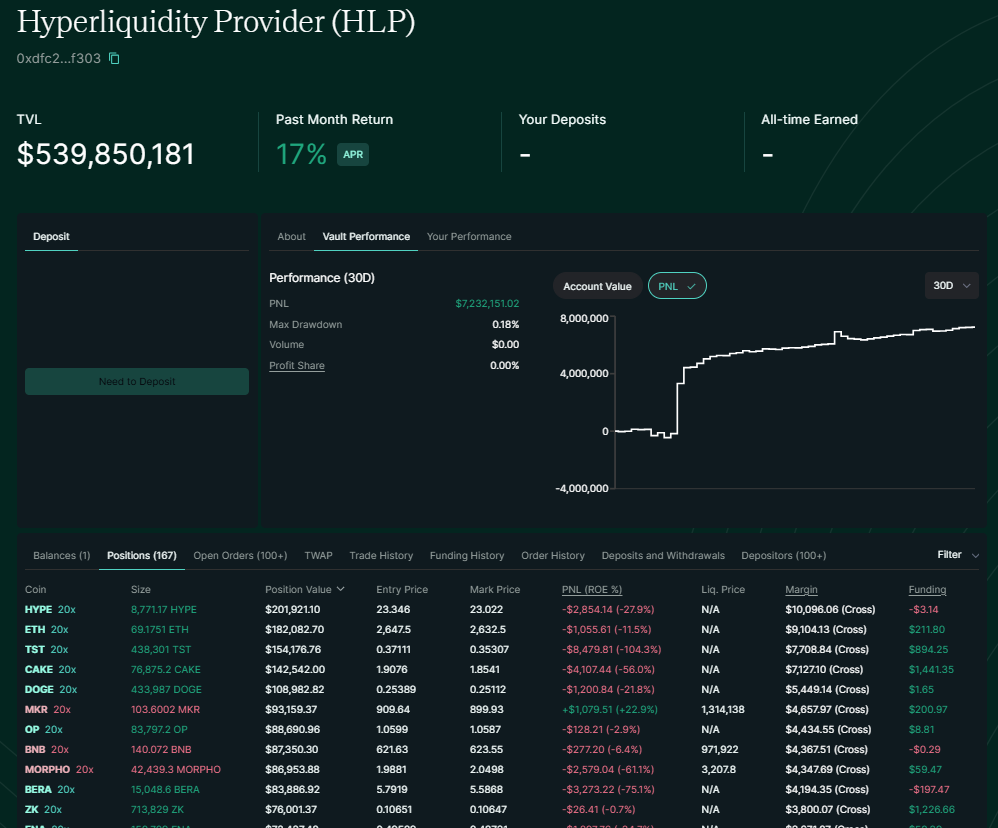

Hyperliquidity Provider (HLP) vaults are automated trading vaults on Hyperliquid. Users can deposit funds into these vaults (or create their own) to allow professional traders or algorithmic strategies to trade on their behalf. Vaults are categorized into two main structures: Protocol Vaults and User Vaults.

- Protocol Vaults: These pools are managed directly by Hyperliquid through strategies such as Arbitrage, Trend Following, and Market Making. The community can provide liquidity by depositing USDC into these vaults and sharing in Profit and Loss (PNL), potentially earning an Annual Percentage Yield (APY) of up to 17%, with no fees charged.

- User Vaults involve two key participants: Vault Leaders and Vault Depositors

- Vault Depositors: When users deposit funds into a vault, they earn profits or incur losses based on the vault’s trading performance. This allows users to invest in the strategies of skilled traders without needing to trade themselves.

- Example: User A deposits 100 USDC into a vault.

- Before the deposit, the vault held 900 USDC, bringing the total vault funds to 1,000 USDC.

- User A now owns 10% of the vault’s total value.

- After a period of successful trading, the vault’s total assets increased from 1,000 USDC to 2,000 USDC.

- User A still owns 10% of the vault, increasing their holdings from 100 USDC to 200 USDC.

Business Model Analysis

Overall, Hyperliquid’s business model is exceptionally well-structured, creating a self-sustaining ecosystem with three interconnected products, where the core revenue streams are derived from trading fees on the PERP DEX and SPOT exchange.

- Hyperchain L1 Infrastructure:

- With 100,000 TPS and no gas fees, the Hyperchain Layer 1 is optimized for the HyperPerpDEX.

- Hyper Perp DEX:

- This platform handles on-chain order books, rivaling centralized exchanges (CEXs) in performance.

- The VIP and Market Maker fee system effectively attracts traders, fosters deep liquidity, enables rapid order matching, and maintains low slippage (0-0.01%).

- Hyperliquid Provider (HLP):

- Hyperliquid has strategically positioned HLP as a key product that directly benefits the community, emphasizing decentralization and transparency to attract capital into the system.

- HLP functions as a market maker, preventing fee leakage, reducing slippage risk during large liquidations, generating user profits, and mitigating market manipulation, thereby promoting long-term sustainability.

- Assistance Fund:

- The Assistance Fund is used to support users in exceptional situations, such as unexpected liquidation events or protection against system risks.

- The fund is denominated in the $HYPE token, which prevents dilution from other entities and helps maintain the token’s price stability.

- Hyperchain L1 Infrastructure:

- With 100,000 TPS and no gas fees, the Hyperchain Layer 1 is optimized for the HyperPerpDEX.

- Hyper Perp DEX:

- This platform handles on-chain order books, rivaling centralized exchanges (CEXs) in performance.

- The VIP and Market Maker fee system effectively attracts traders, fosters deep liquidity, enables rapid order matching, and maintains low slippage (0-0.01%).

- Hyperliquid Provider (HLP):

- Hyperliquid has strategically positioned HLP as a key product that directly benefits the community, emphasizing decentralization and transparency to attract capital into the system.

- HLP functions as a market maker, preventing fee leakage, reducing slippage risk during large liquidations, generating user profits, and mitigating market manipulation, thereby promoting long-term sustainability.

- Assistance Fund:

- The Assistance Fund is used to support users in exceptional situations, such as unexpected liquidation events or protection against system risks.

- The fund is denominated in the $HYPE token, which prevents dilution from other entities and helps maintain the token’s price stability.

2.4. Competitive Landscape

2.4.1. Market Sector

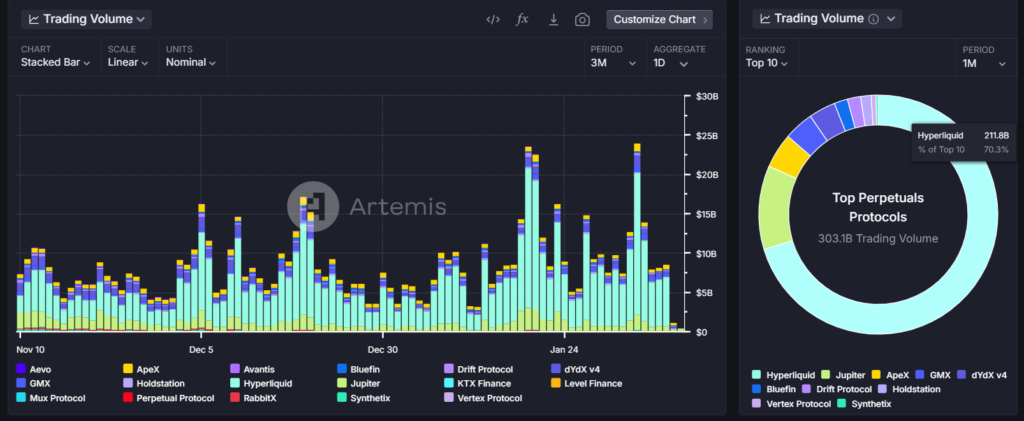

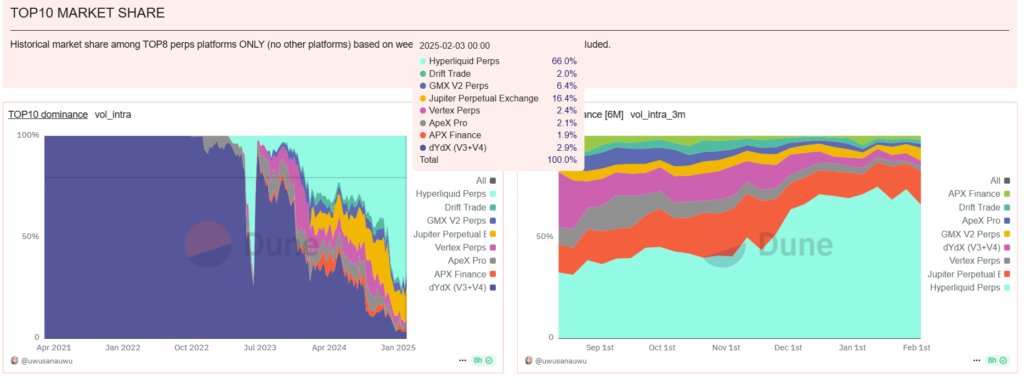

Market Dominance

- Across the entire PERP DEX sector, Hyperliquid leads in trading volume market share, holding 70.3% over the past month.

- Overall, Hyperliquid continues to maintain its top position with a 66% market share.

2.4.2. Milestone On-chain Hyper Growth

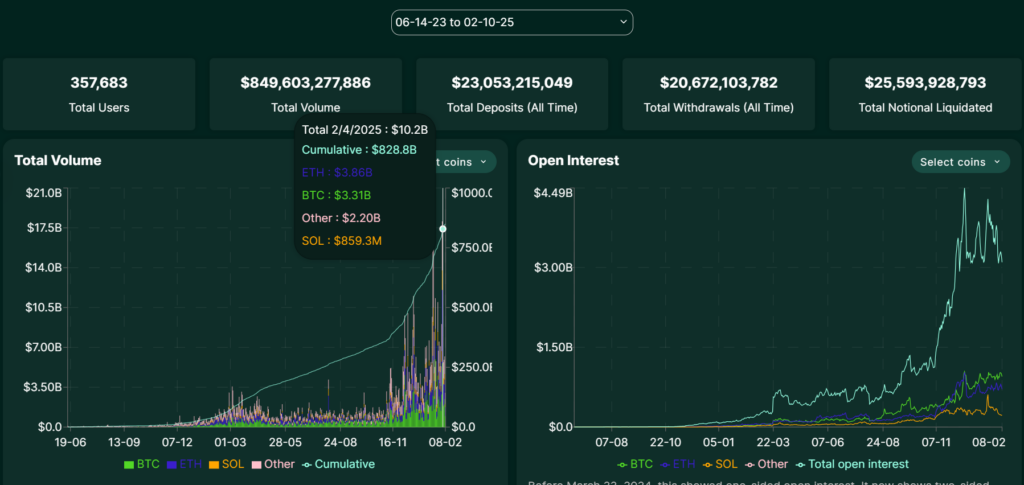

- Total Volume

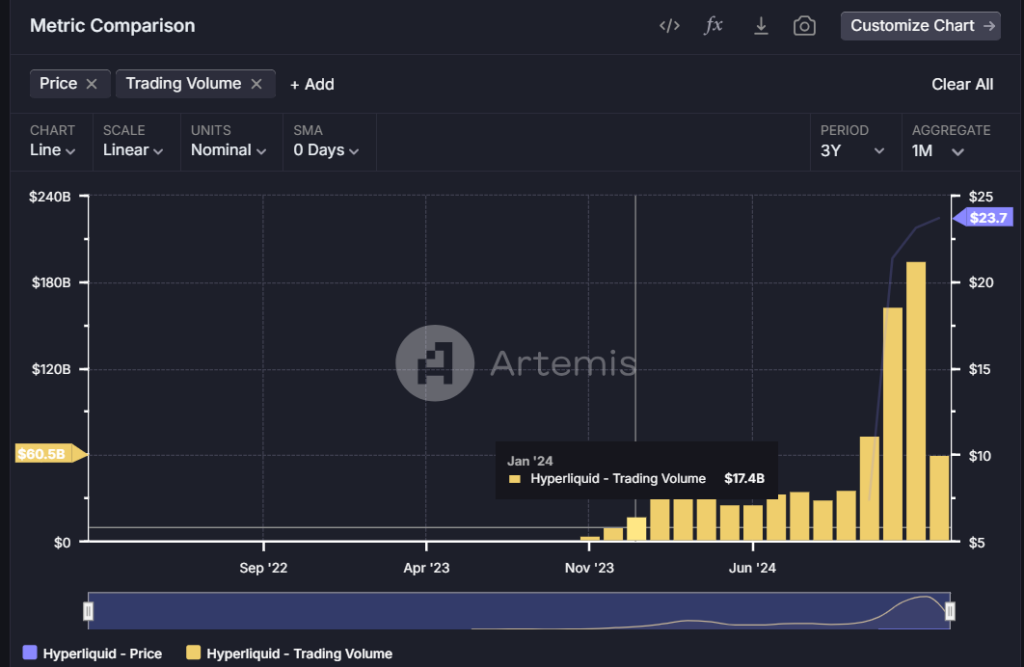

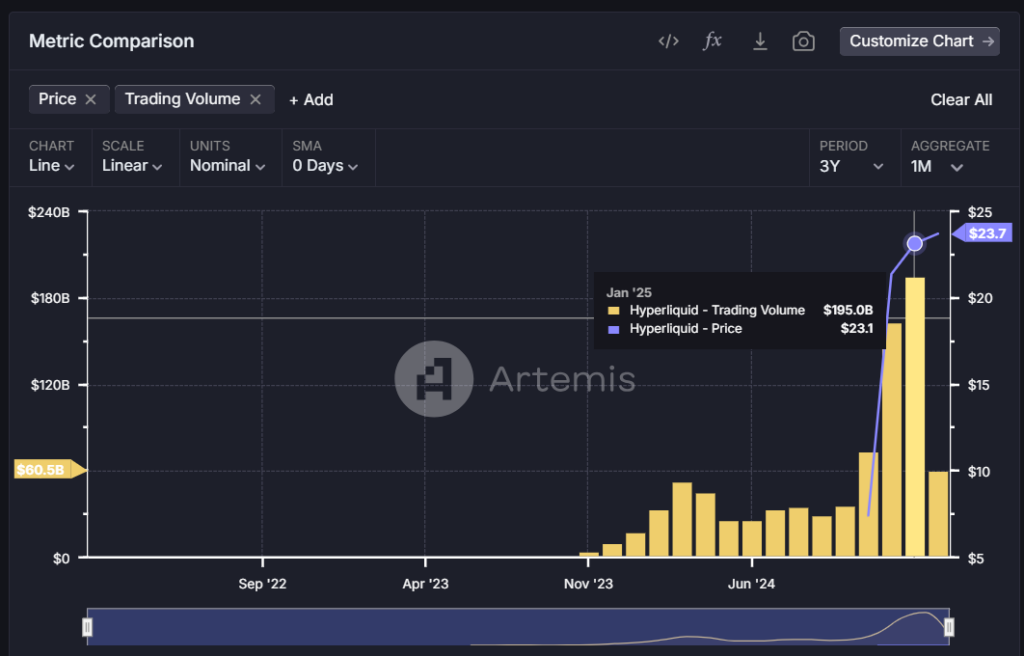

| Metrics | 01.2024 | 01.2025 | % Change |

| Trading Volume | $17B USD | $194B USD | 1.020% |

| Total Volume | $17B USD | $850B USD | 4.900% |

| Daily Volume | $4B USD | ||

With a daily trading volume reaching $4 billion USD, Hyperliquid experienced a significant increase in trading volume, rising from $17 billion USD in early January 2024 (an increase of over 1,020%) to $195 billion USD by January 2025. Following its Token Generation Event (TGE), Hyperliquid has continued to process substantial trading volumes, with $268.9 billion USD traded in the past three months. To date, the cumulative trading volume has exceeded $800 billion USD.

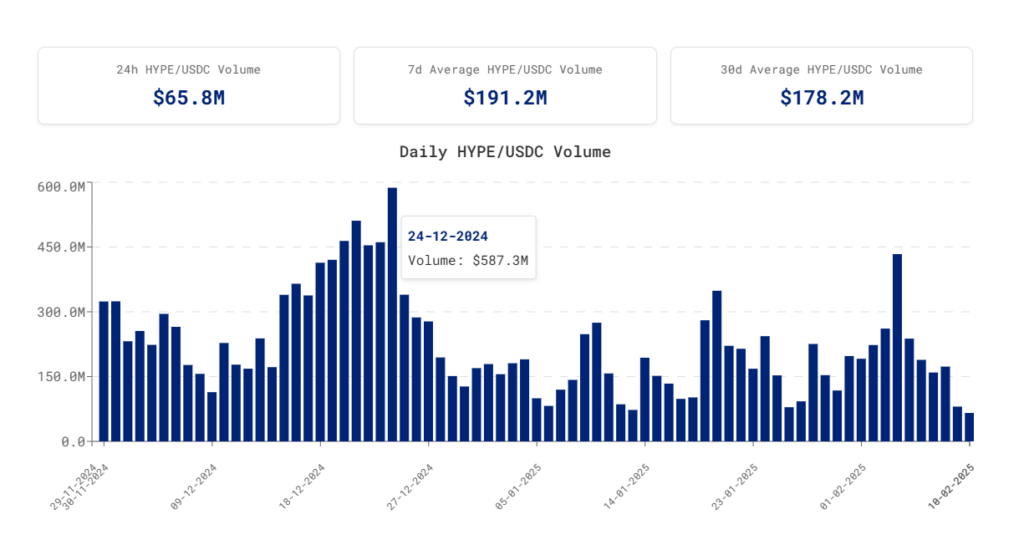

In November 2024, the $HYPER TGE and listing on its own exchange with the HYPER/USDC pair achieved an average trading volume of over $150 million USDC, at times surpassing the trading volume of SOL in December 2024. Currently, the cumulative trading volume for this pair has surpassed $10 billion USD.

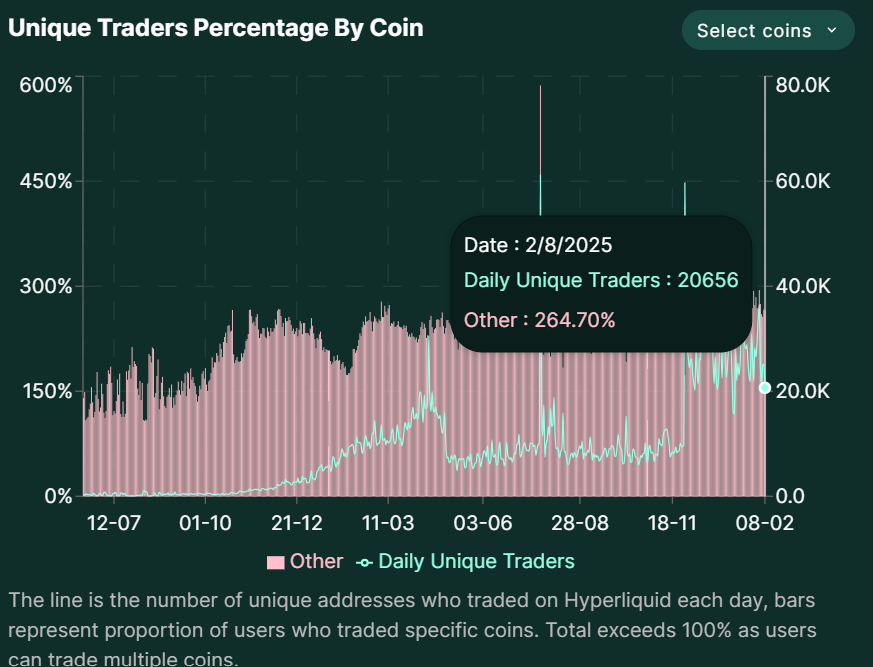

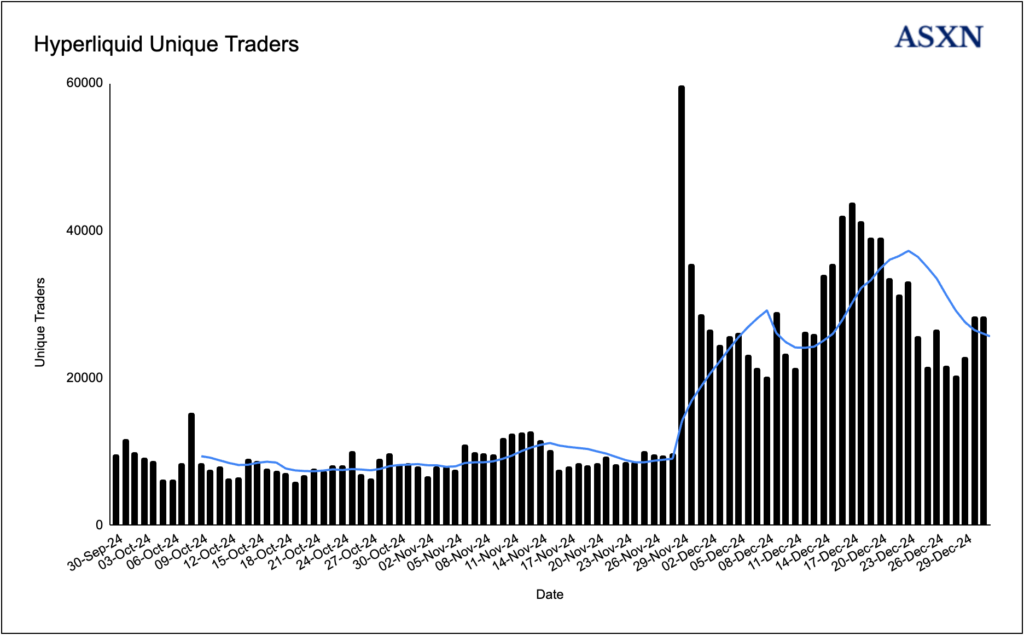

- Unique Trader

The number of unique daily traders continues to average over 20,000, peaking at 60,000 unique traders on the day of the $HYPE TGE. This is an impressive figure.

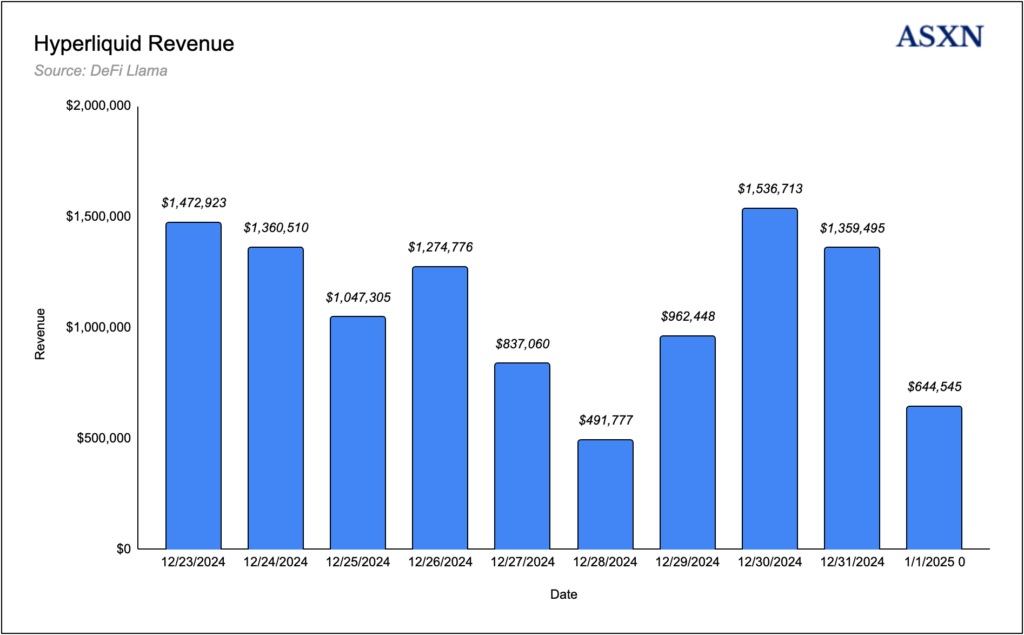

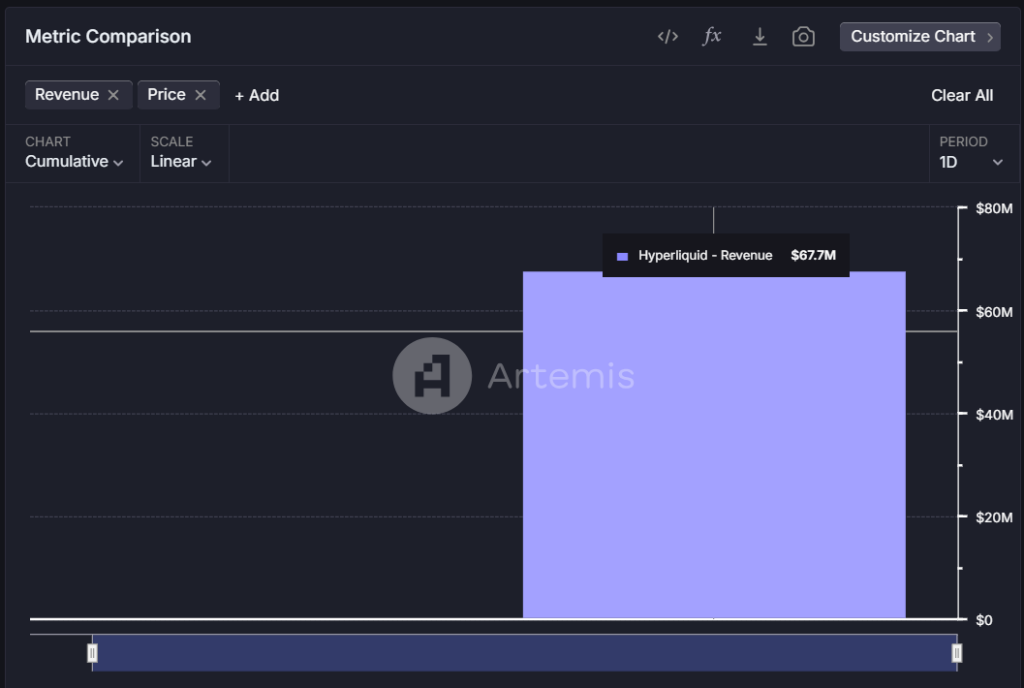

- Hyperliquid Revenue

Hyperliquid has recorded an average daily revenue of over $1.14 million USD since December 23, 2024. To date, the accumulated revenue has reached nearly $67 million USD.

If this impressive performance continues, the projected annual revenue would reach $419 million USD.

| Từ 23.12.2024 | 12.2024 | 01.2024 |

| Avg Revenue Daily | >$1M USD | |

| Revenue Monthly | $10M USD | $51M USD |

| Revenue tích lũy | $67M USD. | |

3. Tokenomics analysis

Token Info

- Total Supply: 1,000,000,000

- Circulating Supply: 333,928,180 (33%)

- Price: $16.64

- Market Cap: $5.4B

- FDV: $16.4B

Raised Fund

- Total Raised Fund: No VC funding raised.

Token Use Case

- Trading Fees: $HYPE will be used as trading fees for activities on the network.

- Governance: $HYPE holders can participate in voting on token listings on the platform.

- Network Validation: Hyperliquid uses a Proof of Stake consensus mechanism, allowing users to stake $HYPE and become validators to operate the network.

Token Allocation & Vesting

| Allocation | Lock | Vesting | |

| Reward Future | 38.888% | Reserved for future community rewards to incentivize project growth → initial release at 2.39% per year. | Fully vested in 3-5 years |

| Airdrop Genesis | 31% | TGE unlock 100% | — |

| Core Team | 23,8% | Unlocking starts after 1 year | Fully vested in 3-5 years |

| Foundation | 6% | No lock – allocated to the Hyper fund (responsible for managing Hyperliquid’s operations) | Fully vested in 3-5 years |

| Community grants | 0.3% | No lock | Fully vested in 3-5 years |

| HIP – 2 | 0.012% | No lock | — |

Analysis & Observations

Hyperliquid’s $HYPER tokenomics are designed with a total supply of 1 billion tokens. Notably, the project did not raise venture capital, allocating 70.2% of the tokens to the community, while the remaining 29.8% is held by the project’s Foundation and Team.

- Decentralization and Community Focus:

- This distribution model enhances $HYPE’s decentralization, encourages organic growth, and motivates $HYPE holders, avoiding dominance by venture capitalists.

- The Foundation and Team’s token allocation, with a vesting period of 3-5 years, is reasonably sized, mitigating concerns about potential token dumps in the future.

- Strategic Listing and Liquidity Management:

- At the TGE and listing in November 2024, 31.3% of the circulating supply came primarily from the genesis airdrop (31%), CM Grants (0.3%), and HIP-2 (0.012%).

- Hyperliquid strategically opted not to list major centralized exchanges (CEXs) like Binance, Bybit, or OKX, instead concentrating all $HYPER liquidity on its own platform. This strategic move provides several key benefits:

- Enhanced liquidity and price control.

- Retention of all trading fees within the ecosystem.

- Creation of organic demand and increased intrinsic value for $HYPER.

- Avoidance of token dump risks and volatility associated with major CEX listings.

- Building a sustainable ecosystem centered around $HYPER.

- Staking and Market Control:

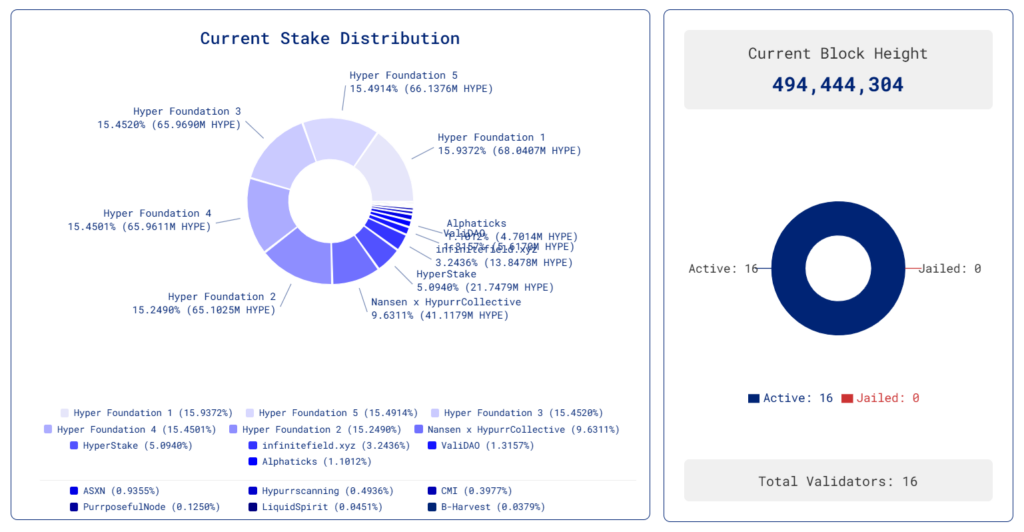

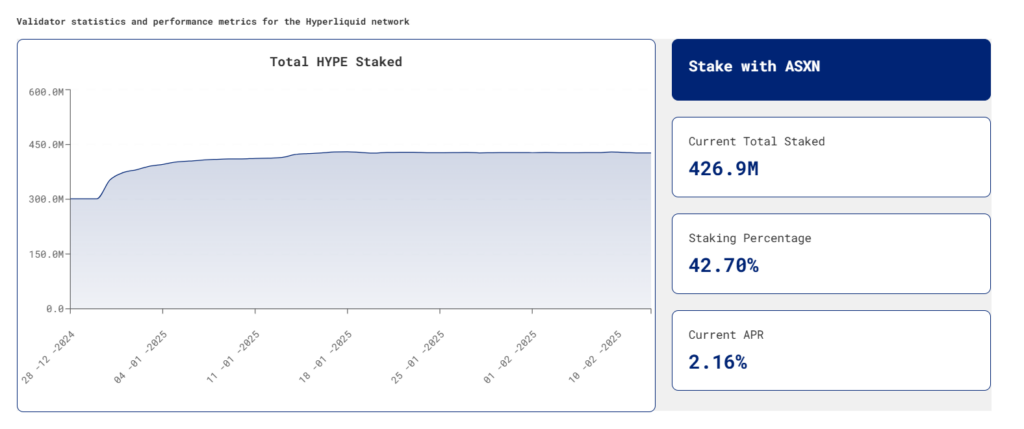

- Currently, 426 million $HYPER (42.6% of the total supply) are staked, primarily by the Foundation (6%), Core Team (23.8%), unclaimed airdrop tokens (4%), and claimed airdrop tokens (8.8%).

- Notably, the actual circulating supply on the market is 18.5%, held by the community. However, liquidity is centralized on the Hyperliquid exchange, enabling better price control compared to other top Layer 1 coins.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.