Key Takeaways

- The intellectual property industry suffers from outdated, expensive processes that result in missed monetization opportunities and financial waste for the long tail of creators.

- Blockchain technology can streamline IP registration, automate licensing and royalty distribution, and enhance transparency and security, significantly reducing costs and inefficiencies.

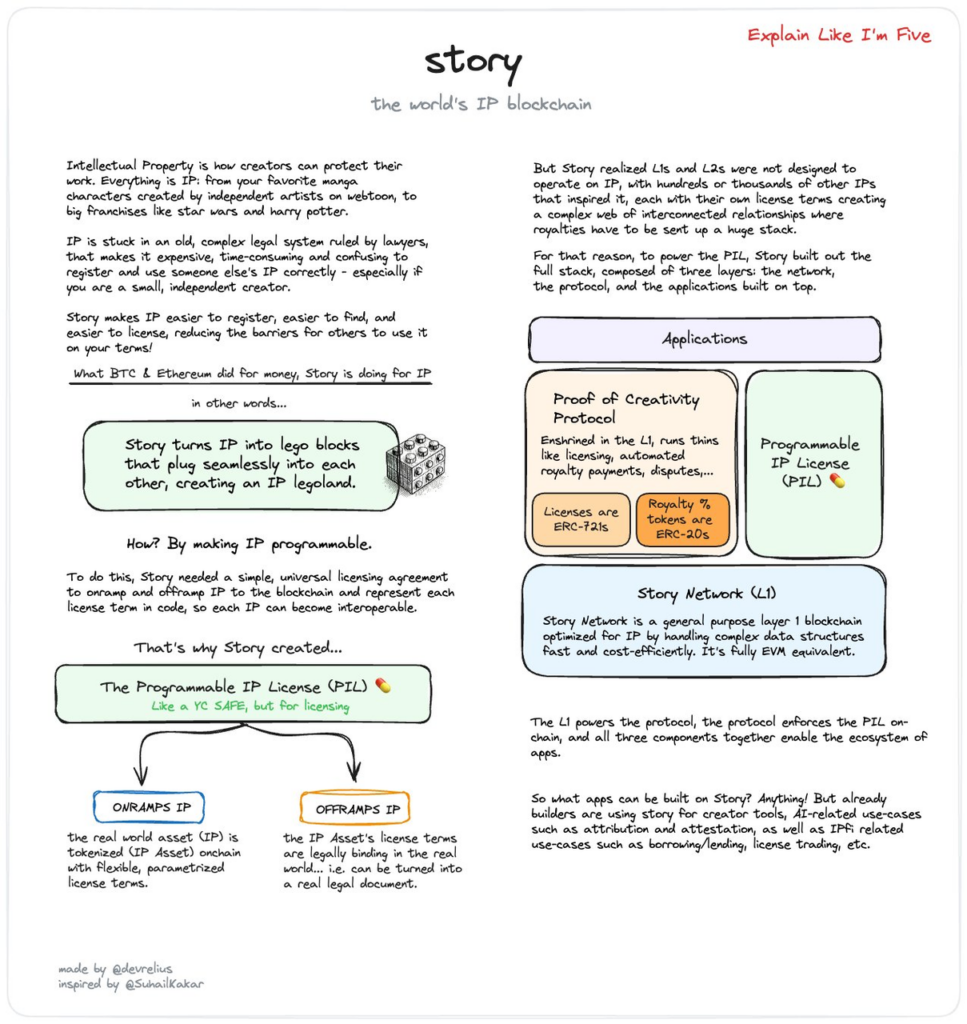

- By rearchitecting the system from the ground up, Story introduces innovations to the IP industry comparable to the advancements smart contracts have introduced to finance.

1. Introduction

In 2023, global sales from licensed merchandise and IP services reached $356.5 billion, marking a 4.6% increase from the previous year. However, this revenue is concentrated among the top 10 global licensors, who account for 52.3% ($186.5 billion) of the total.

The current IP system poses significant challenges:

- Registration: Slow and outdated processes.

- Monetization: Complex and opaque licensing, requiring costly legal negotiations.

- Arbitration: High legal fees for infringement cases.

These inefficiencies deter creators and licensees, leading to missed opportunities. Blockchain technology offers a potential solution, as highlighted by the World Intellectual Property Organization’s Blockchain Task Force. Blockchain could:

- Reduce Costs: Lower registration, licensing, and infringement expenses.

- Increase Efficiency: Automate licensing and payment through smart contracts.

- Enhance Transparency & Security: Provide a tamper-proof, global IP register.

Story Protocol aims to modernize the IP industry using blockchain to create a more efficient, programmable value chain. This report explores IP monetization, Story Protocol’s architecture, its benefits, and the project’s current status and prospects.

Understanding the IP Monetization Concept

IP takes many different shapes and sizes. It’s everything from Nike’s Swoosh and pictures of penguins to voice memos and photos on your phone. Monetizing IP typically involves either selling the IP or licensing it in exchange for royalties, one-time payments, or a combination of both.

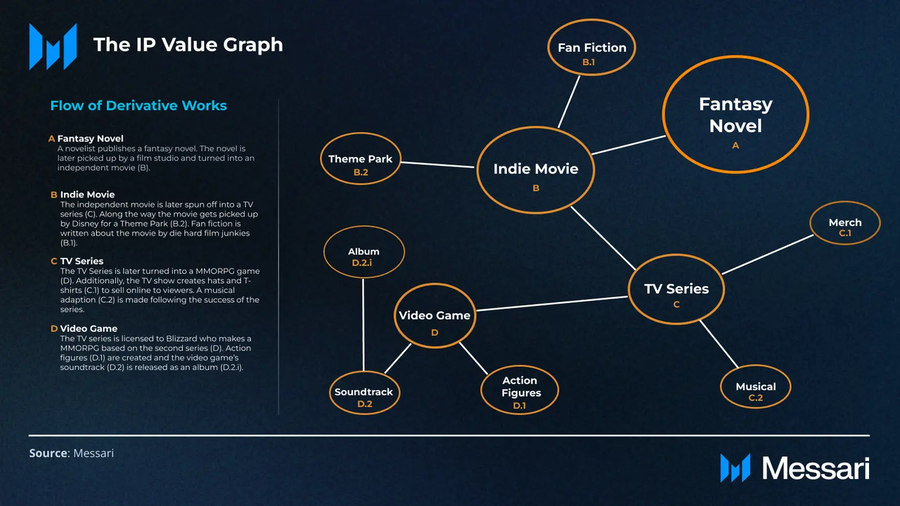

Think of the value flow of licensing as a graph data structure with potentially hundreds or thousands of derivative works that tie back to a single IP. For example, an independent author writes a fantasy novel that gains popularity and gets adapted into an indie movie. This movie then spins off into a TV series, which later becomes a video game.

At each point in that value chain, there are additional branching derivatives: merchandise from the TV series, such as action figures and apparel, fanfiction communities creating their own stories, and musical adaptations, such as soundtracks and theme music.

The complexity increases as each adaptation involves multiple parties: the indie movie involves producers, directors, and actors; the TV series involves streaming platforms, advertisers, and production companies; the video game involves designers, developers, and distributors; the merchandise involves manufacturers and retailers; and fan fiction and musical adaptations add further layers.

At each point along the way, contracts are negotiated, royalties distributed, and last but not least, lawyers paid.

It’s clear that as IP is continually remixed and new derivatives emerge, the value chain becomes increasingly intricate. Applying new blockchain primitives to manage this complexity is an opportunity.

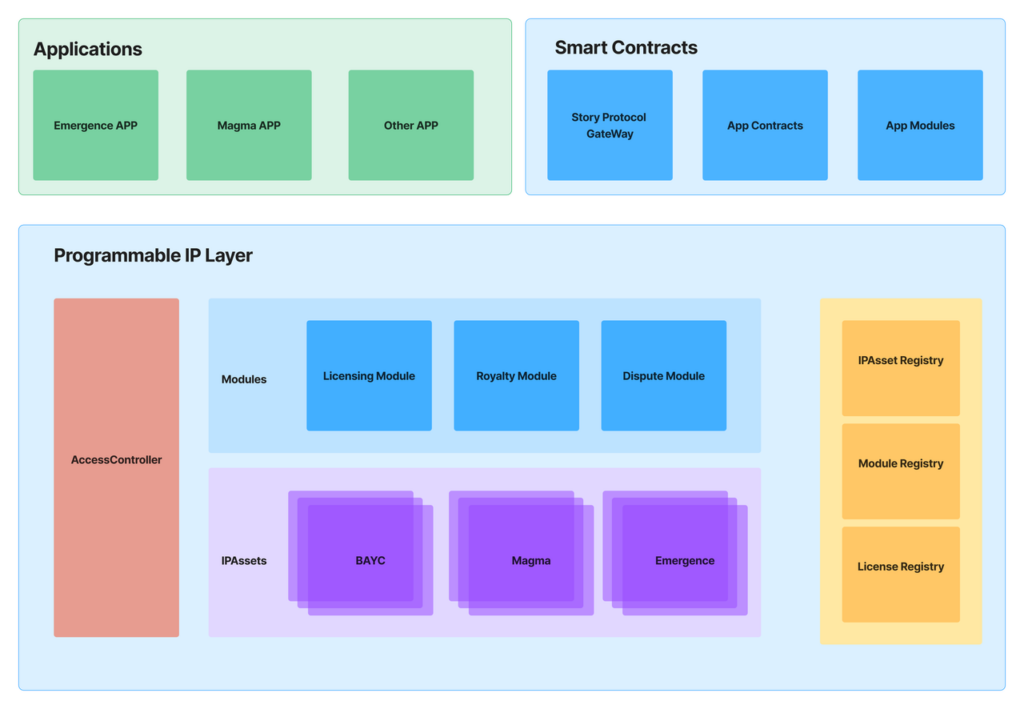

2. Story Protocol Architecture

To make IP programmable within this value flow, Story Protocol built a dual-layered architecture consisting of Story Network, a general-purpose L1, and the Proof-of-Creativity Protocol. Similarly to DeSoc protocols like Lens, applications sit on top of this stack and tap into the underlying infrastructure.

2.1. Story Network

Story Network is an EVM-compatible general-purpose L1 with execution layer optimizations to support the graph data structures present in IP.

Story Protocol optimized the L1 architecture to allow for:

- Highly efficient IP graph search written directly in the execution client to handle thousands of complex licensing and royalty flows in one transaction.

- Future validator upgrades like adding Oracle capabilities to stream off-chain payments data directly from applications running a validator.

Potential roll-up support with cross-chain communications for Web2 apps with millions of transactions requiring rollups.

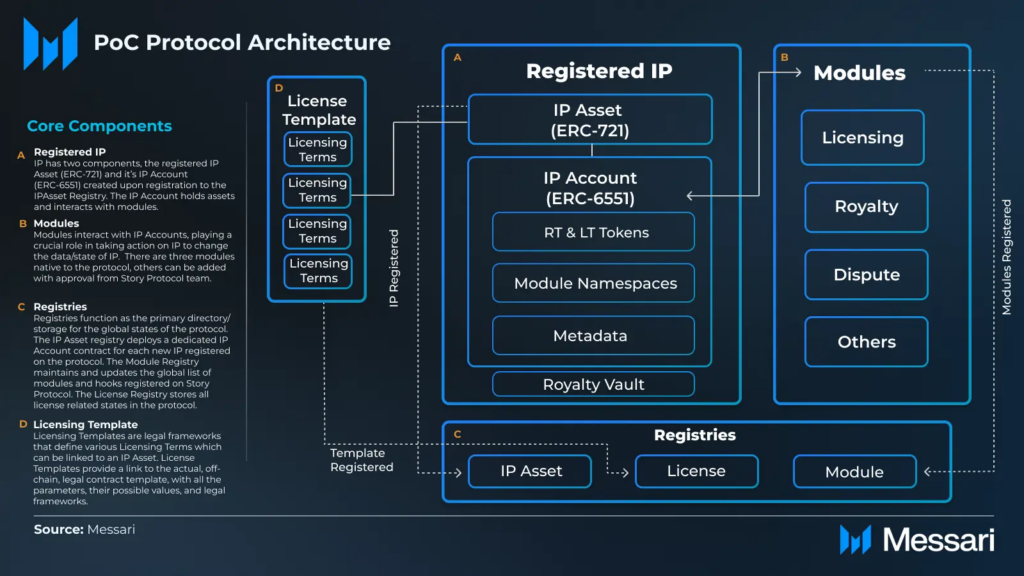

2.2. Proof-of-Creativity (PoC) Protocol

The PoC Protocol includes three main components:

- IP Assets: Each IP is represented by an ERC-721 NFT (IP Asset) and an associated ERC-6551 IP Account (Token Bound Account).

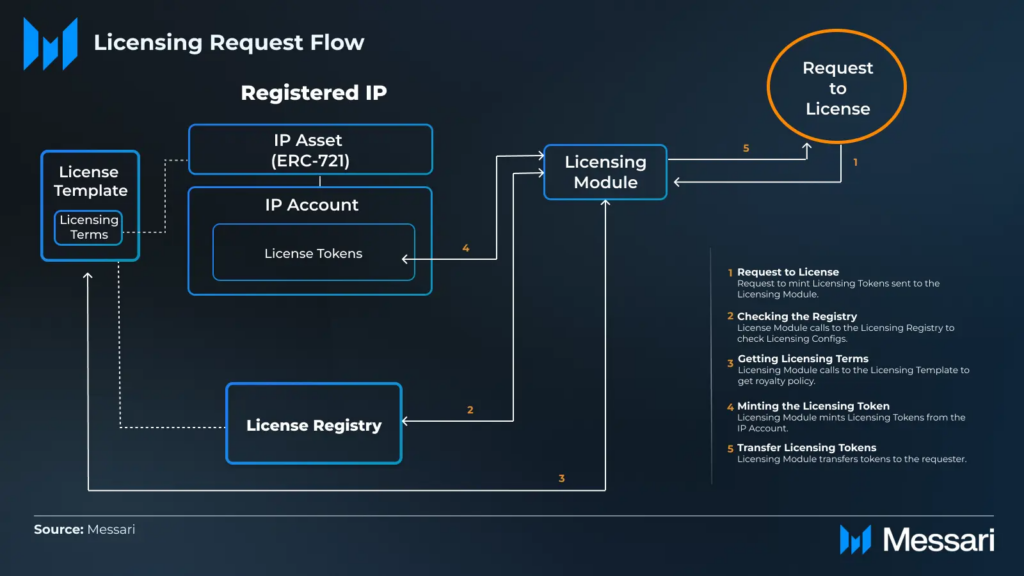

- Modules: Customizable smart contracts that interact with IP Accounts. Key native modules are for licensing, royalty management, and dispute resolution.

- Registries: Three primary registries track global states: IP Asset Registry, Module Registry, and License Registry.

Key benefits of the protocol include:

- Streamlined Registration and Licensing: Registering IP on Story Protocol logs it in the IP Asset Registry and creates an IP Account for metadata and permissions. This process, typically slow and costly, is completed quickly and for free on Story Protocol.

- Efficient Licensing and Royalty Distribution: Licensing is automated, eliminating the need for direct negotiations and expensive legal work. The Licensing Module and License Registry manage these processes seamlessly.

Licensing Templates and Programmable IP:

- Licensing Templates: These predefined frameworks allow users to configure Licensing Terms linked to Licensing Tokens in IP Accounts. The initial template, the Programmable IP License by Story Protocol, facilitates public or private token minting. Users can create and submit custom templates for approval.

- Token Usage: IP Asset owners can attach Licensing Terms, enabling anyone to mint License Tokens or create private tokens for controlled licensing. Tokens can be burned to register derivative works. The Royalty Module ensures payments are distributed according to set terms, with Revenue Tokens sent to Royalty Vaults. Holders of Royalty Tokens can claim their share of revenue.

- Programmable Arbitration: Story Protocol offers an alternative to traditional legal systems for IP disputes. The Dispute Module allows users to raise issues such as unpaid royalties or plagiarism. Initially managed by the protocol team, plans include third-party legal involvement. Disputes can lead to the tagging of assets, affecting their licensing capabilities.

Hypothetical Scenario: Azuki Licensing Success:

- Initial Licensing: An Azuki with terms for a $500 upfront fee and 10% royalties is used by a comic book writer, who pays the fee and mints a License Token to create a derivative comic. The Azuki owner earns 10% of royalties from the comic.

- Further Licensing: The comic gains success, leading a TV studio to pay $20,000 for a license. The comic book owner collects 10% of the TV studio’s royalties, which totals $100,000. The Azuki owner receives $102,000 in total from the comic and its derivatives.

- Token Resale and Collateral: The Azuki owner sells royalty tokens for $50,000. If the TV show generates $1,000,000 in revenue, the new tokenholder earns $150,000 from toy royalties and can use the tokens as collateral for a loan.

3. Growth to market Chapter 1: Ecosystem Development in Web3 – Business Model and Competitors, User acquisition

3.1. Business Model

- Innovative Revenue Model: Story Protocol leverages IP programmability and on-chain automation, offering creators and developers new monetization pathways. Smart contracts enable seamless licensing and automated revenue distribution, generating ongoing income.

- IP Financialization: The platform’s strategy of IP financialization allows IP assets to be traded, invested, and staked like traditional financial assets, enhancing application and profitability.

3.2. Competitor

- VeeFriends: VeeFriends is a community-driven project focused on intellectual property and NFTs, with an emphasis on collectibles and the application of NFTs. It has a wide community base.

- Babylons: Babylons is a multifunctional blockchain platform covering GameFi, NFTs, and multi-chain tools, particularly active in the BNB Chain and Avalanche ecosystems, providing comprehensive services for creators.

- LABEL Foundation: This platform aims to protect intellectual property in the entertainment industry using blockchain technology, mainly operating on BNB Chain and Ethereum.

- SharpShark: A timestamp solution based on Symbol, SharpShark is designed to protect creators’ intellectual property by providing infrastructure and security services.

- Seso Global: This platform uses blockchain technology to address loan security issues in emerging markets, focusing on real estate and IP management.

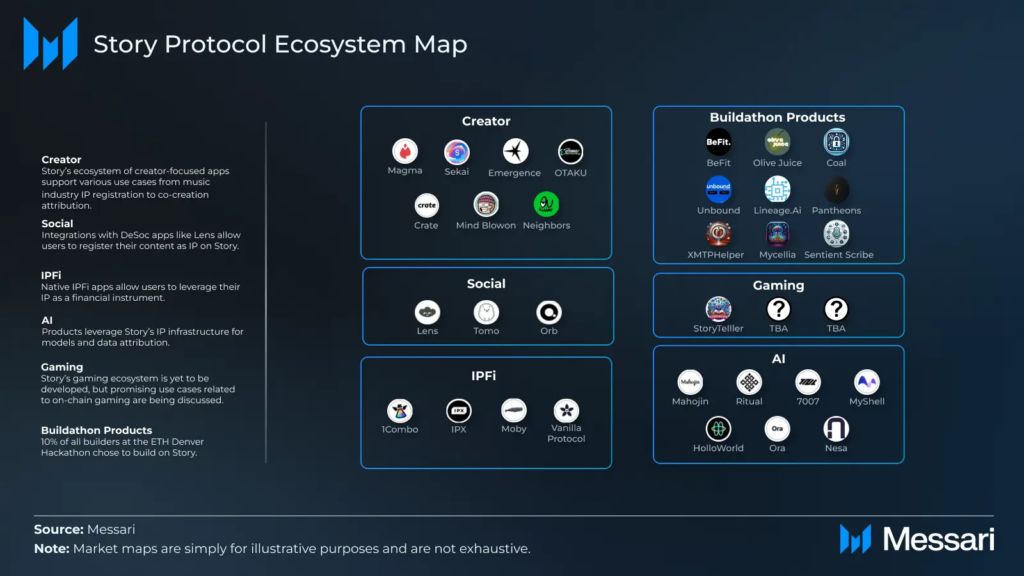

Similar to Lens’ model, Story Protocol is a developer-led protocol without a flagship product. Story’s success depends on developers and applications turning these core protocol value propositions into valuable products for end consumers. These products could range from an IPFi DEX that facilitates better price discovery for IP assets to co-creator products that allow royalties to flow seamlessly between creators worldwide.

3.3. Third-Party App Integrations

The first phase of Story Protocol’s go-to-market strategy emphasizes integrating with third-party applications and attracting early crypto-native adopters. By leveraging its SDK, Story enables projects to incorporate IP registration, licensing, and royalty collection into their existing platforms. This approach aims to attract users from established products to contribute IP to the network.

3.4. Notable Integrations

- Co-Creator: Magma is a Web2 artist collaboration platform with AI enhancements and over 2 million users. Its integration with Story Protocol allows users to register and remix work with clear attribution and provenance.

- AI: Ritual is an on-chain AI inference protocol. Its integration enables the registration of AI models as IP and links outputs as derivatives through Proof-of-Inference.

- DeSocial: Lens is a Web3 social protocol with 100,000 MAUs. Integrating with Story Protocol allows IP registration from social apps and ensures proper attribution and revenue sharing on Lens-powered platforms.

3.5. Developer Acquisition

Story Protocol employs a dual approach to attract developers: hosting competitions and running the Story Academy. These efforts guide developers to build projects that meet ecosystem priorities, such as:

- Creator and Consumer Apps: Content distribution, co-creation platforms, UGC-centric games, CMS plugins.

- IPFi: IP collateralized lending, IP offerings, IP funds/aggregators.

- AI: Model monetization, fine-tuning with creator assets, AI remixing, crowdsourcing datasets.

Some notable projects are:

- Magma: A collaborative digital art platform.

- Mahojin: An AI-generated content platform.

- Sekai: An AI-driven storytelling platform.

- Ablo: A fashion design platform using generative AI.

- BlockBook: A UGC platform for IP assets.

- Color Marketplace: An IP and NFT trading platform.

- PIPERX: An IP liquidity infrastructure.

- Unleash Protocol: An IP registration and trading platform.

- Mycelium Network: An all-in-one creative toolkit.

4. Growth to market Chapter 2: Web2 Adoption

4.1. Web2 Platform Integrations

After establishing a foundation of crypto-native developers, app integrations, and end users, Story plans to target mainstream Web2 integrations. Story Protocol’s infrastructure optimizations at the chain level support this initiative. For example, a platform like Spotify could hypothetically run its own validators, streaming data onchain from an enshrined oracle that programmatically pays out royalty revenues to creators.

Forming these partnerships is challenging, as established Web2 companies are slower to adopt innovation, especially from a nascent market like crypto. However, Story Protocol makes a compelling case by offering a more efficient architecture that reduces expenses for companies with complex royalty distribution systems.

4.2. Monetization Strategies

Story Protocol is still in an early growth phase and appears to prioritize high-growth strategies over monetization for now. Once the project shifts its focus towards monetization, a small take rate on licensing fees could capture significant value for the protocol. If Story Protocol can capture even a 0.01% share of the multi-trillion dollar licensing market, a 3% take rate on licensing fees could mean tens of millions of dollars in yearly fees for the protocol.

5. Conclusion

Story Protocol’s vision is ambitious, with the potential to radically modernize the global IP industry. Transforming antiquated systems into efficient, permissionless, and transparent ones embodies the core tenets of blockchain technology. While still in early development and facing challenges, Story Protocol could become a landmark example of blockchain implementations unlocking untapped value across global industries.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] Enhance reputation management, reducing platform lock-in (DID Adoption). […]

Comments are closed.