The geopolitical crisis in South Korea can lead to unpredictable price movements as South Korea continues to play a pivotal role in the global cryptocurrency ecosystem. In this post, we’ll dive into the aftermath of South Korea’s political crisis and how it impacted the crypto market. Is this the moment Bitcoin proves its value as a hedge against crisis? Let’s explore.

1. The Political Crisis in South Korea

- On December 3, 2024, South Korean President Yoon Suk Yeol declared martial law due to a growing political deadlock in the National Assembly, where opposition parties were blocking key fiscal policies and other essential legislation.

- The martial law declaration was a drastic step to assert control but was quickly overturned. Within hours, the National Assembly voted to revoke the decree, and President Yoon lifted it. Despite the brevity of the declaration, this incident highlighted the fragility of South Korea’s political system and created uncertainty domestically and internationally.

2. Market reaction to uncertainty

2.1. Korean Stock Market and the Won Depreciate Sharply

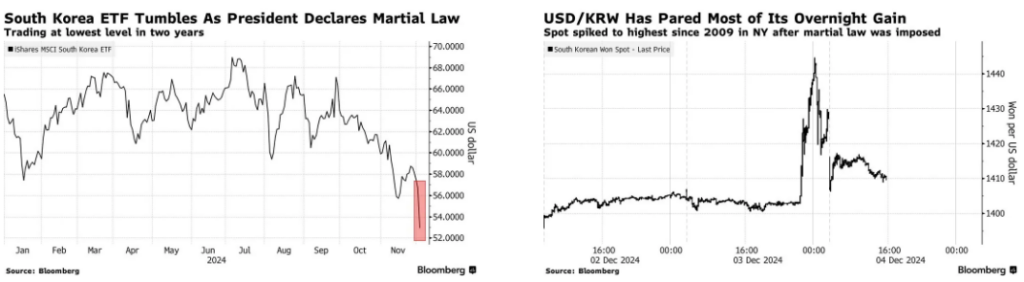

- Following the martial law declaration, the South Korean stock market and the Korean won (KRW) both saw sharp declines. The iShares MSCI South Korea ETF, which tracks more than 90 large and mid-sized companies, dropped 7.1% in U.S. trading, hitting a 52-week low. Meanwhile, the win weakened by 2.9%, falling to 1444.65 per dollar, making it the worst-performing Asian currency of the year.

2.2. Bitcoin Flash Crashes

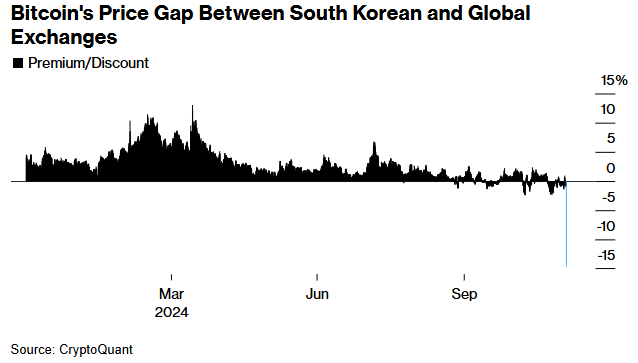

- The political unrest caused heightened volatility across financial markets, including cryptocurrencies. Bitcoin and other cryptocurrencies saw significant declines on South Korean exchanges, with Bitcoin’s price dropping as low as $71,814.99 at one point, while global exchanges showed prices around $93,600.

- This led to the resurgence of the Kimchi Premium, where Bitcoin was priced higher on South Korean exchanges compared to global exchanges. Political instability and emotional investor behavior exacerbated this price discrepancy, although it is likely to be short-lived.

In general, investors may see this as a buying opportunity, capitalizing on the increased demand despite volatility due to the uncertainty surrounding martial law could lead to increased demand for Bitcoin as a safe-haven asset and drive market activity.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.