Welcome to BlockBase Insights Weekly—the free weekly newsletter that keeps you in the know across Bitcoin, rates, risk, and macro. If you want more macro market data to help you assess where we are in the cycle, see the link in the first comment below.

TL;DR

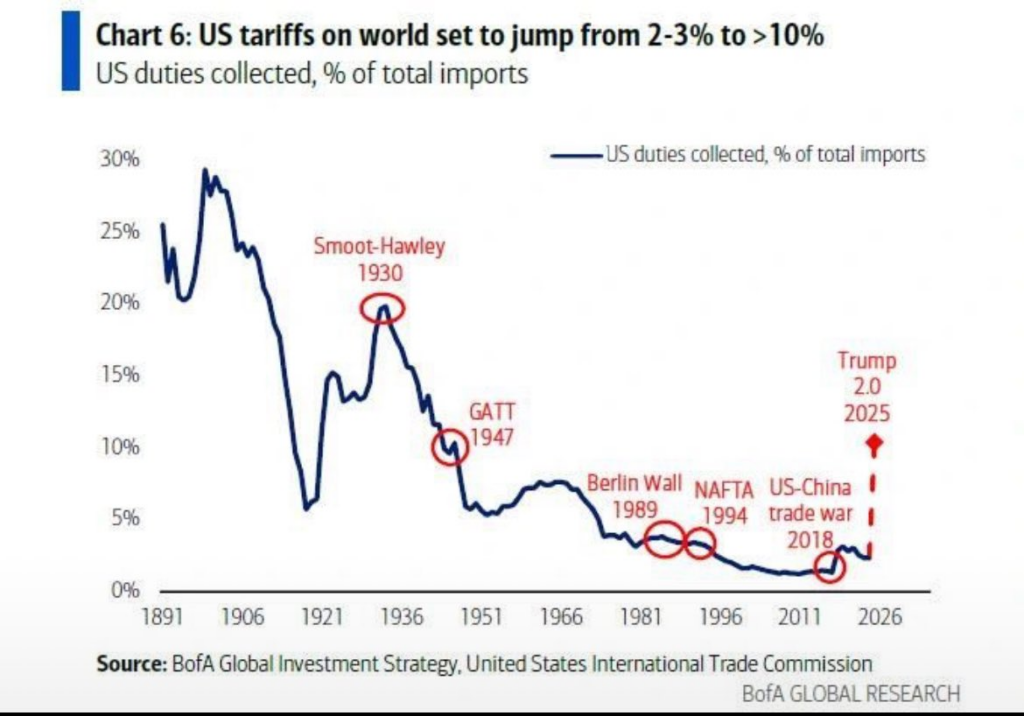

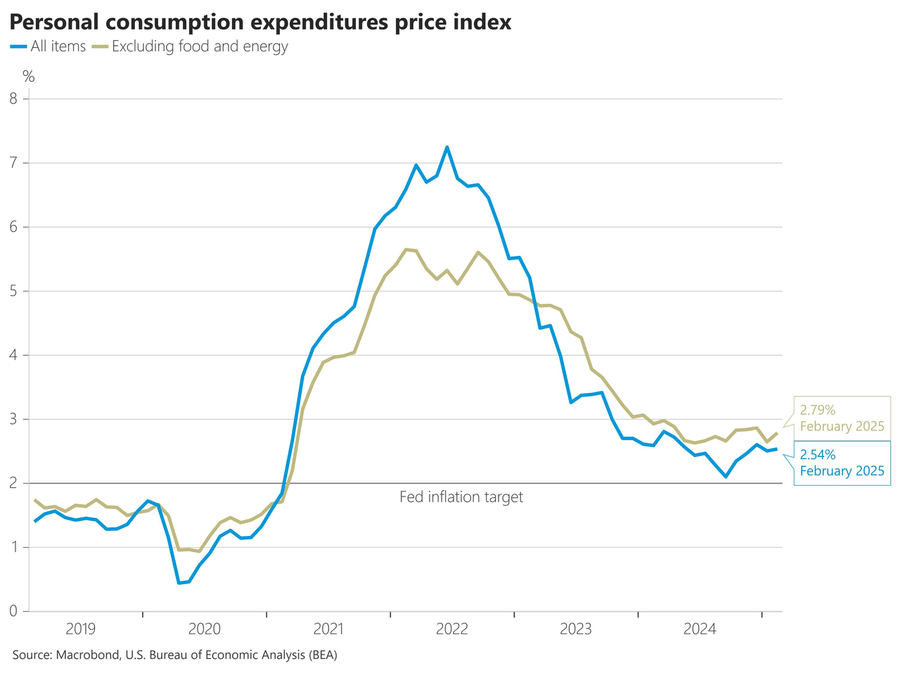

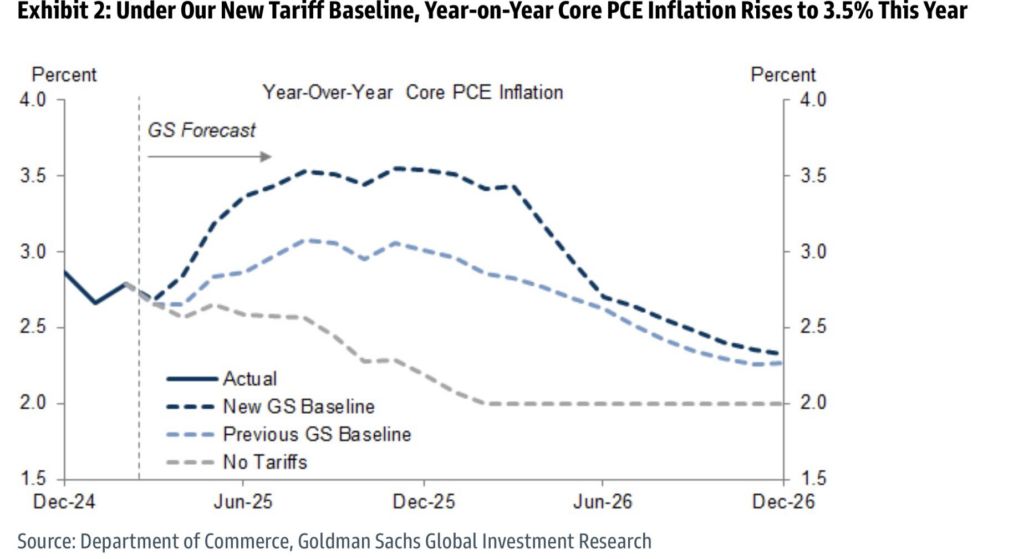

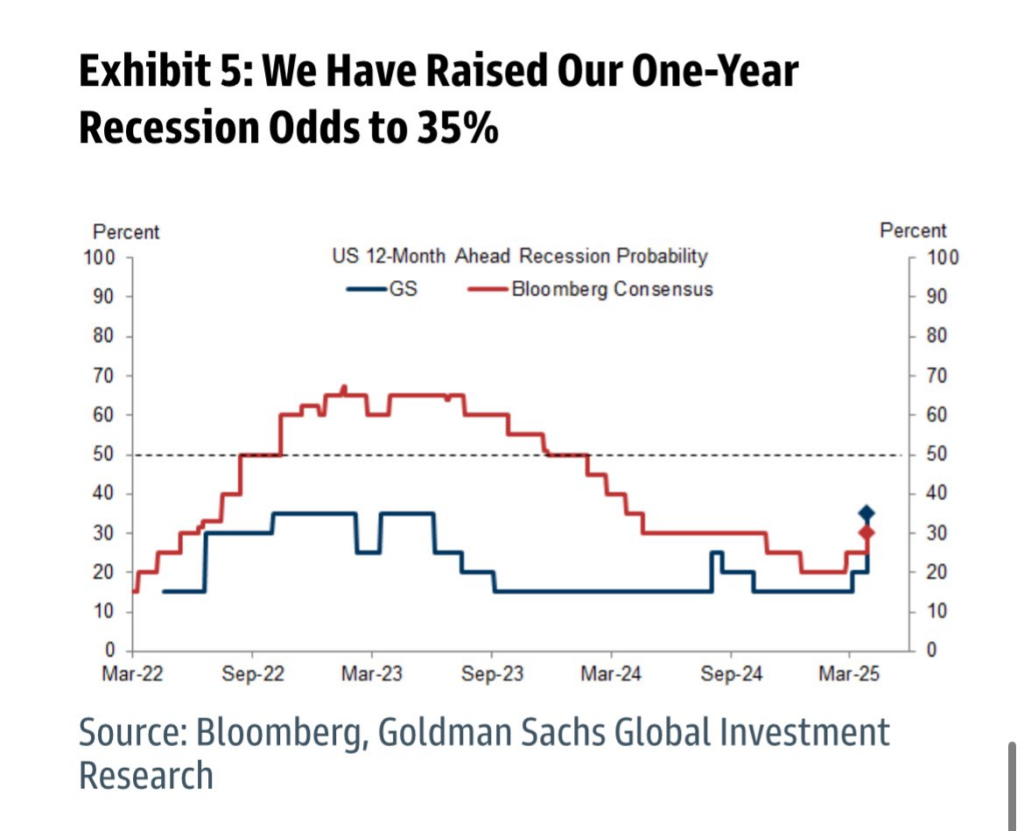

U.S. Economic growth is projected to decelerate in 2025. Tariffs on imported goods in March were triple the average, with further increases expected in April. This escalating tariff environment raises the specter of stagflation, especially given the persistent inflation rate hovering between 2.5% and 2.8%.

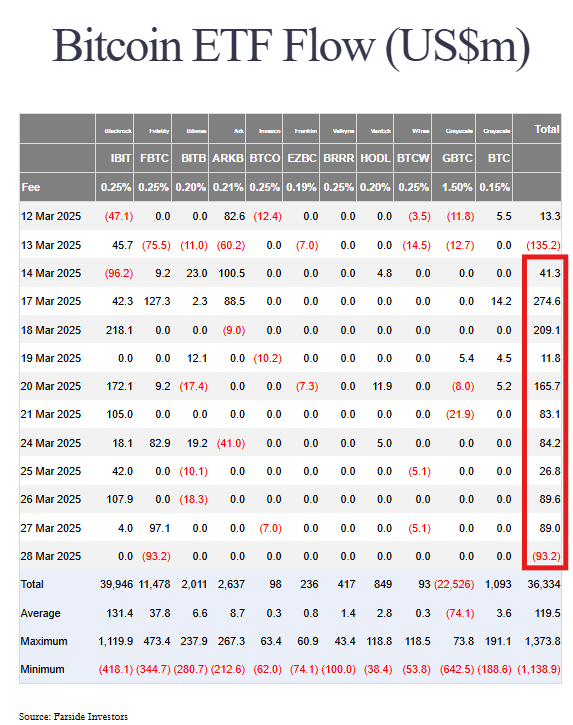

Market Dynamics: While ETF funds have experienced inflows of $1 billion for two consecutive weeks, daily buying pressure remains subdued compared to previous periods. This suggests a less robust positive impact on prices.

Investor Strategy: Investors are currently shifting their net exposure towards defensive sectors, with bonds and gold perceived as less vulnerable to tariff-related risks. This defensive positioning implies that risk assets may face volatility in the coming months.

Short-Term Outlook: The current market structure appears weak, compounded by a challenging macroeconomic backdrop. Consequently, Bitcoin is likely to trade sideways within the $70,000 to $90,000 range, awaiting catalysts such as potential stimulus from Federal Reserve quantitative easing (a surge of liquidity) and favorable U.S. cryptocurrency regulations (which could attract new capital into the crypto market)

Quick TL;DR Macro Market

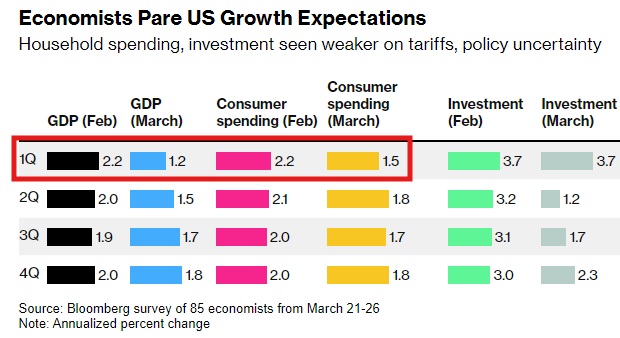

- Economic Slowdown: Recent surveys indicate a notable deceleration in U.S. GDP growth this year, particularly in the first and second quarters.

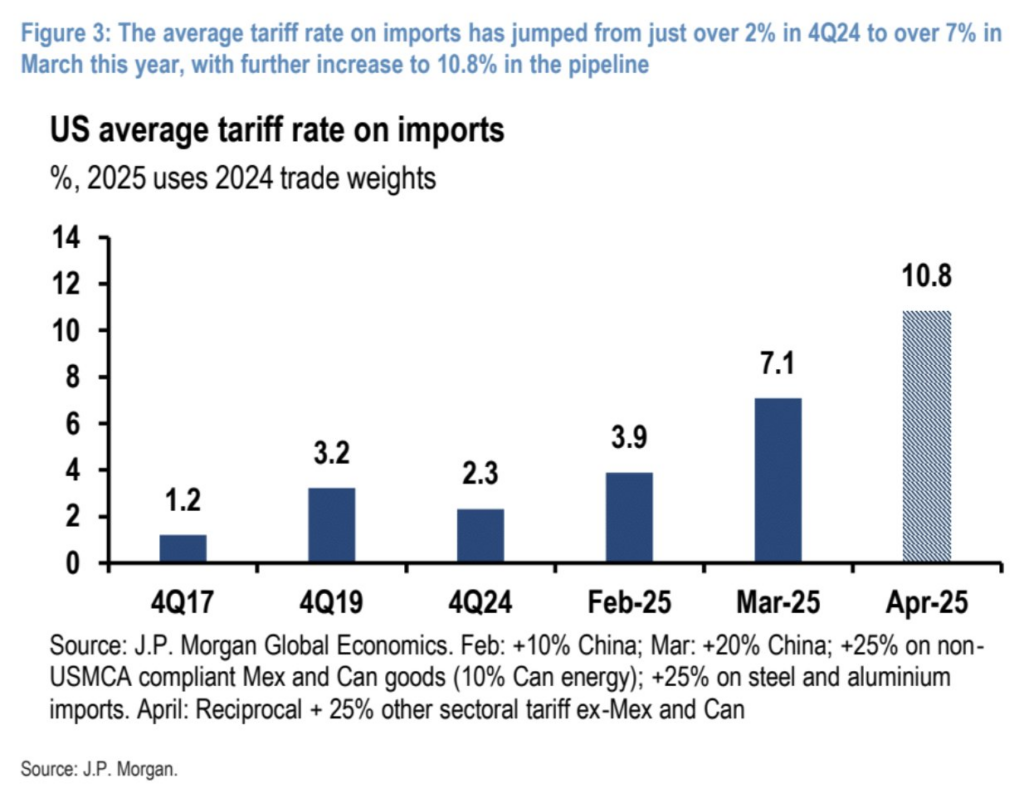

- Tariff Escalation: The average U.S. The tariff rate surged from 2% to 7% in March, with certain sectors like aluminum, steel, and automobiles experiencing a threefold increase.

- Upcoming Tariff Day: On April 2nd, the implementation of retaliatory tariffs by the Trump administration across all nations is expected to push the average tariff rate up to 11%.

- Implications: The ongoing trade war and the resulting restructuring of international trade relationships create significant uncertainty.

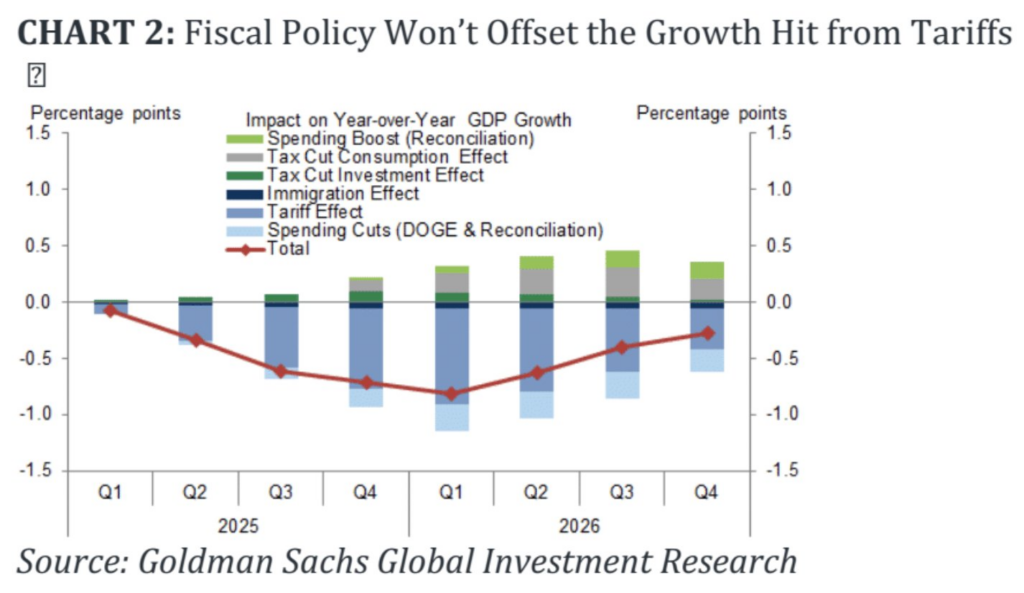

- Impediments to Growth from Higher Tariffs: The growth-dampening effects of increased tariffs cannot be offset by other fiscal measures:

- Impact on Businesses: Higher input costs lead to reduced profit margins for companies and manufacturers. Importers pass these increased costs onto consumers, resulting in slower consumer demand and a contraction in economic activity.

- Consumer Prices: For directly imported goods (electronics, apparel), tariffs can drive up retail prices, diminishing disposable income and suppressing consumer spending.

- Export Markets: Retaliatory measures by trading partners render U.S. Domestic producers are less competitive, leading to lower export volumes and potential job losses.

- Investment Delays: Businesses and investors, facing uncertainty regarding the trajectory of trade policies, adopt a cautious stance and often postpone capital investments and expansion plans

Sticky inflation gives the Fed cause to stay on pause. Risk of stagflation emerges, risky asset classes face downward pressure.

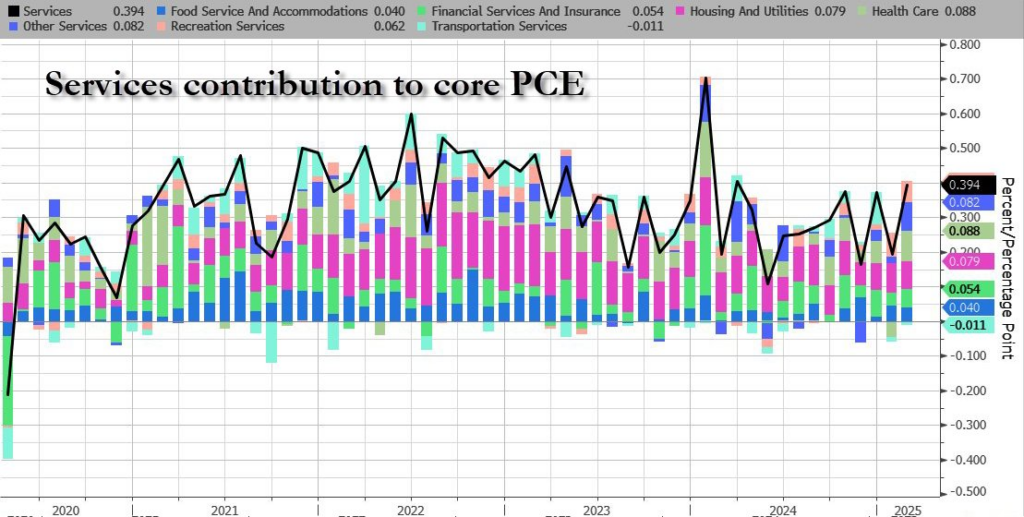

- A key positive is that the core PCE increase was driven by services (78%), with virtually no contribution from goods. This implies that tariffs are not currently impacting PCE.

- With core PCE expected to reach 3.5% (from 3.0% due to higher tariffs), Goldman Sachs forecasts three Fed rate cuts in H2 to counter growth and employment impacts.

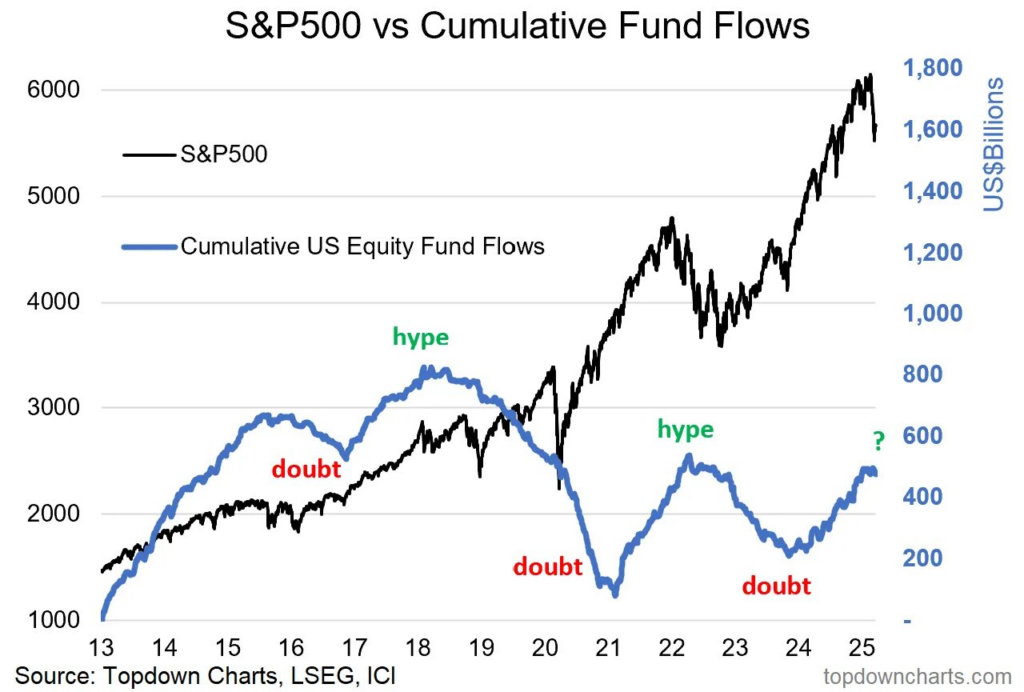

Market Positioning

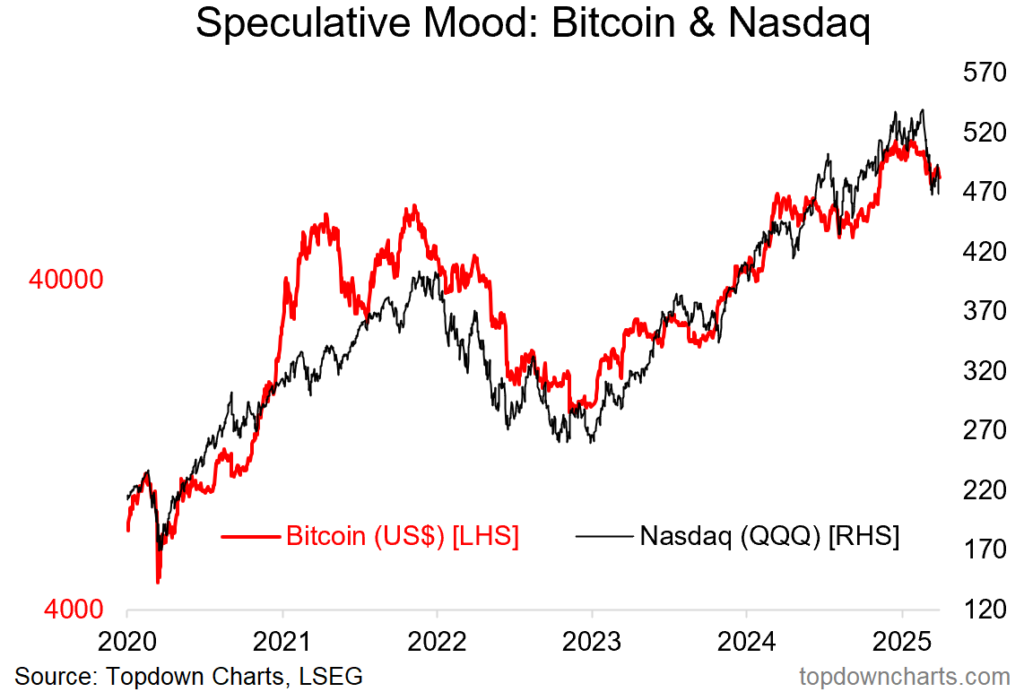

- There’s a sharp decline in risk appetite (speculative sentiment, risk-taking ability).

- More rotation into defensives.

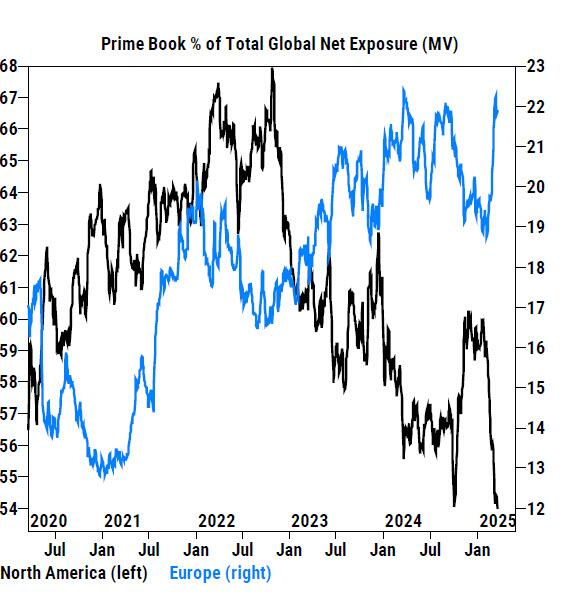

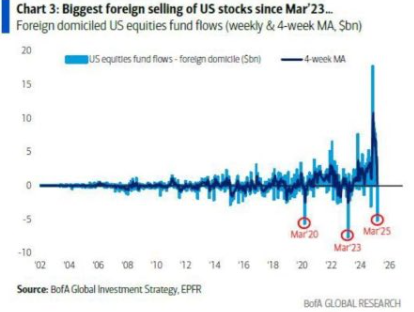

- Hedge funds have been dumping US exposure to buy Europe hand over fist this year – Goldman.

- While BTC ETFs have attracted $982 million in inflows over the last two weeks, the inflow rate is notably lower than before. As a result, BTC and the Nasdaq are experiencing considerable headwinds, as investors are currently prioritizing safe-haven assets, particularly gold.

Bullish Case for Gold

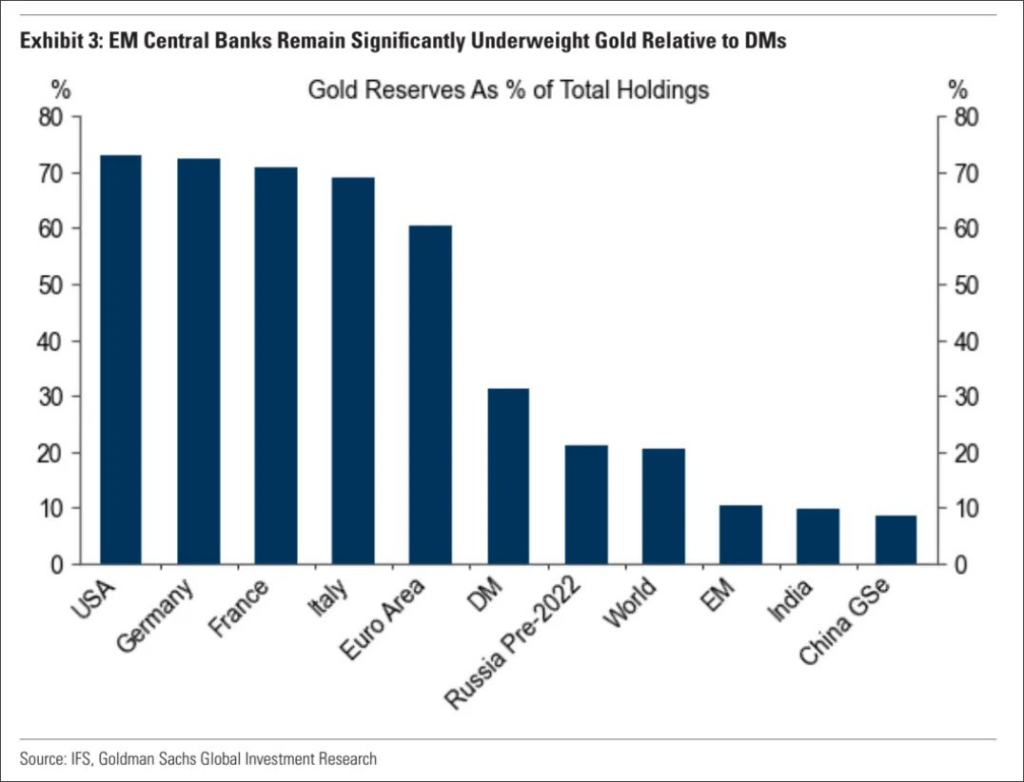

- Central banks in Developed Markets (DMs) maintain substantial gold holdings, frequently exceeding 50% of their reserves.

- Emerging Market (EM) central banks possess a considerably smaller proportion of gold within their overall reserves.

China’s situation is particularly noteworthy in the context of de-dollarization. Their gold reserves represent a relatively modest percentage of their total foreign exchange holdings, which are heavily weighted towards U.S. government bonds (roughly $800 billion).

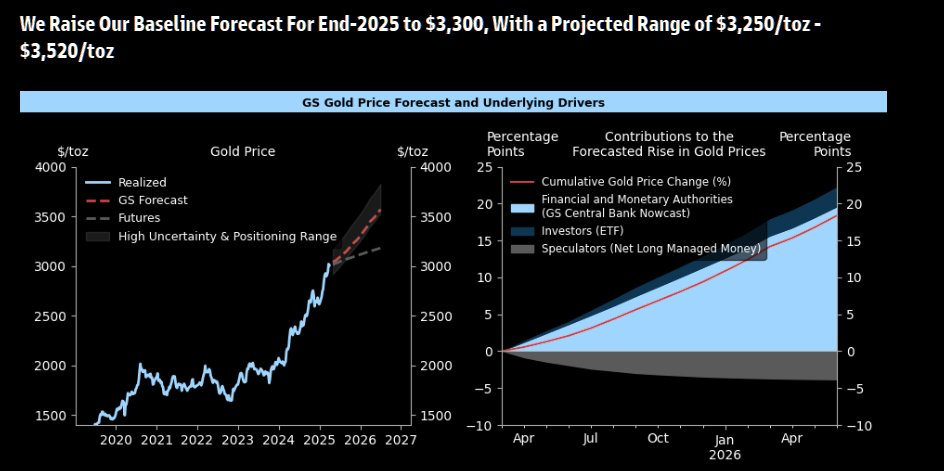

- A confluence of factors from multiple market players—central banks, institutional investors, and retail—is creating significant upward pressure on gold prices. As a result, Goldman Sachs has increased its year-end gold price target to $3,300.

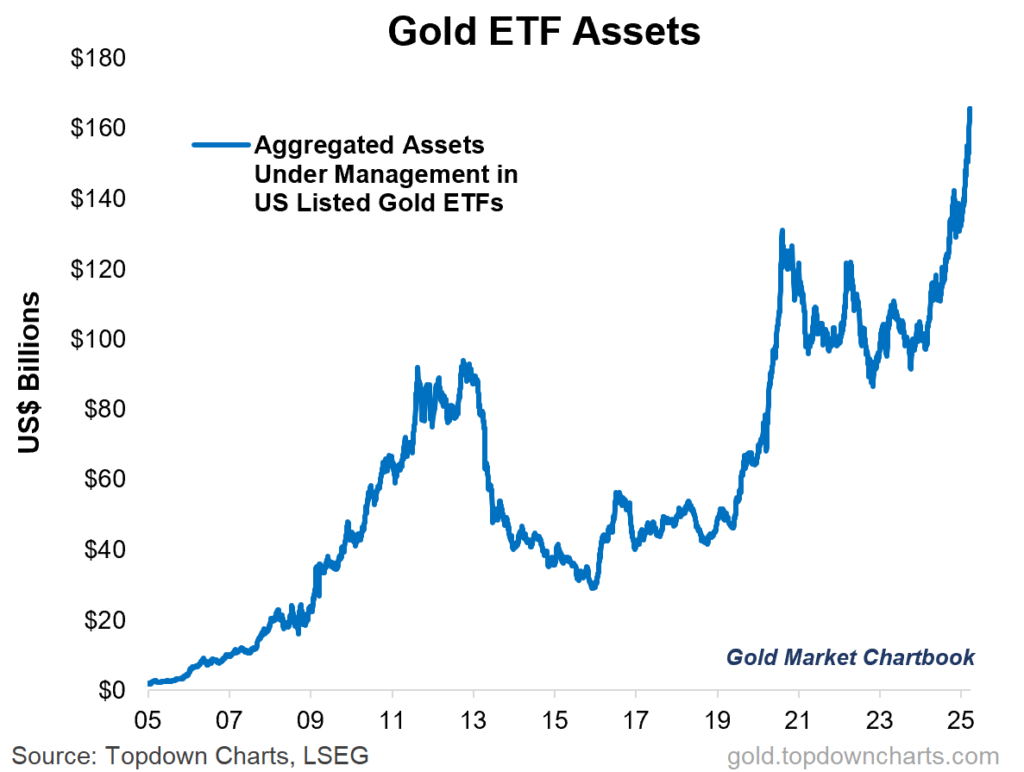

- Notably, aggregated AUM in US listed Gold ETFs exceeded $150B – new ATH.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.