1. TL;DR

Global macro market are recovering (stocks are up, gold is down) following news of US-China talks, even if this turns out to be fake news.

If the US de-escalates without making demands, negotiations will proceed. However, if conditions are attached, China will likely make the US wait for some time, which is the base-case scenario. This implies less uncertainty on the macro level, although risk is not entirely absent, suggesting that short-term volatility will likely remain high.

Amidst the US-China trade war, both the USD and the Yuan have depreciated against major currencies. Consequently, to limit potential negative impacts, central banks in other countries may need to consider lowering interest rates. This would help curb the appreciation of their domestic currencies and provide support to their economies during the trade conflict.

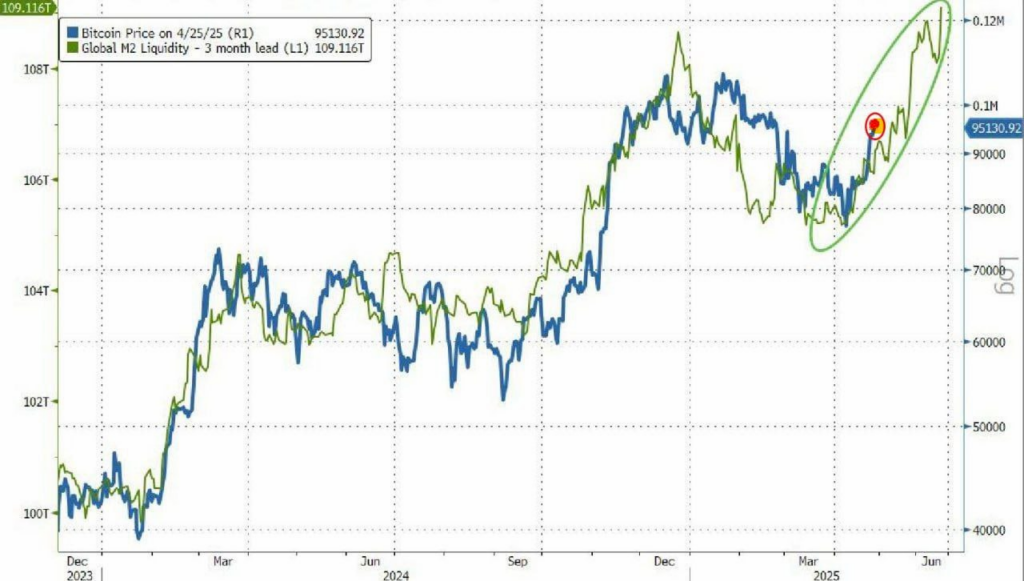

Monetary liquidity from top central banks is at an all-time high (including the PBoC, BOJ, and the EU), which has boosted the global M2 index to an ATH, even though the FED has not yet initiated quantitative easing. This increase in global liquidity has a positive impact on the price of Bitcoin. Furthermore, market upside potential remains because the FED has not yet engaged in QE, and current sentiment is positive. The upcoming week appears favorable for liquid trading ahead of the FOMC and tariff-related events.

Adding to positive momentum, a new SEC leadership has been formed, which has alleviated fears of tightened regulations on the crypto market. This suggests that regulation is shifting towards a more positive stance, a development that the market has not yet fully factored into prices.

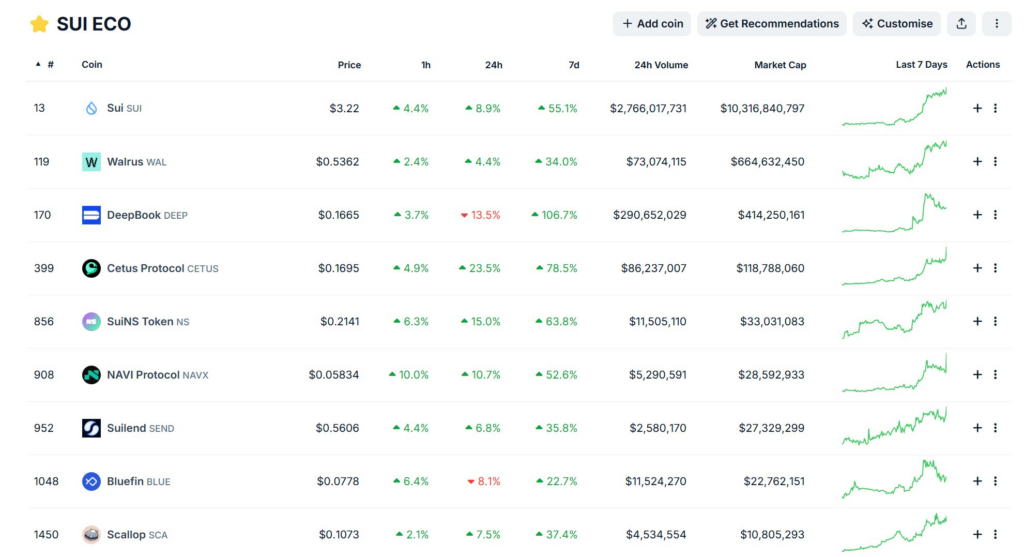

Bitcoin dominance (BTC.D) is showing signs of reaching a peak, with capital currently rotating into Altcoins. Notably, the SUI ecosystem is outperforming the broader market.

Potential Trade Ideas include WAL, CETUS, DEEP, and BLUE.

2. Quick TL;DR Macro Market Crypto

2.1. Trade War Update

US companies are warning of significant price increases for certain major consumer goods. In response, the US is reportedly considering tariff exemptions or reductions for automobiles and some other products.

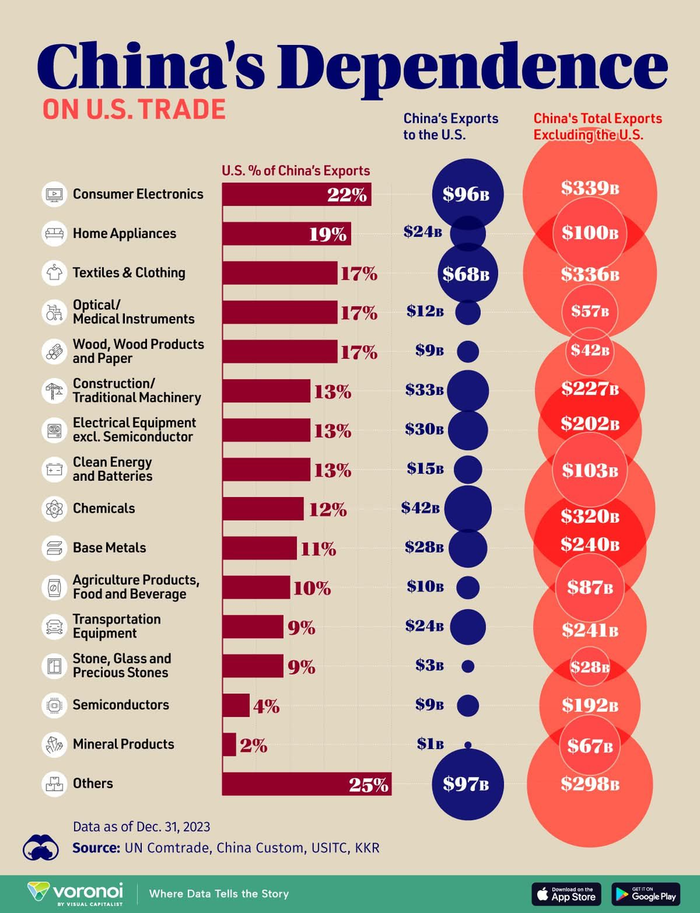

Simultaneously, some Chinese companies are facing risks of order fulfillment issues and production difficulties. Consequently, China is considering reducing tariffs on certain US goods, particularly semiconductors.

These actions suggest both sides are sending ‘subtle signals’ to each other, which is a positive sign that could boost market sentiment.

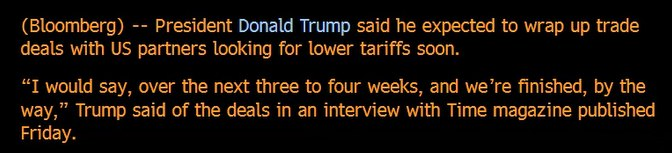

Recently, Trump tweeted that deals with negotiated countries would be finalized within just 3-4 weeks. This suggests that short-term volatility will likely remain high, and market uncertainty will persist.

Note: If the US aims to bring China to the negotiating table, it would need to impose tariffs on both China and all countries importing Chinese goods. Only then would China face a significant 10% GDP loss. Isolated tariffs would only result in a 2.85% GDP reduction.

2.2. Macro Market China Update

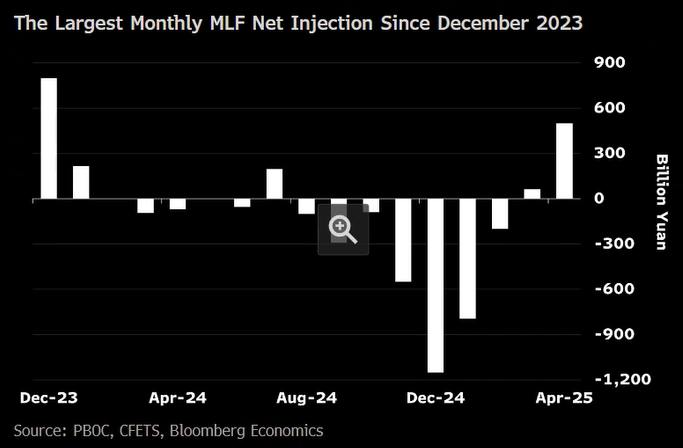

The People’s Bank of China (PBoC) has injected a substantial 600 billion yuan (approximately $82.3 billion USD) through its one-year medium-term lending facility. This action will result in a net cash injection of 500 billion yuan via this tool, marking the largest “injection” since December 2023.

This move signals a supportive monetary policy stance, likely in preparation for potential scenarios arising from trade negotiations.

Note: Boosting credit, in addition to stimulating domestic consumption, also serves as a way to maintain a weaker Yuan, which can help counter trade-related challenges.

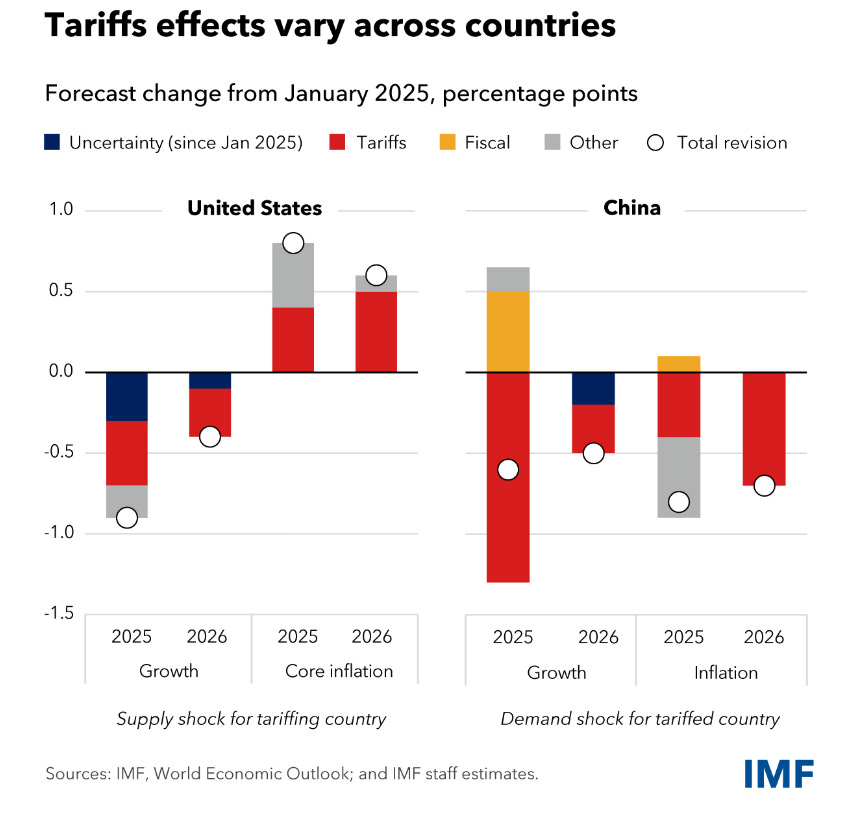

China’s growth is projected to decrease by over 1%, even with the implementation of fiscal spending and acceptance of a larger fiscal deficit to support the economy (the US has experienced a smaller decrease without needing to resort to these measures).

China’s deflationary risks are proving more challenging to manage than the inflationary risks faced by the US.

Note: From a personal perspective, the US seems to be in a greater hurry than China. It’s worth remembering that in 2020, China maintained strict lockdowns for two years despite significant economic disruption. This suggests China is in a stronger position relative to the US this time around.

2.3. Sentiment vs. Positioning vs. Money Flow Update

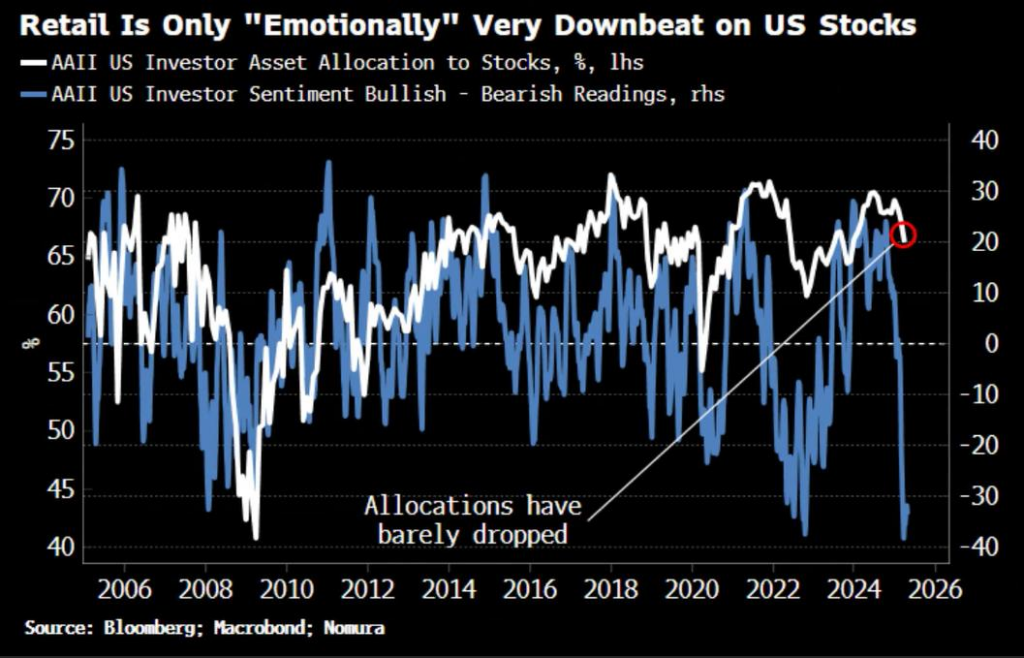

Retail sentiment has collapsed significantly, dropping by 33 points. However, actual equity allocation remains high at around 66%, only slightly below its 2024 peak.

This indicates a disconnect: retail investors are expressing pessimism but are not actually selling their stock holdings. This highlights the difference between what they “think” and what they “do”.

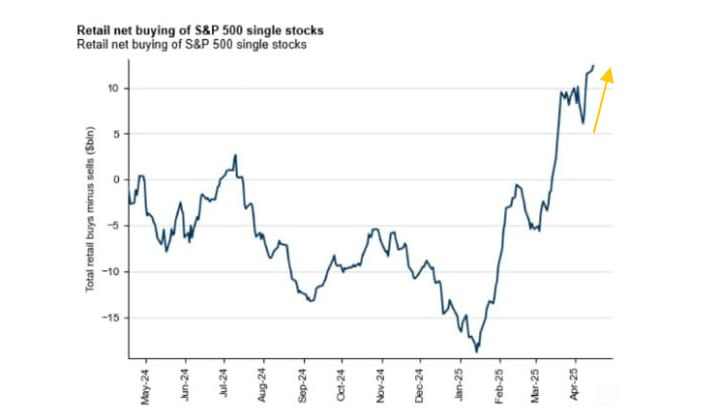

- Retail investors have been strong buyers during the recent market volatility

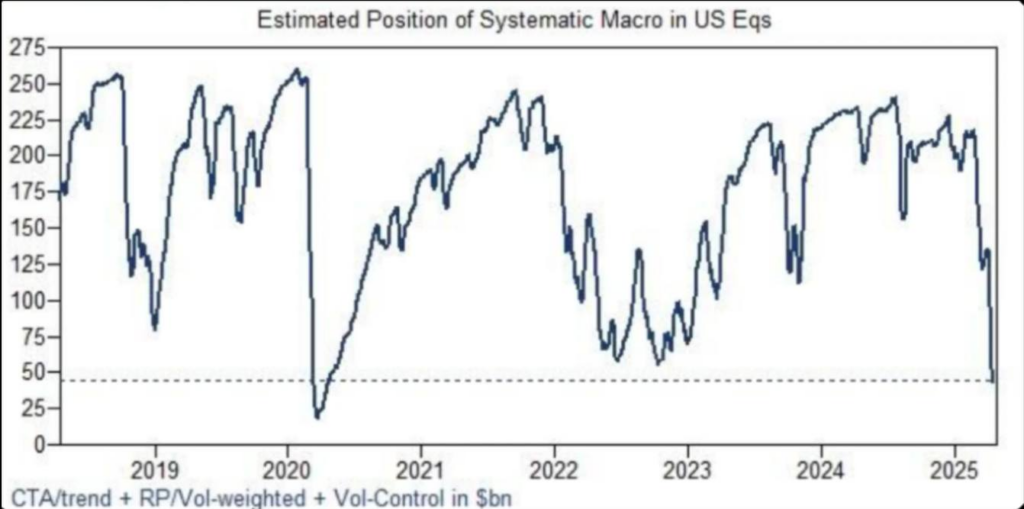

- Meanwhile, funds and institutional investors have been de-risking, reducing their exposure to levels last seen in 2020 (with exposure down by $225 billion).

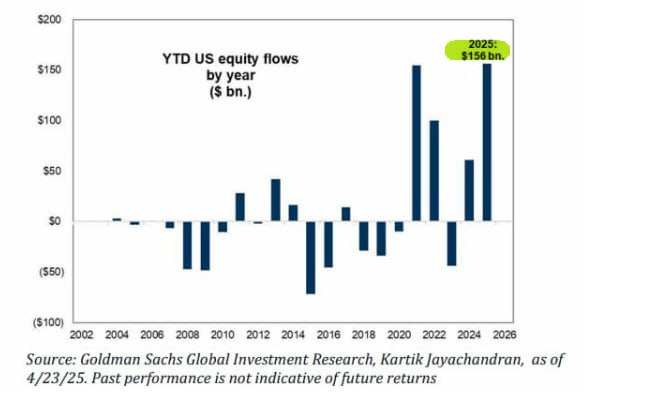

Despite a significant 20% drop in US stocks following the implementation of Trump’s tariffs, year-to-date inflows have already reached record highs, matching the levels seen in 2021.

This makes one wonder: what massive inflows could we witness if tariff tensions ease, the FED cuts rates and resumes QE, and the US successfully avoids a recession?

2.4. Crypto Market Update

Global liquidity is currently at an all-time high, which reinforces a medium-term risk-on appetite, even as positioning is being reset.

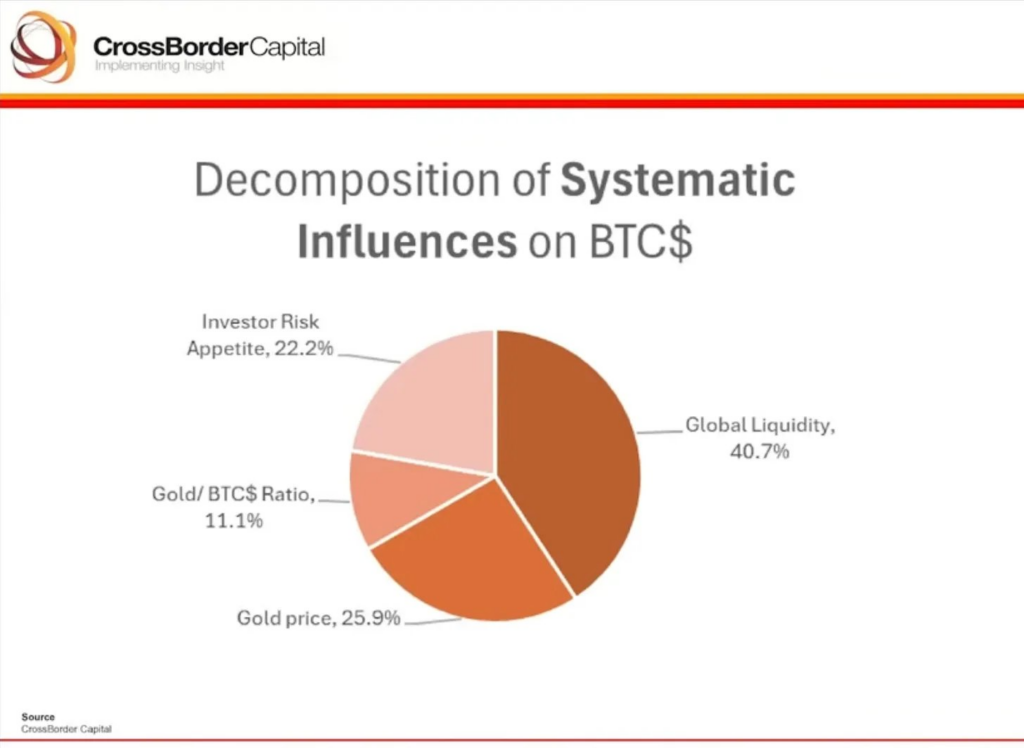

It’s important to remember that global liquidity has over a 40% impact on Bitcoin’s price, followed by Gold, according to key findings from Michael Howell’s macro-fund (which uses systematic factors in a multi-factor regression on weekly data since 2017).

Note: Both major factors influencing Bitcoin’s price, Gold and Global Liquidity, are currently in their all-time high zones.

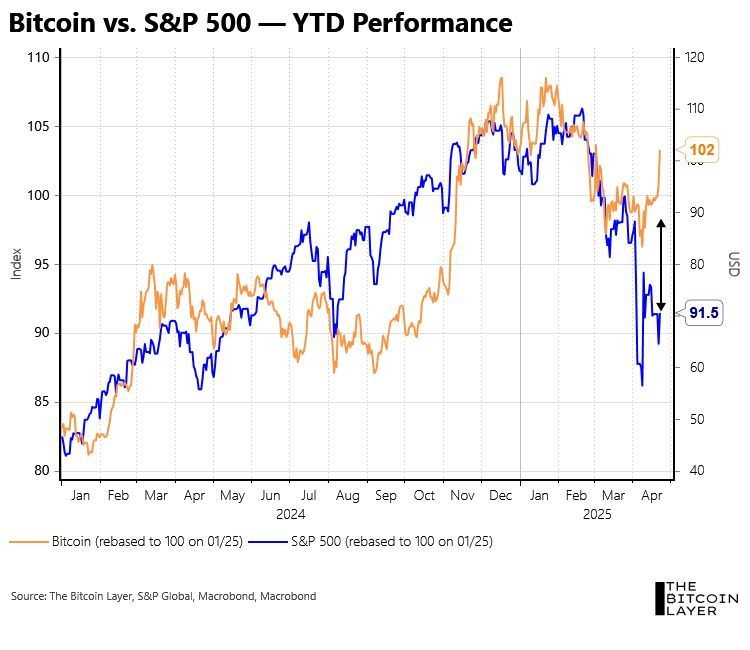

In previous equity drawdowns, Bitcoin experienced sharper sell-offs compared to the S&P 500. However, the current situation is different:

- 2018 (Oct–Dec): S&P -20%, Bitcoin -48%

- 2020 (Feb–Mar): S&P -34%, Bitcoin -50%

- 2025 (YTD): S&P -2%, Bitcoin +16%

This suggests that Bitcoin is beginning to decouple from the general trend of risk assets (like high-beta tech stocks) and is moving more in line with the upward trend of Gold, reinforcing the “Digital Gold” narrative.

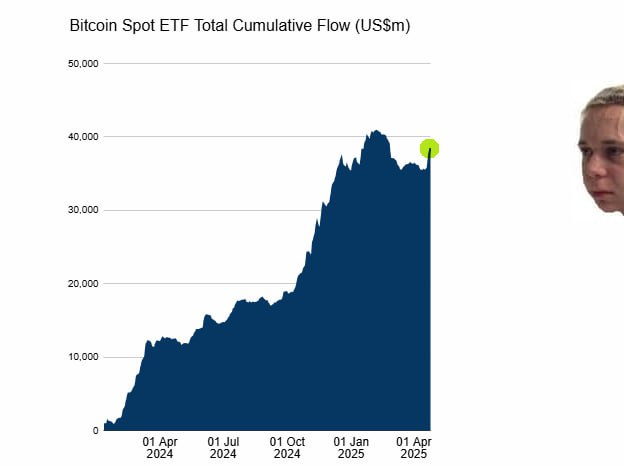

Over the past week, spot Bitcoin ETFs saw inflows of $3 billion, occurring amidst a weakening US dollar and a pause in Gold’s upward movement.

- 13F filings (as of December 31st) reveal significant position increases and new buyers, such as Middle Eastern sovereign wealth funds, take place in October, November, and December.

- Last week’s Bitcoin price drop brought it back to mid-November levels, which coincides with the period of much of that 13F buying activity. This underscores the importance of understanding institutional and whale sentiment:

A sovereign wealth fund doesn’t establish a large position only to liquidate it after a few months of losses or minimal gains. Similarly, Paul Tudor Jones wouldn’t make IBIT his largest stock/ETF holding in his entire personal portfolio just to exit after a short period

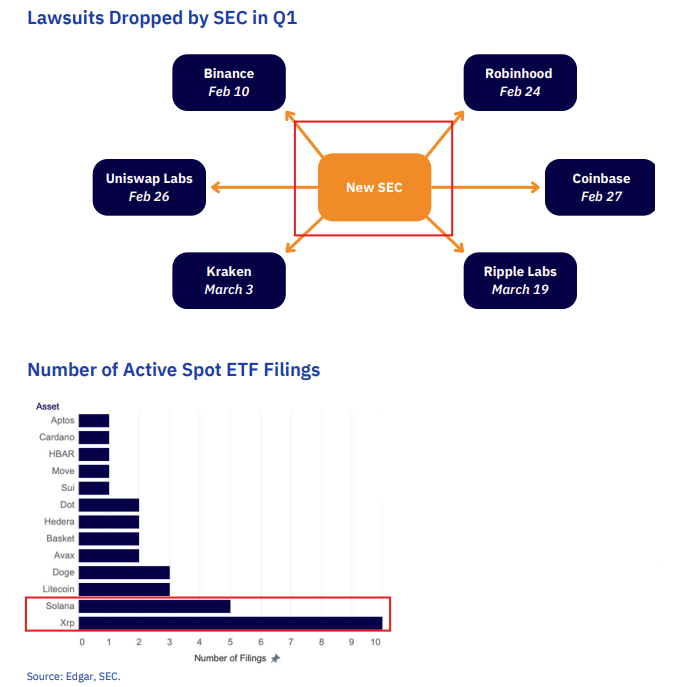

The new SEC has dismissed several lawsuits against crypto entities. Notably, there are 60 Altcoin ETF applications awaiting resolution by Paul Atkins, with XRP and SOL leading the way.

Note: With a fully established pro-crypto administration, US banks may soon be permitted to offer custody and related services for cryptocurrencies, which could generate significant positive sentiment.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.