BlockBase Investment Team’s Research Analyst, Lucas Duong, presents the latest Macro Market Q2 report. This comprehensive analysis delves into macro fundamentals, market dynamics, on-chain metrics, and other key factors influencing Bitcoin’s adoption and price trajectory. The report reinforces our bullish outlook on liquidity and economic conditions for the remainder of the year.

This in-depth study provides investors and Bitcoin enthusiasts with essential data and insights for informed decision-making.

1. TL;DR

The Fed is taming inflation without breaking the economy, suggesting potential interest rate cuts soon. Should the Fed reduce rates, promising investment opportunities will likely arise in long-term technology stocks (biotechnology and renewable energy) and long-term value stocks (banks, real estate investment trusts, and small-cap stocks).

U.S. stocks reached new records in the first half of the year, driven by a robust profit outlook and the artificial intelligence boom. However, recent selling pressure in megacap stocks has impacted the broader market. Historically, August and September are weak months for U.S. stocks, and the upcoming U.S. presidential election in November may heighten volatility. We anticipate that U.S. Stock gains will slow through Q3, but if the economy avoids a recession, the bull market should extend well into 2025.

The crypto market has experienced short-term volatility, with Ethereum lagging and many altcoins undergoing brief rallies followed by significant declines. Despite this, we believe the bull market for cryptocurrencies remains intact. Bitcoin’s increasing relevance and its ties to traditional finance’s liquidity continue to support a broader upward trend.

We are currently experiencing a broad liquidity rotation as central banks expand liquidity. Bitcoin, being the most directly correlated asset to global liquidity, is likely to reach new highs within the next 6-12 months. We recommend capitalizing on any pullbacks during this period.

Bitcoin ETFs have attracted a diverse range of investors, including hedge funds, pension funds, and banks. The initial wave of ETF inflows saw Bitcoin’s price rise from $37K to $73K. This influx is expected to persist, with large institutions anticipated to enter the market soon.

A strategic Bitcoin reserve is a talking point in Trump’s inner circles and mainstream media. Institutions and countries are increasingly adopting Bitcoin, with Larry Fink, BlackRock CEO, recently affirming his belief in Bitcoin’s role in investment portfolios. This endorsement further solidifies Bitcoin’s status as a mainstream investment.

Bitcoin and Altcoins are interconnected, with market movements often driven by capital rotation. We anticipate a typical shift from BTC to ETH, which is expected to outperform due to its high productivity, particularly with high-yield airdrops via restacking. Additionally, the launch of the spot ETH ETF is likely to attract substantial institutional investment, absorb market capital in the next six months, and subsequently drive growth in altcoins.

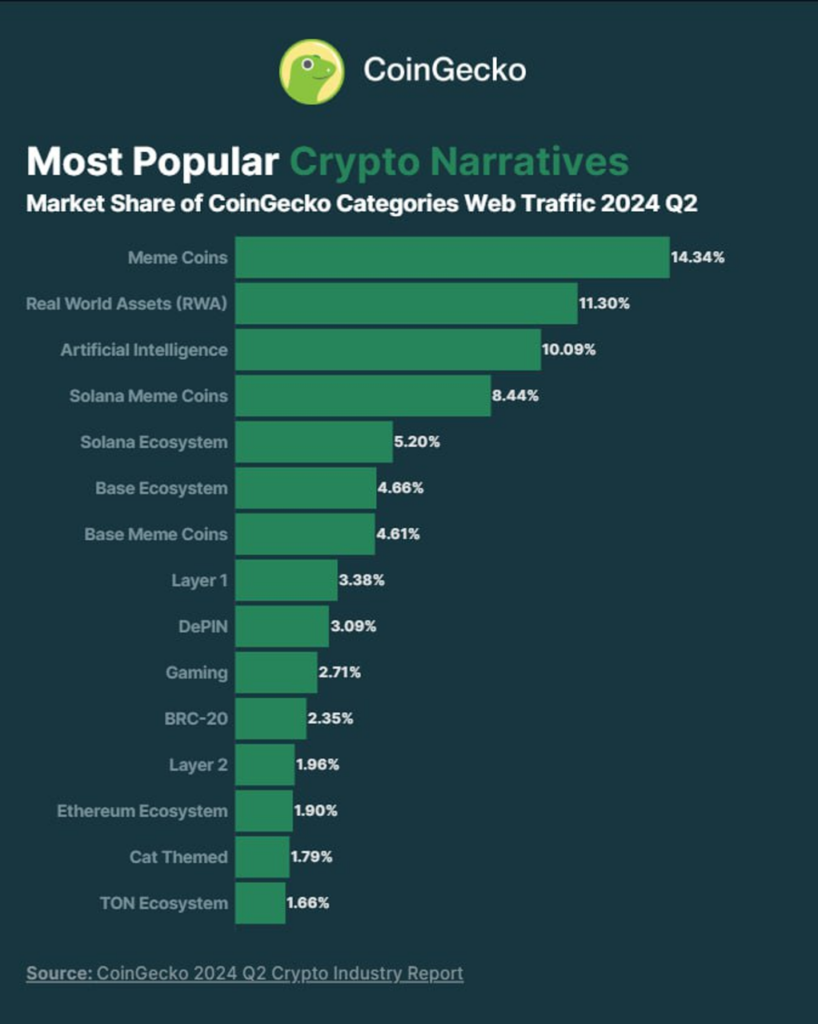

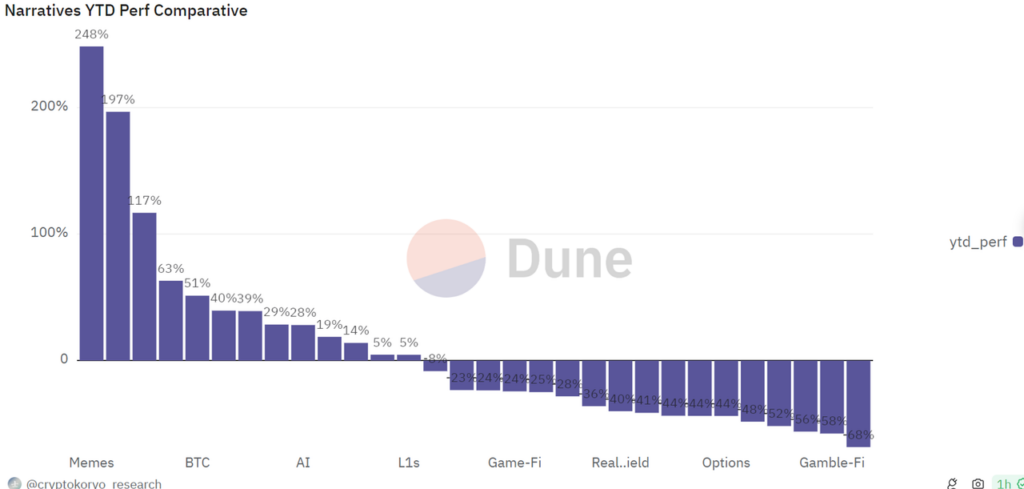

This cycle has been predominantly driven by Bitcoin narratives. So far, narratives around Meme, AI, and RWAs have performed strongly. We expect these trends to continue dominating the market in the future.

2. Macro Market Overview

2.1. U.S. Economy in Brief

Recent economic data shows that the U.S. economy has withstood the Federal Reserve’s aggressive monetary tightening:

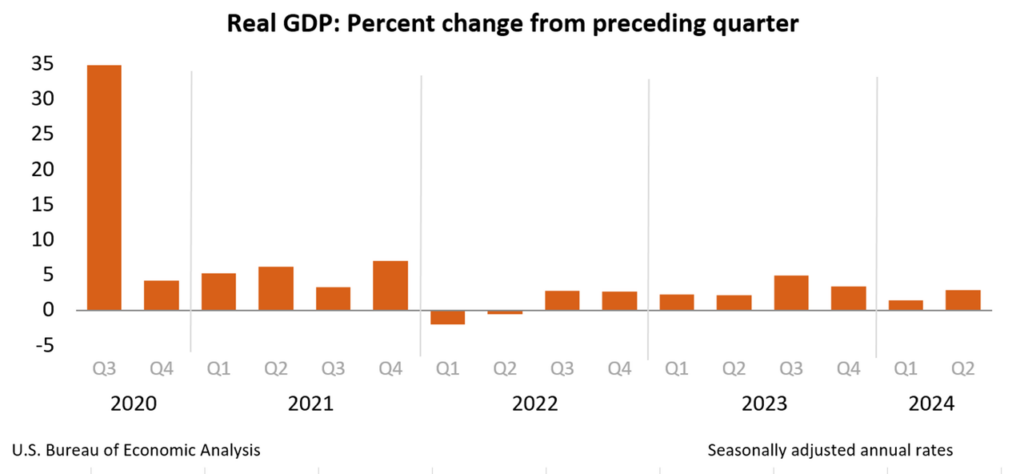

- The second-quarter GDP increased at a 2.8% rate, double the 1.4% growth pace in the first quarter. This rise in GDP growth bodes well for a pick-up in productivity, which could slow the pace of labor cost increases and ultimately reduce price pressures. This scenario supports the Federal Reserve’s efforts to manage the economy via stimulus, aiming for a soft landing. As long as the economy avoids a recession, this bull market is expected to continue through 2025.

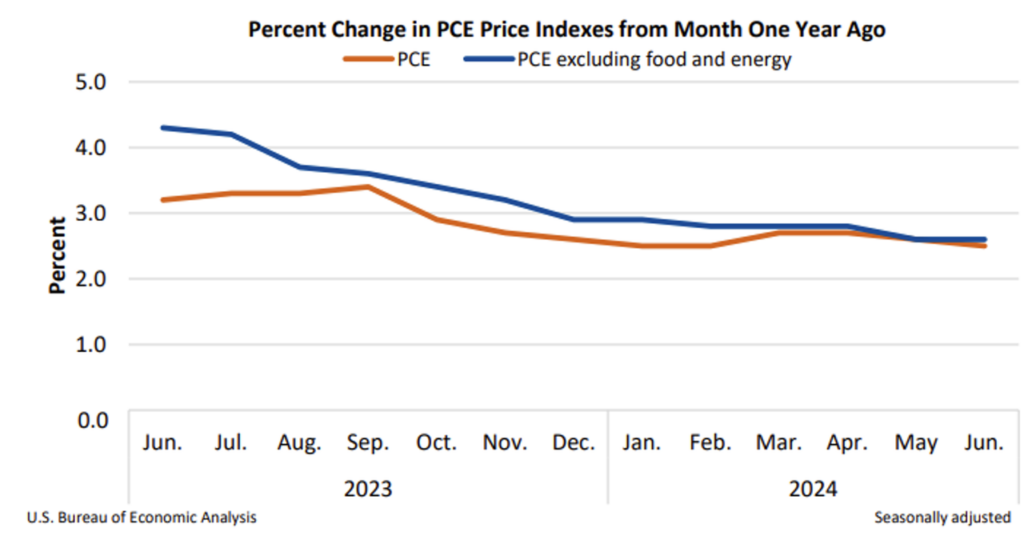

- Inflation pressures have continuously subsided, with the core PCE index increasing by 2.5% YoY in June. Despite a slower decline, inflation is falling, and economic growth remains robust, suggesting that asset prices should continue to perform well.

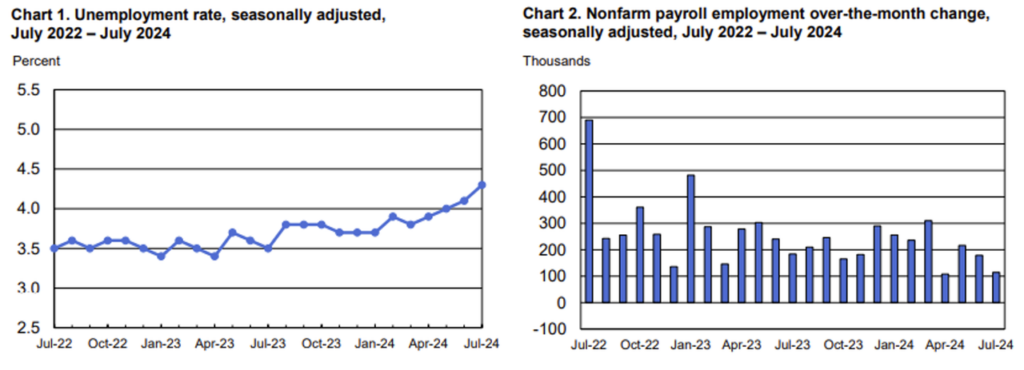

- U.S. hiring has slowed markedly, with the unemployment rate rising to 4.3%, the highest in nearly three years. This increase in unemployment raises recession concerns and puts the Federal Reserve on a solid path to cutting interest rates in September.

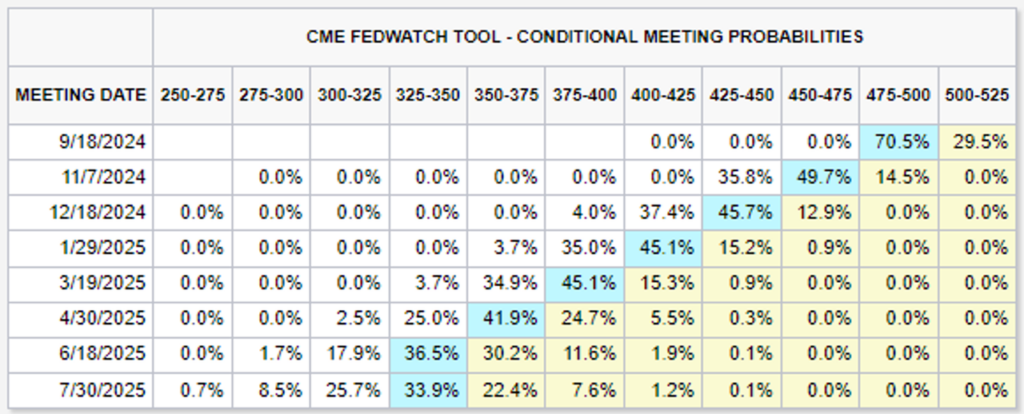

- At the time of writing, traders are pricing in more than a 70% chance of a half-point rate cut in September. If the Fed begins a rate-cutting cycle, it may benefit risky assets.

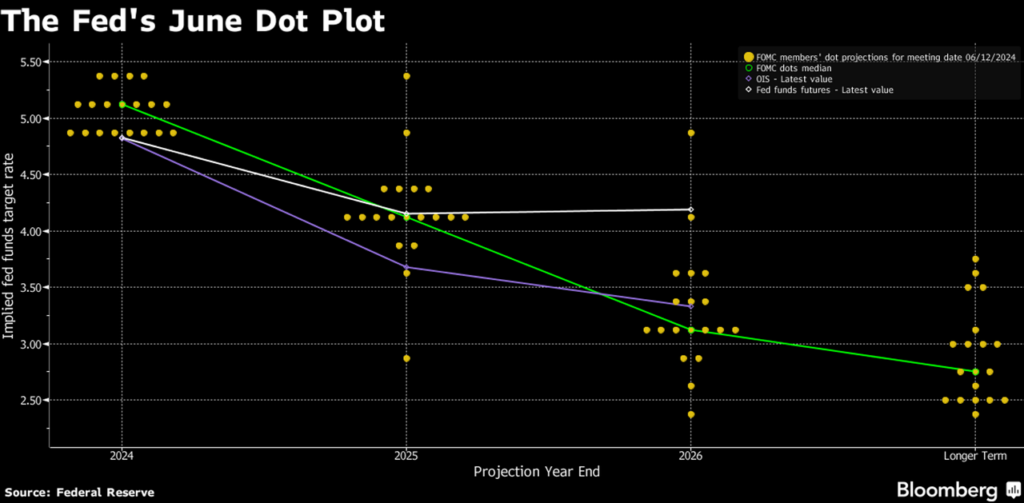

- The latest dot plot indicates that only one 25 basis point cut is expected in 2024, two fewer than the previous round of quarterly forecasts in March. However, the median forecast for 2025 rises to 4.1% from 3.9%, implying four cuts compared to three projected in March.

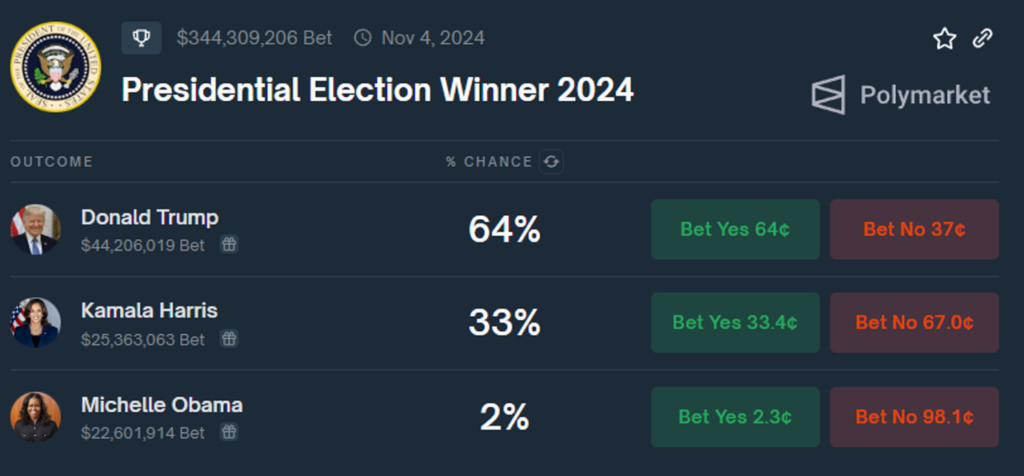

- Politically, Biden has withdrawn from the race, and Vice President Harris has become the Democratic candidate. This late-stage candidate change is unprecedented in modern political history. Nevertheless, Trump’s chances of winning remain high (64%) compared to his opponent (33%) on prediction markets. In the event of Trump’s victory, we can expect a relaxation of crypto regulations.

2.2. Analysis of the U.S. Stock Market Landscape

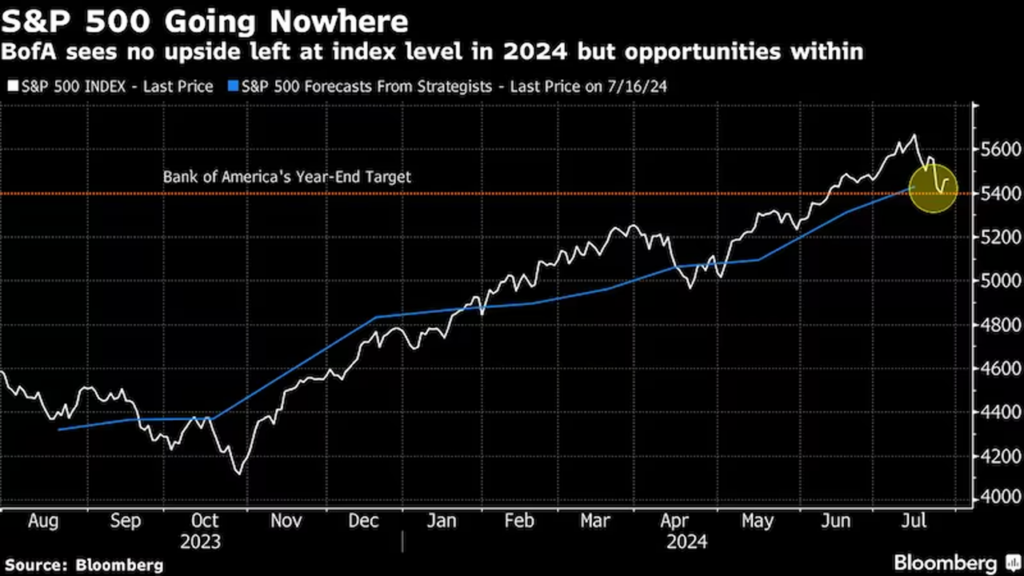

- After setting a record high in mid-July, the S&P 500 has struggled to gain traction due to lackluster earnings reports and investor shifts from heavily weighted megacap shares to smaller companies, driven by expectations of Fed interest rate cuts as early as September. However, the size of this move is typical for a mid-bull market correction, being only halfway to what is normally considered a correction.

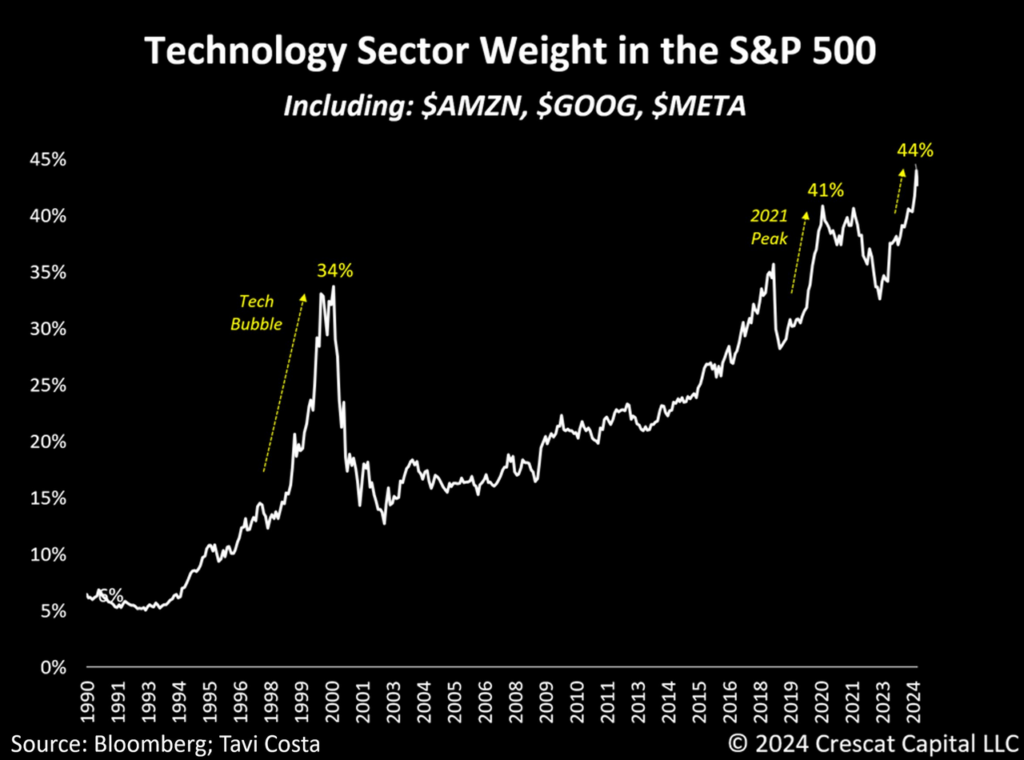

- The megacap tech firms now represent 44% of the S&P 500 index, including Amazon, Alphabet, and Meta. This proportion exceeds the levels seen during the 2000 tech bubble and the 2020-2021 period when central banks worldwide injected liquidity to mitigate the impacts of COVID-19.

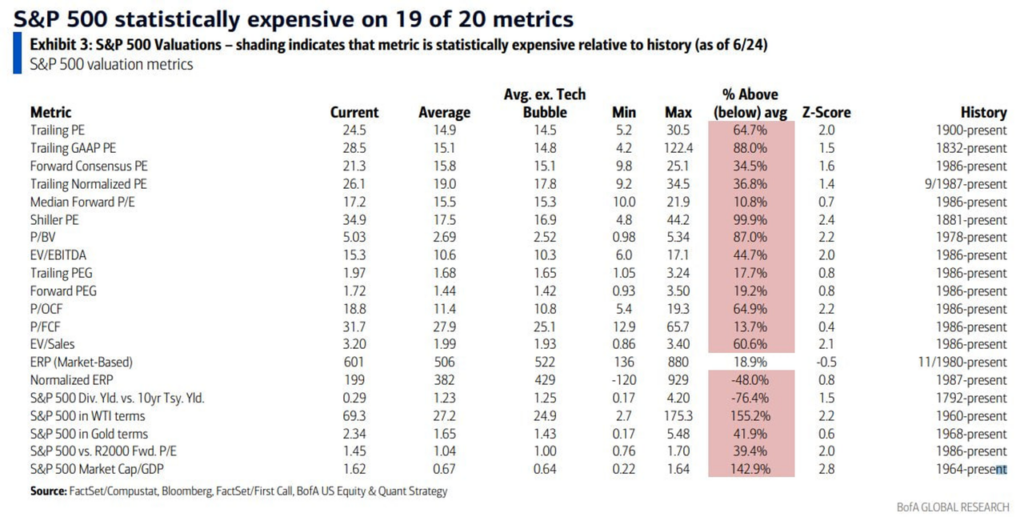

- In the short term, we are likely at a critical juncture for U.S. equity markets, with valuations currently at historically high levels (the S&P 500 is statistically expensive on 19 of 20 metrics). Many investors may be hesitant to buy U.S. stocks during this period due to inflated prices. Therefore, we believe this is not the optimal time to continue chasing stocks.

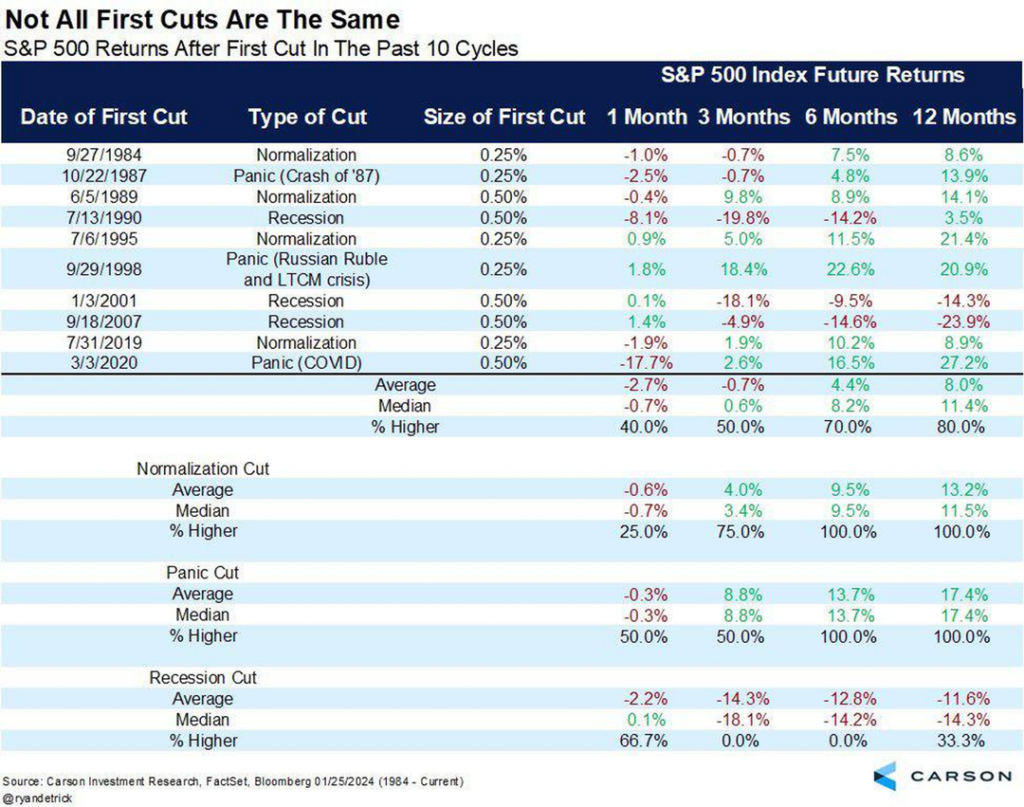

In the mid-term, event studies show the potential benefits of interest rate cuts to the stock market:

- Cuts due to recession are very bad short-to-medium term, requiring 3-12 months for recovery.

- Cuts due to panic are very bad short term but improve medium-to-long term, needing 1-3 months for recovery.

- Cuts for normalization might cause a small drop in the short term but are very good for the medium to long term.

On average, returns post-rate cuts are positive, especially six months after the initial cut. However, this year has “confounding major events” like the U.S. election, so close monitoring of this event and market reactions post-election is crucial.

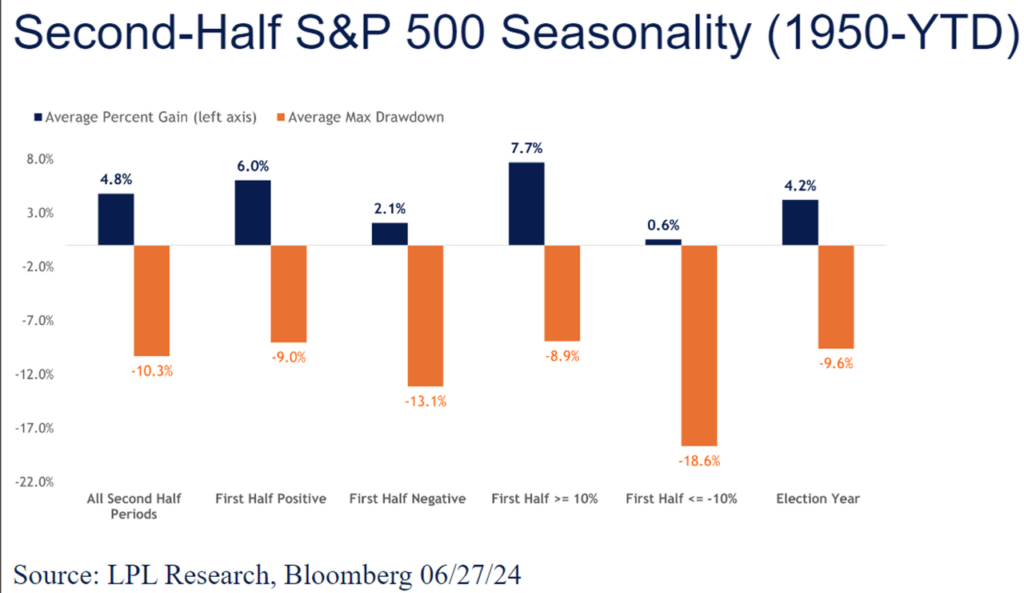

Notably, historically, when first-half gains are 10% or higher, the S&P 500 tends to post average gains of 7.7% in the second half, indicating that a strong first half often leads to above-average second-half returns.

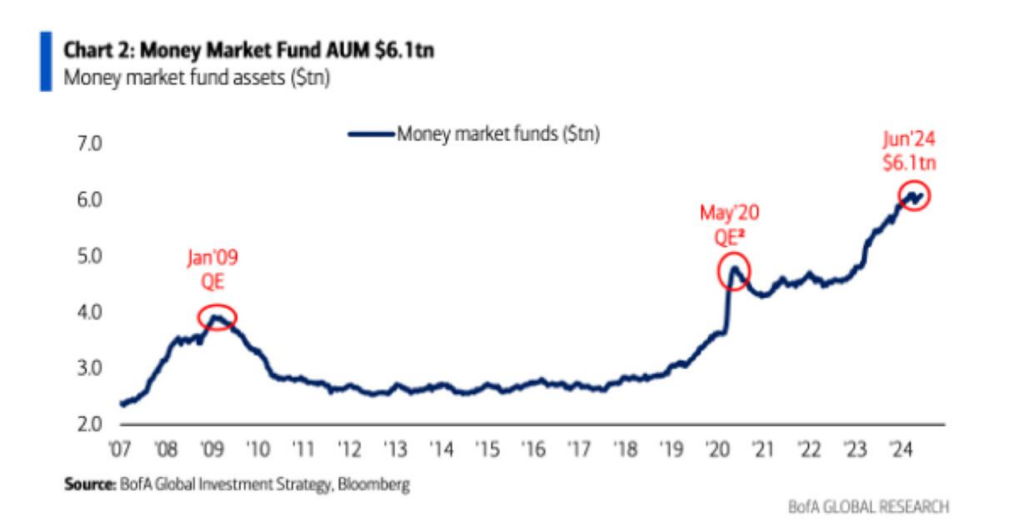

In short, we anticipate the S&P 500 will face headwinds in the coming months, including downward earnings revisions, elevated valuations, and overbought conditions. Waiting for a dip might be the best strategy, as recent dips have been minor due to substantial sidelined money waiting to be invested. Currently, cash funds hold about $6.1 trillion in assets. We expect investors to rotate money from money-market funds into equities approximately 6-12 months after the Fed cuts rates sufficiently, making bond yields less attractive.

2.3. Investor Sentiment and Positioning

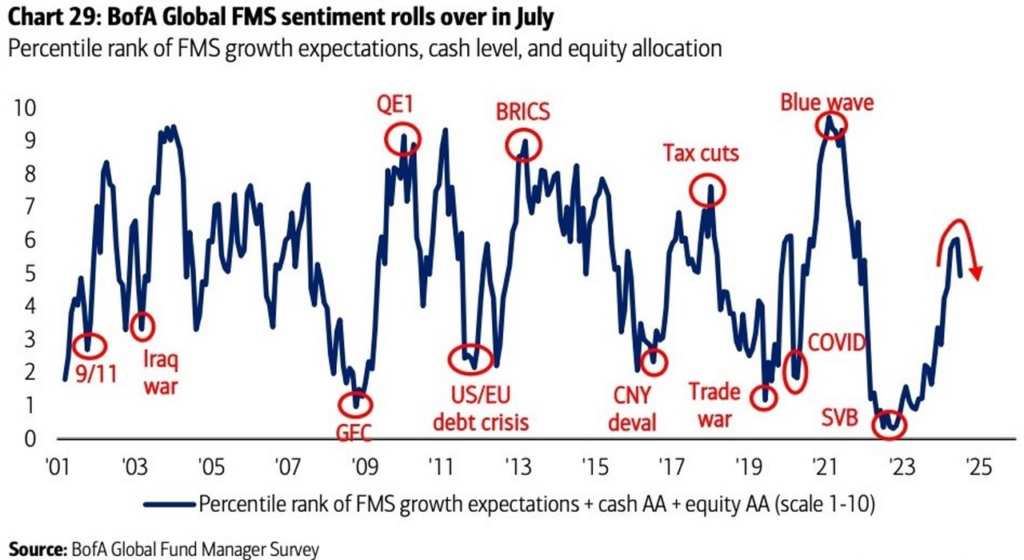

The July Global Fund Manager Survey by Bank of America revealed:

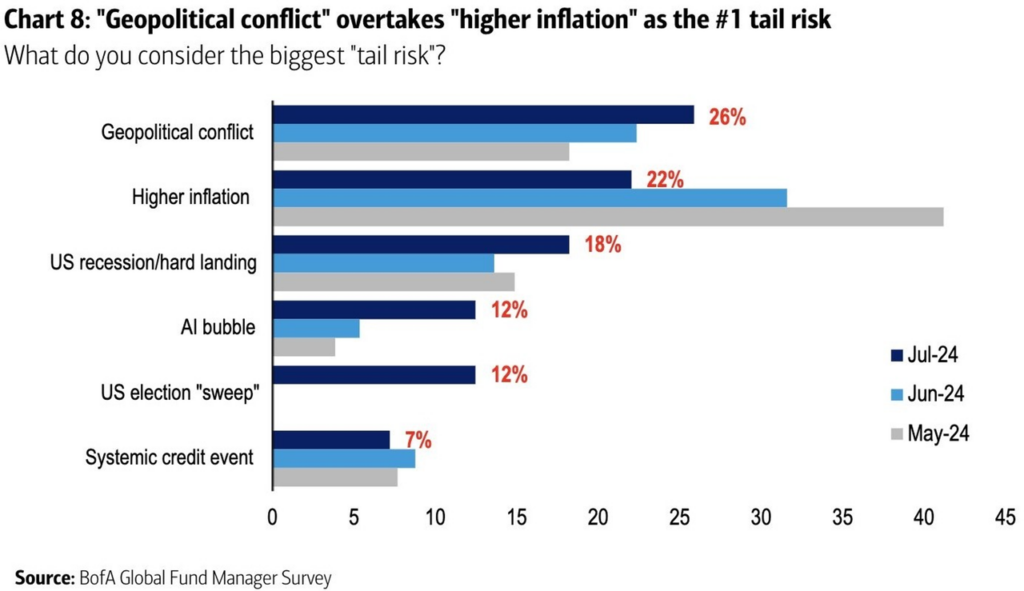

- Investor sentiment remains bullish, primarily due to the rising likelihood of rate cuts and a soft economic landing. However, increasing geopolitical tensions, particularly in the U.S., have dampened global growth expectations, with this metric falling to -27% from -6%—the lowest level since March 2022.

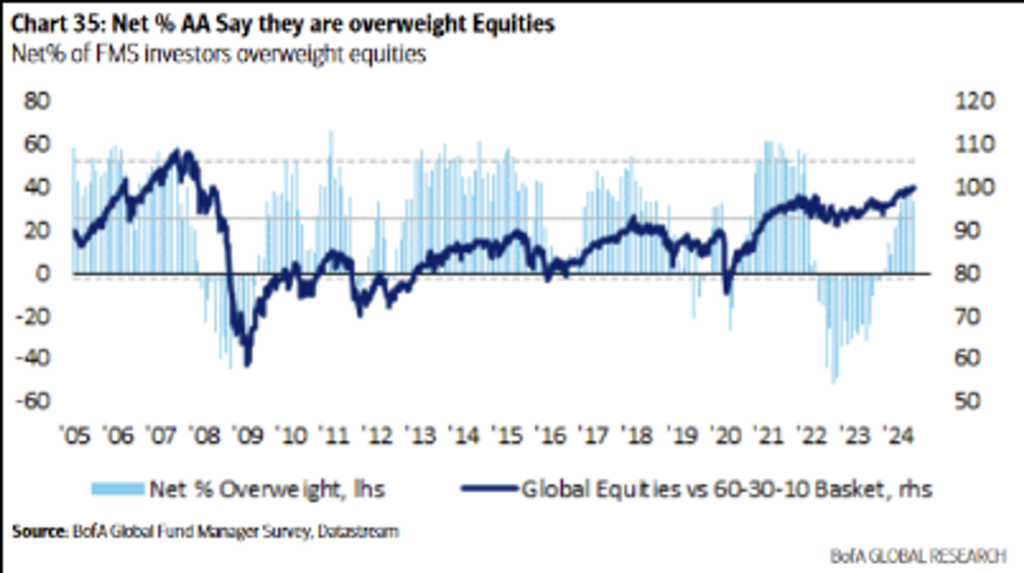

- In terms of asset allocation, fund managers are heavily overweight on stocks (net 33%), compared to a net 39% overweight in June and a net 41% overweight in May.

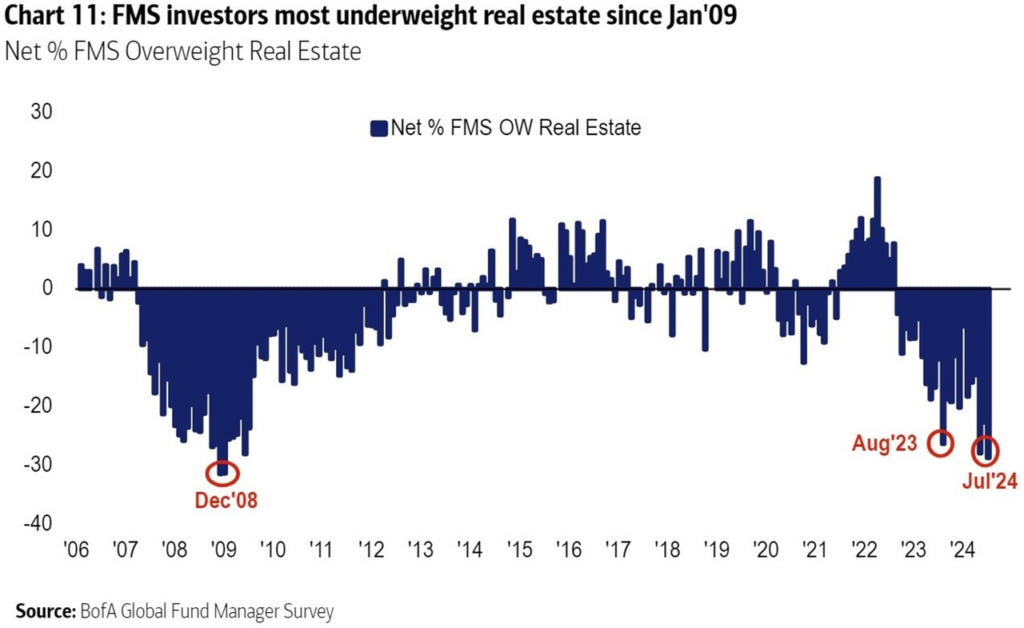

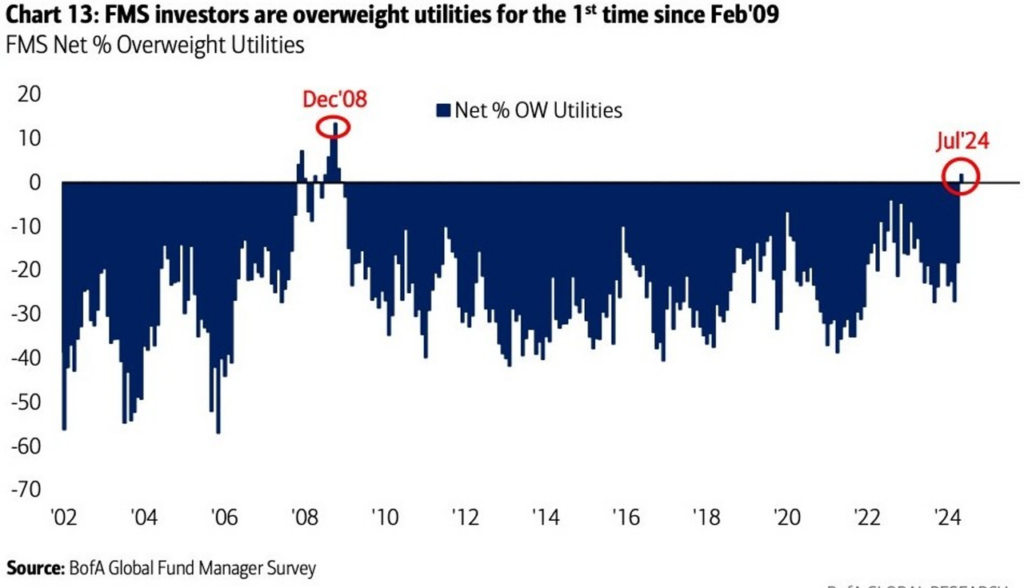

- Notably, the largest underweight positions are in real estate investment trusts (REITs), marking the lowest level since January 2009, while there has been the first overweight position in utilities since February 2009.

- Geopolitical conflict has surpassed higher inflation as the top-tail risk. This shift, the first in six months, reflects heightened global tensions, including ongoing conflicts in Ukraine and Gaza, and strained relations between China and Taiwan.

3. Crypto Market Pulse

3.1. Market Overview

The crypto market experienced a significant sell-off, primarily due to risk aversion swept through financial markets and Genesis began distributing digital assets to creditors. Additionally, geopolitical tension is rising in the Middle East, adding to investor skittishness. At the time of writing, Bitcoin dropped more than 10%, hitting a low near $52K.

In terms of altcoins, they have generally underperformed and suffered significantly against BTC in Q2, as indicated by OTHERS and TOTAL3. OTHERS represents the total crypto market cap without the top 10, reflecting altcoins. OTHERS/BTC is now at what it was in June 2023 and lower than the April crash. TOTAL3, which includes all cryptocurrencies excluding Bitcoin and Ethereum, is still 131% away from their previous all-time highs.

In terms of market narrative popularity and performance, Meme, RWA, and AI are the leaders so far this cycle. In my view, these three trends will continue to dominate the market shortly. Memes are catalyzed by GameStop-related events linked to Keith Gill, known as “Roaring Kitty,” returning to social media, which has fueled a meme-buying mania. AI has a catalyst from NVIDIA, and RWAs have catalysts from traditional big firms like BlackRock and Goldman Sachs, which will launch three tokenization projects by the end of the year.

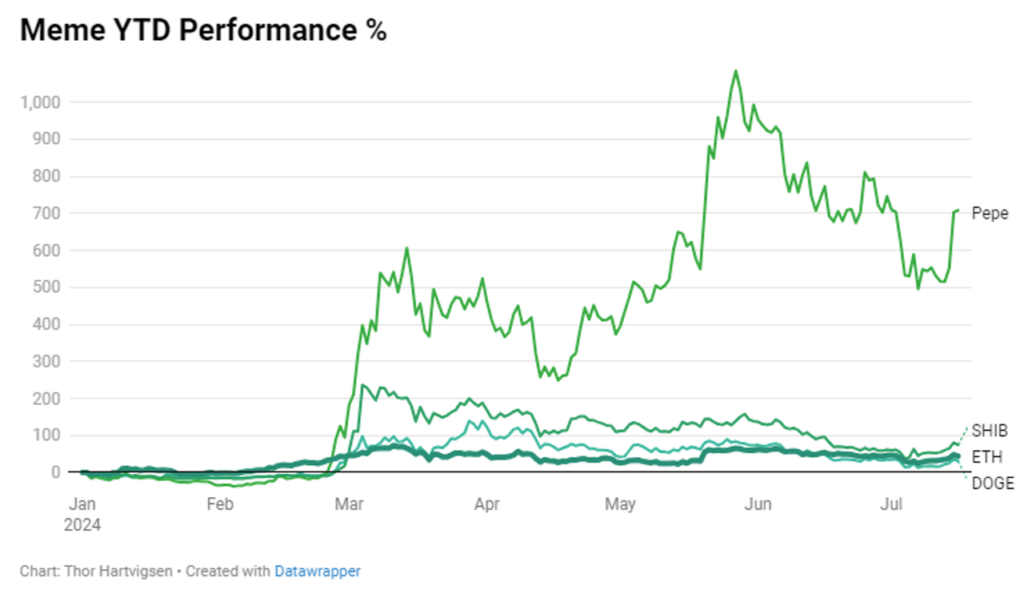

The best-performing category was Meme, led by $PEPE, which has been outperforming the market since the April dump. The ETH ETF news has been very bullish for $PEPE because it is the main ETH memecoin behind $SHIB and is treated as an ETH beta by some traders. I think it will end up flipping SHIB. Within the small and microcap exploration segment, we can consider meme tokens on the Solana ecosystem, which can provide opportunities for transformative investments that can lead to significant long-term wealth creation.

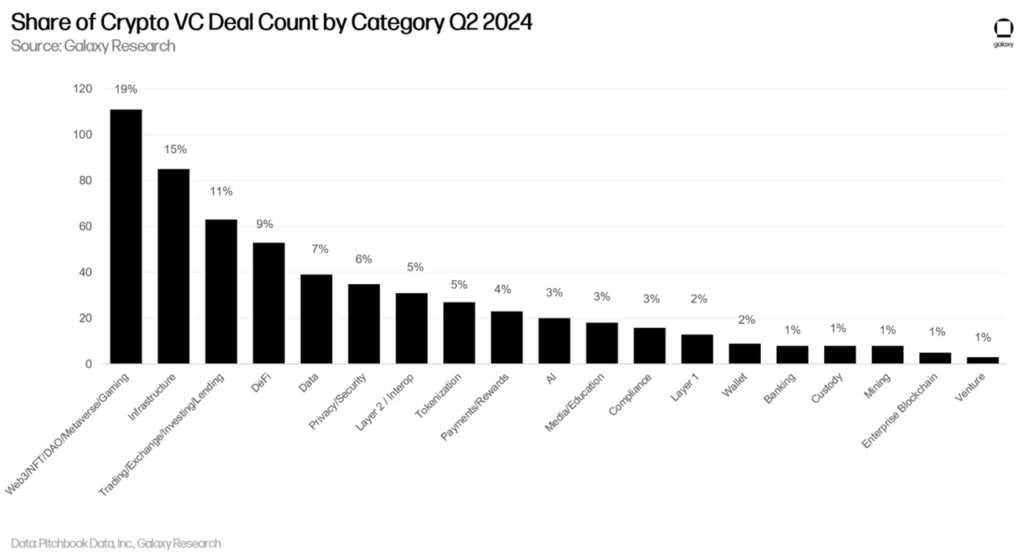

In terms of fundraising by category, Web3 led the way with 19%, driven by an uptick in decentralized social media and gaming-related deals. The infrastructure category ranks second in deal count with 15% of the deals this quarter. Trading and DeFi-related crypto companies followed with 11% and 9% of all deals completed in Q2 2024.

3.2. Some key points to watch

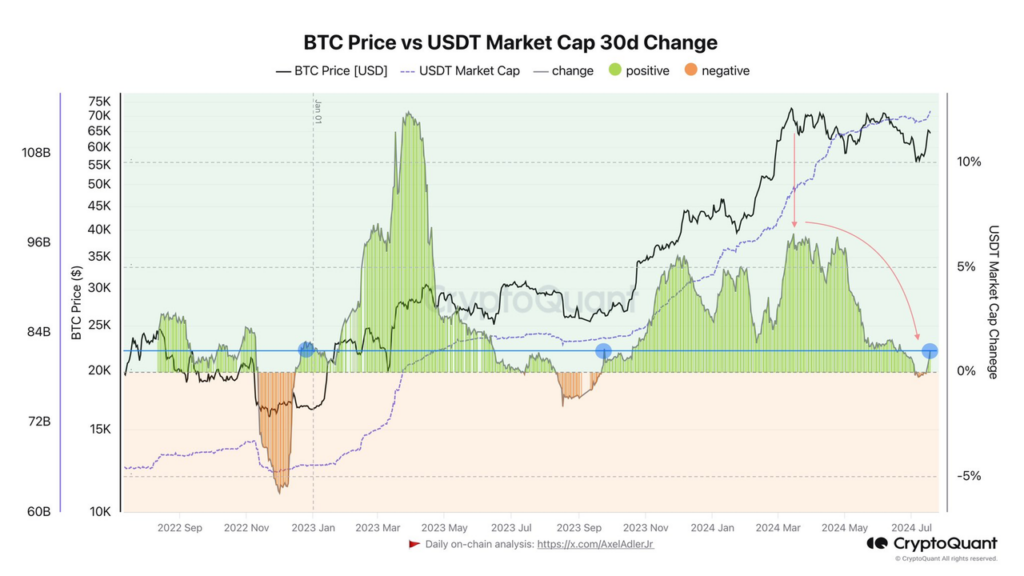

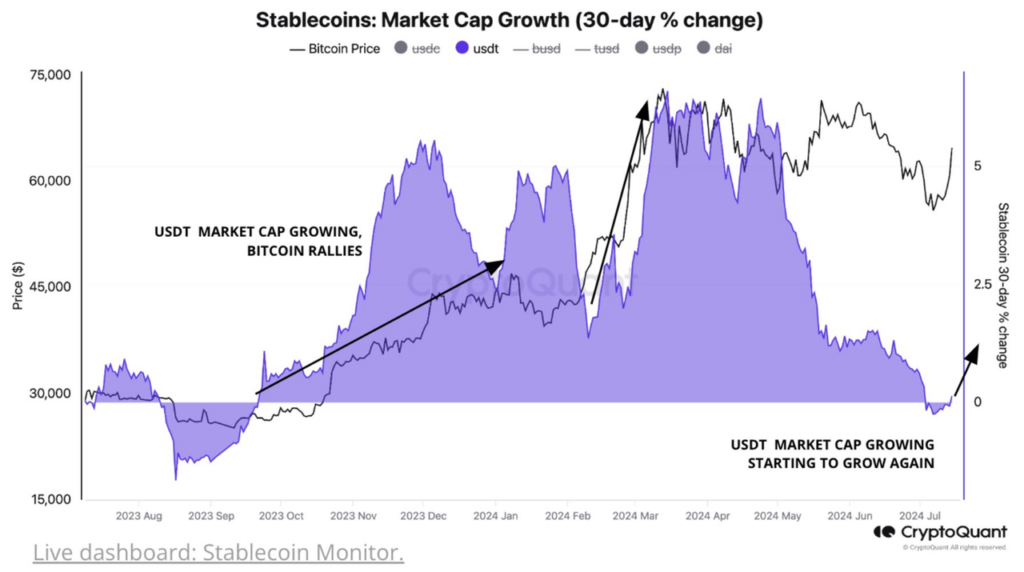

After falling from the $74K level, monthly changes in the capitalization of Tether (USDT) show an increase. Typically, the growth of this metric directly correlates with the rise of Bitcoin.

Additionally, the stablecoin supply is at an all-time high, signaling new capital inflows to crypto. This year alone, their market cap increased by approximately $30 billion, indicating continuous capital injection since October 2023. This suggests the next phase of the upward push is still ahead.

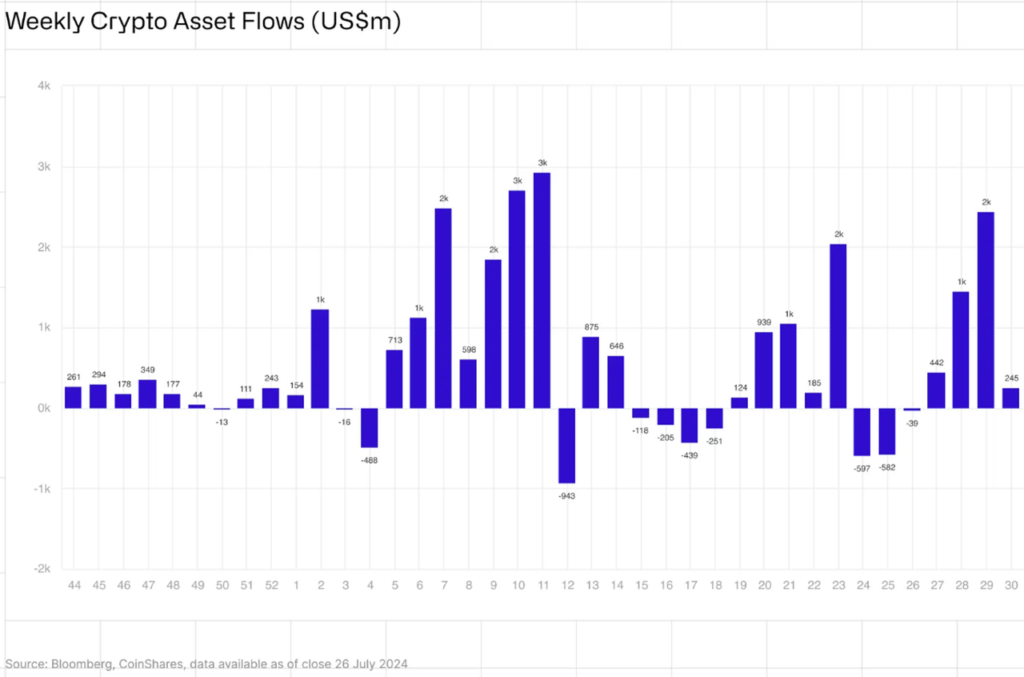

The Bitcoin ETFs have seen $18 billion in net inflows this year. Additionally, Morgan Stanley allowed its financial advisers to offer Bitcoin ETFs to wealthy clients, further legitimizing Bitcoin as a mainstream investment. Morgan Stanley’s decision may pave the way for other banks that have been reticent to offer digital assets to consider tapping into the sector.

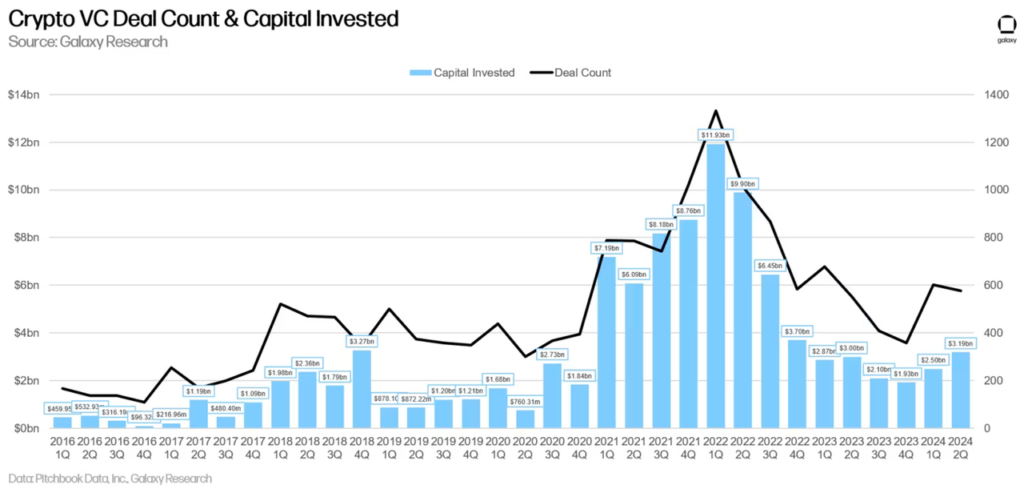

The trends in venture capital investments in the cryptocurrency sector show recovery and stabilization, which makes us more bullish in the long run. Specifically, capital invested rose from $2.5 billion in Q1 to $3.2 billion in Q2, with the deal count stabilizing around 600.

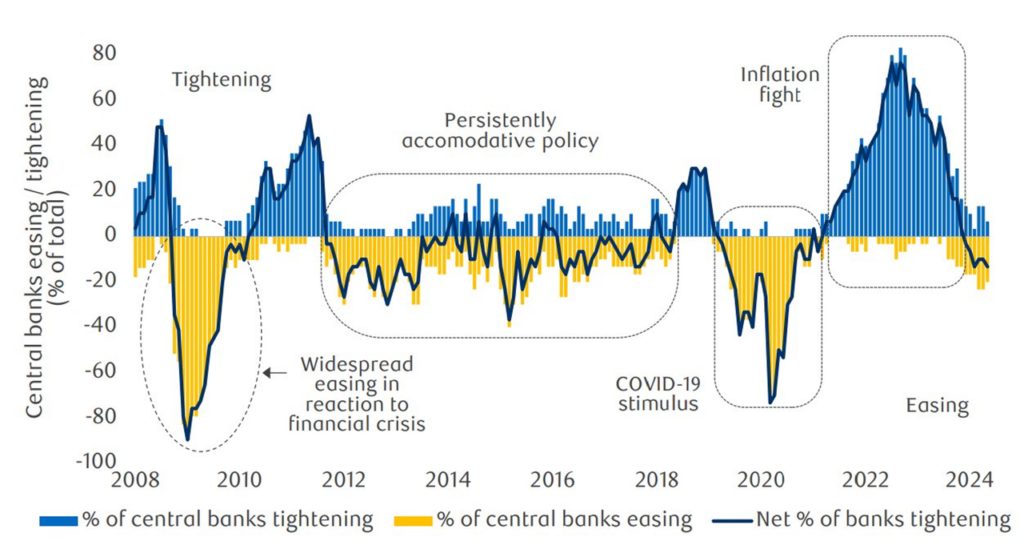

Global liquidity is currently recovering as the central bank easing cycle has begun, with the ECB, BoE, PBoC, and BoC already decreasing rates, and the FED is expected to cut rates soon. Notably, Bitcoin is the most directly correlated asset to global liquidity. Historically, Bitcoin bull markets have coincided with the rapid expansion of global liquidity. We believe Bitcoin’s rise is “inevitable” as long as global liquidity keeps expanding.

Germany’s bitcoin sales are complete; they have sent their entire balance of 50,000 BTC ($3 billion) to exchanges and market makers. Considering the amount sold, the price held up well due to strong ETF demand acting as a counterforce. We don’t need to worry about repaying Mt. Gox creditors billions of dollars worth of Bitcoin next. We think it will not lead to a massive sell-off by creditors since they are more strategic investors than the German government.

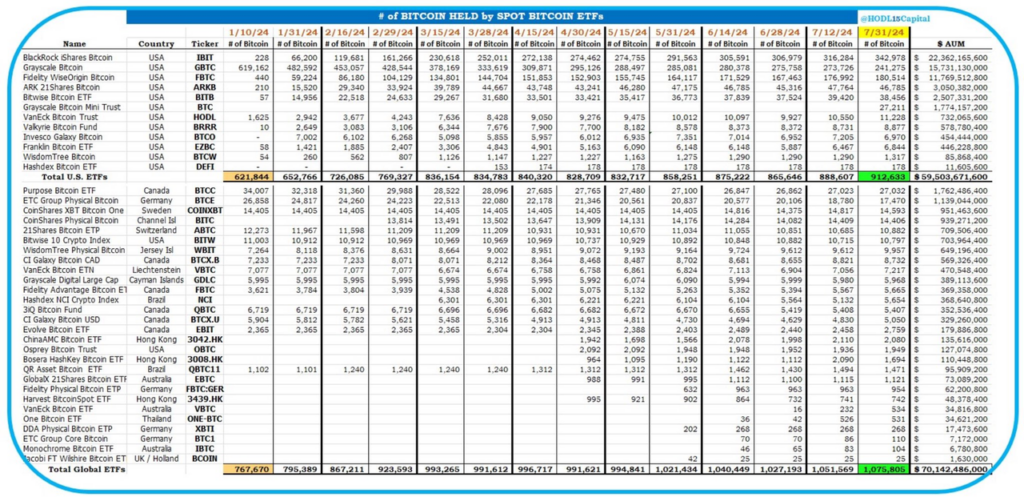

Buying from spot ETF investors is accelerating to a pace not seen since their launch in Q1, especially in the U.S. Bitcoin ETFs around the world now hold 1,075,805 BTC of the 21-million supply cap, underscoring growing institutional interest in Bitcoin ETFs as a strategic investment, even in volatile conditions. Shortly, once regulatory rules for this industry develop, more big players will be able to participate. Thus, we anticipate that ETF Bitcoin Holdings will reach 10% of Bitcoin’s total supply, and the amount of Bitcoin that ETFs accumulate over time will increase significantly, applying upward pressure on Bitcoin prices.

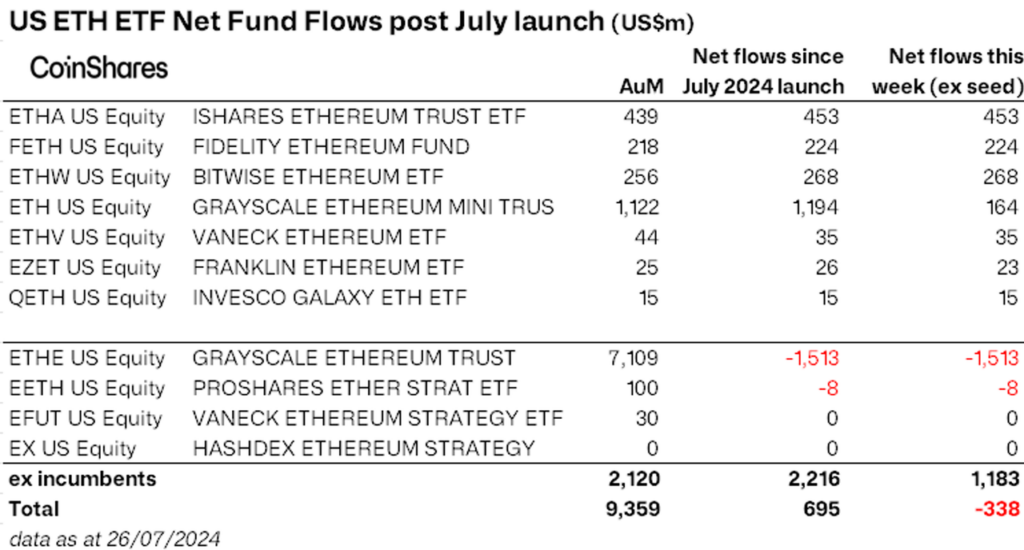

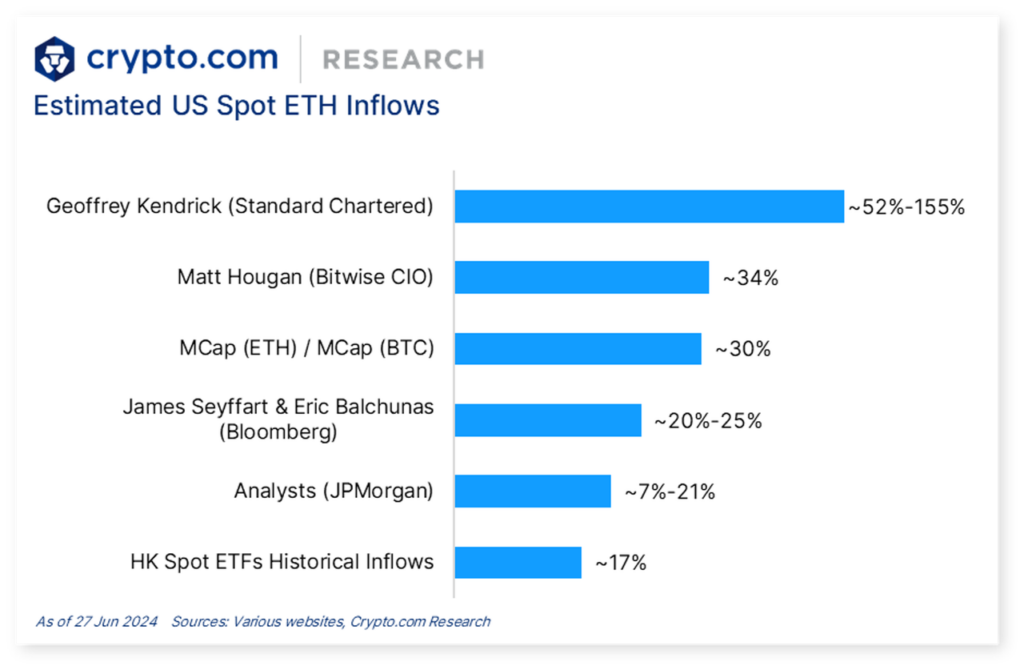

The launch of the ETH ETF has injected renewed hype into the crypto market. Now, not only Bitcoin but also Ethereum is under consideration by financial institutions with billions of dollars of unallocated capital. The Ethereum ETFs, after the first week, saw $1.18 billion in inflows, although massive outflows from Grayscale meant a net outflow of $338 million. Projections estimate ETH ETFs could see $1.4–$4.5 billion in inflows within six months, significantly boosting the price of Ethereum.

Trump spoke at the Bitcoin 2024 conference. The potential future U.S. president speaking at a crypto event is notably bullish. Key takeaways from Trump’s speech include:

- Stopping the U.S. government from selling Bitcoin (they hold over 200k of seized Bitcoin).

- Creating a “Strategic National Bitcoin Stockpile”.

- Embracing stablecoins for U.S. dollar dominance.

- Ending the development of a CBDC and blocking future attempts.

- Convening a Bitcoin council to create transparent regulatory rules, ending anti-Bitcoin policies.

- Positioning the U.S. as the crypto capital of the world and the global Bitcoin superpower.

- Highlighting Bitcoin as the ninth most valuable asset in the world, with the potential to surpass gold in value.

4. Closing Thoughts

The evidence presented in this report suggests that we are still heading in the right direction. We maintain our conviction that the second half of the year will be positive for Bitcoin’s price as significant headwinds have been resolved (German government selling, Bitstamp & Kraken Bitcoin distribution, miner capitulation) and the macro environment supports this outlook (rates dropping, global liquidity returning, Bitcoin stockpile narrative, Trump re-elected president – this scenario could create a major tailwind for cryptocurrency and fuel Bitcoin’s rally).

From an investment perspective, we anticipate that people will take their profits from stocks and roll them into crypto as the US elections approach in November 2024, with crypto becoming a central issue in these elections. Looking ahead, the Magnificent Seven’s growth is unlikely to continue at the same pace due to their considerable size. With stocks being at all-time highs and valuations skyrocketing in 2024, many investors are uneasy about putting more money into equities.

Keep in mind that “Bull markets make you money, bear markets make you rich.” It is important to zoom out and not get caught up in the day-to-day gyrations of the market. When markets sell off, look at the bigger picture. We continue to see dips as buying opportunities for what’s coming later in the year.

Crypto markets are all about capital rotation. It is foreseeable that Bitcoin will continue attracting and absorbing market capital, causing price drops in other assets. However, ETH is probably one of the easiest mid-term long setups right now. We expect ETH/ETH-betas/RWA to lead the next move.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.