1. Overview

- Recently, several key economic indicators have emerged that investors should closely monitor:

- First, let’s examine growth:

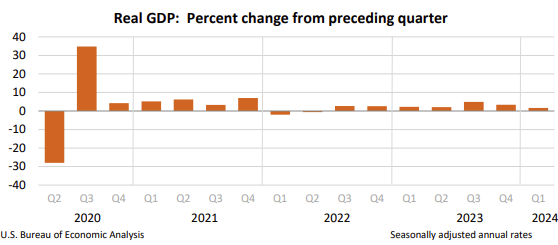

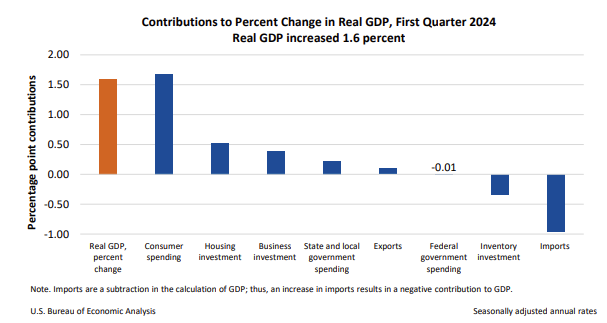

- The US real GDP experienced a QoQ annualized increase of 1.6% in the first quarter, which was significantly below market expectations of 2.5% and marked a notable deceleration from 3.4% in the previous quarter.

- First, let’s examine growth:

- The growth was primarily driven by robust consumer spending and housing investments.

- Next let’s look at jobs:

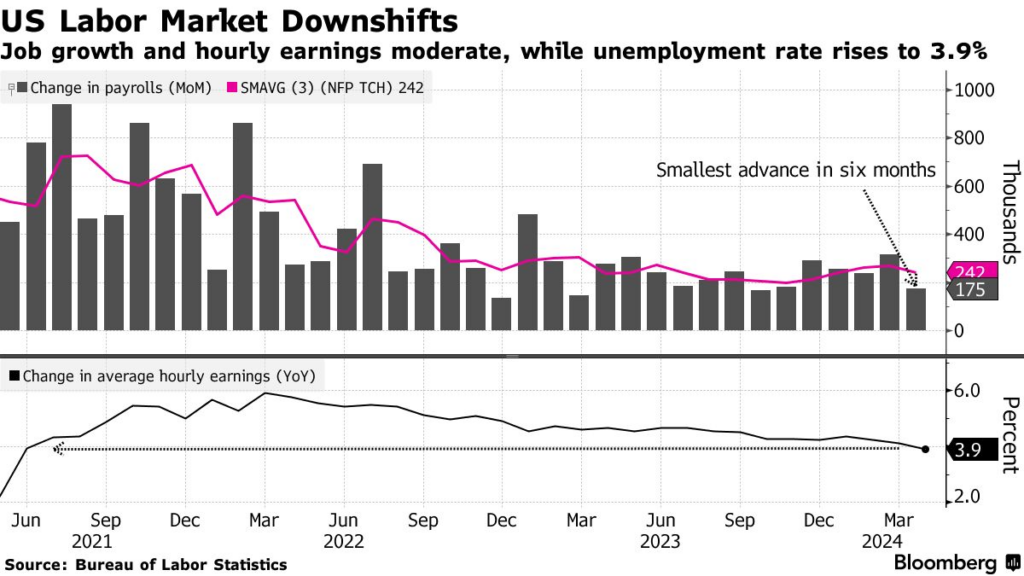

- Nonfarm payrolls in April added 175,000 jobs, marking the smallest increase in six months, as the unemployment rate ticked upward, indicating a slowdown in the labor market. Wage growth was 3.9% year-over-year in April, the slowest rate in nearly three years.

- This moderation in job and wage growth could help contain inflation, potentially supporting the case for interest rate cuts. However, the Federal Reserve will require sustained positive data before making such decisions.

- Finally, let’s comb through the Fed’s policy decision and Chairman Powell’s press conference:

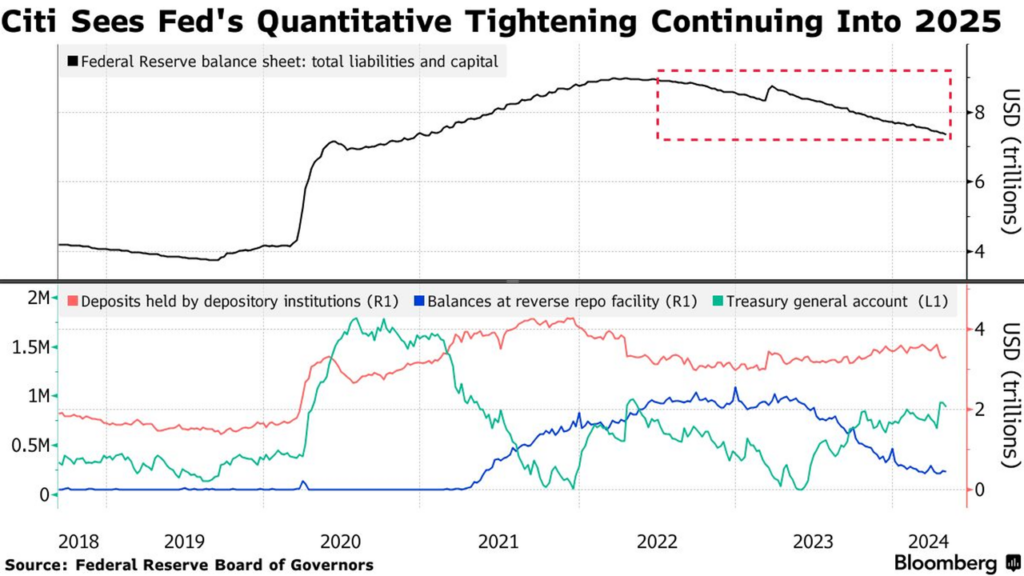

- The U.S. Central Bank maintained its benchmark overnight interest rate at the current range of 5.25%-5.50%, unchanged since July 2023. During its latest meeting and Chairman Powell’s press conference, the FOMC took a dovish stance. It announced a slower pace for reducing its balance sheet starting in June, scaling back to $25 billion from the initially planned $60 billion, which exceeded market expectations.

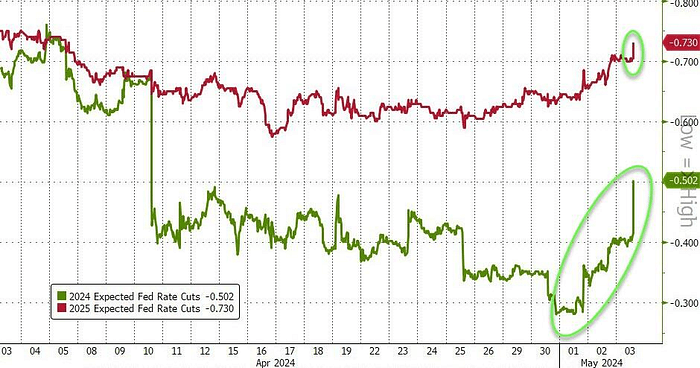

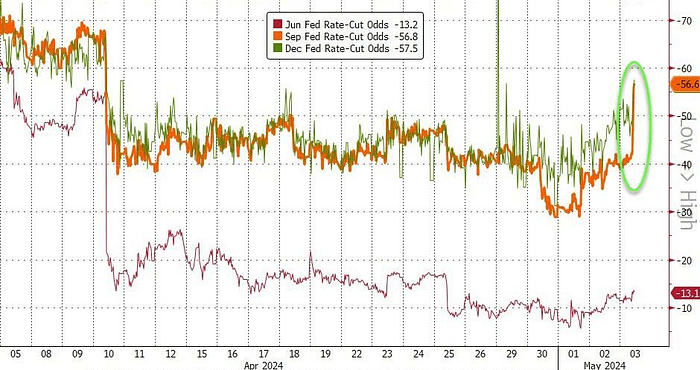

His speech gave zero indication of near-term rate cuts. Consequently, the expectations for a Fed rate cut continue to be delayed and even dampened. Financial markets boosted the odds of a September rate cut and saw the U.S. central bank reducing borrowing costs twice this year instead of only once.

2. Where does that leave us?

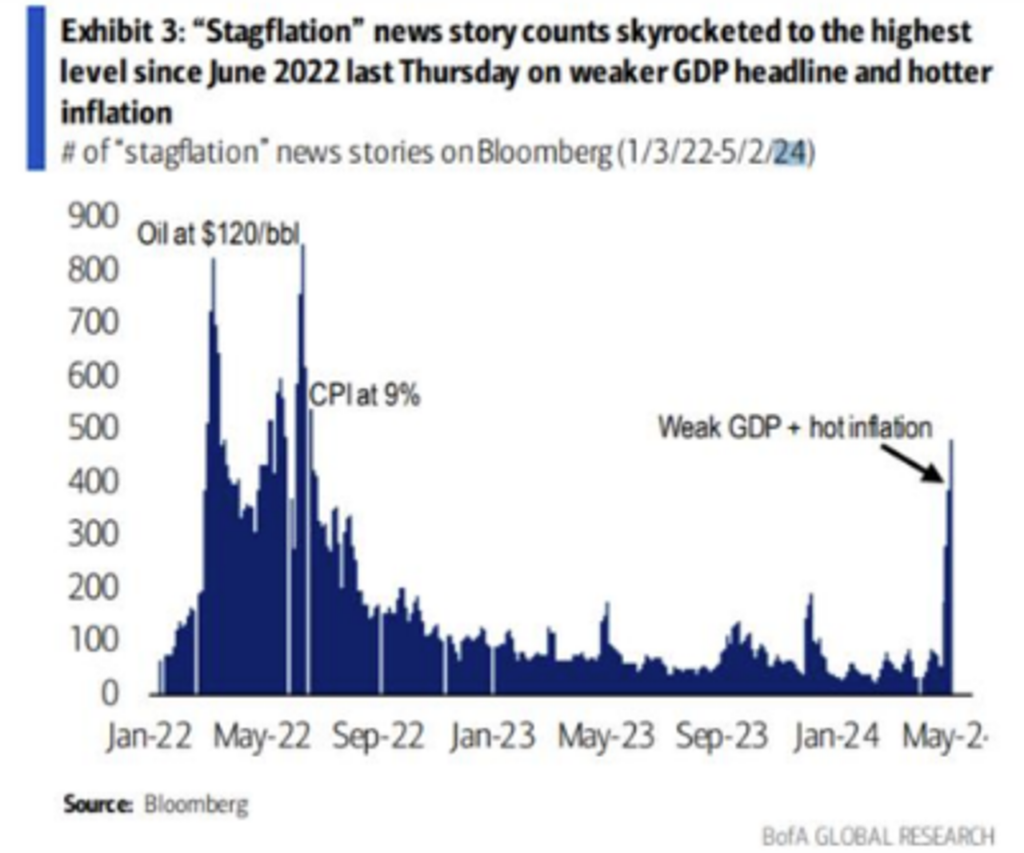

- The market outlook has recently shifted toward a more optimistic perspective, with many analysts anticipating a soft landing. However, signs of stagflation are becoming apparent in the current U.S. economy, introducing a period of economic uncertainty.

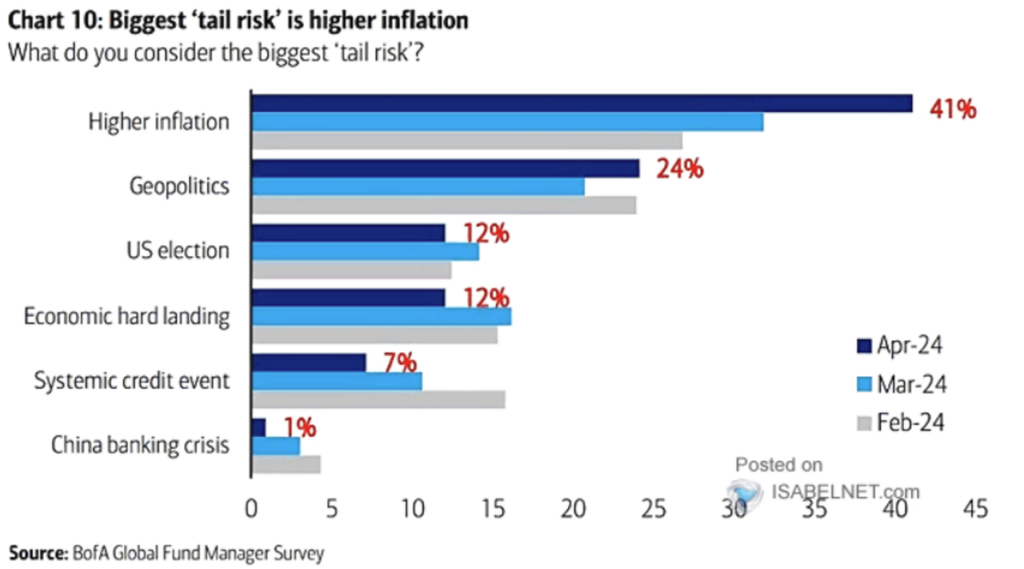

- The return of inflation is largely attributed to geopolitical instability, which could disrupt supply chains and drive commodity prices higher (such as certain food items and oil). It is crucial to remember that it is an election year, and geopolitical tensions are elevated. The unpredictable nature of these factors means anything could happen.

3. Final thoughts

- The current market environment is experiencing reflation rather than recession, making it a conducive period for investment in riskier assets over the medium term. Additionally, recent advancements in AI by major tech companies have generated significant interest in both the U.S. stock market’s AI segment and the crypto AI sector, with Nvidia leading the way following earnings that surpassed expectations and spurred a surge in the AI sector. It is crucial to closely monitor the ongoing developments within this industry.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.