In the fast-paced world of crypto trading, market sentiment plays a crucial role in driving price action. Understanding how this sentiment evolves and reacts in low liquidity markets can be the difference between capitalizing on market moves and getting caught off guard by rapid price changes.

This blog dives deep into three key aspects that every crypto trader must master: funding rates, the dynamics of low liquidity markets, and the strategies that market makers use to drive extreme price movements by leveraging funding rates.

1. Funding Rate: The Pulse of Market Sentiment

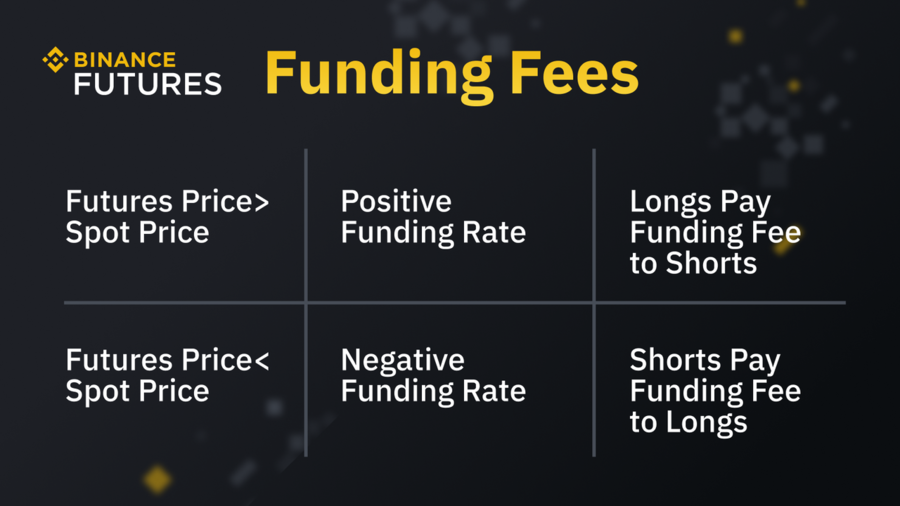

The funding rate is a periodic payment exchanged between long and short positions in the perpetual futures market. Unlike traditional futures that expire, perpetual contracts rely on funding rates to keep the price of futures aligned with the spot market. This mechanism ensures that if the futures price deviates too far from the spot price, the funding rate encourages traders to bring them back into alignment.

- A positive funding rate shows that market participants are betting on a rising price. However, overly positive rates could indicate the market is over-leveraged on the long side, making it susceptible to liquidation.

- The negative funding rate shows pessimism, with the majority of traders expecting a decline. However, extremely negative funding rates can signal a potential short squeeze if the price moves against the shorts.

For crypto traders, the funding rate serves as a real-time gauge of market sentiment.In low liquidity markets, exaggerated funding rates combined with small changes in price can lead to sudden price explosions or crashes. Understanding these dynamics allows traders to position themselves strategically and avoid being caught off guard.

2. Low Liquidity Markets: The Playground of Volatility

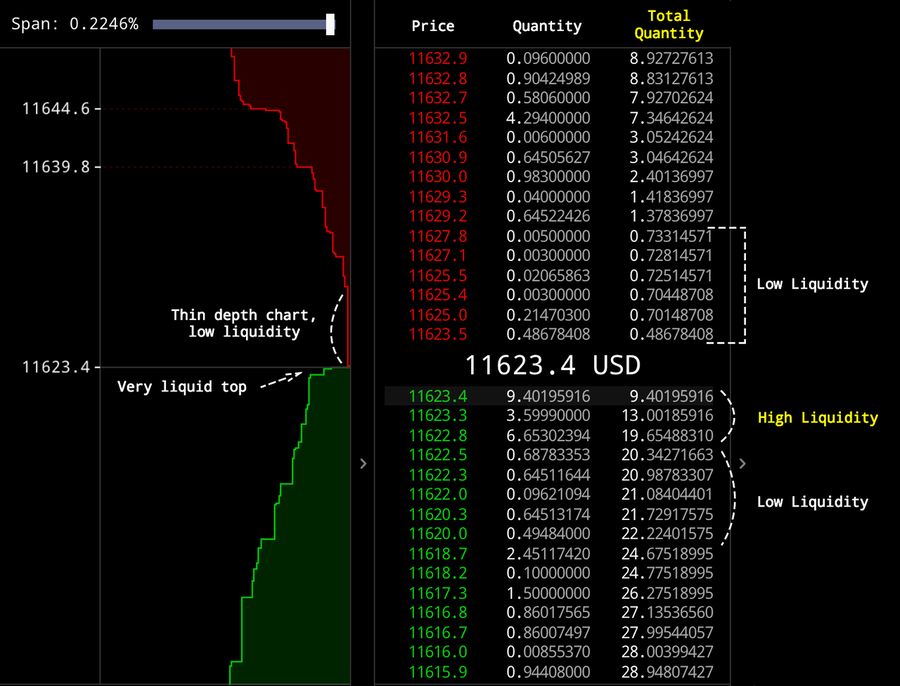

A low liquidity market is one with fewer active traders, smaller trading volumes, and thin order books. In such markets, there is limited availability of buy or sell orders at any given time, meaning even small orders can significantly impact prices.

Characteristics of low liquidity markets:

- Wider bid-ask spreads: The difference between the buy and sell prices is larger, making it costlier to enter and exit trades.

- Higher slippage: When placing large orders, the execution price can be far from the expected price due to a lack of counterparties.

- More volatility: Price movements tend to be sharper and less predictable, as fewer trades are needed to cause significant fluctuations.

In low-liquidity markets, the price discovery process is erratic and susceptible to manipulation. Traders with significant capital (often called “whales” or “market makers”) can easily influence the market by placing large buy or sell orders that move prices disproportionately.

For retail traders, these markets are both an opportunity and a risk:

- Opportunity: Traders can capitalize on quick price moves if they anticipate volatility correctly.

- Risk: Small errors in judgment can lead to outsized losses due to sharp and unpredictable price swings.

A key risk in low liquidity markets is that technical indicators and market data (like funding rate, open interest, and liquidation heatmap) become quite noisy. Traders must be more cautious and look for confirmation across multiple indicators before committing to a trade.

3. How Market Makers Drive Token Prices Skyrocket in Low Liquidity Markets Using the Funding Rate Tool

Market makers are entities that provide liquidity by placing both buy and sell orders in the market. In low liquidity markets, they wield significant influence due to their ability to control large portions of trading activity. Market makers strategically use automated algorithms to place orders that ensure they profit from the spread between bid and ask prices.

However, market makers can go beyond just providing liquidity — they can also manipulate market sentiment and price direction through their trading activity, especially by leveraging the funding rate mechanism.

3.1. Manipulating Funding Rates to Influence Market Sentiment

Market makers can manipulate the funding rate by strategically placing orders that create the illusion of either bullish or bearish sentiment:

- Bearish Signal Manipulation: A market maker can open large short positions in the futures market, driving the funding rate negative. This encourages retail traders to also go short, expecting a price drop, while the market maker simultaneously accumulates long positions in the spot market at favorable prices.

- Bullish Signal Manipulation: Conversely, a market maker can push the funding rate positively by opening significant long positions. This inflates the appearance of bullish sentiment, encouraging others to follow the trend, only for the market maker to offload their tokens as the price surges.

3.2. The Short Squeeze: Driving a Skyrocketing Price

One of the most powerful ways market makers drive prices skyward in low liquidity markets is through the creation of a short squeeze. This happens when a large number of traders take short positions in response to negative funding rates, betting on a price decline. The market maker can then manipulate the spot market by driving the price higher, forcing short traders to cover their positions.

This creates a cascade of buying pressure, as short positions are liquidated, forcing traders to buy back the asset at increasingly higher prices. This artificially generated buying pressure sends the price skyrocketing.

Short squeeze on the Teller project

Steps to Trigger a Short Squeeze:

- Artificially Lower the Funding Rate: Market makers open short positions, driving the funding rate negative, which lures other traders into going short.

- Spot Market Manipulation: They begin buying up large quantities of the token in the spot market, driving up the price.

- Short Liquidations: As the price rises, short traders begin to hit their liquidation points, forcing them to buy back the asset and further push up the price.

- Exit at the Peak: Once the price has surged enough, market makers begin selling their tokens into the buying frenzy, profiting from both their spot positions and any long positions in the futures market.

3.3. Why This Strategy Works in Low-Liquidity Markets

- Thin-order books make it easier for large traders to move the price with relatively little capital.

- Retail traders are more likely to be caught off guard by rapid price swings and may not have enough capital to cover their short positions, leading to forced liquidations.

- Low liquidity amplifies volatility, which means that even modest price moves can spiral into extreme price changes.

- Market makers (and project owners) typically hold a substantial portion of the token supply, giving them outsized control over the market. Coordinating project-moving news, they can directly influence the token’s price through their buying and selling actions.

4. Closing thoughts

Mastering market sentiment in low liquidity markets requires a deep understanding of both the funding rate mechanism and the behavior of market makers.

Traders who can anticipate how funding rates will evolve and understand the manipulative tactics used by market makers in low liquidity environments stand to capitalize on extreme price movements. However, it’s equally important to recognize the risks and avoid getting caught in liquidation traps or manipulated price surges.

By using funding rates as a sentiment tool, navigating the volatility of low liquidity markets, and recognizing the tactics of market makers, traders can enhance their strategies and profit from these unique market dynamics.

Stay tuned for our next blog where we’ll explore a detailed case study of a well-known market maker driving the price of a crypto project.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.