1. Recommendation & Position Summary

OKX and OKB: A Strategic Transformation

Historical Context (Pre-2025):

Founded in 2017, OKX (formerly OKEx) quickly rose to become a top-tier global crypto exchange. By 2023, the platform had a strong focus on derivatives and expanded its reach into the DeFi/Web3 space with products like the OKX Wallet and NFT marketplace, creating a comprehensive, closed-loop ecosystem.

While the native token, $OKB, offered utilities such as fee reductions, it lacked a clear, robust blockchain ecosystem. The OKT Chain struggled to attract significant Total Value Locked (TVL), rendering it a “dead chain.” This absence of a dedicated ecosystem limited $OKB’s utility and led to it being undervalued compared to competitors like Binance’s $BNB.

Current Position and Strategic Shift:

OKX has recently unveiled a comprehensive strategy to fundamentally change the tokenomics of $OKB. The plan includes a massive burn of 65.26 million $OKB (valued at approximately $7.6 billion), reducing the total supply by over 50%. The total supply is now capped at 21 million, mirroring the “hard cap” of Bitcoin.

This strategic move has driven the price of $OKB to soar from $43 to $120 (+179%), firmly establishing the native token as the central component of the entire exchange and its growing ecosystem.

The new tokenomics also introduces several key changes:

- Abolition of new issuance: New $OKB tokens will no longer be minted.

- End of periodic burning: The previous burn mechanism has been discontinued.

- Migration to a new blockchain: $OKB is migrating from the Ethereum network to OKX’s new native blockchain, “OKX X Layer”, to enable deeper integration with its DeFi, payments, and Real World Assets (RWA) initiatives.

As part of this transition, the old OKT Chain will be decommissioned on January 1, 2026. The $OKT token has been delisted, with users given the option to swap their $OKT for $OKB at a price of $104. Additionally, OKX is expanding its regulatory compliance efforts, with a rumored re-entry into the U.S. market in April 2025 and a potential U.S. IPO listing in September 2025.

2. OKB Investment Thesis

This thesis argues for a re-evaluation of $OKB, driven by its new tokenomics and strategic positioning.

2.1. “Hard Cap + Native Chain” – A Fundamental Re-rating of OKB

OKX’s decision to fix the total supply of $OKB at 21 million (by burning 65.26M tokens and halting all new issuance and periodic burns) is a game-changer. By elevating $OKB to the native token of its new X-Layer blockchain (replacing the old OKT/OKT Chain), OKX is unifying its utility across the ecosystem. This makes $OKB not just a utility token for CEX fee discounts, but also the native asset for on-chain gas fees and other functions.

This tokenomics reset is akin to a transformation from a “utility-only” token to a full-fledged “platform token”, mirroring the re-rating that $BNB experienced with the launch of the Binance Smart Chain (BSC). From a valuation perspective, this scarcity-driven hard cap combined with expanded utility suggests a higher valuation multiple, even if short-term revenue doesn’t fully reflect it yet.

2.2. Sustained Market Leadership & Product Flywheel

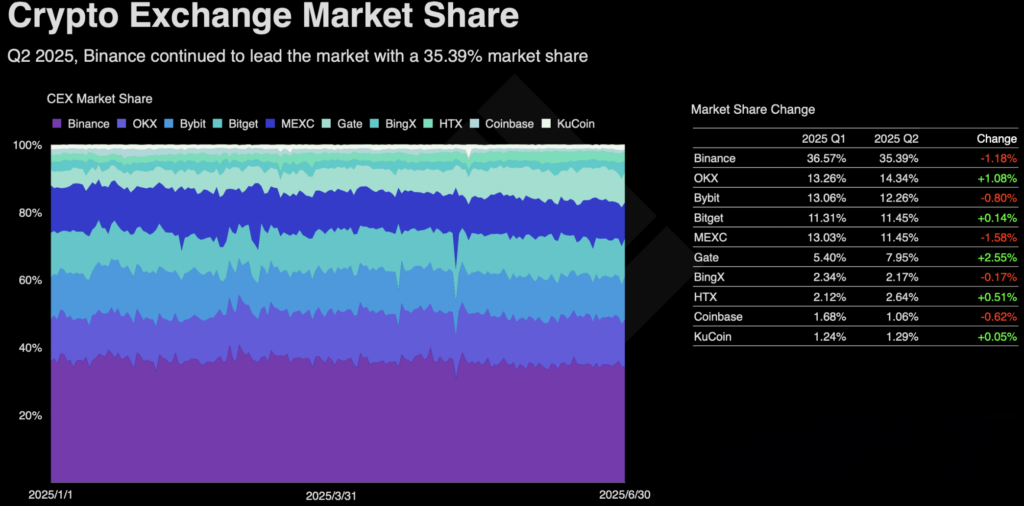

OKX has maintained its position as a top-two exchange from 2023 to 2025, demonstrating remarkable resilience and disciplined product execution. Despite competition from platforms like Bybit, OKX currently holds a significant 14.35% market share, trailing only Binance.

The platform has created a powerful product flywheel: from the OKX Exchange (CEX) to the OKX Wallet and DEX Aggregator, and now to the X-Layer L1. This integrated “triangle” offers users a seamless all-in-one experience, lowering user switching costs. The Wallet/DEX Aggregator briefly held the top market share in Q1 2025 for on-chain transactions and has since recovered to a top-four position.

With the X-Layer mainnet launching on August 16, 2025, and a $100M grant fund to attract builders, this flywheel is designed to shift the business model from CeFi-only to a CeDeFi hybrid. This diversification of revenue streams—from CEX fees and DEX routing margins to on-chain activity—bolsters the ecosystem’s self-sustaining loop.

2.3. Valuation & Growth Potential

- Current Metrics: $OKB currently has a market capitalization of $4.18B.

- Revenue: OKX’s estimated 2024 revenue is $1.5B, giving it a Price-to-Revenue (P/R) ratio of 2.7x. This is significantly lower than Coinbase (trading at 5x P/R) and $BNB (with an estimated 2024 revenue of $10B, trading at 12x P/R).

- Growth Target: Based on these comparisons and the catalysts driving the platform, we project $OKB has the potential to reach a 5x capital appreciation, targeting a market cap of $8.4B – $9B in 2025.

2.4. Key Growth Challenges

- Competition: Increased competition from exchanges like Bybit and Bitget could shrink OKX’s fee pool.

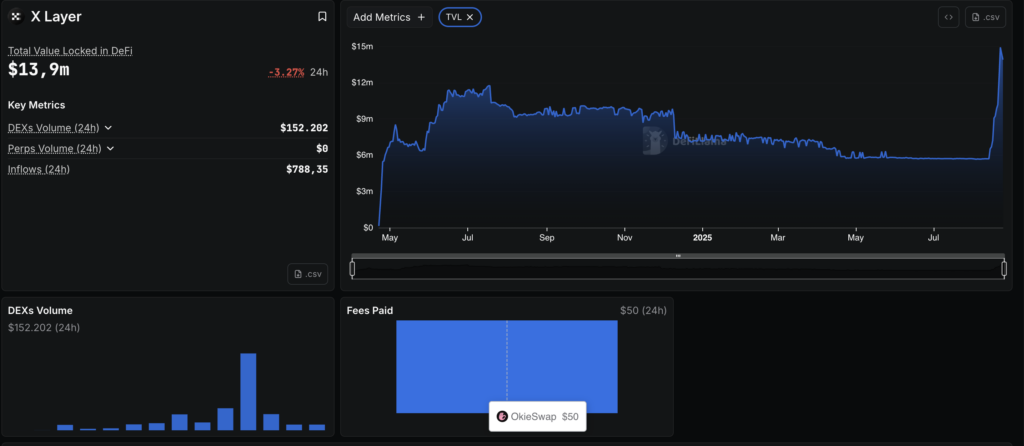

- On-chain Adoption: The X-Layer could face challenges in achieving product-market fit, with TVL/DAU remaining stagnant for several quarters.

- Regulatory Risk: Legal and regulatory issues could disrupt operations in key markets.

- Token Microstructure: Concerns remain regarding the token’s liquidity and concentration, which could lead to price shocks.

3. Business Model & Snapshot Metric

OKX’s business model is primarily driven by three core products: the Exchange, DEX Aggregator, and the X-Layer Chain. However, the main source of revenue currently comes from trading fees on its Spot and Futures markets. For this reason, analysts tend to focus their deep-dive analysis on these two key areas. The ecosystem also includes supplementary services that generate additional revenue, such as the Chain, NFT Marketplace, and Wallet.

3.1. Spot & Futures Trading

OKX’s fee structure for Spot trading is 0.08% for makers and 0.1% for takers. VIP users enjoy significantly lower rates (under 0.05%). For Futures trading, fees range from 0.02% to 0.05%, with VIP fees as low as 0.01% to 0.03%.

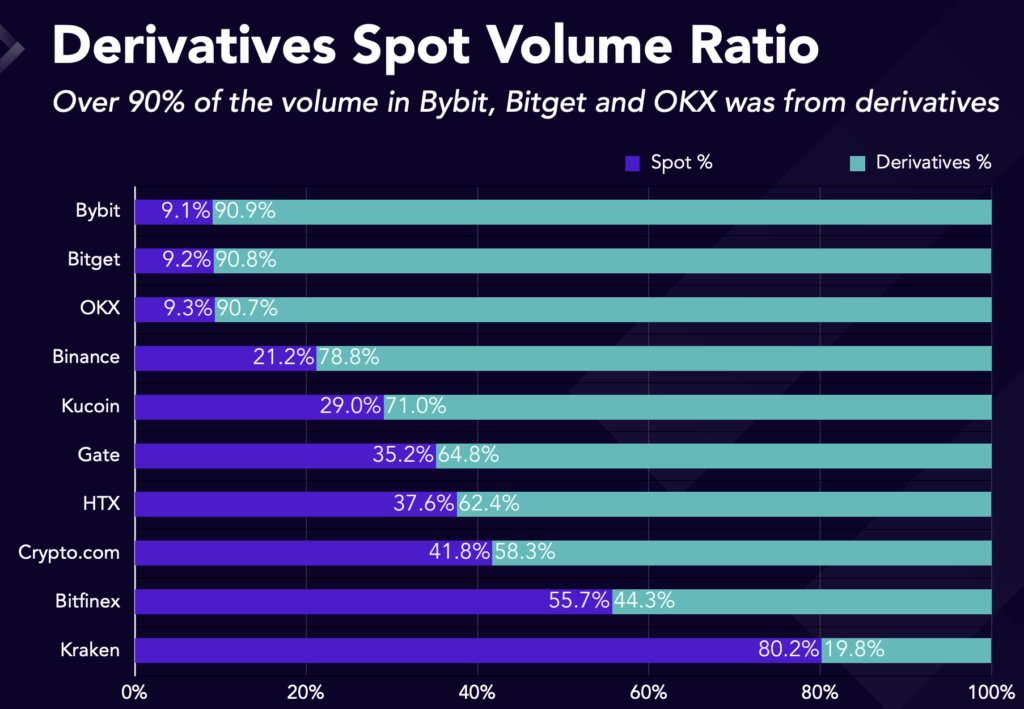

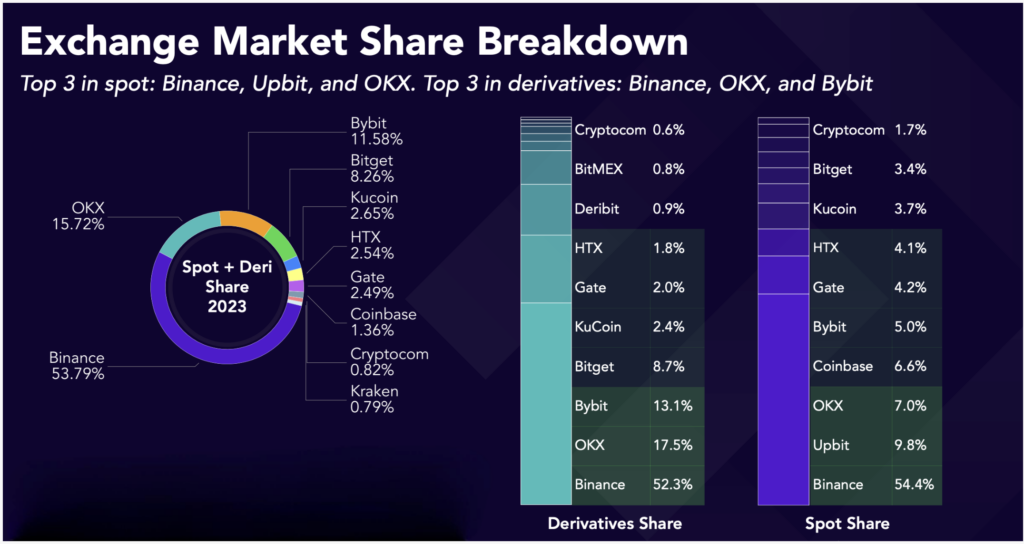

- Revenue Breakdown: In 2023, trading fees accounted for the majority of OKX’s revenue, with derivatives (Futures) making up 90.8% and Spot trading contributing 9.3%. This breakdown highlights OKX’s strong position in the perpetual market. The exchange solidified its status as the second-largest globally, capturing 15.72% of the total trading volume market share, only behind Binance (53.79%).

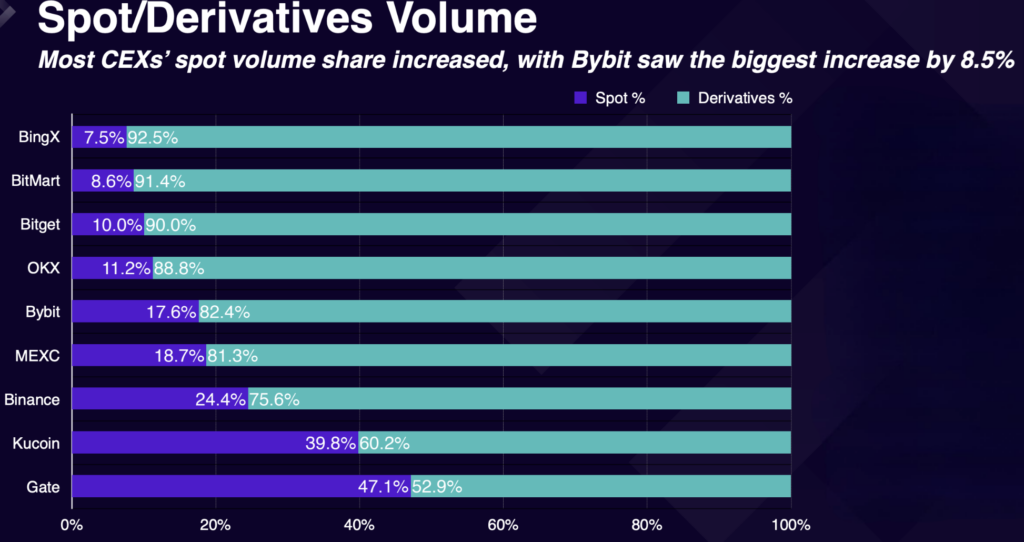

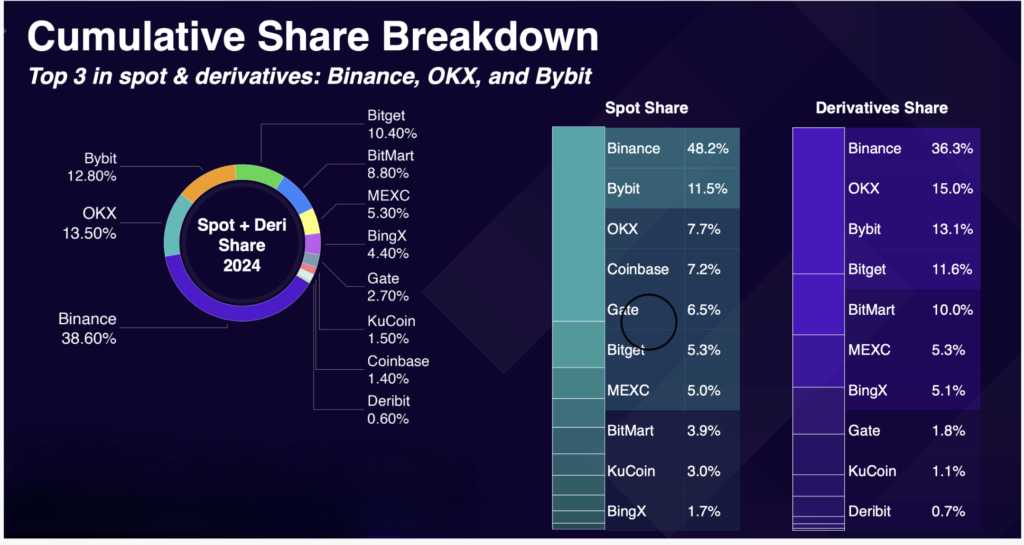

- In 2024, revenue from derivatives volume continued to make up the largest share at 88%, with spot trading at 11.2%. While OKX maintained its number two market share, both it (13.5%) and Binance lost ground to key competitors. Bybit (12.8%) is a direct regional rival to OKX in both the Spot & Futures sectors, while Bitmart (8.8%) and Bitget (10.4%) have also gained market share.

H1 2025 Market Performance

- In the first half of 2025, total crypto trading volume reached $21.6 trillion, marking a 6.16% decrease in Q2 compared to Q1.

- Despite this market-wide decline, OKX continued to solidify its position as the second-largest exchange. Its market share saw a positive increase from 13.26% in Q1 to 14.34% in Q2, signaling a strong trend toward its all-time high of 15.72% set in 2023. Analysts estimate OKX’s Q2 2025 revenue to be approximately $1.2 billion USD, based on its total spot and futures trading volume.

- Margin & Lending Services: In addition to providing margin trading, OKX allows users to borrow assets for leveraged trading. The exchange earns interest in these margin loans (e.g., approximately 0.01% per day for USDT). The platform also features OKX Earn, which connects lenders and borrowers.

- Staking, Earn & Launchpad: OKX Earn is a comprehensive suite of products that includes flexible savings, staking, and various DeFi investment opportunities.

3.2. OKX Wallet – Dex Aggregator

OKX’s second core product is the powerful combination of its Web3 Wallet and DEX Aggregator, which are deeply integrated.

- The OKX Wallet is a standout product, featuring MPC (Multi-Party Computation) Keyless technology that eliminates the need for a seed phrase. It offers an all-in-one experience within the wallet itself, including a swap/DEX aggregator, bridge, NFT support, Earn products, and a DApp browser. Despite supporting over 120 chains and a wide range of services, the wallet maintains a simple, user-friendly UX/UI for a smooth and accessible experience.

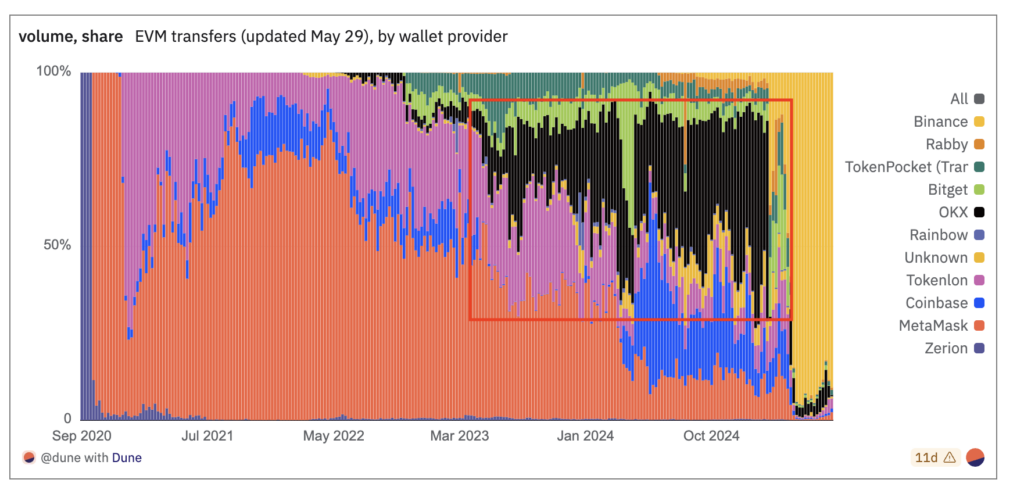

- In Q4 2024 and Q1 2025, the OKX Wallet was the market leader, capturing a dominant 40% to 50% of the transaction volume, far ahead of its competitors. However, in early Q2, following money laundering FUD, OKX temporarily paused its DEX. During this time, the launch of Binance Alpha 2.0 quickly propelled the Binance Wallet to the top spot, seizing an 80% market share. OKX currently holds the number two position with a 10% market share.

Dex Aggregator – The DEX Aggregator is deeply integrated into the OKX Wallet, allowing users to swap and bridge tokens across multiple chains. It is designed to be simple, fast, and secure, offering low gas fees by routing orders through the most cost-effective chains.

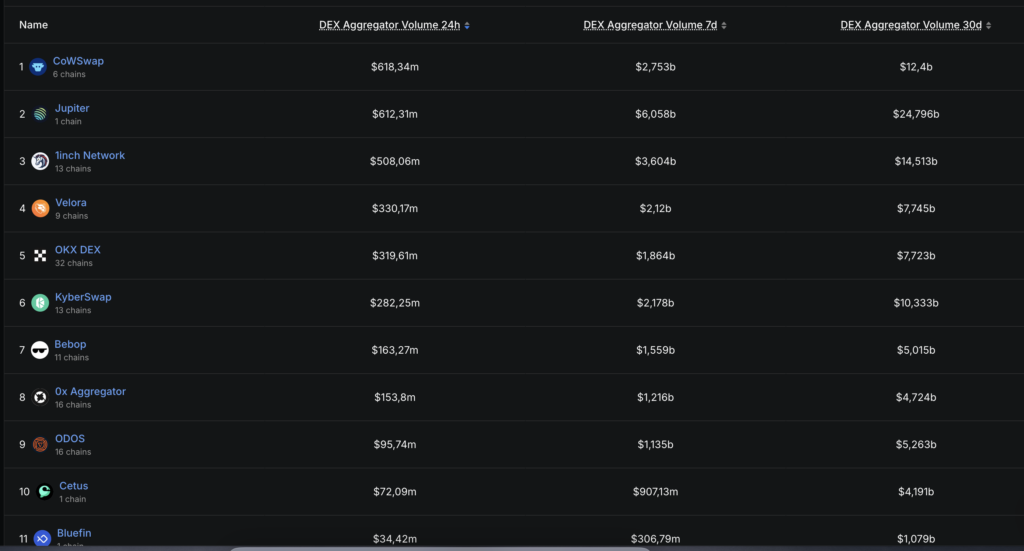

- Currently, the OKX DEX ranks fourth in 24-hour trading volume, processing approximately $319.61 million USD, with the majority of volume coming from the Solana (SoL) and Ethereum chains.

- In Q1 2025, the OKX DEX was the second-largest aggregator, trailing only behind Jupiter. Analysts believe that given its strong product quality, deep wallet integration, and robust community support, the OKX DEX is poised to quickly regain its top-two market position.

3.3. X – Layer

OKX’s new X-Layer is a Layer 1 blockchain that launched on August 16, 2025. It acts as the core infrastructure, connecting the OKX Wallet and Exchange to payments, Real World Asset (RWA) settlements, and consumer DeFi DApps.

As of now, the chain has a Total Value Locked (TVL) of $13 million and 40,000 daily active users. To accelerate ecosystem growth, OKX launched a $100 million Ecosystem Fund on August 22, 2025, to attract and support developers building on the X-Layer.

OKX has excelled at driving growth through effective marketing, market education, and strong product development. This has been crucial in helping the exchange maintain its position in the top two from 2023 through 2025.

Although OKX briefly lost its number two spot to Bybit, it has since regained its footing. Overall, the OKX Exchange is widely regarded as providing a smoother and “cleaner” user experience compared to its competitors.

| Metric | 07.2025 | 08.2025 (24h) | Comment |

| Price | $43 | $200 | +360% M/M |

| Market Cap | $2.5B | $4.1B | +64% M/M |

| Circ. Supply | 58M | 21M | $OKB was burned, current circulating supply is 21M $OKB |

| Total Supply | 280M | 21M | Fixed total supply of 21M $OKB |

| FDV | $12B | $4.1B | FDV dropped sharply after the full burn of $OKB |

| Proof of Reserves | 28.8B USD (04.07.2025) | ||

| Vol Spot Exchange | $105.5B (~ 4.76% market share) | $2.4B (~6.2% market share) | In July, OKX’s spot market share ranked top 4, behind MEXC and Bitget.MTD, over the last 7 days, OKX has consistently maintained the #2 position. |

| Vol Futures Exchange | $1.12T (~ 17.09% market share) | $10.85B (~8.79% market share) | Overall total exchange volume secures OKX’s position as #2. |

| Estimate Revenue | $494M USD | $170M USD (annual 30D) | Analysts estimate revenue based on trading fees: spot at 0.065% & futures at 0.038%. |

OKX Revenue Estimates

Based on OKX’s trading fee structure, we can estimate the median revenue from its two primary products:

- Spot Trading: With maker fees at 0.08% and taker fees at 0.1% (and VIP fees below 0.05%), the median fee is estimated at 0.065%.

- Futures Trading: Fees range from 0.02% to 0.05% (with VIP fees at 0.01% to 0.03%), resulting in a median fee of approximately 0.038%.

| Time | 2023 | 2024 | Q2.2025 |

| Total Trading Vol ($trillion) | $34,260,000,000,000 | $17,688,000,000,000 | $21,800,000,000,000 |

| Volume Share | $5,385,672,000,000 | $2,532,921,600,000 | $3,126,120,000,000 |

| Spot Volume | $538,567,200,000 | $283,687,219,200 | $281,350,800,000 |

| % share | 10.00% | 11.20% | 9.00% |

| Futures volume | $4,847,104,800,000 | $2,249,234,380,800 | $2,844,769,200,000 |

| % share | 90.00% | 89.00% | 91.00% |

| Revenue Estimate | $2,191,968,504 | $1,039,105,757 | $1,263,890,316 |

4. Catalyst Timeline

Upcoming Catalysts for OKX / OKB

| Timelines | Events | Expected Impact |

| Q3/2025 | – Launch of “X Layer” Mainnet – OKX completes Polygon CDK integration, migrating users to the new OKX Chain. – Migration of OKB to its native chain: Withdraw to X Layer feature goes live, encouraging holders to move OKB on-chain. – OKX launches a $100M ecosystem grant fund to attract builders and Dapp development on X Layer. | – Expected to increase on-chain utility of $OKB, attracting the DeFi community to use OKX Chain. – Long-term positive impact on OKB demand (though short-term price volatility may occur during network swap operations). |

| Q4/2025 | – Expected pilot launch of a USD savings platform (Stablecoin) backed by U.S. Treasuries. – Expansion into the U.S. & EU with potential license applications (e.g., BitLicense in New York or MiCA in the EU once effective). – IPO preparation (rumor): possible engagement with investment banks or restructuring legal entities. | – Likely to attract traditional investors’ attention and increase market trust in OKX. – Indirectly supportive of OKB valuation (similar to how Coinbase’s IPO boosted other exchange tokens). |

| 6 – 12 months Outlook | Focus on executing new strategies (X Layer, CeDeFi) and navigating macro market events. Overall, catalysts lean positive for $OKB if favorable conditions play out. | |

5. Valuation

To value OKB, we’ll use a comparative analysis of other exchange tokens and an internal analysis based on OKX’s revenue.

5.1. Analyst Outlook: $400/OKB Target

Analysts believe that OKB could reach $400 per token (implying a market capitalization of ~$8.4B) within the next three months. This projection is based on two key factors:

- Improving Revenue Outlook: The market is in an uptrend, and OKX is effectively attracting new users, leading to an anticipated increase in revenue.

- Favorable Market Sentiment: The market is currently rewarding exchange tokens with strong deflationary narratives. For example, Bitget’s $BGB token saw a +900% YTD increase after its token burn. OKB possesses the strongest deflationary story, combined with an expanding ecosystem, making a re-rating a reasonable expectation. A price of $400 would put OKB’s Price-to-Sales (P/S) ratio at approximately 3-4x, which is still lower than BNB’s current P/S ratio.

5.2. Market Share & Market Cap Comparison

At the end of 2024, Binance held roughly 48.2% of the spot market share, while OKX had about 7.7%.

Assuming a direct correlation between market share and valuation, we can estimate OKB’s potential market cap. If Binance’s market cap is $120B, then 7.7% of $120B would equal $9.24B. This suggests that OKB could be valued at $8B – $9.24B, corresponding to a price of around $428/OKB. This is a 2.14x increase from its current price and represents a realistic medium-term potential if OKX solidifies its top-two position.

5.3. Price/Revenue (P/R) Valuation

Since OKB is a token and not a stock, we’ll use the P/R ratio instead of EPS.

- Current P/R: With an estimated 2024 revenue of ~$1.5B and a market cap of $4.18B, OKX has a P/R of ~2.7x. This is significantly lower than tech stocks like Coinbase (P/S ~5x) and even BNB (Binance’s 2024 revenue is estimated at ~$10B with a $120B market cap, resulting in a P/S of ~12x).

- Target P/R: Even accounting for legal risks, a P/R of 2x is a conservative estimate. However, during bull markets, exchange tokens often see their P/R ratios pushed up to 5-10x. Applying a 5x P/R to OKX’s revenue would result in a valuation of $8B – $9B.

| OKX | BNB | |

| Market Cap ($Bilion) | 4.18 | 120 |

| FDV | 4.18 | 120 |

| Rev 2024 (estimate – $Billion) | 1.5 | 10.68 |

| P/S (Price/Revenue) | 2.79 | 11.24 |

6. Tokenomics

- Total Supply: 21M $OKB

- Circulating Supply: 21M $OKB

7. Key Risks

- Regulatory Risk: The $500M penalty from the U.S. Department of Justice (DOJ) and the commitment to improving compliance show that OKX is still under significant regulatory pressure. This is a critical risk, especially as the exchange operates in jurisdictions where it is not fully licensed.

- Centralization Risk: OKB is a centralized token managed by a single exchange, meaning its value is directly tied to OKX’s business performance and reputation. OKX’s authority to unilaterally change token policies, such as the burn mechanism and supply, pose a risk to the token’s value.

- Competition: Exchanges like Binance, MEXC, Bybit, and Bitget have consistently high trading volumes and are engaged in fierce fee competition. This intense rivalry could negatively impact OKX’s growth.

- Macroeconomic Risk: The price of $OKB is highly volatile and moves in tandem with the broader crypto market, influenced by major assets like Bitcoin and Ethereum and overall market cycles. Investors must be prepared to evaluate and manage this market-wide risk.

8. Position Sizing & Implementation Plan

- Target position size: 3% of your Net Asset Value (NAV)

- Buy zone: $170 – $180

- Take Profit 1: $350

- Take Profit 2: $400

- Stop loss: -25% from the final dollar-cost averaging (DCA) price

- Timeline: 3 months

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.