1. Spectral – Tokenomics

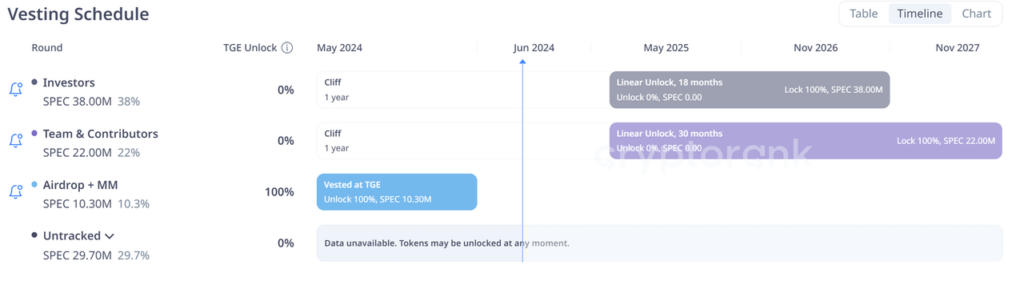

As of May 2025, vesting has begun for investors and the team. The allocation of the Foundation Treasury was not previously tracked.

The airdrop has been fully unlocked, but the token contract shows the vesting is still linear. About 1.5M $SPEC has flowed out so far.

2. Spectral – Buying Pressure

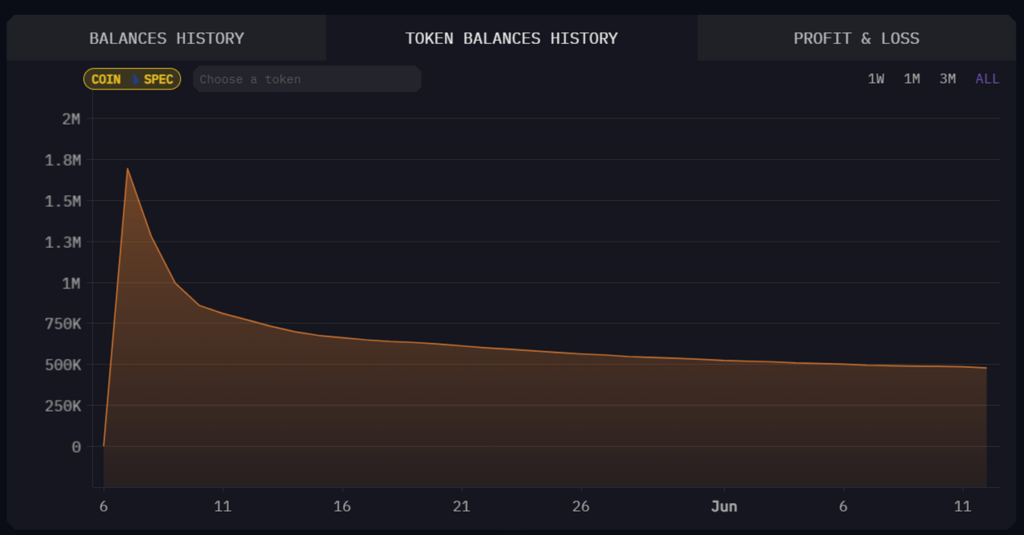

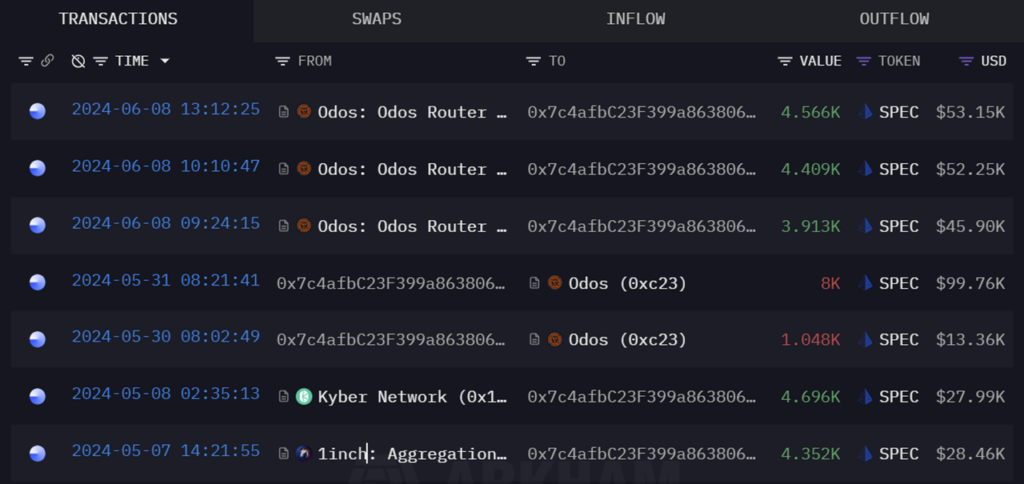

A well-performing trading wallet has increased by over 100% since its initial purchase on 7/5. Recently on 6/8, as $SPEC dropped significantly, this wallet started buying back at 3x its previous amount, now holding 12.8k $SPEC ($126k).

- Wallet Address: 0x7c4afbC23F399a863806f976a8A5fb1303949954

Another wallet bought in fairly early, and while the exact P/L is not calculable, its transaction history shows FOMO buying. It recently DCA’d with an order 70% the size of its previous one on 6/11, averaging in at $9.8 and holding 17.7k $SPEC.

- Wallet Address: 0x3bA2F83860b978509F6B89Ee32636ea8Ebf648Bc

3. Spectral – Selling Pressure

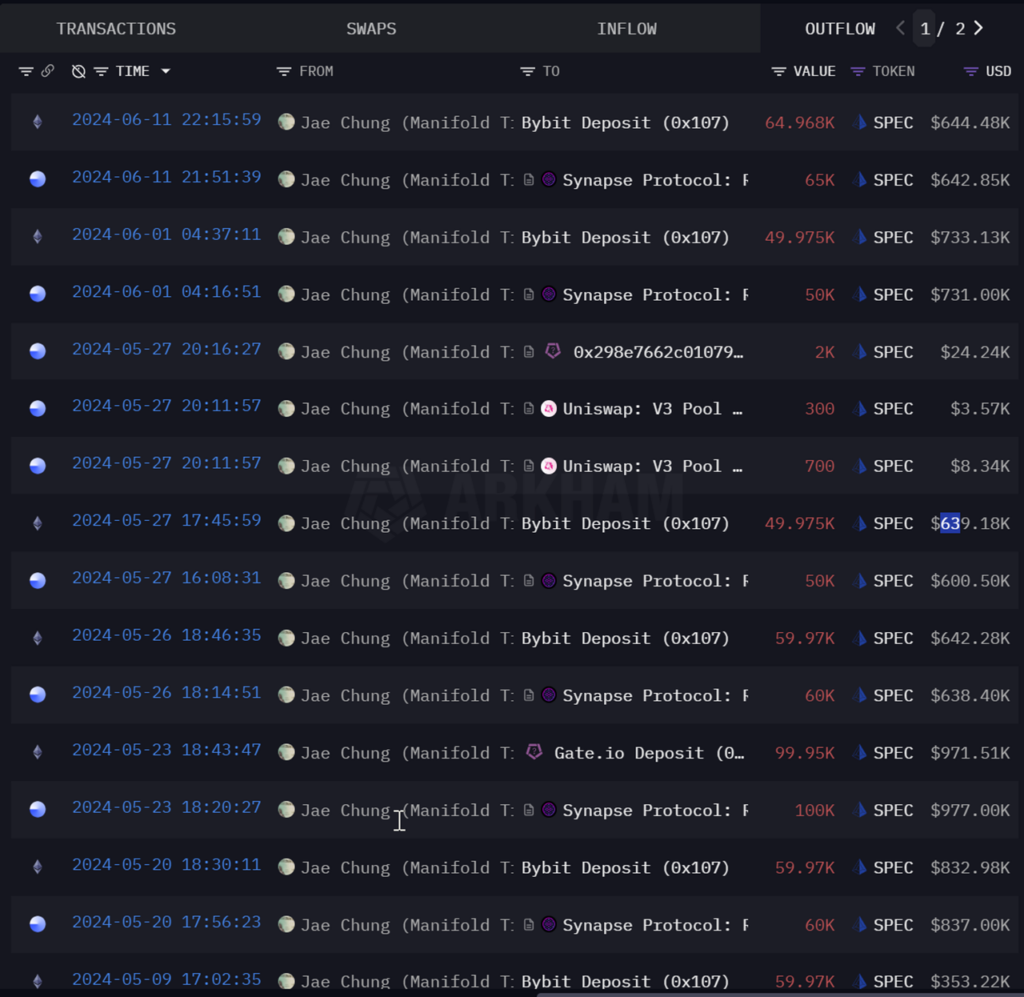

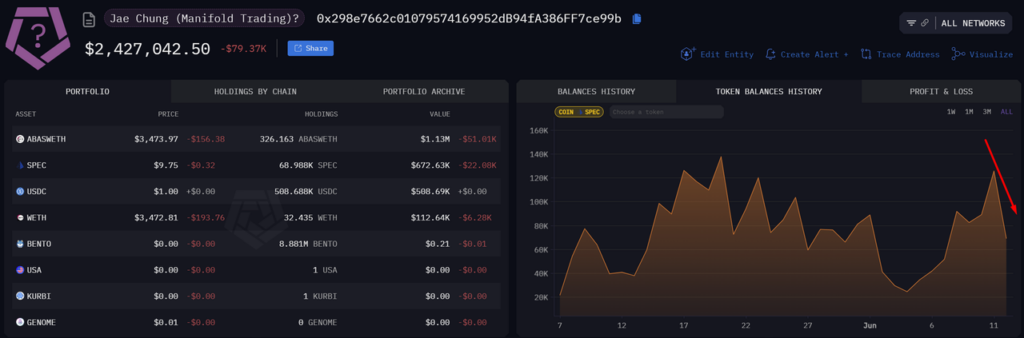

Significant selling pressure is coming from a wallet labeled as a “Founding Partner Manifold Trading (MM),” likely a MM account. This wallet received $SPEC purchased from a separate MM trading contract, and the most recent activity was transferring 65k $SPEC two days ago, which the contract had been accumulating since 6/5. Overall, this appears to be MM activity, running their own trading algorithms for profit, and may not be the project’s official MM.

- Address: 0xc947a5aa5b91A0a9952E9e1e492f619e80610000

Contract Address: 0x298e7662c01079574169952dB94fA386FF7ce99b

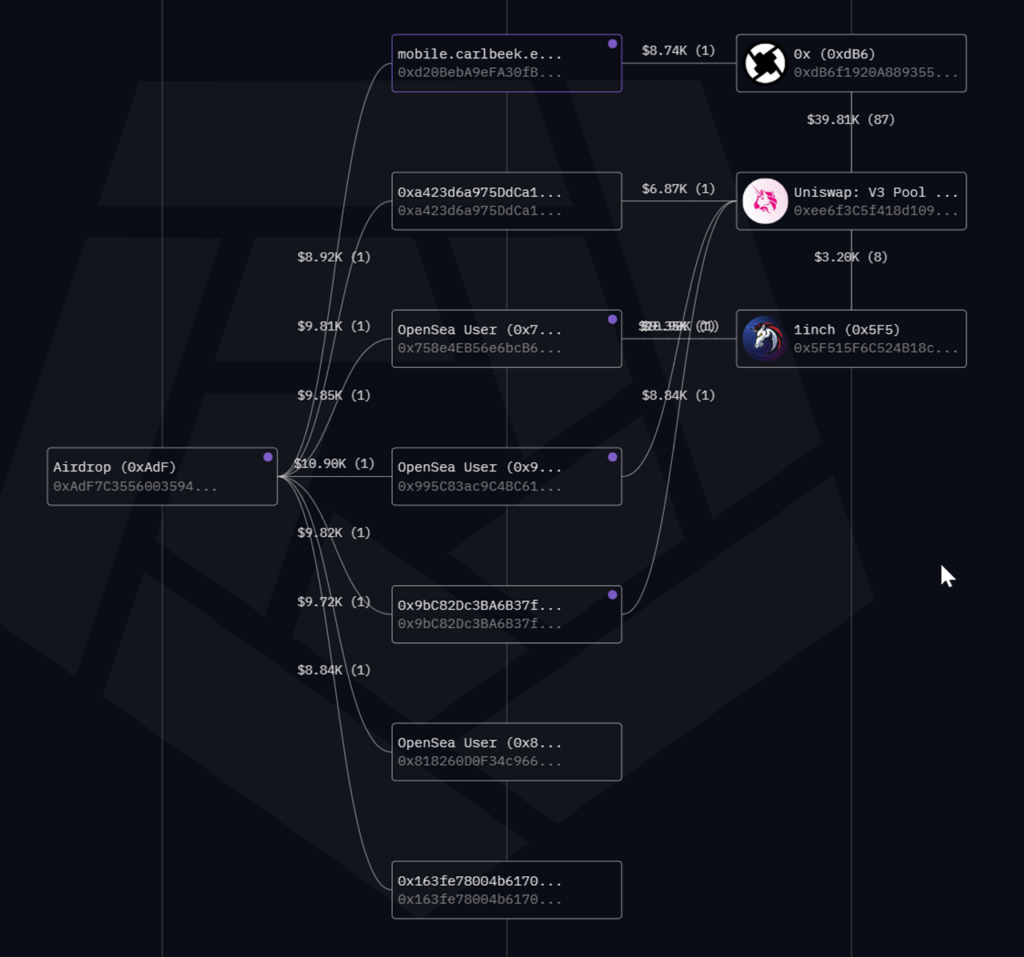

Airdrop recipients have also been selling, averaging around $10k per wallet. The images show representative wallets of this selling pressure since the listing. Airdrop Contract: 0xAdF7C35560035944e805D98fF17d58CDe2449389

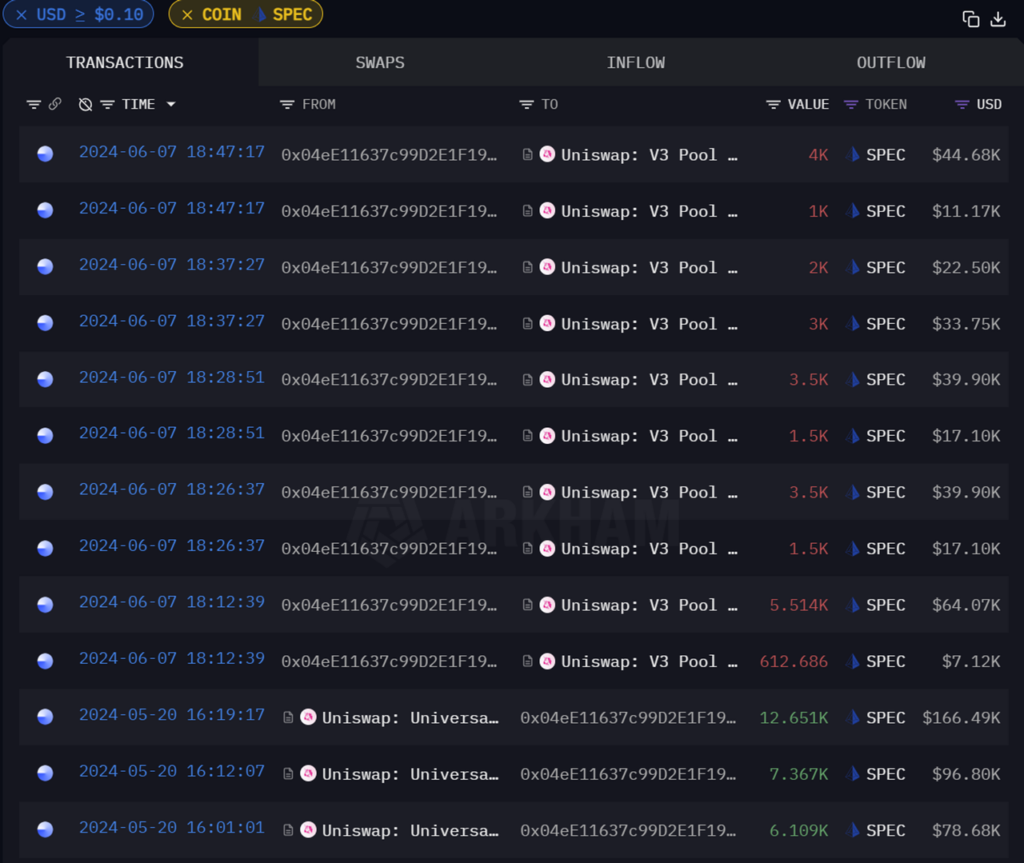

Many wallets have also been cutting losses as the price returned to their entry levels, trying to preserve capital. For example, one wallet bought around $13.5 on 5/20 and sold below $12 on 6/7, estimated to have lost around $44k. ⇒ This type of loss-cutting behavior is common on DEXes, as traders try to protect their capital when prices retrace to their entry points.

- Wallet Address: 0x04eE11637c99D2E1F1983e4023D1fD97D5Cb4C0B

4. Final thoughts

The on-chain data suggests there is significant selling pressure, however the buying demand seems to be gradually being absorbed at the base level. The Ethereum on-chain activity appears to be concentrated in exchange wallets rather than broad retail participation.

It’s unclear if the market maker (MM) activities are impacting the project, but the fundraising details indicate involvement from Jump Capital, which is known to operate as a market maker. Jump Capital tends to be discreet in their market influence tactics, so they may be focusing their efforts on CEX.

Looking at the tokenomics:

- The airdrop contract has already seen 1.5M outflows, indicating 75% of the 2M allocation has been absorbed. This significantly reduces the sell-side pressure from this bucket.

- The team and investor vesting schedules are still about a year away, so this overhang is not an immediate concern.

- The foundation treasury movements are harder to track, and could still pose a sell-side risk through various services.

The potential trading strategy based on this analysis would be to look for entry points in the $7.5-$9 range, targeting a market cap of $300-$500M based on prevailing market sentiment. However, it will be important to closely monitor the next major price push to confirm if Jump Capital is indeed acting as a market maker.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.