1. Aethir Overview

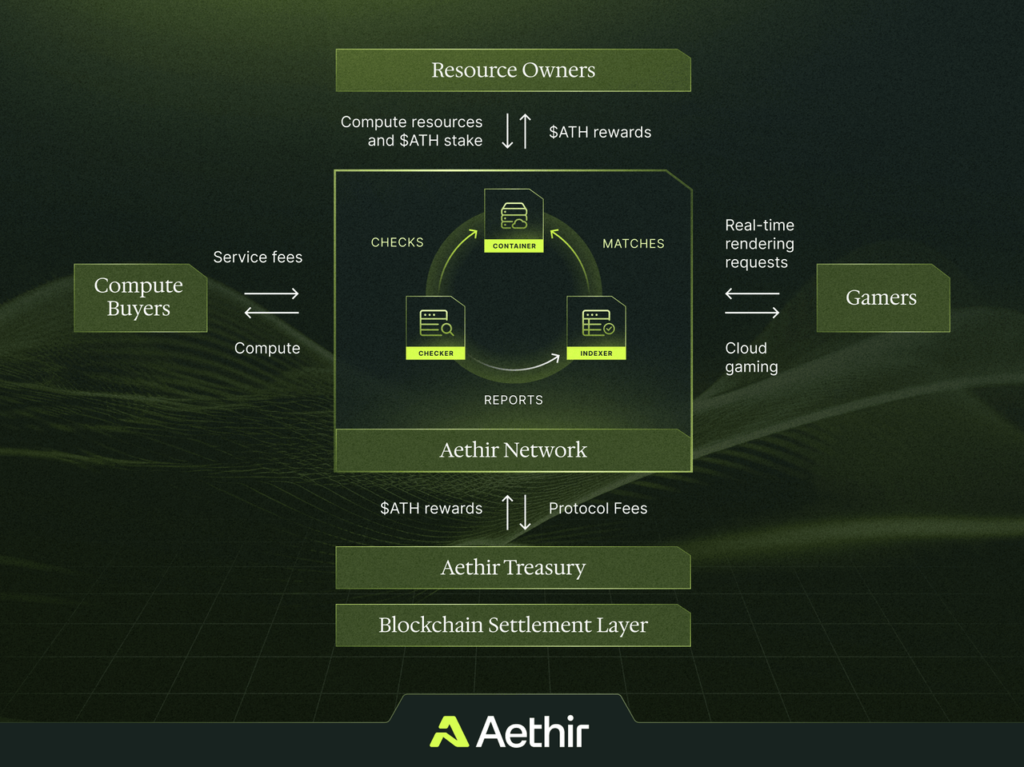

Aethir is a decentralized cloud computing platform that leverages blockchain technology to enable the sharing of high-performance computational resources, specifically targeting compute-intensive domains like Gaming and AI.

At the core of Aethir’s design is the concept of resource pooling. By unifying GPU clusters into a single decentralized network, Aethir aims to increase cluster sizes and improve the overall performance and reliability of the services offered. This approach not only reduces costs for users but also creates a more equitable and accessible platform for developers and researchers who require access to powerful computational resources.

The Aethir Network is a decentralized economy composed of miners, developers, users, token holders, and the Aethir DAO. Three key roles are involved in ensuring successful network operations – the container, the indexer, and the checker.

- Containers – These are the specialized nodes that provide the actual computing power, handling tasks like transaction validation and real-time digital content rendering. They form the backbone of the network.

- Checkers – Serving as quality assurance workers, Checkers continuously monitor the performance and reliability of the containers to ensure efficiency suitable for the requirements of GPU consumers

- Indexers – Acting as matchmakers, Indexers connect users with the best available Containers to meet their specific computing needs.

Underpinning this entire structure is the Arbitrum Layer 2 blockchain. This blockchain provides a decentralized way to facilitate payments and transactions on the Aethir network using the $ATH token.

Proof of Rendering

Aethir nodes serve two crucial functions:

- Proof of Rendering Capacity – Every 15 minutes, a random group of nodes is selected to validate transactions happening on the Aethir network. This helps maintain the security and integrity of the system.

- Proof of Rendering Work – The nodes continuously monitor the performance of the network, making sure users are getting the best possible service. They can dynamically adjust the available computing resources based on demand and user location.

The participants running these nodes are rewarded for their contributions in the form of Aethir’s native $ATH token. This incentivizes people to lend their computing power to the network, creating a robust and decentralized cloud infrastructure.

2. Onchain Analysis

2.1. Tokenomics

Token Allocation + vesting

Total supply: 42B $ATH

- Team: 12.5%

- Advisors: 5%

- Ecosystem: 15%

- Checkers and Compute providers: 50%

- Investors: 11.5%

- Airdrop: 6%

Based on this information, we can estimate that the current circulating supply is greater than 9% of the total. This includes the Ecosystem allocation, Airdrop Season 1, and a portion of the Checkers/Compute Providers.

- Ecosystem: 7.5% + DAO treasury (linear vesting)

- Airdrop Season 1: 1.5%

- Checkers and Compute Providers: Linear vesting, exact schedule unknown

Initial Selling Pressure

The main source of initial selling pressure is likely to come from the 1.5% Airdrop allocation, which equates to around 630 million $ATH tokens. On the first day of trading, the trading volume was very high, estimated to be around 2.2 billion $ATH. Thus, the project has sufficient liquidity to absorb this initial airdrop sell-off.

The ongoing selling pressure is likely to come primarily from the project itself.

2.2. Buying pressure

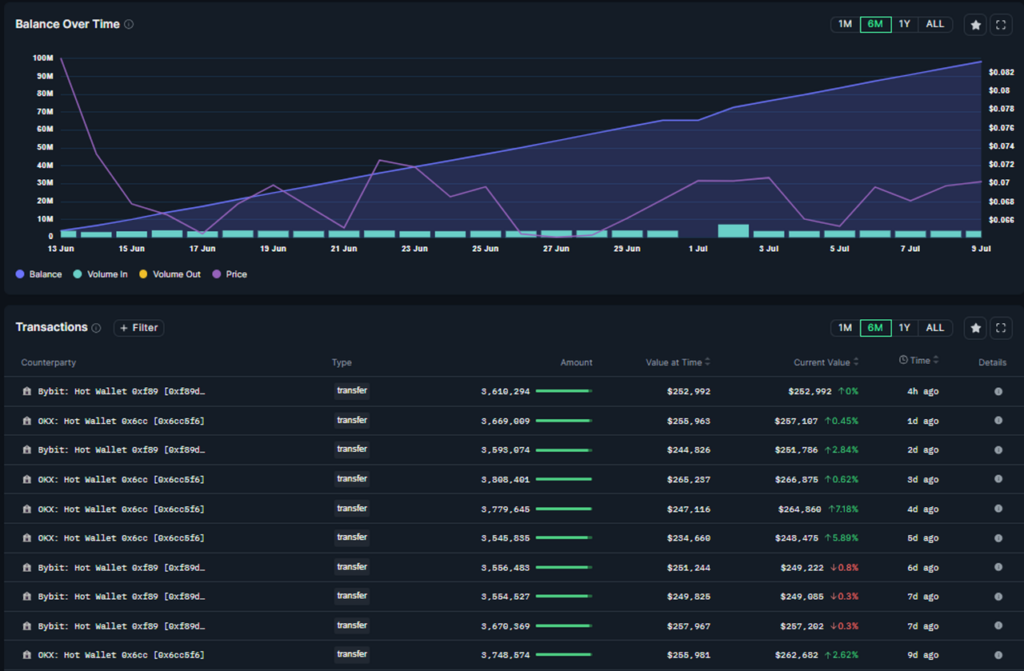

Interestingly, we’ve observed a significant amount of $ATH being withdrawn from major exchanges like Bybit, Gate, and OKX, totaling around 98.3 million tokens. This suggests some buying interest and accumulation is happening, likely from long-term holders.

2.3. Selling pressure

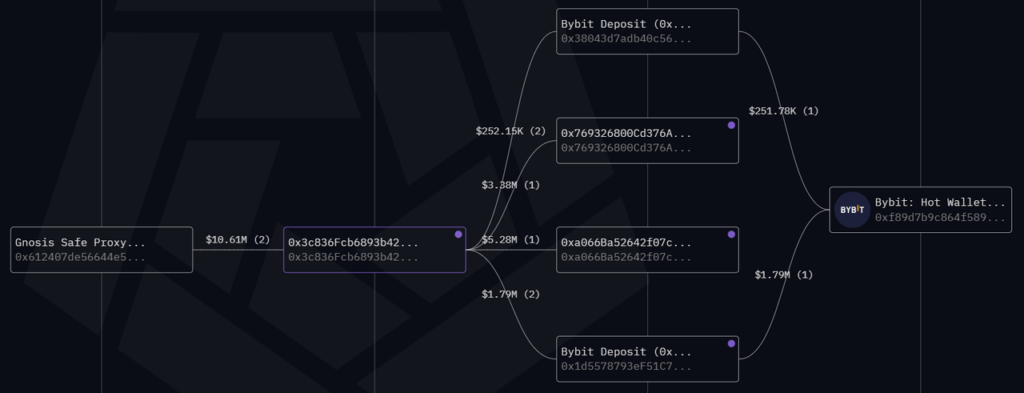

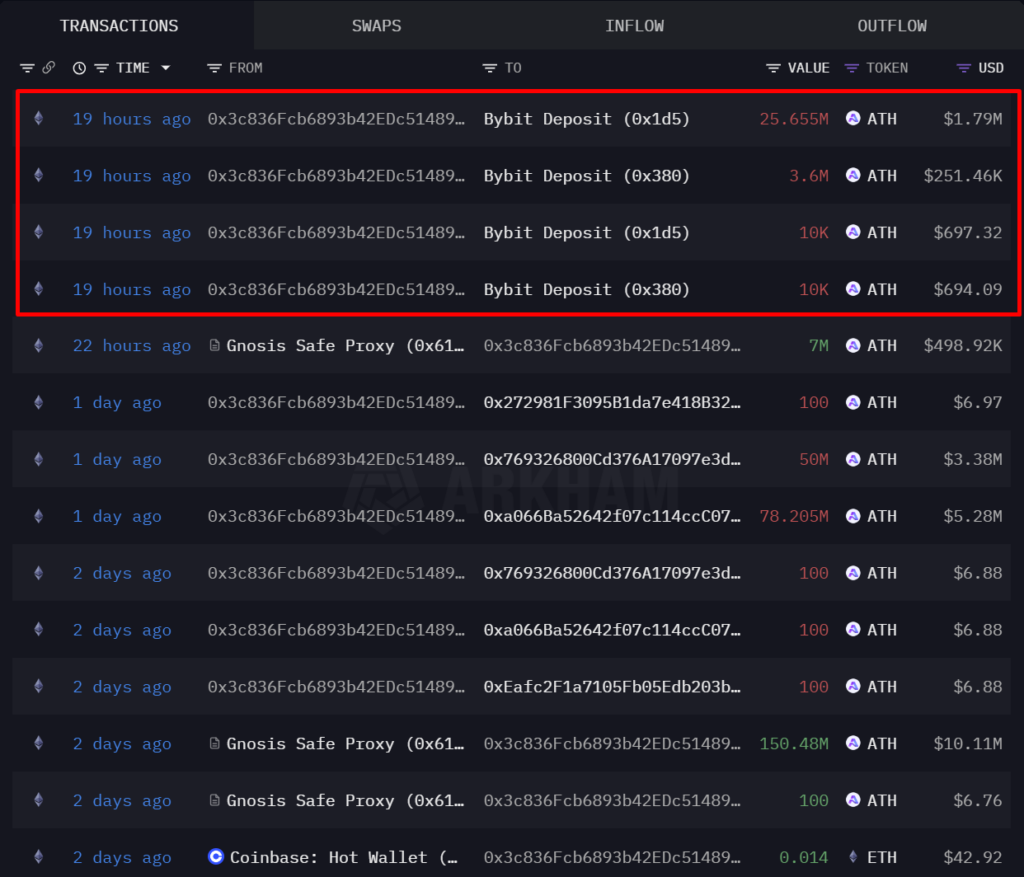

On the sell side, we’ve identified a few key wallet addresses that have been actively distributing their $ATH holdings. One wallet 0x3c836Fcb6893b42EDc51489410C6944b489Ad4C8 received a large amount of $ATH from the project contract and has since transferred over 29 million $ATH to Bybit exchange.

Additionally, we’ve observed three other wallets that seem to be associated with this entity holding 50 million, 78.2 million, and 25.6 million $ATH respectively. While they have sold a small portion, it appears they are mostly holding for the long term.

- Wallet 1: 0x769326800Cd376A17097e3d800A4A474b19CA961 – 50M $ATH

- Wallet 2: 0xa066Ba52642f07c114ccC07BdE091A196A2E7D62 – 78.2M $ATH

- Wallet 3: 0x5e191e4e397648d7b1eff12e06a31fe8ca089e78 – 25.6M $ATH

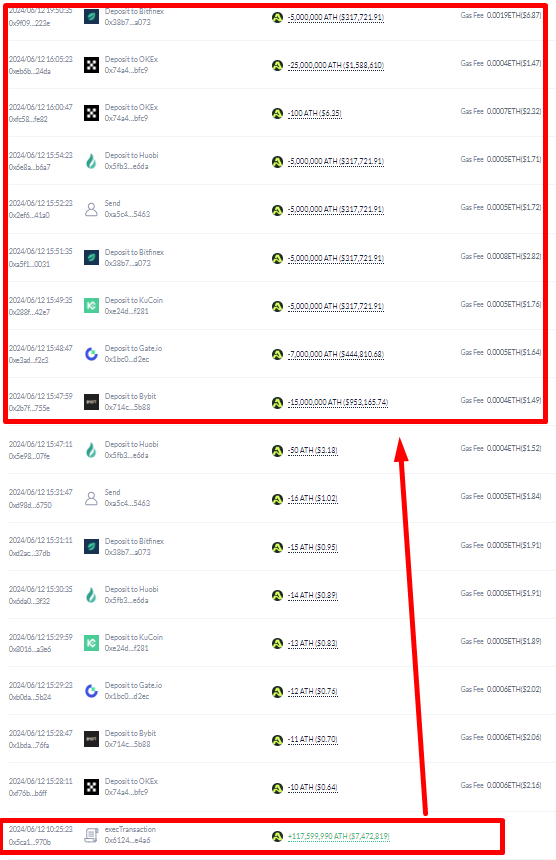

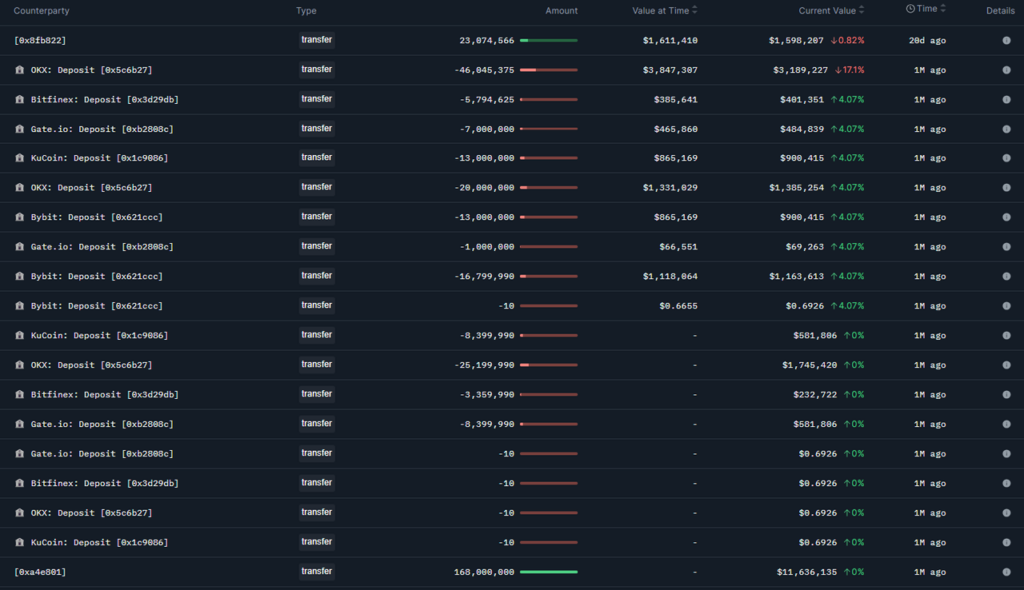

On the other hand, market maker Flow Traders received 117.6 million $ATH from the project contract. Within 24 hours, they sent nearly all of these tokens to various exchanges for selling and providing liquidity.

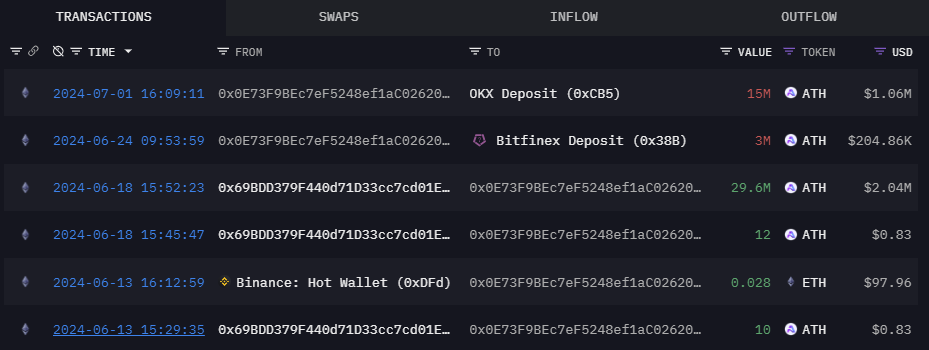

A week later, on June 18th, Flow Traders transferred 29.6 million $ATH to another wallet, from which an additional 18 million $ATH was sent to exchanges.

Wallet: 0x0e73f9bec7ef5248ef1ac0262079b07978cfd3c6

Another wallet (0xab75b39f34bb66cfc4e7766642290fdb430773ad) received a large 168 million $ATH allocation from the project contract and has since transferred most of it to exchanges, currently holding only 23 million $ATH.

3. Conclusion

Based on the analysis of token allocation, vesting schedules, and on-chain movement, a few key takeaways emerge:

- The initial selling pressure mostly comes from the Airdrop allocation, which the project has sufficient liquidity to absorb.

- Market makers and project-affiliated wallets offloading their holdings primarily drive ongoing selling pressure.

- Retail buy-side demand seems relatively limited so far, with the majority of accumulation happening in larger wallets.

- The technical analysis remains relatively stable, as the price has held up well despite the selling pressure. Further price appreciation will likely depend on the market makers’ offloading activity slowing down.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.