We’ve been closely monitoring the developments surrounding the Biconomy (BICO) token. In this blog post, we’ll delve into the key insights we’ve gathered from on-chain data and provide an assessment of the current market dynamics.

1. Buying pressure

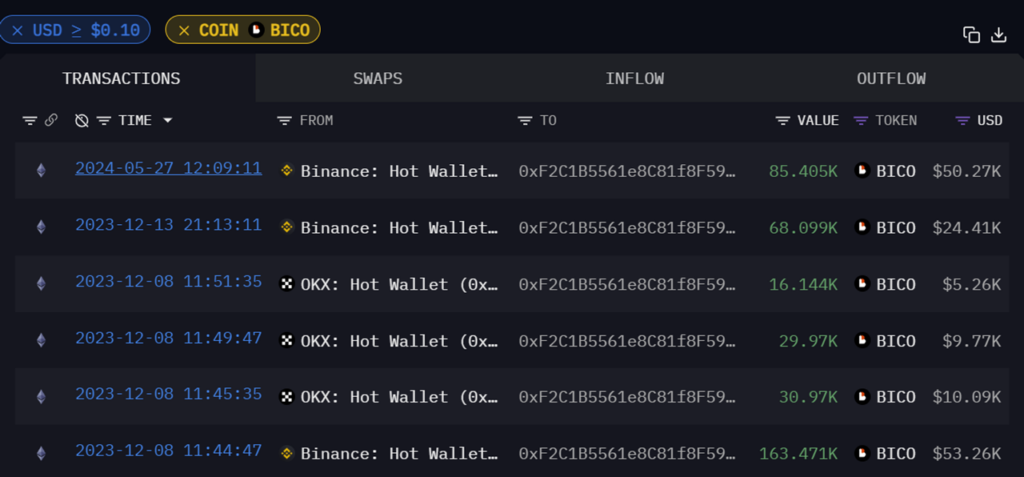

Our analysis has identified a few key wallets that have been accumulating Bico tokens. One wallet, in particular, has been adding to its position from quite early on. This wallet recently purchased more Bico at an entry price of $0.56, after having previously acquired tokens around $0.30. Interestingly, this wallet also seems to have interactions with the Amber wallet, though it’s unclear if they are the same entity. The wallet currently holds a substantial 394k Bico tokens, valued at $224k.

- Wallet address: 0xF2C1B5561e8C81f8F59053a9Bf9aC38b144034CF

Another wallet has been focused on trading Bico and Voxel, with Bico being the primary holding. Based on its withdrawal history, the estimated entry price for this wallet is around $0.44. This wallet currently holds 190k Bico tokens, worth $108k.

- Wallet address: 0x3DF0c9e0d3E9D7debaa934C4BFa0F7138C357aE1

2. Selling pressure

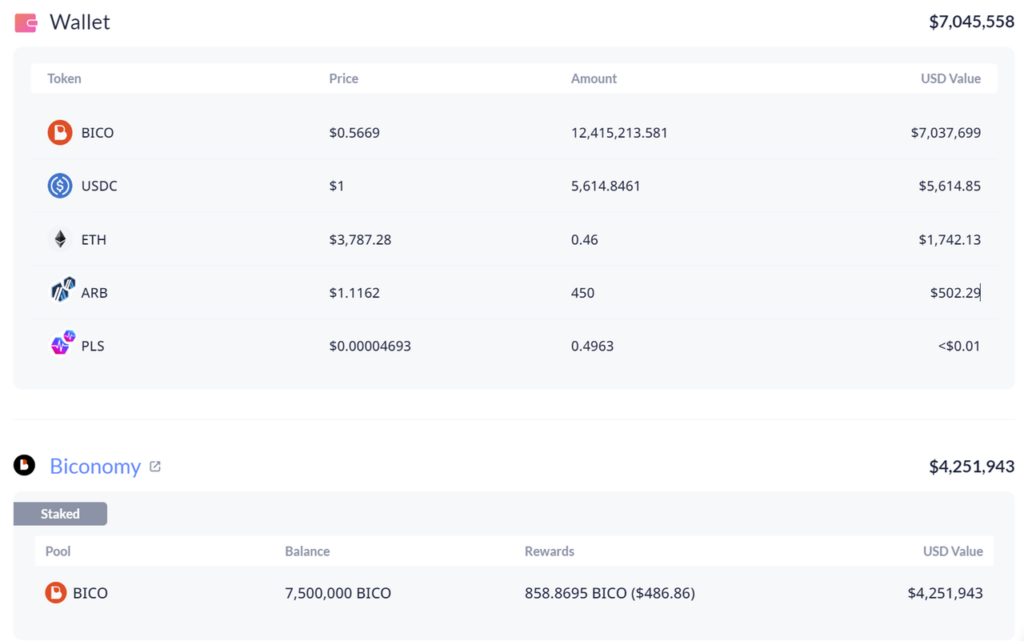

The Bico project is currently running a staking program to attract more TVL to the protocol. This staking activity is generating selling pressure, as some wallets are receiving their staking rewards and immediately selling them.

One wallet, for instance, started staking 3.5 million Bico tokens in late March, and then added another 4 million Bico in late April. This wallet has been consistently receiving and selling the staking rewards, as evidenced by the address 0x2Adb28EB8983864ac96c47329d0d817b392839aA.

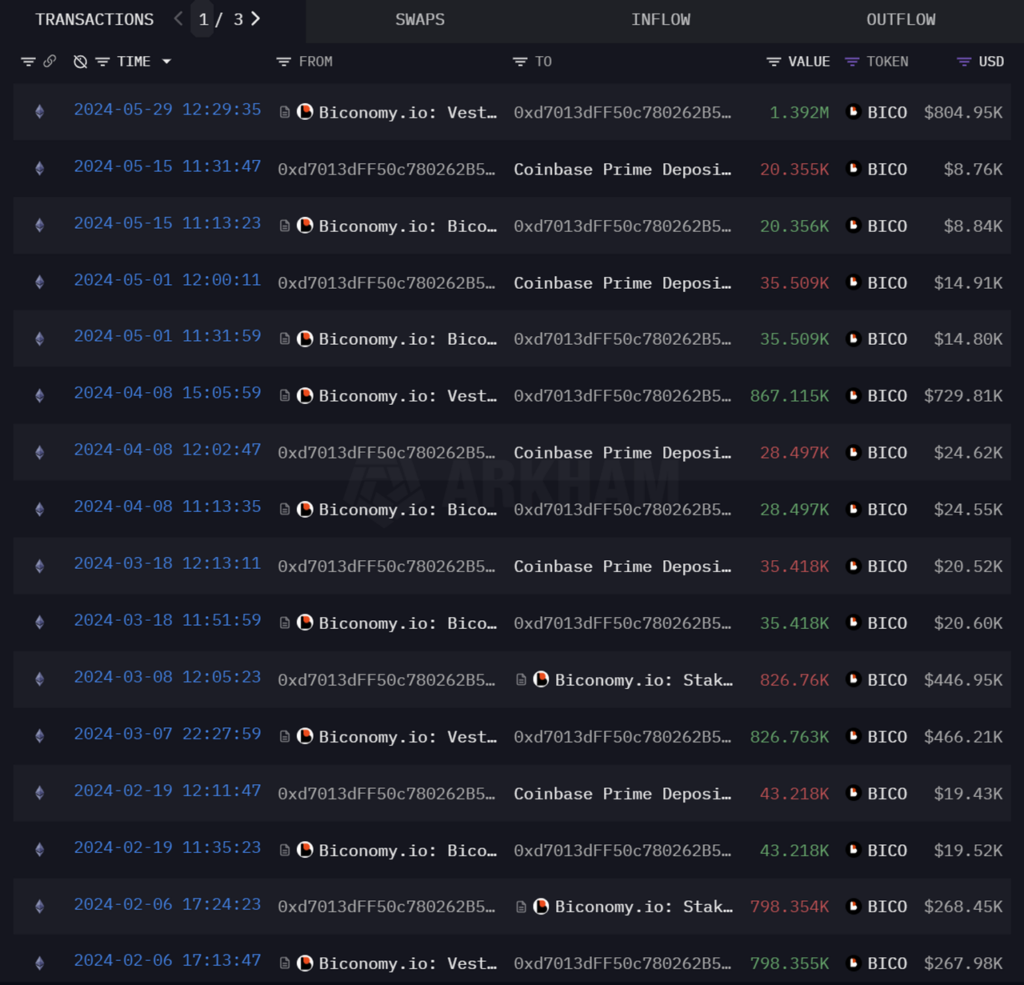

Another wallet has been staking since November 22, 2022, and has also been selling the vesting rewards it receives, as seen in the address 0xd7013dFF50c780262B5cdAA530C9Ea104fBf94Ec.

3. Final thoughts

Bico’s TVL has grown by over 100% since the beginning of the year, with an impressive APR of 3.8%. The total Bico tokens staked currently stand at 75.6 million, representing around 7.57% of the total supply.

While the stake amount is not yet considered huge, it is growing significantly as more vesting tokens are being added to the staking pools, including some from the Amber Group fund (the project may require committed staking from certain funds).

The major investors in Bico are still holding strong, with only some funds selling the staking reward tokens. Retail selling pressure does not appear to be a significant factor based on onchain data.

We’ve also observed some new accumulation happening, but it remains relatively small in scale compared to the overall Bico token supply. With the upcoming TGE and listing of zkSync Era, the Account Abstraction sector is expected to attract significant attention from the community. This could serve as a catalyst that drives Bico’s price performance in the future.

A potential buying entry point for Bico could be in the range of $0.4 to $0.5.

[…] Onchain Analysis: Biconomy, the pioneer of ERC-4337 Account Abstraction […]

Comments are closed.