1. Executive Summary

Token Overview

- Ticker: $ONDO

- Sector: Real Word Asset

TLDR;

- Ondo, a project specializing in short-term U.S. Treasury bond Real World Assets (RWA), has successfully raised $46 million in funding from tier-1 investment firms such as Pantera, Coinbase Ventures, Founders Fund, and Wintermute.

- The project’s core team consists of seasoned professionals from major financial institutions like Goldman Sachs and BlackRock, with extensive experience in digital asset finance and Web3.

- Ondo currently holds a top-3 market share in the RWA sector and is the first DeFi project to demonstrate strict legal compliance. User assets are managed on/off-ramp by prominent organizations including Coinbase, BlackRock, and Clear Street.

- Potential policies favoring U.S.-based companies under a Trump presidency could further benefit Ondo.

- Despite a significant token unlock event of nearly $2 billion USD, Ondo has maintained price stability at $1.3, successfully absorbing the influx of tokens without experiencing a price dump, even amidst adverse market conditions.

2. Due Diligence Summary

2.1. Overview

Ondo Finance is a decentralized finance platform catering to both retail and institutional investors. By leveraging blockchain technology, the project focuses on developing Real World Assets (RWA) as a core component, bridging the gap between traditional finance (TradFi) and decentralized finance (DeFi).

Ondo is building a transparent, efficient, and accessible infrastructure for investors, enabling retail and institutional clients outside the U.S. to easily invest in tokenized U.S. Treasury products and bank demand deposits by bringing them onto the blockchain.

2.2. Team

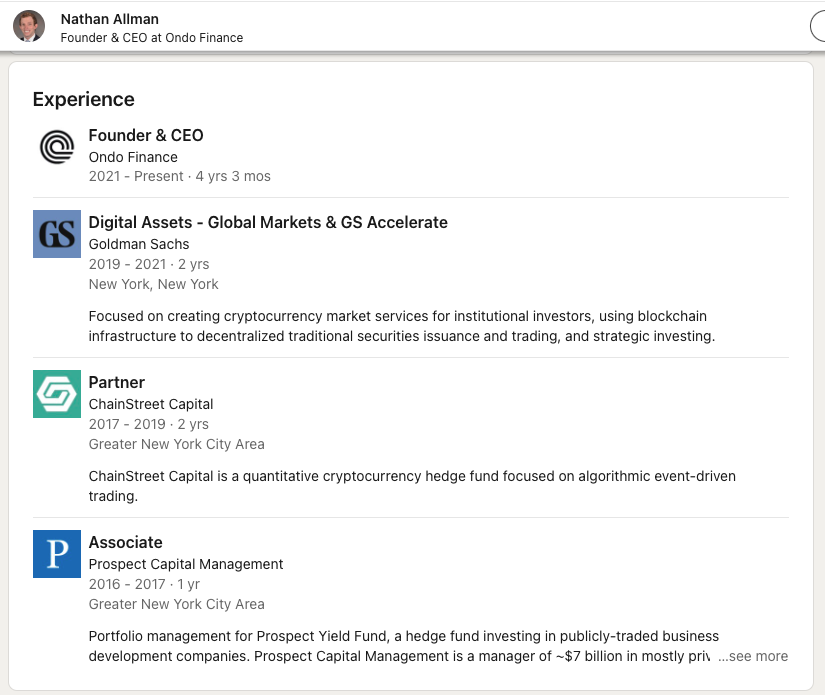

The development team at Ondo Finance comprises 22 key members, all seasoned professionals in both traditional finance and DeFi. Notable individuals include:

- Nathan Allman – Founder & CEO: With experience at firms such as Chain Street Capital and Prospect Capital Management, Nathan also served in a digital asset management role at Goldman Sachs, a leading global bank.

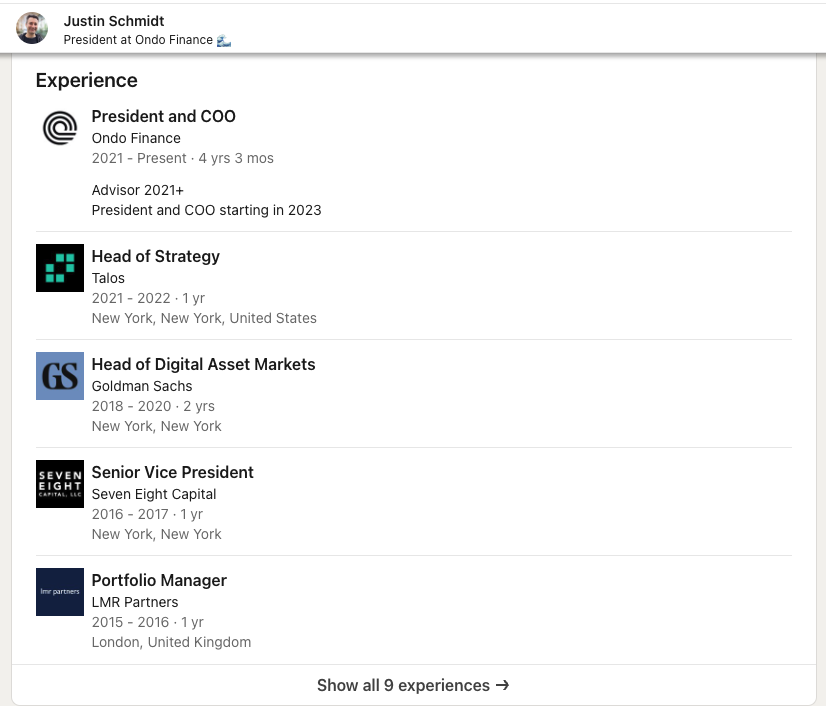

- Justin Schmidt – President & COO: Possessing extensive experience in the financial sector, Justin’s previous roles include Vice President at Merrill Lynch, Portfolio Management at WorldQuant LLC, Portfolio Manager at LMR Partners, Senior Vice President at Seven Eight Capital, Head of Digital Asset Markets at Goldman Sachs, and Head of Strategy at Talos.

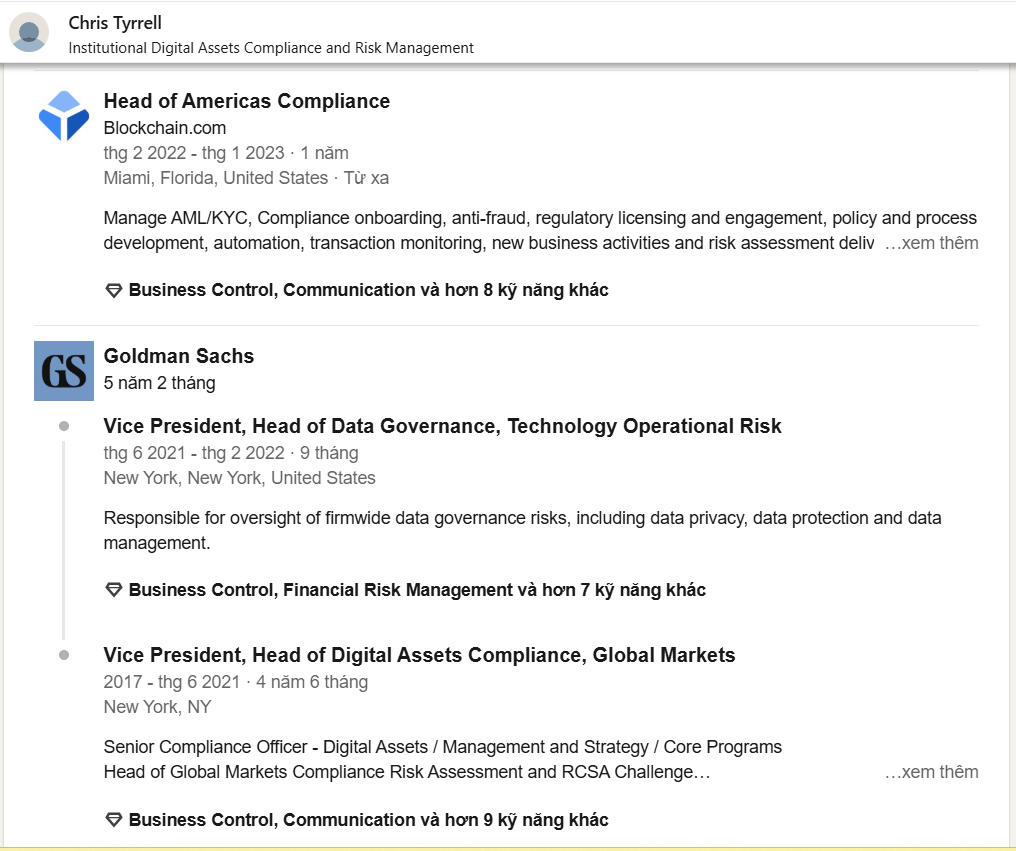

- Chris Tyrell: Chris formerly held the positions of Head of Digital Asset Compliance and Head of Data Governance Risk at Goldman Sachs, where he collaborated closely with Nathan (CEO) and Justin (COO).

The team comprises individuals with extensive experience in both traditional finance and crypto. Their expertise spans not only market knowledge but also deep understanding of legal, risk management, and strategic aspects – a significant highlight.

Moreover, their backgrounds and senior positions at Goldman Sachs and BlackRock provide a powerful network, elevating the project’s standing compared to competitors. This instills confidence in the project, backed by major players, enabling them to play a larger game and capture a significant share of the RWA market, particularly in the U.S., where the crypto asset landscape under a potential Trump presidency is anticipated to flourish

2.3. Product

Ondo’s product offerings include two main products: $USDY (for retail investors) and $OUSG (for institutional investors), as well as Flux Finance, a lending and borrowing protocol.

| OUSG | USDY | |

| Underlying Assets | Primarily invested in short-term U.S. Treasury bonds or Treasury repurchase agreements (REPO) – largely invest in BlackRock’s BUIDL fund, with the remainder in BlackRock’s FedFund (TFDXX), bank deposits, and USDC for liquidity. | Short-term U.S. Treasury bonds and bank deposits, plus equity subordination. |

| Yield | As underlying investments generate daily returns, these returns are reflected by an increase in the Net Asset Value (NAV) of the base fund, which in turn increases the NAV of the OUSG token. These investments have limited interest rate risk. | Variable interest rate set by Ondo Finance; no principal value fluctuations due to interest rate risk. |

| APY | 3.93% | 4.35% |

| Investor Scope | Global (U.S. and non-U.S.) | Non-U.S. |

| Investor Eligibility | Institutional investors (Qualified Purchasers) | Retail and institutional investors |

| Issuer | Ondo I LP. | Ondo USDY LLC. |

$USDY – US Dollar Yield Token

$USDY is a tokenized representation of short-term U.S. Treasury products and bank demand deposits, enabling investors to easily seek safe, low-risk returns from the U.S. government.

$USDY is designed for retail and institutional investors (excluding those in the U.S.), with a minimum investment of $500 USDC. It functions as a yield-bearing stablecoin, initially pegged at $1 upon issuance, and then gradually accumulates yield at a %APY over time.

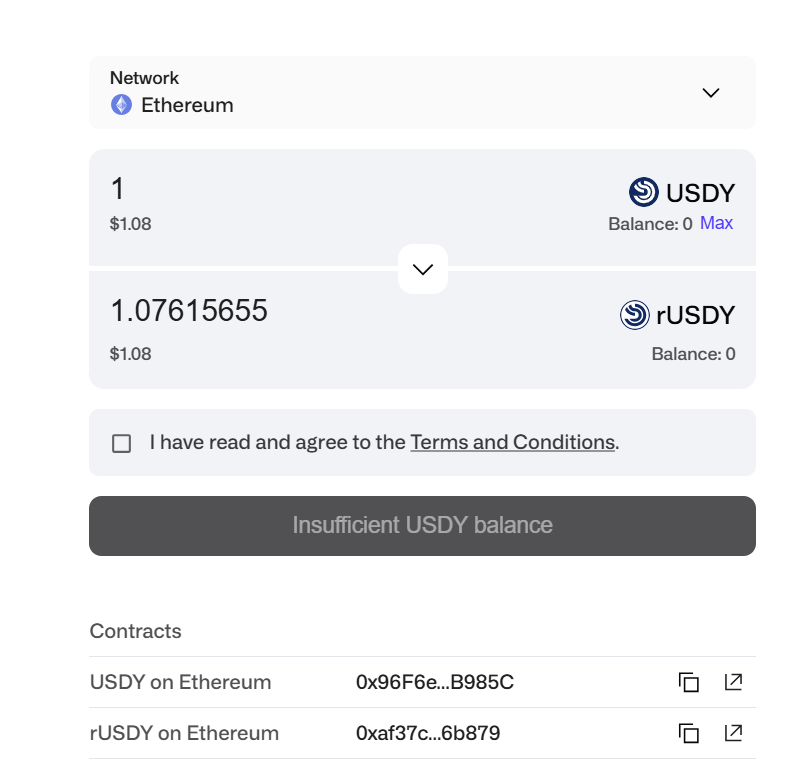

Currently, 1 USDC = 1.07 USDY, with an APY of 4.35%. $USDY offers two versions:

- Rebasing: The number of $rUSDY tokens in your wallet increases. For example, if you have 100 $rUSDY, with each $USDY valued at $1, and you earn a 5% yield, you will then have 105 $rUSDY, but each $USDY will still be worth $1.

- Yield-accrual: The value of each $USDY token increases. For example, if you have 100 $USDY, with each $USDY valued at $1, and you earn a 5% yield, each $USDY will now be worth $1.05, but you will still hold 100 tokens.

- In essence, both versions result in the same final value of $105. Ondo provides easy conversion between the two versions via https://ondo.finance/convert

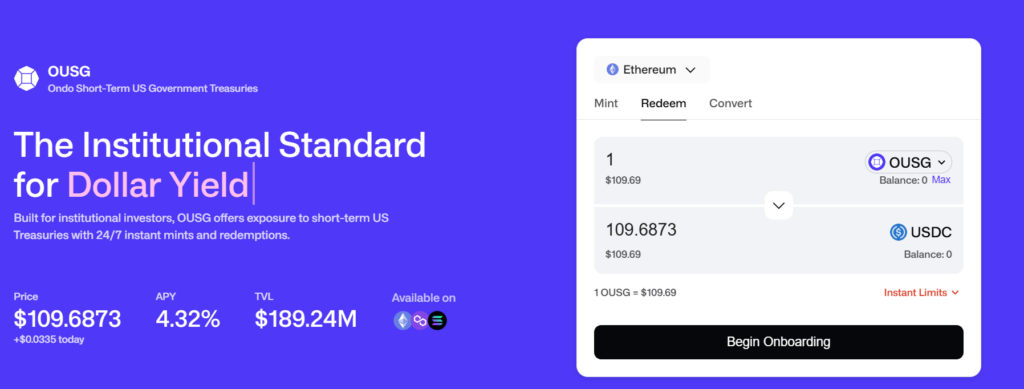

$OUSG – Ondo Short-Term US Government Treasuries

- $OUSG is a product that allows users to earn yield from short-term U.S. Treasury products.

- $OUSG is a tokenized version representing a U.S. government short-term bond ETF (for institutional investors).

- When customers purchase $OUSG, the majority of the funds are invested by Ondo into the Digital Liquidity Fund (BUIDL – BlackRock), with the remainder allocated to BlackRock’s FedFund (TFDXX), bank deposits, and $USDC.

- $OUSG offers features such as 24/7 instant issuance and redemption.

- Currently, 109 USDC = 1 OUSG, with an APY of 4.32%, and it supports 3 chains: ETH, Polygon, and Solana.

- $UOSG has the 2 versions same as $USDY

- Rebasing

- Yield-accrual

Operational Process

The operational process for $OUSG is similar to $USDY but more stringent and complex, primarily because OUSG is designed for institutional-level clients and involves more stakeholders, with the product being coordinated and managed by BlackRock.

- Ondo I GP: The overall coordinating entity.

- Ondo Capital Management: The investment management entity.

- Ondo Finance Inc.: The technology entity responsible for tokenizing the ETF.

- Ondo I LP: The entity that gathers investor capital.

- Qualified custodian: The entity that oversees customer assets.

- Clear Street: The securities brokerage firm that executes ETF buy and sell orders.

- Coinbase: The entity that monitors and manages on-chain assets.

- NAV Consulting: The ETF consulting entity.

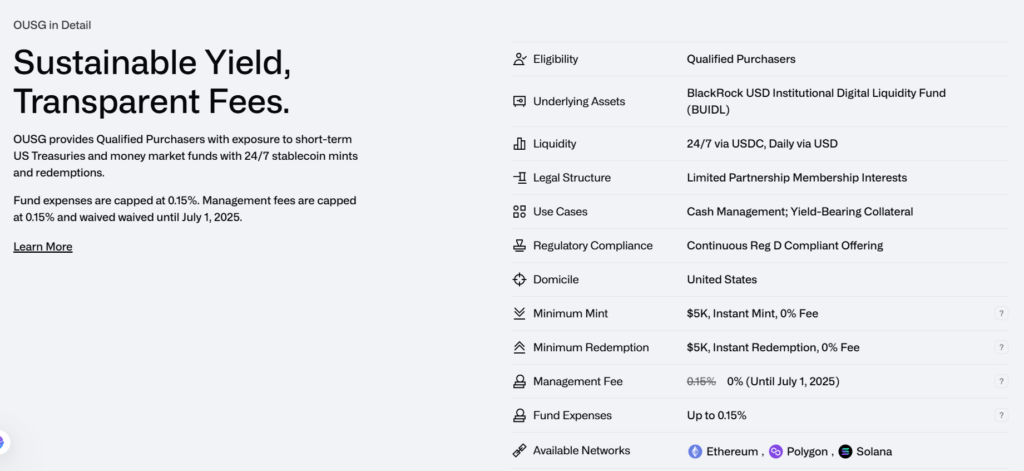

Due to the involvement of multiple parties, the product is exclusively for institutional clients and incurs various fees and conditions. To purchase $OUSG, investors must participate in Ondo’s Qualified-Access Funds program.

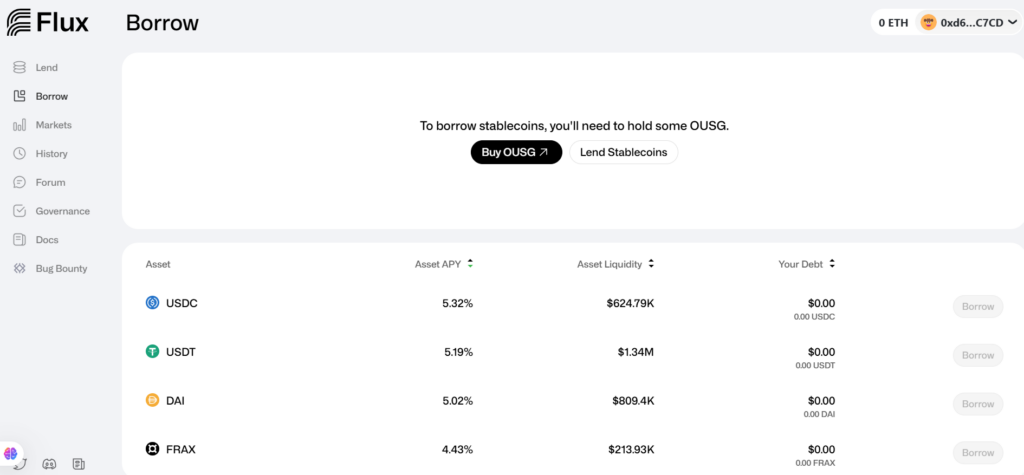

Flux Finance

Flux Finance is a decentralized RWA lending and borrowing market protocol governed by the Ondo DAO. The protocol supports lending and borrowing using stablecoins such as DAI, USDT, USDC, and FRAX.

Additionally, the $ONDO token serves as the governance token within Flux Finance. Holders of the $ONDO token (i.e., the Ondo DAO) can exercise voting rights proportionate to their token holdings.

Analysis & Commentary on Business Model

Before assessing whether Ondo’s business model is attractive, prominent, and has achieved Product-Market Fit (PMF), we need to examine the RWA narrative through two key factors: its growth potential and the actual demand.

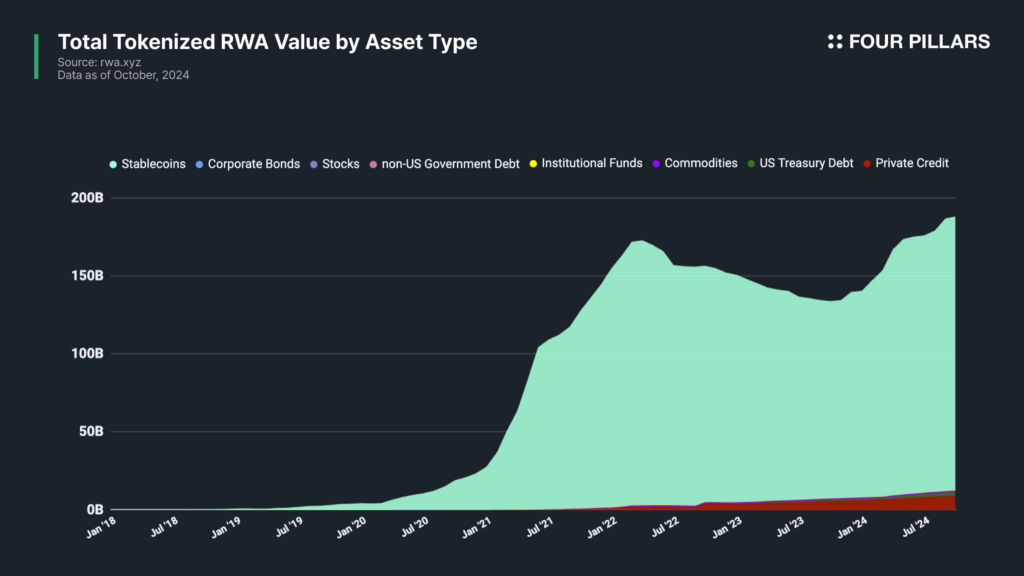

- Strong Growth Potential: 2024 has witnessed an RWA boom as major traditional institutions have entered space, such as BlackRock (managing over $10 trillion USD) launching the BUIDL fund on Ethereum, Hashnote (USYC), and Franklin Templeton (FOBXX).

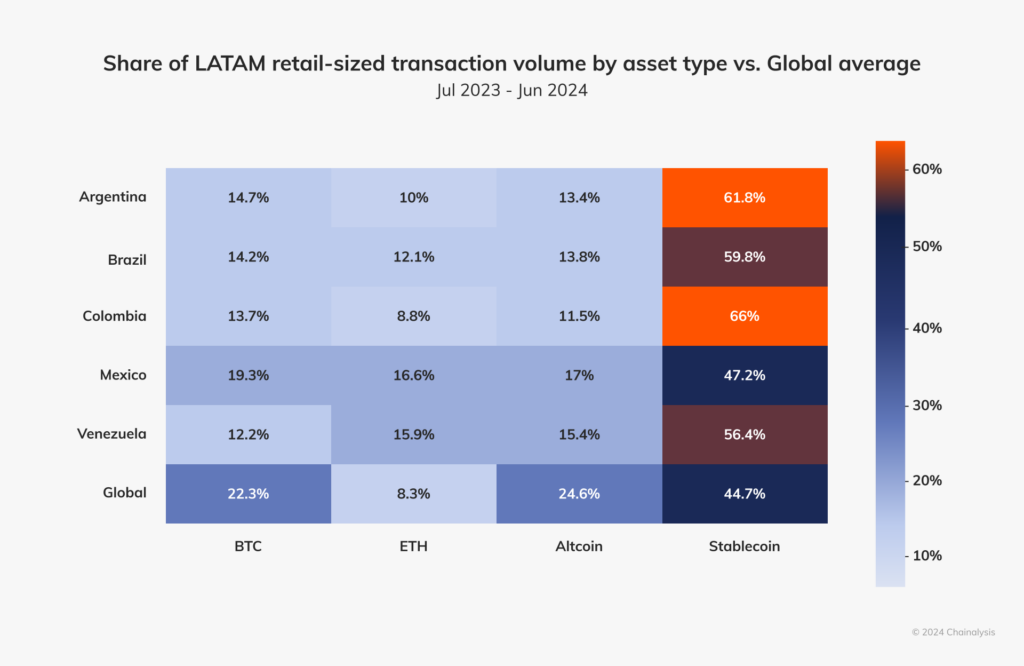

- High Effectiveness: The most successful tokenized RWA to date is the “stablecoin,” with transaction volume reaching 66% in the Americas, dominated by “non-yield stablecoins” like USDT and USDC. Alongside this, we’ve seen the growth of “yield-bearing stablecoins” backed by “synthetic assets,” with the concept of being a store of value that generates safe returns in the eyes of investors rapidly gaining traction, evidenced by the total market cap growth from $16 billion in 2021 to $210 billion (~1,212%) in 2024.

This demonstrates that RWA is a significant and promising market.

Ondo Finance has tokenized traditional financial products on the blockchain (RWA) through $USDY (yield-bearing stablecoin) and $OUSG (with a significant portion invested in BUIDL).

- Ondo satisfies both of the above factors, quickly achieving Product-Market Fit (PMF) with its $USDY and $OUSG products, which have Total Value Locked (TVL) of $384 million and $184 million, respectively, placing Ondo in the top 3 market positions, behind only Hashnote and Securitize.

- Essentially, Ondo is an organization (investment management fund) that raises capital from institutional and individual investors seeking to participate in the market with a risk-averse fund allocation, attracting capital flows and investing them into the BUIDL fund. Direct revenue (for OUSG) is derived from various fees collected from the involved parties.

- For the USDY product (representing short-term bonds and demand deposits), which is not dependent on a management fund but managed directly by Ondo, interest rates are adjusted accordingly. Profits are generated from investment spreads and asset management by Ondo.

Roadmap Milestone – Catalyst

Ecosystem

Ondo has excelled in growth and scaling through partnerships with L1 and L2 blockchains, making $USDY and $OUSG more accessible, enhancing the liquidity and utility of tokenized assets within DeFi, and building the necessary infrastructure to improve the efficiency of the traditional financial system.

- Ondo has also integrated $USDY as a reserve asset for DAOs like Arbitrum and MakerDAO.

- Collaborated with Helio and Sphere within the Solana ecosystem for payment stablecoin applications.

- Partnered with LayerZero and Axelar to facilitate seamless transfer of $USDY and $OUSG, preventing liquidity fragmentation.

Roadmap #Milestone for 2024:

Phase I: Driving the adoption of tokenized cash equivalents – Completed.

- Focusing on RWA and Collaboration with BlackRock is a Key Strategy

- The transition of OUSG’s underlying assets to BlackRock’s BUIDL fund in March not only enhances liquidity but also reduces risk for investors.

- Insight: Ondo Finance is betting on the Real-World Assets (RWA) narrative by aligning with major traditional financial institutions like BlackRock. This makes their products more credible and attracts capital from traditional financial sectors.

- Prediction: This “crypto meets traditional finance” model could pave the way for more financial institutions to enter the on-chain RWA market.

- Expanding $USDY Across Multiple Blockchains to Reach DeFi Retail Users

- $USDY has been expanded to Aptos, Arbitrum, and Plume Network, increasing the number of supported blockchains from 3 to 8.

- Insight: Ondo Finance is not only targeting institutional investors but is also seeking to penetrate the DeFi retail user market—a, a customer segment that favors yield-bearing stablecoins.

- This move could help $USDY become a standard yield-bearing stablecoin on blockchains, directly competing with USDT, USDC, and even stETH.

- PayPal and LayerZero Open Opportunities for Liquidity & Scalability

- Partnerships with PayPal (supporting USDY ↔ PYUSD transactions) and integration with LayerZero (facilitating seamless asset transfers between blockchains).

- Insight: Addressing the challenges of liquidity and cross-chain scalability.

- If further integrated into Venmo or other popular financial applications, USDY could redefine how people use stablecoins, making it a mainstream asset management tool.

- Politics and Regulations Play a Crucial Role

- Contributing $1 million to Donald Trump’s inauguration fund is a clear political move.

- Insight: This indicates that Ondo is preparing for potential regulatory changes in the U.S., especially as stablecoins and RWA gain increasing attention from lawmakers.

- If a more favorable regulatory environment emerges under a Trump administration, Ondo Finance could take the lead in tokenizing traditional financial assets.

Catalyst Growth 2025 -> Phase II: Expanding to Additional Securities -> Currently Developing & Expanding

To attract both retail and institutional investors, Ondo Finance needs to introduce a variety of compelling products that align with the rapidly changing macroeconomic environment. Accordingly, Ondo Finance has announced its intention to bring hundreds of additional RWAs onto the chain soon, using the same institutional-grade standards they have applied to their yieldcoins.

- U.S. Government Support for RWA → Significant Capital Inflows to Ondo

- The Trump administration would likely promote clearer regulations for crypto, particularly stablecoins and real-world asset (RWA) tokenization, leading traditional funds to allocate a portion of their capital to on-chain RWA.

- Ondo Finance could become a leading destination due to its partnership with BlackRock and its robust RWA fund.

- On January 24th, Larry Fink, CEO of BlackRock, expressed hope that the SEC would quickly approve the tokenization of bonds and stocks.

- High U.S. Treasury Yields → RWA on Blockchain Booms

- U.S. Treasury interest rates remain high (~5%), making RWA funds more attractive to crypto investors compared to other assets (such as ETH or BTC staking).

- Non-yield bearing stablecoins (USDT, USDC) become less appealing compared to Ondo’s USDY (with an APY of 4-5%).

- DeFi capital flows strongly shift from USDC and USDT to USDY to optimize yield.

- Deeper Collaborations with BlackRock and PayPal → Expanding Adoption

- If BlackRock continues to expand its BUIDL fund and strengthen its ties with Ondo, OUSG could become the leading “On-Chain U.S. Treasury ETF.

- With PayPal integrating USDY, expanding to Venmo and Cash App could make USDY a popular yield-bearing stablecoin for payments.

- Potentially, Ondo Finance could become a “Crypto Bank” for traditional financial institutions.

- Ondo Finance Launches New Financial Products

- Tokenized real estate assets (Real Estate RWA).

- On-chain cash management funds (Stablecoin Money Market Fund).

- Lending protocol using USDY/OUSG as collateral

If the Trump administration truly supports crypto and establishes clear policies for RWA, Ondo Finance could be one of the strongest growth projects in 2025.

2.4. Competitive Landscape

- Market Sector

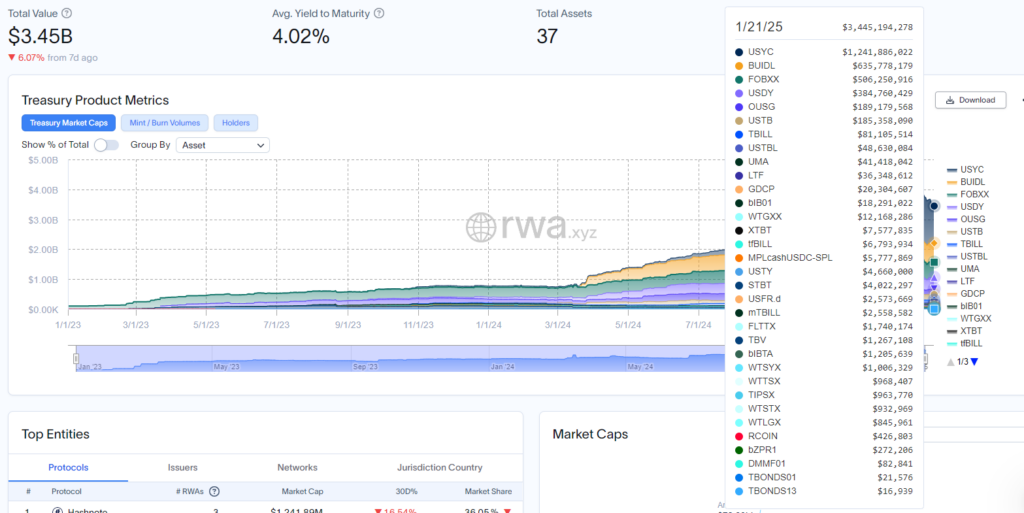

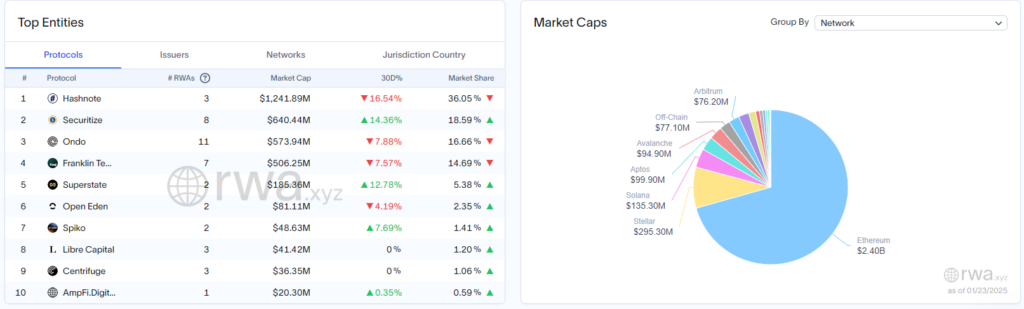

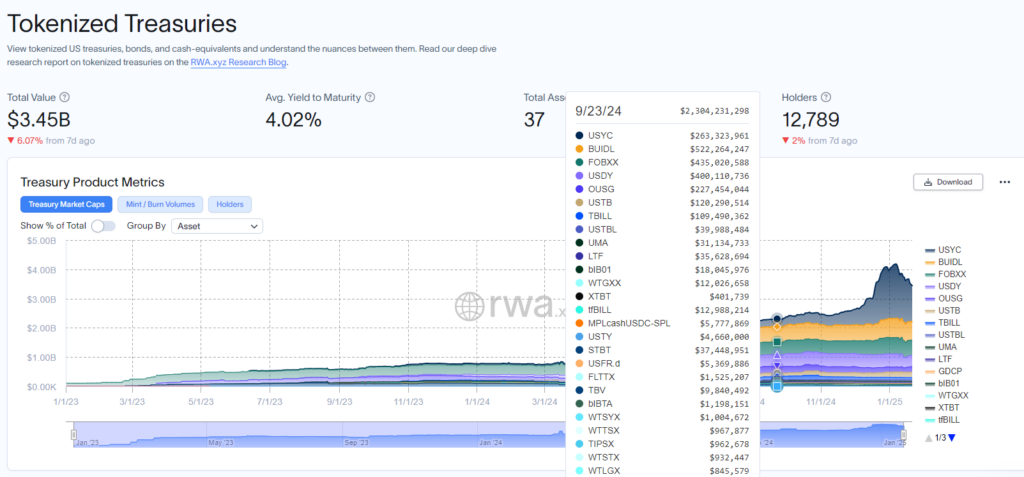

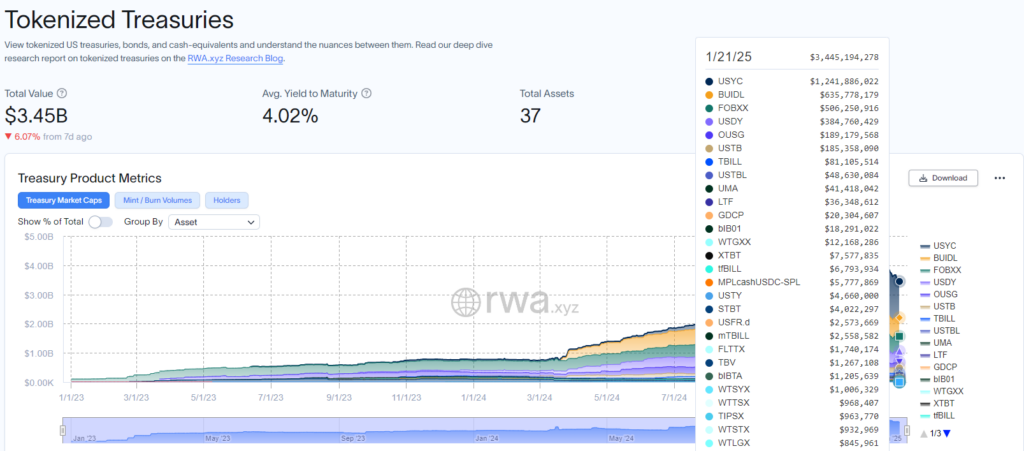

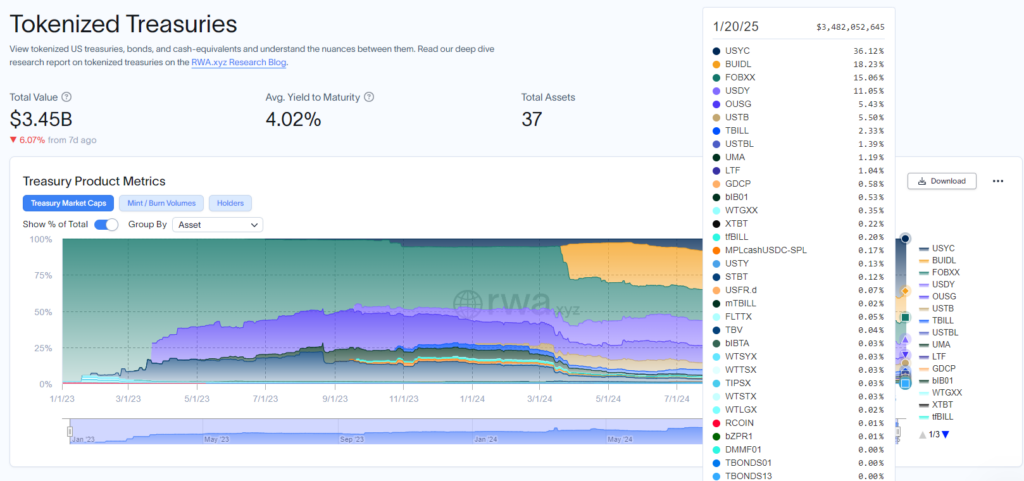

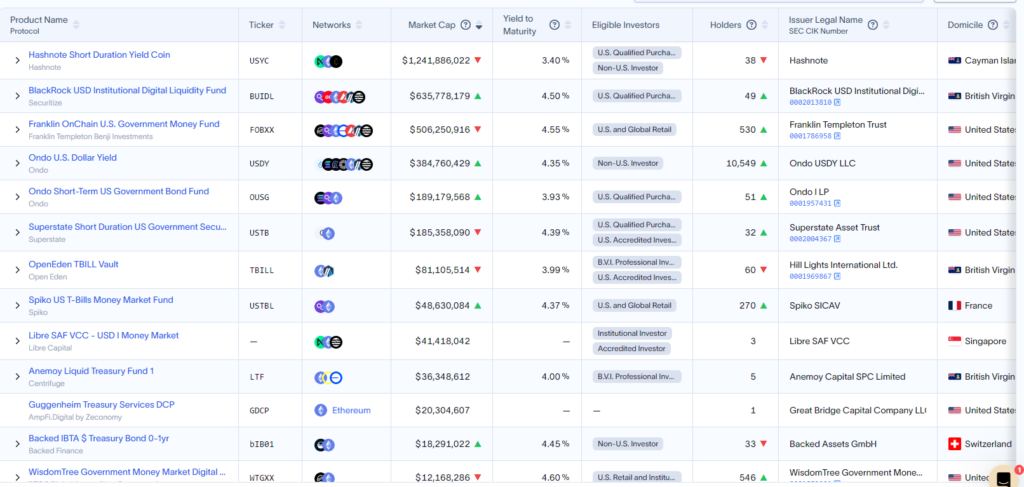

To gain an overall perspective on market share, using the Tokenized Treasuries metric is appropriate for assessing the tokenized products (representing U.S. Treasuries) of current RWA competitors. The Total Value stands at $3.2 billion, with USYC leading at 36.12% (~$1.2 billion), BUIDL at 18.23% (~$635 million), and Ondo ranking third with 16.66% (~$573 million).

From early 2024 to the end of Q3 2024, BlackRock’s $BUILD recorded a value of $500 million, securing the top market share position. The second position belongs to Ondo ($USDY & $OUSG), and the third position is held by Franklin Templeton (FOBXX).

However, with the explosive launch of the yield-bearing stablecoin $USD0 (backed by USYC), offering an attractive APY of 30-50% (reward = $USUAL), which has drawn in users, the $USD0 TVL volume has rapidly increased. This directly contributed to Hashnote’s USYC climbing to the top 1 market share position at the present time.

Comparision Table

Analyst’s Observations

Overall Market Sector: With the RWA boom, as of January 2025, the market recorded $4 billion, a remarkable 417% growth compared to January 2024, which had a Total Value of $773 million. However, as of January 23, 2025, the Total Value has decreased from $4 billion to $3.2 billion (-25%). This decline is influenced by investors’ tendency to seek better yields during market uptrends compared to downtrends.

Ondo’s Market Share: Ondo holds the third-largest market share. However, it’s crucial to analyze the fact that a significant percentage of funds from investors in Ondo’s $OUSG are used by Ondo to purchase BlackRock’s BUIDL. With OUSG’s value at $189 million, it contributes significantly, up to 29%, to BUIDL’s TVL. Therefore, it’s logically accurate to say Ondo holds the second-largest market share.

Yield to Maturity: Ondo’s USDY offers a modest APY of 4.35%, which doesn’t significantly differ from competitors like BUIDL, Franklin Templeton’s FOBXX, and Hashnote’s USYC, which offer 4.55%. However, these competitors cater primarily to institutions, limiting retail access. This gives Ondo an advantage as USDY is accessible to all without requiring accreditation, resulting in over 10,000 unique USDY holders. BUIDL’s partnership with Ondo facilitates capital attraction through $OUSG (with conditions but not overly restrictive), enabling Ondo to achieve higher upside potential

2.5. Tokenomics analysis

Token Info

- Total Supply: 10,000,000,000

- Circulating Supply: 3,159,107,529

- Price: $1.18

- Market Cap: $4,228,816,921

- FDV (Fully Diluted Valuation): $13,386,112,636

Raised Fund

- Total Raised Fund: $46M

- Coinlist round sold at $0.055/Ondo ~ (198 million $ONDO) → ROI 15.36x

- SEED round sold at $0.013/Ondo ~ (307 million $ONDO) → ROI 65x

- Series A round sold at $0.02/Ondo ~ (983 million $ONDO) → ROI 42.5x

- Tier 1 Investors: Founders Fund, Coinbase Ventures, Wintermute, Pantera.

Token Use Case

- ONDO DAO governance voting rights.

- Flux Finance protocol governance rights.

- Treasury management.

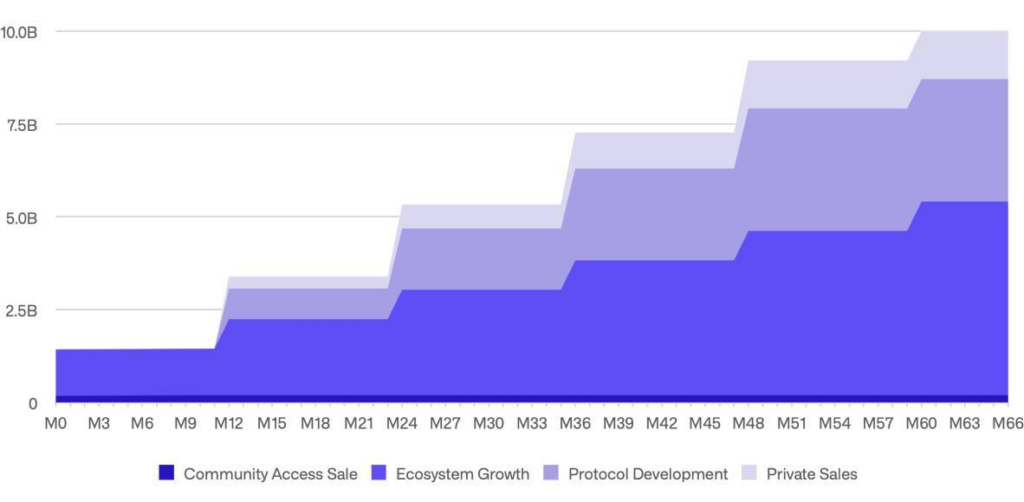

Token Allocation & Vesting

Token Distribution

- Community Access Sale: 198,884,411 (~2.0%), 90% unlocked (179 million) at TGE, the remaining 10% vesting linearly over 12 months.

- Ecosystem Growth: 5,210,869,545 (~52.1%), 24% unlocked (1.25 billion) at TGE, the remainder unlocked linearly every 12 months.

- Protocol Development: 3,300,000,000 (33.0%), locked for 12 months, then unlocking linearly every 12 months.

- Private Sales: 1,290,246,044 (~12.9%), locked for 12 months, then unlocking linearly every 12 months.

Analysis & Commentary

Ondo’s tokenomics design is relatively simple, with clear objectives and less complexity compared to other RWA projects, but it is limited to token growth incentives (lacking project-specific use cases) beyond DAO governance participation.

At TGE in January 2024, 14.29% of the circulating supply was released. After one year, Ondo unlocked 1.94 billion $ONDO (~19.4% of the total supply) on January 19, 2025, distributed to [Private Sales, Protocol Development, Ecosystem Growth, and Access Sales], increasing the current circulating supply to 3.16 billion $ONDO (~31.16% of the total supply), which will remain until January 19, 2026.

On January 19, 2025, the $ONDO price ranged from $1.2 to $1.5 per token. Despite unlocking 322 million $ONDO (~$400 million USD) for [Private Sales] with an average ROI of 20x, the price has remained stable at $1.33, indicating two possibilities:

- Very large volume absorption & the project bought OTC back from the investor.

- Investors are holding for the long term.

The risk from private sales has been mitigated as the project’s price remains stable post-unlock, reinforcing confidence among $ONDO holders in the bull market.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.

[…] Ondo Research — BlockBase Insights, https://insights.blockbase.co/ondo-research/ […]

Comments are closed.