1. USDe & sUSDe

1.1. Overview

Ethena Labs offers USDe, a synthetic US Dollar (USD) that aims to serve as a crypto-native “Internet Bond.” The key characteristics Ethena is targeting with USDe are censorship resistance, scalability, and stability.

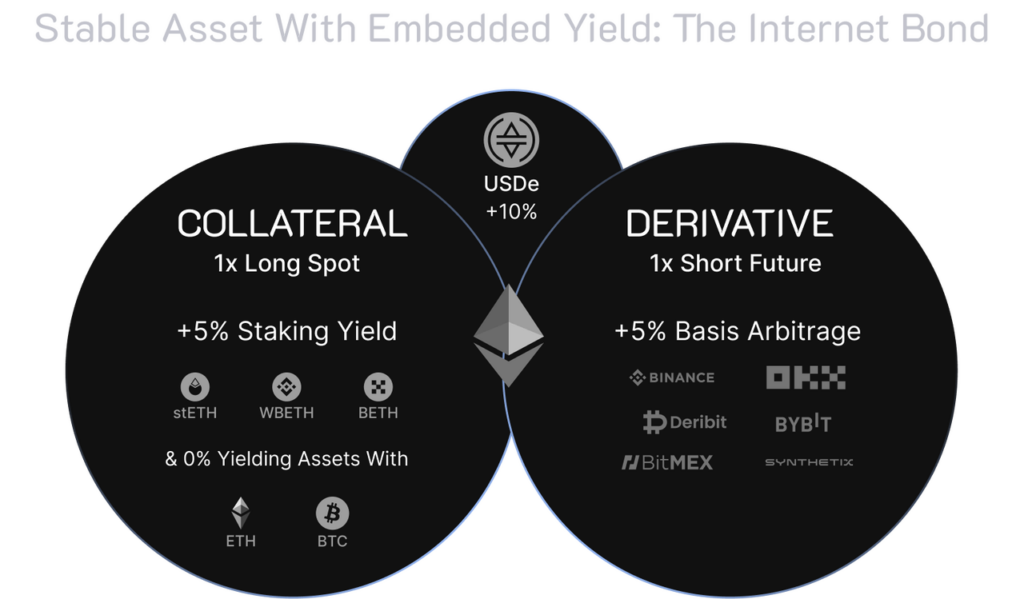

Ethena’s synthetic dollar, USDe, is designed to provide a crypto-native, scalable solution for a stable currency. It achieves this by delta-hedging Ethereum and Bitcoin collateral. Specifically, USDe is backed by a “delta-neutral” position, which involves going long on the spot price of stETH (and BTC) while simultaneously going short on an equivalent ETH-PERP (and BTC-PERP) position.

The rationale behind this strategy is that the long and short positions offset each other, allowing USDe to theoretically maintain a 1:1 peg to the US dollar. This approach aims to provide a stable, crypto-native currency that can be freely composed throughout the decentralized finance (DeFi) ecosystem.

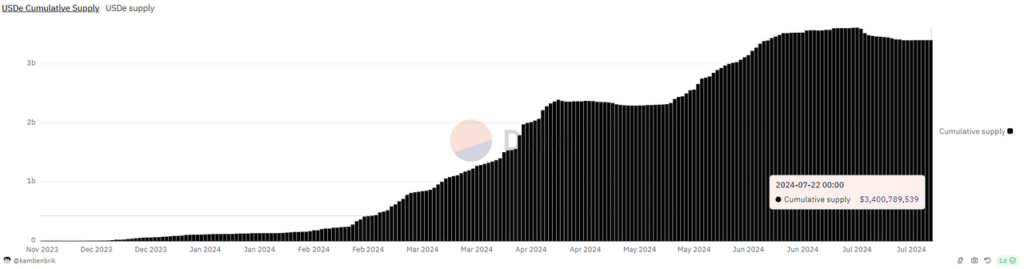

At the time of writing, the total supply of USDe is 3.4B USDe in circulation. The evolution of the cumulative supply can be seen on the dashboard below:

To earn a yield on USDe, users can either:

- Provide USDe liquidity in DeFi

- Stake their USDe into sUSDe -> Ratio sUSDe/ USDe = 0.4628%

1.2. sUSDe: How to generate yield?

The yield for sUSDe comes from two sources:

- stETH, USDe’s collateral: The yield from stETH comes from three main sources:

- Inflation rewards on the Ethereum network: This is like earning interest because the network creates more ETH as a reward for participating.

- Transaction fees on Ethereum: When people make transactions, they pay fees, and a portion of these fees goes to those who stake ETH.

- Maximal Extractable Value (MEV) rewards: This is a bit more complex, but it essentially means stalkers can earn extra from certain transaction order placements.

- Funding rate: The periodic payments made between long and short positions in the futures market, which are influenced by the demand and supply dynamics of the underlying asset.

2. Ethereum ETF Approval: A Catalyst for sUSDe Growth

The approval of a spot Ethereum ETF could potentially make sUSDe an attractive option for investors, drawing parallels from the recent Bitcoin ETF approval experience. Also, approval would likely bring more institutional capital into the Ethereum ecosystem, potentially increasing the demand for dollar-denominated yield-generating assets like sUSDe.

2.1. Status inflow ETH ETF

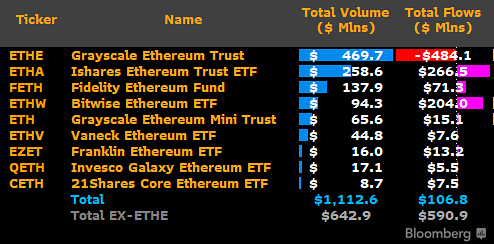

The first day of trading for the Ethereum ETFs saw significant inflows, with BlackRock’s $ETHA leading the way with $266.5 million, followed by Bitwise’s $ETHW with $204 million. This demonstrates a strong institutional demand for exposure to Ethereum.

Many analysts are using Bitcoin ETF performance as a benchmark, with inflow estimates for Ethereum after approval ranging from 15% to 50% of Bitcoin ETF inflows.

2.2. Looking Back at Bitcoin ETF Approval

The approval of Bitcoin ETF has profoundly impacted the market, driving up prices and increasing funding rates.

- The approval led to a notable surge in Bitcoin’s price, which climbed from around $40,000 to nearly $80,000 within a few months.

- Additionally, the funding rates for Bitcoin perpetual futures contracts saw a substantial increase, reaching as high as 50% annualized, up from the relatively stable pre-approval rates of around 10%.

Similarly, an Ethereum ETF approval could drive up funding rates for ETH perpetual futures, benefiting sUSDe holders since the token’s yield is partially derived from these funding rates

3. Conclusion

Ethena’s synthetic dollar, USDe, has become the fastest crypto dollar to reach $3.4B in total supply, surpassing the records of DAI and USDC. The approval of an Ethereum ETF could bring new liquidity to the Ethereum ecosystem, leading to opportunities for increased yields for Ethena’s synthetic dollar, sUSDe, much like the yields observed following the Bitcoin ETF approval.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.