1. Executive Summary

- Token Overview

- Ticker: $Pendle

- Current Price: $2.29

- Market Cap: $378M

- FDV: $591M

- Sector: Yield Trading

TLDR;

Founded in 2022, Pendle is a pioneering project in the “yield trading” sector. Their products target experienced retail DeFi investors and VCs seeking to optimize returns and hedge risks.

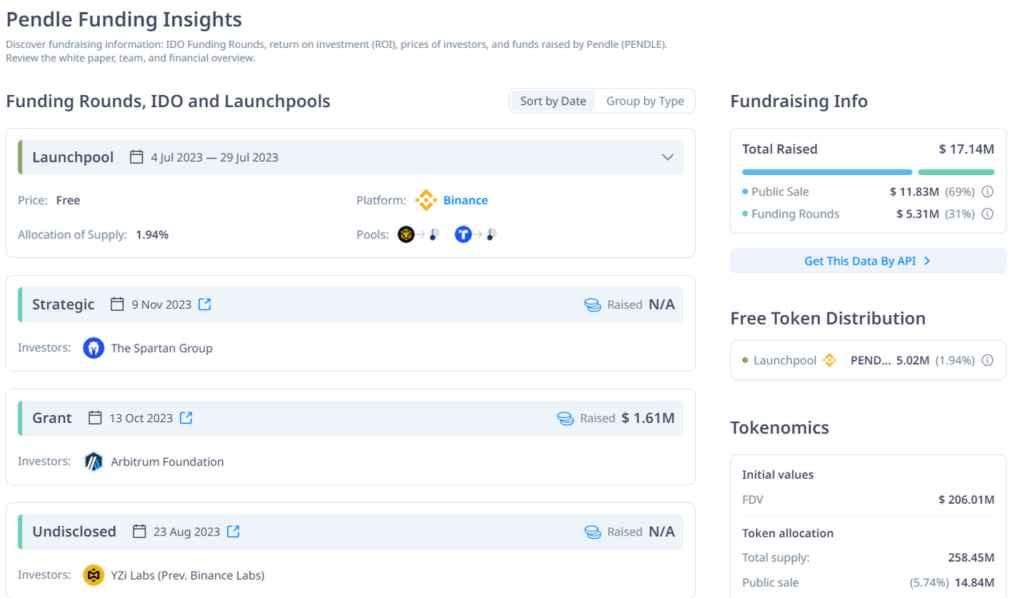

Pendle has raised a total of $17 million from top-tier investors, including Binance Labs, Hashkey Capital, The Spartan Group, and Arbitrum. Strong backing from industry-leading investors, particularly Binance Labs’ dedicated investment round, is a significant advantage for DeFi projects like Pendle.

The team has extensive technical and business expertise, a deep understanding of DeFi, and notable experience from Kyber Network (2017-2021). With their market insights and strategic vision, they quickly launched a product, achieving a unique selling proposition (USP) and a total value locked (TVL) of $5.17 billion, leading the yield trading sector.

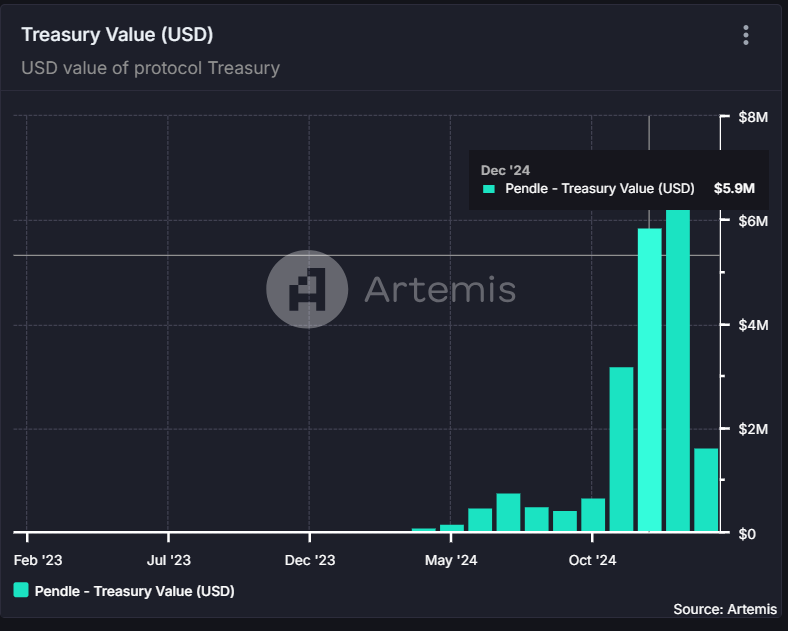

Pendle has generated stable revenue since June 2024, averaging over $4 million per month. The 2025 roadmap, featuring new advancements, is poised to bring significant benefits. Pendle is preparing for the Real World Assets (RWA) x Traditional Finance (TradFi) boom in 2025, with their product achieving product-market fit (PMF) and establishing a unique market position.

Pendle’s tokenomics are designed similarly to CRV and Aerodrome, optimizing value for all stakeholders, including liquidity providers (LPs), token holders, and end-users. Token sell pressure from the team and investors has been eliminated following the full unlock in September 2024.

2. Due Diligence Summary

2.1. Overview

Pendle Finance is a pioneering decentralized finance (DeFi) protocol that empowers users to dynamically trade, manage, and optimize fixed-yield strategies for their cryptocurrency holdings.

Its core innovation lies in the ability to segregate asset ownership (Ownership Tokens – OTs) from future yield streams (Yield Tokens – YTs), unlocking sophisticated trading opportunities within the DeFi landscape.

2.2. Team

TN Lee

- Co-Founder & CEO of Pendle Finance.

- Formerly, co-founder of Kyber Network and held the position of Head of Business in South Korea, China, the United States, and Europe from 2017 to 2019.

- Founder of a company specializing in the sale of semiconductor components.

Vu Nguyen

- Co-Founder & CTO of Pendle Finance.

- Formerly, CTO of the Digix DAO project on Ethereum, specializing in gold tokenization.

- Graduated with a degree in Computer Science from Singapore.

Anton Buenavista

- Core Contributor, responsible for Ecosystem Growth at Pendle Finance.

- Formerly, Core Contributor of Kyber Network from 2018 to 2021.

- Ken Chia: Leads Institutional Business development at Pendle Finance.

- Long Vuong Hoang: Heads the Engineering division at Pendle Finance.

Pendle Finance’s leadership team is distinguished by its Vietnamese founders and core contributors with proven track records at Kyber Network and across specialized Web3 roles. This combination of robust computer science expertise and profound DeFi acumen underscores their capability to architect and manage a sophisticated protocol.

Their demonstrated success in international programming competitions further attests to their exceptional problem-solving and innovative prowess.

In summary, the Pendle Finance development team is characterized by a high degree of professional competence and significant growth potential, providing a robust foundation that has propelled Pendle to its current $5 billion TVL milestone.

2.3. Business Model – Product

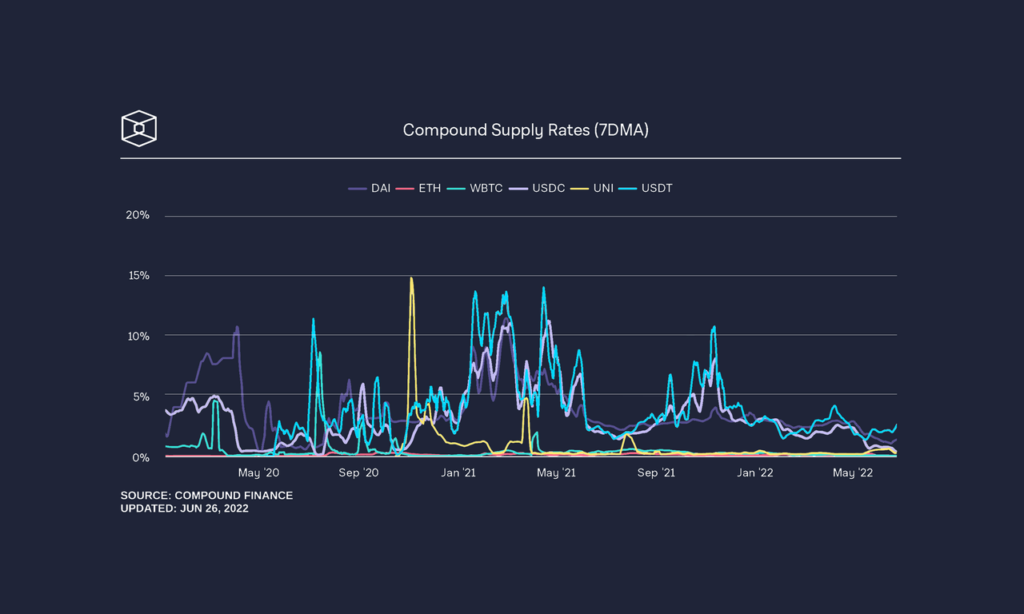

Pendle’s core mission is to address the inherent volatility of DeFi interest rates, which are subject to supply and demand dynamics. By implementing speculative instruments and fixed-yield derivatives, Pendle seeks to provide a more stable and predictable environment for trading mature DeFi assets, similar to that found in traditional financial markets.

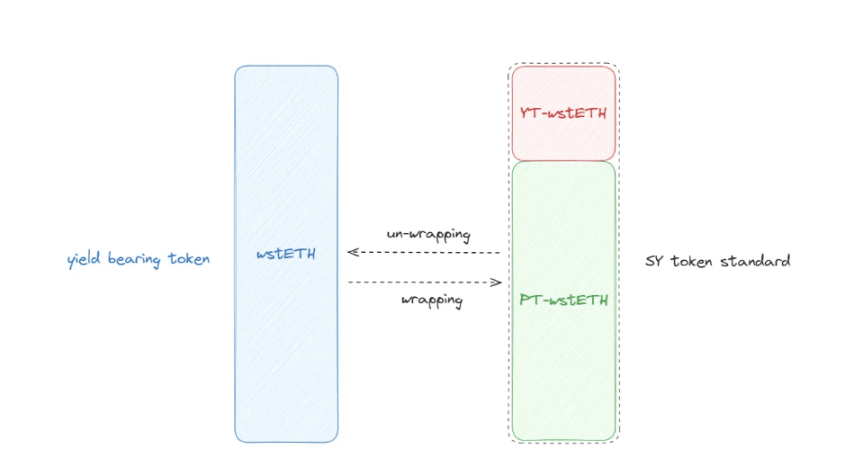

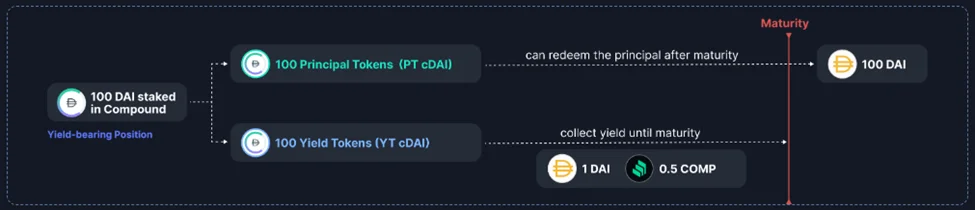

Yield tokenization

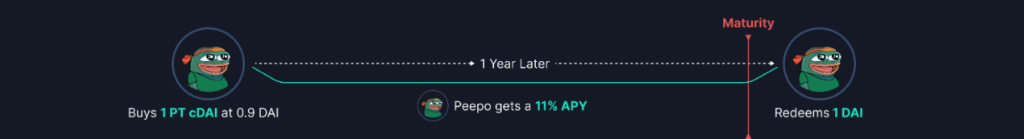

Yield Tokenization involves converting the yield of a base token into separate, tradable tokens. This allows users to actively engage with their future returns, enabling them to buy, sell, or optimize their profits instantly, rather than passively holding assets and waiting for yield accrual. Pendle Finance achieves this by splitting user assets into two distinct components:

| Asset | Function | |

| Standardized Yield Token (SY) | Principal Token (PT) – Underlying Asset | – Represents the principal value of an asset, redeemable at maturity. – Similar to bonds, users can buy PT at a discount and receive full value at maturity. – Tradable at any time, even before maturity. |

| Yield Token (YT) – Future Yield | – Represents the separated yield portion, tradable without waiting for maturity. – Users can buy YT to earn higher yields or sell if they don’t want to hold it. – Tradable at any time, even before maturity. | |

Example: Suppose A has 1 ETH staked on Lido (stETH) with a 5% APY. If A holds stETH for 1 year, A receives 1 ETH + 5% interest = 1.05 ETH. With Pendle, A can:

- Sell the yield (YT) in advance → Receive money immediately without waiting for 1 year.

- Buy PT at a discounted price → Take advantage of a better investment opportunity.

- Trade YT if predicting APY changes → Profit from interest rate fluctuations.

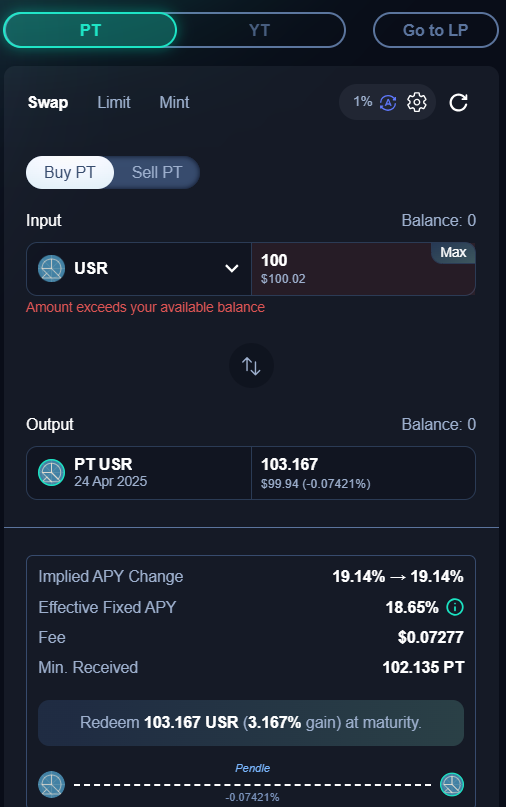

Pendle DEX AMM

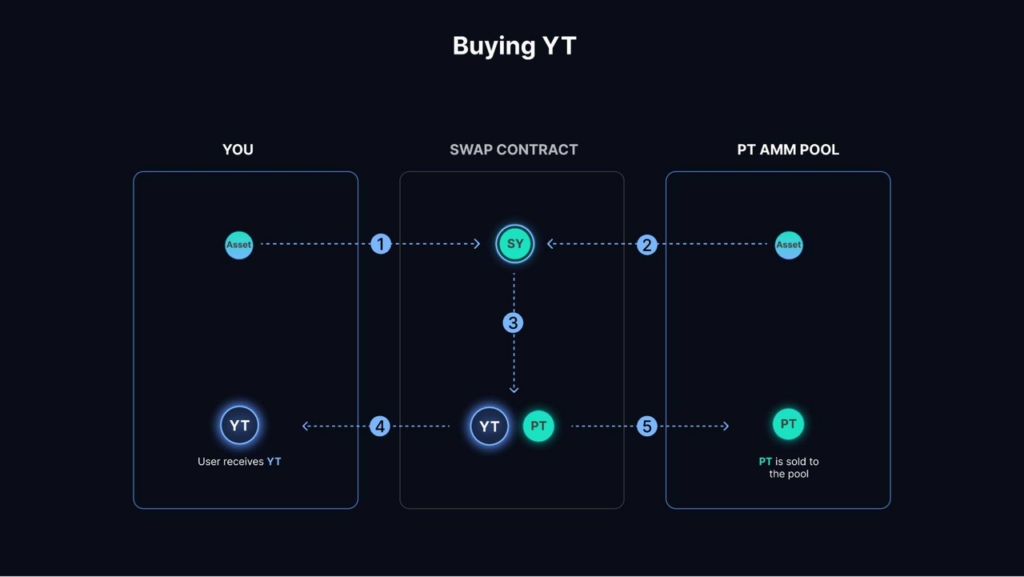

To enhance asset liquidity, enable speculative trading, and facilitate the free trading of yield for the assets mentioned in the example, Pendle provides support for trading both PT and YT tokens on its Decentralized Exchange Automated Market Maker (DEX AMM). This allows users to speculate on the yield generated by these assets through the following AMM mechanism:

- Users deposit their original asset (stETH) into the Swap Contract.

- The deposited asset is then converted into a Standardized Yield Token (SY) and transferred to the Principal Token (PT) Automated Market Maker (AMM) Pool.

- The system then splits the SY into two distinct tokens: the Principal Token (PT) and the Yield Token (YT).

- Users receive the Yield Token (YT) to accrue yield.

- The Principal Token (PT) is subsequently sold into the PT AMM Pool to ensure liquidity

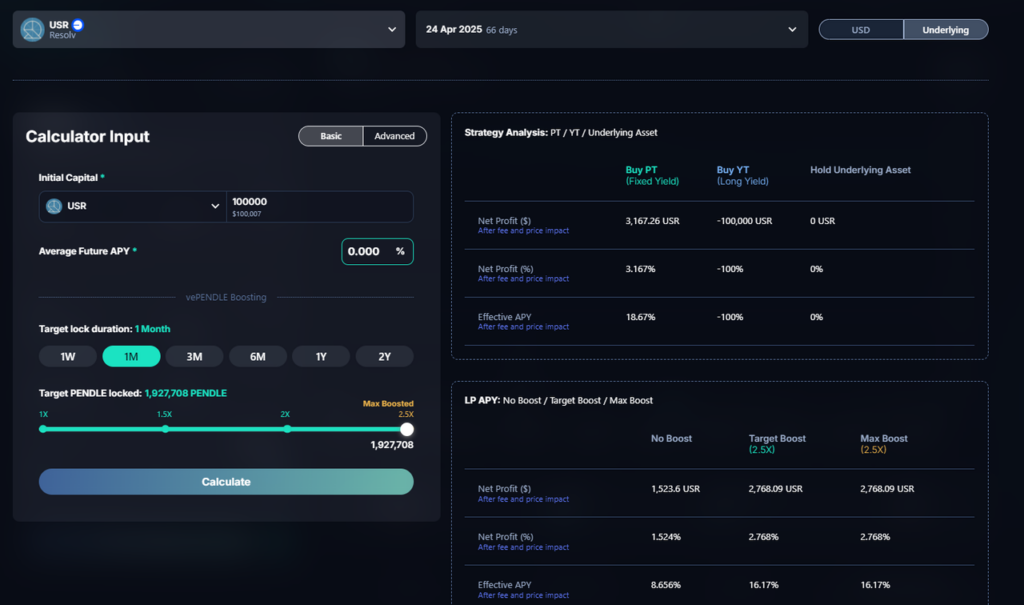

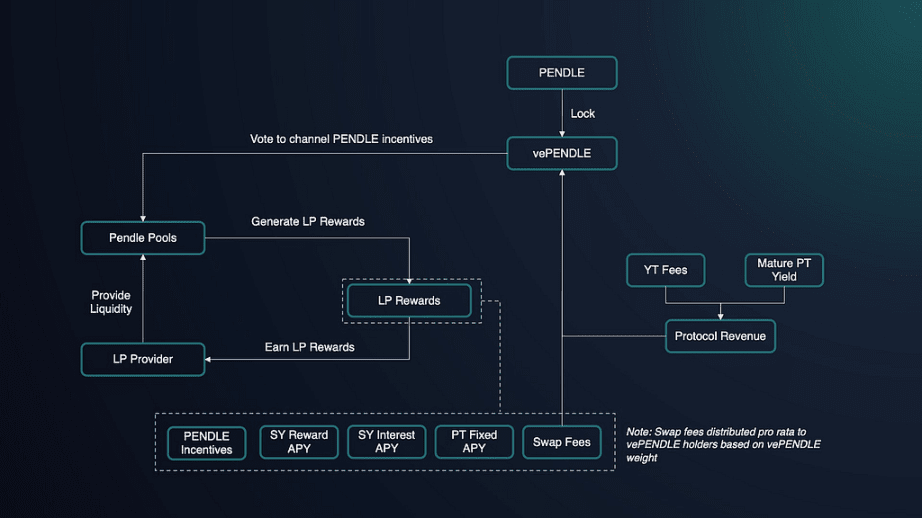

vePendle

Users have the option to lock their PENDLE tokens in exchange for vePENDLE. Holding vePENDLE grants users access to enhanced benefits within the Pendle ecosystem.

- vePENDLE holders can vote on liquidity pools, directing $PENDLE rewards to Liquidity Providers (LPs). As users trade within these pools, vePENDLE holders receive a portion of the transaction fees. Additionally, new $PENDLE tokens are minted and distributed to LPs as incentives.

Revenue

Pendle Finance functions as a platform for trading yield, rather than generating it directly, akin to Uniswap’s role as an Automated Market Maker (AMM) for token exchanges. Consequently, Pendle’s revenue streams are derived from:

| Thu | % fee | Fee Allocation | |

| Swap Fee | Fee from PT & YT trading on AMM | 1% | – 0.85% allocated to – $vePendle.0.15% allocated to Treasury |

| Yield Fee | Fee from yield claimed via YT | 3% | Treasury funds protocol development. Currently distributed to veHolders. |

Pendle is the first project that helps users freely trade %Yield, something that traditional DeFi platforms cannot do. The team clearly understands DeFi & grasps the trend, having developed 3 main products: Yield Tokenization, Pendle AMM, vePendle, which are interconnected and complementary, forming a unified block that makes

- Pendle is the most complete in Yield Trading, a self-operating product ecosystem, not dependent on third parties.

- Optimizes liquidity and capital efficiency for investors and institutions.

The project has core revenue generation, transparent. The project also applies a share-revenue strategy in the early stages to attract users to its products, easily achieving USP in the market.

Bizmode transforms asset yield into freely tradable assets similar to stocks & bonds, contributing to bringing DeFi closer to traditional finance (TradFi).

2.4. Competitive Landscape

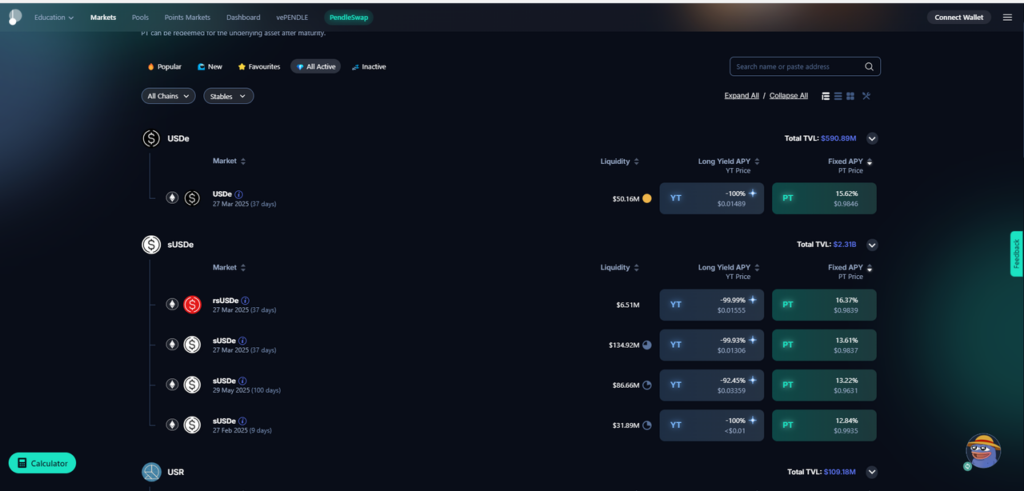

Market Sector

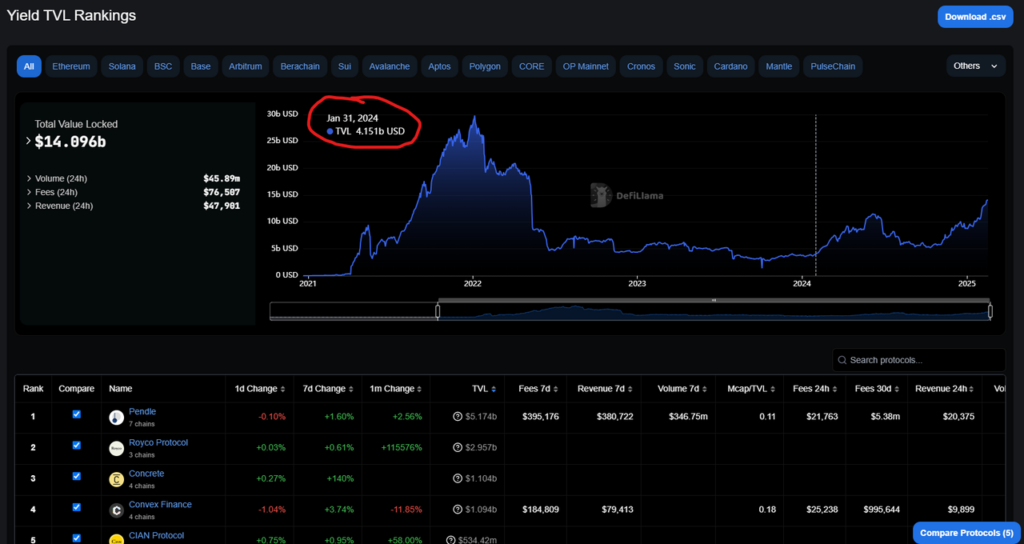

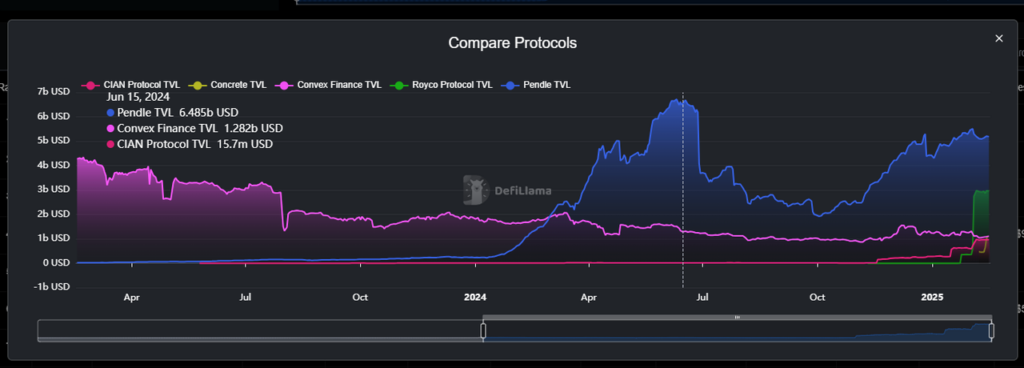

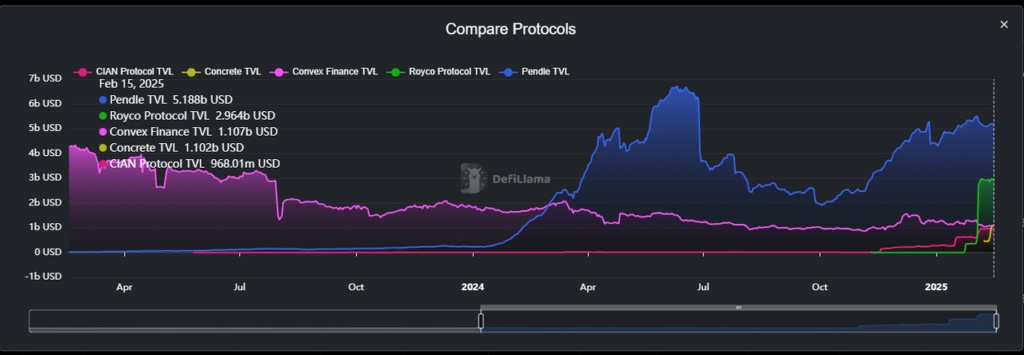

In the Yield Sector during 2022-2023, Pendle faced competition from Saffron Finance, Element Finance, and Yield Protocol, all of which employed comparable models. However, currently, these three projects exhibit low Total Value Locked (TVL) figures, with Saffron Finance at $3 million, Element Finance at $0, and Yield Protocol having ceased operations.

From a broader perspective, utilizing the TVL Ranking of the entire Yield Sector for evaluation and analysis reveals: The Yield Sector’s TVL reached $14.07 billion in February 2025, marking a significant 251% increase from $4.15 billion in February 2024. This surge indicates a recovery in TVL following a market downturn in Q3 2024, and it surpasses the previous local peak in Q2 2024 by over 26%, driven primarily by the growth in stablecoin yields during Q4 2024.

| Total TVL | % Share | Change 30D | |

| Pendle | $5.17B | 36.9% | +2.56% |

| Royco Protocol | $2.95B | 21.07% | +115,576% |

| Concrete | $1.104B | 7.88% | — |

| Convex Finance | $1.094B | 7.81% | -11.85% |

Analyzing TVL among projects within the Yield category, Pendle stands out with its unique ‘Yield Trading’ business model, commanding the top position in the Yield Sector with a TVL of $5.17 billion, representing a 36.9% market share.

Securing the second position, Royco Protocol, utilizing the Incentivized Action Markets (IAM) business model, has experienced an extraordinary TVL growth of over 115,000%, reaching $2.95 billion.

Milestone Growth On-chain

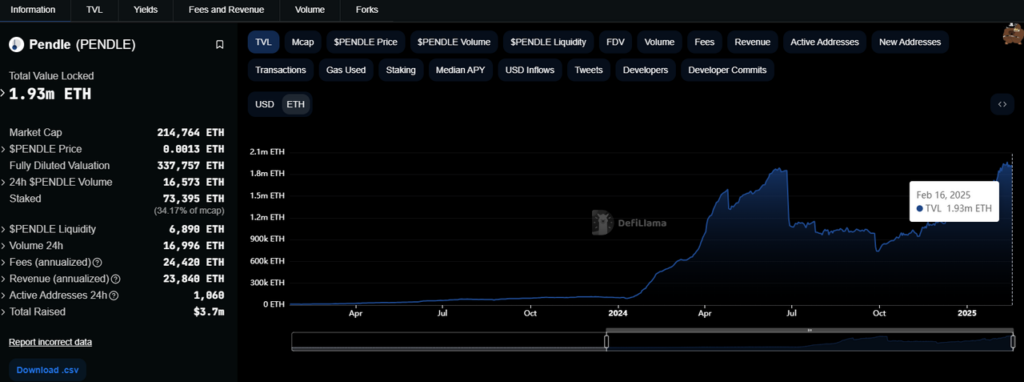

- Total Value Lock

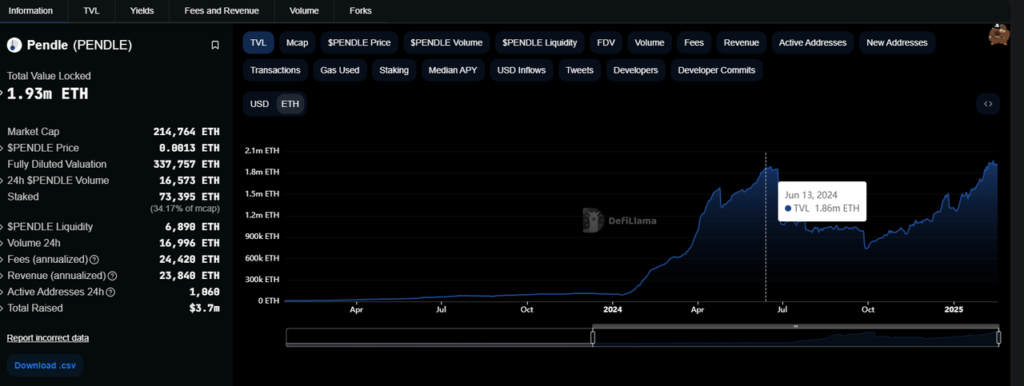

| TVL | 06.2024 | 02.2025 | % Change |

| USD | $6.72B | $5.18B | -29% |

| ETH | 1.86M $ETH | 1.93M $ETH | +3% |

The protocol’s Total Value Locked (TVL) experienced a significant surge, reaching an All-Time High (ATH) of $6.72 billion USD (approximately 1.86 million ETH) in June 2024, driven by the strong growth of Liquid Staking Token (LST) and Liquid Restaking Token (LRT) protocols. However, the market subsequently underwent a price correction in Q3 2024, with TVL dropping to $1.9 billion in September 2024, representing a 253% decline.

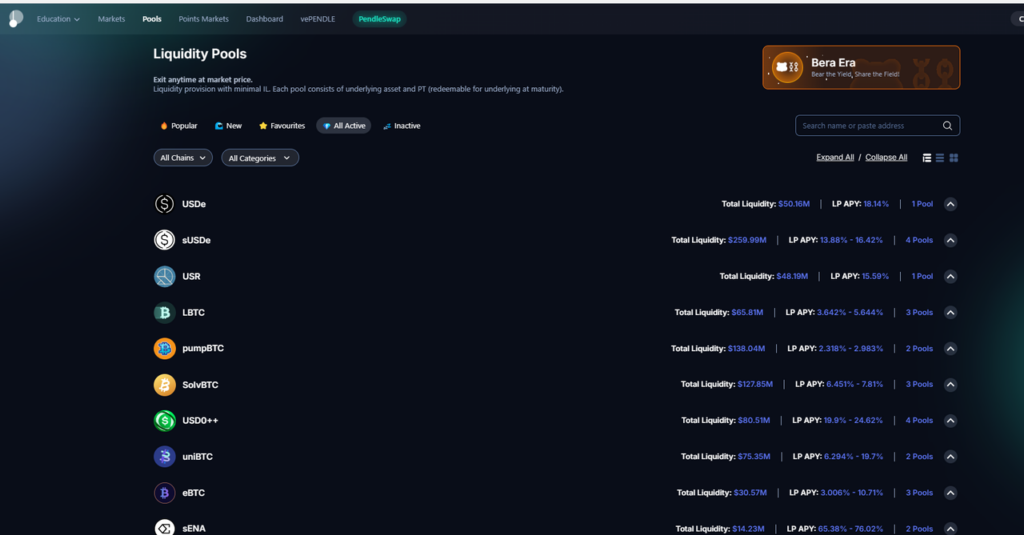

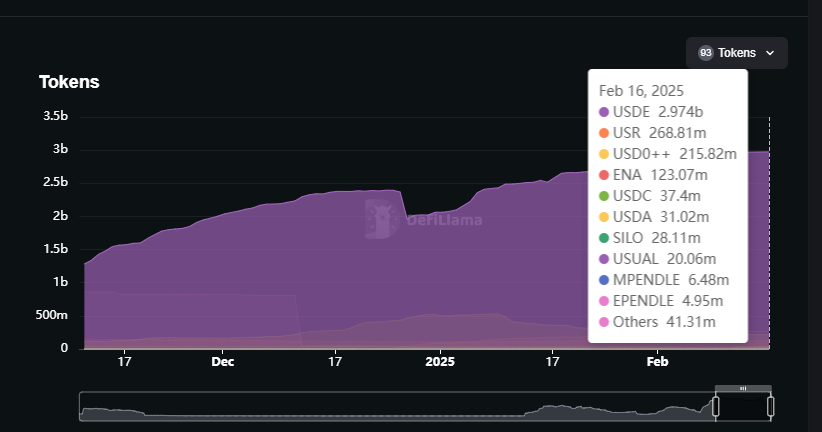

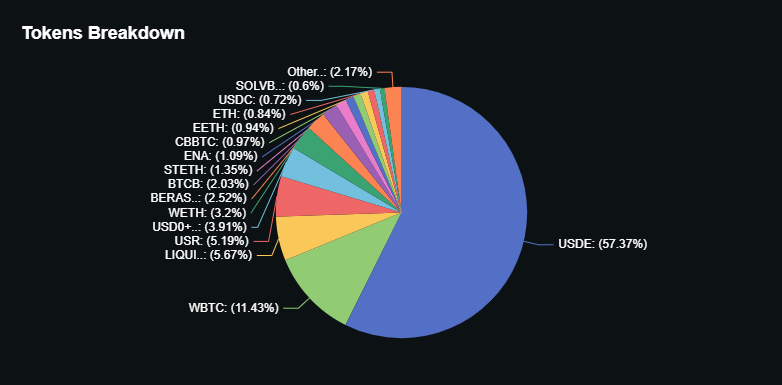

Nevertheless, the market rebounded strongly in Q4 2024, fueled by Bitcoin’s (BTC) ATH and the explosive growth of the Stablecoin Yield Sector, exemplified by projects like Ethena, Usual, and Sky. This resurgence propelled Pendle’s TVL back up to $5.18 billion (approximately 1.93 million ETH) as of February 2025. Notably, stablecoins constitute over 60% of Pendle’s TVL, reinforcing the perception that Stablecoin Yield offers a secure investment option during periods of market consolidation and volatility.

Interestingly, while the USD-denominated TVL decreased by 29%, the ETH-denominated TVL increased by 3%. This discrepancy suggests that users are actively optimizing their yield strategies despite the declining ETH price.

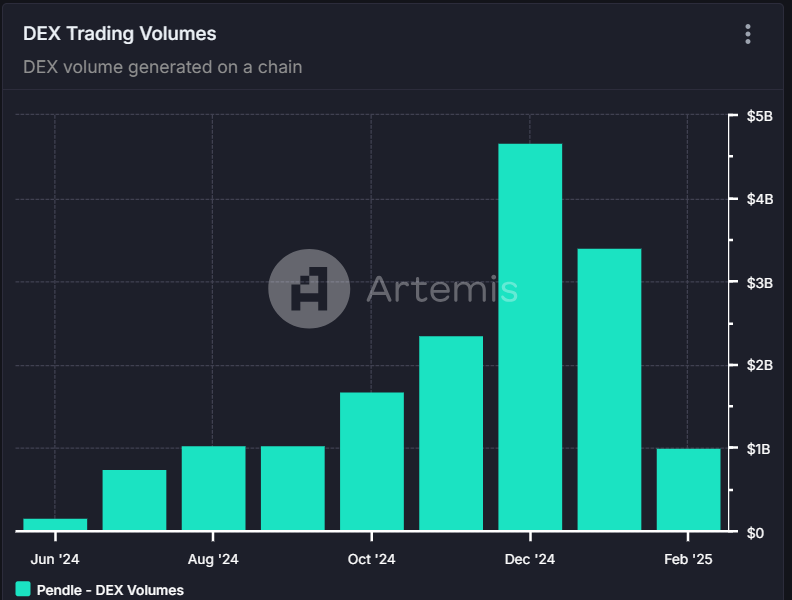

- Dex Trading Volume

By integrating its own Pendle DEX AMM directly into the protocol, thereby eliminating reliance on third-party intermediaries, Pendle has achieved remarkable month-over-month growth. Notably, it reached an All-Time High (ATH) of $4.7 billion in December 2024, representing a staggering 2,740% increase compared to June 2024. This strategic move has resulted in consistent, stable, and sustainable revenue generation for the project.

2.5. Tokenomics

Token Info

- Total Supply: 258,446,028 ~ 2% annual inflation rate starting on 05.2026

- Circulating Supply: 164,744,520 ~ 63%

- Price: $2.29

- Market Cap: $378M

- FDV: $591M

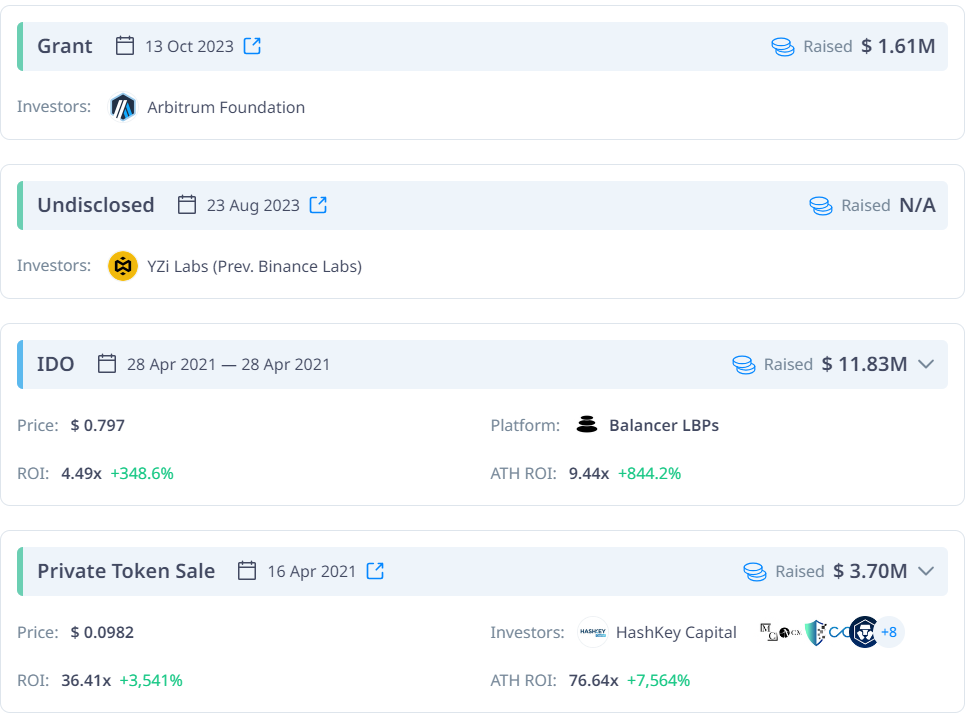

Raised Fund

- Total Raised Fund: $17M USD

- Investors: Binance Labs, The Spartan Group, Arbitrum Foundation, Hashkey Capital….

Token Use Case

- Governance participation through voting rights acquired by staking $PENDLE to obtain $vePendle.

- Holder $vePendle

Token Allocation & Vesting

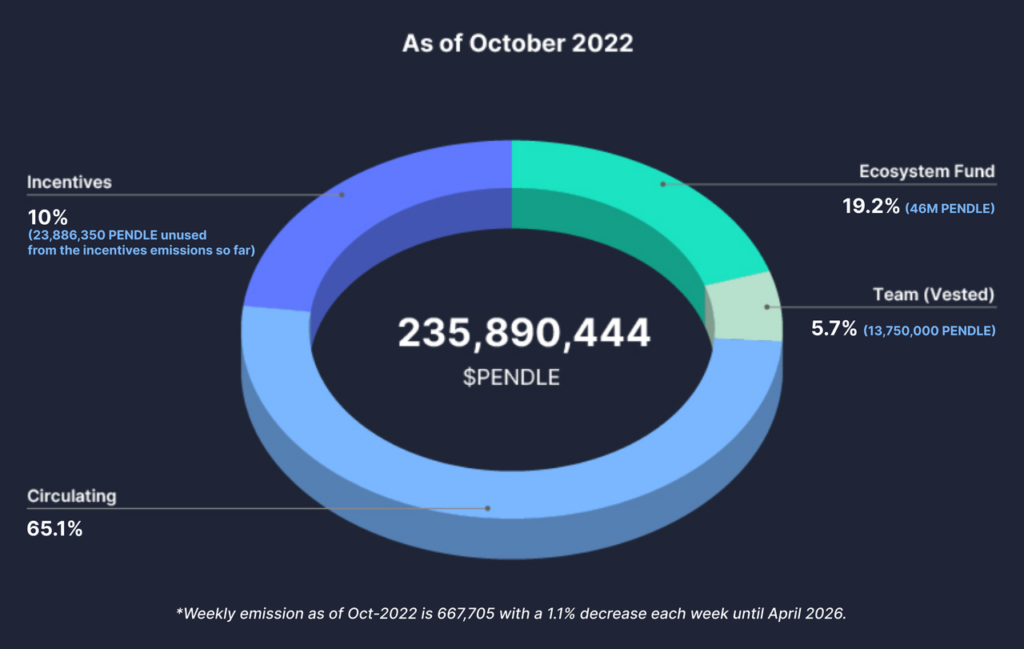

By September 2024, the full vesting period for all team and investor tokens will have concluded. Subsequent increases in the circulating token supply will originate from the project’s Incentives and Ecosystem Fund allocations.

The projected maximum circulating supply of $PENDLE by July 2025 is 251,061,124. Any additional supply beyond this amount will originate from incentives.

Analysis and Observations

Pendle’s tokenomics mirrors that of CRV and Aerodrome (on Base), emphasizing value accrual for Liquidity Providers (LPs) who earn $Pendle, and $vePendle holders who collect swap fee revenue, while also ensuring deep liquidity and minimizing price slippage for traders.

The selling overhang from Team and Investor token unlocks has been resolved, as all tokens were fully vested by September 2024.

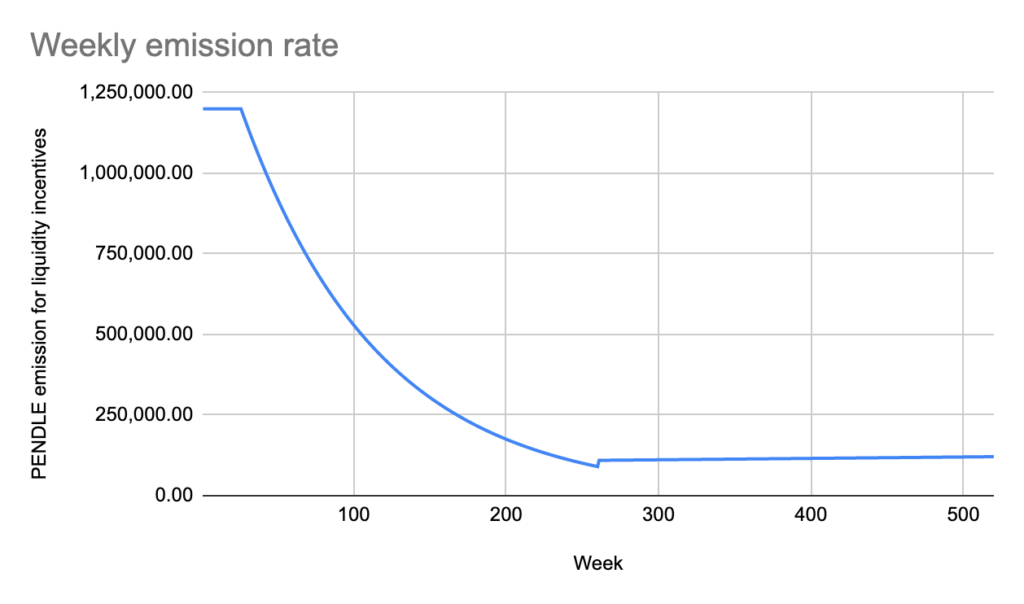

The current circulating supply is solely from incentive emissions, now in their 83rd week, with a weekly distribution of 600,000 $PENDLE (equivalent to roughly 2.4 million $PENDLE or $8.4 million USD per month). This emission rate will taper off by 1.1% each week until April 2026, followed by a 2% annual inflation rate starting May 2026, calculated against the $251 million circulating supply.

With a total circulating supply of 164 million $PENDLE, 38 million $PENDLE are currently staked (23%), leaving a free-floating supply of 126 million $PENDLE, or approximately 50% of the total, actively traded on the market.

Catalyst 2025

Potential Catalysts for Pendle’s New All-Time Highs in 2025:

- The launch of Pendle AMM V3, featuring significant enhancements, will position the platform to capitalize on the growing convergence with TradFi. This includes the development of KYC-compliant products, facilitating institutional investor access to crypto yields through partnerships with entities like Ethena.

- Ecosystem expansion through integrations with prominent blockchains such as Solana (SOL), TON, Hype, and Sui. This multi-chain approach and the enhanced trading capabilities for Liquid Staking Derivatives (LSDs) are expected to attract a wider user base and drive token value.

- The continued surge of Real World Assets (RWAs) in 2025, with TradFi assets being brought on-chain and stablecoin yields achieving Product-Market Fit (PMF), will escalate the demand for yield trading. As the leading protocol in this space, Pendle stands to benefit significantly.

- The increased demand for yield trading will drive user adoption, leading to higher Total Value Locked (TVL), increased revenue generation, and greater vePENDLE holder participation. This will further reduce weekly $PENDLE emissions, ultimately boosting the token’s price.

| Pendle | x2 | x3 | |

| Price | $3.61 | $7.22 | $10.83 |

| Market Cap | $587M | $1,174B | $1.71B |

| FDV | $923M | $1.846B | $2.769 |

| FDV/TVL | 0.18 | 0.35 | 0.53 |

With the current FDV/TVL ratio standing at 0.18, and considering the potential catalysts in 2025, reaching multiples of 0.35 and 0.25 is within reasonable expectations.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.