TLDR

Puffer Finance: A Promising Project with Significant Growth Potential in the Liquid ETH Restaking Sector

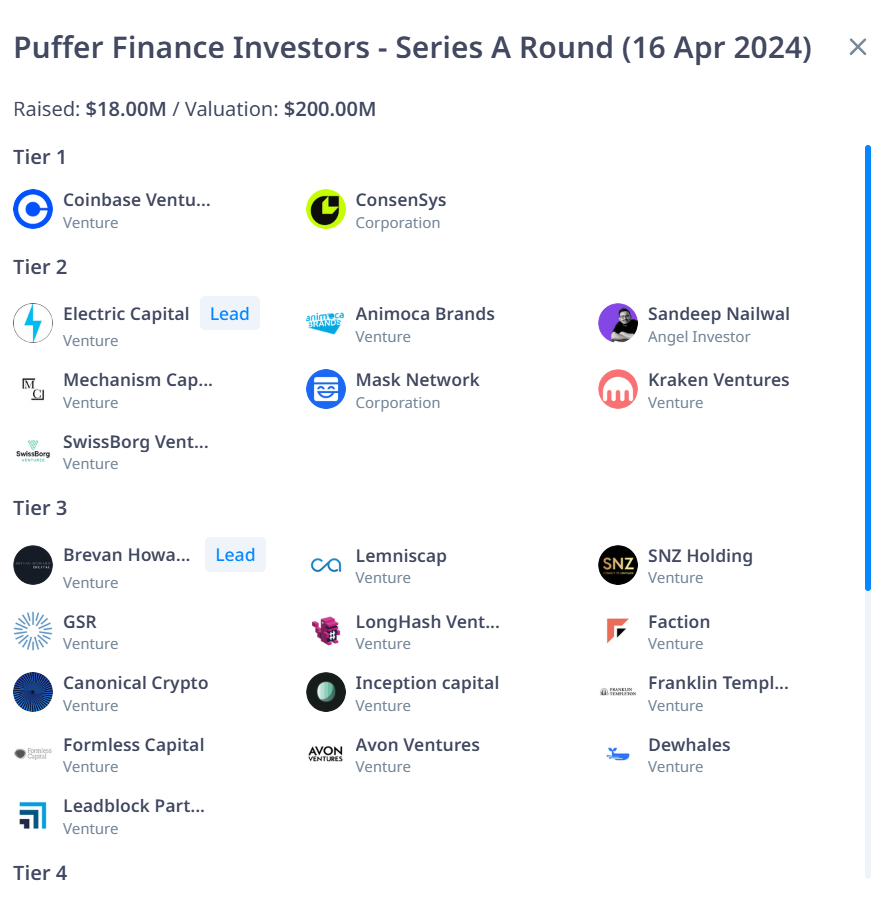

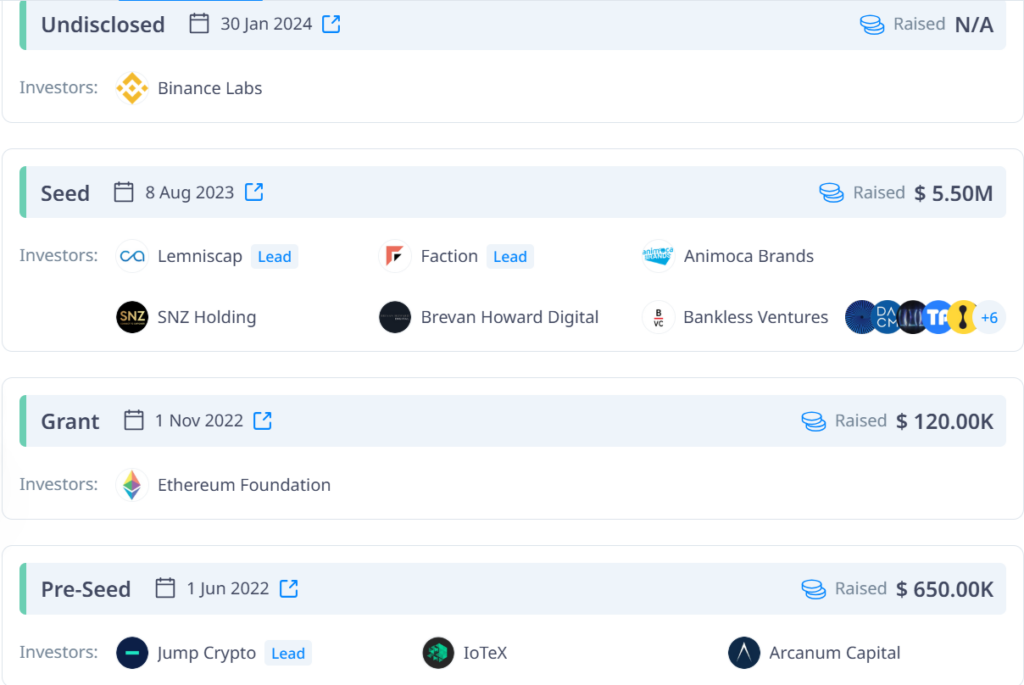

- Puffer Finance is a project with strong backing, including direct support from the Ethereum Foundation and $25 million in funding from major investment funds such as Coinbase, Binance Labs, and Consensys.

- Puffer once held a top 3 market share in terms of TVL (Total Value Locked) in ETH restaking for a considerable period (10 months), second only to Etherfi and Renzo.

- The most recent private sale round had a purchase price of $0.2, with a ROI (Return on Investment) of 3.45x. However, these tokens will not be unlocked until October 2025, making the current situation relatively safe.

The project’s fundamentals grew by over 50% from the beginning of March 2024 to October 2024. However, the TGE (Token Generation Event) in October 2024 was negatively affected by an underwhelming airdrop and overall market conditions, causing the price of $PUFFER to drop to around $0.26 (~$25 million market cap). As a result, the project’s fundamentals have declined significantly since November.

The tokenomics are favorable, with no significant selling pressure from investors and contributors until October 2025. The only potential pressure comes from Airdrop 2 and the Ecosystem allocation, but these are not considered major risks as the token price has already declined at the TGE.

The circulating supply is low, and inflation will bring the total circulating supply to 13% by April 2025. This, combined with the absence of selling pressure from the project itself, aligns well with market growth expectations in Q1 2025.

1. Due Diligence

1.1. Technology and Product

- Core Technology & Product

Puffer Finance is a native Liquid Restaking protocol built on Eigenlayer, making Ethereum staking more accessible and profitable.

Puffer has three main products: Liquid Restaking, UniFi (L2), and Uni AVS.

- Technology Overview

Puffer employs two distinct technologies that differentiate it from competitors in the market: Secure Signer and RAVe.

- Innovation Level

Puffer launched an L2 rollup based on Based Rollup technology to differentiate itself in terms of sequencer validation. The protocol is verified directly by L1, unlike other L2s on the market, such as Optimism and Arbitrum, which use centralized sequencers.

1.2. Competitive Landscape

- Market Sector – Liquid Restaking Token

Overview of the Lending Market Sector using two indicators: TVL (Total Value Locked) and Restaked ETH, with data statistics from DeFi Llama & Token Terminal.

| Market Sector | TVL | Restaking ETH |

| EtherFi | $9.159b ~ (61%) | $2.2M ~ (55%) |

| KelpDao | $1.924b ~(12.8%) | $480k ~ (12.1%) |

| Renzo | $1.69b ~ (11.2%) | $367.9k ~ (9.3%) |

| Eigenpie | $1.63b ~ (10.8%) | $421.1k ~ (10%) |

| Mantle | $678M ~ (4.52%) | $222k ~ (5.6%) |

| Puffer | $478M ~ (3.1%) | $122k ~ (3.08%) |

| Swell | $255M ~ (1.7%) | $143.7k ~ (3.6%) |

| Total | $17B | 3.95M |

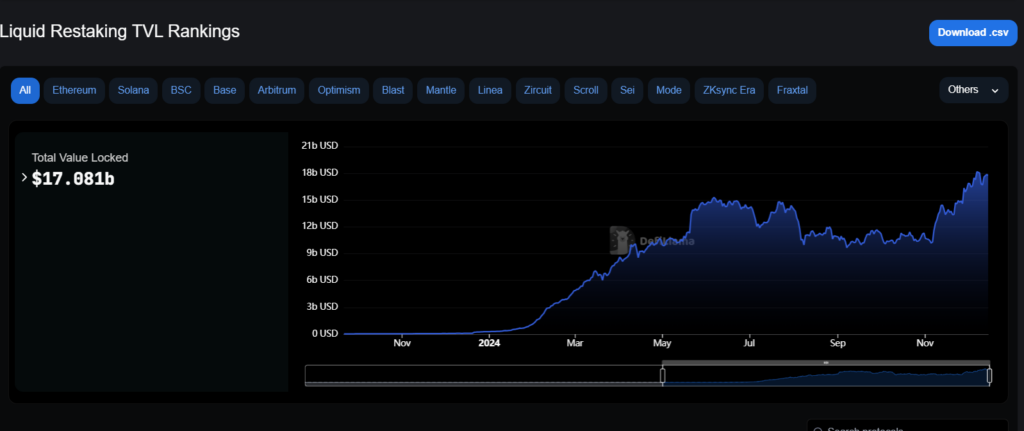

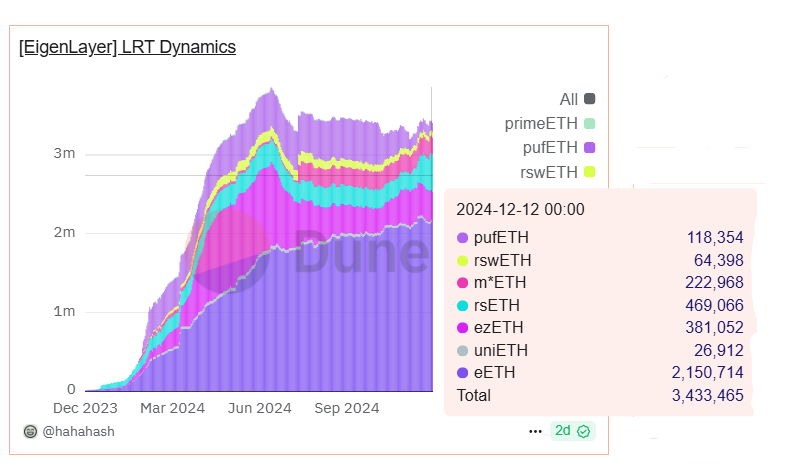

The amount of ETH and TVL has gradually decreased from its peak at the end of June, currently only at $15 billion USD in TVL. Most $LRTs have lost market share, except for Etherfi’s eETH.

The sector made a comeback in the last 6 months of the year with renewed growth as the market saw positive developments at the price of $ETH, leading to an ATH (All-Time High) TVL of $17 billion USD. However, the amount of $ETH has not changed significantly.

- Key Metrics (Financial & On-chain Metrics)

| Time | 09/2024 | 10/2024 | 11/2024 | YTD |

| Restake ETH | 518.3k | 533.1k(2.8%) | 331.5k(-60%) | 145.5k |

| TVL | $1.3B | $1.4B(7.69%) | $834.7M(-67%) | $541.7M |

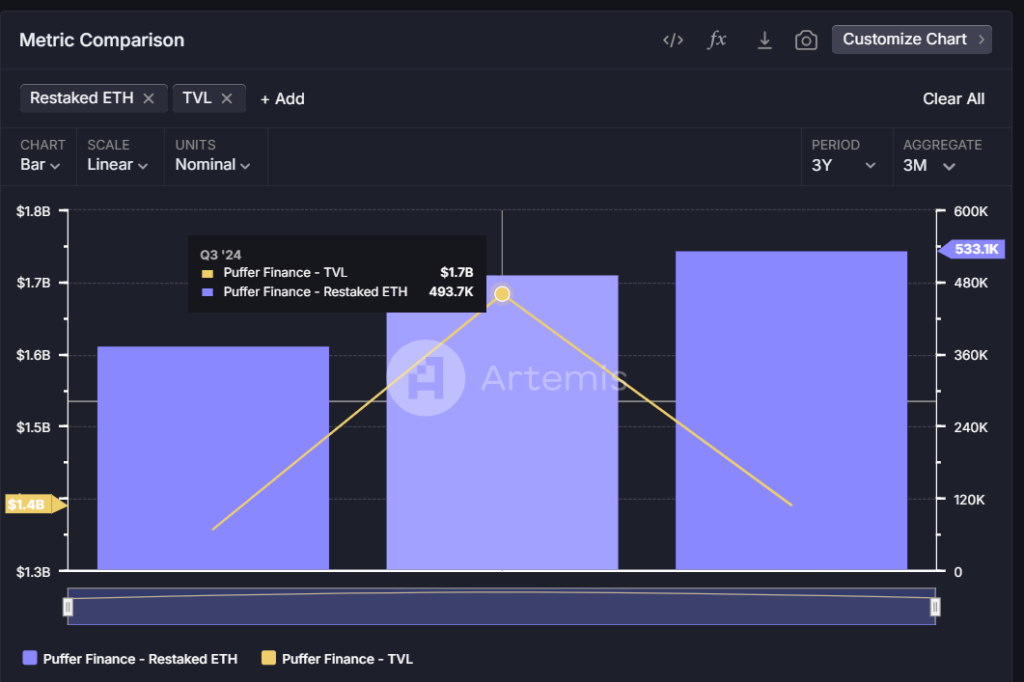

Looking deeply into Puffer’s fundamentals, we can clearly see the project started to change in March 2024, with LRT and TVL at $359k and $1.3 billion respectively. By June 2024, it reached $475k and $1.8 billion, with LRT growth of 32% and TVL growth of 50%. This is explained by the boom of the Liquid Restaking Token trend in the first 6 months of the year, which brought optimal yield and attracted users.

Restake ETH continuously grew steadily by 5-10% until October, but TVL dropped sharply by -60%. The price of $ETH fell sharply in Q3 when the market was negative, and the launch of native $Puffer with a disappointing airdrop event led to a sharp decrease in LRT and TVL by -67% in November compared to October.

- Competitive Landscape

| LRT ETH & TVL | Q2/2024 | Q3/2024 | 10/2024 | 11/2024 |

| Ethefi | 921K – $3.4B | 1.8M – $7.2B | 2M – $6.3B | 2.1M – $6.5B |

| Renzo | 614K – $2.2B | 861K – $3B | 322K – $1B | 321K – $1B |

| Puffer | 374.9 – $1.4B | 493.7K – $1.7B | 533K – $1.4B | 331K – $834M |

Overall, compared to its competitors, Puffer maintained its top 3 position in Q2 and Q3. However, in October, Puffer rose to 2nd place with 533K LRT and $1.4 billion TVL, an increase of 65% and 40% respectively compared to Renzo. Etherfi remains the top 1, holding a significant advantage over its competitors.

1.3. Tokenomics

1.3.1. Token Information

- Total Supply: 1,000,000,000

- Circulating Supply: 102,300,000

- Price: $0.6948

- Market Cap: $71,139,338

- FDV (Fully Diluted Valuation): $695,399,201

- Total Raised Fund: $24.27M

- Tier 1 Investors: Coinbase, Binance Labs, Consensys

1.3.2. Token Use Case

The $PUFFER token will be used for the following purposes within the UniFi Rollup:

- Selecting restaking operators and guardians.

- Selecting supported AVSs (Actively Validated Services).

- In the future, $PUFFER will play a role in allocating ETH to operators and AVSs.

- Controlling the fee structure.

- Monitoring AVS security parameters.

- Setting cost parameters for rollup transactions.

- Using rewards to incentivize ecosystem growth.

- Governance of the entire protocol.

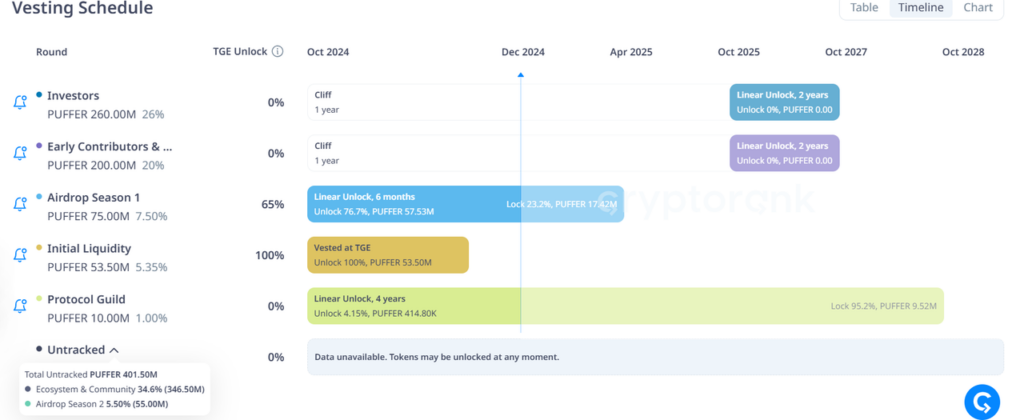

1.3.3. Token Allocation & Vesting

| Allocation | Lock | Vesting | |

| Airdrop 1 | 7.5% | TGE unlocks 50%, remaining 50% vests over 6 months (~0.625% per month of total supply) | 6 months |

| Liquidity | 5.35% | 100% unlocked at TGE | — |

| Guild | 1% | 1% vests over 4 years (~0.02% per month of total supply) | 4 years |

| Investor | 26% | Locked for 1 year, unlocking starts in October 2025 at 1.092% per month of total supply | 2 years |

| Contributor | 20% | Locked for 1 year, unlocking starts in October 2025 at 1.092% per month of total supply | 2 years |

| Ecosystem | 34.6% | No lock | — |

| Airdrop 2 | 5.5% | No lock, snapshot begins in October 2024 | — |

$PUFFER is set to be listed in October with an initial circulating supply of 10.32%, allocated across three categories: Airdrop 1, Protocol Guild, and Liquidity.

- The token distribution model minimizes selling pressure from investors and contributors, as their tokens will only start unlocking from October 2025 at a rate of 2.184% per month (~21.8 million $PUFFER) of the total supply.

- By April 2025, the circulating supply is expected to reach 13% (~130 million $PUFFER), assuming the project remains impacted by its current fundamentals and has yet to implement plans for ecosystem development or Airdrop 2.

With limited circulating supply, $PUFFER holds strong growth potential from its $0.67 price point (corresponding to 10.32% circulating supply) up to April 2025, especially as the market is projected to experience a strong uptrend in Q1 2025.

2. Valuation

2.1. Evaluating MC/TVL Ratio Compared to Competitors

| Token | TVL | Cap | MC/TVL | |

| Puffer | $PUFFER | $478M | $70,077,174 | 0.146 |

| EtherFi | $ETHFI | $9.159b | $557,094,220 | 0.06 |

| Renzo | $REZ | $1.69b | $243,948,492 | 0.14 |

| Eigenpie | $EGP | $1.63b | $6,970,325 | 0.004 |

| Swell | $SWELL | $255M | $66,514,505 | 0.26 |

- Median MC/TVL = 0.14

- Average MC/TVL = 0.122 → Adjusted MC/TVL Ratio = 0.11

2.2. Projected Market Size (TVS) Based on Growth Scenarios

The total market TVS currently stands at $15B, with projected growth across different scenarios (Low, Base, High). Puffer’s market share is assumed to range from 10% to 50%, corresponding to the estimated TVS values below:

| Growth Sector | Low (50%) | Base (100%) | High (150%) |

| TVS | 7.5B | 15B | 22.5B |

| Puffer %share | Low 50% | Base 100% | High 150% |

| 10% | 750M | 1.5B | 2.25B |

| 20% | 1.5B | 3B | 4.5B |

| 30% | 2.25B | 4.5B | 6.75B |

| 40% | 3B | 6B | 9B |

| 50% | 3.75B | 7.5B | 11.25B |

2.3. Projected Market Cap & Price in 2025 (MC/TVL = 0.11)

Using a 0.11 MC/TVL Ratio, the expected market capitalization and price of $PUFFER in 2025 under different scenarios are as follows:

Market Cap Projections ($)

| Cap | Low 50% | Base 100% | High 150% |

| 10% | 82.5M | 165M | 247M |

| 20% | 165M | 330M | 495M |

| 30% | 247M | 495M | 742M |

| 40% | 330M | 660M | 990M |

| 50% | 412M | 825M | 1,237M |

Price Projections ($)

| Price | Low 50% | Base 100% | High 150% |

| 10% | $0.63 | $1.2 | $1.9 |

| 20% | $1.26 | $2.53 | $1.5 |

| 30% | $1.9 | $3.8 | $5.7 |

| 40% | $2.53 | $5.07 | $7.6 |

| 50% | $3.16 | $6.34 | $9.5 |

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.