Real-world assets (RWA) tokenization has recently resurfaced and gained widespread attention in the cryptocurrency market. RWA tokenization is not a new concept; more specifically, stablecoins backed by USD, such as USDT and USDC, are successful versions of this approach and they play an important role in the market nowadays.

So, what are tokenized real-world assets?

Tokenized real-world assets represent the progress of transferring the value of real-world assets into digital tokens. This allows for the digital ownership of assets to be transferred and stored without the need for a centralized intermediary, and the value of the assets is reflected and transacted on the blockchain. RWAs can include both tangible and intangible assets.

The concept of RWA tokenization is essentially to establish a virtual investment vehicle on the blockchain linked to real-world assets such as real estate, bonds, commodities, art, collectibles, and more. As a result, instead of holding ownership certificates on physical paper, the ownership is stored on the blockchain, enabling easy transfer, fractional ownership (which can be split into small parts), exchange, and listing on the secondary market. By tokenizing RWAs, market participants can enjoy increased efficiency, higher transparency, and reduced human errors as these assets can be stored and tracked on-chain.

Why has RWA tokenization recently gained prominence?

There are several factors contributing to this rise. Firstly, Web3 native assets have reached a bottleneck, resulting in numerous projects being launched daily, but with relatively homogeneous assets. Secondly, the Defi infrastructure is continuously improving, thanks to advancements in Oracle technology, the creation of new token standards, and other developments that are bridged the gap between on-chain and off-chain operations. Thirdly, in the aftermath of the collapse of Cefi companies like Celsius and Voyager, compliance and risk management have become a major focus. Traditional finance sectors are known for their stringent management practices, and RWA provides investors with higher protection compared to other cryptocurrencies (many of which have experienced significant value loss).

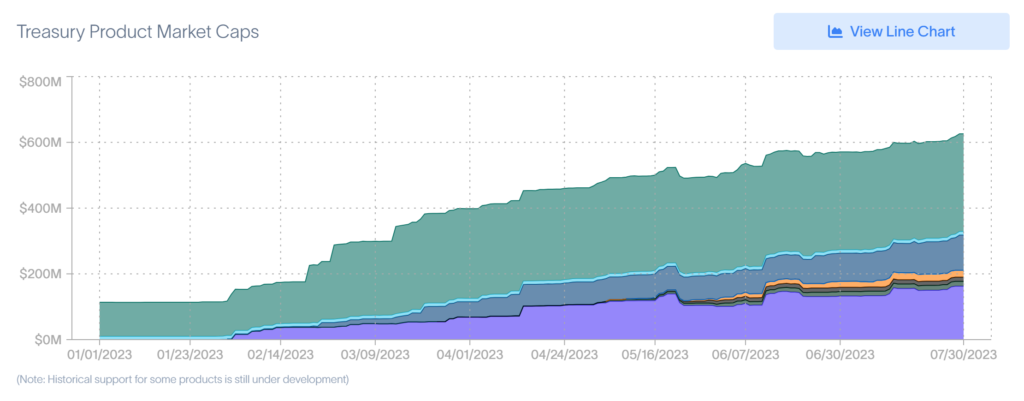

https://app.rwa.xyz/treasuries

In reality, the RWA tokenization market has attracted $1 billion in funds, with the demand for tokenized US Treasury assets experiencing a significant increase, accounting for 60% (~ $600 million) of the market share. When the interest rates were at 0, there was little interest in US Treasury assets. However, with short-dated Treasury yields now exceeding 5%, the situation has changed. Furthermore, the instability of banks at the beginning of the year has led to concerns about depositing money in traditional financial institutions. Consequently, investors have turned to Treasury bills for their safety. In the crypto world, the bear market has resulted in “slow-motion” activities on the blockchain, with the yields of Defi becoming less attractive and less secure. These factors combined have led to a surge in demand for tokenized US Treasury assets.

Traditional institutions have begun to take advantage of blockchain technology

RWA tokenization is a segment that multiple traditional financial companies choose to participate in on the blockchain. Traditional financial firms are enthusiastic about the idea of tokenizing assets they have been trading, such as gold, stocks, and commodities. The investment fund giant Franklin Templeton launched the Franklin OnChain U.S. Government Money Fund on the Stellar blockchain and expanded to Polygon in 2023. Franklin OnChain U.S. Government Money Fund pioneer move made it the first U.S. registered mutual fund to utilize the public blockchain for its transactions and record-keeping.

In November, the giant U.S. bank JPMorgan executed its first direct transaction using tokenized versions of the Singapore dollar and yen on the Polygon blockchain. A month later, asset manager WisdomTree announced nine digital funds, adding to the successful funds it launched earlier in the year. These funds allow agents to transfer ownership of secondary record shares on the Stellar or Ethereum blockchain.

More recently, the Hong Kong central bank offered $100 million worth of green bonds, and French investment bank Credit Agricole CIB and Swedish bank SEB agreed to develop a blockchain-based platform for digital bonds. Now, the future of tokenization looks promising, with the global business consulting company Boston Consulting Group forecasting that the tokenized asset market could surge to $16 trillion by 2030.

Inclusion, trust, liquidity, transparency, security, efficiency, and innovation come with the advent of blockchain technology, but the cryptocurrency industry seems to be facing challenges in finding new growth opportunities; the crypto market is in dire need of something new, like the next big narrative. And RWA tokenization creates a bridge between traditional finance and cryptocurrency finance, bringing new hope to the saturated crypto market.