TLDR;

- Sei Network is a high-speed Layer 1 blockchain with low costs and high scalability, achieved through its parallel execution capabilities and full EVM compatibility.

- The network’s performance has seen consistent growth from September to December (current), with increases of 20%-30%, primarily driven by Incentive Programs from the Foundation aimed at revitalizing the chain. The two most benefited sectors are Lending and Liquid Staking Tokens (LST). However, when viewed more broadly, $SEI’s fundamental competitiveness is still lacking.

- SEI needs a major breakthrough in the form of substantial Incentives or Airdrops, particularly from Gaming or NFT initiatives, to regain credibility and attract users back to the platform.

- The biggest highlight comes from Gaming and NFT sectors, which hold significant potential as a foundation for future recovery. However, betting on SEI at this time may not be effective, especially in terms of Liquid Trading Tokens, given existing risks from investors. Instead, observing Ethereum and BNB could be more strategic, as their fundamentals are showing a gradual shift and growth during December.

1. Overview of Sei

Sei Network, a Layer 1 blockchain built on the Cosmos SDK, stands out with its exceptional speed, low transaction costs, and high scalability. Designed with advanced features such as parallel execution and full EVM compatibility, it promises to deliver robust performance. However, its capabilities have yet to be tested in real-world scenarios.

1.1. Team

- Jayendra Jog (Co-Founder of Sei Labs): A software engineer at Robinhood for over three years, leading projects related to cryptocurrency.

- Jeff Feng (Co-Founder): Spent three years at Goldman Sachs in the TMT (Technology, Media & Telecommunications) Investment Banking division.

Overall, the core members of Sei Labs are relatively young but possess solid foundations in technology, business, and investment. → Sei Network is the first major project for both founders, which means they may still lack experience in certain areas. The project’s airdrop controversy sparked outrage among users, leading the community to attribute unflattering nicknames to Sei.

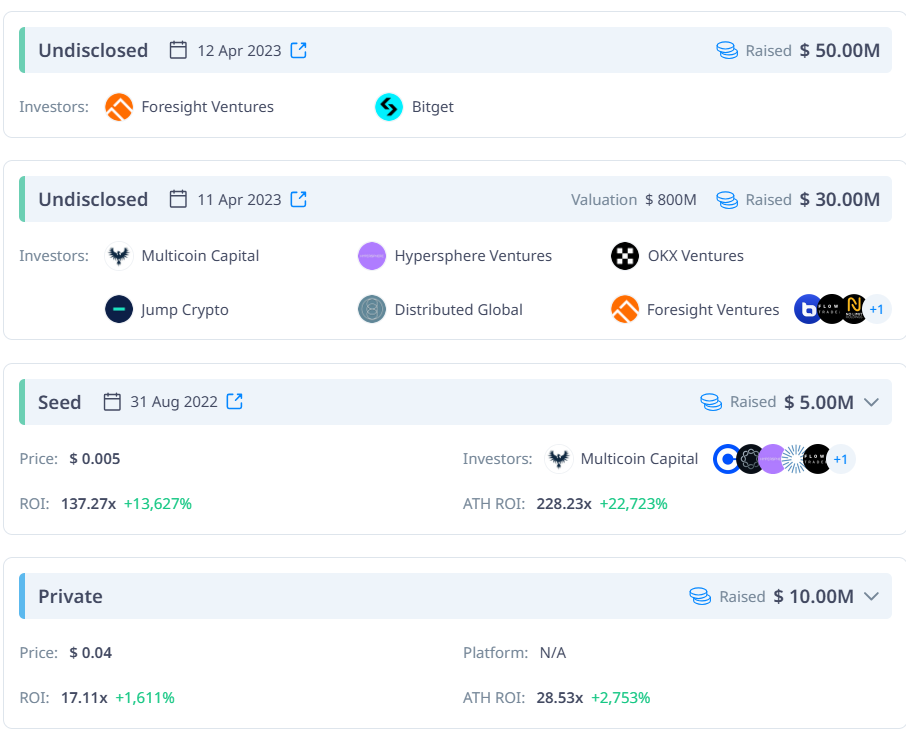

1.2. Investor

Sei has successfully raised a total of $95 million across four funding rounds, with participation from Tier 1, 2, and 3 investors such as Multicoin Capital, Coinbase Ventures, Jump, and Delphi Capital.

1.3. Road Map

Sei’s biggest plan for 2024 is to complete Sei V2, and they have already succeeded with the Sei V2 update.

2. Fundamental Sei

2.1. Ecosystem Sei

Sei provides an infrastructure platform for developers, enabling them to easily build decentralized financial applications.

The Sei ecosystem has developed essential DeFi projects that are core to a Layer 1 blockchain, such as DEXs, Lending platforms, Liquid Staking solutions, and Cross-Chain applications. Additionally, it offers a diverse range of gaming applications and notable NFT initiatives.

- Lending: Yei Finance with a Total Value Locked (TVL) of $141 million USD (token not yet launched)

- Liquid Staking: Silo Stake with a TVL of $109.92 million USD (token not yet launched).

DEXs:

- Dragon Swap with a TVL of $50.7 million USD (token not yet launched).

- Jellyverse with a TVL of $36 million USD (token launched).

NFT Projects: Seiyans, WeBump, The Colony, CAPPYS.

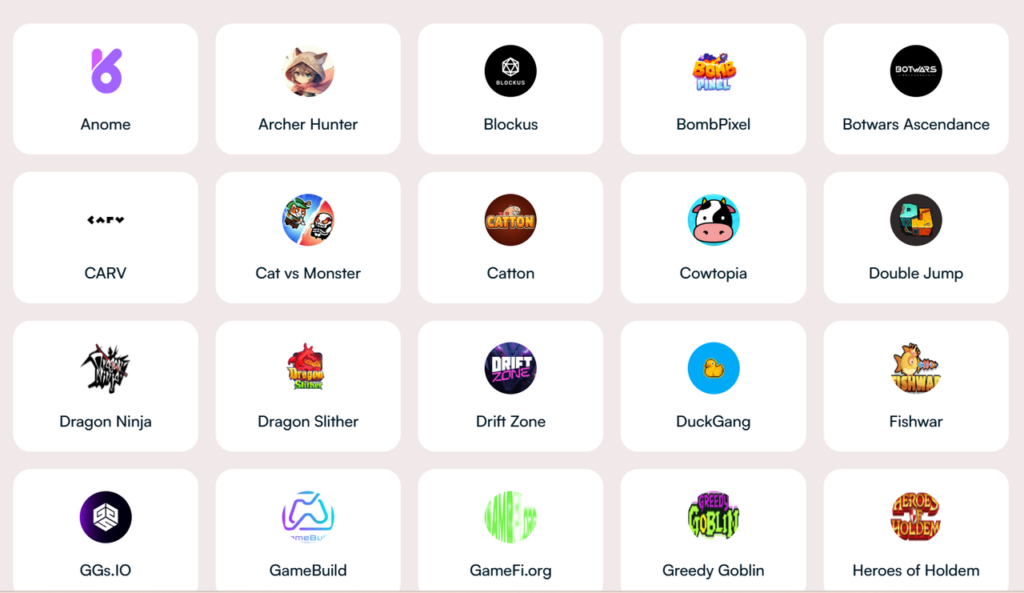

Gaming Project: Double Jump, Dragon Ninja, Rabbit, LasMeta, Heroes of Holdem, Meta Arena, Star Symphony.

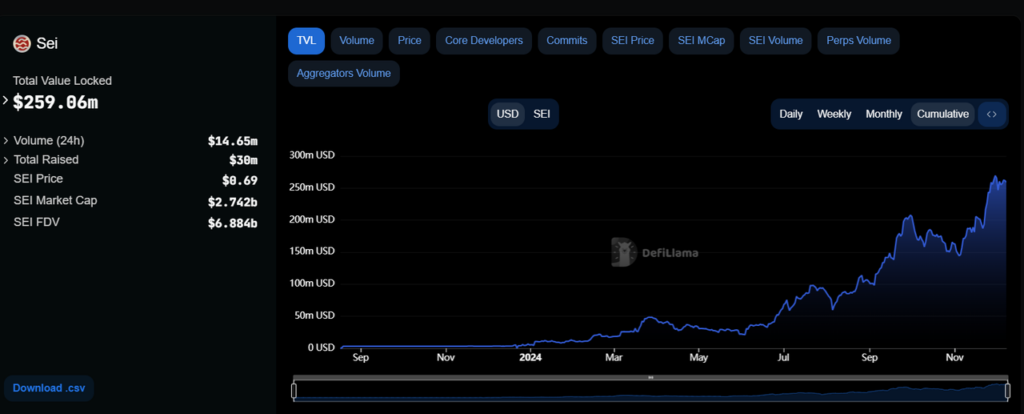

Lending and Liquid Staking Token (LST) projects account for 96% of the total TVL, representing the majority of Sei’s ecosystem. However, this growth is relatively recent, driven by incentive programs such as Super Seiyan Week and Sei DeFi Season during September and October, which encouraged user participation in DeFi.

The standout NFT collection, Seiyans, is currently priced at 234 $SEI (~$160). This NFT collection has become a symbol of the ecosystem and is frequently featured in Foundation announcements and promotions.

Sei has announced several gaming projects through the Sei Creator Fund (worth $500k USD) to support game development on its platform. However, the impact of these initiatives remains to be seen. A major challenge is the lack of a compelling narrative or a flagship game launch (e.g., a high-profile game with an airdrop campaign) to draw user attention and create significant buzz.

2.2. Performance network

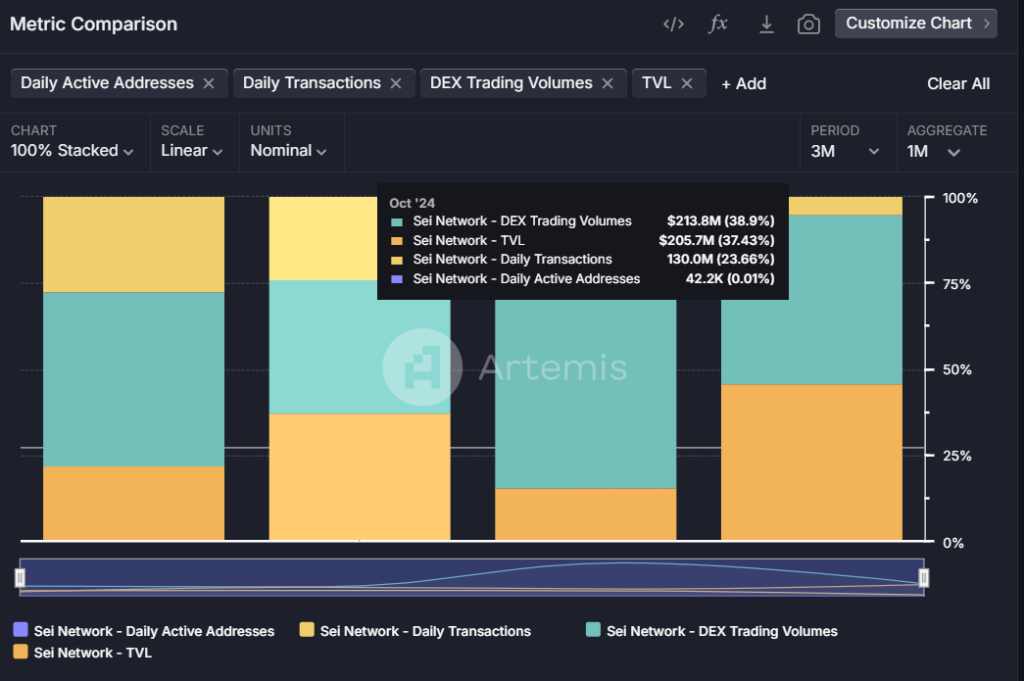

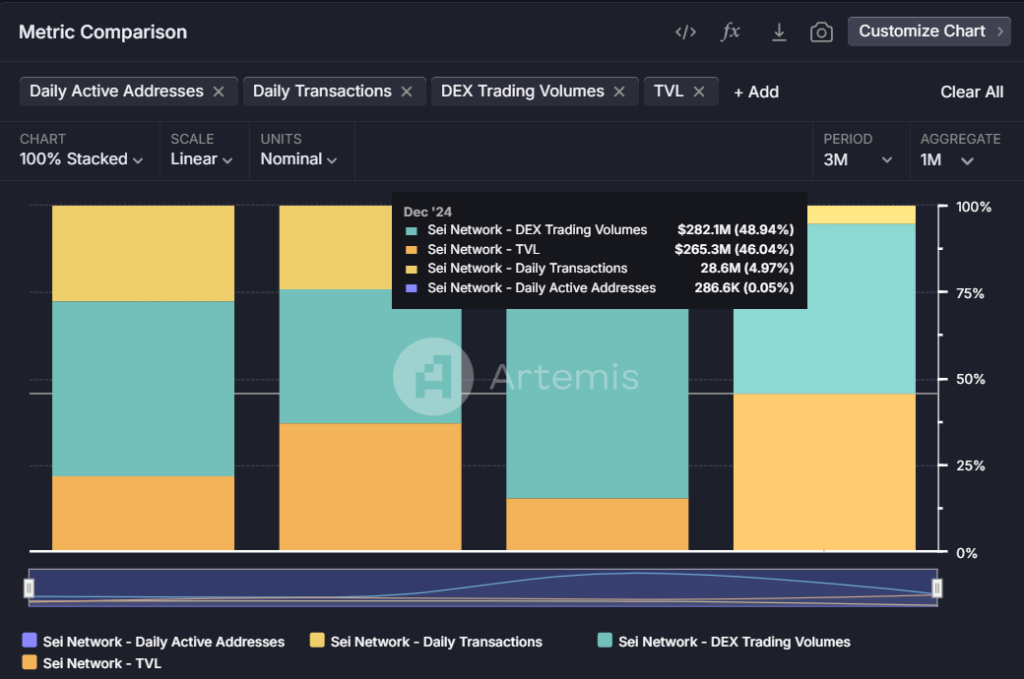

Use key metrics such as Daily Active Addresses, Daily Transactions, and DEX Trading Volume.

| 9/2024 | 10/2024 | 11/2024 | Change | YTD | |

| Daily Active Address | 32.5k | 42.2k | 116.3k | 175% | 286.6k |

| Daily Transaction | 126M | 130M | 121.9M | -7.4% | 28.6M |

| DEX Trading Volume | $233M | $213M | $760M | 256% | $282M |

| Total Value Lock | $101M USD | $205M USD | $162.8M USD | -25.9% | $265.3M USD |

Overall, a deeper look at the metrics representing Sei’s health reveals steady growth averaging 20-30% from September 2024 to October 2024. However, by the end of November, Sei experienced a sharp increase in metrics, with DAA growing by 175%, DEX Volume by 256%, but TVL declining by -25.9%.

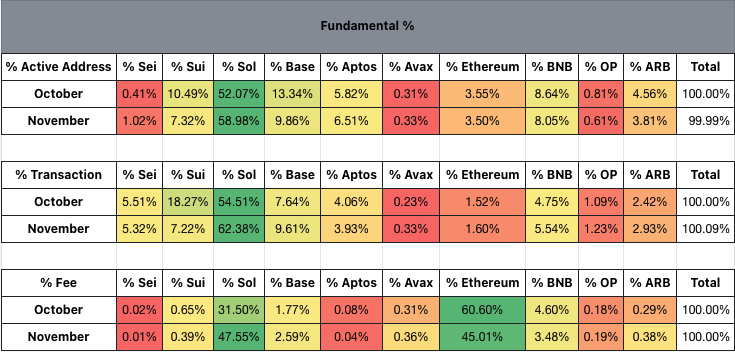

2.3. Competitive Landscape

- Fundamentals – % Active Address, % Transactions, and % Fees in October & November: The Active Address rate on Sei grew from 0.41% to 1.02%, reflecting an improvement in attracting users. However, the majority of the competitive market share has already been captured by SOL, BNB, and Base.

- Transactions on Sei reached 5.51% in October and only slightly decreased to 5.32% in November, indicating that transaction activity per address remains stable. However, despite the increase in Active Addresses, the drop in the transaction rate suggests that Sei’s DeFi ecosystem is not as vibrant as other chains, which could be considered “poor.”

- This is further illustrated by Sei’s % Fee, which dropped from 0.02% in October to 0.01% in November.

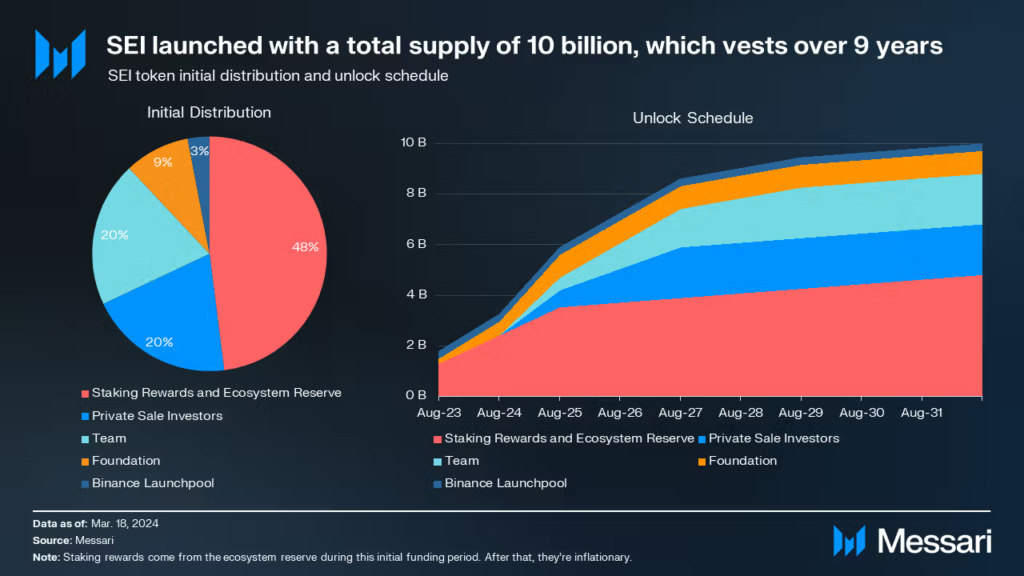

2.4. Tokenomics

- Total Supply: 10,000,000,000

- Circulating Supply : 3,982,916,666

- Market Cap: $2,736,668,625

- FDV: $6,871,016,529

- Price: $0.68

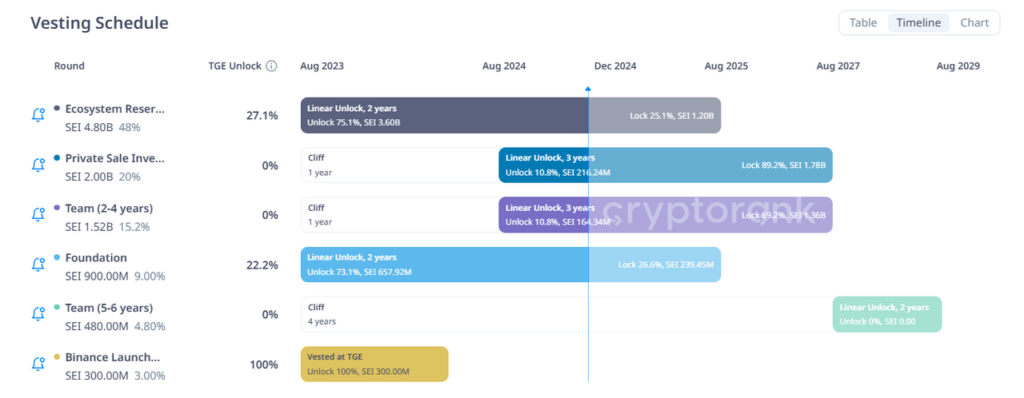

Token Allocation & Vesting Schedule

Key Point

- Sei is currently in the phase of token distribution for the following allocations: Ecosystem Reserve (3%/month), Private Investors (54M ~ 2.7%), Team (2.11%), resulting in a monthly unlock of approximately 2.002% of the total supply. This equates to around 200.2M $SEI tokens being unlocked and entering circulation each month, causing an inflation rate of 5.02% on the circulating supply.

- Among these allocations, the Ecosystem Reserve and Team tokens are under the project’s control. Given the current weak performance of the ecosystem, the selling pressure from these categories is likely to be minimal.

- However, the selling pressure from Private Investors is significant, as $54M ~ 0.54% of the total $SEI supply is unlocked monthly. These investors are seeing extremely high ROIs, with the Seed round ($0.005) achieving 135x and the Private round ($0.04) achieving 16.91x returns.

3. Due Diligence

- The Sei Network ecosystem offers low costs, high scalability, parallel execution, and full EVM compatibility, making it an ideal destination for future projects.

- The Sei Foundation holds a significant amount of tokens in its reserve for ecosystem development. To revitalize Sei, the foundation needs to launch larger incentive programs, particularly in areas like gaming and NFTs, which could serve as major growth drivers to attract users and boost activity.

- Based on the above analysis of On-chain Performance, Ecosystem, and Tokenomics, the only rare bright spots for $SEI to inspire community confidence lie in gaming and NFTs as future opportunities.

- However, at present, as a Liquid Trading Token, $SEI faces significant selling pressure risks from investors. In contrast, other ecosystems like BNB and Ethereum are showing stronger fundamental growth, making them better options for the time being.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.