Once viewed as a risky investment following the collapse of FTX, Solana (SOL) has made a remarkable comeback, emerging as one of the strongest performers in the latest crypto bull run. With its lightning-fast transaction speeds, minimal gas fees, and rapidly expanding ecosystem, SOL has regained investor confidence and is now being hailed as a serious contender to Ethereum’s throne.

What’s driving this resurgence? Today, we delve into the surging on-chain activity within the Solana network. The network’s rapid growth underscores its game-changing potential. Join us as we explore the forces propelling Solana into the spotlight and assess its prospects.

1. Solana Overview

Solana is a Layer 1 blockchain renowned for its speed and low gas fees. In the past, Solana’s success was closely tied to FTX Ventures and Alameda Research due to substantial funding from these entities. Consequently, the collapse of FTX two years ago was devastating for Solana, causing the price of SOL to plummet below $8. However, SOL has made a strong comeback, emerging as the top gainer among major cryptocurrencies in the current bull run. Its token price has surged nearly 25 times from its 2022 lows.

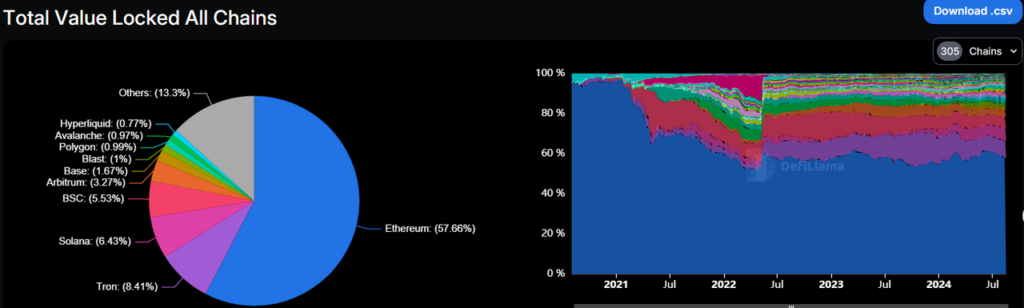

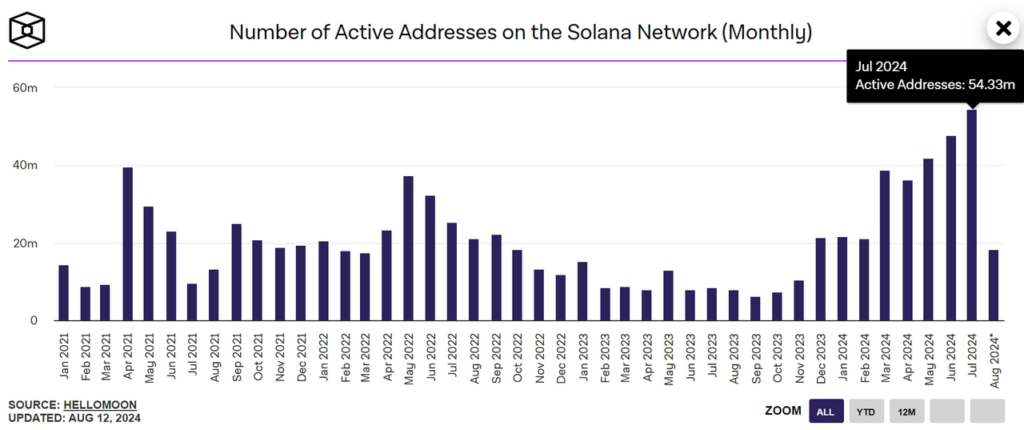

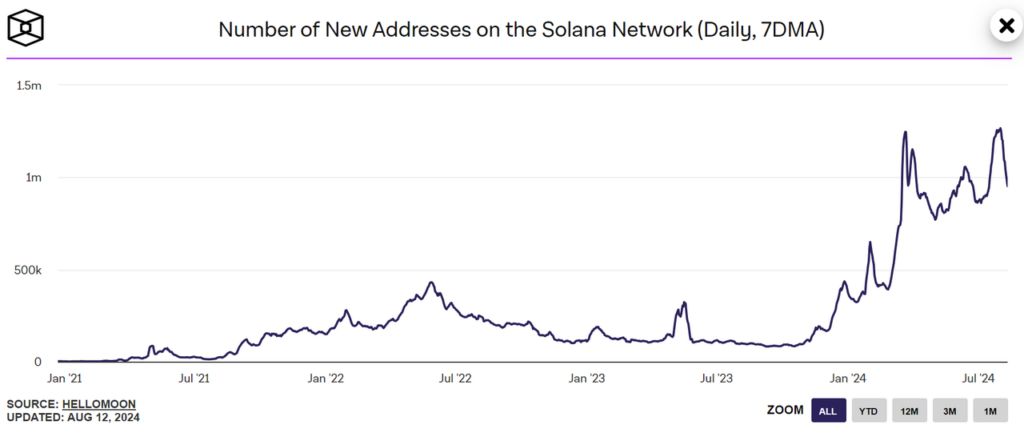

Additionally, on-chain metrics for the Solana network indicate a significant surge in network activity and user engagement. Monthly active addresses reached an all-time high last month, and the total value locked (TVL) in the protocol has soared to approximately $5.7 billion — an increase of more than threefold since the beginning of 2024. The substantial rise in new user activity on the Solana platform demonstrates increasing interest and adoption.

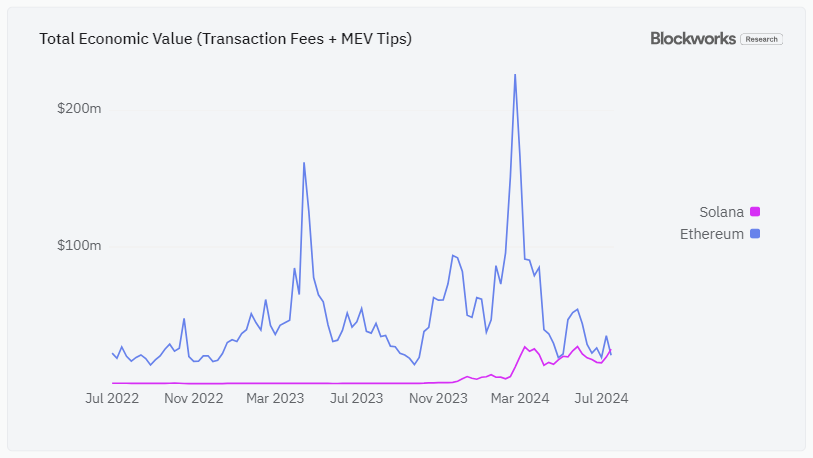

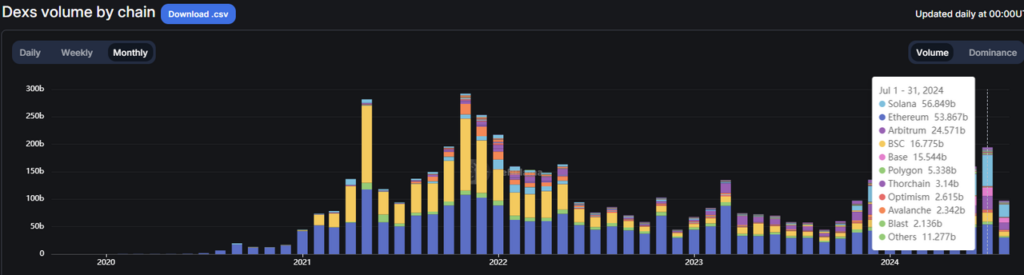

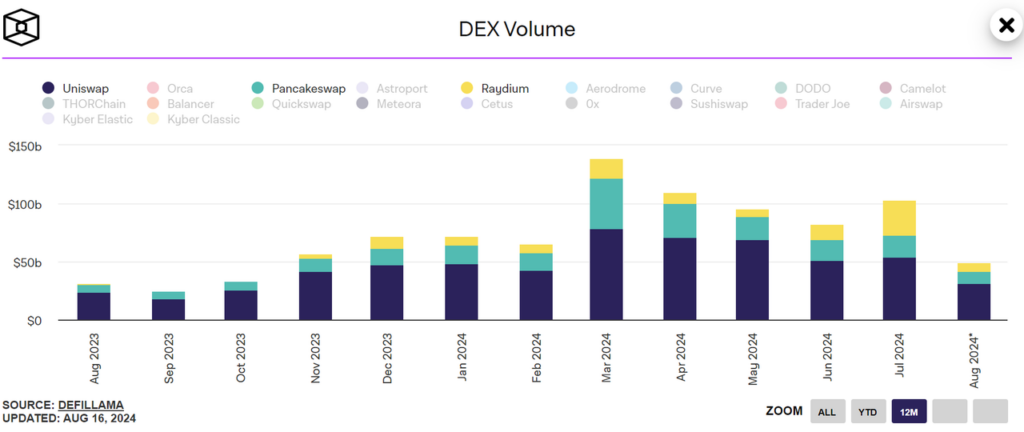

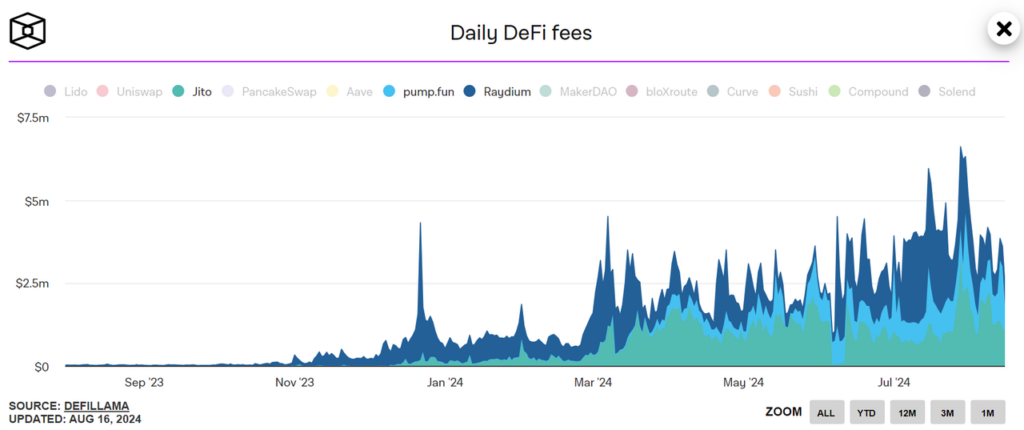

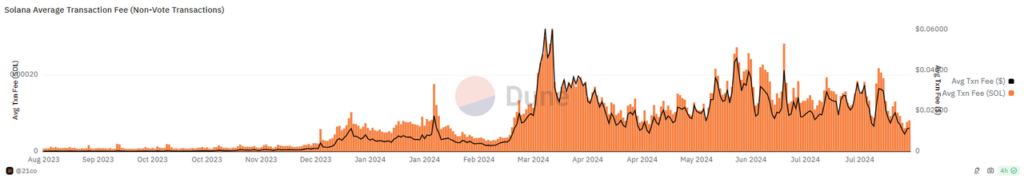

Notably, in July, Solana outpaced Ethereum in weekly total fees and monthly decentralized exchange (DEX) trading volume for the first time, generating approximately $25 million and $56.849 billion in respective indexes.

2. Several Factors Behind Solana’s Growth

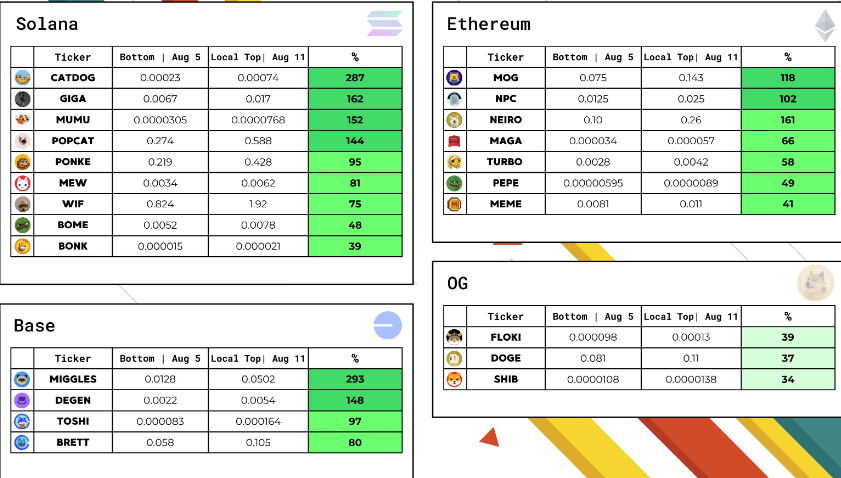

Memecoin on Solana becomes trending: The rising popularity of Solana’s native memecoins, such as WIF, BONK, and BOME, has been a significant catalyst for its growth. These coins have generated over 1,000% returns, leading to millions of new addresses being created on the network each month. The surge in Solana’s revenue can be attributed to increased activity on its network, particularly through memecoin trading platforms like Pump.fun and Moonshot. Notably, memecoins on Solana have shown a strong recovery from the recent market decline.

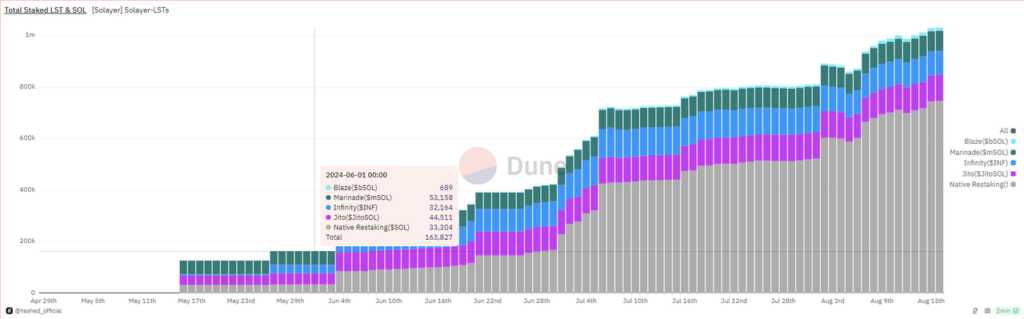

Robust Liquid Staking Ecosystem: Another key narrative driving Solana’s explosive growth is its strong liquid staking ecosystem. Liquid staking tokens (LSTs) have led Solana’s DeFi space, with Jito and Marinade being the top protocols. The total amount of SOL deposited in liquid staking derivatives more than doubled in 2024, with staked LSTs increasing from 163,827 to 1,031,932 — a remarkable 630% surge between June 1 and August 15.

DEX Volume and Raydium Protocol: Although decentralized exchange (DEX) volume slightly decreased compared to its peak in March, it remained at elevated levels. In July, the Raydium Protocol, a DEX on Solana, became the second-largest DEX by volume, trailing only Ethereum-based Uniswap. Raydium also emerged as the leading fee generator for Solana, with fees almost doubling from $33 million in June to $65 million in July 2024. This growth was fueled by the launch of tens of thousands of tokens on Solana each week through platforms like PumpFun, many of which were memecoins.

Airdrop Campaigns: Numerous projects on the Solana network have announced token airdrops and listings on Binance, including prominent names like Jito, Pyth Network, Jupiter, and Wormhole. The allure of high-value airdrops (ranging from thousands to tens of thousands of USD) has attracted a large influx of users to the Solana ecosystem.

| Project | Category | Airdrop Announcement Daily | Listing on Binance |

| Pyth Network (PYTH) | Oracle | Nov 01, 2023 | YES |

| Jupiter (JUP) | Aggregator DEX | Nov 16, 2023 | YES |

| Jito (JTO) | Liquid Staking | Nov 27, 2023 | YES |

| Wormhole (W) | Bridge | Mar 07, 2024 | YES |

| Tensor (TNSR) | NFT Marketplace | Mar 08, 2024 | YES |

| Drift Protocol (DRIFT) | Perpetual DEX | Apr 16, 2024 | N0 |

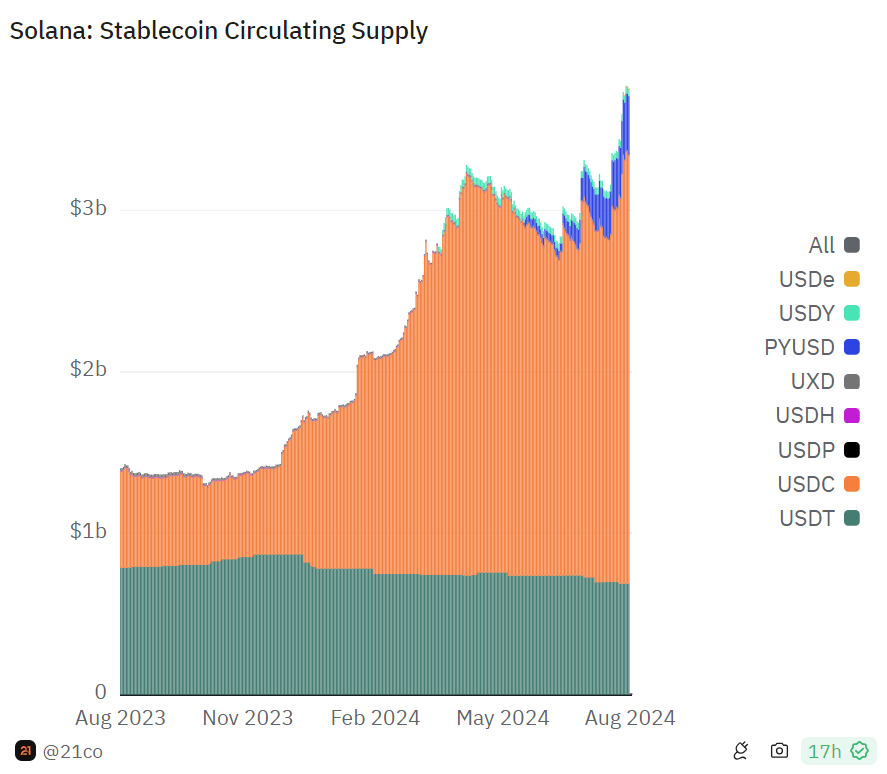

Institutional Adoption and Usage: PayPal expanded its PYUSD to Solana, leveraging token extensions such as confidential transfers, while Stripe announced support for crypto payments on the Solana network. Notably, Hamilton Lane, a renowned asset manager with approximately $857 billion in assets under management (AUM), announced the launch of a private credit fund on the Solana blockchain.

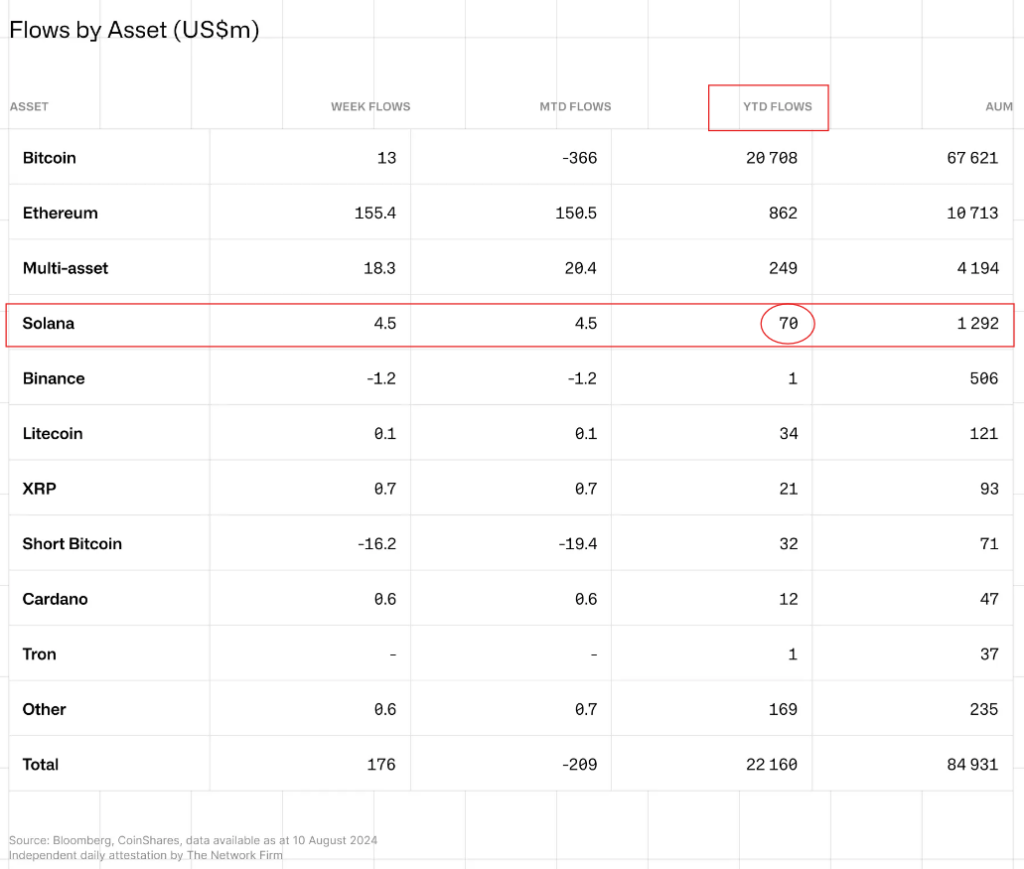

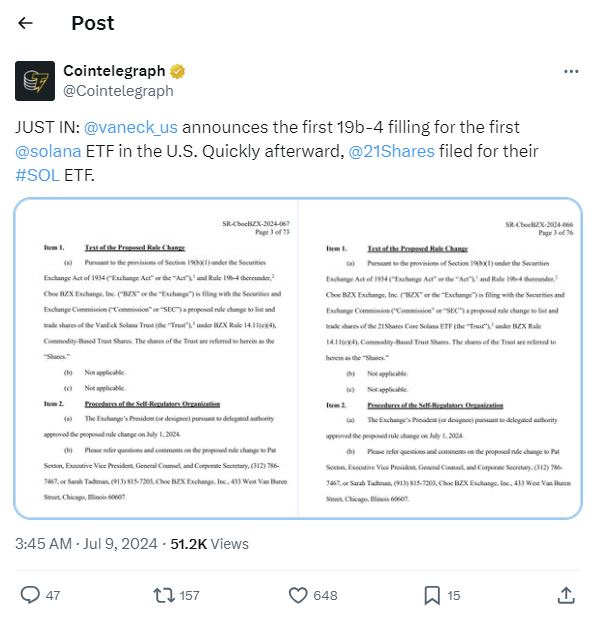

Institutional Involvement: Since the beginning of the year, approximately $70 million has flowed into Solana from global financial institutions. Additionally, VanEck and 21Shares have officially filed 19b-4 forms for Spot Solana ETFs, indicating growing institutional interest and potentially driving further attention and investment into the Solana ecosystem.

Community and Developer Support: Solana’s community and developer ecosystem are thriving, with initiatives like the Solana Radar Hackathon fostering innovation and attracting new projects.

Comparative Advantages: Solana offers a superior user experience with lower fees ($0.018 compared to Ethereum’s $1.80) and higher throughput (up to 65,000 TPS compared to Ethereum’s 15 TPS), making it an attractive option for developers and users alike. With low transaction costs, sub-second finality, and a network of several thousand nodes, Solana is poised to power mainstream payment flows—an assertion supported by Visa’s expansion of its USDC settlement to Solana.

3. Closing thoughts

Solana’s architecture has made it a popular choice among memecoin developers and decentralized physical infrastructure network builders. While Solana has been the go-to network for retail users, it is also seeing increased institutional adoption, as mentioned earlier. Its high-performance architecture and expanding ecosystem are likely to attract more users and developers, potentially leading to greater adoption and value appreciation.

SOL is now on par with Ethereum in key metrics. The founding team has implemented effective development strategies, and Solana boasts a vibrant developer community and thriving DeFi ecosystems. However, it currently trades at approximately 20% of Ethereum’s market cap. The filing of Solana ETFs by major financial institutions like VanEck and 21Shares marks a significant step towards mainstream adoption and institutional investment in the future.

From a fundamental perspective, SOL has considerable upside potential, and we anticipate that its market capitalization could exceed $500 billion in this bull run—a level Ethereum reached during the peak of the late 2021 cycle.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.