1. Sonic Labs Overview

1.1. What is Sonic Chain?

Sonic Chain is an EVM layer-1 platform utilizing an ABTF mechanism based on DAG, formerly known as (Fantom), rebranded with a new brand, Sonic Labs, promising to bring new technologies, provide developers with attractive incentives, and a robust infrastructure

Typically: The fastest layer-one for digital assets with over 10,000 TPS (theoretically) and near-instant transaction confirmation times, along with a secure native Ethereum gateway.

The launch of the new Sonic Chain will lay the groundwork for the establishment of the Sonic Foundation and Sonic Labs. Accordingly, Sonic Foundation will be responsible for managing the treasury and governance system, while Sonic Labs will focus on driving growth among applications, partnerships, and users.

1.2. Sonic Chain’s Objective

Sonic Chain aims to redefine layer-1 blockchain performance by achieving over 10,000 transactions per second (TPS) and one-second transaction finality, powered by a suite of innovative technologies, including:

- 10,000 TPS & Average transaction costs under $0.01

- Enhanced Bridging and Security

- Staking and Liquid Staking mechanisms

- Parallel FVM architecture

- ZK Execution Scaling solutions

- A Canonical Stablecoin implementation

- Shared sequencer infrastructure for L1 and L2 chains

Ultimately, the key objective is to restore Sonic Chain to prominence once held by its predecessor, Fantom, which scaled from no users to a $10 billion Total Value Locked (TVL) in 2022.

1.3. Infrastructure

Positioned as the fastest EVM L1 platform with a completely rebuilt infrastructure compared to its predecessor, Sonic Chain inherits the DAG-based ABTF consensus mechanism and incorporates all the latest trending technologies such as Parallel processing, ZK Scaling, Shared Sequencer, 10,000 TPS, etc.

However, technically, Sonic Chain has a distinct difference. According to the project, Sonic Gateway technology is the key to outperforming and solving the problems the market is facing, bringing market share to the project.

1.3.1. Sonic Gateway

The Current Situation

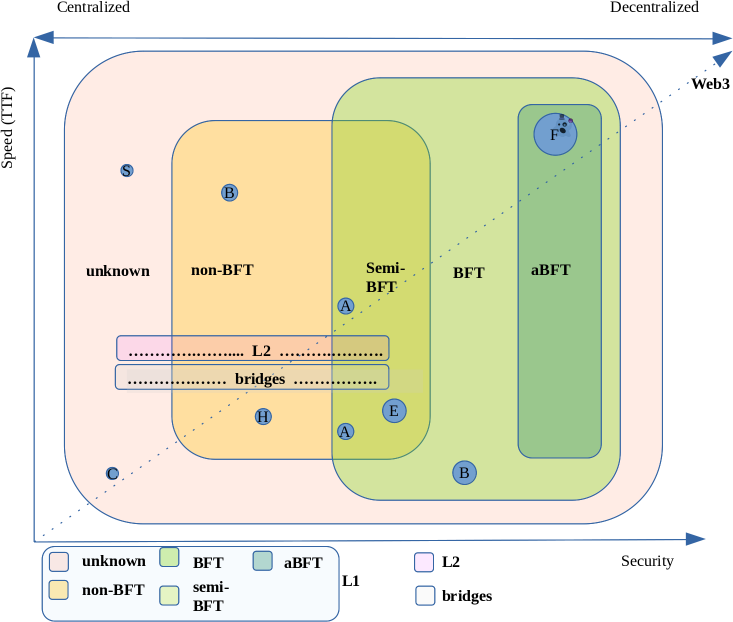

Sonic has highlighted a very practical and sensitive issue for current L1 and L2 blockchain projects on the market

Currently, cross-chain asset bridge systems are often centralized or semi-centralized models, which expose user assets to significant risks. The “trilemma” of decentralization—Security, Speed, and Decentralization—has resulted in over $2.5 billion lost due to hacks.

The Solution

To address the above problem, Sonic has built:

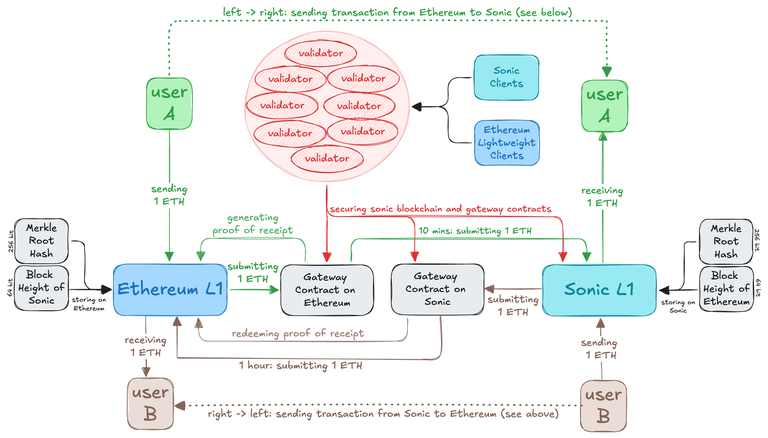

- Sonic Gateway (a decentralized bridge) on the Sonic Chain itself.

- No need for trust between Ethereum & Sonic.

- Eliminates custody risk through third parties.

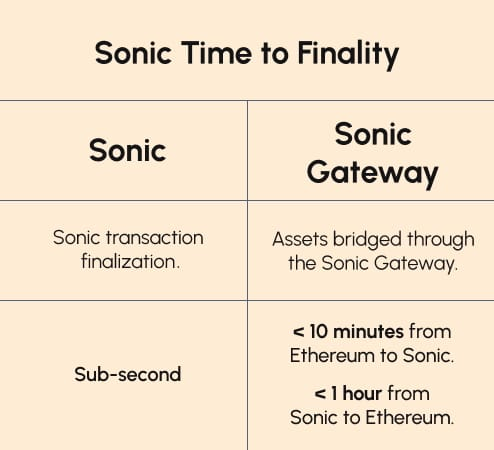

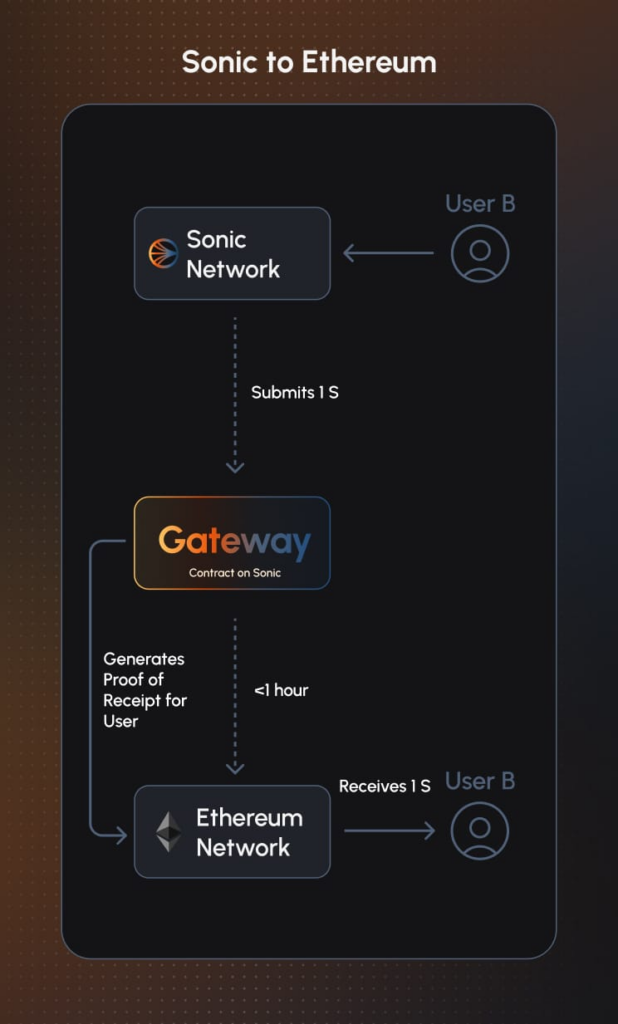

Sonic Gateway uses its own validators to securely verify ERC-20 token transfers, while users retain full control of their funds at all times, resulting in transfer times of:

- Approximately 10 minutes from Ethereum → Sonic

- Approximately 1 hour from Sonic → Ethereum

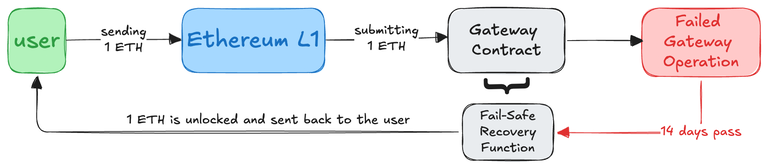

1.3.2. Gateway Fail-Safe Mechanism

The Gateway’s fail-safe mechanism allows users to retrieve their assets on Ethereum if the Gateway malfunctions within 14 days.

The 14-day fail-safe period is immutable, meaning that Sonic Labs or any other third party cannot change it after the Sonic Gateway is deployed.

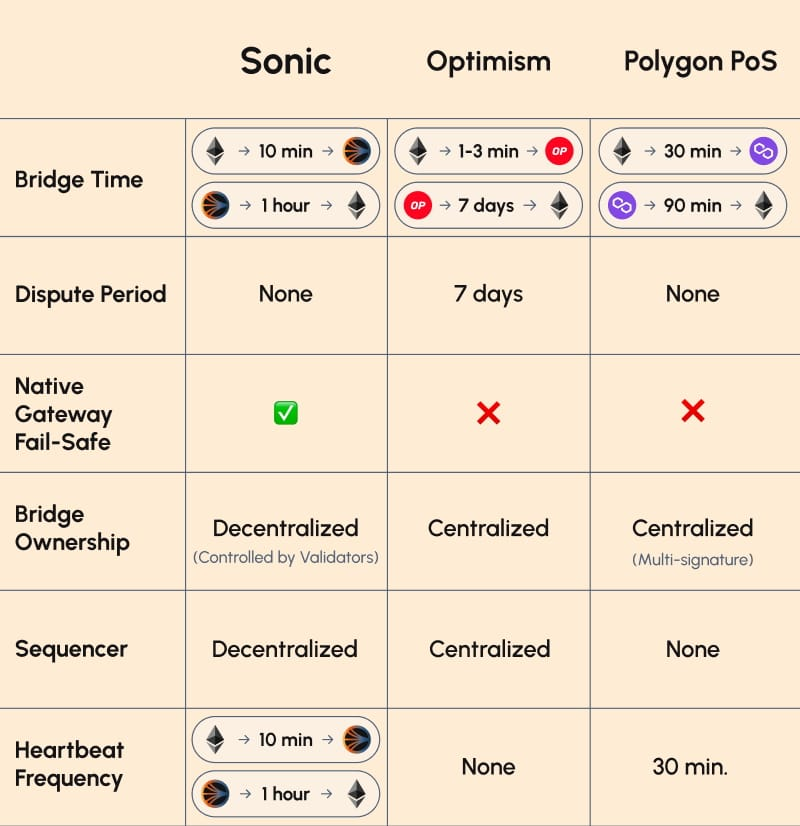

1.3.3. Compared to L2 on Ethereum & other L1s

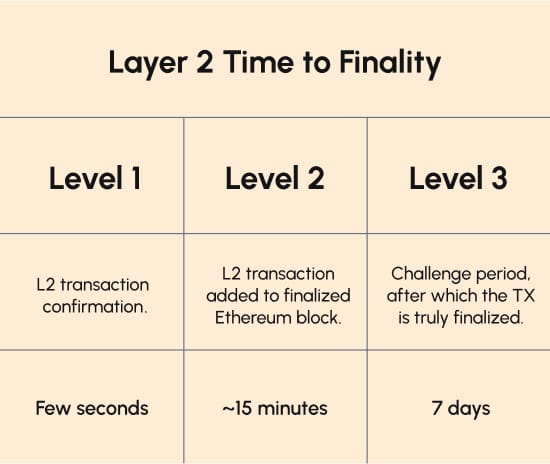

Ethereum has always been the focal point of concern when discussing the blockchain trilemma of “security – scalability – speed” as we know. Layer 2 was born to solve the scalability problem on Ethereum but is still limited to “speed.

- Level 1: Transactions are quickly confirmed on L2 within seconds.

- Level 2: The transaction is added to an Ethereum block for finalization (~15 minutes).

- Level 3: After 7 days (the challenge period), the transaction is truly considered final and absolutely secure.

This process aims to enhance security, especially when transferring assets from layer-2 back to Ethereum, but it also makes the finalization time longer. Therefore, Sonic Chain has positioned its “technological advantage” in the place of Layer 2 solutions on Ethereum to provide faster processing.

For on-chain activities, Sonic completes all transactions with near-instant confirmation and no waiting. As for Sonic Gateway, as a layer 1 platform with its own secure validators, it provides instant transfer services without associated risks, as these transactions do not undergo any challenging period. Ultimately, although Sonic is not an L2, and even has a technological advantage competing with L1s, it still positions itself within the L2 space to fully optimize and regain its DeFi market share.

1.3.4. Sonic Gateway Visualizations

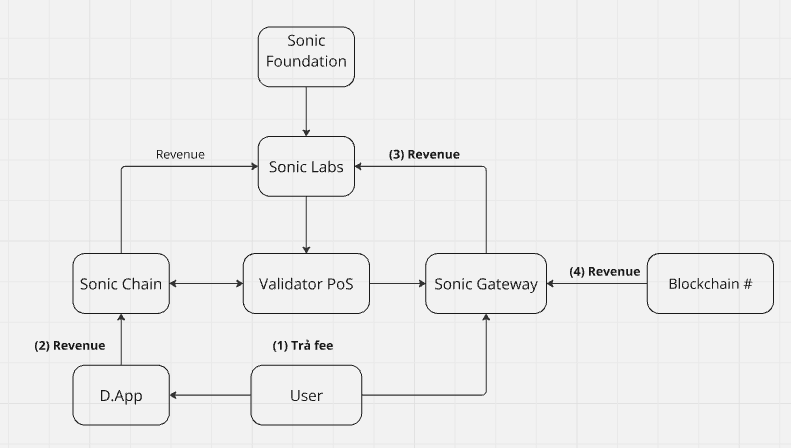

1.4. Model Business

The project’s business model will revolve around Sonic Chain (L1) & Sonic Gateway, with revenue coming from gas fees of the native token $S.

Sonic Chain

- Native DApps of the chain & other DApps built on the network.

- Users join the network.

- Sponsorship activities.

- Token growth.

Sonic Gateway

- Users converting assets between trends.

- Blockchains, L1s, L2s & DApps using Gateway technology from Sonic

1.4.1. Inside Sonic Chain’s Business Model

- Staking Rewards – Sonic will have a target block reward rate of ~3.5%

- Liquid Staking – Staking the $S token will have a maximum lock-up period of 14 days

- Gas Monetization – DApps will receive up to 90% of the gas fees from their transactions (with the remaining 10% going to validators). Transactions not related to the Gas Monetization program will be divided as follows: 50% burned, 45% to validators, and 5% to the Ecosystem Vault.

- Ecosystem Vault – The Ecosystem Vault will be replenished with funds allocated quarterly to the Sonic Community Council (SCC) for the purpose of developing and supporting the Sonic ecosystem

1.4.2. Integrated project

Consumer Applications

1.5. RoadMap

The detailed roadmap has not been publicly released yet. However, the project has announced and confirmed some important information to take note of:

- Mainnet expected in December 2024

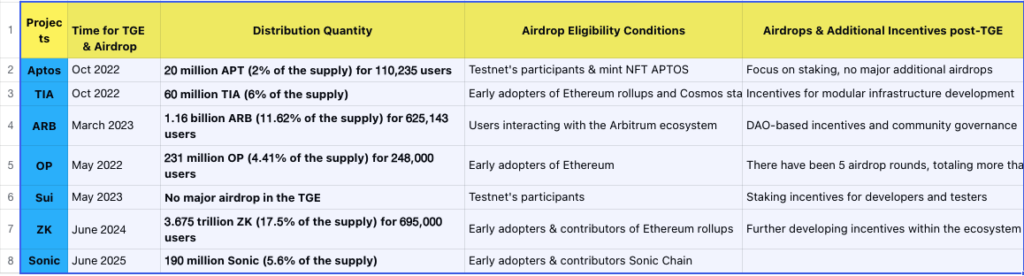

- Airdrop program of 190 million $S tokens

- Innovation fund for DApps of 200 million $S tokens

- New DeFi mechanisms for DApps, new mechanisms to combat $S token inflation

- Launch of Sonic University providing top-tier blockchain development, design, and marketing classes to university clubs around the world

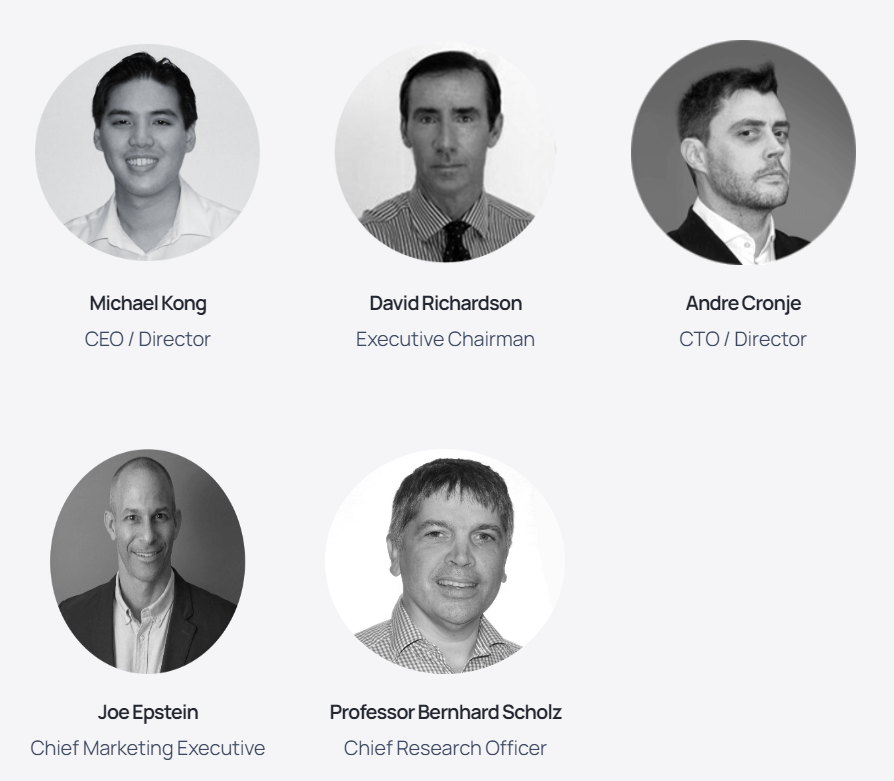

1.6. Team

Andre Cronje – CTO: responsible for leading the design and development of the new Sonic network, especially the “Sonic Gateway” bridge technology, a pioneer in the field of decentralized finance (DeFi)

Quan Nguyen – Before Andre took on the CTO role, Quan Nguyen held this position and made significant contributions to the development of the network’s aBFT (asynchronous Byzantine Fault Tolerance) technology.

Michael Kong – CEO/Director

David Richardson – Co-Founder

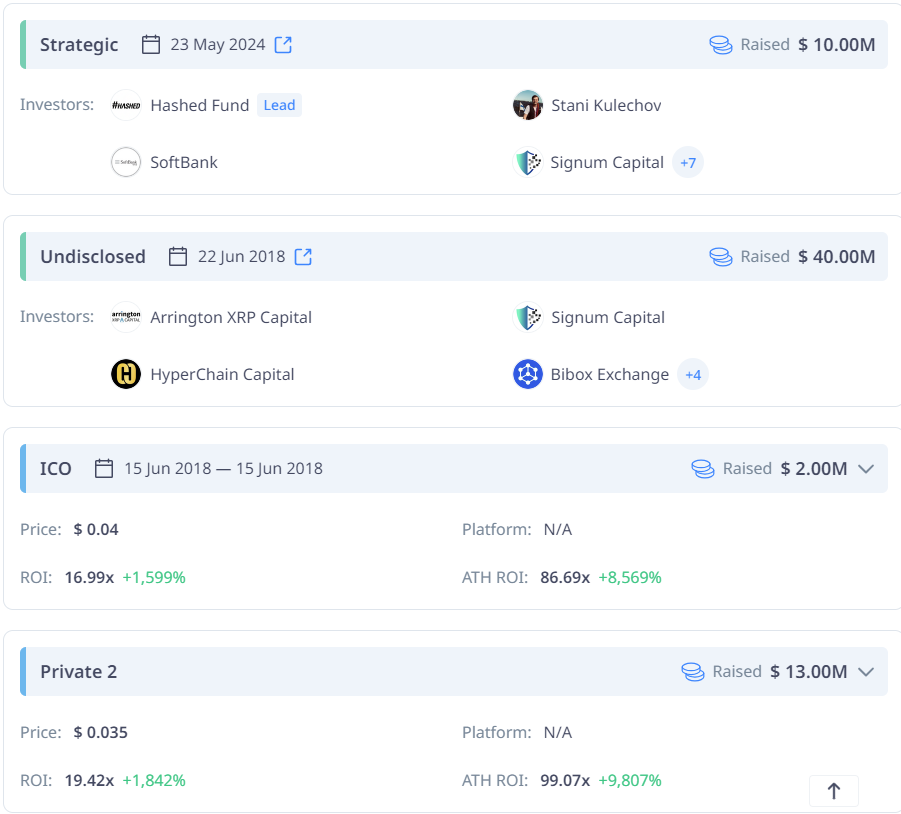

1.7. Investor/Backed

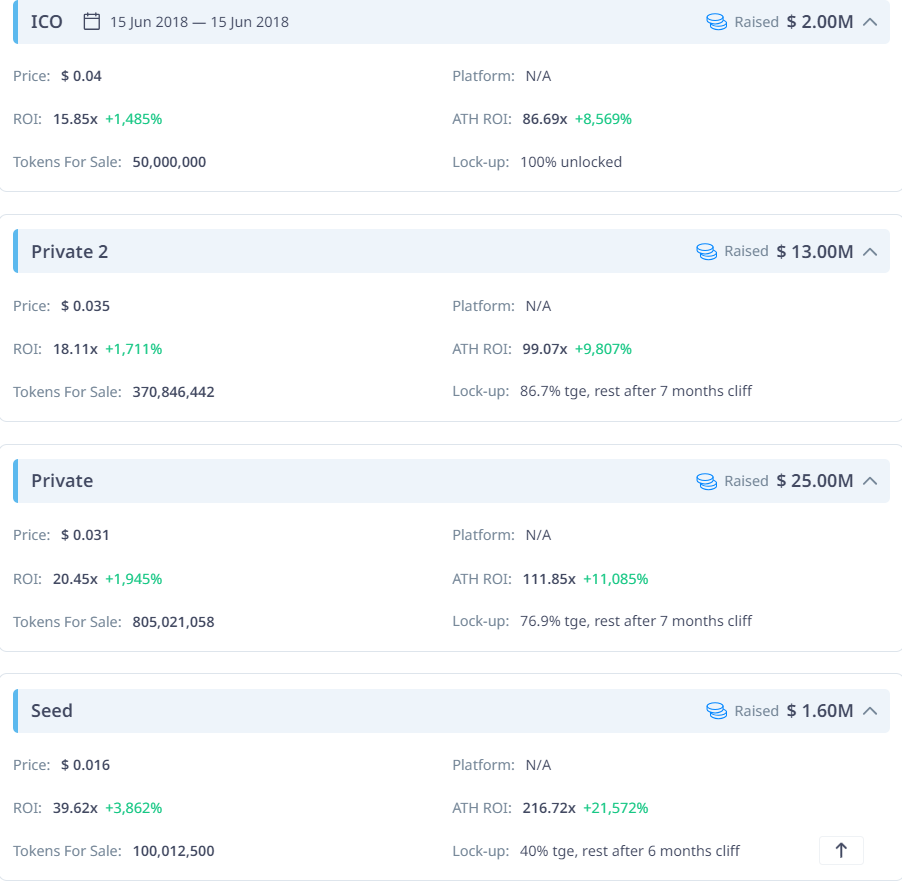

Raised fund totaling $91M including previous rounds such as: Seed, Private 1, 2, ICO and most recently Strategic.

Strategic – $10M – 23/05/2024 – Hashed Fund, SoftBank, Signum Capital, UOB Ventures, Aave, Stani kulechov, Robert Leshner, Sam Kazemian,…

2. Metric Network

Performance

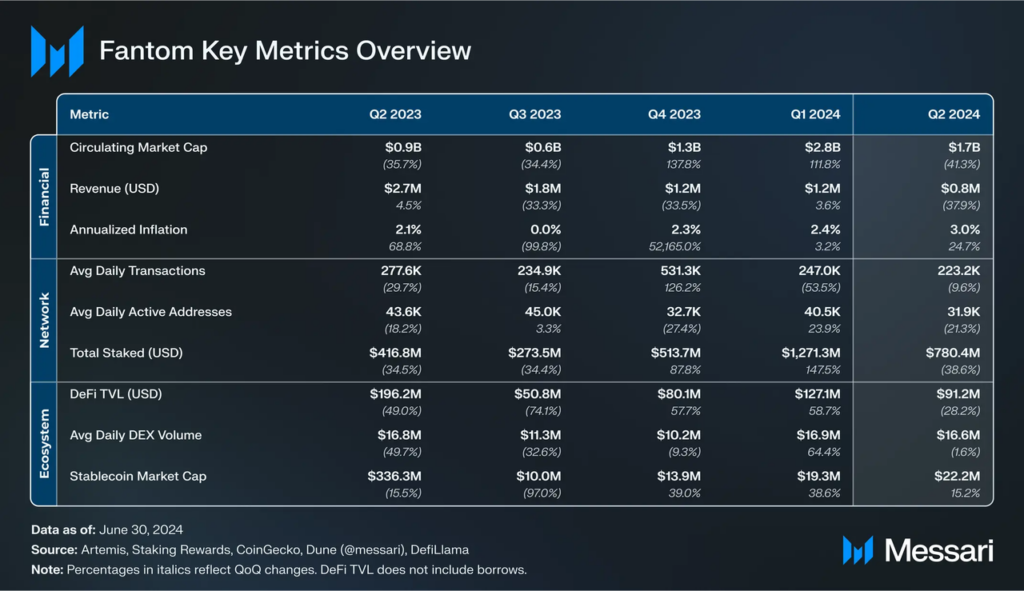

Q2/2024 concluded with notable operational metrics:

- Revenue (USD): $0.8M

- Daily Transactions: 223K

- Daily Active Users: 31.9K

Q3/2024 showed significant growth with:

- Daily Active Users: 458K

- Daily Transactions: 419K

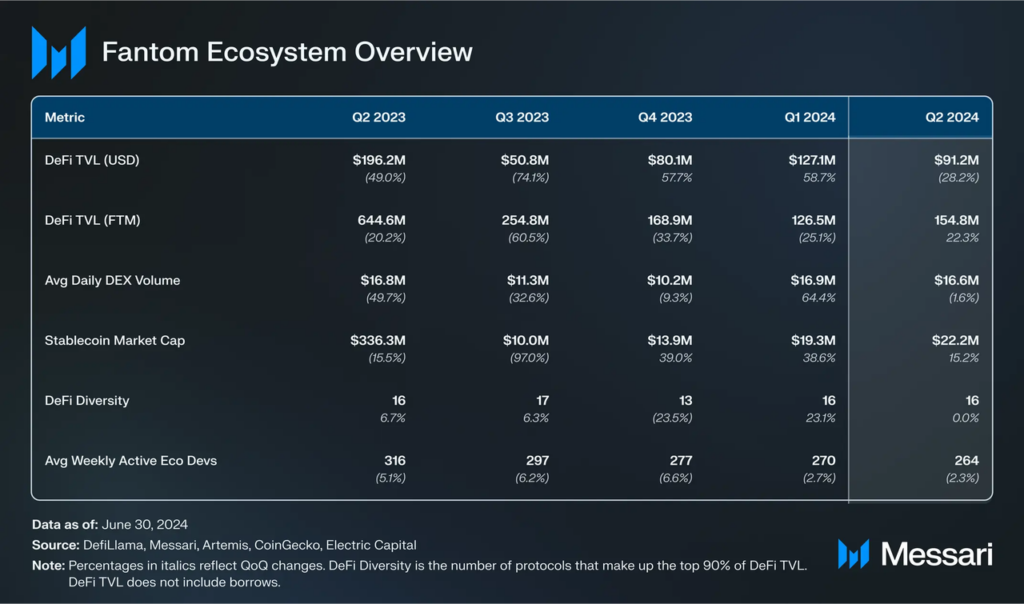

Despite a challenging market environment in Q2, which saw a 64% decrease in Market Cap compared to Q1, the project demonstrated underlying strength. While the USD value of Total Value Locked (TVL) declined, the number of native $FTM tokens locked within the protocol increased by a significant 22.3%. This positive divergence suggests renewed user confidence following the successful implementation of key governance proposals during Q2.

3. Tokenomics

3.1. Token Metric

→ Token:$FTM ~ $S

→ Price:0.69/$FTM ~ $S

→ Total supply:3,175,000,000$FTM ~ $S

→ Circulating supply: 2,803,326,983 $FTM ~ $S

→ Market Cap:$1,829,035,154

→ FDV: $2,000,250,000

3.2. Token Use Case

→ Governance → stake to participate in governance

→ Security → stake $S to secure the network

→ Gas → pay fees on the network

→ Reward → for users and validators

3.3. Token Sale

The project underwent four token sale rounds along with an investment round from a Venture Capital fund, with prices ranging from $0.016 to $0.04. Currently, the return on investment (ROI) ranges from 15x to 40x. However, it’s important to note that these token sale rounds took place during a market bull run and all tokens have been fully distributed to investors from those rounds.

3.4. Allocation & Release

All investor allocations have been fully unlocked; only staking rewards remain

3.5. Insight Tokenomics

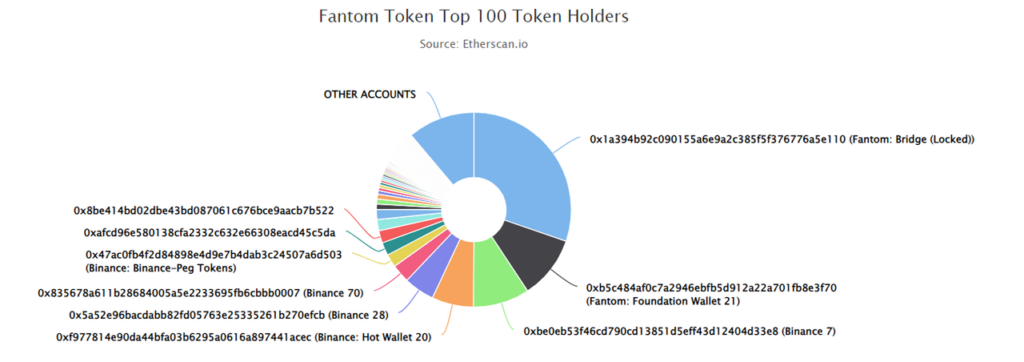

Current Distribution statistics show the project’s circulating supply at 2.8B tokens (representing 88.3% of the total supply) with a price of $0.69, resulting in a market cap (MC) of approximately $1.9B. The breakdown is as follows:

- Total Staked: $1.3B ~ 46% of the total supply.

- CEX Binance [Retail, VCs, Foundation,…]: $575M ~ 18.1% of the total supply.

- Foundation: $222M ~ 7% of the total supply.

- Fragmented [CEXs, DEXs, DApps, Retail,…]: $546M ~ 15.7% of the total supply.

- Burned Tokens: $47.65M ~ 1.5% of the total supply.

- Not yet unlocked [Staked PoS]: $371M ~ 11.7% of the total supply.

→ [Total Staked, CEX Binance, Foundation, Fragmented] → The project holds a significant portion of the supply, likely in preparation for a chain transition.

The conversion from $FTM to $S will occur at a 1:1 exchange rate.

- Technically, the initial total supply of $S will be 3.175B, corresponding to the total supply of FTM.

- The circulating supply is projected to be approximately 2,883,358,939 tokens upon launch in December 2024 (as announced by the project), with the circulating supply remaining constant until May 2025.

An additional 6% airdrop (~190M $S) of the 3.175B will be minted, along with a 1.5% ongoing funding allocation (~47.62M) annually for 6 years designated for initiatives like Sonic Park and University. This minting will commence 6 months after the Sonic Chain launch (June 2025). → Total supply will then become 3.412B.

4. Analysis

4.1. New Technology & Game

Facing the impact of the Bear Market + new competitors (Sui, Aptos, etc.) + outdated technology has led to user disinterest in Fantom and a shift in capital, causing the project’s TVL (Total Value Locked), which once reached the top 2 DeFi TVL among Layer-1s in 2022, to plummet to just over $100M currently. Therefore, the team aims for a complete overhaul, building a brand new Layer-1 (Sonic Chain) + new DeFi models (Sonic Gateway, Gas Monetization, a new token burn mechanism, etc.) to attract developers and users.

4.2. Financial Health

The project’s financial health appears insufficient for long-term goals. The project has raised an additional $10M to maintain and operate the new business model (Sonic Chain).

4.3. The Essence of the Rebranding Strategy

The project introduces two policies to attract users and dApps: an airdrop of 6% of the total supply and a funding program of 1.5% annually over six years. However, the airdrop and funding will not be launched immediately when the Sonic Chain mainnet goes live in December but will occur six months after the mainnet launch. As a result, during the six months of mainnet operation, combined with market timing, the project can continue raising funds as network metrics experience breakthroughs driven by the attraction of users and developers through [Airdrop + Funding].

4.4. Tokenomics

The project’s circulating supply is expected to reach 2.88B $S by December 2024 (T12/2024), compared to 2.817B $S in October 2024 (T10/2024), showing a difference of 70 million $S (block rewards over 4 years). When comparing market capitalization with current L1s, Sonic is 3 times lower in FDV compared to peers such as Sui, Aptos, DOT, and ATOM. Token distribution analysis reveals that the project holds the majority of the circulating supply, leaving very little for retail investors, which significantly limits liquidity. To regain its market share, the project is compelled to push token prices. The rebranding strategy is designed to optimize this approach, making it easier to improve liquidity.

5. Conclusion

Sonic Labs, along with its new technologies [Sonic Chain + Sonic Gateway], addresses existing challenges and introduces long-term development policies that allow developers to retain 90% of the fees when users utilize their d.apps.

Fantom’s business model and financial health are weak, leading to a deficit in the ecosystem. As a result, it is raising a new $10M funding round to support its rebranding strategy and sustain the operation of its business model with new L1 technologies, tokenomics model, and DeFi solutions.

The tokenomics will see an additional 7.5% of the total supply minted six months after the mainnet launch, increasing to 15% over 9 years (Total supply: 3.65B). Before June 2025 (T6/2025), the circulating supply will be maintained at 2.883B $S. The project holds the majority of the supply, but liquidity remains low due to the lack of users in the ecosystem. Therefore, the rebranding strategy is seen as a suitable approach to legitimize the increase in token price.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.