1. Executive Summary

Sui, a high-performance Layer 1 blockchain utilizing the Move programming language, has rapidly become a dominant player in the blockchain space. In 2024, Sui saw remarkable growth across various metrics, solidifying its position as a leader in the ecosystem.

This report analyzes Sui’s network performance and the growth of its ecosystem. We will also explore emerging protocols within the Sui ecosystem, offering valuable insights to seek investment opportunities in this promising network.

2. Sui Growth

2.1. Network

2.1.1. Daily transactions

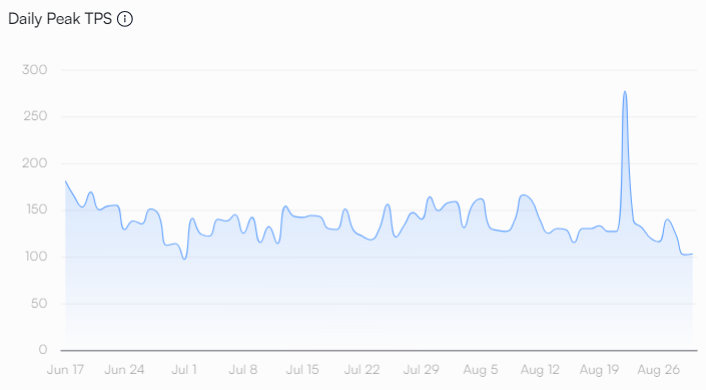

Sui’s network architecture is built for high throughput. Sui has performed a series of tests to determine the current peak throughput on various workloads and time to finality, with early tests showcasing a maximum transaction capacity of 297,000 TPS. This exceptional performance is driven by Sui’s Programmable Transaction Blocks, which can handle up to 1,024 instructions per transaction. Notably, even during peak activity, the network remains steady.

2.1.2. Daily active addresses

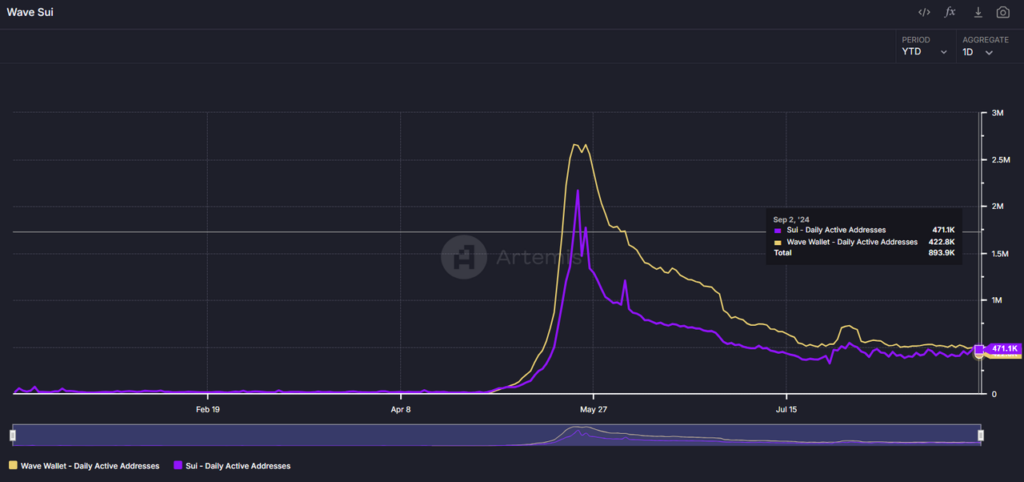

Since May 2024, Sui has experienced a dramatic increase in user engagement, averaging 471.1k daily active addresses — up to 10x from the previous period. The network’s daily active addresses peaked at over 2.2 million on May 23. This growth was largely driven by outstanding popular applications like Wave Wallet within the Sui ecosystem, indicating strong user adoption and engagement.

2.2. DeFi

2.2.1. Total Value Locked (TVL)

TVL on Sui has surged by 213% YTD, increasing from $241m to $754m. Since launching the main net, Sui’s TVL has peaked at $980 million.

2.2.2. Total Value Bridged

The total value bridged to Sui is also growing, currently standing at $2B year-to-date, with 90.2% coming from Ethereum. This growth reflects increasing network activity and a diverse inflow of assets and users, as net inflows have crossed $700M. (inflow: $2B, outflow: $1.3B)

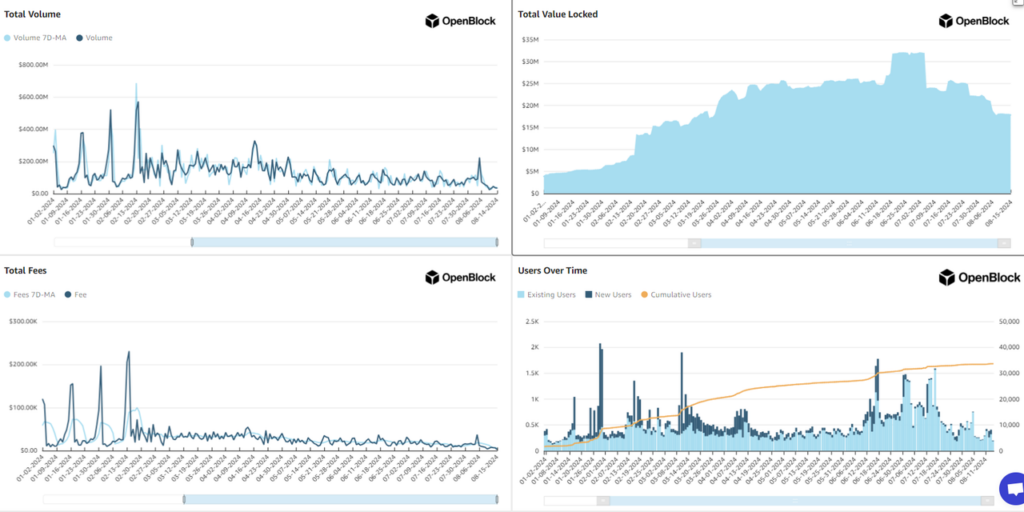

2.2.3. Trading volume

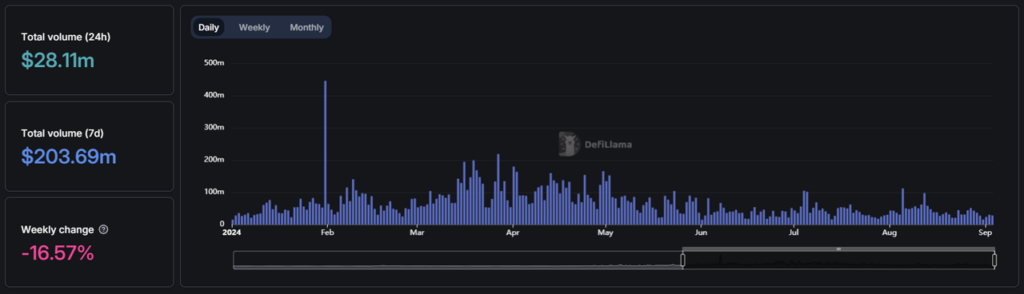

YTD daily trading volume, particularly from January onwards, indicates growing adoption, usage, and consistent engagement, averaging over $85 million in daily trading volume without dramatic spikes or drops. However, there has been a decline in recent months due to market conditions.

3. Sui ecosystem

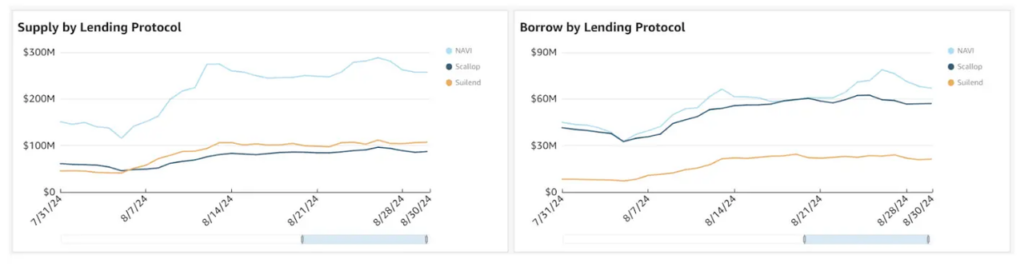

3.1. Navi Protocol

NAVI Protocol has emerged as a leading player in Sui’s DeFi ecosystem. As a one-stop liquidity protocol, NAVI has secured the top spot in the lending/borrowing category, boasting a supply value of $258m and a borrow value of $67m.

The introduction of NAVI Pro has further bolstered the protocol’s TVL, which recently surpassed $300m, accounting for more than 50% of all lending TVL on Sui.

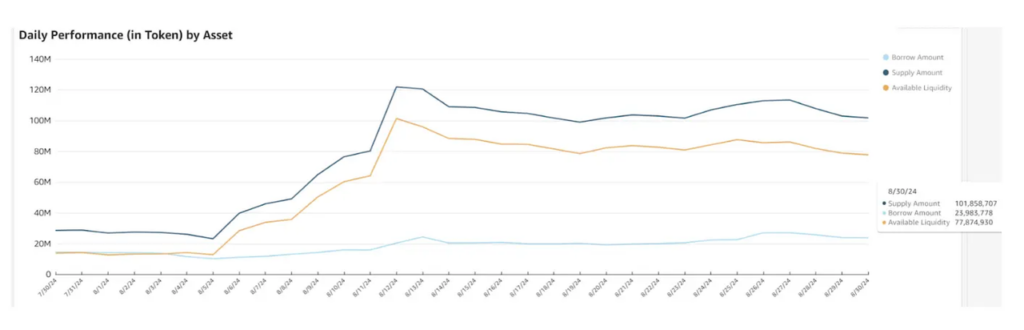

In August, USDC supply and borrowing surged significantly, increasing by 254% and 63%, respectively. Notably, the USDC supply increased by nearly $100 million in just one week.

In August 2024, the Navi platform on Sui exhibited strong performance and resilience, marking a notable rebound early in the month. This resurgence was highlighted by a significant surge in USDC supply and borrowing activity, underscoring Navi's growing influence within the Sui ecosystem.

3.2. Bluefin

Bluefin, a decentralized orderbook DEX on Sui, has become a significant platform for both professional and retail traders. Since its launch, Bluefin has processed over $34B in trading volume from more than 33.3k users. The platform’s competitive funding rates and robust liquidation processes have made it a preferred choice among traders.

If we look at Bluefin’s metrics, there is a significant decline in all metrics. This reflects a bearish market sentiment and does not attract retail investors

Bluefin’s focus on high-frequency trading and its ability to attract significant trading volume highlight its potential as a major player in the DeFi space. The platform’s design ensures protection against systemic risks, adding an additional layer of security for users.

The upcoming launch of Bluefin V3 will significantly enhance the platform's performance with advanced features like cross-margin trading, enabling more efficient capital use. Additionally, the Bluefin Foundation's move to cover gas expenses will make trading more cost-effective, attracting a broader user base. These upgrades are expected to drive Bluefin's growth, solidifying its position as a leading DEX in the Sui ecosystem.

3.3. Wave Wallet

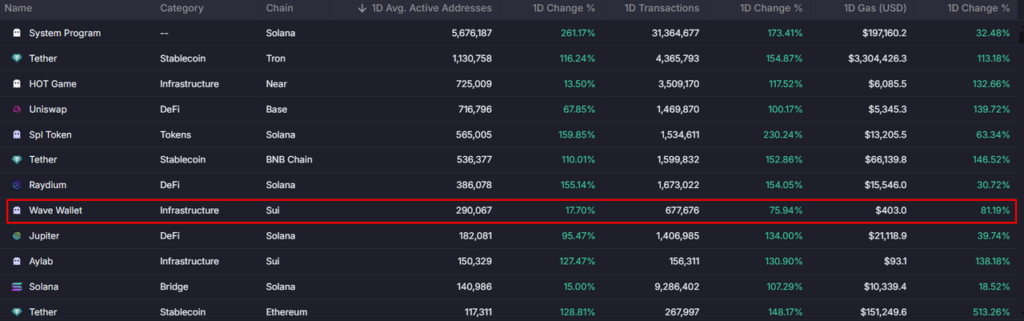

Wave Wallet has emerged as a cornerstone of the Sui ecosystem, demonstrating remarkable growth and user engagement. With over 3m users and more than 250m transactions processed, Wave Wallet has become a key driver of activity on the Sui network since May 2024. At its peak in May, the wallet boasted 1.3m active users. Although the number of active wallets has since declined, Wave Wallet remains consistently in the top 10 applications for active addresses across the blockchain industry, as tracked by Artemis.

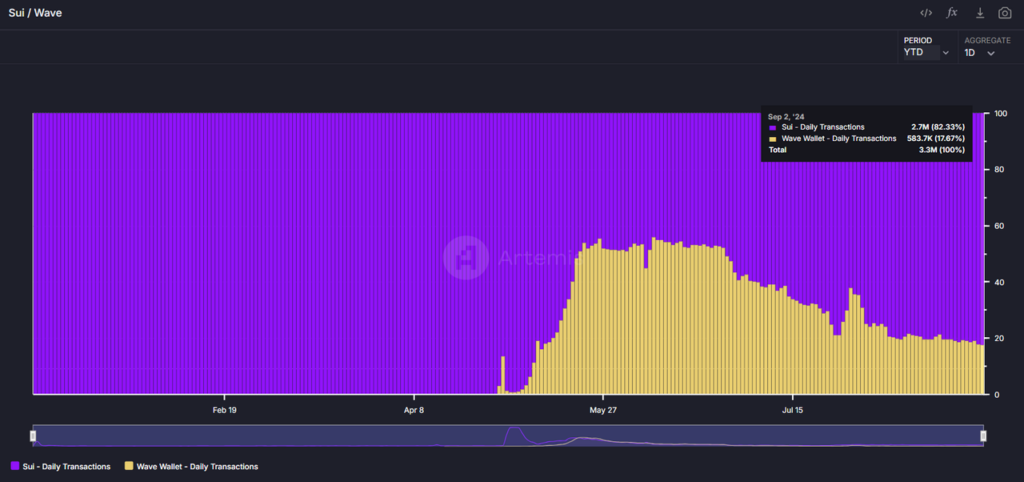

The wallet’s role in onboarding new users to Sui is unparalleled, accounting for 80% of daily active addresses, a dominance that has been unwavering since its launch.

In addition, Wave Wallet facilitates between 18% and 50% of all transactions on Sui daily.

With the vision of creating a user-friendly gateway into Web3 while incorporating a fun, gamified element representing the OCEAN game, Wave Wallet has driven significant growth and user engagement within the Sui ecosystem.

4. Conclusion

Looking ahead, Sui is well-positioned to continue its upward trajectory. The network’s focus on high-performance applications, combined with its expanding DeFi ecosystem, suggests sustained growth and innovation. Investors should closely monitor developments within the Sui ecosystem, as emerging protocols and new use cases could present additional investment opportunities.

[…] fact, as per the recent research posted on Blockbase (published by Sui’s second anniversary report) highlights that the number of […]

Comments are closed.