1. Overview

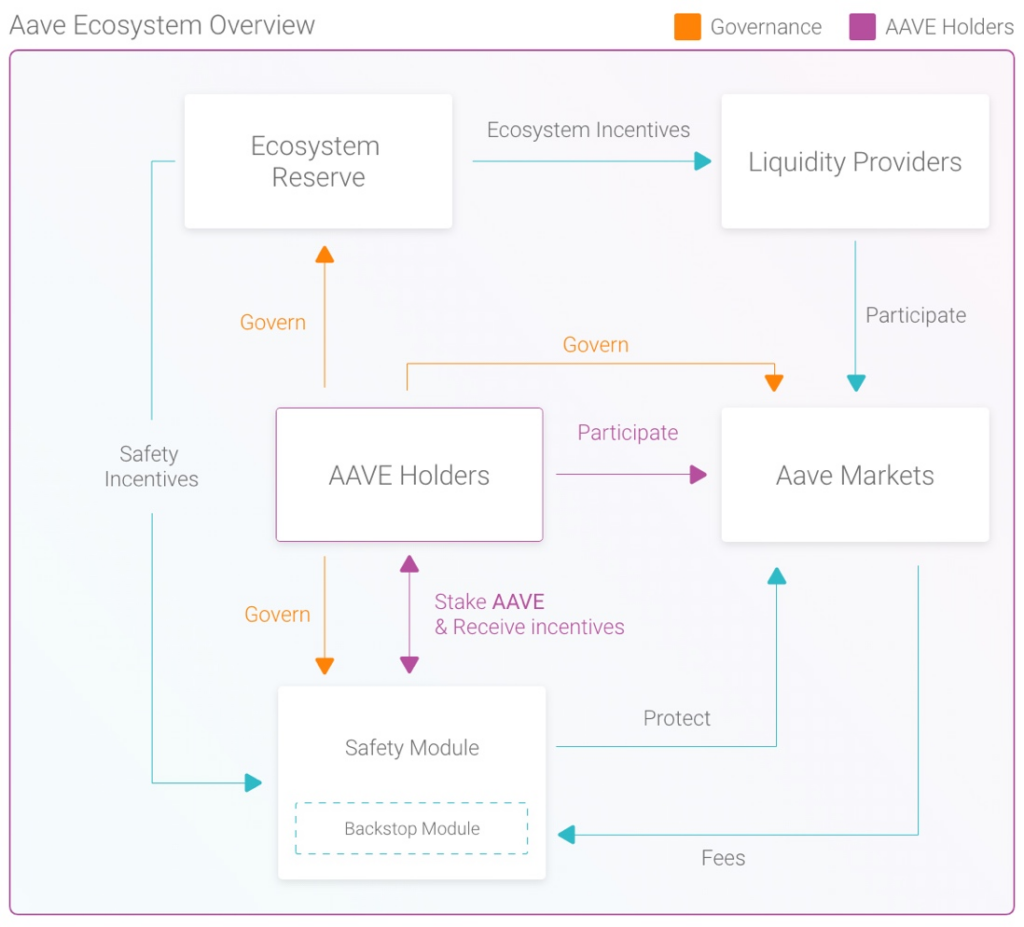

Aave is a decentralized, over-collateralized lending platform that has become a cornerstone of the DeFi ecosystem. It enables users to borrow debt against collateral with predefined risk parameters. Aave’s system is designed to maintain security and stability; if a user’s collateral value falls below the Liquidation Threshold (LT), the position becomes eligible for liquidation. In such cases, anyone can repay the debt, earning a portion of the collateral and a liquidation bonus. This mechanism ensures the protocol remains solvent while incentivizing market participants to maintain stability.

2. Key metrics

2.1. Total value locked, active loans

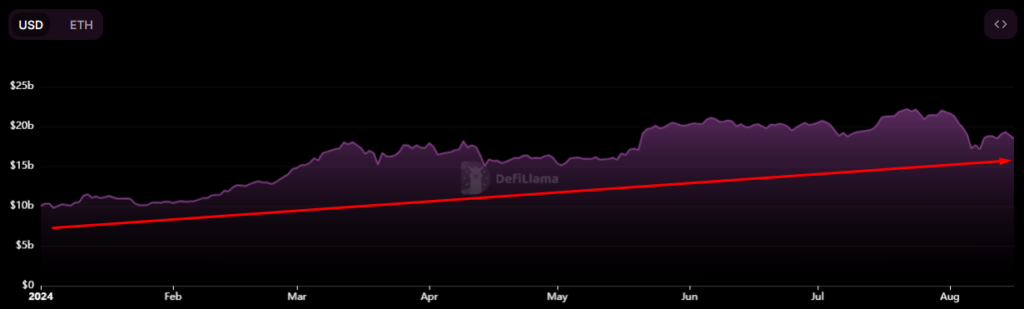

Since January 2024, Aave’s Total Value Locked (TVL) has seen remarkable growth, doubling from $10 billion to a peak of $22.2 billion in July before market turmoil during the Black Monday crash. This growth trajectory underscores Aave’s dominance in the DeFi lending sector while protocols like MakerDAO and Compound experienced a 17% and 18% decline, respectively.

Aave now ranks as the second-largest DeFi protocol by TVL, trailing only Lido. This growth is not just a recovery but a sign of strength in DeFi lending, with increasing active loans potentially reflecting a rise in leverage. According to Token Terminal, this could be a leading indicator of an upcoming bull market.

Aave’s TVL now stands at a robust $18.5 billion, with $11 billion lent, $7.2 billion borrowed (65% utilization rate), and $300 million staked.

2.2. Total Weekly Borrowers

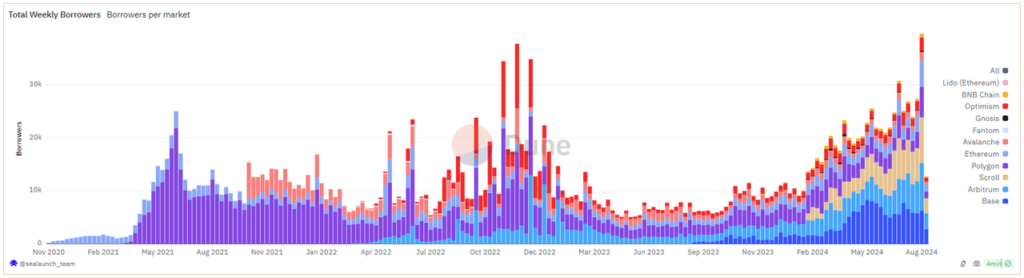

Aave has achieved a significant milestone, reaching approximately 40,000 active weekly borrowers, surpassing the previous high recorded in late 2022. This increase has been driven by the expansion of new lending markets, particularly on Base and Scroll.

- Base alone now accounts for nearly 30% of the total unique wallets on Aave V3.

- Arbitrum and Polygon follow closely, holding Aave wallet shares of 23.4% and 21%, respectively.

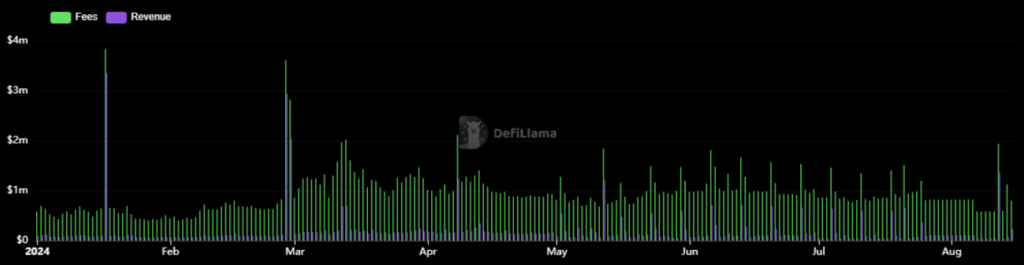

2.3. Fees and revenue

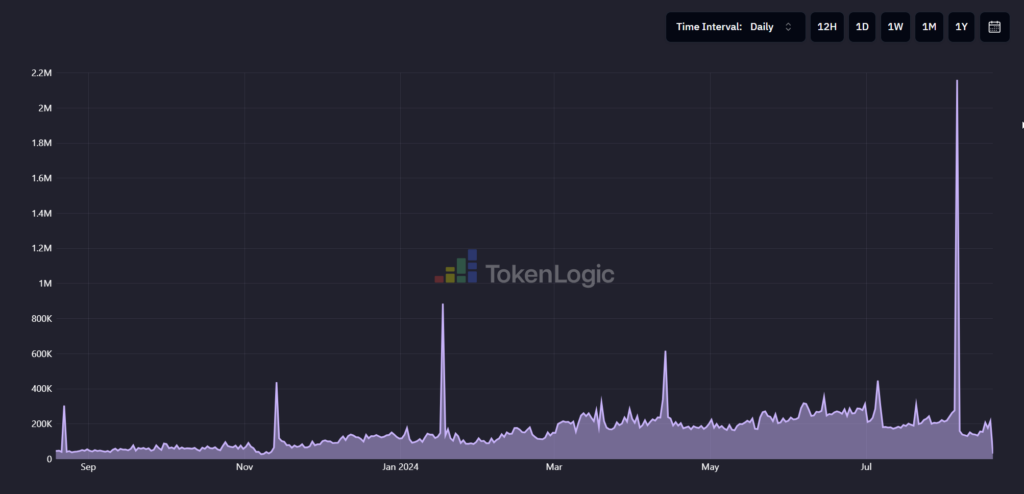

Notably, one of the most stress-tested OG protocols in the crypto space generated $2.1 million in daily revenue amid a flood of cascading loan liquidations on Aug 5, based on TokenLogic data.

In general, Aave’s financial performance has been solid, with average daily fees reaching $1 million and daily revenue averaging $200,000. This steady revenue stream highlights the strong product-market fit.

3. The bull case for Aave

3.1. Temp check: AAVEnomics update

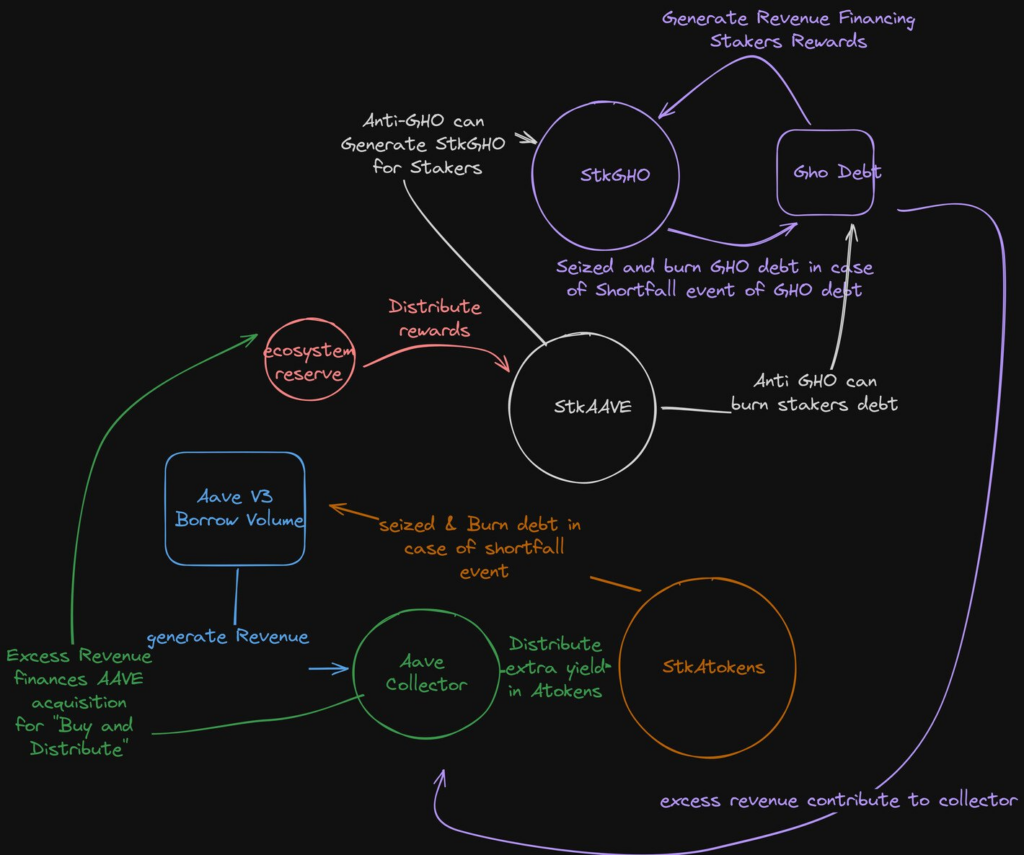

On July 25th, the Aave Chan Initiative (ACI) published a “Temp Check” proposal to activate the fee switch, which could significantly impact the AAVE token’s value. The proposal introduces a “Buy and Distribute” program, where Aave’s excess revenue would be used to buy $AAVE tokens and distribute them to stackers. This mechanism could create a continuous demand for AAVE tokens, potentially driving up the price.

Key takeaways on Aave token from the proposal include:

- The AAVE staking module will become slashing-free. However, a 20-day lockup period will still apply.

- Staking rewards will be generated from revenue captured through borrowing activities and the GHO stablecoin. Rather than releasing AAVE from the ecosystem reserve, excess revenue will be used to buy back AAVE from the secondary market and distribute it to stackers.

- The AAVE staking module will no longer cover bad debt. Instead, users who lend on AAVE can use their aTokens to restake (as stkAtokens) for additional yield or to cover bad debts.

The proposal is currently in the “Temp Check” phase. If there is no significant pushback from the community, it will proceed to a snapshot vote. Even if passed, the fee switch will not be activated immediately; certain prerequisites must be met first.

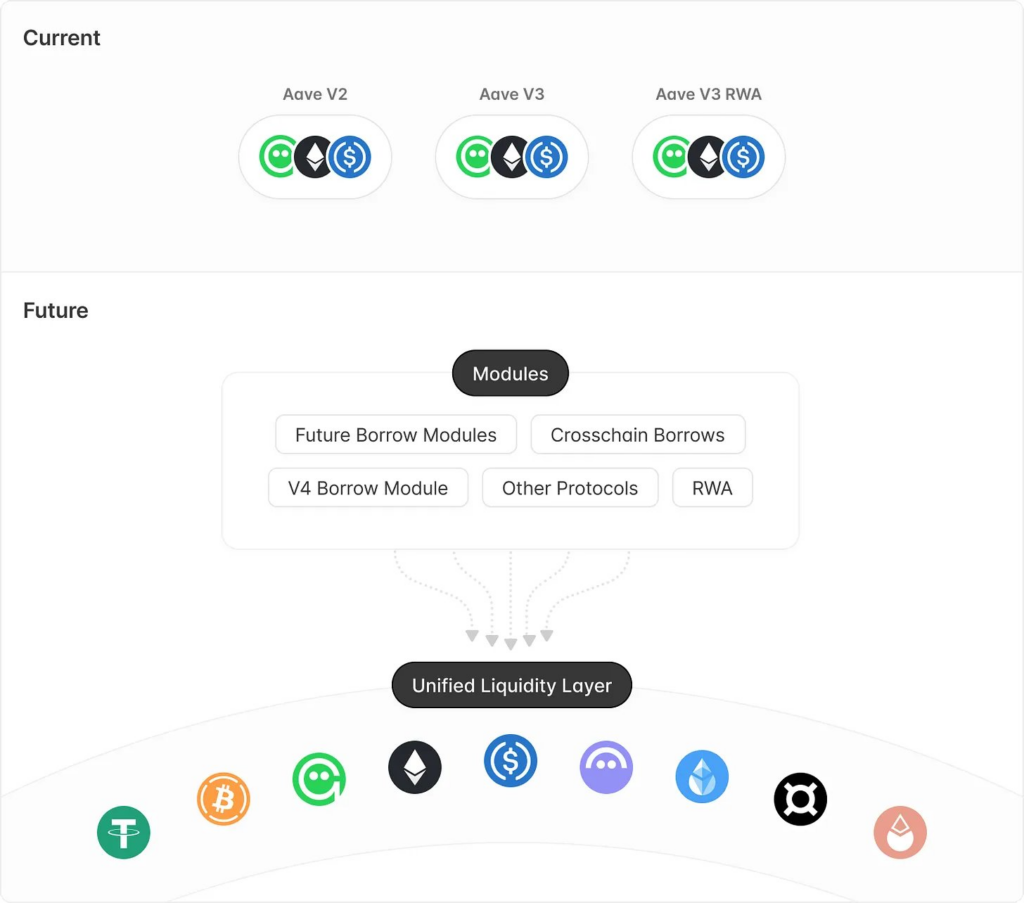

3.2. Aave V4 development

The Aave V4 release introduced several critical enhancements aimed at solidifying Aave’s market position. One of the most significant changes is the introduction of a Unified Liquidity Layer, an evolution of the “Portal” feature from V3. This layer facilitates easier liquidity migrations from previous protocol versions, thereby reducing liquidity fragmentation.

The V4 proposal addresses two key areas crucial for Aave’s long-term success:

- Increasing Market Share: Each blockchain tends to have a dominant lending platform, often boosted by high incentives. To remain competitive, Aave must launch early on new ecosystems. The cross-chain Liquidity Hub proposed in V4 positions Aave to lead across all chains without the need for specific deployment strategies.

- GHO Use Cases: The GHO stablecoin will have multiple use cases within the Aave ecosystem, including paying fees on the Aave network, being utilized in RWA projects, and generating yield.

4. Conclusion

On June 23, 2023, MakerDAO introduced the Smart Burn Engine governance proposal, shifting from a traditional buy-and-burn model to the Protocol Owned Liquidity model. Under this new approach, $MKR tokens are accumulated in the form of UniV2 LP tokens rather than being burned, creating consistent buy pressure. This change has led to a remarkable surge in $MKR’s value, with peaks of 450% against USD and 150% against BTC.

Similarly, we believe the upcoming changes in AAVEnomics and the V4 upgrade could significantly enhance Aave’s market position and deliver substantial value to AAVE token holders. These developments have the potential to drive strong price appreciation for AAVE, much like what we’ve observed with MakerDAO.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.