1. What are royalties, and why do we care?

For those involved in the NFT market, you are surely familiar with the concept of royalty fees. Essentially, when a user sells an NFT, two fixed fees need to be paid:

- Platform fee: This is the amount that Marketplaces charge on every NFT sale. Currently, the fee on OpenSea is 2.5% for each transaction.

- Royalty fee: This is the amount that Marketplaces “collect” on behalf of the Creators for each NFT sold. This fee is determined by the Creators themselves and is paid back to them.

Since its inception up to the fantastic story that NFTs have told the Crypto maxis from 2021 to the present, the concept of royalty seems to be the Unique Selling Point, seen as a progressive step from Digital art compared to Traditional art. For Traditional art, the only source of revenue for Artists comes from the primary market, meaning Artists can only earn money from the initial sale of their work.

In contrast, with NFTs and the royalty fee mechanism, any buying or selling action on the secondary market also generates revenue for the Artist. It is believed that this is fairer for creators compared to traditional methods, and that’s why more and more renowned artists are gradually shifting to selling more NFTs such as Murakami Flowers NFT by Takashi Murakami – a famous Japanese artist.

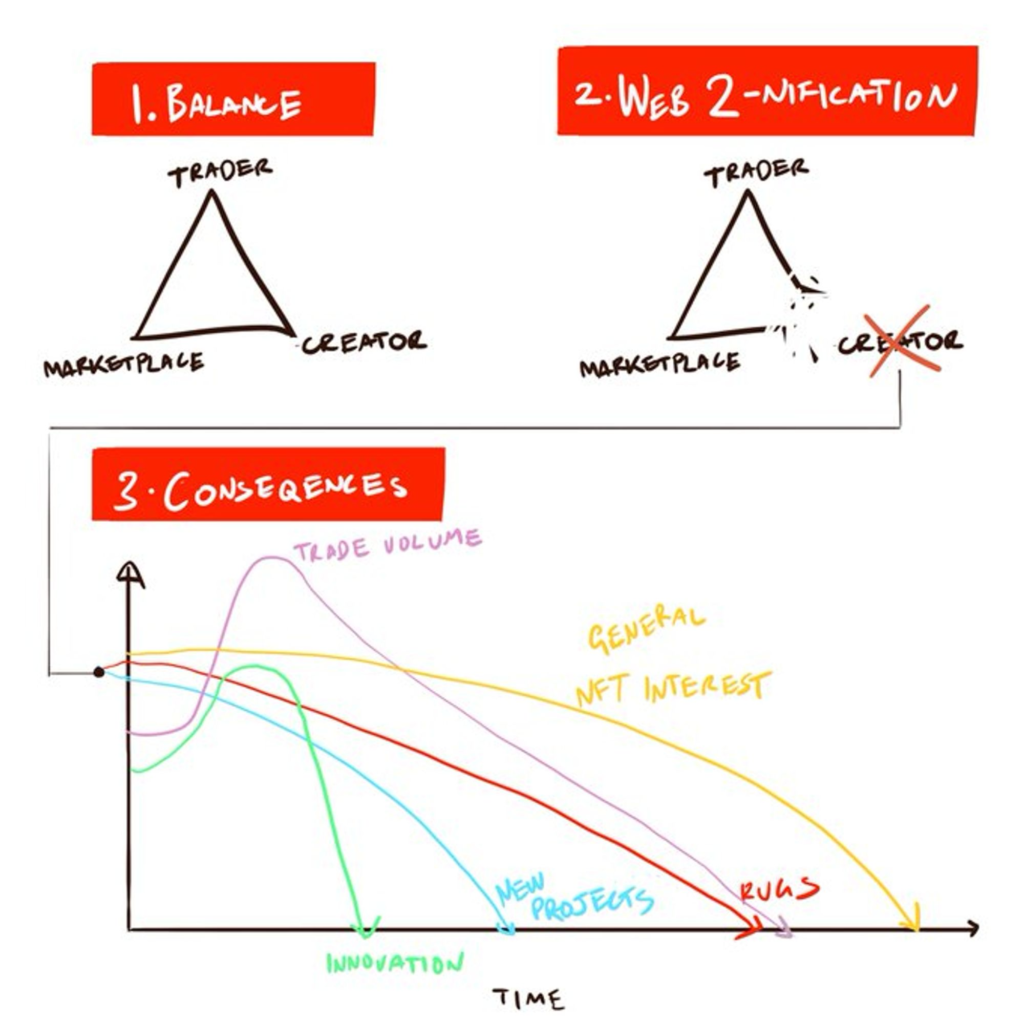

Controversy arose as more and more NFT Marketplaces were launched, accompanied by competitive strategies to capture market share. A few Marketplaces no longer respected the Royalty fees to attract users, moving to optional royalties or even completely eliminating this fee. This led to outrage among Creators, with some arguing that without this revenue source, NFTs surely wouldn’t grow as there would be no incentive to build.

2. Background of the Story

- For a long time, royalty payments were consistently paid to Creators until SudoSwap emerged in August. At that time, NFT AMM was seen as a groundbreaking idea. Almost everyone was drawn into the SudoAMM mechanism with the chance to receive airdrops, nearly all overlooking the fact that SudoSwap indirectly set a precedent for not collecting royalty fees for each transaction.

- The royalty issue truly exploded when X2Y2 introduced the Optional Royalty feature, allowing buyers to choose to pay 100%/50%/0% of the royalty fee with each transaction. A debate erupted within the NFT community. Around this time, it seemed that NFT Marketplace platforms were trending towards completely rejecting Creators’ royalty fees.

- Even OpenSea considered implementing flexible royalty charges. The NFT market on Solana was no exception, with Magic Eden also introducing optional royalty payments, allowing royalty fees to be paid at the buyer’s discretion.

Marketplaces believe that royalties won’t significantly harm the platform and projects, but instead offer users the right to purchase NFTs at lower costs. And there’s no reason for users not to choose markets without royalty fees for transactions, as long as there’s good liquidity.

- However, in November of the previous year, in the face of criticism from Creators, OpenSea for the first time launched The Operator Filter – a tool allowing Creators to enforce Royalties directly on the Smart contract (only applicable for new collections).

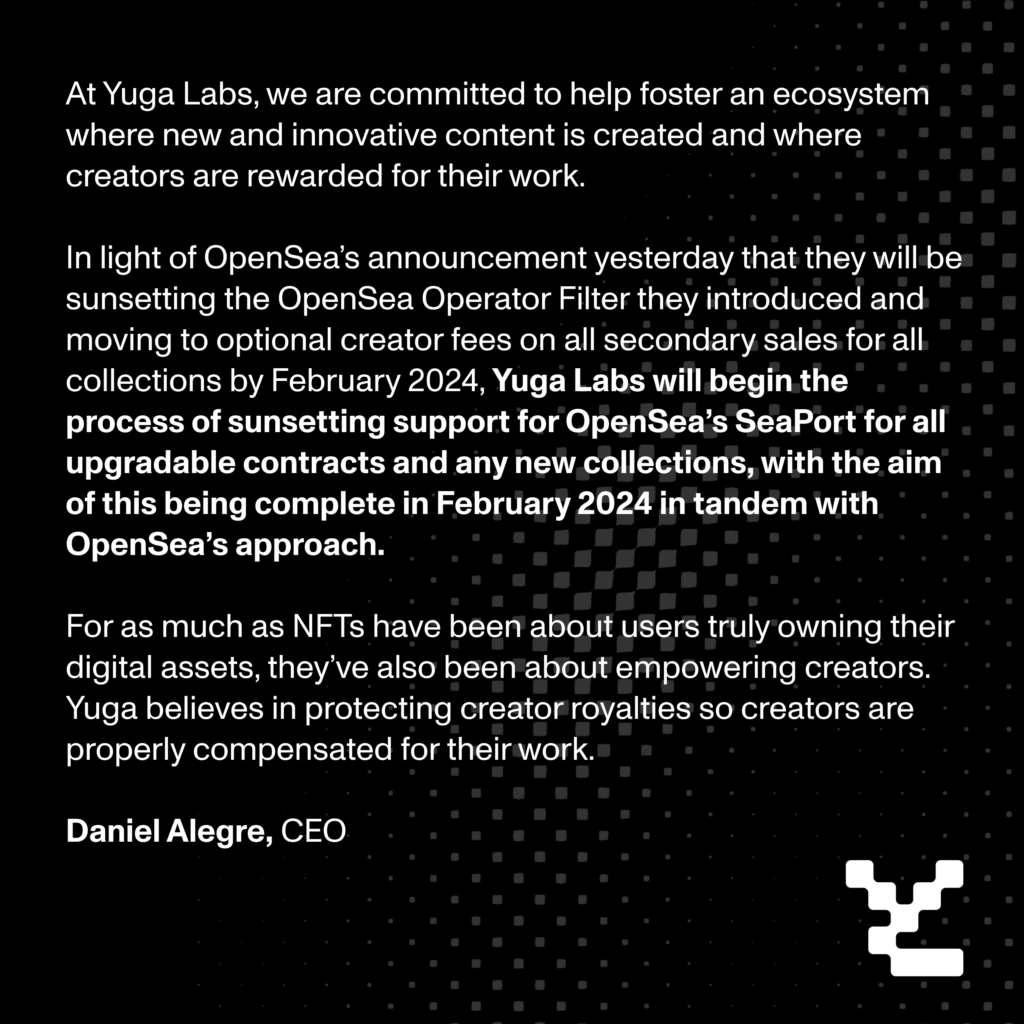

- Six months after Blur officially airdropped to users (02/14/2023), which is also the day OpenSea officially lost its number one market share to this emerging platform, OpenSea once again caused significant controversy when they announced the removal of The Operator Filter at the end of August. Collections that had already applied The Operator Filter would still have Royalties enforced until February 2024. After this date, all Royalties would no longer apply.

The BAYC community reacted vehemently to this action, retaliating by ending support for OpenSea’s SeaPort, starting from February 2024.

3. Future Solutions

Royalties are seen as the primary source of revenue for the majority of NFT projects. As projects grow over time and the buying power for NFTs on the secondary market increases, the revenue subsequently rises. The discontinuation of royalties is perceived as an indirect action that kills the market since creative teams no longer have the incentive to continue developing and maintaining their projects. A new solution, named ERC 721-C, has been introduced with hopes to address this issue.

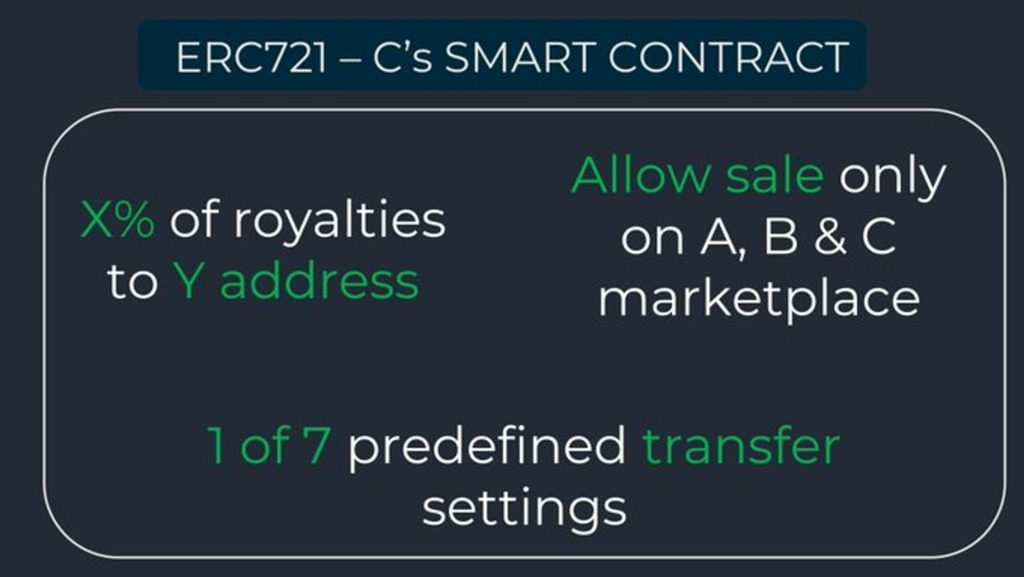

Developed by the gaming company Limit Break, ERC 721-C allows creators to set new rules for royalty fees on their blockchain. Simply put, this new standard assists artists and developers in creating a type of Smart Contract licensed to specify locations and methods for transferring royalty fees.

Fundamentally, ERC 721-C allows creators to select where to sell their NFTs and grants them the authority to filter interactions only from contracts and applications of their choosing. At the same time, traders cannot bypass royalty fees by using other platforms that do not charge fees because any collection created using the ERC 721-C standard can choose not to participate in transactions on such NFT Marketplaces anymore.

With ERC 721-C, creators can set up royalty policies for the NFTs in their collection. These policies include the following information:

- Royalty Rate: The percentage of the NFT sale price that the creator will receive.

- Permitted Locations: The NFT Marketplaces where the NFT can be traded.

- Royalty Recipients: Other parties, besides the creator, who can receive royalties, such as the community, partners, or agents.

When an NFT is traded on a market that complies with the ERC 721C standard, copyright policies are automatically enforced. The creator of the NFT will receive a royalty fee based on the percentage they have set.

At present, faced with decisions from OpenSea that affect Creators, Xterio – a game studio that has successfully raised $55M backed by Binance Labs, has announced the launch of an entirely new marketplace, integrating the ERC 721C standard to maximally protect Royalties fees.

The Royalty war seems to be far from over as competition among marketplaces becomes increasingly fierce. Is the ERC 721C solution truly the fairest direction for Creators, given that this standard allows them to halt transactions of their collections on marketplaces that don’t collect Royalties? And what will the NFT market look like if OpenSea no longer receives support from Creators? Only time will tell.