1. The news drives the price: An Insight into Crypto Valuation

In crypto circles, the phrase “the price is the news” often surfaces whenever there is a surge in network engagement following rapid price movements. However, the reverse could hold even more weight: “The news is the price.”

In his contribution to What Multicoin is Excited About For 2024, Shayon Sengupta described a marked shift in how markets price assets that he labeled the “Attention Theory of Value”. In the realm of crypto, asset pricing hinges less on traditional multi-factor models involving risk premiums or cashflows, and more on the perceived time, energy, and money devoted by a community to a particular asset. This is not a normative statement but an observation of capital flows in the history of tokens (recent memecoin trends exemplify this).

Today’s consumer internet, encompassing streaming platforms, online media, mobile apps, social media, etc, functions as a marketplace for attention. Consequently, money and attention are becoming increasingly intertwined.

2. The Rise of the Marketplace of Attention Model

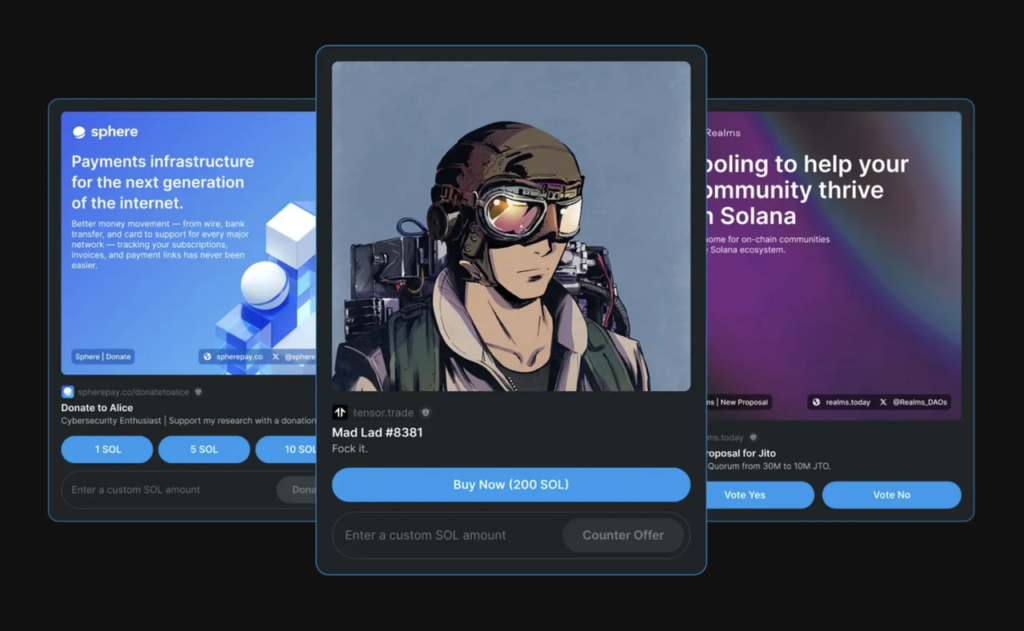

Developers integrate crypto into their apps, reshaping what can be traded and where. Exchanges (or marketplaces) are a natural fit in the crypto ecosystem as they facilitate value transfer. Examples include Coinbase (fiat on/off ramp and centralized exchange), Tensor (digital collectibles exchange), Jito (transaction intent and block space exchange), and Phantom (taker order flow exchange). Exchanges hold a similar role in crypto to what major publishers (e.g., X, Instagram, The New York Times) do on the consumer internet: controlling the flow of money and attention, respectively.

The goal of Marketplaces of Attention is to facilitate trading alongside user attention. Future consumer crypto apps will enable users to issue and trade assets natively, directly monetizing their attention.

3. Potential SocialFi Application Categories

3.1. Messengers

WhatsApp and WeChat showcase this by leveraging robust developer ecosystems and state-backed payment systems in India and China, allowing for seamless integration of AI labor markets and local e-commerce within user interactions.

In the crypto world, Telegram serves as the main messenger, with its bot API enabling trading and value exchange directly within chats, as seen with products like Dialect Operator and Maestro.

These bots combine discovery, intent, and execution, enhancing the link between attention and value transfer. Telegram also features a hidden app store with numerous bots for various functions, including payments, games, and content discovery. These bots not only speed up trade execution but also open up new possibilities for work, crowdfunding, and issuing playful assets like memecoins within chat groups.

3.2. Content network

Social media giants like Instagram, TikTok, X, and YouTube function as content marketplaces, where creators vie for user attention to monetize their content or sell branded products.

Crypto content networks seek to reward creators with a significant share of their content’s value, though creator tokens alone won’t succeed without integration with the platforms. Innovative platforms like Farcaster Frames or recent Solana’s innovation Blinks and Actions are experimenting with in-app token issuance and trading.

Traditional ad-based models are becoming obsolete, with Direct Value Issuance (DVI) emerging as a superior method where advertisers directly reward users with tokens. This approach not only improves user experience by offering financial rewards but also enables the integration of financial services within the app.

3.3. Information market

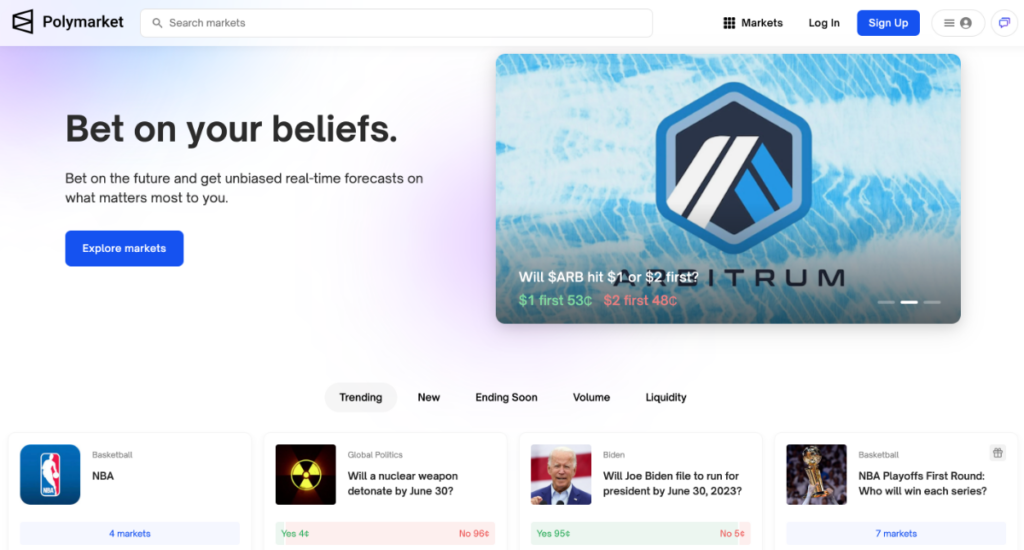

Now, information is found in forums, chats, podcasts, and databases. Information markets, such as prediction and sports betting platforms, help users filter useful insights from these sources. While these markets currently don’t use crypto, they could be enhanced by it, either by financializing information quality or embedding markets where information is shared.

Prediction markets like Polymarket face challenges in liquidity and attention, unlike cultural assets like memecoins and NFTs, which attract more interest. New attention-tracking spot assets could better represent information flows. Integrating these assets into news or editorial platforms could surpass traditional prediction markets. Platforms that value votes and reputation financially or let users stake in trends could better aggregate and monetize quality information with crypto.

3.4. Special-interest community

Tokens allow communities to draw attention to novel problems, and steward resources toward them. ConstitutionDAO demonstrated that a memecoin could pool together enough funds to bid on a rare artifact, and the network took a life of its own after the auction itself.

The takeaway in this instance is that tokens are more likely to coordinate real-world action when there is a mission attached to them. This exact collaborative funding model could support new ventures that are traditionally ignored by conventional lines of funding and research: capital-intensive projects like VR headsets, obscure corners of open-source software, artistic spaces, or drug discovery for rare diseases.

Tokens uniquely enable capital formation from distributed sources, and give capital providers strong ownership rights around the products of that capital. This means that groups around the world can coordinate capital to run experiments on a massive scale, productize the results of those experiments, and pass through earnings back to the token.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.