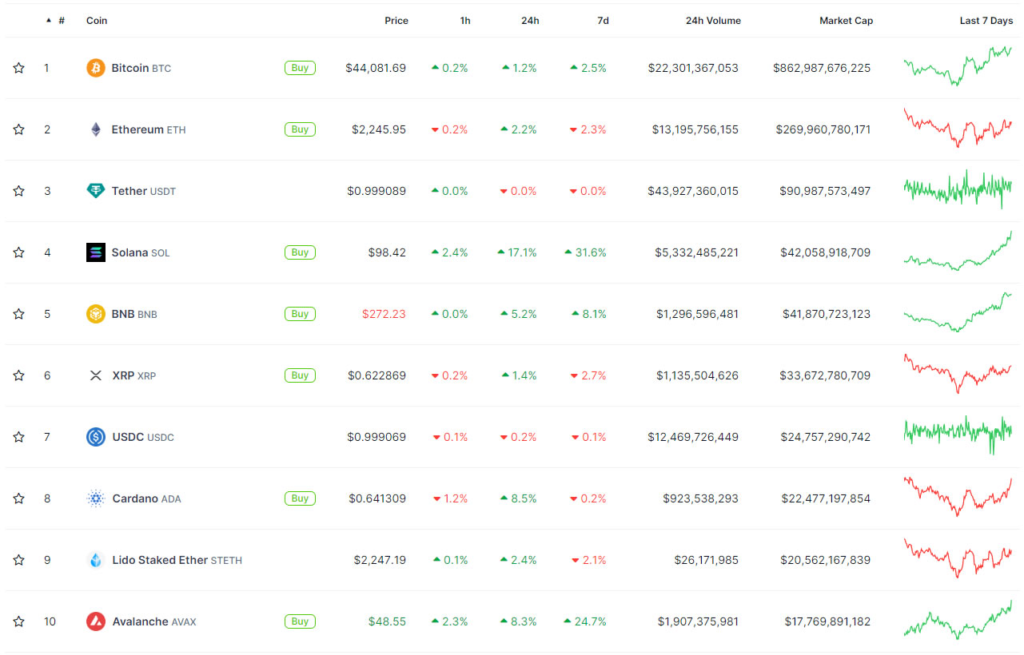

Solana, often dubbed the “Ethereum killer,” has experienced a remarkable surge in price. Since early December, SOL has seen a 100% surge, marking a staggering 10x increase since the beginning of the year. Consequently, SOL stands out as one of the best-performing tokens of the year, surpassing BNB in market capitalization and claiming the fourth position, trailing only Bitcoin, Ethereum, and Tether. During a period when Bitcoin’s price remained flat, the upward trajectory of Solana contributed to the rise of other layer 1 tokens such as Sui (SUI), and Sei (SEI).

Solana has captured the market’s attention through significant airdrops, commencing with the Pyth Network. Pyth Network launched the network via token airdrop with an initial market capitalization of $765 million, recently settling at $500 million. Positioned as the second-largest oracle provider after Chainlink, Pyth caters to 120 projects compared to Chainlink’s 361.

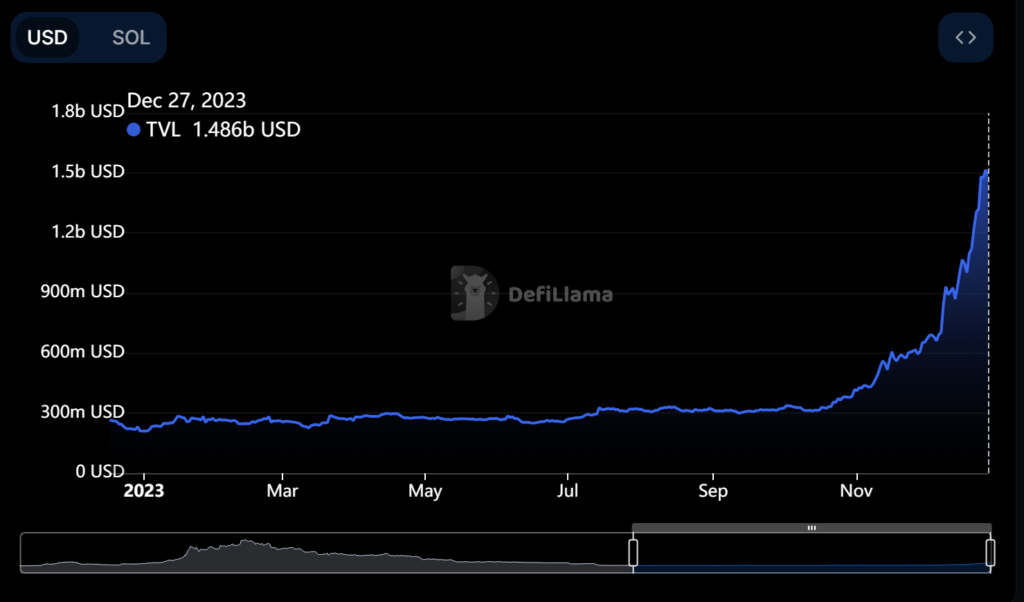

Another notable airdrop is JTO, which required just 1 SOL (equivalent to $30 at the time) for staking and received JTO tokens valued at $5000 during the Token Generation Event (TGE). Expanding on this trend, Saga Mobile, the recipient of the BONK airdrop, once sold for $5,000 on eBay, when the BONK price experienced a remarkable 1000x increase. These events spurred a surge of users and airdrop enthusiasts converging on the chain in pursuit of potential gains. Solana, at its peak, surpassed Ethereum and other blockchains in daily active users, reaching 1 million DAU, a significant rise from the 239,000 DAU recorded in June.

Another noteworthy blockchain in the spotlight is Sei, a Layer 1 blockchain optimized for high-speed trading applications. Recently experiencing a 2x increase, SEI price reached an all-time high of $0.4, propelling the project’s market capitalization to $1 billion. SEI launched the beta mainnet in August and received criticism from the community. Users or airdrop hunters were provided with an amount of SEI tokens that was just enough to compensate for transaction costs when using the network. This led to the emergence of trending hashtags such as #seiscam on Twitter during that period. Despite Sei’s total value locked at $6 million nowadays, the surge in Solana’s popularity has sparked speculation about a new generation of blockchains that leverage parallel execution to offer high transaction speeds and fast finalization times. This trend has fueled significant price surges in SEI, and SUI over the past few weeks.