As AI reshapes the global economy, its full potential remains constrained by traditional financial systems reliant on identity verification and expensive payment networks. Cryptocurrencies, particularly through micropayments, offer a solution by enabling autonomous AI agents to participate in financial activities. With blockchain technology and stablecoins, AI systems can conduct low-cost, instant transactions, facilitating machine-to-machine (M2M) payments and unlocking new opportunities in sectors like cloud computing and data services.

1. What is micropayment?

A micropayment is a small, digital transaction often involving amounts less than a dollar. These payments are commonly used online, such as purchasing digital goods, accessing premium content, or making donations. Micropayments typically involve low fees, making them ideal for frequent, small-value transactions.

AI systems need small payments because they often consume digital resources in small increments, such as accessing data, renting processing power, or paying for content. These interactions happen frequently but in small amounts, making large payments inefficient. For example, an AI may need to pay for a fraction of a second of cloud computing power or individual pieces of data. Large payments would be unnecessary and impractical for such micro-consumptions, which happen at high frequency and low value, making micropayments ideal for use.

2. Traditional Financial Bottlenecks

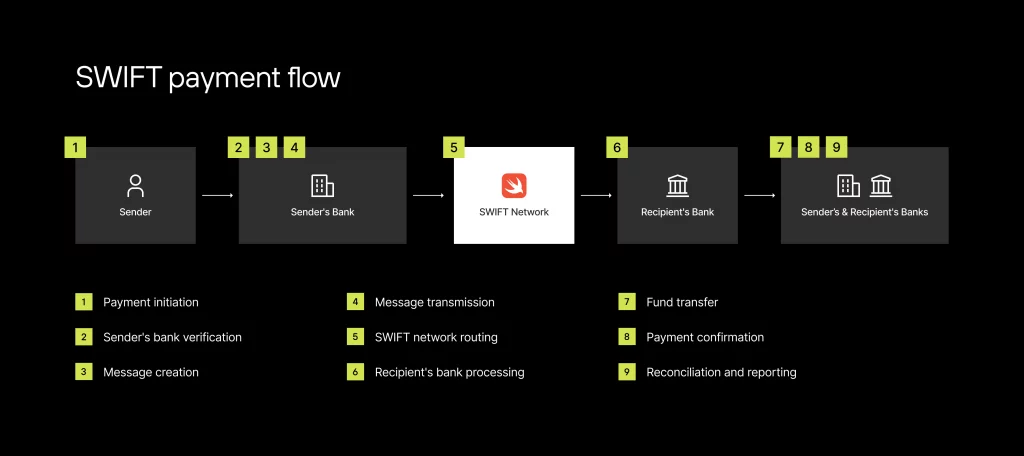

The traditional financial system, built on networks like SWIFT and platforms like Visa or Mastercard, depends heavily on identity verification. This presents a significant obstacle for AI systems, as they lack the necessary documentation to access bank accounts or credit cards. As a result, AI agents must rely on human-owned accounts, limiting their financial autonomy and the potential for a fully decentralized AI economy.

Furthermore, traditional systems struggle to process micropayments efficiently. Small financial transactions are often costly due to high fees, making them impractical for agents that require frequent, small-value transactions. To facilitate an AI-driven economy, the financial system needs to evolve to support seamless, frictionless micropayments.

3. Crypto Micropayments: A Game-Changer

Cryptocurrency offers a viable alternative for AI’s systems. With crypto wallets, AI agents can bypass identity verification and engage in autonomous transactions. Blockchain technology allows micropayments down to the 16th decimal place, enabling real-time, low-cost machine-to-machine payments. This opens the door to new economic models where systems can purchase services, data, or computing power on demand.

“Crypto has a real opportunity to capture the AI payments pool, by allowing greater programmability and financial autonomy to AI agents.” - Gautam Chhugani, Analyst at Bernstein concluded.

The scalability of blockchain networks, especially with Layer 2 solutions like the Lightning Network, reduces transaction costs and speeds up settlement times, making crypto a more suitable payment method for AI. These innovations align perfectly with AI consumption patterns, allowing for instant, frictionless payments without the need for human intervention.

4. The Role of Stablecoins in AI Payments

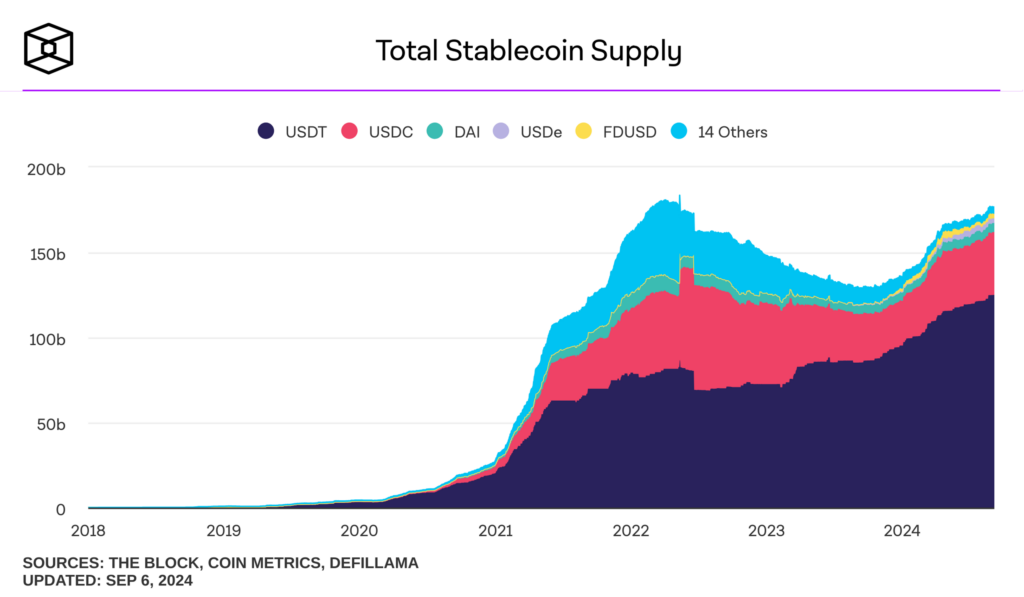

Stablecoins pegged to traditional currencies like the U.S. dollar, address one of the key challenges of using cryptocurrency for frequent transactions: volatility. Unlike Bitcoin or other volatile cryptocurrencies, stablecoins maintain a consistent value, making them ideal for handling micropayments in AI’s economy.

Stablecoins have already gained traction in cross-border payments and crypto trading but have struggled to penetrate e-commerce. However, the rise of AI could offer a new opportunity for stablecoins to thrive in commercial transactions, according to Gautam, especially as AI agents begin to handle payments for services like travel, data storage, or even content creation.

5. AI and Machine-to-Machine Payments

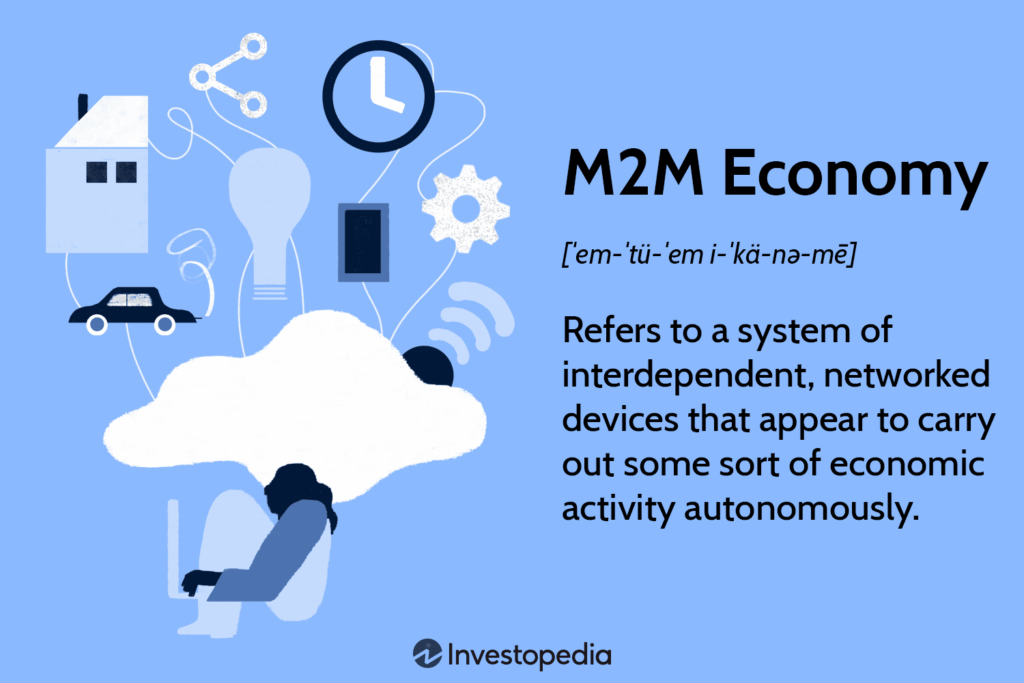

Machine-to-machine payments are set to become a cornerstone of the AI economy. As AI systems increasingly interact with one another, the need for autonomous financial transactions grows. For example, they could autonomously pay for data access or computing resources on a per-second basis, enabling a more efficient and cost-effective way to manage digital services.

With crypto micropayments, these transactions can happen seamlessly, removing the bottlenecks that traditional financial systems impose. This could revolutionize industries that rely on frequent, small-scale financial exchanges, such as cloud computing and data analytics.

6. Opportunities for Crypto and AI’s Convergence

The convergence of crypto and AI is already underway. Bitcoin mining operations, such as Core Scientific’s partnership with CoreWeave, demonstrate how these technologies can work together. As AI continues to grow, the demand for low-cost, real-time payments will increase, and cryptocurrencies, particularly stablecoins, are well-positioned to meet this need.

Integrating crypto wallets into AI systems could further enhance the synergy between these technologies. For instance, AI-powered platforms could use stablecoins to handle transactions, creating new commercial opportunities and reducing reliance on traditional payment systems. By enabling financial autonomy for AI agents, crypto has the potential to unlock a new wave of digital economy innovation.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.