The FET token serves as a utility token within the Fetch.AI ecosystem, fulfilling several essential functions:

- Staking and Node Operation: Holders can stake FET tokens to become processing nodes that manage transactions and system operations.

- Access to Digital World: Agents use FET tokens to gain entry into Fetch.AI’s Digital World ecosystem.

- Utilization of Resources: Upon accessing Fetch.AI, agents can explore and utilize resources available on the platform, particularly focusing on Artificial Intelligence (AI) and Machine Learning (ML) services.

- Transaction Fees: Similar to how ETH is used for gas fees on the Ethereum blockchain, FET tokens are utilized for covering gas fees on the Fetch.AI network.

- Agent Collaboration: When two agents collaborate to exchange value, they are required to stake FET tokens. This mechanism provides agents with the incentive to operate effectively, regardless of their location.

- Rewards for Miners: FET tokens are also used to reward miners who contribute to the processing nodes.

1. Tokenomics Assessment

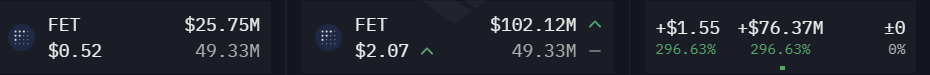

The project has unlocked over 90% of its total token supply, which mitigates inflationary pressures for token holders. However, given that this is an established project with a significant amount of its supply in circulation, accumulating tokens to influence price dynamics could be challenging. This extensive utilization of the FET token boosts demand and supports its functional value within the ecosystem.

2. On-chain Analysis

2.1. Binance

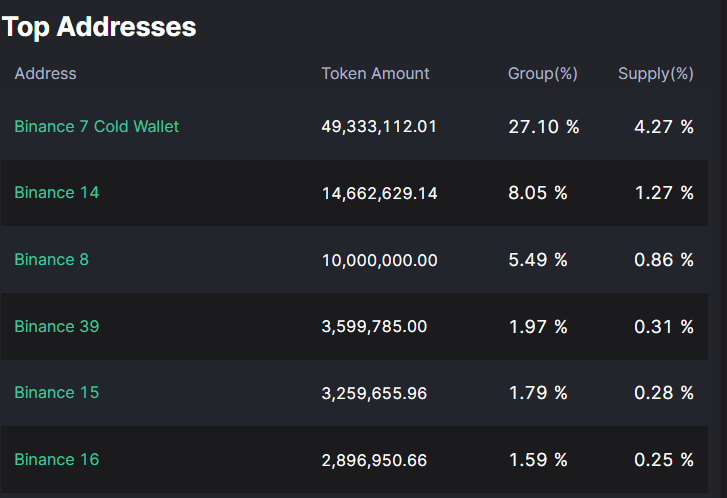

Binance employs a cold storage wallet, notably designated as “Binance 7”, for the secure retention of a significant volume of FET tokens. Commencing sales approximately 3 years ago, Binance continues to maintain a substantial reserve of the token, currently holding about 50 million tokens valued at approximately 125 million USD. As of January 1, 2024, the balance within Binance Wallet 7 has remained consistent up to the present date.

2.2. Token Supply and Market Dynamics for Fetch.AI (FET)

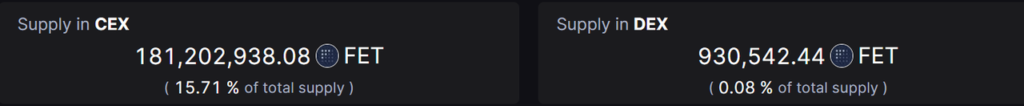

The actual circulating supply of FET tokens on exchanges is approximately 181,202,938.08 FET, constituting 15.71% of the total supply. This relatively low supply level facilitates potential market consolidation and price manipulation efforts.

2.3. Recent Exchange Withdrawal Trends

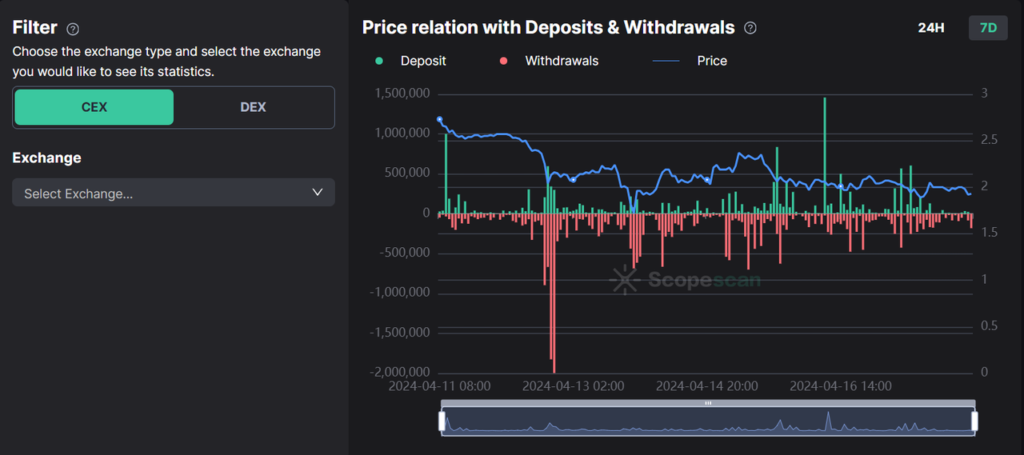

Over the past week, there has been a notable volume of FET tokens withdrawn from centralized exchanges (CEXs), particularly on the following date:

- April 12: Approximately 5.5 million FET were withdrawn.

- Deposits to exchanges were minimal during this period.

- The price of FET decreased by approximately 10% over the last three days.

- Binance holds the largest portion of these tokens, approximately 45%, with an identified wallet presumably used for holding by Binance containing 4.3% of the total supply because there has been no transactions occurring in the last 5 months. The discrepancy between the data provided by Arkham and Scopescan can be attributed to the timing of their data updates, with Scopescan typically delivering data after Arkham.

This trend indicates a shift towards token accumulation outside of exchanges, which could impact liquidity and price stability.

2.4. Analysis of High-Balance Wallets

Numerous wallets have been observed to receive tokens from Coinbase consistently since 2021 and have maintained holdings exceeding USD 500,000 in FET tokens. These wallets share common characteristics: they all received tokens from Coinbase on the same day and have retained similar quantities of tokens. Below is a list of some wallets that have been verified:

- 0xE0383Ef660d9060015a14942427E1b89f6db9d16

- 0xa28cbeF098b57FB453bdcF7383227229B354dA8b

This pattern suggests strategic holding behavior among certain investors, potentially indicating longer-term confidence in the token’s value or involvement in planned holding strategies.

2.5. Long-Term Investor Confidence in FET

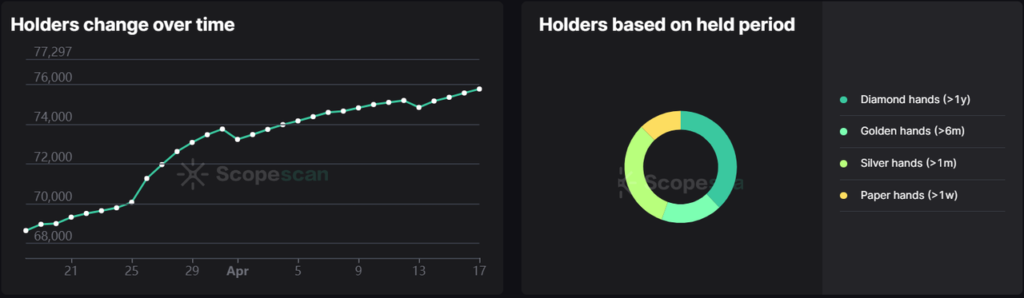

Over 38% of FET token holders have retained their holdings for more than one year, demonstrating significant investor confidence and commitment to the project. This substantial proportion of long-term investors underscores a strong trust in the token’s potential and stability.

Conclusion

Despite the rally at the beginning of 2024, Binance continues to hold a significant quantity of FET tokens. This suggests that FET has substantial potential to maintain its upward momentum.

The current market capitalization of the FET token stands at USD 1.8 billion, indicating a robust valuation. FET is anticipated to rise sharply shortly. Investors are advised to consider purchasing the token around the USD 1.1 mark, which has been identified as a significant support level, potentially offering a strategic entry point for investment.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.