1. GENIUS Overview

S. 394 – formally the “Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act of 2025” – was introduced on 4 Feb 2025 by Sens. Bill Hagerty (R‑TN), Tim Scott (R‑SC), Kirsten Gillibrand (D‑NY) and Cynthia Lummis (R‑WY). It was immediately referred to the Senate Banking Committee.

1.1. Key provisions at a glance

| Section | What it requires | Why it is important |

| Chartering options | Creates a new “Federal Payment‑Stablecoin Issuer” license through the OCC or recognises state‑chartered non‑bank issuers that opt in. | Combines the Fed’s desire for uniform standards with political pressure to let innovative state regimes (e.g., Wyoming, New York) survive. |

| 1:1 reserve mandate | Reserves limited to (i) cash, (ii) demand deposits, (iii) ≤ 90‑day U.S. Treasury bills or repos collateralised by them. | Bans commercial paper or longer‑dated bonds – a direct response to Terra USD & liquidity problems at USDT in 2021. |

| Redemption rights | Holders must be able to redeem at par within two business days; issuers must publish daily reserve statements and monthly attestations by a PCAOB auditor. | Eliminates the timing & information gaps that fuelled prior bank‑run fears. |

| Algorithmic‑stablecoin moratorium | Two‑year prohibition on issuing tokens whose “primary backing arises from the expectation of future issuance or burn” (i.e., algorithmic designs). | Gives regulators time to study systemic‑risk implications after the 2022 Terra / Luna collapse. |

| Fed oversight trigger | Issuers with > US $10 bn tokens outstanding become “systemically important payment entities” subject to Fed examinations and stress tests (liquidity, cyber, operational). | Mirrors the $250 bn threshold for large U.S. banks – seeks to prevent a “shadow systemically‑important” issuer. |

| Clarity on securities laws | Tokens meeting the bill’s strict reserve & disclosure tests shall not be deemed securities solely by virtue of being stablecoins. | Removes the SEC overhang for fully‑backed payment coins (USDC, PYUSD, PayPal USD). |

| FDIC / SIPC | No government insurance for holders; marketing must disclose this clearly. | Prevents moral‑hazard arguments and keeps public costs limited. |

1.2. GENIUS Market back‑drop

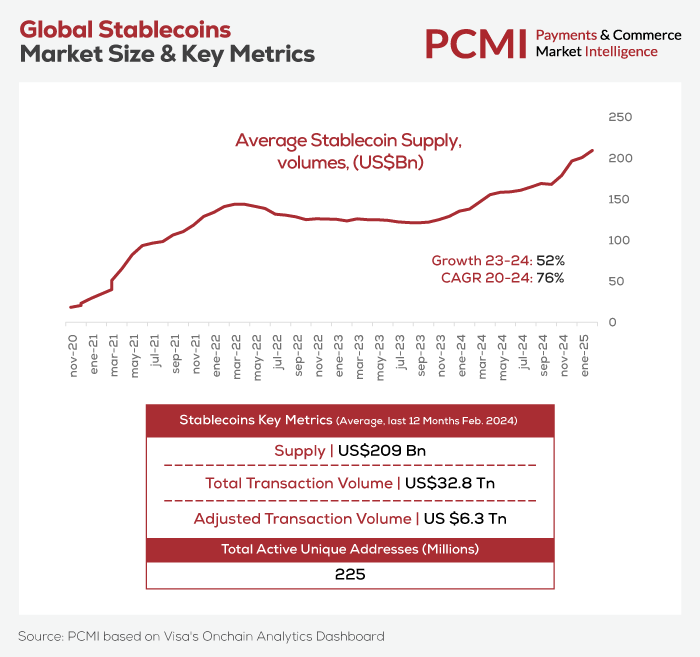

- It arrives while dollar‑pegged stablecoins already command ≈ US $210 bn in market‑value and settle > US $6,3 tn / monthin the 12 months to February 2025, equivalent to 15% of global retail cross-border payments in 2024.

- Overall, GENIUS unlocks the on‑shore portion of the next US $200 bn+ of growth by giving large U.S. wealth and corporate treasuries a Fed‑blessed rule‑set.

2. Market implications

- Reg‑arbitrage premium flips — compliance is now the moat; scale issuers gain cheaper liquidity than off‑shore rivals once bank treasurers and asset managers switch from USDT to GENIUS‑grade tokens.

- Treasury‑bill flywheel — forced 0‑90‑day collateral means every new dollar of circulation buys near‑risk‑free bills, further anchoring issuer trust and U.S. dollar hegemony.

- Interoperability unlocks network effects — common federal standard means Visa + JPM + Circle tokens become fungible in atomic‑swap layers and bank‑grade blockchains (Canton, Provenance, Hyperledger).

| Winners & most‑promising opportunities | Why |

| Bank‑linked stablecoins: JPM Coin, USDF consortium | • Can leverage existing deposit‑insurance and Fed master‑account access to keep reserve costs low. |

| High‑grade non‑bank issuers already 100 % cash/T‑bill: Circle (USDC), Paxos (USDP), PayPal (PYUSD) | • Already publish daily reserve breakdowns and hold only cash + T‑bills; path to Fed‑level charter creates institutional credibility. • Meet GENIUS reserve/attestation bar today; can obtain the new OCC licence fastest. |

| Payment processors / card networks: Visa, Mastercard, PayPal | • GENIUS clarity lets them embed stablecoin rails without securities‑law overhang. • Instant FX < $5 fees; 24/7 merchant settlement; program‑mable rewards. |

| Broker‑dealers & RIAs once “restricted‑access” is lifted (Morgan Stanley, BofA, JPM, Schwab Advice) | • Clients hold US $31 tn that is currently blocked or capped for spot‑BTC ETFs and token money‑markets. • Offer tokenised T‑bill funds inside managed‑account sleeves; stablecoins as sweep. |

| DeFi money‑markets & RWAs (Aave, Maker, Ondo) | • On‑shore issuers = lowest counter‑party risk; collateral for tokenised Treasuries, repo, FX swaps. • At a 4-5% yield, every US $100 bn of new on‑shore stablecoins implies ≈ US $95 bn incremental demand for T‑Bills – a welcome buyer amid record issuance. |

| Potential loser | Why |

| Tether (USDT) & offshore issuers | Would need to flip reserve mix and submit to U.S. examinations or risk being barred from U.S.‑facing platforms. |

| Algorithmic & re‑hypothecated models | Two‑year ban plus tough reserve rules freeze out experimental designs. |

| Small start‑ups | Annual attestation + Fed‑compliant AML programme ≈ > US $2 m/yr fixed cost – high barrier to entry. |

3. Conclusion

GENIUS will likely formalise a “G3” of regulated issuers (Circle/PayPal, top‑6 U.S. banks, Paxos white‑labels) that can deliver programmable, insured‑grade dollars worldwide. Passing the bill is a step‑function moment for dollar‑stable liquidity, pushing the entire crypto complex closer to traditional capital‑market scale while reinforcing the USD’s digital dominance.

The biggest immediate trades:

- Long on‑shore stablecoin issuers vs. offshore (USDC > USDT pairs).

- Long front‑end Treasury‑bill demands beneficiaries (SGOV, BIL) on reserve uptake.

- Allocate to on‑chain Treasury and repo protocols ahead of explosive collateral growth.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.