TL;DR

- Usual Protocol is a decentralized stablecoin issuance platform focused on converting tokenized Real-World Assets (RWAs) into the $USD0 stablecoin.

- This innovative model is community-centric, sharing revenue generated from collateralized RWAs, yields tied to Total Value Locked (TVL), and protocol growth.

- The native $USUAL token grants holders governance rights, enabling them to make decisions regarding the DAO and protocol treasury. This approach aims to facilitate the growth of the vast potential market for Real World Assets.

1. Introduction

Usual Protocol is a pioneering platform bridging Real-World Assets (RWAs) with Decentralized Finance (DeFi), offering a novel solution for distributing Treasury Bills and overnight securities within the DeFi ecosystem.

By issuing the decentralized stablecoin $USD0, fully backed by RWAs such as T-Bills and on-chain reverse repos, Usual Protocol ensures transparency and delivers real value to users. The revenue-sharing model from $USD0 eliminates the centralization of profits seen in entities like Tether and Circle, democratizing benefits and incentivizing community participation.

The $USUAL token plays a pivotal role in governing the protocol and treasury, while fostering the adoption and utilization of $USD0. As USD0 grows, so does the value of the ecosystem, ensuring users are both participants and beneficiaries of long-term growth.

2. Fundamental

2.1. External

2.1.1. Raised Fund

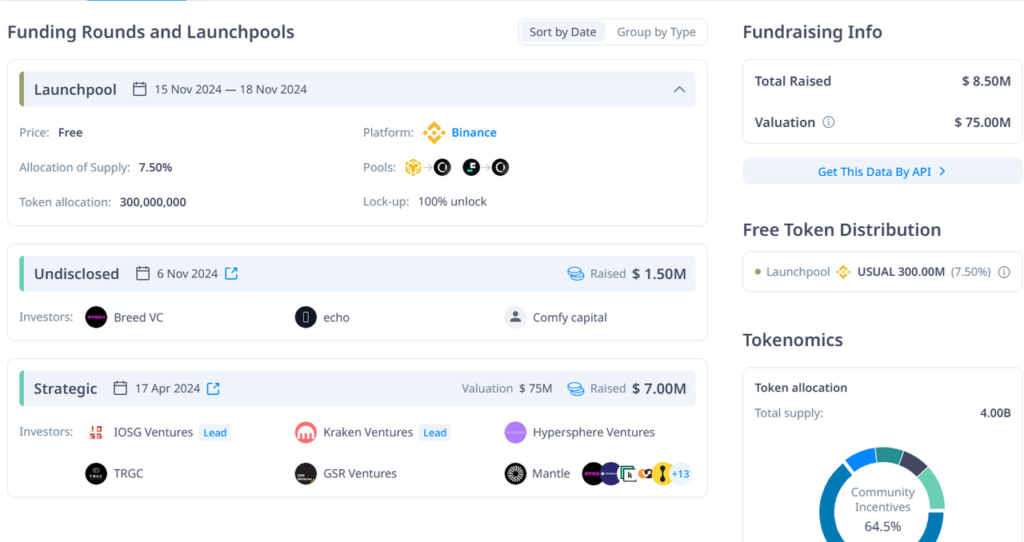

| Fundraising | Time | Raised | Valuation | Investor |

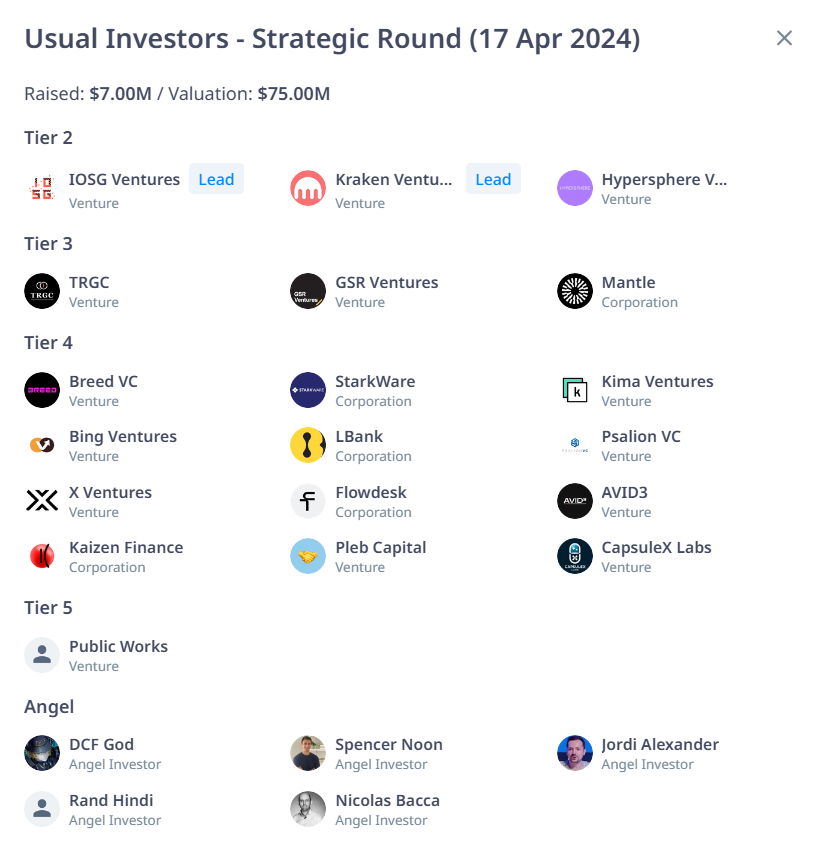

| Strategic | 17/04/2024 | $7.5M USD | $75M USD | Tier 2, 3, 4 |

| Community | 06/11/2024 | $1.5M USD | N/A | Breed VC, Echo, Comfy Capital |

- The project has completed two fundraising rounds: Strategic and Community, raising a total of $8.5 million USD, which is equivalent to a committed TVL of approximately $75 million USD for $USD0.

- In April 2024, a strategic round of $7.5 million was raised with the participation of funds such as IOSG Ventures, Kraken Ventures, Hypershare Ventures, TRGC Ventures, GSR Ventures, Mantle, and others.

- In November 2024, a seed round of $1.5 million was raised by the community through three entities: Breed VC, Echo, and Comfy Capital.

- In November 2024, the project launched a Binance Launchpool, allocating 7.5% of the total supply (~300 million tokens) to the community.

2.1.2. Backed/Partners

The project is backed by leading industry organizations and has strong partnerships with infrastructure providers such as Hashnote, Axelar, Layer Zero, Arbitrum, Curve, and RedStone….

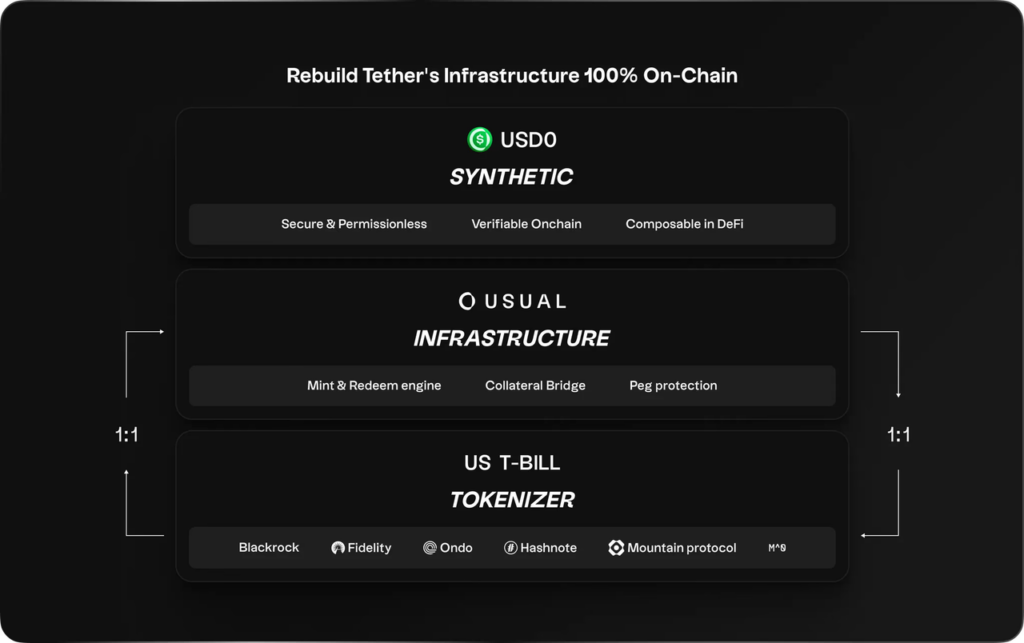

Following the Token Generation Event (TGE) and listing, the project plans to integrate its stablecoin product with major RWA organizations like BlackRock, Ondo, Backed, and Spiko (currently partnered with Hashnote) to ensure seamless liquidity within DeFi.

2.1.3. Team

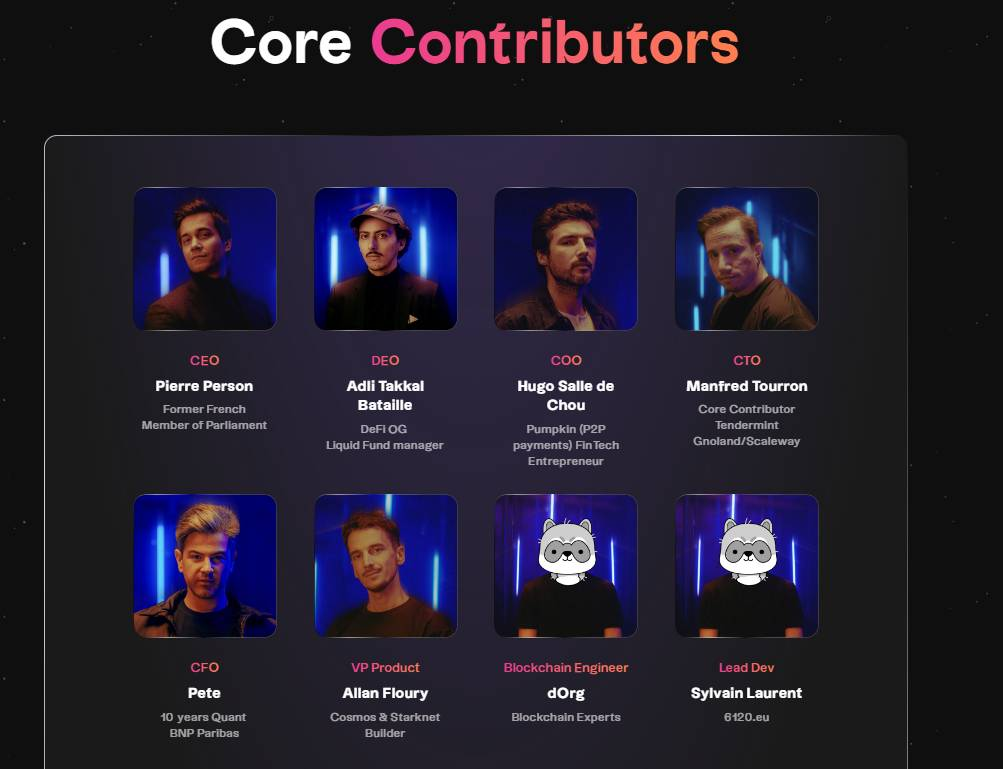

Usual Protocol’s team is comprised of seasoned professionals from various backgrounds:

- Pierre Person (CEO): Former French National Assembly member, Finance Committee Secretary, and Legislative Committee member.

- Adli Takkal Bataille (DEO): DeFi fund manager at Liquid.

- Hugo Sallé de Chou (COO): FinTech entrepreneur and founder of Pumpkin (P2P payment).

- Manfred Tourron (CTO): Core contributor to Tendermint Gnoland/Scaleway.

- Pete (CFO): Quantitative analyst with 10 years at BNP Paribas.

- Allan Floury (VP Product): Cosmos & Starknet developer.

2.2. Internal

2.2.1. Model Business

The project operates around three key elements, with the following use cases:

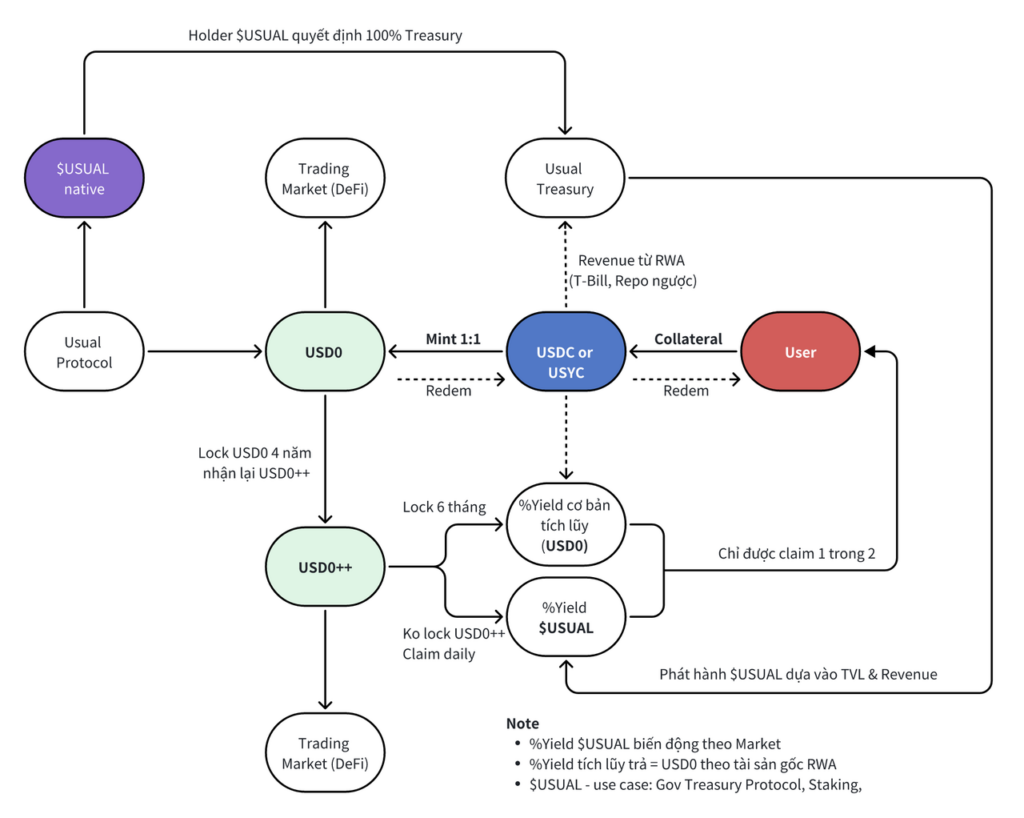

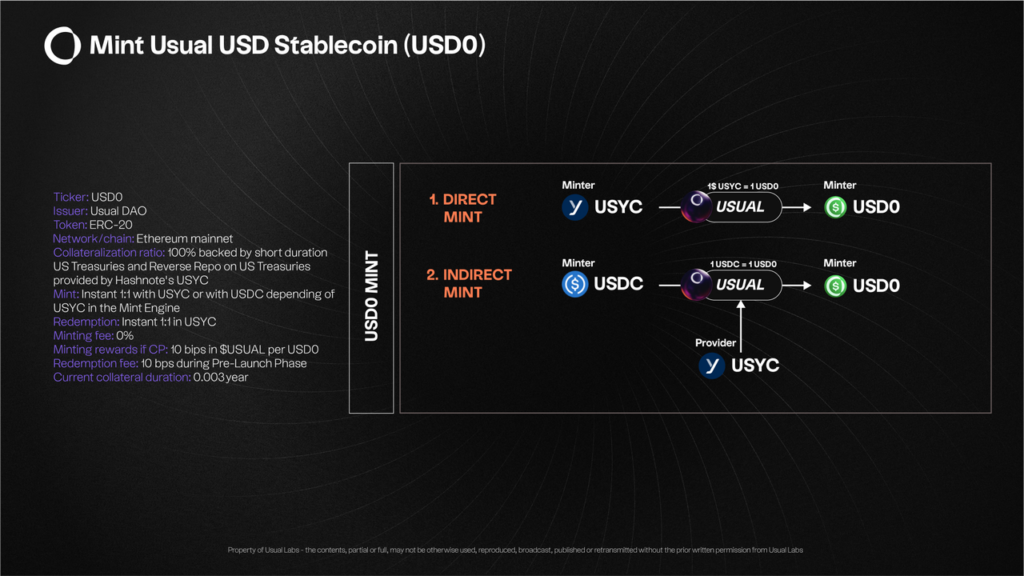

- $USD0 – Decentralized RWA Stablecoin

Users deposit assets like $USDC or $USYC (RWA) into Usual Protocol as collateral to mint the $USD0 stablecoin on a 1:1 basis. $USD0 is fully collateralized (by $USYC, $BULD, etc.) on-chain and traded in the DeFi secondary market (Liquidity Provider, Lending/Borrowing, Liquid Staking Token…), similar to USDT and USDC.

However, unlike other fiat-backed stablecoins, Usual Protocol’s model shares stablecoin revenue with users by locking $USD0 for 4 years to mint $USD0++ (LBT), creating a unique revenue-sharing mechanism.

- $USD0+ (LBT – Liquidity Bond Token)

Users can buy $USD0+ directly on the secondary market or lock $USD0 to mint $USD0+. Holding $USD0+ generates yield from RWAs for holders. There are two options for yield:

- Yield from low-risk RWA interest paid $USD0, distributed every 6 months.

- Yield paid daily in $USUAL tokens. (The issuance rate decreases as TVL increases.)

- $USUAL Native

The native token of the project is tied to the following use cases:

- Governance (DAO & Treasury Protocol)

- Staking & rewards for staking

- Rewards for holding $USD0+

2.2.2. Financial Metrics

- Total Supply & Total Value Lock (TVL)

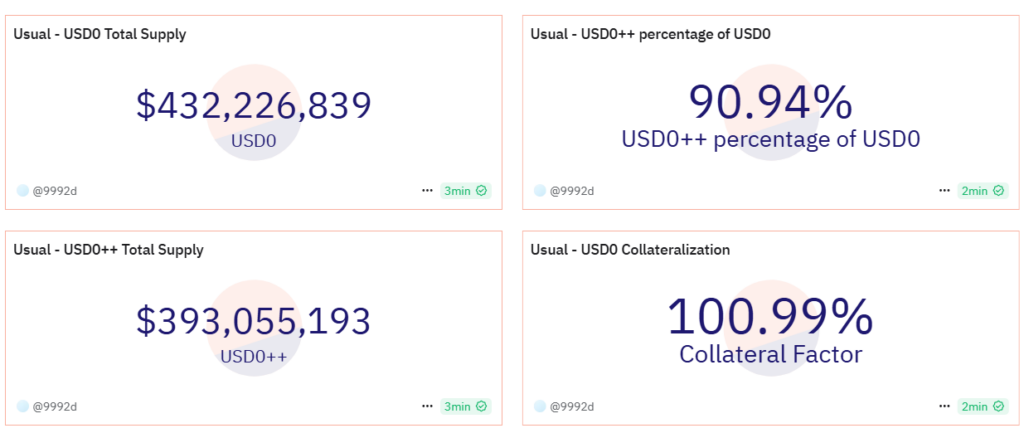

| Total Supply | Q3/2024 | Q4/2024 | %Change |

| $USDO | $216M | $432M | 200% |

| $USD0+ (TVL on $USD0) | $175M | $393M | 245% |

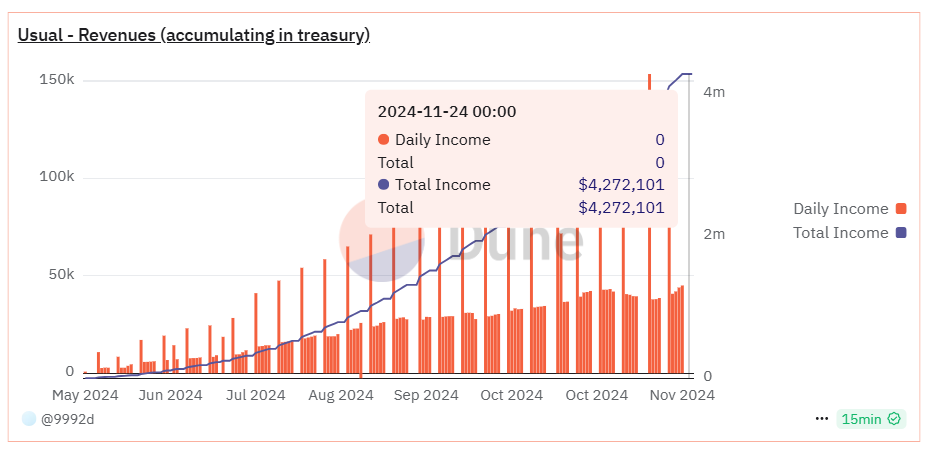

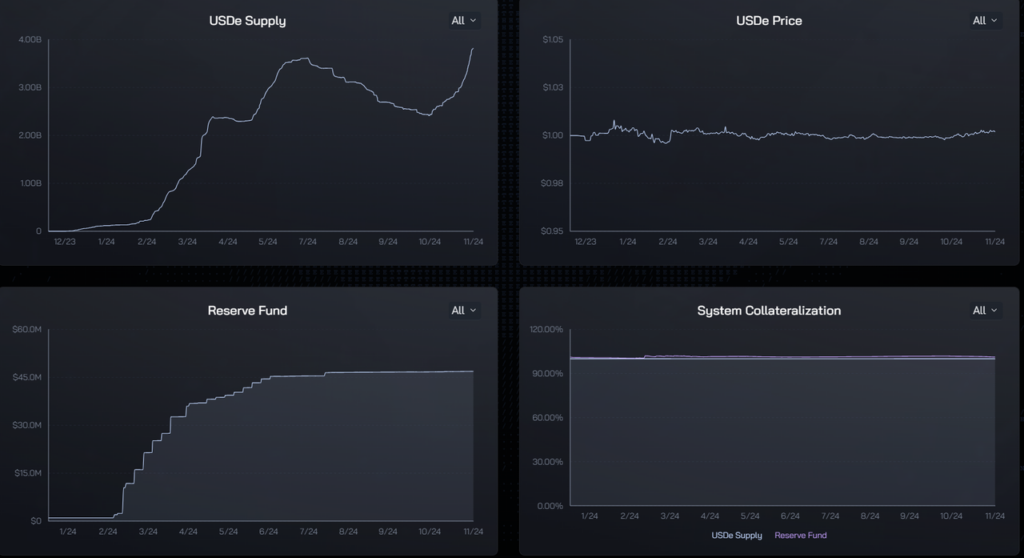

As of Q4/2024, the Total Supply of $USD0 has reached $432 million, marking a 200% increase from Q3/2024. The $USD0++ token, a liquidity bond, now represents 90.94% of the total $USD0 supply, with a TVL of $393 million, reflecting a 245% growth from Q3/2024.

This growth demonstrates the community’s strong trust in the RWA-backed stablecoin within the DeFi ecosystem.

The Collateral Ratio of $USD0 is at 100.99%, ensuring every $USD0 token is fully backed by either physical or crypto assets, providing users with confidence in the protocol’s security and risk mitigation.

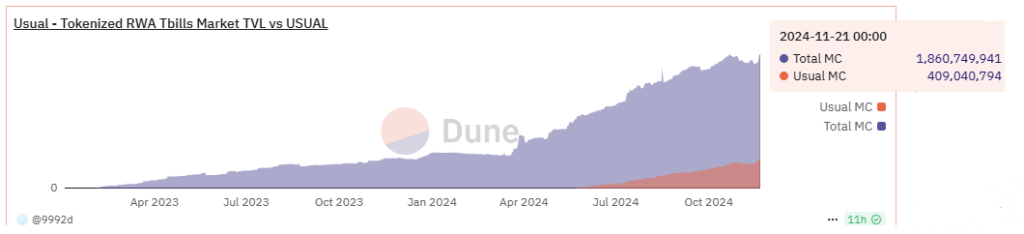

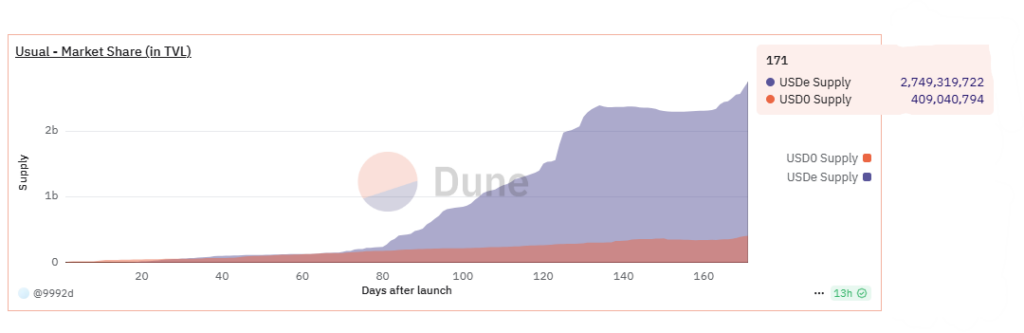

- Market TVL RWA vs Usual

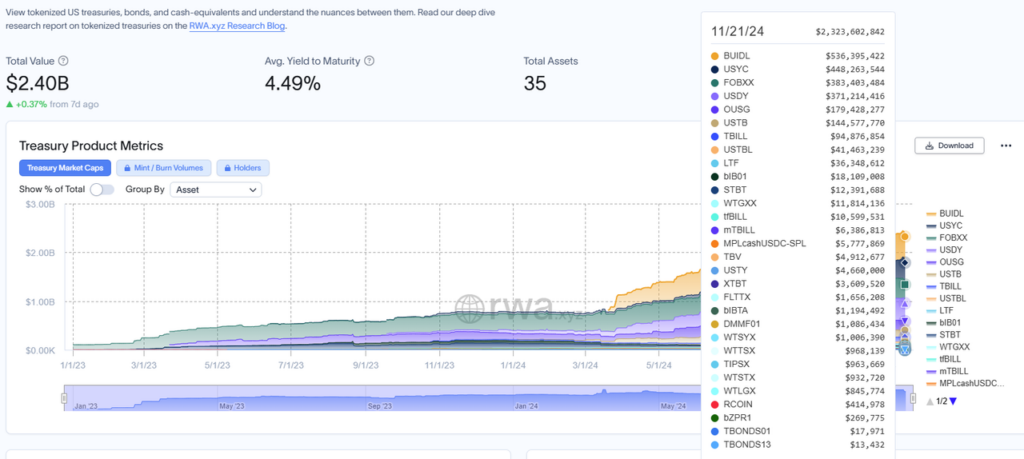

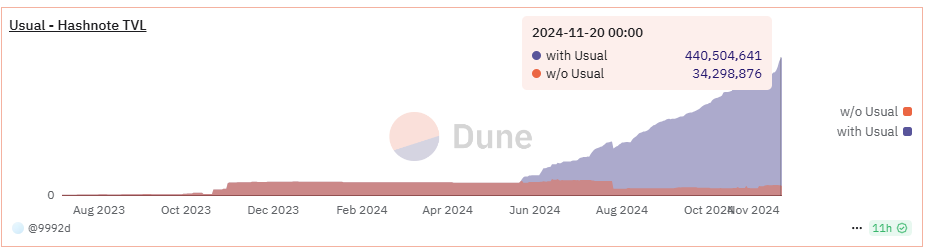

The robust growth of Usual Protocol, as a pioneer in the Real-World Asset stablecoin model, has directly contributed to the surge of $USYC (by Hashnote) to the second position with a TVL of $440M, capturing 19% of the total $2.3B TVL in the Tokenized Treasuries market. BlackRock’s $BULD remains in the top spot with a TVL of $536M, accounting for approximately 23% of the total market share.

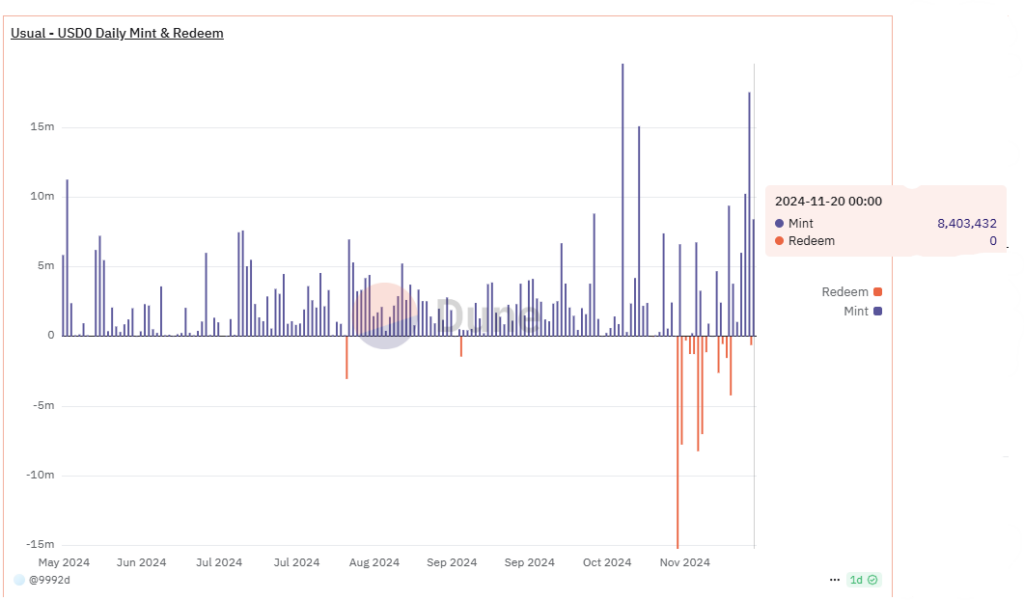

The significant discrepancy between the recent daily Mint and Redeem volumes of $USD0 in October and November, with much higher Mint volumes compared to Redeem volumes, reflects a positive feedback loop for both $USD0 and $USD0+. This indicates that users are prioritizing minting $USD0 to maximize their returns from the protocol ahead of the $USUAL TGE, or they may be choosing to swap to the $USD0/USDC pair.

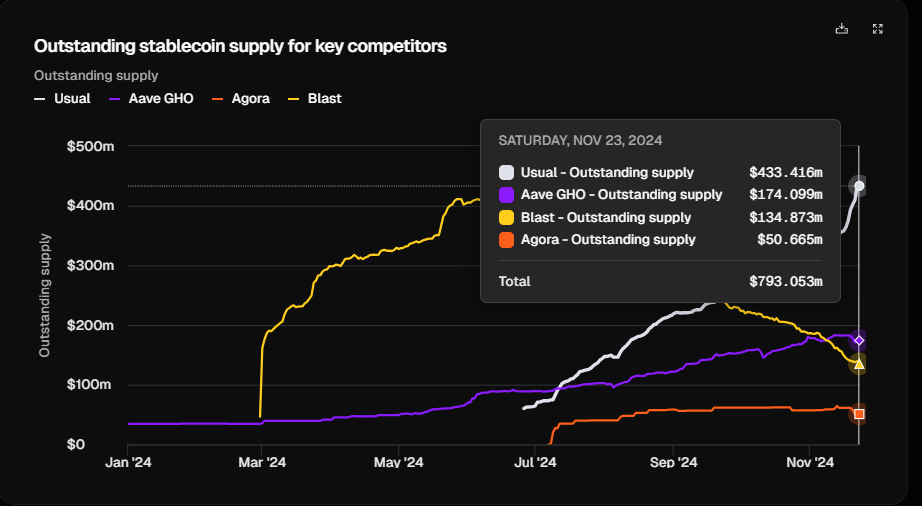

- Competitors – regions

| Characteristics | Usual | Ethena | |

| Similarities | Stablecoin | $USD0 (RWA) | $USDe (Fiat Stb, LST) |

| Liquidity Stablecoin Token | $USD0++ | $sUSDe | |

| Differences | Total Supply | 433 million $USD0 | 3.8 billion $USDe |

| Market Share (% in TVL) | 10% | 89% | |

| Collateral | $USYC , $BUILD, $Ondo (RWA) | USDT, USDC, LST | |

| Reserve Fund | 100% | 1.2% | |

| Yield | $USD0 or $USUAL | $sUSDe | |

| Source of Yield Paid for LST | Base rate from RWA or $USUAL (Revenue) | Hedged derivative positions & staking ETH LST | |

| Token Native | $USUAL is only issued when $USD0+ is minted | Distributed according to allocation schedule | |

Usual’s main competitor, Ethena, launched in February 2024 as an algorithmic stablecoin protocol, offering $USDe and $sUSDe collateralized by Liquidity Staking Tokens (LSTs), primarily $ETH. Recently, Ethena has shifted its collateral to fiat stablecoins.

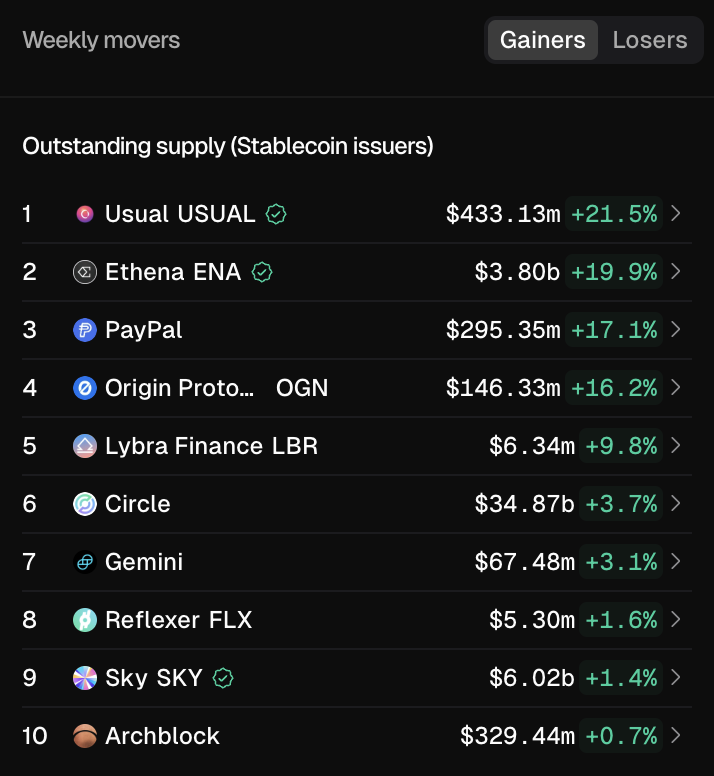

While Usual, launched in May 2024, has achieved a TVL of nearly $500 million in just six months with its attractive business model, it currently holds only a 10% market share of algorithmic stablecoins compared to Ethena.

Usual’s unique model, which involves collateralizing its stablecoin with Real-World Assets (RWAs) at a 100% reserve ratio, sets it apart from Ethena’s 1.2% ratio. Additionally, Usual offers holders of $USD0++ the choice of earning yield in the form of $USUAL tokens or as interest from $USDO, which is generated from the underlying RWA. The issuance of $USUAL is directly tied to the minting of new $USD0++ and is proportional to the protocol’s TVL and revenue.

As a result, $USD0 offers better safety and liquidity, maintaining a 1:1 peg even during market downturns. Coupled with its unique revenue-sharing model, Usual aligns its interests more closely with the community.

2.2.3. Tokenomics

Token Metric

- Symbol: $USUAL

- Total Supply: 4,000,000,000 (4B $USUAL)

- Circ Supply: 494,600,000 (12.37% of total supply)

Token Use Case

- Staking mechanism

- Burn $USUAL when unlocking after 4 years, $USD0

- Treasury management and protocol

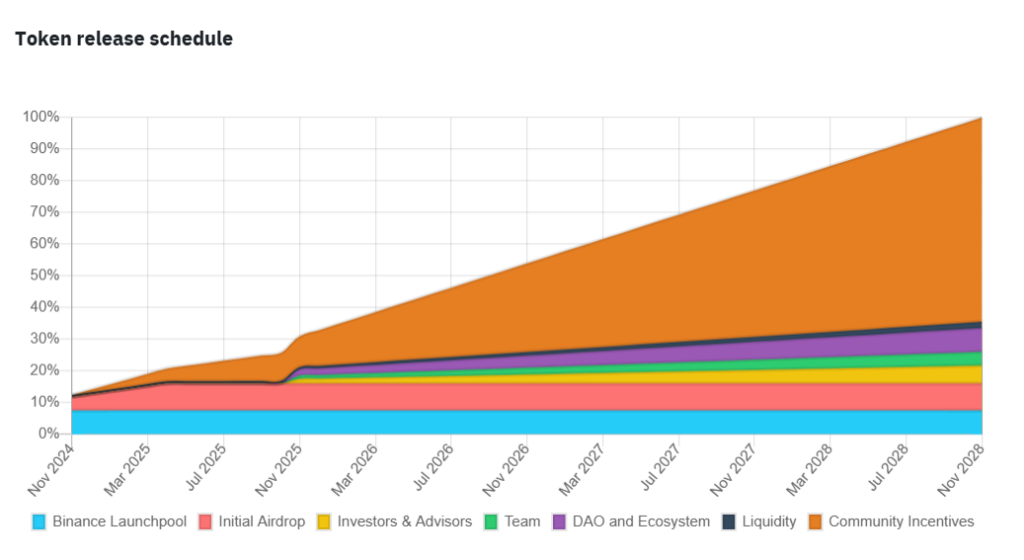

Token Allocation & Release Schedule

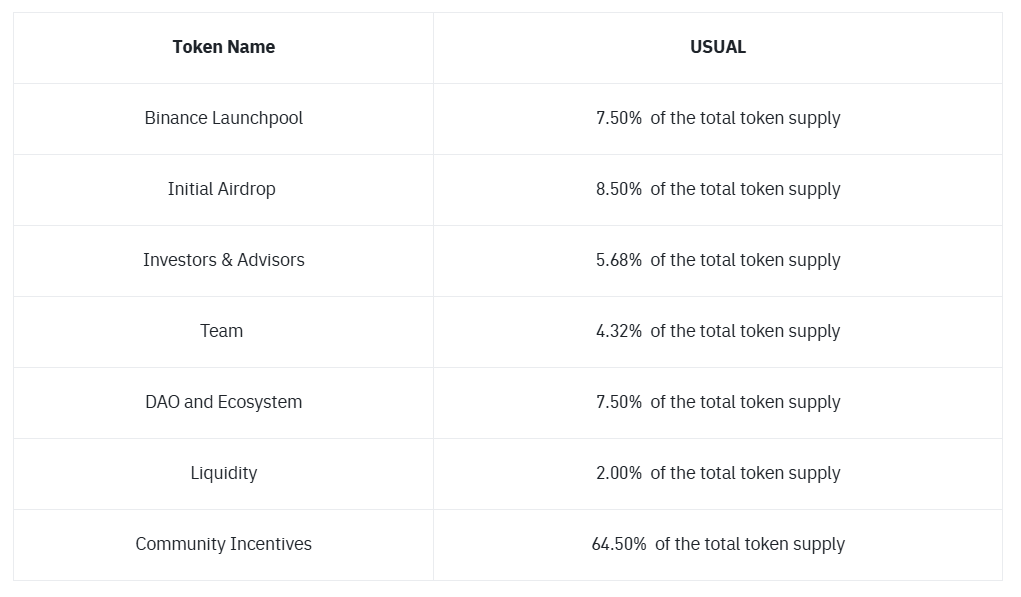

- Binance Launchpool – 7.50%: Allocation for the Launchpool program on Binance, fully unlocked at TGE.

- Initial Airdrop – 8.50%: Airdrop for early participants in the project to earn Pills (similar to the Point farming program). 4.25% of the total supply is unlocked at TGE, and the remaining portion will be unlocked gradually until April 2025.

- Liquidity – 2.00%: Allocation for market makers to provide liquidity for USUAL when traded on CEX platforms.

- Community Incentives – 64.50%: Allocation for the community, with 10% of the total supply as rewards for USUAL stakers, part allocated for liquidity providers, and the remainder as rewards for USD0++ holders.

- Investors & Advisors – 5.68%: Allocation for investors and advisors. With a 1-year lock-up from TGE, followed by gradual release from November 2025 to November 2028.

- Team – 4.32%: Allocation for project contributors. With a 1-year lock-up from TGE, followed by gradual release from November 2025 to November 2028.

- DAO and Ecosystem – 7.50%: Treasury fund for DAO and ecosystem, with a 1-year lock-up from TGE, followed by gradual release from November 2025 to November 2028.

Key points

- From TGE to May 2025, only 1.68% per month will be circulating, primarily from Community Incentives, with no selling pressure from investors or the team.

- Before June 2025, 21.57% of the supply will be in circulation, with the largest shares coming from Binance Launchpool (7.5%), Initial Airdrop (8.5%), and Community Incentives (4.84%), all of which are allocated to the community.

- Before October 2025, 25.67% of the supply will be in circulation, with the largest shares coming from Binance Launchpool (7.5%), Initial Airdrop (8.5%), and Community Incentives (8.87%), all of which are allocated to the community.

Token Sales

- The project underwent two fundraising rounds: Strategic & Community, raising $7.5M and $1.5M, respectively. The tokenomics allocation for Investor & Advisor is 5.68%.

- Thus, based on the above calculation, the book value for the Strategic & Community rounds is approximately $0.03 – $0.031 per token, with an FDV of $125 million USD.

2.3. Project Evaluation

- External comparison with competitors: Compared to Ethena, where the raised fund reached only $8.5 million USD with investors from Tier 2 and 3 upwards, while Ethena raised $20.5 million USD from Tier 1 and 2 investors → Relatively.

- Internal comparison in terms of business model: The business model of Usual has brighter points compared to Ethena in three aspects:

- Safety: $USD0 is minted with 100% collateral from RWA – $USYC (T-Bill, overnight securities). Therefore, in case of market fluctuations, the peg loss rate will occur less frequently, ensuring a 1:1 ratio compared to Ethena’s $USDe, where the collateral consists of Fiat Stable Coin & LST token with a 1.29% Reserve Fund.

- Sustainable Yield %: $USD0 is secured by 100% RWA collateral – USYC (T-Bill, overnight securities) and shares the revenue at the base interest rate % from RWA to users. Even if the price of $USUAL fluctuates sharply, it still guarantees optimal returns for users.

- 82.5% of $USUAL supply allocated to the community: The project has allocated 82.5% to the community, while the remaining 17.5% goes to the team, investors, and DAO Ecosystem. Tokens are only minted when $USD0++ is minted. As the TVL of the protocol increases, the demand for %Yield from $USUAL rises, causing the minting of $USUAL to decrease. This leads to an increase in the value of $USUAL.

- Usual is targeting a large market of Real World Assets. The protocol has proven the value of its product by directly bringing Hashnote – $USYC to the top 2 in the market by TVL, second only to $BUILD (Black Rock).

A. In the near future, the project will continue to integrate $BUID & $ONDO into its product ($USD0), thereby expanding its user base. This will easily increase $USD0’s supply, helping the project move from the top 10 to the top 5 in the market.

B. The project has timed well by launching Binance Launchpool and releasing its token during a bullish market, which minimizes the negative price risks for the token.

- Risks: In the short term, the project needs broad approval for $USD0 in the market and must offer a yield that is attractive enough to users. Therefore, focusing on yield paid at $USUAL, rather than the base interest rate (RWA), is an initial attraction but also a risk for $USUAL holders as $USUAL is minted to encourage mass adoption.

3. Closing Thoughts

The Usual Protocol is innovative and creative in its product model, with a stablecoin backed by Real World Assets (RWA) with a 100% safe reserve ratio, aiming to benefit and empower the community as much as possible through a revenue-sharing mechanism from collateralized stablecoin assets.

Real World Assets represent a highly potential market in the near future, as large traditional organizations have already adapted and joined the game, with examples such as BlackRock and Hashnote. With its pioneering direct-link model, Usual will face both challenges and opportunities in the coming time that the project must seize and overcome.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.