1. Recommendation & Position Summary

Historical: Venus Protocol was the leading lending/borrowing platform on the BNB Chain, with its Total Value Locked (TVL) peaking at $6 billion USD and a Loan-to-Deposit Ratio (LDR) reaching 66% in 2021. Its native token, XVS, launched in 2020, hit an all-time high (ATH) of around $147 in May 2021 before a sharp decline of 95%.

Currently, XVS has a market cap of approximately $100 million and a fully diluted valuation (FDV) of about $196 million. The token has been consolidating within a price range of $3.14 to $6.3 since 2022. It maintains its position as the top lending protocol on the BNB Chain with a total supply of $2.7 billion USD and a total borrow of $800 million. This translates to a current LDR of 29%, and a TVL of $1.9 billion USD. The platform has significant borrowing liquidity remaining, with an additional 60% that can still be supplied to the market.

Analysts recommend opening a spot position (or a 1x long position) for the XVS token.

- Allocate 1.5% of your Net Asset Value (NAV) to this position.

- Distribute the allocation by deploying 30% of this 1.5% NAV weekly.

| Token | Price Recommend | Price | Weekly | Monthly |

| $XVS | $6.00 | $6.09 | 12% | 20% |

- Price Spot: $6.15

- Price target: $15 (143% absolute)

- Stop Loss: $4.8 (-25% absolute)

- Time position spot: 3 months

- Leverage: 1x

- ROI: 143%

- Reward/Risk: 6.5:1

2. Investment Thesis

2.1. Sustainable Revenue & Business Model

The protocol generates a stable average revenue of $2 million per quarter, or $8 million annually. This is supported by a mechanism that allocates 20% of revenue to buy back XVS and 25% to burn BNB. This strategy enhances liquidity from the BNB Foundation and drives a flywheel effect: higher demand for borrowing BNB leads to increased revenue, which in turn boosts the APY for XVS holders.

2.2. Primary Lending Hub for BNB Chain & Binance Ecosystem

Venus benefits significantly from its strong relationship with the Binance ecosystem. Over 90% of its borrowing revenue comes directly from the BNB Chain, with revenue often increasing during Launchpool cycles, which incentivize BNB borrowing. The BNB Foundation directly supports the protocol with deep liquidity.

Venus serves as the central liquidity hub for Binance’s key products, such as TGE Wallet and Launchpool, with 90% of BNB borrows originating from the Venus Protocol.

2.3. Tokenomics & Value Accrual for Holders

The XVS token has a total supply of 30 million, with 100% of tokens fully unlocked as of August 2024. Although 16.5 million XVS (55.8%) are currently in circulation, the current circulating supply on the market is much lower. With 7.5 million XVS staked and another 13.5 million locked as rewards, the real circulating supply is only around 9 million XVS (30%). This scarcity enhances utility and value for holders.

2.4. Undervalued Compared to Protocol Scale

XVS has a market capitalization of approximately $105 million, which is only about 5% of its TVL. This is significantly lower than the typical 15–50% ratio seen in major lending protocols like Fluid and Morpho. When considering its revenue model, this valuation suggests that XVS is undervalued, with its Market Cap-to-TVL multiple sitting far below the industry average of 2.4x.

3. Business Model & Key Metric

Lending/Borrowing Model: Venus Protocol operates as a lending platform where users can deposit assets like BNB, BTC, and stablecoins to earn interest and borrow other assets. Interest rates are dynamically adjusted using a “jump rate” model, which is based on the utilization rate of each asset pool.

- The protocol generates revenue from the interest fees paid by borrowers. A portion of these fees is distributed to lenders as interest, while the remainder is retained as protocol revenue.

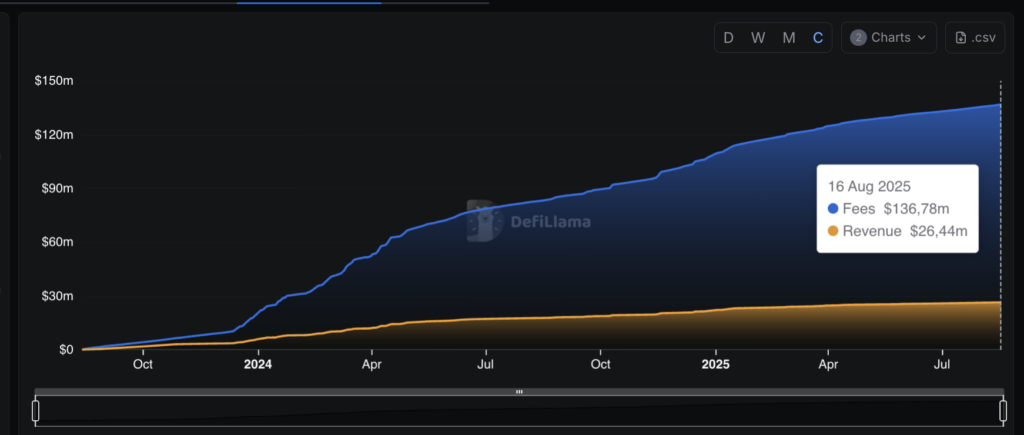

- To date, the total interest fees collected from borrowers amount to approximately $136.7 million USD. Of this amount, the protocol has retained $26.4 million USD as its accumulated revenue.

| Metric | 07.2025 | 08.2025 (MTD) | Comment |

| Price | $6.33 | $6.1 | -4.4% m/m |

| Market Cap | $105M | $102M | -2.94% m/m |

| Circ. Supply | 16,737,999 | 16,737,999 | No change |

| Staking | 7M | 7.57M | +8.14% m/m |

| Total Supply | 29,745,107 | 29,745,107 | 100% unlocked, of which ~13M $XVS (~44%) is locked for emissions/rewards |

| FDV | $188M | $181M | -3.86% m/m |

| Total Deposit | $2B | $2.7B | +35% m/m |

| Active Loan | $725M | $790M | +8.9% m/m |

| TVL (Available liquidity) | $1.92B | $1.94B | +1% m/m. The loan-to-Deposit ratio still has ~70% room, meaning ~$1.94B liquidity can be supplied to the market on BNB Chain. |

| Revenue | $323.409 | $175.711 | July revenue increased +28% m/m. August annualized revenue is projected at $291k, down 10% vs July. |

| Vaults $XVS | Total buy back: 2,443,985 $XVSTotal reward: 2,267,126 $XVS Source: Dune | Buyback is 7% higher than rewards, which drives circulating supply inflation of $XVS towards ~0% → sustainable tokenomics & value capture for holders. | |

| Competitive | In the lending sector, main competitors include Aave, Spark, Morpho. However, it’s worth noting that Venus is only active on BNB Chain, so FA metrics are not directly comparable across competitors.Looking at the total lending market size, Venus ranks top 8, capturing 2.5% of the total market share. | ||

4. Catalyst Timeline

| Timeline | Events | Expected Impact |

| Q2/2025 | Venus partners with Safe (May 2025) to support multi-signature wallets and integrate new assets (weETH, wstETH, SolvBTC…) along with stablecoin USD1. | Expansion of multi-chain ecosystem, expected to boost TVL and user base. |

| Q3/2025 | Implementation of VIP-515: Venus Afterburn mechanism. 25% of BNB Chain revenue allocated to periodic $BNB burns. 20% of revenue used to buy back $XVS into Vaults, then distributed as staking incentives for holders. | Revenue reallocation to BNB burns: 25% of BNB Chain revenue ($6M ≈ 9.9k BNB/year based on 2024 levels). This reduces net supply without reliance on new token issuance, complementing BNB’s Auto-Burn mechanism. No dilution: BNB burn program uses real protocol cash flow instead of minting new XVS → preserves holder value and strengthens long-term capital efficiency. Liquidity flywheel for XVS: BNB Chain commits to adding LP to Venus → deeper markets, higher borrowing demand → rising revenue → steady XVS buyback budget (20% unchanged) and sustainable vault rewards. System safety & tail risk mitigation: Risk Fund increased from 0% → 20% (both Reserves & Liquidation fees), providing stronger risk absorption and indirectly protecting Venus protocol health and long-term XVS value. |

5. Valuation

Base Case:

- If Venus were to achieve a Market Cap-to-TVL ratio (MC/TVL) of 0.12 (the industry median) with its current TVL of $2.7 billion, the fair market cap would be approximately $324 million USD.

- This represents a 3.2x upside from the current valuation. The potential price for XVS could reach around $18 (compared to the current price of ~$6).

Bull Case:

- In a more optimistic scenario, assuming a conservative MC/TVL ratio of 0.2 (still below that of protocols like Fluid or Aave), the market cap would be $540 million USD.

- This would put the price of XVS at approximately $30.

Worst Case:

- If TVL declines or revenue remains flat, the current valuation is still considered inexpensive, but the potential upside would be limited.

| Project | FDV ($B USD) | FDV vs Median | Market Cap (B) | MC vs Median | MC/TVL |

| Venus | $0.18 | 0.27 | $0.10 | 0.18 | 0.05 |

| Aave | $4.46 | 6.75 | $4.42 | 8.04 | 0.13 |

| Morpho | $0.65 | 0.98 | $0.65 | 1.18 | 0.11 |

| Fluid | $0.67 | 1.02 | $0.45 | 0.82 | 0.35 |

| Median | 0.6605 | 0.549 | 0.12 | ||

6. Tokenomics

- Total Supply: 30M $XVS

- Circulating Supply: 16M $XVS

Currently, about 16.7 million XVS – or 55.8% of the total supply, is in circulation. The remaining 13.26 million XVS (44.2%) is locked and used for incentives at a rate of 3,000 XVS per day. This translates to an annual release of 1 million XVS, representing a 3.3% inflation rate on the total supply.

However, a new mechanism allocates 20% of protocol revenue for XVS buybacks. Based on Q2 2025 data, the project generated $9.4 million in revenue. Allocating 20% of this would lead to a buyback of $1.8 million, which could reduce annual inflation by 1.5%.

7. Key Risks

- Market Risk: The price of XVS could be significantly impacted if the broader crypto market or the BNB Chain ecosystem experiences a downturn. Sharp volatility in collateral assets such as BNB, BTC, and ETH could trigger mass liquidations and a decline in TVL and revenue, creating a negative feedback loop.

- Liquidity/Execution Risk: With a 24-hour trading volume of approximately $6–11 million, XVS’s liquidity is relatively low compared to its market cap on both CEXs and DEXs. This can make large orders difficult to execute without causing significant price slippage.

- Competitive Risk: Venus faces competition from numerous other lending protocols like Aave, Compound, Kamino, and JustLend. If these platforms grow more aggressively, they could draw users and assets away from Venus, leading to a loss of market share and a decrease in its TVL.

- Regulatory/Stability Risk: Venus’s operations involve multiple stablecoins (VAI, USDX) and reliance on oracles. The platform is vulnerable to increasing regulatory scrutiny on stablecoins and broader DeFi transactions. While this is an industry-wide risk, Venus must proactively ensure compliance to mitigate potential impacts.

8. Position Sizing & Implementation Plan

- Target position size: 1.5% NAV

- Buy zone: $6

- TP1: $12

- TP2: $18

- Stop loss: $4.8

- Time: 3 months