1. Overview

On the morning of June 19, Consensys revealed that the US SEC had concluded its investigation into Ethereum. In a post on the X social-media platform, Joseph Lubin, one of the original developers of Ethereum and CEO of Consensys, announced, “The SEC’s decision to close this inquiry marks a significant victory for Ethereum and the web3 community as a whole.”

2. Market Response

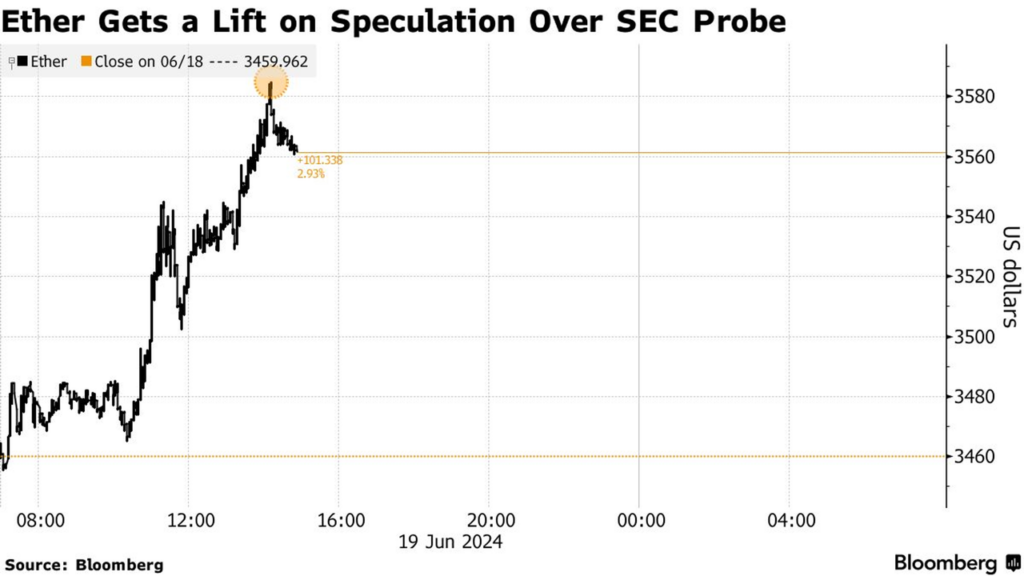

- The end of the SEC’s investigation into ETH 2.0, combined with expectations of a spot Ethereum ETF potentially launching as early as July 2, has led to a rebound in ETH and notable gains in blue-chip tokens within the ETH ecosystem.

ETH price rose 3% to $3,567 after the SEC ended its investigation into Ethereum.

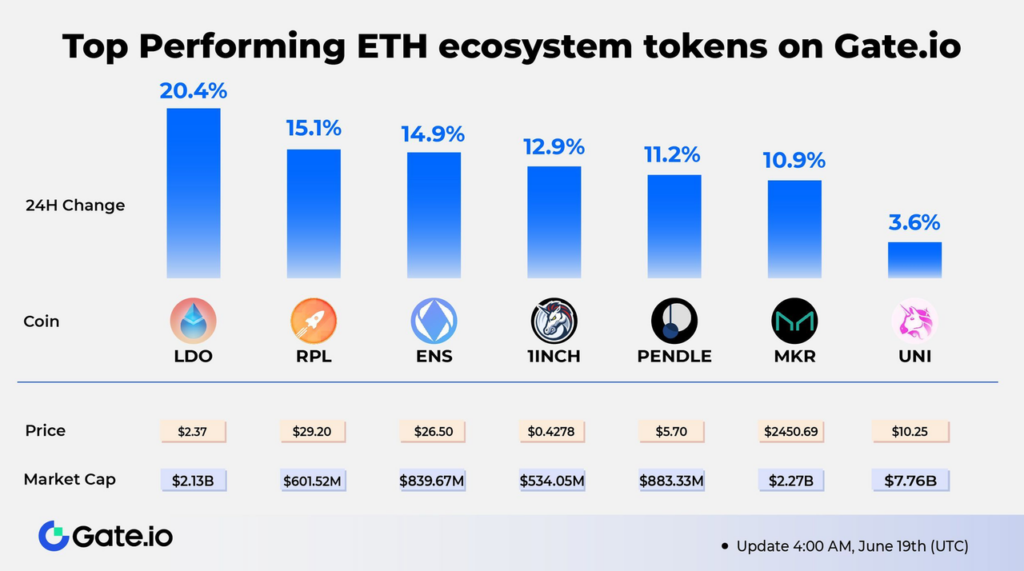

- Prominent ETH ecosystem projects such as CVX, ENS, LDO, and RPL have all experienced double-digit gains in the past day, defying the general decline in altcoin prices.

3. Future Prospects

- We anticipate that the spot Ethereum ETF will be approved and begin trading within a few weeks to a few months. According to a Bloomberg ETF analyst on X, the best guess is that spot Ether ETFs might launch as early as July 2.

- Until then and following approval, the ETH/BTC exchange rate is likely to continue rising. ETH is expected to reach new highs in the coming months, potentially triggering an altcoin season.

- From an investment perspective, we believe the performance of ETH ecosystem projects will be relatively strong in the future. As traders on the Ethereum chain increase their leverage and trading activities, blue-chip projects, especially those with actual earnings in the DeFi sector, are expected to continue rising. Specific tokens to watch include ENS, UNI, LDO, and PENDLE.

- While this sector is expected to outperform others in the future, overall market conditions in the short term remain weak, so caution is advised in trading.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.