1. Executive Summary

Token Overview

- Ticker: $WAL

- Sector: Blockchain Storage

Investment Thesis

Walrus Protocol offers a pioneering data storage solution on the Sui ecosystem with low storage costs. It addresses the challenge of storing large data files, PDFs, and images, particularly AI and 3D data, which the market has yet to effectively achieve on blockchain.

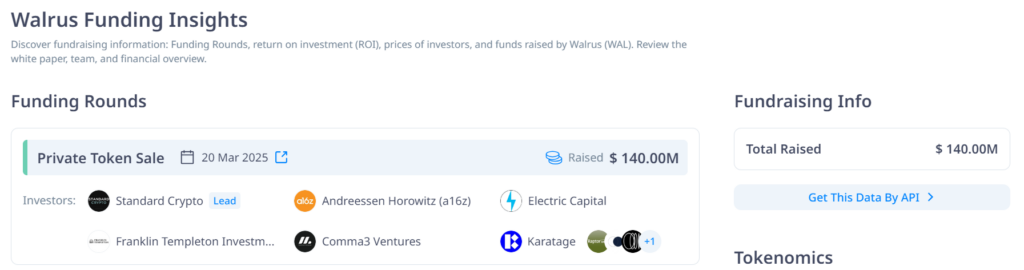

Total Raised Funds: $140M from Tier 1 Funds.

Funding was secured through a token sale at $0.4 per token to prominent funds like A16z and Franklin Templeton, valuing the Fully Diluted Valuation (FDV) at $2B USD on paper. The project is directly developed and funded by its parent company, Mysten Labs.

Tokenomics: Strong in the short term but potentially less promising long term. In the first year, only 1% of the total supply unlocks per month (~$13M USD). Compared to a 24-hour trading volume of $100M, the selling pressure is insignificant, and there is no immediate selling pressure from investors. However, risks may arise from strategies to educate the community and airdrops to other projects on $WAL.

$WAL Price Potential: Driven by key catalysts in 2025. Lower actual circulating supply than reported (supply squeeze) initiated by the project in the short term. Expansion of the Walrus Data Storage platform with integrations on other Layer 1 blockchains like Solana and Ethereum. The boom of 3D Gaming & AI and Payments on the Sui ecosystem -> direct use cases driving $WAL’s price increase.

2. Overview

Walrus Protocol is a decentralized data storage project designed for cost-effective and high-performance storage of large binary files (blobs). It utilizes a proprietary Red Stuff encoding technology, based on fountain codes, to achieve significantly lower storage costs compared to solutions like Filecoin.

Built on the Sui blockchain, Walrus launched its mainnet on March 27, 2025, with the aim of supporting web3 applications such as NFTs, AI Data, and SocialFi.

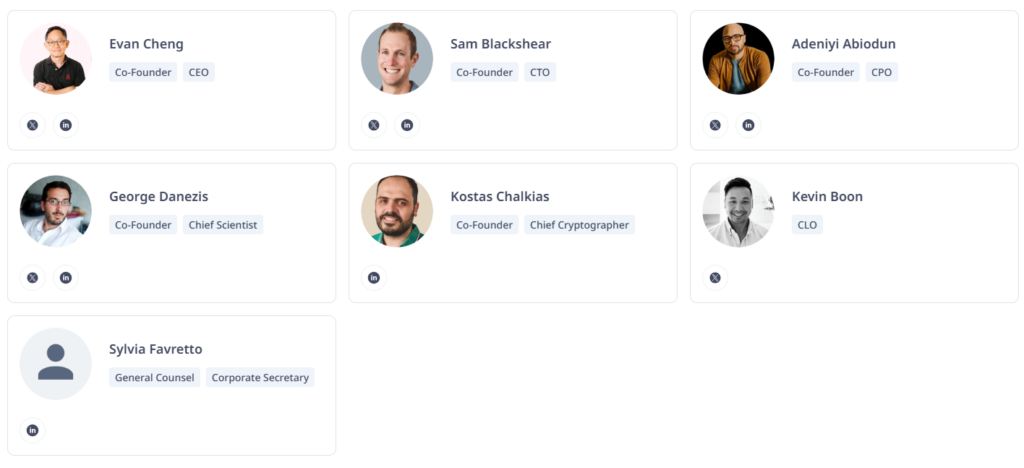

2.1. Team

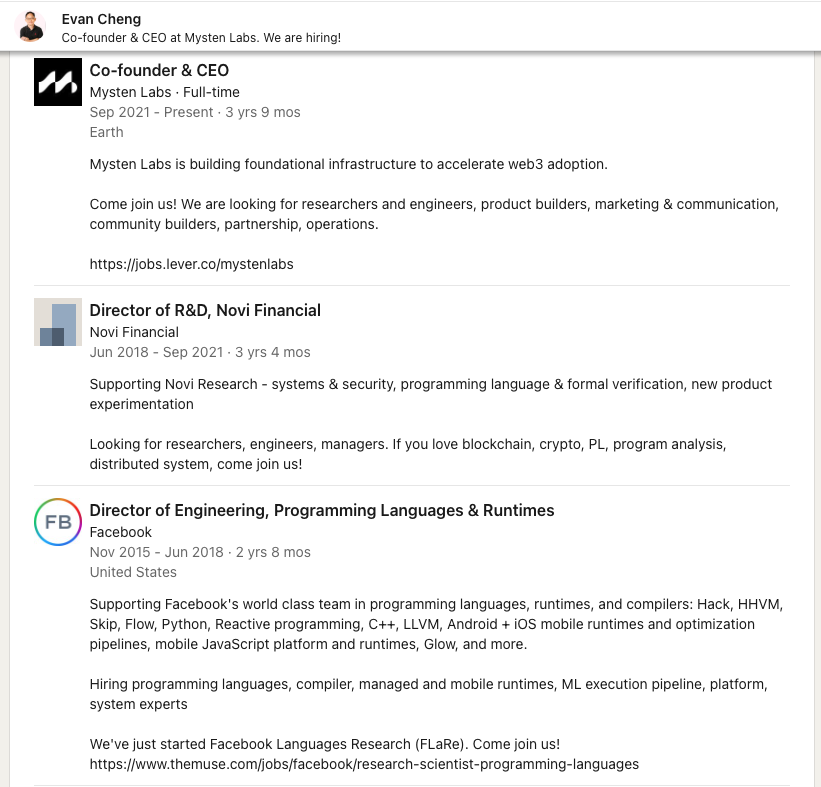

Evan Cheng – Co Founder/CEO Mysten Labs

- Possessing over 20 years of experience in the software and infrastructure systems industry, with a notable track record in programming languages, compilers, and performance optimization.

- He has held senior leadership positions at major corporations such as Apple and Facebook.

- At Novi Financial (Meta), serving as the Director of R&D, he demonstrated an ability to balance academic research with practical application.

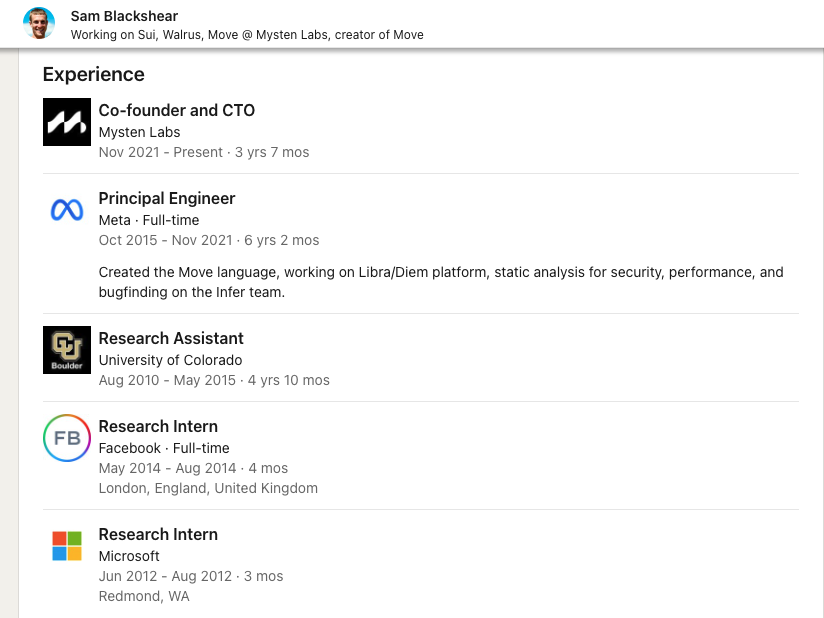

Sam Blackshear – Co-Founder/CTO Mysten Labs

- The creator of the Move programming language, specifically designed for blockchain development. Initially conceived for Meta’s Libra/Diem project, Move later became the core foundational technology of the Sui Blockchain.

- Prior to Mysten Labs, he served as a Principal Engineer at Meta (2015–2021), where he was a key contributor to Libra/Diem – a global stablecoin initiative.

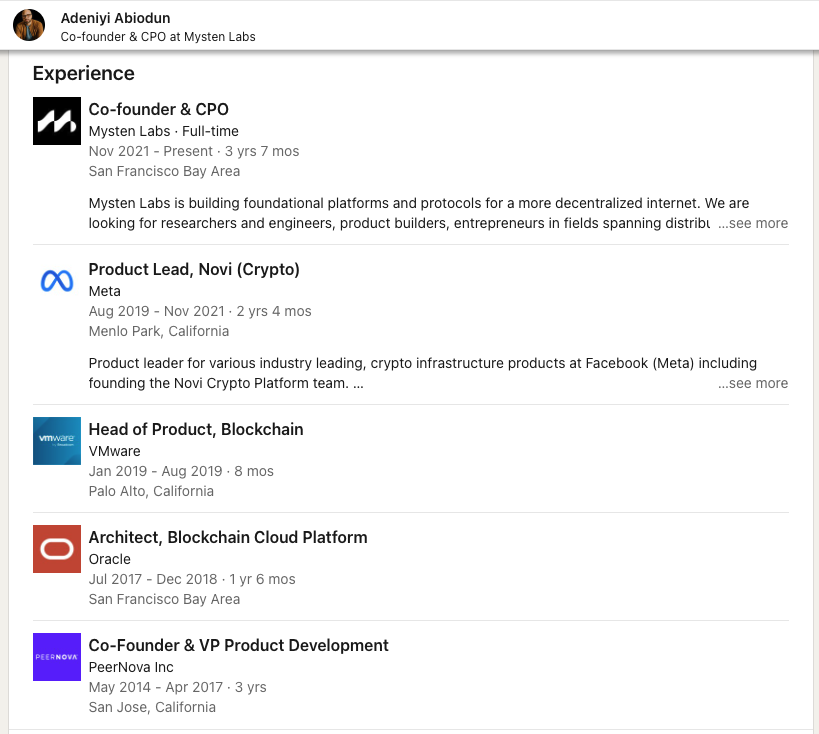

Adeniyi Abiodun – Co Founder/CPO Mysten Labs

- Former Product Lead at Novi (Crypto) – Meta (Facebook)

- Novi Crypto Platform – Facebook’s wallet and payment platform

- Collaborated with Sam Blackshear to help build the current Move ecosystem

Observations

Walrus Protocol is being developed by the founding team of Mysten Labs – comprised of exceptional former engineers and leaders from Meta, Apple, and Oracle. Their extensive experience in both academic research and real-world product development indicates a deep understanding of blockchain technology at the infrastructure level, as well as the ability to make it accessible to end-users.

Backed by such a highly skilled team, the launch of Walrus Protocol positions it to spearhead a new era of decentralized big data within web3, particularly in sectors like AI and Payments.

2.2. Product & Business Model

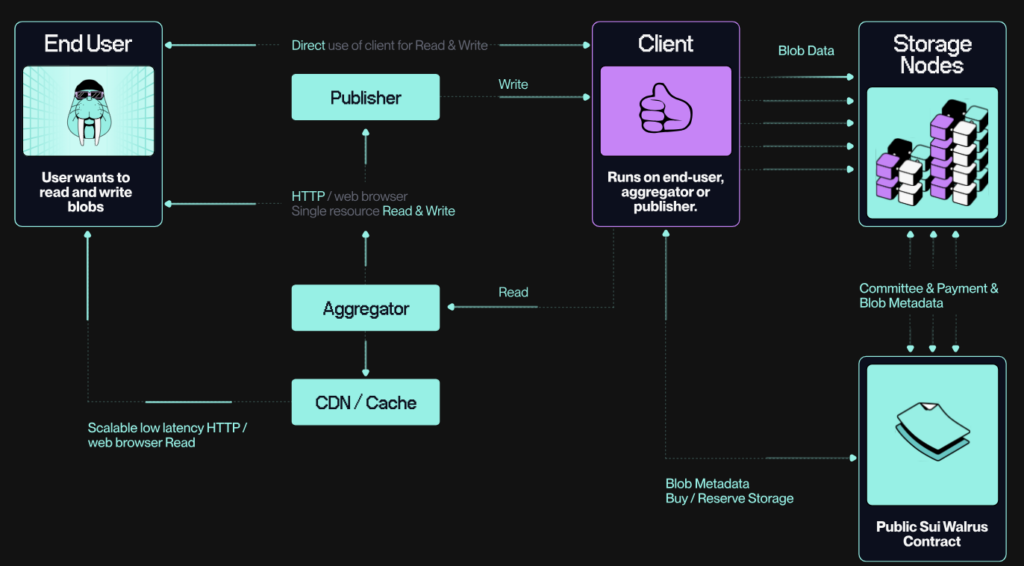

Walrus Protocol offers a decentralized storage model where users pay for data storage using the $WAL token.

- According to the whitepaper, the product employs Red Stuff encoding for data, enabling low-cost storage and rapid recovery in case of errors.

- Users can select storage durations of up to two years, with the option to either delete or retain the data afterward, enhancing flexibility.

- The pricing for data storage and writing is determined in advance by node voting (requiring 66.67% based on stake weight), utilizing a prepayment mechanism with distribution occurring at the end of each epoch.

The economic mechanism encompasses

- Rewards: Incentives are provided for successfully responding to challenges, assisting with data writing, and recovering data fragments.

- Penalties: Token burning is implemented for failure in challenges (above 50%) or failure to recover data fragments, thereby enhancing network security.

Business Model Observations

Focused on providing large data storage infrastructure (PDFs, images, files, etc.) on the blockchain. The target customer base is organizations (B2B) requiring storage for AI data, 3D game play, payment systems, etc., offering low storage costs. However, the platform will need time to prove its capabilities compared to existing competitors in the market.

With the launch of Walrus by its parent company, Mysten Labs, a crucial factor emerges:

- It positions Walrus as a vital core data storage platform for Sui and the Sui Ecosystem in the future.

- This reflects Sui’s long-term strategic vision for AI, Fully Onchain 3D Gaming, and Payments.

RoadMap 2025: Not publicly disclosed

2.3. Competitive Landscape

Walrus competes with decentralized storage platforms like Filecoin and Arweave. In comparison to its rivals:

Walrus distinguishes itself with its low costs, attributed to Red Stuff encoding, deep integration with Sui, and strong scalability potential. Walrus claims to potentially reduce storage costs by up to 100 times compared to Filecoin and Arweave, while also supporting programmable storage, making it well-suited for web3 applications.

| Criteria | Walrus | Filecoin | Arweave |

| Storage Cost | 4–5x replication, low cost | 25x replication, higher cost | Full replication, very high cost |

| Encryption | Red Stuff (fountain codes) | Reed-Solomon, lower performance | Unknown, depends on the node |

| Blockchain Integration | Strong coordination with Sui | Native Filecoin, more complex | Arweave, not deeply integrated |

| Scalability | Blob-level sharding, infinite scale | Limited as node count increases | Limited due to full replication |

2.4. Tokenomics

Token Info

- Total Supply: 5B

- Circulating Supply: 1.25B ~ 25%

- Price: $0.42

- Market Cap: $525M

- FDV: $2.1B

Raised Fund

- Total Raised Fund: $140 million USD

- Investors Tier 1 & 2: Standard Crypto, A16z, Electric Capital, Franlink Templeton Investment.

Token Use Case

- Payment

- Gov

- Security

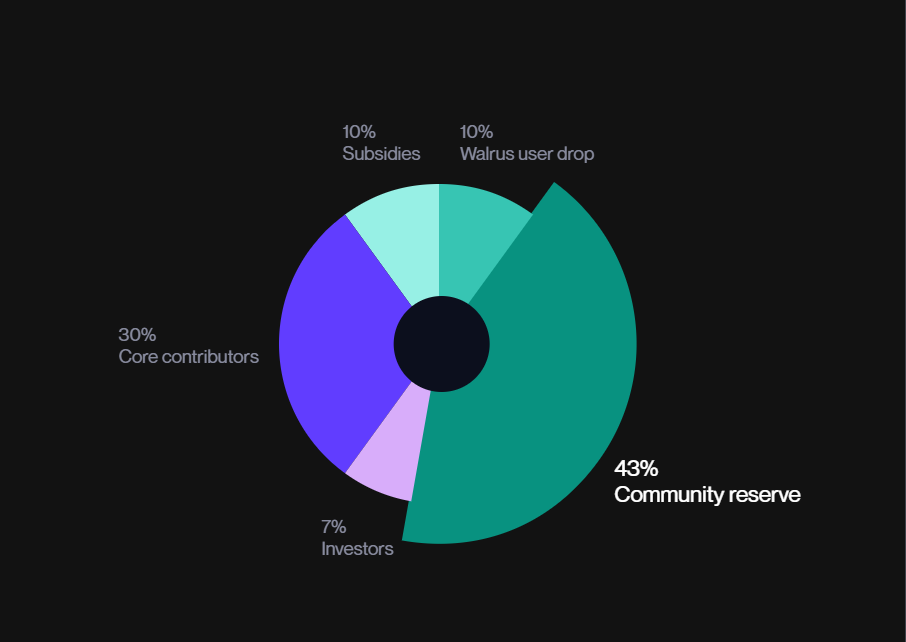

Token Allocation & Vesting

| 5,000,000,000 | Allocated | Percentage | TGE Unlock | Locked up (Months) | Vesting | Initial TGE Supply | USD Amount at TGE |

| Community reserve | 2,150,000,000 | 43.00% | 32.10% | 0 | Released over 96 months | 690,150,000 | $289,863,000 |

| Early Contributor | 1,000,000,000 | 20.00% | 0.00% | 12 | Released over 36 months | 0 | $0 |

| Mysten Labs | 500,000,000 | 10.00% | 10.00% | 0 | 10% TGE, released over 60 months | 50,000,000 | $21,000,000 |

| Subsidies | 500,000,000 | 10.00% | 0.00% | 0 | Released over 50 months | 10,000,000 | $4,200,000 |

| Investor | 350,000,000 | 7.00% | 0.00% | 12 | Released over 1 month | 0 | $0 |

| Initial airdrop | 200,000,000 | 4.00% | 100.00% | 0 | 100% TGE | 200,000,000 | $84,000,000 |

| Futures Airdrop | 300,000,000 | 6.00% | 100.00% | 0 | 100% TGE (in the future) | 300,000,000 | $126,000,000 |

| Total | 5,000,000,000 | 100.00% | 1,250,150,000 | $525,063,000 |

Analysis & Observations

The Token Generation Event (TGE) and listing will have 1.25 billion $WAL tokens in circulation, representing 25% of the total supply. This allocation comes from various rounds [Community Reserve, Mysten Labs, Subsidies, Initial Airdrop, Futures Airdrop]. Notably, 4% of the total supply is designated for airdrops, and 21% is held by the project. It’s crucial to monitor two key catalysts that will influence the token’s price:

- Walrus’s upcoming strategies for community education and growth.

- The potential for the project to intentionally limit the actual circulating supply on the market, which could drive up the price of Walrus.

The project raised a single round of funding totaling $140 million USD through token sales. Based on calculations, investors received 7% of the total supply, equivalent to approximately 350 million $WAL tokens, purchased at a price of $0.4 per token (currently at a +5% ROI). These tokens are locked until March 2026, indicating no immediate selling pressure from investors within the next year.

In the short term (under one year), a potential growth phase for $WAL can be anticipated, driven by the “low actual circulating supply” catalyst. However, this opportunity is accompanied by risks such as:

- Community education and growth strategies implemented through airdrop campaigns.

- The project potentially gradually exiting investor capital through Over-The-Counter (OTC) deals or providing liquidity with their allocated tokens.

Regarding the long term, there is less optimism for $WAL due to the anticipated selling pressure from investor unlocks occurring within a single month. As a subsidiary project of Mysten Labs, $SUI is expected to be the primary focus and hold greater long-term potential.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.