1. Money flow

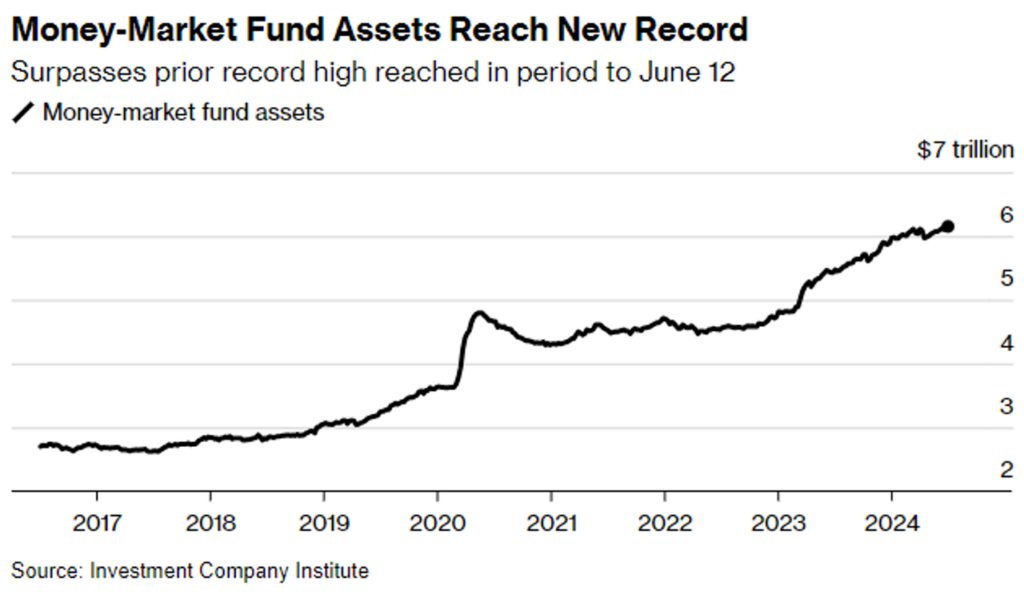

1.1. Money-market fund

The money flow in MMFs comprises 60% of retail investors and 40% of institutional investors.

- There has been a continued inflow of investors into MMFs, with total assets reaching an all-time high (ATH) of $6.2 trillion. This figure is expected to reach $6.5-7 trillion as cash from institutional investors (e.g., institutions) has not yet been fully deployed.

- Since the Fed rate hike in March 2022, over $1.4 trillion has flowed into MMFs, with more than half of that coming from retail investors.

- MMFs are locked in high yields by purchasing longer-duration T-bills. This strategy allows them to maintain higher yields for longer, even after the Fed cuts rates.

Historically, in the three previous rate cut cycles, money did not start moving out of MMFs until the Fed had significantly reduced rates, typically by around 2%. With 4-5% yields, the money remains attractive and continues to flow into MMFs.

For the "alt season" to explode as it did in 2021, it will take time for the money in MMFs to flow into riskier assets.

1.2. Stablecoin

After remaining relatively flat in the $160-$164 billion range for about 3 months, the stablecoin market capitalization has now surpassed the $166 billion mark, growing by around $2 billion since July 10th. This indicates a return of positive momentum and increased capital inflows.

Stablecoin market cap reaches new ATH $166B in 2024.

The growth comes from $2 billion in USDT stablecoin.

The stablecoin (ERC-20) balances on exchanges have also shown a similar trend, aligning with the growth in stablecoin market capitalization.

- After returning to the $21 billion level comparable to January-February 2024, the stablecoin balances have started to increase again, with over $1.1 billion in net inflows across both the spot and derivatives markets. This reflects healthy buying pressure.

- However, it’s important to note a recent $300 million net outflow from stablecoin balances on exchanges over the past week.

Source: Cryptoquant

While the growth numbers are not yet "impressive," this can be seen as the beginning of an "on-chain season." It reflects increased investor confidence and optimism, leading to enhanced market liquidity and the potential for sustainable price appreciation.

2. Onchain movements

2.1. Sell-side BTC

2.1.1. Mt.Gox repayment

The ongoing movements of Mt. Gox have been negatively impacting the price of BTC for some time. This impact will gradually decrease as the repayment process nears completion. After transferring around 46.8k BTC to the Kraken exchange for distribution to creditors, Mt. Gox currently holds over 80k BTC.

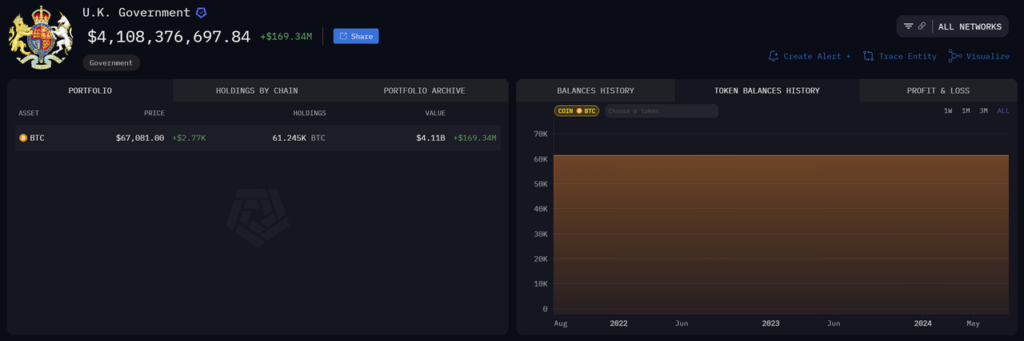

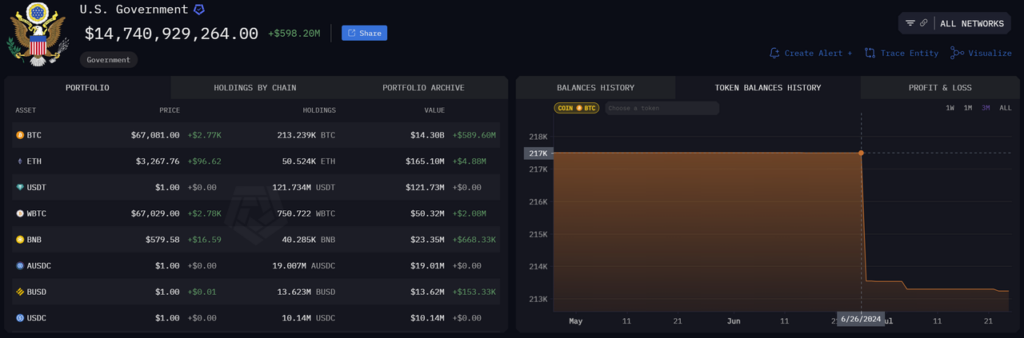

2.1.2. Government holdings

This is a potential large sell-side pressure from the U.S. and U.K. governments, as they do not have a clear timeline for liquidating their Bitcoin assets.

- The U.K. holds 61k BTC and has not seen any movements in the past 3 years.

- The U.S. holds 213k BTC and has moved 3k BTC to Coinbase on June 26th. This is the largest government-held Bitcoin asset.

With a daily trading volume of $30B, Bitcoin can absorb the sell-side pressure from Mt. Gox, the U.S., and the U.K. in a single day or a few days. Understanding this fact presents an opportunity to look for entry points after the "FUD" has played out.

2.2. Market makers

2.2.1. Jump Trading

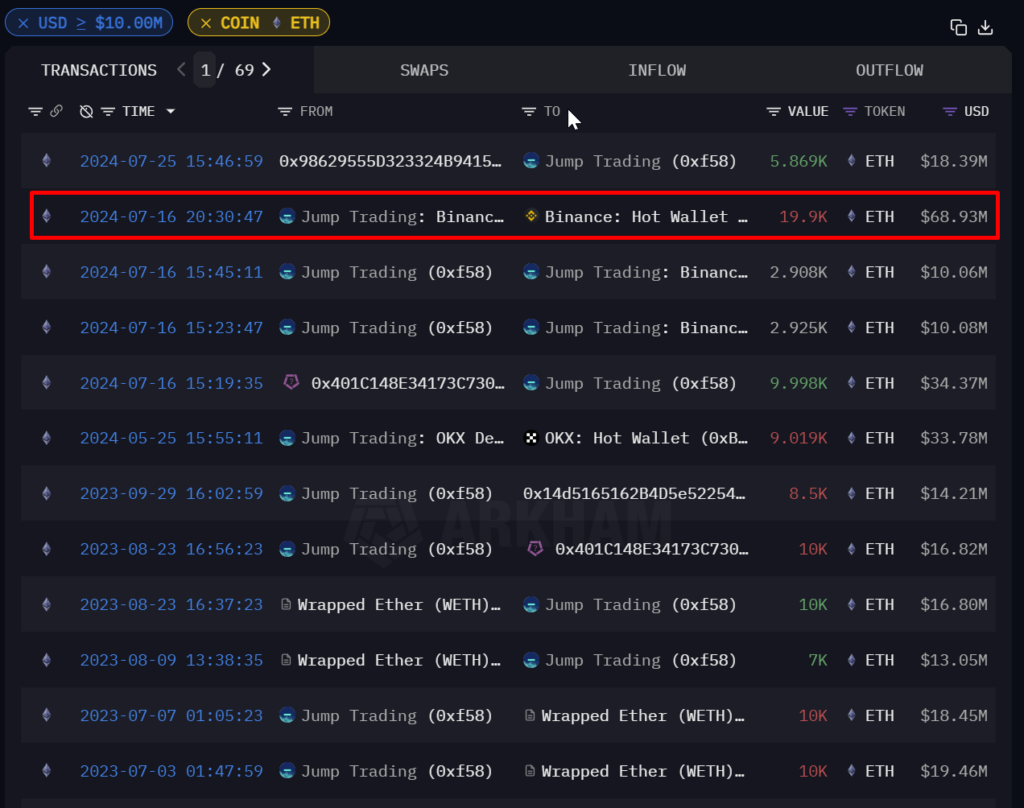

Notably, before the official Ethereum trading date on July 23rd, Jump transferred over 120k $wstETH + 3k $rETH to a new wallet, and around 9k $ETH to an exchange (likely to realize 2x gains on their holdings from 11 months ago).

- The new wallet address holding $wstETH is 0x48d62ED012E327FaaCb9c8d2A56330E215DA0575.

Recently, this $wstETH wallet address has shown significant activity: Unwrapped wstETH to stETH, then withdrew ETH from Lido to the 0x986 wallet, and finally transferred back to the Jump Trading wallet.

Pushed ETH to the Binance exchange for sale on July 16th.

Withdrew USDC from the Coinbase exchange a few days later on July 19th.

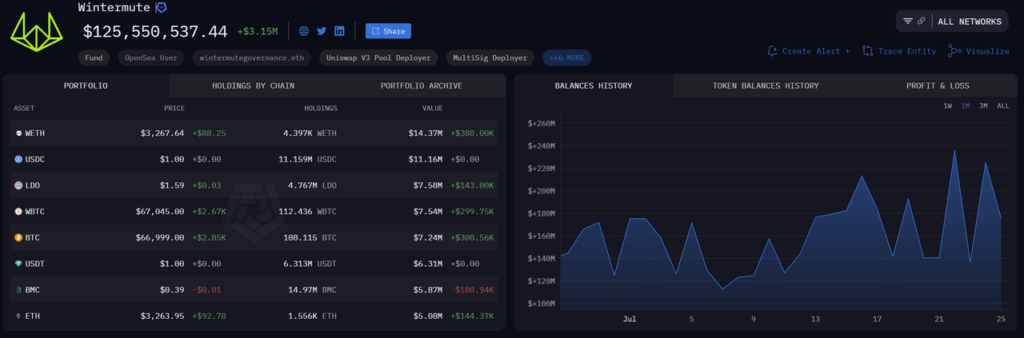

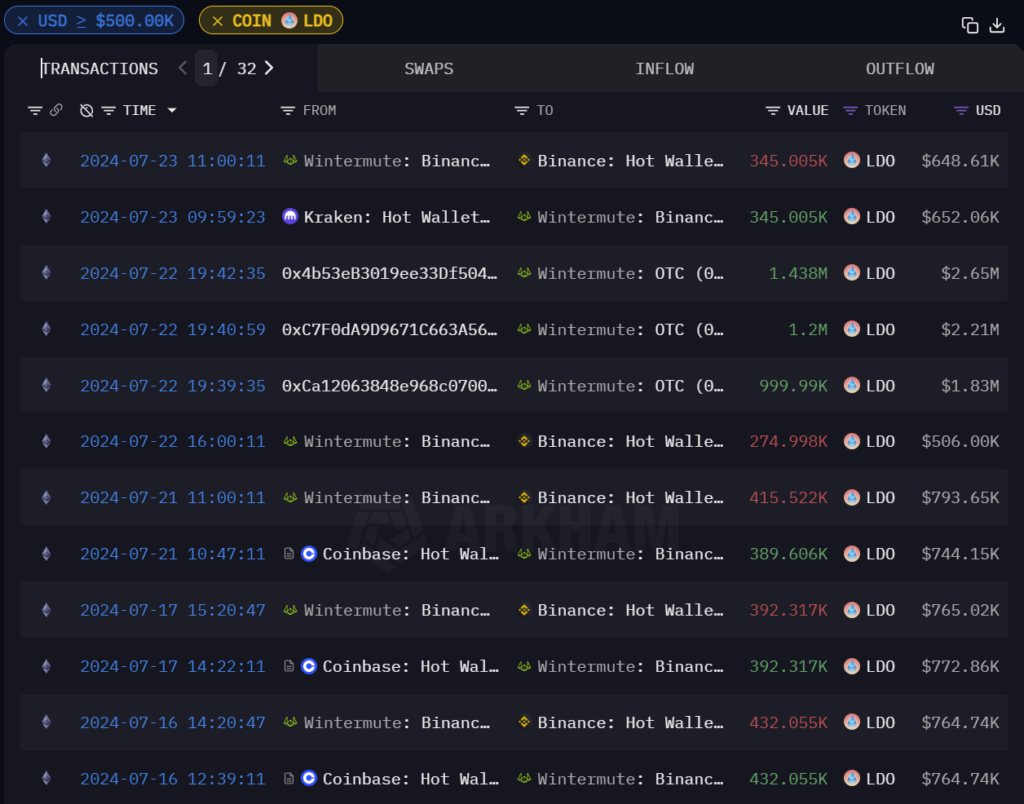

2.2.2. Wintermute Trading

Notable movements:

- Pushed over $80M USDT to the Binance exchange in the past day.

- Received 4.6M Lido Finance tokens to their OTC wallet.

Jump Trading holds a significant amount: over 105k $wstETH + 6.3k $ETH + 3.2k $rETH. As Jump Trading sells Ethereum, their stablecoin holdings have increased, while Wintermute has been pushing stablecoins to the exchange for trading.

2.3. Venture Capitals

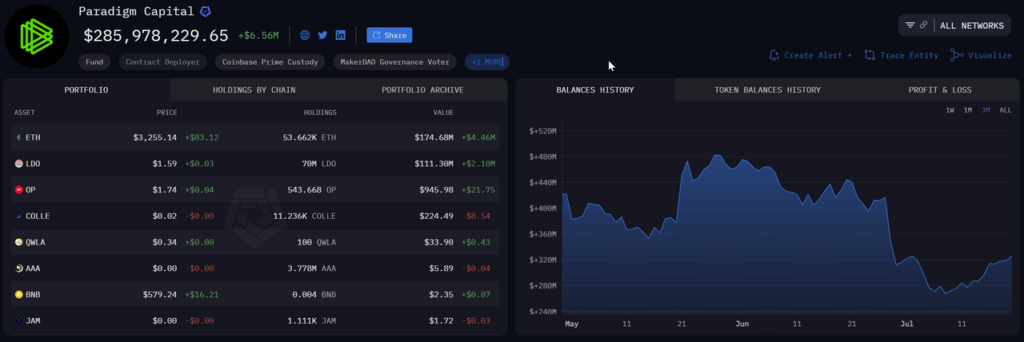

Paradigm Capital

Paradigm’s current portfolio is valued at $285M, primarily in ETH and LDO. Notably, they transferred over 20k ETH to Anchorage Digital on June 27th, possibly to obscure the trail and enable direct exchange sales or OTC trades, potentially related to the 10k ETH received by Wintermute a few days later.

3. Final Thoughts

There have been several notable movements from the entities mentioned above. However, we remain optimistic about the market’s prospects shortly due to the following catalysts:

- Macro: The anticipated Federal Reserve interest rate cut in September, as predicted by many analysts, is expected to create favorable conditions for the broader economy, particularly the stock and crypto markets.

- Stablecoin Market Cap: The stablecoin market cap is expected to reach a new all-time high of $166B in 2024, after a period of sideways movement.

- Bitcoin Halving: Based on historical data, each Bitcoin halving event has been followed by a significant price increase.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.