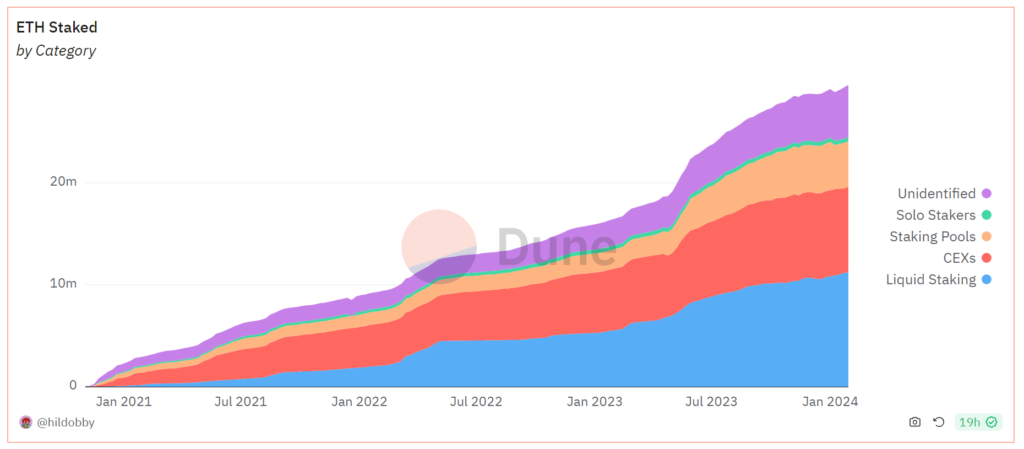

In the fast-paced blockchain landscape, liquid staking has emerged as a transformative force, reshaping how users interact with staked assets. Over the past 180 days, the aggregated value of assets staked in the liquid staking market sector has increased by 66%. During this time, the actual growth in newly staked assets stood at a remarkable ~20%, and the ETH price witnessed a 37% increase, climbing from $1600 to $2200.

Source: https://dune.com/hildobby/eth2-staking

Staking involves participants running validator nodes by putting tokens at stake. This adds an extra layer of security to the network, with participants subject to potential slashing penalties if they engage in malicious actions or prove unreliable. However, staked tokens traditionally face limitations, being unable to be transacted or used as collateral to earn yields in the decentralized finance (DeFi) ecosystem.

Liquid staking service providers have tackled the liquidity problem by minting new tokens representing claims on the underlying staked assets. These providers enable users to trade or deposit in DeFi protocols. For example, a user could deposit ETH to Lido and receive stETH tokens, then deposit the stETH to Aave to earn yield. Essentially, liquid staking builds upon existing staking systems by unlocking liquidity for staked tokens. Lido stands tall as the market leader, with over $20 billion in TVL by the end of January, or 80% of the LSD market share, accounting for 31% of all Ethereum staking. Another notable player is Rocket Pool, with a TVL exceeding $1.8 billion.

In addition to decentralized liquid staking protocols like Lido and Rocket Pool, these services are also provided by centralized entities, such as exchanges, for their customers. The primary distinction lies in the fact that decentralized services operate on a non-custodial basis, while centralized services retain complete control over users’ staked assets. The largest player in centralized liquid staking is Coinbase, with over $9.5 billion in TVL.

Introducing restaking

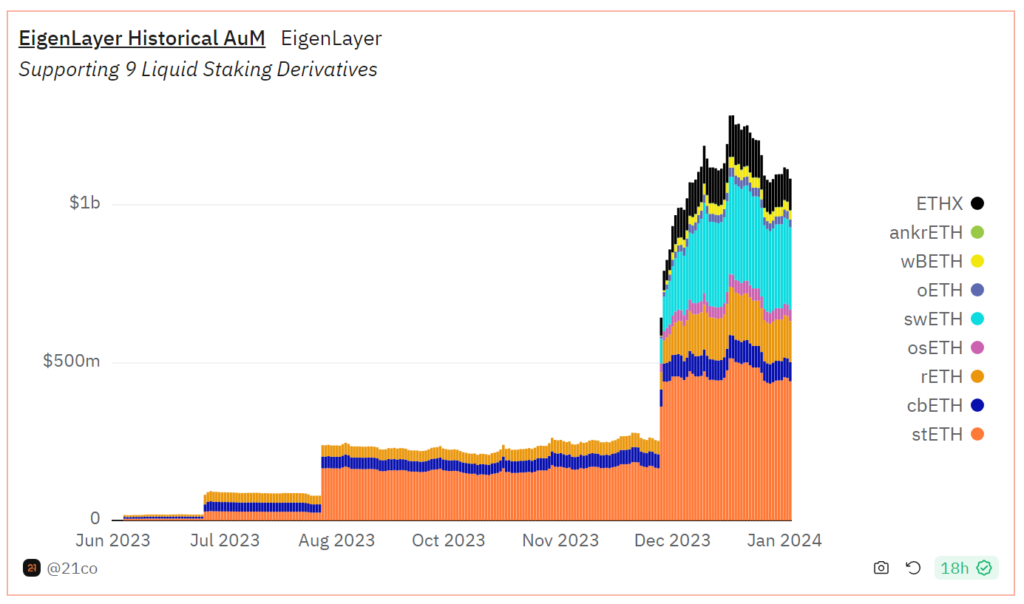

In this dynamic landscape, EigenLayer has introduced a new concept – “restaking.” EigenLayer facilitates the deposit and restaking of ether from different liquid staking tokens and staked ether, directing these funds to secure third-party networks. The protocol, currently in its first stage on the Ethereum mainnet since June 2023, received over $2 billion of TVL. EigenLayer’s restaking allows users to leverage staked ether and liquid staking tokens across multiple platforms. This strategy aims to maximize earnings by optimizing the utility of locked assets.

Source: https://defillama.com/protocol/eigenlayer

EigenLayer is set to elevate its staking caps on January 29th, welcoming three new LSD tokens, including frxETH, mETH, and LsETH. Currently, over 450.000 LSD tokens are deposited in Eigenlayer, accounting for 1/20 of the liquid staking circulating on the market.

Source: https://dune.com/21co/eigen-layer

In conclusion, liquid staking marks a transformative chapter in the blockchain narrative, bridging the gap between staked assets and their utility in the broader decentralized ecosystem. EigenLayer’s innovative restaking approach adds an intriguing layer to this evolving landscape, promising a future where locked assets can be truly dynamic and versatile.