In the dynamic landscape of blockchain technology, the need for cross-chain solutions has become increasingly evident. With various blockchains supporting different protocols, decentralized applications (dApps), and cryptocurrency assets, the interoperability between these diverse environments has become a critical challenge. Imagine you are holding Ethereum (ETH) and want to participate in decentralized finance (DeFi) protocols on Solana or transfer USDC from Arbitrum to another layer 2—cross-chain infrastructure is the key. The inability of different blockchains to communicate directly poses a significant hurdle, preventing seamless transfers between chains. This is where cross-chain bridges play a pivotal role.

Cross-Chain Bridges

The Web3 ecosystem is evolving into a multiple-chain environment, with decentralized applications spread across various blockchains and layer-2 solutions. Each blockchain or layer-2 solution has its own security approach and trust model. However, these blockchains are not inherently capable of communicating with each other, making interoperability crucial for unlocking the full potential of a multi-chain ecosystem.

A cross-chain bridge is essentially a system that supports the transfer of cryptocurrency assets between different blockchains. Its core functions involve users depositing assets from one end of the bridge (the source blockchain), the bridge updating the account balance, and users being able to withdraw funds from the other end of the bridge (the destination blockchain). The development of solutions, like cross-chain bridges, becomes crucial to facilitate the transfer of cryptocurrency assets.

To understand the necessity of cross-chain bridges, envision blockchains as separate continents with vast oceans between them. Each continent represents a blockchain with unique capabilities—some rich in resources, others fertile for growth, and some with advanced industries. For these blockchains to derive maximum benefit, they need a way to connect their economies. Without bridges or shipping infrastructure, these regions cannot fully utilize their individual strengths.

How Cross-Chain Bridges Work

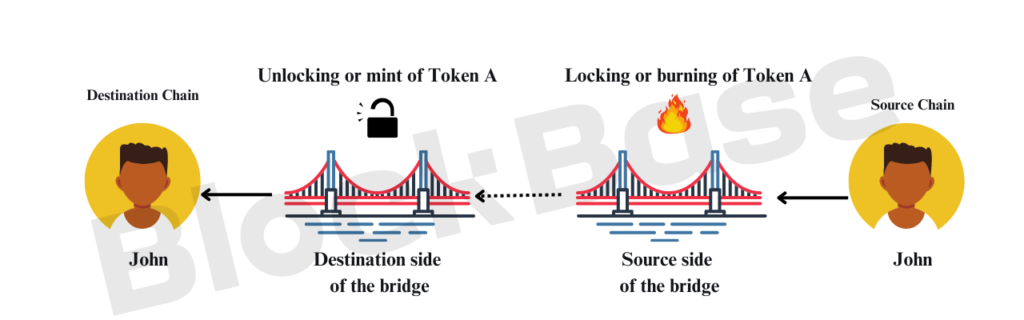

A cross-chain bridge is a decentralized application facilitating the transfer of assets from one blockchain to another. Typically, it involves locking or burning tokens on the source chain through a smart contract and unlocking or minting tokens through another smart contract on the destination chain. The process varies and includes mechanisms such as lock and mint, burn and mint, and lock and unlock, each serving specific purposes.

For example, John has native token A on the source chain and wants to use it on another chain

- John sends an amount of token A to a specific blockchain address on the source chain and pays the transaction fee.

- A smart contract (bridge) locks the amount of token A that John sent.

- Another smart contract on the destination chain mints equivalent units of token B (wrapped in token A as usual) on this chain.

- John then receives token B in his wallet address. He can freely use token B to execute transactions on the destination blockchain.

The risk of cross-chain bridge

Since early 2020, hackers have orchestrated sophisticated attacks, draining billions of dollars from multiple cross-chain bridges. According to blockchain research firm Chainalysis, these crypto bridge hacks currently constitute a staggering 70% of total cyberattacks in the blockchain industry.

The cross-chain bridge acts as a central hub for cryptocurrency transfers. Users, in pursuit of interoperability, lock their tokens on one end of the bridge to mint wrapped tokens on another chain. The substantial cryptocurrency assets held within these protocols make them tempting targets for hackers, capable of pilfering millions if not billions. As a result, before using any cross-chain bridges, users should have due diligence, which becomes imperative. Assess the operational history of the bridge and scrutinize its track record regarding security breaches. An ideal bridge should have undergone third-party audits, validating the integrity of its code.

Noteworthy Cross-Chain Bridge Attacks:

- Nomad Bridge Hack (August 2022): In August 2022, Nomad, a cross-chain bridge, exploited approximately $200 million.

- Harmony Bridge Hack (June 2022): The Horizon Bridge, linking Harmony blockchain, Ethereum, and the BNB Smart Chain, experienced a significant hack in June 2022. Hackers infiltrated the bridge, making away with an estimated $100 million in crypto assets.

- Ronin Bridge (2022): In 2021, Sky Mavis, the gaming studio behind the play-to-earn game “Axie Infinity,” opted to shift the game from the main Ethereum chain to its Ronin sidechain. An Ethereum-to-Ronin bridge facilitated token transfers between these chains; however, vulnerabilities in this bridge were exploited, and the hackers drained over $625 million in USDC and ether (ETH).

In a world where blockchain diversity is the norm, cross-chain bridges play a vital role in creating a more connected and collaborative ecosystem. As blockchain technology continues to evolve, the development of robust cross-chain solutions becomes crucial for unlocking the full potential of decentralized finance, decentralized applications, and the broader blockchain space.