1. Recommendation & Position Summary

Historical Context: Worldcoin ($WLD) launched in Q3 2023, generating buzz with an airdrop narrative centered around its biometric Orb device. The surge in AI narratives during Q1 2024 propelled $WLD to an all-time high (ATH) of $12. However, at that time, the token lacked clear utility, raising concerns about its tokenomics and legal issues surrounding user data collection.

Current Status: Worldcoin has pivoted its strategy, now focusing on building World Chain, an L2 blockchain leveraging the OP Stack. This chain prioritizes applications requiring Proof-of-Personhood identity verification. This new direction offers clear potential for generating real revenue, expanding its competitive edge, and aligning with a future vision where AI Agents are verifiable by World IDs.

Action: Our analysis recommends opening a spot position (1x long) on $WLD.

Trade Details:

- Recommended Entry Price: $0.50 – $0.55 (targeting this range during significant market breakdowns from now until the price reaches the recommendation).

- No Short Position Recommended: Due to high volatility and the risk of price manipulation.

| Token | Price Recommend | Price | Weekly | Monthly |

| $WLD | $0.58 | $0.87 | 12% | 90% |

- Long Entry Price: $0.55

- Price Target: $3 (tăng 445% absolute)

- Stop Loss: $0.406 (giảm 26,18% absolute)

- Time Horizon for Spot Position: 5 months

- Leverage: 1x

- ROI: 627.27%

- Reward/Risk: 17:1

2. World Chain Investment Thesis

Strong Influence from Sam Altman

Sam Altman, the founder of Worldcoin, is leveraging his significant influence within the AI ecosystem to position World ID as a future standard. There’s a potential opportunity for ChatGPT to integrate World ID in the future to combat spam and verify user identities, which could multiply the value of $WLD.

Impressive Fundraising and Valuation

Worldcoin has successfully raised an additional $135 million through token sales, bringing its total capital raised to $375 million USD, with a valuation exceeding $3 billion USD. Notably, A16z has been a lead investor from the Seed Round to private token sales, demonstrating the immense confidence venture capitalists are placing in the ID-as-a-Service model.

Innovative and Highly Promising Business Model with Product-Market Fit (PMF)

The World ID product (its Unique Selling Proposition) addresses a critical use case in the age of AI and AI Agents: distinguishing between humans and AI. World ID is packaged as an API and is poised for distribution in massive potential markets like e-commerce, finance, and social media (e.g., Twitter, Tinder), with even greater reach as the project “owns” the world’s IDs.

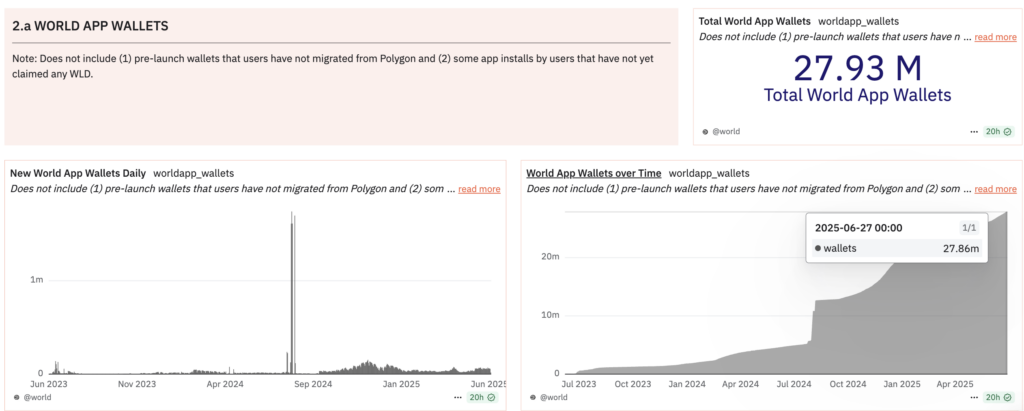

The World App boasts 27 million users, with a remarkable 48% conversion rate, meaning approximately 13 million users have already verified their World ID. This represents an exceptionally large number of real users that any project or organization would desire.

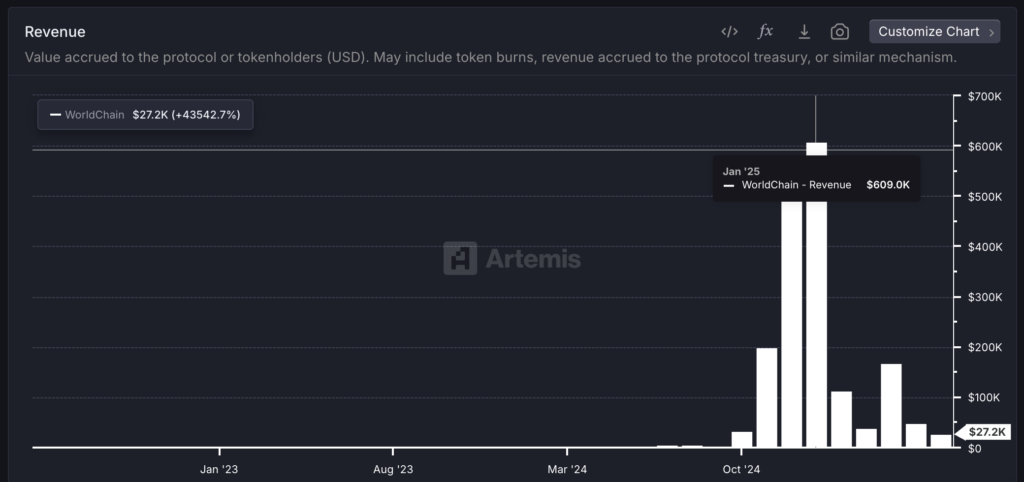

Instead of merely being a token tied to Orb scans, the launch of World Chain serves as a dedicated infrastructure for hosting dApps. This significantly increases $WLD’s utility, demand, and long-term revenue (cumulative revenue from March 2025 to June 2025 reached $1.8 million USD).

Tokenomics: Low Effective Circulating Supply

The actual circulating supply of $WLD is low, accounting for only 16% of the total supply after two years of development. While 150 million $WLD (1.5% of total supply, approximately $135 million USD) is unlocked monthly, 100 million (1%) $WLD only enters market circulation when new users scan an Orb. The remaining 0.5% belongs to VCs and the team. Importantly, there has been no token movement from major VCs in the past two years, indicating security.

With 85% of tokens centralized within the World Foundation and the team, analysts are betting that a strategy of rapidly scaling users will necessitate a higher $WLD price to provide attractive rewards for users, making this the most effective approach.

3. Business Model & Snapshot Metric

The World Foundation is actively building its business model around a product triad:

3.1. World ID – The Unique Human Verification Protocol

World ID is a groundbreaking protocol that verifies unique individuals through iris scans. With over 13 million verified users, this represents a significant number of real users that any organization or app developer would be eager to acquire.

Worldcoin’s business model is innovative and highly promising, based on the analyst’s understanding that the project aims to onboard millions of users onto the World App and World ID. For example, World ID plans to monetize by charging large platforms (like Twitter) recurring fees for its “proof-of-personhood” service, while remaining free for end-users. This model is akin to services like Captcha and has vast potential applications in e-commerce, banking, and government sectors.

3.2. World App – The Mobile Wallet, Payment Gateway, and App Store

The World App will feature various mini-apps within its ecosystem, serving as a revenue stream for Worldcoin by fostering the platform’s growth (similar to Apple’s model).

The World App has accumulated 28 million wallet registrations, with 13 million of those being active, real users who have verified their World ID. There are two key insights to understand here:

- The conversion rate is an impressive 48% of real users, representing 13 million users out of the total 28 million active wallets.

- The metric for daily active “real” users (from the 13 million verified) is not publicly disclosed, as this data resides on a private chain. Nevertheless, 13 million real users is a remarkably large figure, a fact that has led even Vitalik Buterin to express concerns about the potential risks this business model poses to users.

3.3. World Chain – An OP-Stack-Based L2 Prioritizing “Human-Verified Block-Space“

World Chain is an L2 (Layer 2) blockchain built on the OP Stack, specifically designed to prioritize “human-verified block-space.” This chain generates revenue by collecting fees from users transacting on its various DeFi dApps.

Since its mainnet launch in early Q2 2025, World Chain has achieved a PnL (Profit and Loss) of $1.8 million USD (after deducting L1 costs). World Chain also offers grants to incentivize ecosystem growth: 100,000 WLD per month is allocated to dApps with existing active users, and 300,000 WLD per month is distributed among developers with innovative ideas for building new products.

Ultimately, the core of Worldcoin’s business model will revolve around emphasizing human identity and Proof-of-Personhood (PoP). This is a strategic direction aimed at merging AI alignment with crypto identity to forge an entirely new market.

| Metric | 04.2025 | 05.2025 | 06.2025 (MTD) | Comment |

| Price | $1 | $1.575 | $0.93 | -48% MoM |

| Market Cap | $1.4B | $2.2B | $1.5B | +28% MoM |

| Circ. Supply | 1.4B (14%) | 1.4B (14%) | 1.66B (16.6%) | +18.5% MoM |

| Staking | — | — | — | No native staking available |

| Total Supply | 10B | 10B | 10B | No change |

| FDV | $10B | $15B | $9.3B | -38% MoM |

| TVL World Chain | 2.92M | 41.87M | 43.5M | +3% MoM; driven by Lending via Morpho integration in World App |

| Active address Chain | 301k | 368k | 401k | +8.9% MoM |

| Total Active World App | 25M | 26.2M | 27.8M | +6% MoM |

| User World ID | 3.1M | 8.9M | 13M (46% of Total Active WAP ) | +46% MoM; 13M real user verifications is a remarkable non-bot milestone |

| Orb Supply | Currently 2,000 ORBs: 1,700 in London, 300 in other countries. Target: 10,000 ORBs for U.S. deployment | |||

| Raised Fund | $375M (Valuation Series B – $3B USD). | |||

| Team | Sam Altman – Founder World Chain & ChatGPTAlex Blania – Co-Founder/CEO World ChainThe legal entity developing the Worldcoin project is Tools For Humanity, which has a total of 378 affiliated members on LinkedIn. | |||

| Competitive | – Humanity Protocol: Uses biometric palm scanning (vs. iris scan). Raised $50M+ with a valuation of $1.1B. Mainnet has not yet launched. – Government-Issued Digital ID: Outside crypto, existing incumbents include state-backed ID solutions. For example, India has issued 1.3B biometric-verified IDs. Vietnam is also rolling out similar initiatives. – These are key competitors in the race for innovation and Product-Market Fit (PMF). | |||

4. Catalyst Timeline

| Time | Event | Expected Impact |

| Q1/2025 | – Launch of Visa debit test version – Expanded developer grants ($100K/month for active-user dApps) – Preparing rollout of more ORBs & new partnerships – Partnership with Circle & Stripe (payment via stablecoins) | Developer Grant Program for apps integrated into World App (e.g., Hold Station) No direct impact on $WLD price |

| Q2/2025 | – Launch of World Chain Mainnet – Migration of World ID from Optimism → Native chain – Release of Deep Face – Raised $135M via token sale – Targeting 7,500 ORBs for US expansion – Partnerships with Tinder, Razer, Shopify (World ID integration) | Successful $135M raise from A16z & Bain Capital through private token sale → U.S. becomes the main Orb & PoH dApp distribution hub (targeting 6 cities: SF, LA, Miami, Atlanta, Nashville, Austin) → $WLD price surged 90% in May ($0.55 → $0.95) → Broad user access via World ID through dating & gaming apps |

| Q3/2025 | – Deploying ORBs on-demand – Resolving regulatory issues in EU – R&D for compact Orb devices (phone-like size) | Regaining access to users previously limited by regulations, especially in Germany, France, and Spain User scaling to new highs |

| Q4/2025 | World ID API monetization begins | Mass Adoption dApps may achieve Product-Market Fit (PMF) → Huge revenue potential via unique selling proposition (USP) |

5. Valuation

$WLD is currently trading at a Fully Diluted Valuation (FDV) that is 3.2 times higher than the median of other Layer-2 chains, due to its “low float, high FDV” structure — with only 16% of its total supply in circulation, significantly lower than most competitors with >50% circulating supply.

However, its market cap remains close to the median, suggesting that due to the low float nature, $WLD’s market cap could continue to climb higher relative to other Layer-2 networks as demand increases.

| Projects | FDV ($B USD) | FDV vs Median | Market Cap | MC vs Median |

| World Chain | 9 | 3.21× | 1.5 | 1x |

| Optimism | 2.4 | 0.86x | 1.5 | 1x |

| Arbitrum | 3 | 1.07x | 1 | 0.67x |

| Near | 2.6 | 0.93x | 2.6 | 1.73x |

| Median | 2.8 | 1.5 | ||

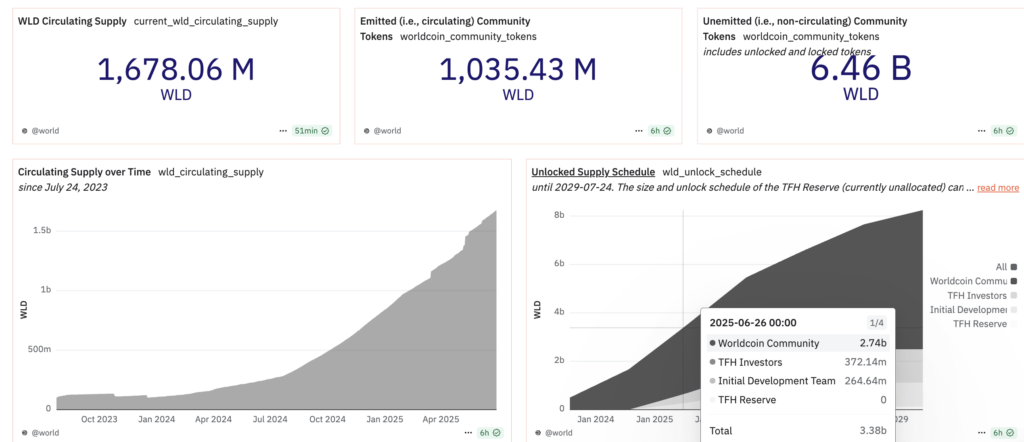

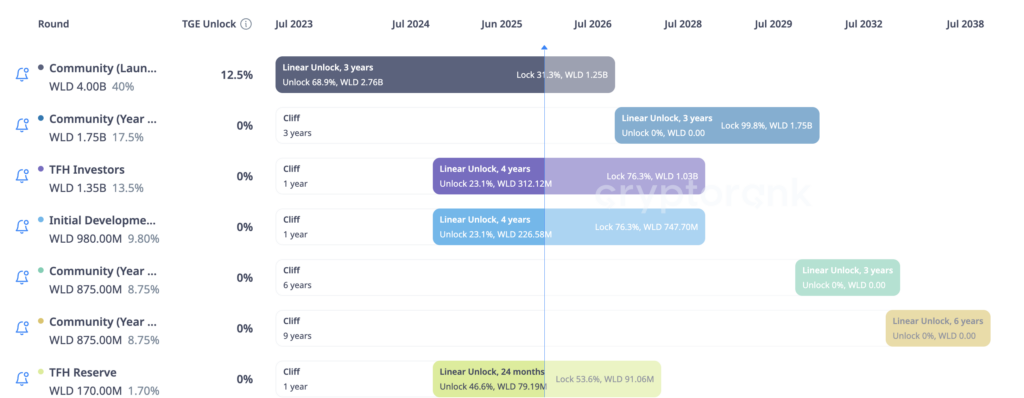

6. Tokenomics

Total Supply: 10 Billion $WLD

Circulating Supply: 1.6 Billion $WLD. (While 3.2 billion tokens have been unlocked according to records, the remaining 1.6 billion will only enter circulation as new users join the chain and scan the Orb.)

Token Release Rate into Circulation: 1.5% of total supply per month.

- Community: Unlocks 0.96% of total supply/month (~96M $WLD)

- TFH Investor: Unlocks 0.275% of total supply/month (~27M $WLD)

- Team: Unlocks 0.19% of total supply/month (~19M $WLD)

- TFH Reserve: Unlocks 0.069% of total supply/month (~6M $WLD)

Analysis

- The effective circulating supply is 1.6 billion $WLD, which is approximately 16% of the total supply after two years of Token Generation Event (TGE). This indicates the project has excellent control over the token release rate on the market, creating a “Low Float, High FDV” situation, leading to an FDV of $9 billion USD.

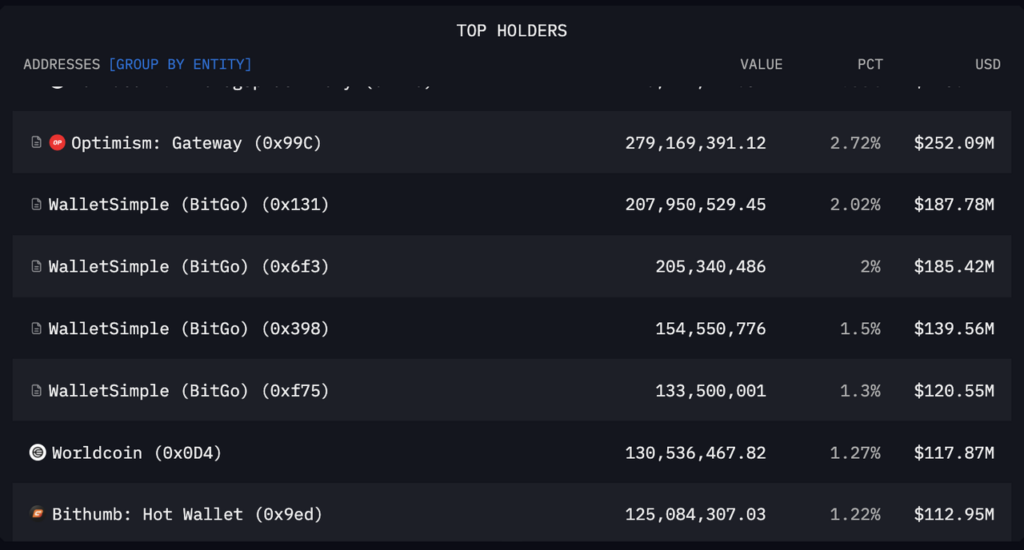

- On-chain data reveals that 84% of the supply is still centralized in wallets controlled by the World Foundation and has not yet entered circulation. Of the 16% currently circulating, investors hold 3%, the team holds 6%, and the remaining 7% is circulating on DEXs, CEXs, and has been air-dropped to the community.

The “Low Float, High FDV” situation, with only 16% of the supply in circulation, means that 70% of the tokens are centralized within the World Foundation. Financially, this allows for the potential to create supply pressure, pushing the $WLD market cap to $3 billion – $4 billion from its current $1.6 billion. (Historically, the project reached an ATH of $3 billion market cap with approximately 5% of the supply in circulation.) This strategy can significantly facilitate the rapid scaling of user adoption within the network.

| Metric | Current | x2 (6 months) | x3 (6 months) |

| Price | 0.85 | 1.7 | 2.55 |

| Circ. Supply | 1,600,000,000 | 1,700,000,000 | 2,000,000,000 |

| % change | – | 6.25% | 17.65% |

| Total Supply | 10,000,000,000 | 10,000,000,000 | 10,000,000,000 |

| Market Cap | 1,360,000,000 | 2,890,000,000 | 5,100,000,000 |

| % change | – | 112.50% | 76.47% |

| FDV | 8,500,000,000 | 17,000,000,000 | 25,500,000,000 |

7. Key Risks

Legal/Regulatory Risk: Worldcoin faces significant regulatory scrutiny. Numerous countries, including Spain, Germany, Portugal, France, the UK, Kenya, Indonesia, and Hong Kong, have temporarily halted or banned Worldcoin operations due to concerns over biometric data privacy and its cross-border ID system.

Low Token Float: Worldcoin is set to unlock a substantial amount of tokens over the next three years. If the project fails to generate sustained demand for World ID (and the token), this influx of supply could act as a major drag on the token’s price.

Reliance on Sam Altman: Worldcoin was founded by Sam Altman, currently one of the most influential figures in the AI world. The project’s success is heavily tied to its ongoing involvement and influence.

Concerns from Vitalik Buterin (Ethereum Founder): Vitalik Buterin has openly criticized World ID, arguing that user data is highly centralized, lacks decentralization, and raises concerns about the operations involving registered World ID users.

8. Position Sizing & Implementation Plan

- Target position size: 0.15% NAV

- Buy zone:$0.55 – $0.58

- TP1: $3

- TP2: $4.0

- Stop loss: $0.406

- Time Horizon: 3–6 months

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.