1. Tokenomics

Tokenomics refers to the economic and distribution model of a cryptocurrency token. It outlines how the token supply is allocated and distributed among various stakeholders within a project. Understanding tokenomics is crucial for investors and participants in the crypto industry as it provides insights into the potential value and future prospects of a token.

Let’s take a closer look at the tokenomics of the project in question:

Max Supply: The maximum supply of the token is set at 1 billion tokens.

Initial Circulating Supply: At the start, there are 427 million tokens in circulation.

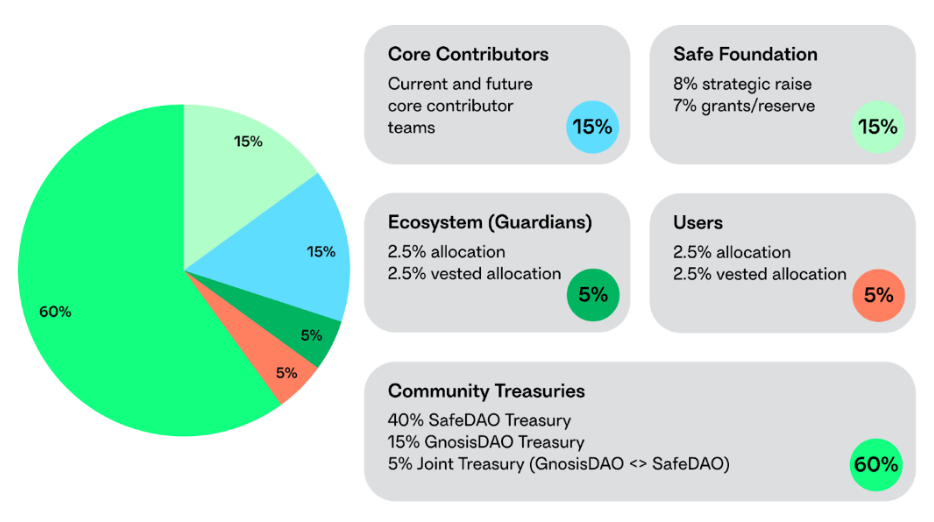

Token Allocation

- User Allocation: Users are allocated 5% of the total token supply, which amounts to 50 million tokens. Out of these, 25 million tokens are available immediately, while the remaining 25 million tokens are vested over a period of 4 years.

- Ecosystem Allocation: The ecosystem is allocated 5% of the total token supply, which is also 50 million tokens. The distribution includes an initial airdrop of 25 million tokens, with half of them available immediately and the other half vested over 4 years. The remaining 25 million tokens are reserved for future Guardians programs via SafeDAO.

- Core Contributors Allocation: Core contributors receive 15% of the total token supply, amounting to 150 million tokens. These tokens are allocated to 40+ core contributors, with the remaining tokens reserved for future talent. The tokens are generally vested over a period of 4 years.

- Safe Team (Strategic and Foundation): The strategic allocation is set at 8% of the total token supply, which is 80 million tokens. These tokens are vested among 60+ backers over 4 years, with a 1-year initial lockup period.

The foundation allocation is set at 7% of the total token supply, which is 70 million tokens. These tokens are vested over a period of 4 years, with 20 million tokens available immediately.

DAO (Decentralized Autonomous Organization): The SafeDAO and GnosisDAO treasuries receive the largest allocation, accounting for 55% of the total token supply. SafeDAO receives 40% (500 million tokens) and GnosisDAO receives 15% (150 million tokens). The distribution of these tokens is vested over 8 years for SafeDAO and 4 years for GnosisDAO. Out of these, 50 million tokens for SafeDAO and 10 million tokens for GnosisDAO are available immediately.

Additionally, there is a joint treasury allocation of 5% of the total token supply (50 million tokens) for the collective governance of SafeDAO and GnosisDAO, which is available immediately.

Next, looking at the buying and selling pressure:

2. Onchain

2.1. Buying Pressure

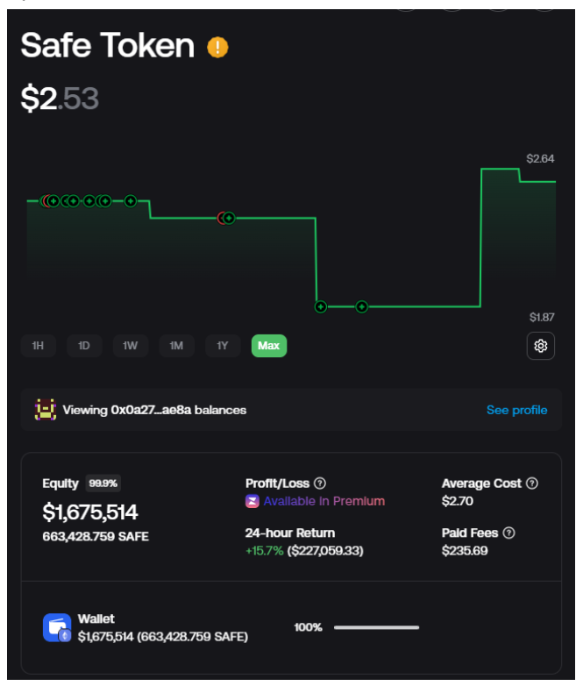

- There is a wallet associated with the EthSign project that holds over 660,000 $SAFE tokens at an average price of $2.3. The wallet address is 0x0a2763aCCF788d10c98fB68591113C5e79AbAe8A.

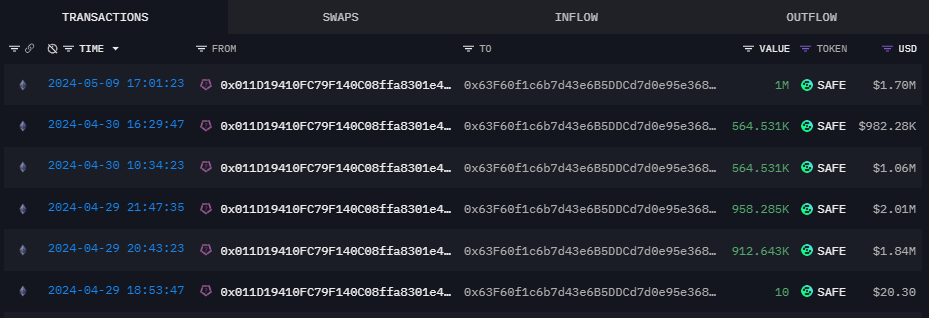

- Amber received 4 million $SAFE tokens from exchanges through the wallet address 0x011D19410FC79F140C08ffa8301e4153F17F4e27

2.2. Selling Pressure

- Flow Traders received 6 million $SAFE tokens from the project and has sold 3.1 million tokens, currently holding 2.9 million tokens.

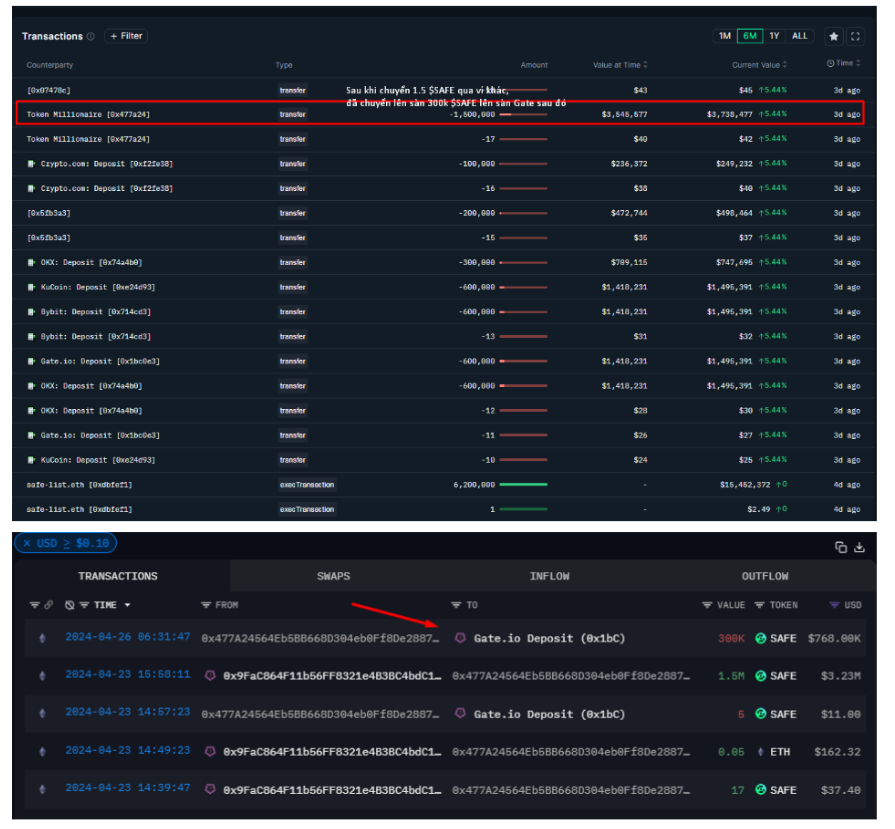

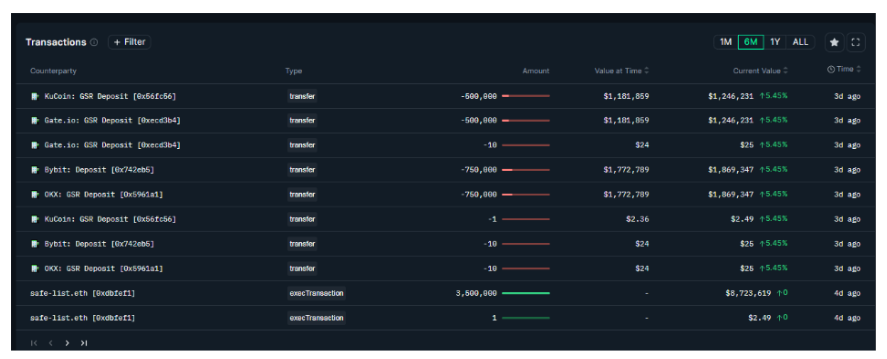

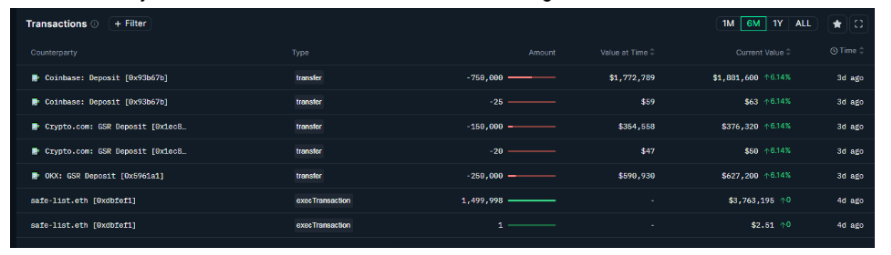

- GSR Markets received 3.5 million $SAFE tokens and sold 2.5 million tokens, currently holding 1 million tokens.

- Another wallet associated with GSR Markets received 1.5 million $SAFE tokens and sold 1.15 million tokens, currently holding 350,000 tokens.

- ArringTon XRP Capital received 2.4 million $SAFE tokens and sold 1 million tokens, currently holding 1.5 million tokens. The wallet address for selling is 0x1A34DfA5d894aE10999DA22bff8553a36c5cb4B2.

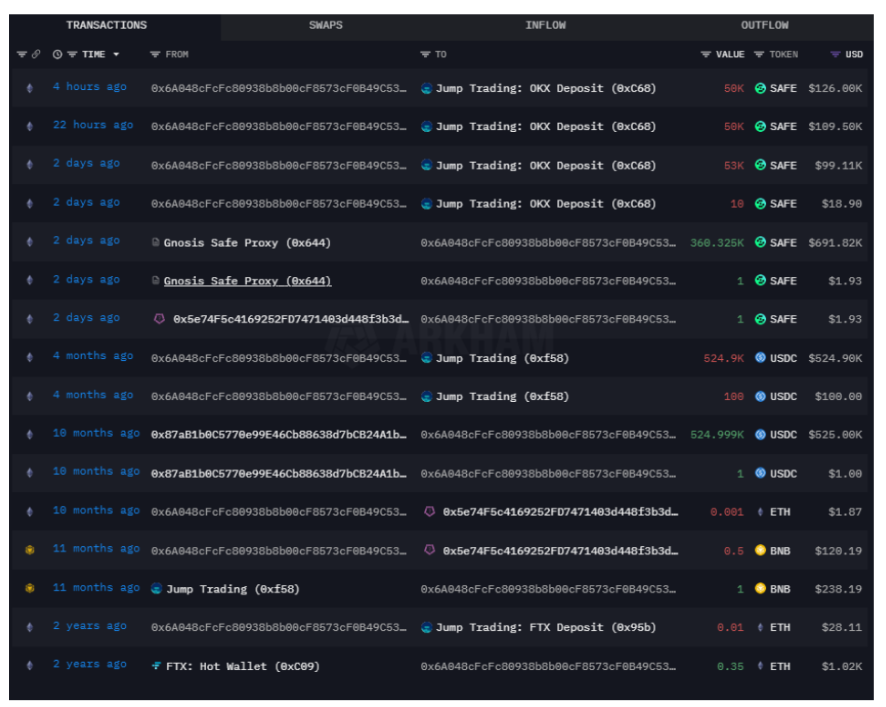

- Jump Trading received 360,000 $SAFE tokens and sold over 150,000 tokens, currently holding around 210,000 tokens.

3. Conclusion

Overall, there is currently significant selling pressure from various funds and market makers who have received tokens through vesting schedules or direct allocations. Additionally, the Safe foundation has an immediate supply of 20 million tokens, which is partially sold OTC and partially follows a vesting schedule for certain funds like GSR Markets.

On the buying side, there is limited on-chain activity, but the current price on the chart suggests some accumulation is taking place. However, it is not yet clear which wallets are involved in accumulating tokens.

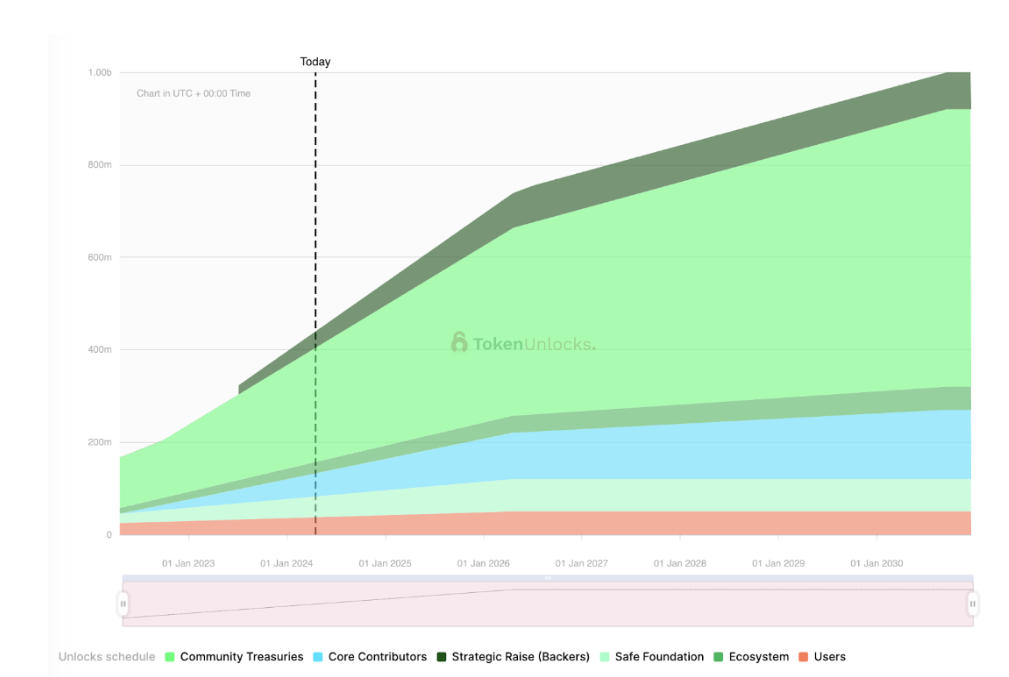

It’s important to note that with the vesting schedules, there will be a considerable amount of tokens vesting in the future for the Community Treasury (DAO) and Core Contributors. This will likely create selling pressure on the market based on proposals and the ongoing token distribution to these groups.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.