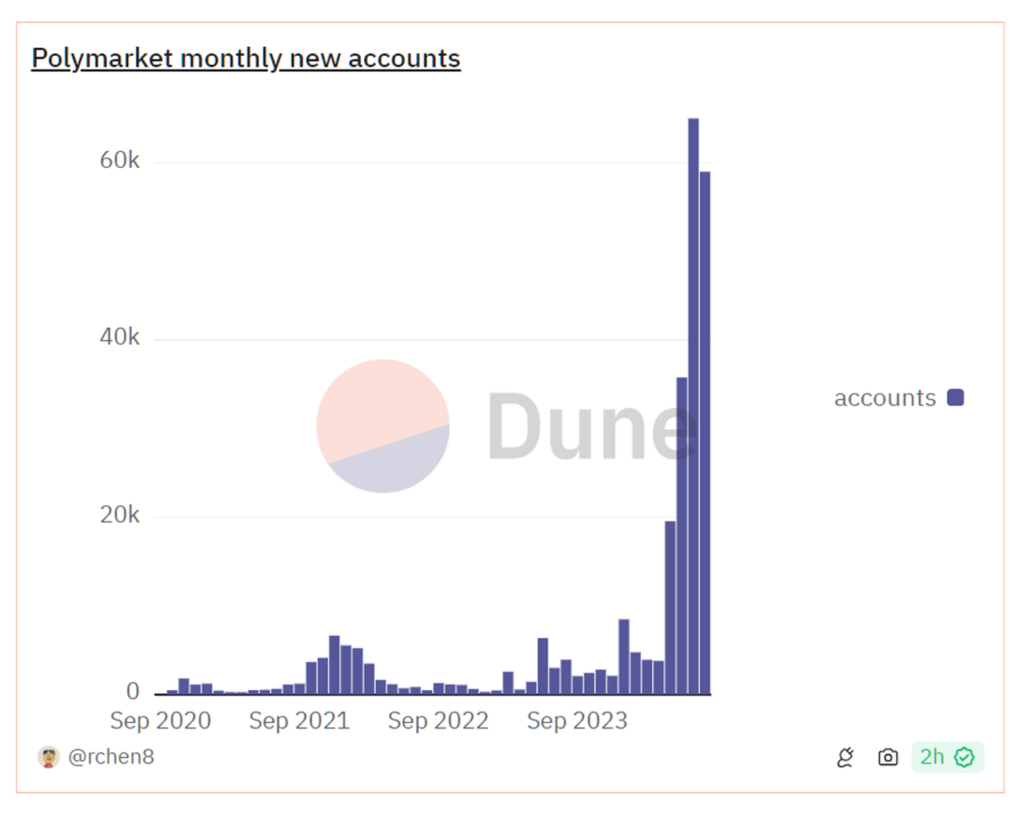

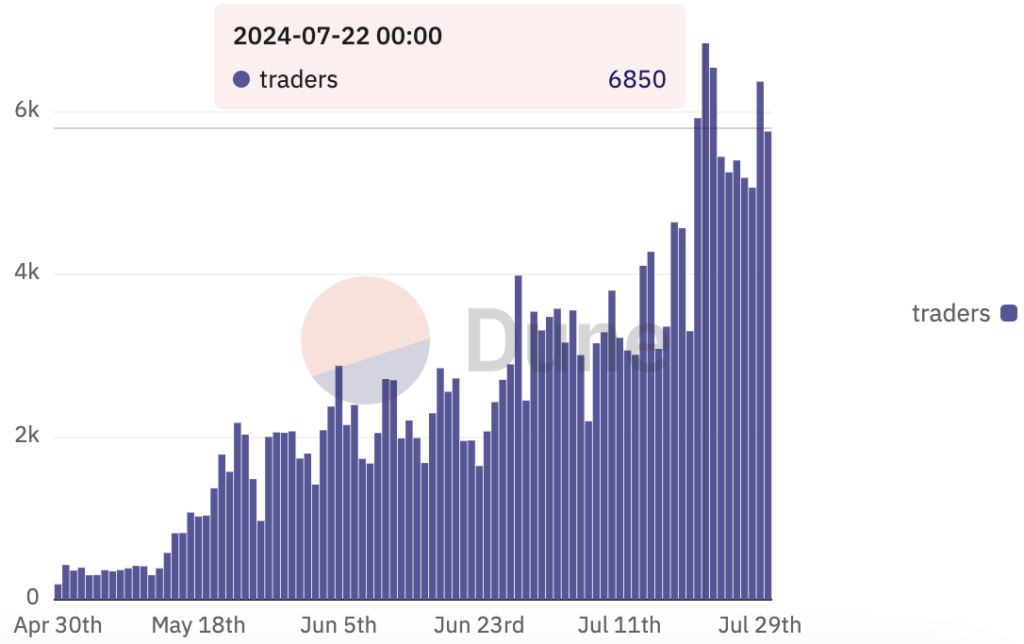

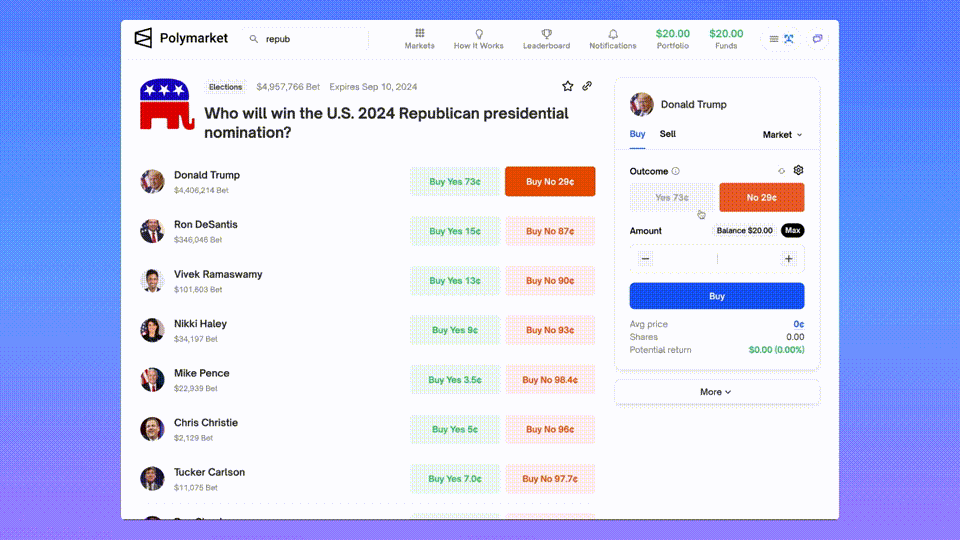

As of early August 2024, Polymarket has witnessed a substantial increase in activity, with monthly user transactions nearing 54,000, setting a record for the fourth consecutive month. Moreover, the trading volume on Polymarket has exceeded $380 million for two successive months, and its asset holdings have topped $100 million for the first time.

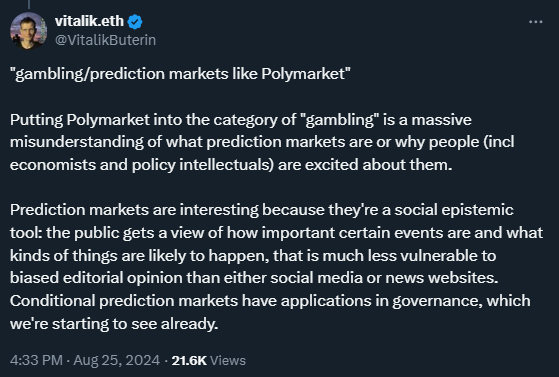

Recently, debates have highlighted Polymarket’s role in providing nuanced, valuable market predictions rather than simple gambling interactions.

1. The debate regarding the gambling characteristics of Polymarket

The advocates argue that Polymarket should be recognized for contributing to broader predictive analytics.

Vitalik Buterin has stepped forward to clarify the function and intent of Polymarket, countering the view that it merely serves as a betting platform. According to a recent statement, Buterin suggests that Polymarket transcends traditional betting activities by offering significant applications that enrich community knowledge and influence societal and economic decision-making processes.

In further discussions, Buterin points out the misclassification of Polymarket alongside traditional betting platforms, advocating for a more informed view that recognizes its potential to offer clear and unbiased insights into probable societal trends and events. Over $733 million has been wagered on the platform, reflecting its significant impact and the trust users place in its predictive capabilities.

2. The interests of economists and policy experts towards predictive markets as transformative tools

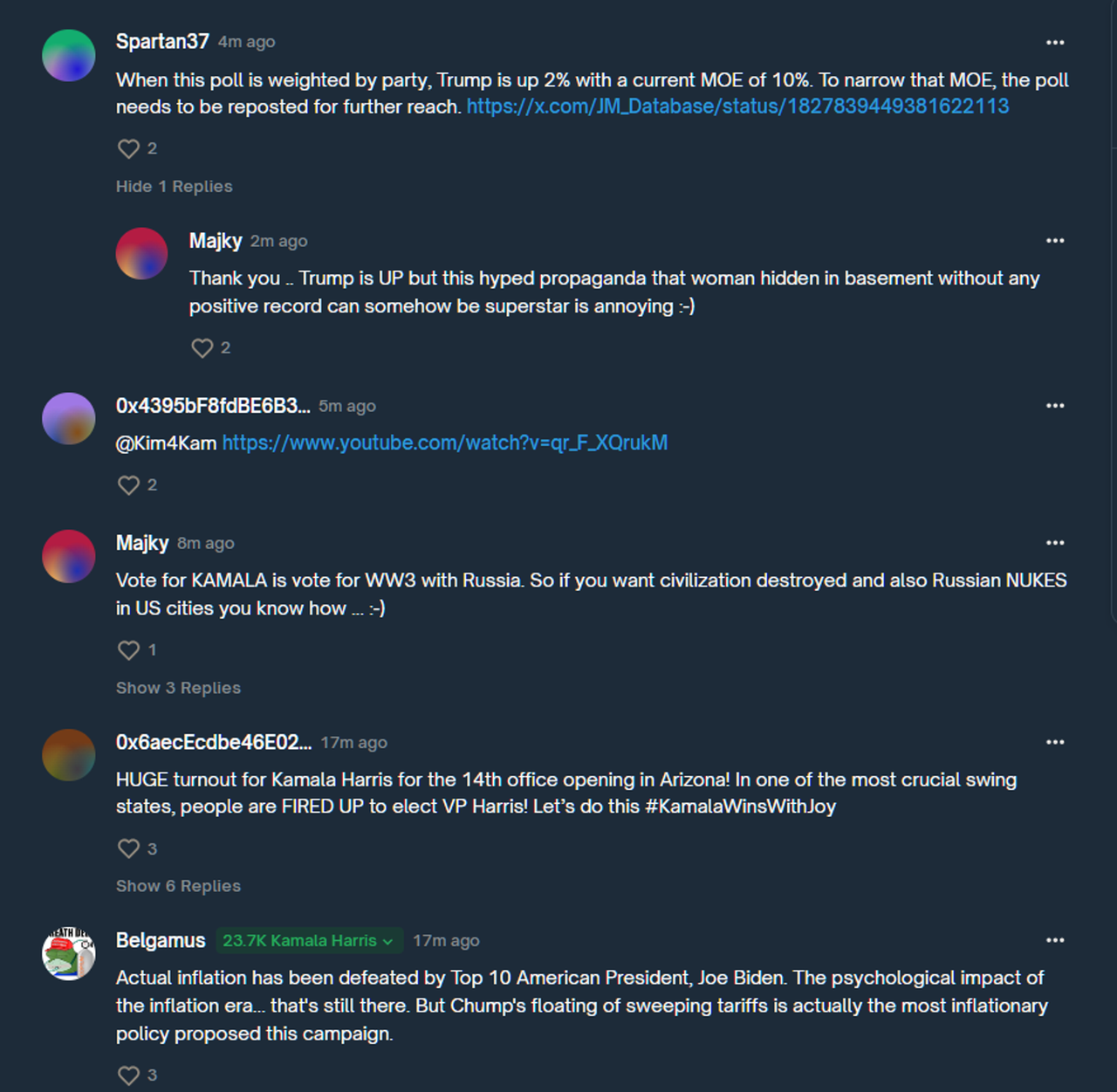

Prediction markets are increasingly recognized for their potential to provide more accurate and less biased economic and social strategies compared to traditional forecasting methods such as surveys or expert analysis.

- Collective Intelligence: Prediction markets leverage the collective insights and knowledge of a diverse group of participants. Each participant, drawing from their unique perspectives and information, contributes to the market. This aggregation results in a more nuanced and comprehensive understanding than could be achieved through individual or isolated analyses. The diversity of thoughts and knowledge leads to a consensus that is often more accurate than the sum of its parts.

- Financial Incentives: Participants in prediction markets often have real money at stake. This financial motivation drives them to thoroughly research and analyze available data before making a prediction. The desire to maximize returns or minimize losses ensures that participants are more committed and less likely to contribute biased or poorly considered predictions. This mechanism helps filter out noise and speculative behavior, enhancing the reliability of predictions.

- Dynamic Updates: Unlike traditional surveys or forecasts, which might be conducted periodically, prediction markets are dynamic and continuously open to new information. As fresh data becomes available, participants can adjust their bets in real time. This ability to rapidly incorporate new insights allows prediction markets to remain up-to-date and reflect the latest changes in sentiment or factual circumstances, often outpacing conventional methods that may become outdated between analyses.

- Reduced Bias: Traditional forecasting methods, especially surveys, can be influenced by the way questions are framed, as well as the personal biases of respondents. Prediction markets minimize these issues by focusing on actual financial stakes rather than opinions or perspectives. The real-money aspect encourages participants to overcome their personal biases to focus on the most likely outcomes, reducing the impact of subjective factors.

3. What we truly need is a decentralized platform

Decentralization is essential for prediction markets, preventing censorship and manipulation. By leveraging blockchain technology, it benefits from the immutability of transactions, which safeguards the integrity of predictions and outcomes. Additionally, decentralization allows for the fair distribution of profits through smart contracts, eliminating the risk of fraudulent behavior by central authorities. This open, secure environment encourages broader participation and fosters innovation, leading to more accurate predictions and a more trustworthy market overall.

Opinion Labs, a project similar to Polymarket, clarifies that the common misconceptions about prediction markets being mere gambling are misplaced, especially since platforms like Polymarket operate with a degree of centralized management akin to traditional betting platforms but with a focus on generating profitable and high-value interactive games. This management structure enables strategic decision-making focused on profit maximization, thus muddying the distinction between prediction markets and gambling platforms.

However, Polymarket is still effectively demonstrating the true value of prediction markets by underscoring their role in shaping public discourse and enhancing understanding. Recent data shows a significant growth in user engagement and transaction volume, with the platform consistently setting records and outpacing other DeFi projects in traffic and user growth, especially as the U.S. presidential election approaches.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.