The latest Bank of America survey, which engaged 189 institutional fund managers overseeing a staggering $508 billion in assets, unveils crucial data to guide your investment strategy. If you’re an investor who can’t monitor the market every second, this analysis is your window into smart money maneuvers. Dive into our comprehensive recap to explore the actionable insights from this influential survey.

1. Overview

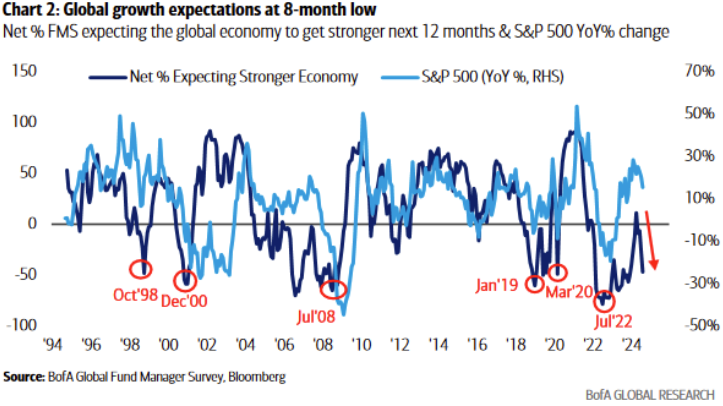

- Global growth expectations in the August survey fell sharply 20ppt from July, with a net 47% of respondents now expecting a weaker global economy in the next 12 months.

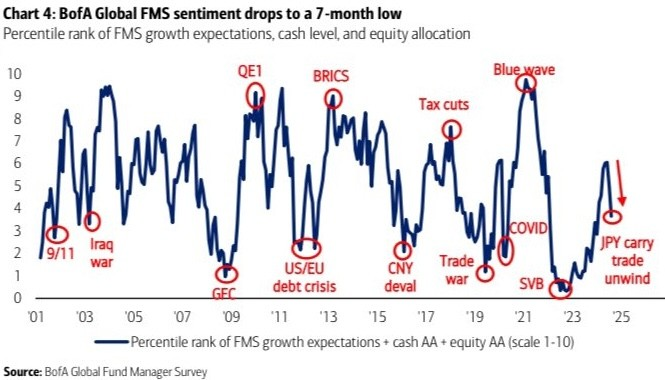

- Investor sentiment turned defensive and dropped to 3.7 from 5.0 last month. This decline is driven by growing concerns over the global economic outlook, the JPY carrying trade unwind, and geopolitical uncertainties.

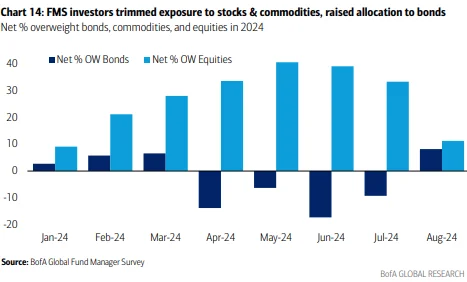

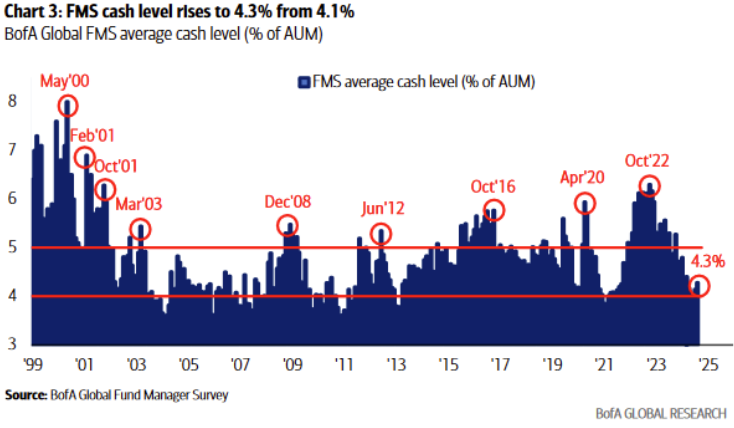

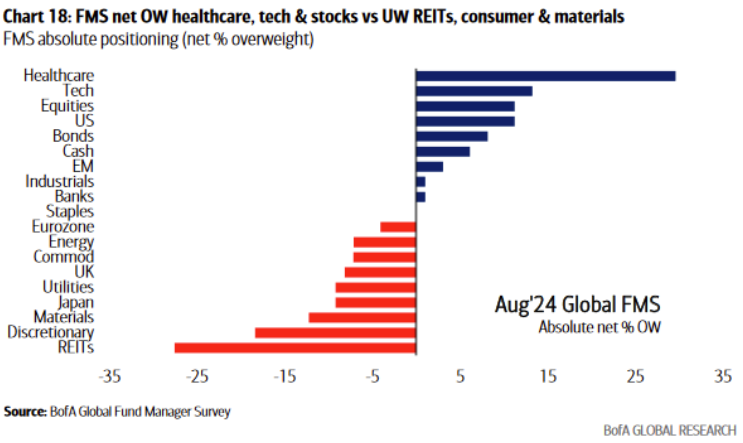

- This cautious sentiment was reflected in a marked shift towards reduced equity exposure and increased cash holdings among fund managers. Only a net 11% of respondents were overweight in stocks, down from 33% in July and that is the biggest month-over-month decline since September 2022, while cash levels rose again for the 2nd month to 4.3% from 4.1%.

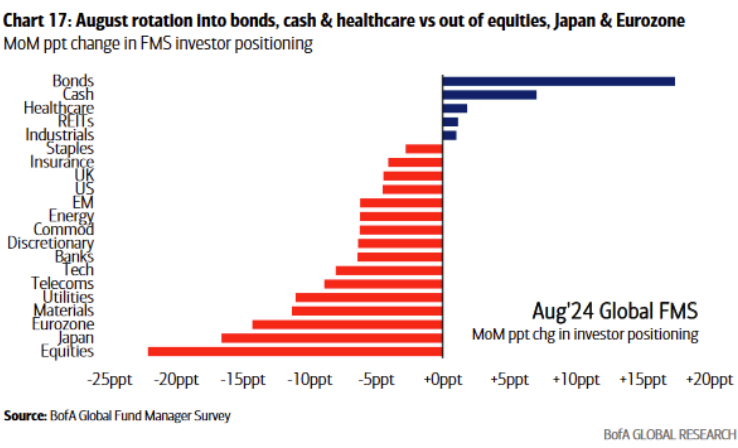

- In terms of asset allocation, there has been a marked shift towards more defensive positions, with August witnessing increased allocations to bonds and cash, and a corresponding reduction in equity exposure.

- In terms of regional equity allocations, the biggest regional equity allocation was US equities, while exposure to Japanese stocks saw the largest one-month drop since April 2016. Meanwhile, the Eurozone and global emerging markets witnessed smaller declines in their overweight positions.

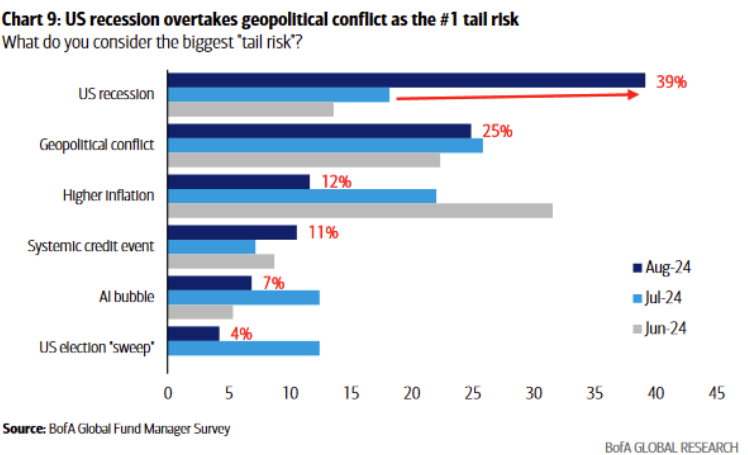

- The survey identified a potential U.S. recession as the most significant tail risk, cited by 39% of respondents, up from 18% in July. This concern has now surpassed geopolitical conflict, which was the primary risk in the previous month and is now cited by 25% of respondents. Other critical risks include the threat of higher inflation, systemic credit events, and the possibility of a bubble forming in artificial intelligence stocks.

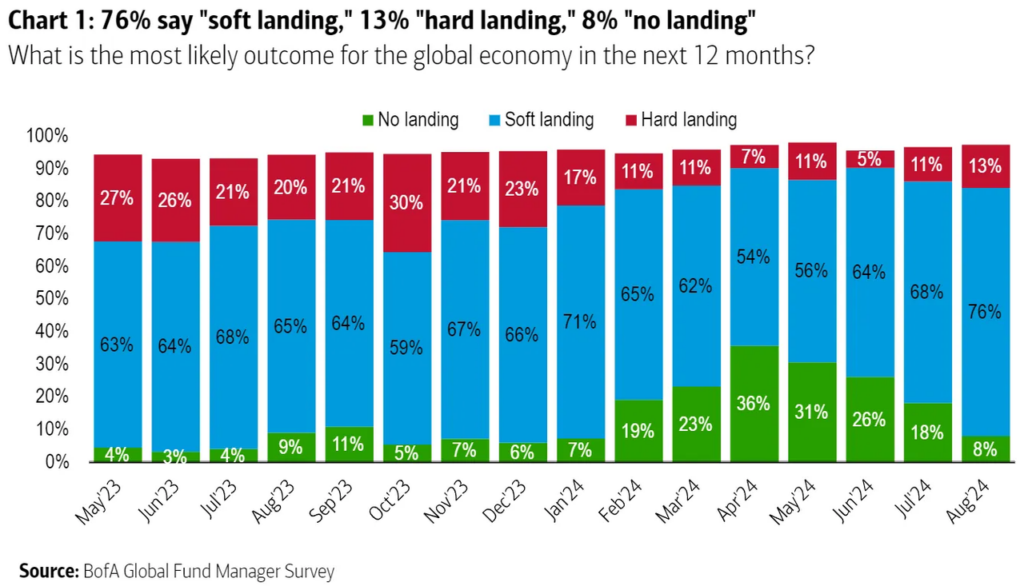

- Despite prevailing pessimism, a significant 76% of respondents expectations of a soft economic landing, indicating expectations of a gradual economic slowdown rather than a severe recession.

- Optimism is strongly linked to expectations of reduced interest rates, with 93% of respondents predicting lower short-term rates within the next year. This represents the highest consensus on this outlook in 24 years.

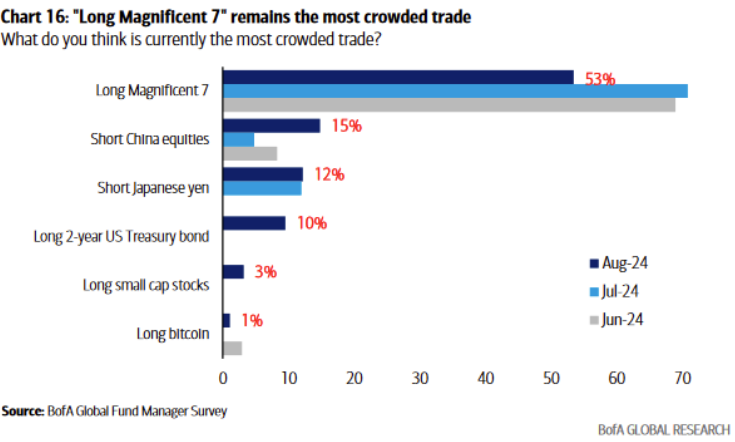

- The volatility in global financial markets hasn’t derailed investor optimism around US technology behemoths, the “Long Magnificent Seven” remains the most crowded trade. However, investor conviction in this trade has weakened, with only 53% of respondents identifying it as such, down from 71% a month ago.

2. Closing Thoughts

- While market sentiment remains cautious, it hasn’t yet reached the level of panic selling. We believe that fears of a recession and concerns about growth have been overblown and will soon be recognized as such.

- In our assessment, the U.S. is unlikely to enter a recession in the coming months. The overall outlook for companies remains fairly optimistic, especially with the Federal Reserve poised to potentially loosen monetary policy shortly, which could significantly boost market sentiment. Therefore, being overly cautious now might cause investors to miss out on a potential market rally from now until the end of the year.

- Ultimately, the recent widespread market downturn presents valuable opportunities for bargain hunting, particularly in equities and cryptocurrencies. As we highlighted in our previous insight, “U.S. Recession Alert! An In-Depth Analysis of the Market”, any short-term dips should be viewed as opportunities, offering solid entry points and creating compelling prospects for those willing to invest in riskier assets.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.