1. Why did this FDV meta happen in the first place?

What’s behind this low float high FDV craze? Several factors are at play

| Factors | Sub-factors | Reason |

| Investment | Valuation | This is a topic for another thread, but the oversupply of VC money from 2021/2022 led to inflated private valuations. VCs consistently overpaid for each round, while public markets had no appetite for such high valuations. Since no projects wanted to TGE at a lower valuation than their last private round, they were forced to find ways to launch at even higher valuations. |

| Investment | Founder bias | This cognitive bias influences decisions based on an initial reference point. If founders believe their project is worth $1 billion, they might launch at a $10 billion FDV, setting an anchor in the market’s mind. Even if the token drops 90%, it returns to the founder’s perceived fair value. |

| Token | Incentives & Treasury | A $10 billion FDV on paper boosts a project’s treasury, enabling it to attract top talent with vested tokens, offer ecosystem grants, and forge partnerships—driving growth with substantial paper value. |

| Token | Supply | Post-ICO and SEC crackdowns, distributing tokens to the community has become more challenging. Airdrops and community incentives often fail to allocate a meaningful percentage of the supply at launch. This remains a major hurdle for the industry. |

| Token | OTC Sales | A high launch price facilitates cashing out through discounted OTC sales or hedging positions with perps (hard to do with size though). |

| Marketing | FOMO | This is how our minds are wired. Higher valuations create an illusion of success. People are drawn to what seems like a winning venture, and everyone wants a piece of it. |

| Marketing | Product support | It is a famous project easy to gain short-term users and dApps to build on and attract a rise in on-chain statistics. |

2. How was that possible in the first place?

Method 1: The mechanics behind inflating token valuations are rooted in liquidity pool dynamics.

For instance, by creating Token A with a total supply of 1 billion and pairing a single USDC with Token A in a Uniswap pool, you establish an initial price of $1 per token, resulting in a fully diluted valuation (FDV) of $1 billion. However, this valuation is entirely artificial, as it reflects only nominal liquidity rather than any substantive market demand or underlying value.

Method 2: The artificial inflation of token valuations can also be achieved even without liquidity pools.

For example, a project could mint Token A with a total supply of 1 billion tokens and sell a small portion—say 1%—to private investors or in a limited public sale at a fixed price of $1 per token. This would immediately create a notional FDV of $1 billion, based solely on the small initial sale price, even though the vast majority of tokens remain unsold and effectively illiquid.

In these scenarios, the circulating supply at launch is minimal, often representing just a fraction of the total supply. Once early investors or participants sell their tokens after a vesting period, the majority of tokens are concentrated in the hands of market makers or large holders (“whales”). These actors, with control over the limited circulating supply, can influence price dynamics in the market. This structure allows projects to achieve an inflated FDV that creates the appearance of high value, despite only a small portion of the supply being actively traded or supported by tangible demand. In this way, a billion-dollar FDV can be established with only a small amount of capital entering the market.

3. Problems with the High FDV Meta

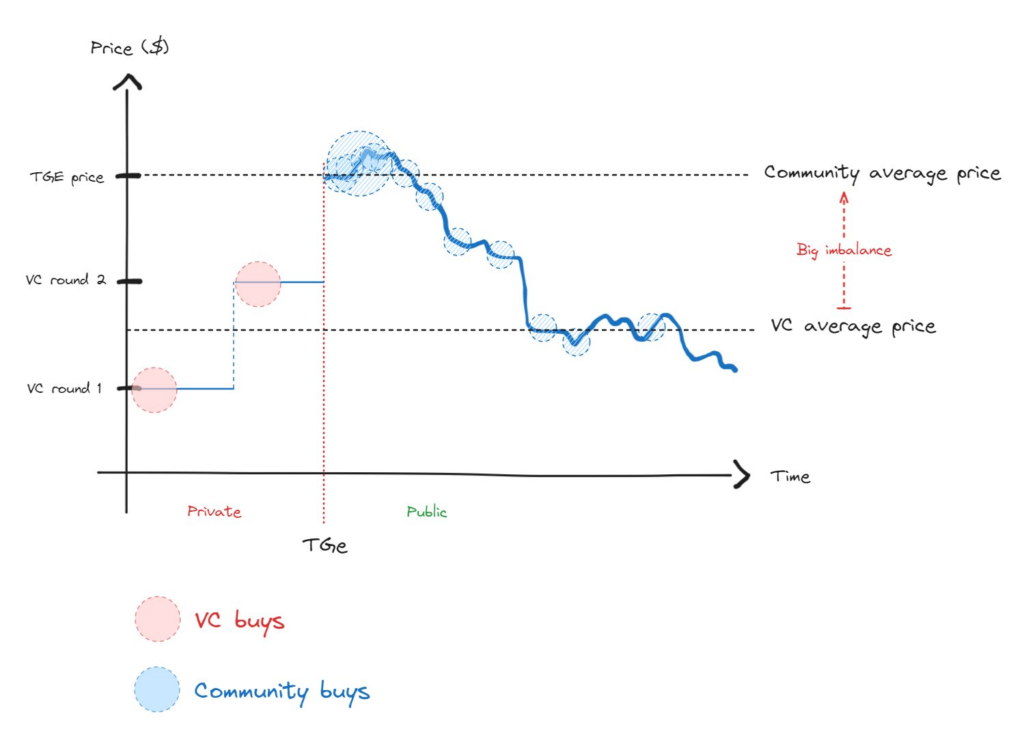

The current high FDV trend creates stark imbalances in cost basis and token supply distribution between liquid buyers at the Token Generation Event (TGE) and private investors. These disparities foster ongoing friction between the two groups, which persists until market forces drive a mean reversion. Typically, TGE participants find themselves in negative positions almost immediately after purchase, while venture capital (VC) investors, having acquired tokens at significantly lower prices, are incentivized to sell as soon as their allocations unlock. As community investors become increasingly aware of this dynamic, they pull back, leading to a sharp decline in interest for new altcoins.

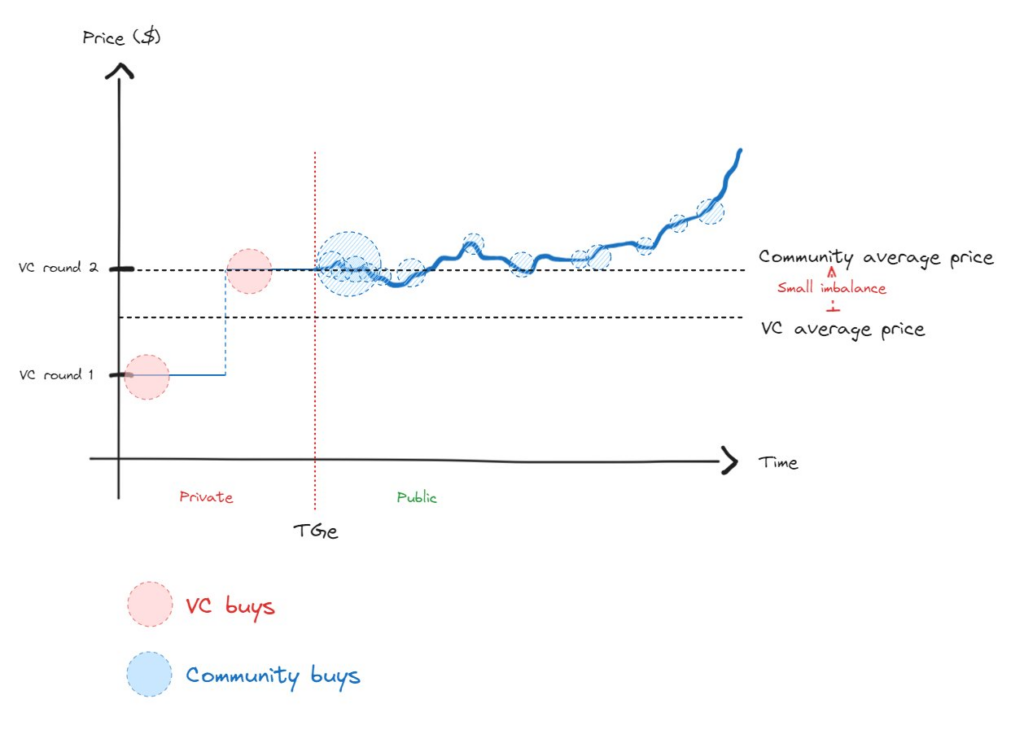

For a more sustainable and balanced market, there needs to be greater alignment between the token prices offered to the community and those given to VCs, facilitating genuine price discovery. In efficient markets, price discovery is inevitable. Although short-term manipulations may artificially sustain elevated valuations, they merely delay the unavoidable correction to the asset’s true market value. Because markets are path-dependent, prolonged downtrends are far more painful than launching with realistic valuations that allow price equilibrium to be established from the outset.

4. Conclusion

To foster a healthier and more sustainable ecosystem, the crypto market must move away from artificially inflated FDVs and reduce the disparities between community and institutional pricing. Aligning incentives between early investors and retail participants will facilitate genuine price discovery and reduce the long-term volatility and negative sentiment currently plaguing new token launches. While short-term valuation strategies may create temporary advantages, the market’s natural forces will inevitably drive prices back to their true value. For investors and projects alike, the focus should shift towards long-term value creation, realistic valuations, and transparent supply distribution to avoid the inefficiencies that have become prevalent in today’s high FDV landscape.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.