1. Banana Gun Introduction

Launched in June 2023, Banana Gun is a Telegram-based trading bot initially developed on the Ethereum blockchain to enable rapid, high-precision trades for its users. Known as a “sniping bot,” Banana Gun is designed to help traders capture early opportunities in new token launches, particularly in the fast-paced world of meme tokens, which often see brief but explosive lifespans.

Since its launch, Banana Gun has rapidly gained traction, expanding to support other ecosystems like Base and Solana. In this article, we’ll explore the unique features of Banana Gun, how it works, and its revenue model.

2. Key Features

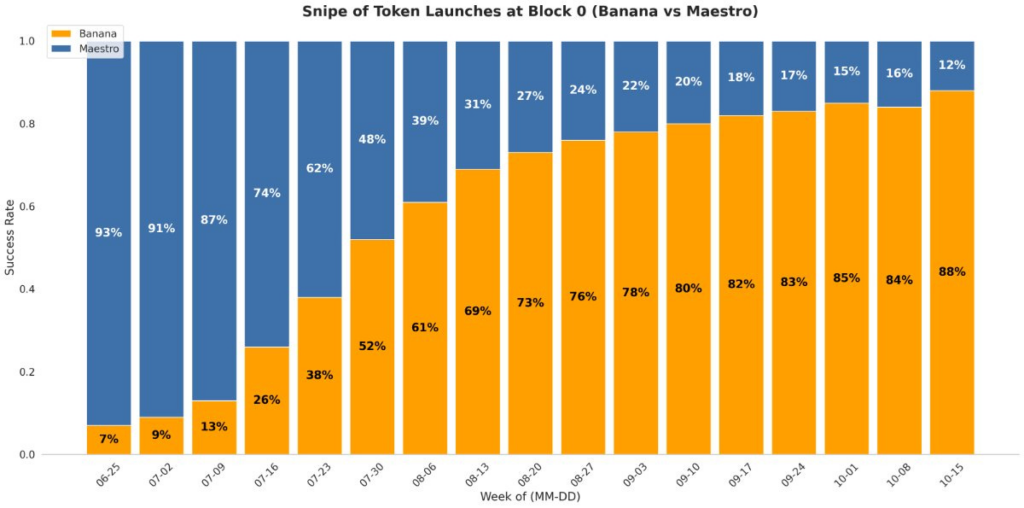

2.1. Sniping Capability

The standout feature of Banana Gun is its sniping function, enabling traders to secure positions in new tokens at “block 0”. This means that the bot allows users to place trades almost instantly as tokens become available on DEXs. Banana Gun’s robust, high-speed trading mechanism provides an advantage over other trading bots by executing orders in the first block of trading, often at a lower price before market participants react. This precision is critical for meme traders, who rely on quick entry and exit points to capitalize on price surges.

2.2. Multi-Chain Expansion

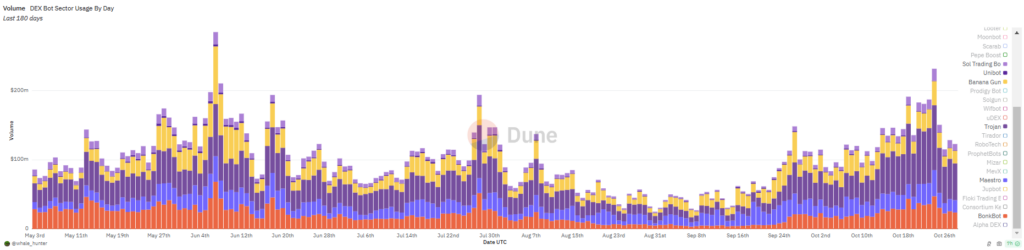

After achieving strong initial success on Ethereum, Banana Gun expanded to Solana, where it faced well-established competitors like Bonkbot and Bullx. Despite these challenges, Banana Gun quickly gained traction on Solana, underscoring its adaptability and community trust. Expanding to Base and Solana not only increased user adoption but also positioned Banana Gun as a cross-chain solution in the high-frequency trading sector, a strategic move that reduces reliance on Ethereum’s network and opens opportunities in ecosystems with lower fees and faster transaction speeds.

2.3. Revenue Model

Banana Gun distinguishes itself with a sustainable revenue model, focusing on “real yield”. Unlike traditional models that rely heavily on trading fees without redistributing value, Banana Gun uses its fees to generate real revenue, which is then allocated back to $BANANA holders. The project thus becomes part of the “real yield” trend – alongside protocols like GMX – which emphasizes sustainable revenue models over token inflation. By prioritizing real returns, Banana Gun has created a long-term value proposition, enhancing token appeal and fostering loyalty among holders.

2.4. Advanced Trading Features

Beyond its sniping capability, Banana Gun incorporates comprehensive trading functionalities commonly found on CEXs, including limit orders, stop-loss mechanisms, dollar-cost averaging (DCA), and copy trading. These tools not only allow users to create customized strategies but also add significant value for those seeking versatile trading options within a single platform.

3. How it works: Trading at “Block 0”

Banana Gun’s value proposition for traders is simple but powerful: executing trades at the moment a token becomes available on a DEX at “block 0″. For traders, entering a position within the first block offers a unique edge to capture high returns before broader market participants catch on.

Banana Gun enables this by wrapping sniping bundles with a mechanism designed to secure priority on Ethereum’s network – a process supported by the strategic use of Ethereum’s Proposer Builder Separation (PBS) model.

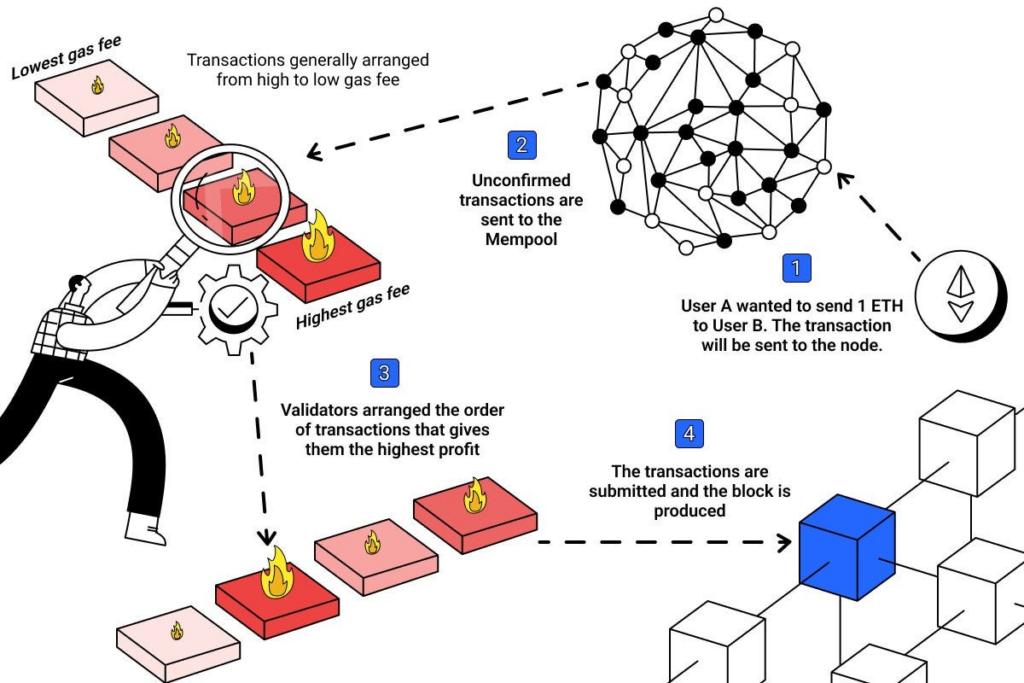

3.1. PBS Model

To fully understand how Banana Gun secures its high-speed execution, it’s crucial to grasp Ethereum’s PBS model. This structure was implemented with Ethereum’s transition to Proof of Stake in The Merge upgrade. PBS separates two critical roles:

- Validators (Proposers): These nodes validate and propose blocks to be added to the blockchain.

- Block Builders: These entities create blocks containing transaction bundles and submit bids (or “bribes”) to proposers, hoping their blocks will be chosen.

The separation addresses challenges related to Maximal Extractable Value (MEV), where priority transaction positioning can lead to front-running or other manipulations. By decoupling these roles, PBS reduces centralization, mitigates MEV vulnerabilities, and enhances network security.

How PBS Works

- Block Builders Bid for Inclusion: Block builders compile transactions into blocks and bid with a “bribe” (part of the transaction fee) that proposers receive if they accept the bid.

- Proposers Select the Highest Bid: Proposers choose the highest bidder to maximize rewards, resulting in efficient value distribution.

The PBS model also introduces Exclusive Order Flows (EOF), enabling certain bundles, such as Banana Gun’s sniping transactions, to be prioritized and sent exclusively to a selected builder. This feature is crucial to Banana Gun’s ability to secure rapid, near-instantaneous entry into trades.

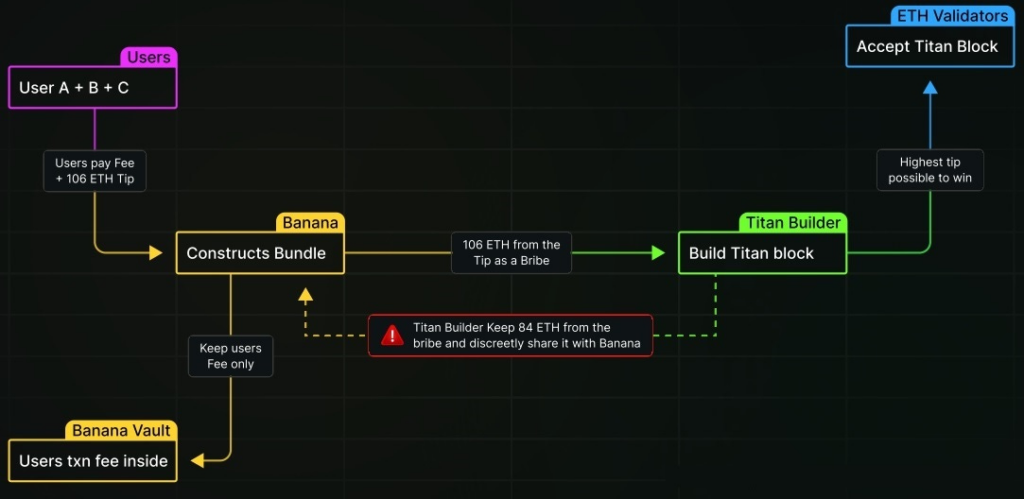

3.2. Banana Gun Model

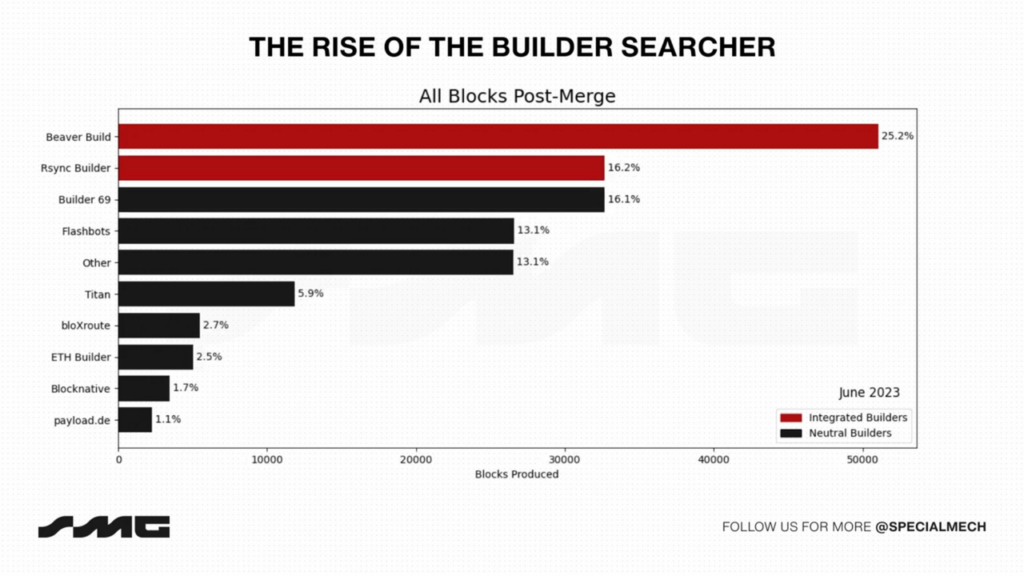

Banana Gun’s model hinges on exclusive order flows that prioritize its “sniping bundles” for execution within the first block of trading. By working directly with Titan Builder, Banana Gun ensures that these bundles are consistently processed before other market participants, securing a near-instantaneous entry.

Here’s how their collaboration works:

- Setting Competitive Bids: Banana Gun sends transaction bundles with high fees (bribes) to Titan Builder. For example, a sniping bundle may include a 5 ETH bribe. If the highest competing bid is 1 ETH, Titan Builder places a slightly higher bid, say 1.1 ETH, ensuring its bid wins while retaining most of the initial bribe (3.9 ETH) as profit.

- Strategic Bidding and Cost Management: Titan Builder’s controlled bidding approach keeps Banana Gun’s transaction costs low while guaranteeing priority access. This balance allows Banana Gun to maintain a competitive edge in decentralized trading with minimal cost overhead.

The result? Titan Builder consistently prioritizes Banana Gun’s sniping transactions, allowing Banana Gun to offer unmatched speed and efficiency for traders aiming to capture the earliest trading opportunities.

Since the partnership with Banana Gun began, Titan Builder has experienced substantial growth. In June 2023, Titan held a 5.9% share of Ethereum’s block-building activity, a figure that has since grown to 18.4%, making Titan one of the network’s top two block-builders. This increase highlights the profitability of prioritizing exclusive transactions, which have contributed significantly to Titan’s revenue and market share.

4. Growth Metrics

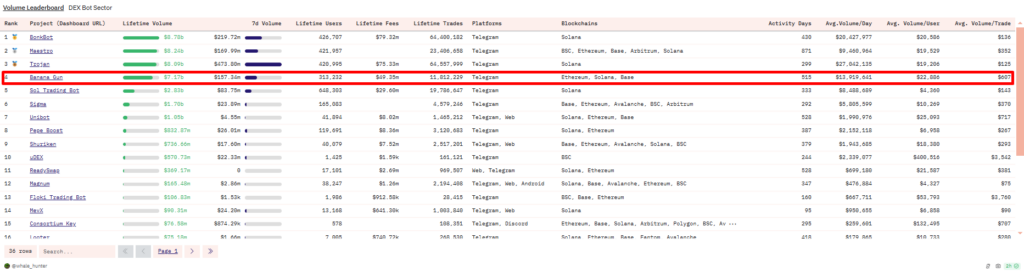

Banana Gun is currently among the top 4 trading bots on Telegram, a significant accomplishment in a competitive bot ecosystem. However, it’s worth noting that Banana Gun is the only project in this space to introduce its token ($BANANA), which enhances its overall credibility and financial model.

The bot generates revenue through transaction fees of 0.5% for Ethereum trades, 1% for Ethereum sniping, and 1% for trades on other chains like Solana and Base.

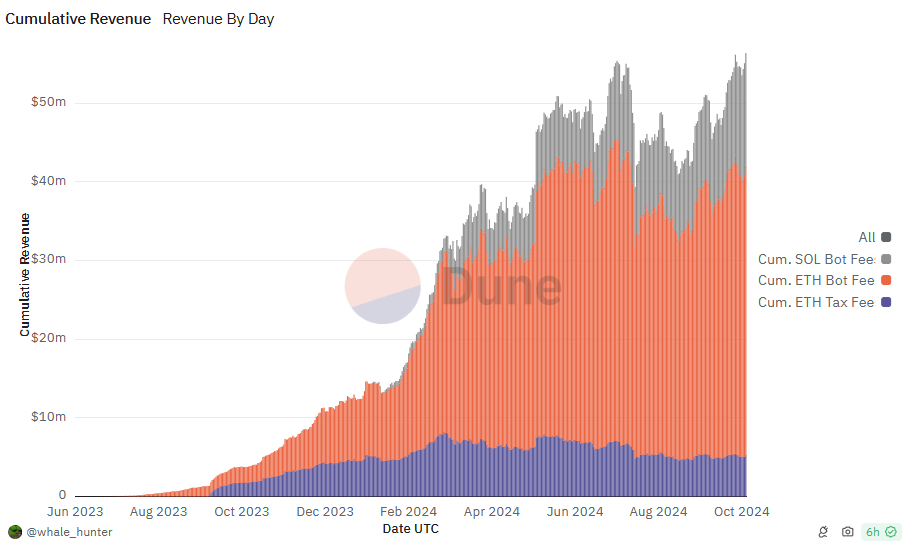

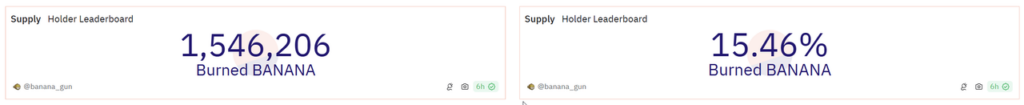

As of the last recorded month, Banana Gun’s monthly accumulated revenue reached $56.37 million, marking a 12% increase. This growth trajectory is slightly lower than the 15% increase seen in September, though it indicates ongoing expansion. Banana Gun’s revenue also supports a token burn mechanism, reducing $BANANA supply and reinforcing its tokenomics by bolstering token scarcity. To date, approximately 1.55 million $BANANA, or 15.5% of the total supply, has been burned.

Banana Gun’s revenue also supports a token burn mechanism, reducing $BANANA supply and reinforcing its tokenomics by bolstering token scarcity. To date, approximately 1.55 million $BANANA, or 15.5% of the total supply, has been burned.

5. Tokenomics

Banana Gun’s tokenomics are structured to create a sustainable ecosystem with long-term incentives for participants.

The $BANANA token has a max supply of 10 million, allocated across various stakeholder groups:

5.1. Token Allocation

- 11% burned

- 8% airdropped to Binance HODLers

- 24% for general holders

- 1% for locked liquidity

- 46% for the treasury and ecosystem fund

5.2. Token Utilities

$BANANA serves as the platform’s governance token and can also be burned to unlock premium bot features. Additionally, token holders gain access to exclusive groups and can benefit from real yield, with 40% of the bot’s revenue distributed among $BANANA holders.

The remainder is allocated to a DAOa that manages $BANANA buy-backs, increasing its intrinsic value.

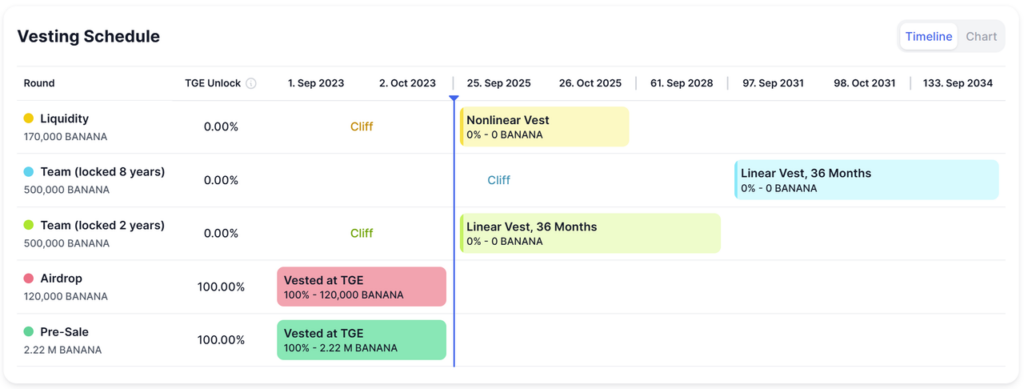

5.3. Token schedule

Since its launch, $BANANA has shown impressive growth, climbing 450% amid strong support for its real yield narrative. This reflects the successful absorption of the airdrop allocation. Currently, $BANANA has a circulating supply of 3.47 million tokens out of a total supply of 8.45 million.

While the project enjoys momentum, there is potential future selling pressure as tokens allocated to the team will be unlocked from September 2025.

6. Closing thoughts

- The Banana Gun team has effectively leveraged the PBS model to secure dominance in the token sniping niche, generating additional profit through an exclusive partnership with Titan Builder that utilizes Exclusive Order Flows.

- By benefiting directly from this mechanism, Banana Gun has established an additional competitive edge over real yield model competitors. The team further strengthens its value proposition by allocating 40% of bot trading fee revenue directly to token holders, providing substantial value to its community.

- The recent Binance listing of $BANANA has also lent significant legitimacy to Banana Gun, especially among the “degen” trading community.

- Another important aspect of Banana Gun’s operational mechanism to consider is the potential for the team to leverage internal information by adding higher bribes – exceeding those submitted by users – to transaction bundles for a trading advantage. This practice has raised transparency concerns within the community, sparking discussions and scrutiny in several instances.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.