I. Overview of the BlackRock USD Institutional Digital Liquidity Fund:

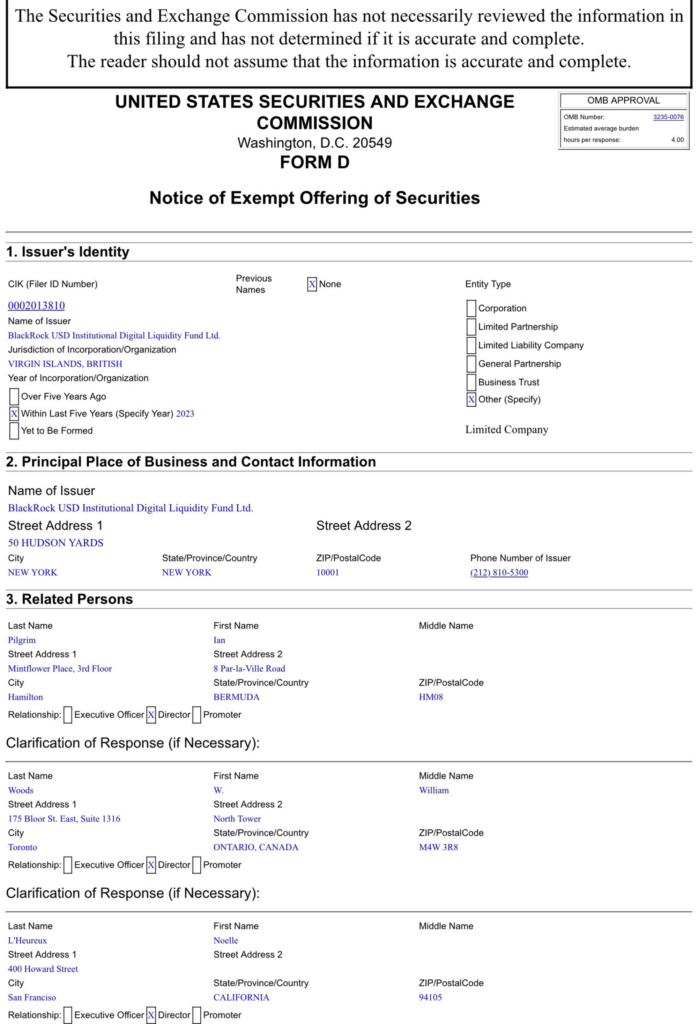

- BlackRock has announced the launch of a tokenized asset fund, depositing $100 million USDC on the Ethereum network.

- Securitize will act as the transfer agent and tokenization platform, while BNY Mellon will serve as the asset custodian for the fund.

- Coinbase has been selected as the primary infrastructure provider for BlackRock and the Securitize Tokenized Investment Fund.

- The tokenized fund serves three main use cases:

- Aimed at crypto companies seeking to manage their treasuries on blockchains, and this includes decentralized autonomous organizations, or DAOs.

- For crypto projects focused on creating derivatives of Treasury bills, the fund can be a foundational asset for developing these products.

- An alternative to stable coins (BUIDL tokens), and can be used as collateral for borrowing and trading. The “BUIDL” Tokenized Fund is fully backed by cash, US Treasury bonds, and repurchase agreements.

II. Current state of the tokenized RWAs:

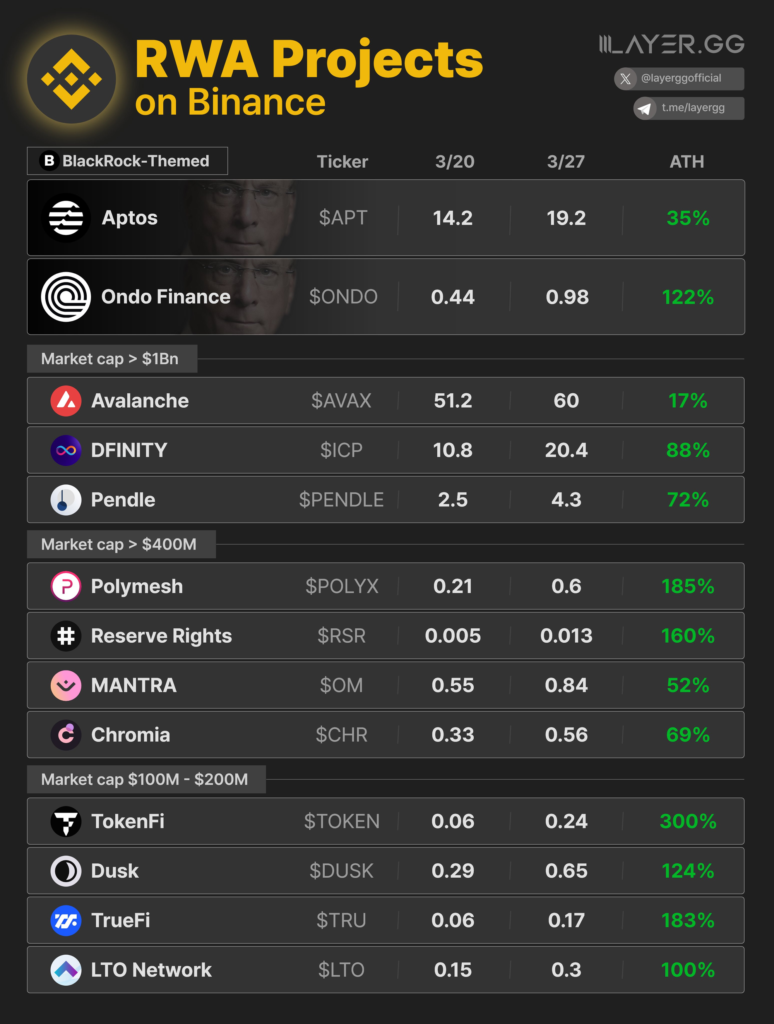

- “Mid/Low cap” RWA projects listed on Binance are exhibiting outstanding performance ($POLYX +200%, $ONDO + 131%, $TRU & $GFI +100%).

- The current standout RWA projects are confined to areas including:

- Tokenizing institutional-grade financial products & services like US Treasuries (ONDO).

- Private Credit (TRU, Maple).

- Yield farming (Pendle).

- Infrastructure for converting RWAs into legally compliant digital securities (CFG, LINK,…) / Layer-1 Blockchain for RWAs (LTO, OM).

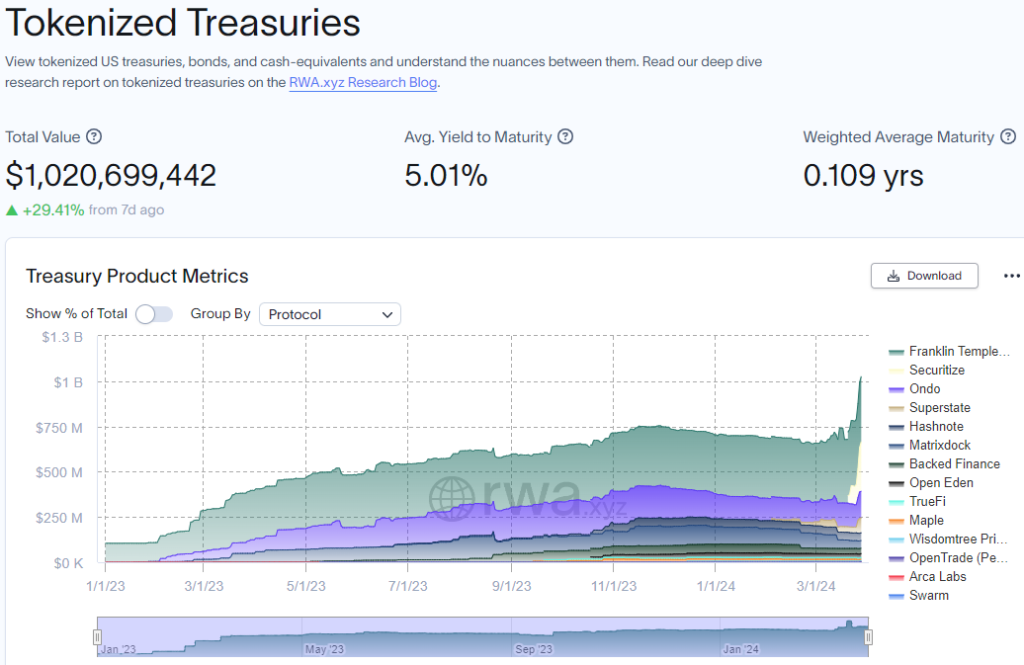

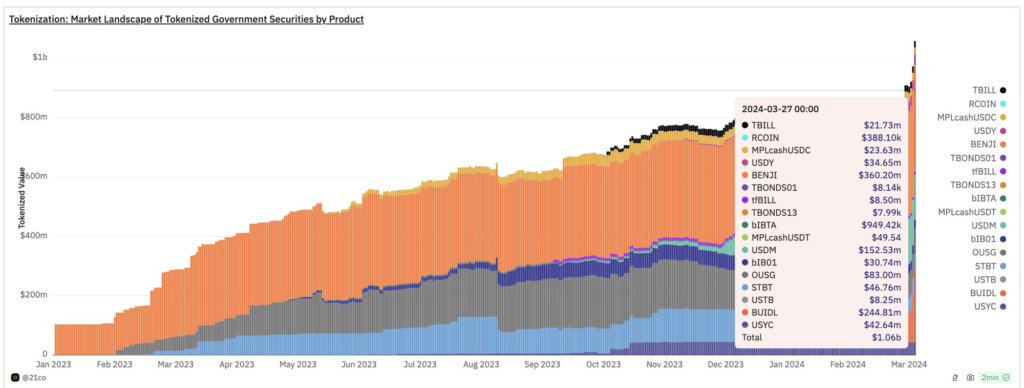

- Notably, creating blockchain-based tokens of traditional investments such as bonds and funds represents a rapidly growing use case for blockchain technology. Tokenized U.S. Treasuries, for instance, have expanded to $1 billion from $100 million in early 2023 as crypto firms look to earn steady yields by investing their on-chain funds. Protocols $MKR $ONDO utilizing US Treasuries for tokenization have bridged high yields, safe government debt, and blockchain liquidity, attracting significant capital inflow.

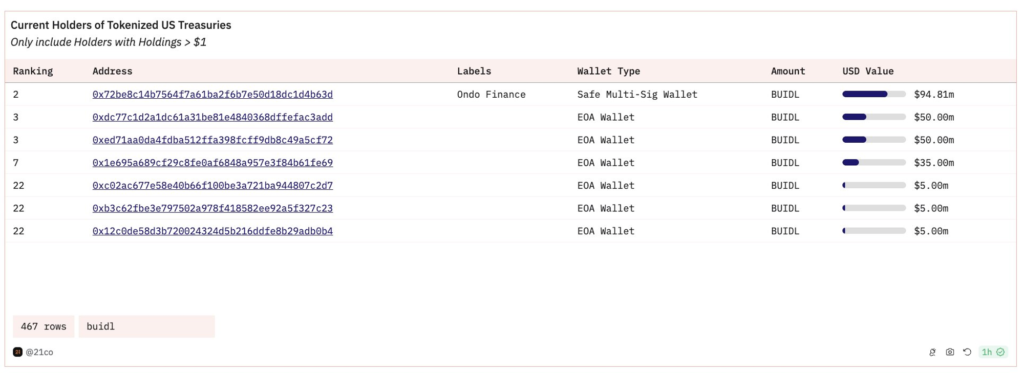

- BlackRock’s BUIDL experienced a 500% increase on March 27, from a supply of 40M to 245M in a week. Moreover, over $1 billion in US Treasuries have now been tokenized on-chain, partly driven by the recent success of the BlackRock USD Institutional Digital Liquidity Fund. Consequently, I anticipate $5 billion in tokenized treasuries by the end of the year.

- Ondo Finance has invested a total amount of $95 million in BlackRock’s BUIDL and become the largest holder of BUIDL (possessing 38% of the total supply). Now, Ondo’s OUSG is fully backed by BUIDL.

III. Final Thoughts:

- This cycle is not focused on retail investors but rather on institutions like BlackRock and their forthcoming actions. CEO Larry Fink believes that tokenization and exchange-traded funds (ETFs) will revolutionize finance. Currently, the RWA narrative is being driven by BlackRock’s tokenization fund.

- The second major developmental boost comes as other giants in traditional finance have already made significant advancements in technology:

- Banking titan JPMorgan Chase & Co. has launched Onyx Digital Assets, focusing on tokenization and has processed over $700 billion in transactions since 2015.

- Citi has engaged with blockchain technology since 2015, recruiting Ryan Rugg, a former executive at IBM, to lead the bank’s tokenization efforts.

- Franklin Templeton has operated its FOBXX fund on the public decentralized blockchain Stellar since 2021 — becoming the first fund to run on a public blockchain.

- From an investment perspective, should a partnership with a global asset management company like BlackRock be announced, it is highly likely that RWAs coin will follow the trajectory previously seen by AVAX, which saw a price increase of more than 4x following the “Project Guardian” with JPMorgan & Wisdomtree.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.