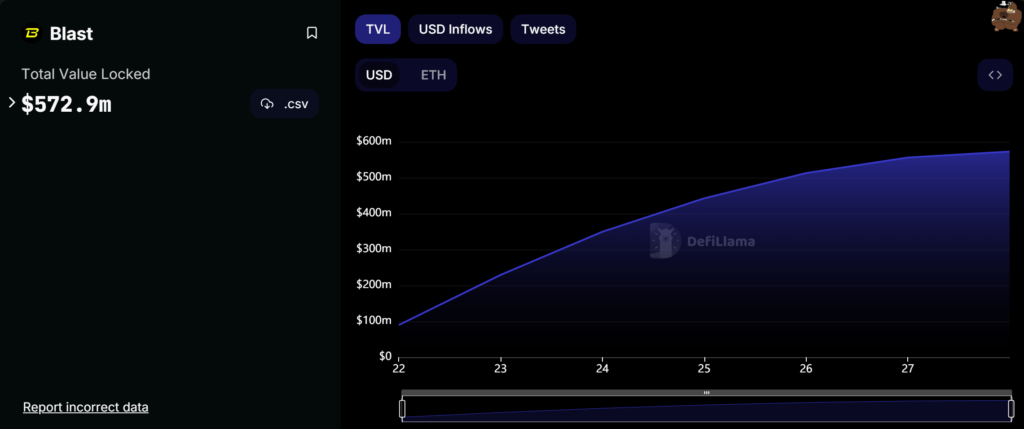

Blast, a new Layer 2 EVM-compatible developed by the team behind the NFT marketplace Blur, has surpassed $550 million in total value locked just seven days after its launch. Blast introduced it as an EVM-compatible optimistic rollup, offering a base yield for users and developers through staking, providing a 4% yield for ETH and 5% for stablecoins.

https://defillama.com/protocol/blast

Significantly, the Blast smart contract operates as a one-way bridge, enabling users to send their funds but not get them back. Despite the inability to withdraw funds until February 2024, when the network becomes operational, the total amount sent to the contract has surpassed $550 million. The Blast total value bridged exceeds the zkSync Era and trails only behind Layer 2s like Arbitrum, Optimism, and Base. In addition to earning yields through staking rewards from Lido and MakerDAO, users can accumulate Blast Points based on their token deposits. These points can be redeemed in May of the following year, and users can earn additional points by utilizing a referral code to onboard others to the network.

The launch of Blast has faced criticism within the community. Despite presenting itself as a layer 2 optimistic rollup, Polygon developer Jarrod Watts expressed concerns, stating, “There’s no testnet, no transactions, no bridge, no rollup, and no sending of transaction data to Ethereum. And It’s not an L2.” Adding to the concerns, Watts mentioned that users won’t be able to withdraw their money unless 3-5 people hold the key of multisig to allow withdrawals in the future. On the downside, to retrieve users’ funds, Blast needs to deploy a new contract with the withdraw function. However, the owner of the contract could potentially drain all funds via the “enableTransition” function without requiring an upgrade to the code.

In response to criticism tweets, Blast stated that upgradable contracts enable developers to promptly address contract bugs and exploits. They argued that timelocks on upgrades or immutable smart contracts provide less security when responding to such issues. Blast emphasized that each of its multisig signers uses different hardware wallets, is geographically separated, and employs cold storage to secure user assets. However, the Twitter account named Beetle pointed out that four out of the five individuals holding the multisig key had their first transaction funded by the same wallet, suggesting that despite being multisig, it has the same owner.

Lately, Dan Robinson, a researcher at Paradigm (an investor in Blast), expressed dissatisfaction with Blast’s choice to release its bridging contract before deploying its Layer 2, the inability of depositors to withdraw their assets until after three months, and the marketing campaign conducted by the Blast team. Robinson’s tweet garnered varied reactions from the crypto community, with many accusing Paradigm of attempting to save face in a disingenuous manner.