1. Overview

BounceBit is a groundbreaking staking platform that seeks to enhance the utility of Bitcoin by integrating various forms of Wrapped BTC into a unified ecosystem.

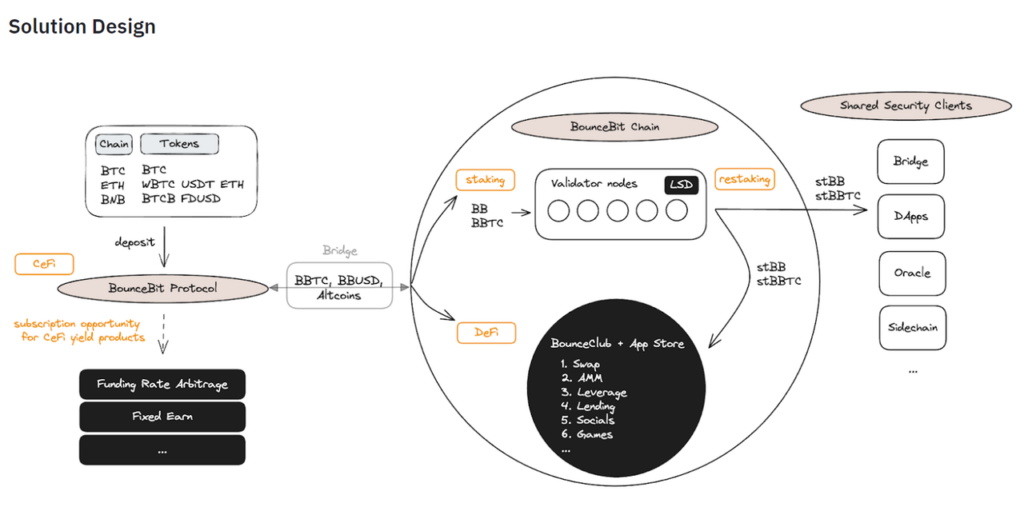

With its innovative approach, BounceBit offers personalized experiences through Bounce Club, enabling users to interact with and customize Dapps available on the BounceBit app store. By centralizing liquidity and improving the efficiency and flexibility of BTC assets, BounceBit aims to unlock the full potential of Bitcoin in the DeFi space.

- For holders: Through its unique CeDefi framework, BounceBit empowers BTC holders to earn yield from multiple sources. This framework combines the benefits of centralized and decentralized finance, providing users with a comprehensive and flexible solution.

- For developers: BounceBit is designed to establish a Web3 ecosystem that caters to the needs of both developers and end-users. The platform simplifies smart contract deployment, providing users with a user-friendly interface for interacting and customizing Dapps. This accessibility encourages wider adoption and participation in the decentralized finance space. Developers, on the other hand, have access to a robust environment and powerful tools to build their own decentralized applications, fostering innovation and growth within the ecosystem.

2. Key Features

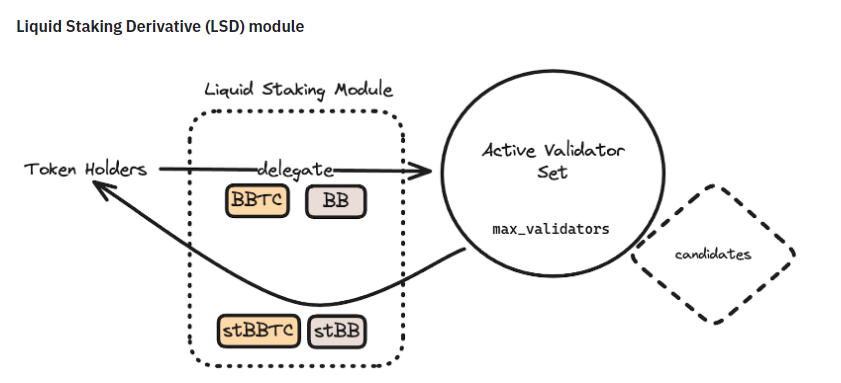

BounceBit operates on a Layer 1 infrastructure that comprises a dual-token PoS consensus mechanism and a native Liquidity Staking Delegation (LSD) module. The dual-token PoS mechanism allows validators to accept both $BBTC and $BB tokens, ensuring a secure and efficient staking process. The native LSD module enables users to delegate their staking activities to validators and receive LST vouchers in return. This further enhances the flexibility and accessibility of the staking process.

To ensure the safety and security of user funds, BounceBit has a foundational CeFi layer that includes regulated custody solutions utilizing Multi-Party Computation (MPC) wallets. This robust custody framework provides peace of mind to users, knowing that their assets are stored in a secure environment. Additionally, BounceBit incorporates an Off-Exchange Settlement (OES) mechanism, enabling users to access liquidity from CEX while settling transactions off the exchange itself. This feature enhances liquidity and accessibility without compromising security.

One of the standout features of BounceBit is its distinction as the first Megadrop project on Binance. This pioneering initiative introduces the concept of Megadrops, allowing users to benefit from unique opportunities and incentives within the BounceBit ecosystem. This innovative approach sets BounceBit apart and positions it as a leader in the market of the Bitcoin Ecosystem.

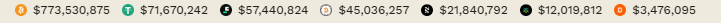

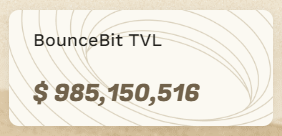

Additionally, BounceBit boasts an impressive Total Value Locked (TVL) that exceeds $1 billion, with over 80% of the TVL consisting of BTC assets. This achievement showcases the platform’s success in attracting significant value and participation from the crypto community.

3. Financial

BounceBit has successfully raised $6 million in a seed funding round co-led by Blockchain Capital and Breyer Capital during its past fundraising event, highlighting strong support and confidence from investors.

Recently, Binance Labs announced its investment in BounceBit to support Bitcoin restaking and CeDeFi innovations.

4. Tokenomics

4.1. Token Metrics

The total token supply of $BB is set at 2,100,000,000, with a circulating supply of 409,500,000 upon listing.

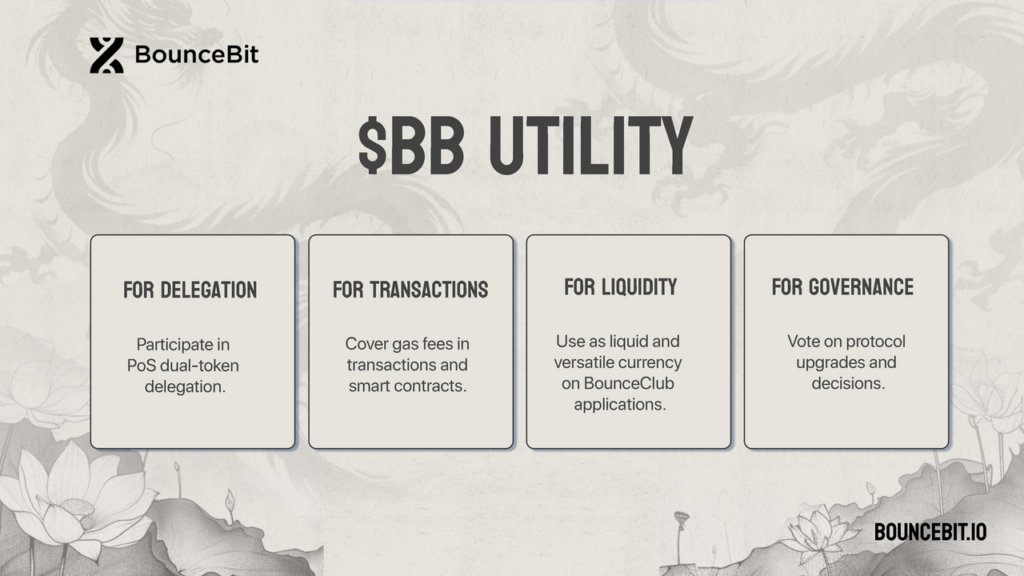

The $BB token has several other crucial utilities within the BounceBit ecosystem.

- It serves as a protocol incentive, rewarding validators who secure the network with staking rewards.

- $BB is used as the denomination for gas fees required to conduct transactions and execute smart contracts on the platform.

- The token enables holders to participate in on-chain governance, granting them voting rights on protocol upgrades and other important decisions.

- The token is used as liquid and versatile currency on BounceClub applications.

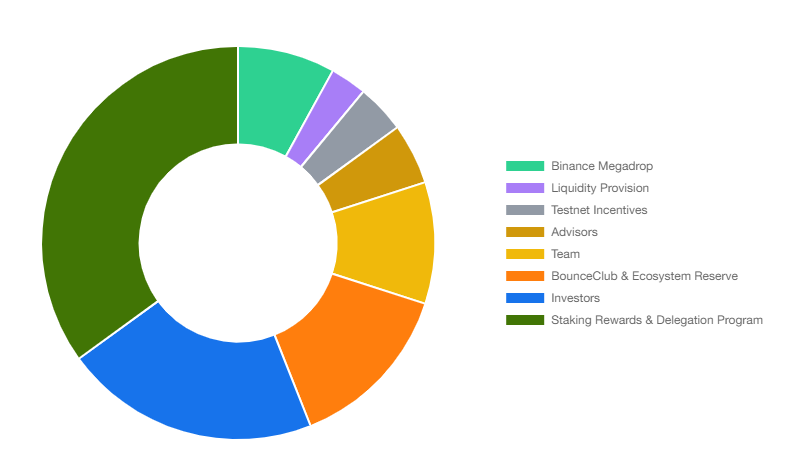

4.2. Token Allocation

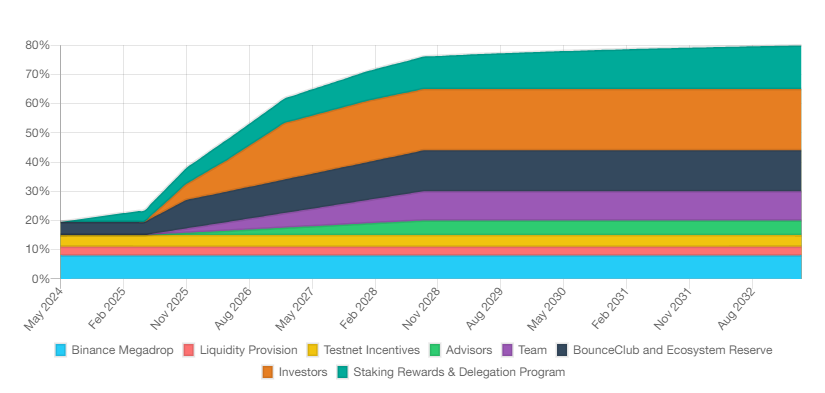

4.3. Token Release Schedule

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.