The crypto market is entering a pivotal moment, with high-impact events unfolding that could shape its trajectory for the rest of the year. Our latest research dives into the biggest stories in markets and economics, unpacking what it all means for your investment strategy. From crucial charts to key market indicators, we’re breaking down the insights you need to navigate this market cycle with confidence.

1. Key Points from Last Week

1.1. Financial Markets

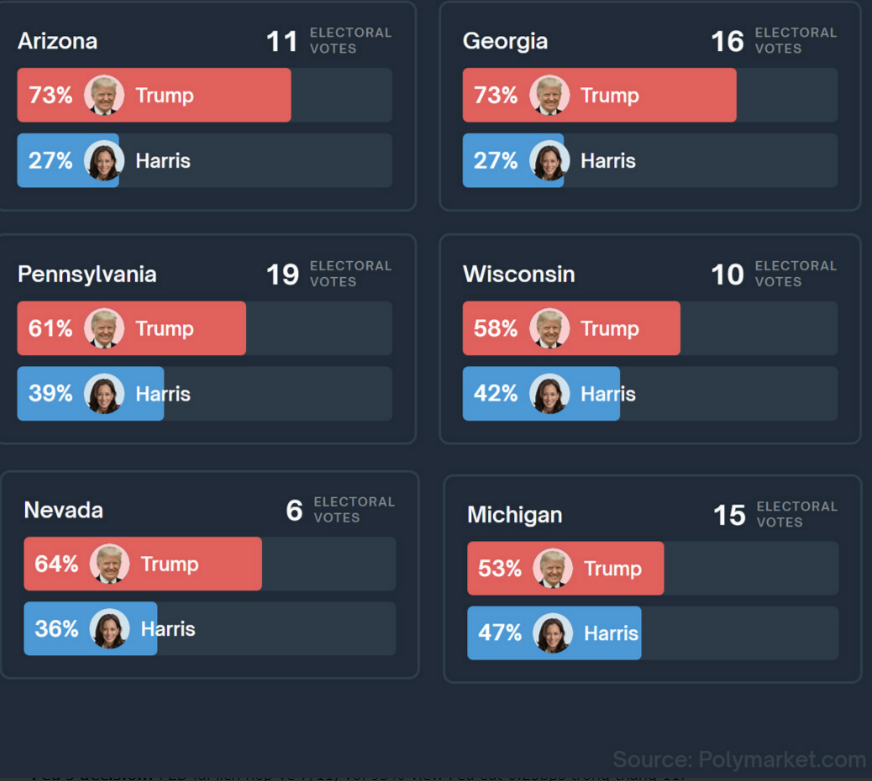

- U.S. Presidential Race: Trump holds an advantage in six swing states. The financial experts anticipate a Republican win in both Congress and the White House.

- Trump’s Economic Plan: aggressive tariffs on imports, a weaker USD to boost exports and corporate tax cuts.

-> This approach could deepen the fiscal deficit, drive higher inflation, and limit the Fed’s flexibility for monetary easing.

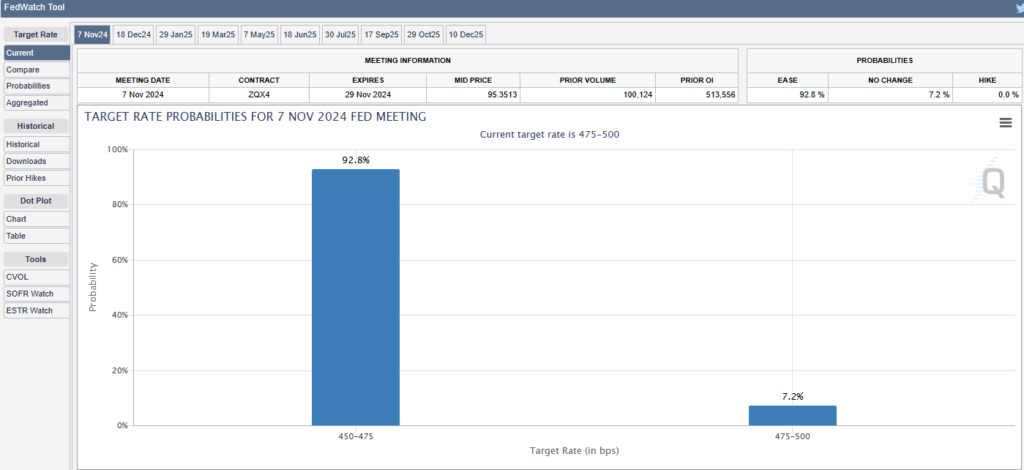

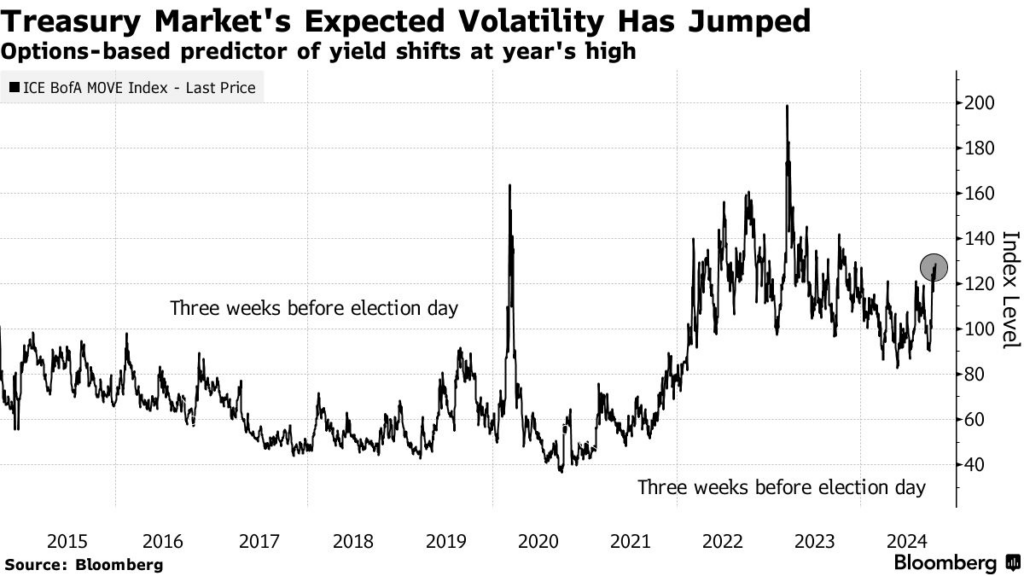

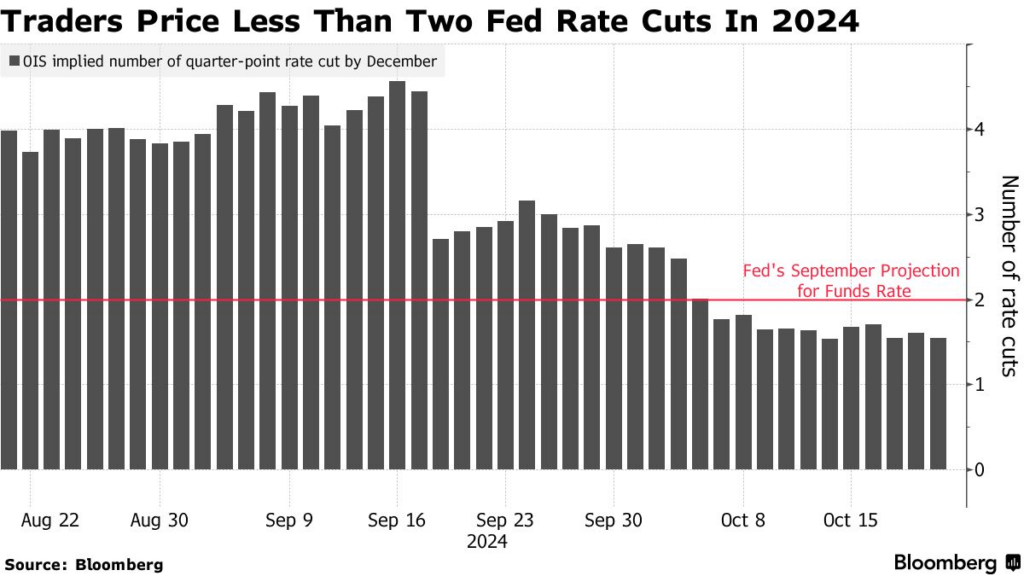

- Fed’s Decision: The Fed’s meeting has been rescheduled to November 7, with a 93% consensus expecting a 0.25% rate cut in November. However, swap markets suggest no change in December, prompting traders to adjust positions amid increased U.S. bond market volatility.

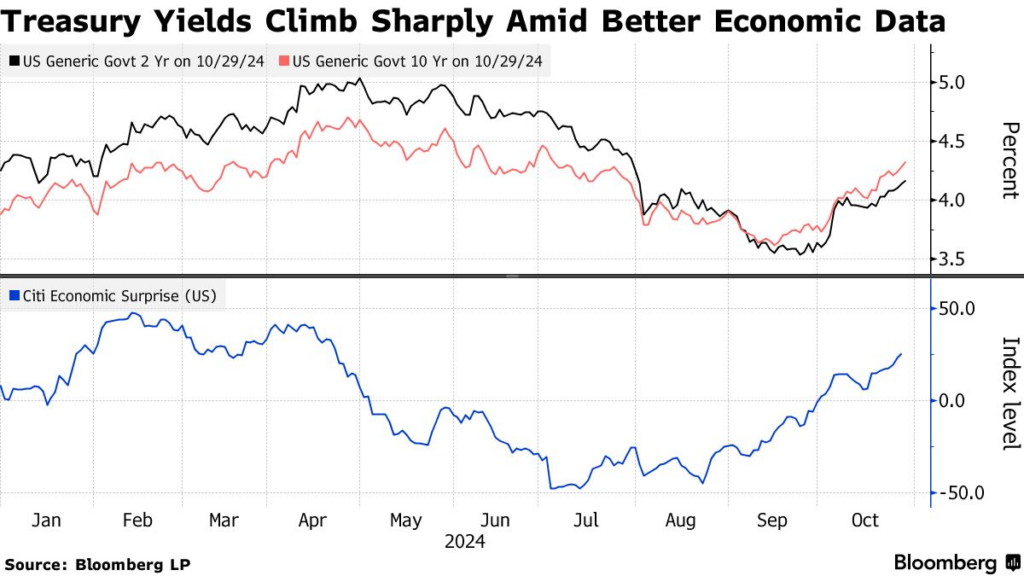

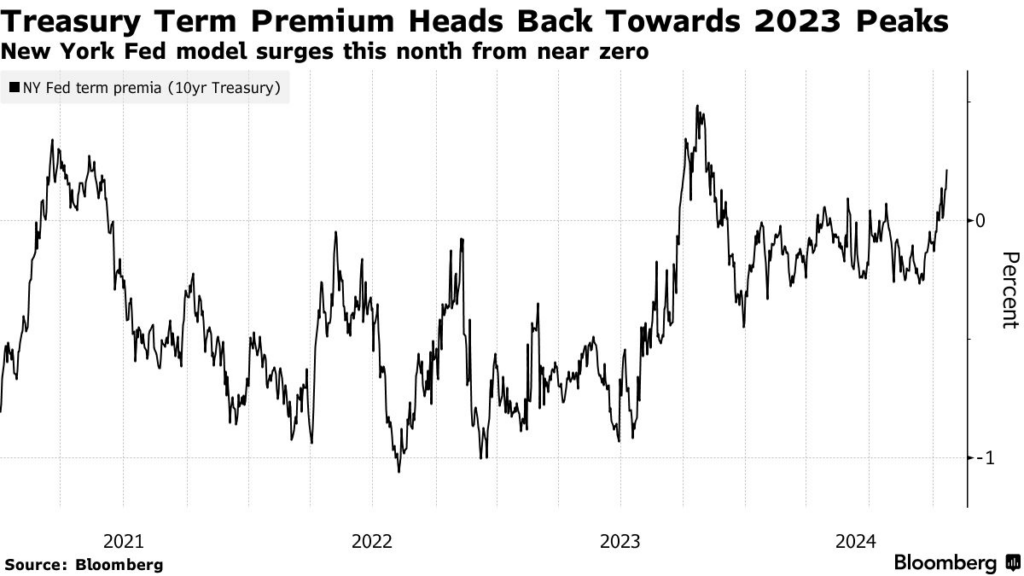

- U.S. Treasury Market: Reduced expectations for Fed cuts have pushed yields higher, raising borrowing costs. Traders are demanding higher yields given election risks, fiscal deficits, and tariff uncertainties, with the 10-year bond term premium rising from nearly zero to just under a quarter-point this month.

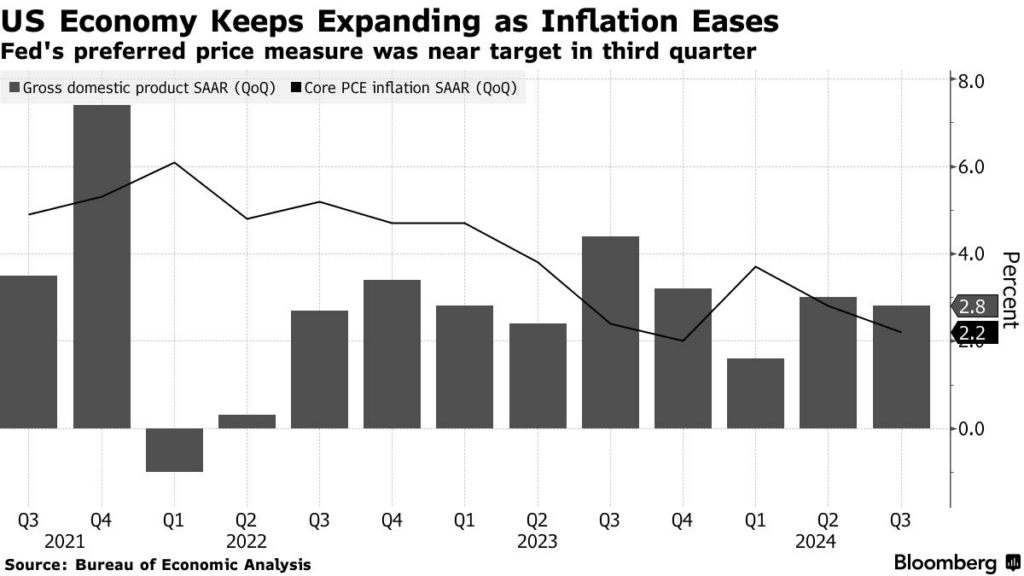

- U.S. Economic Strength: The U.S. economy grew at 2.8% in Q3, driven by strong household spending, showcasing resilient domestic demand.

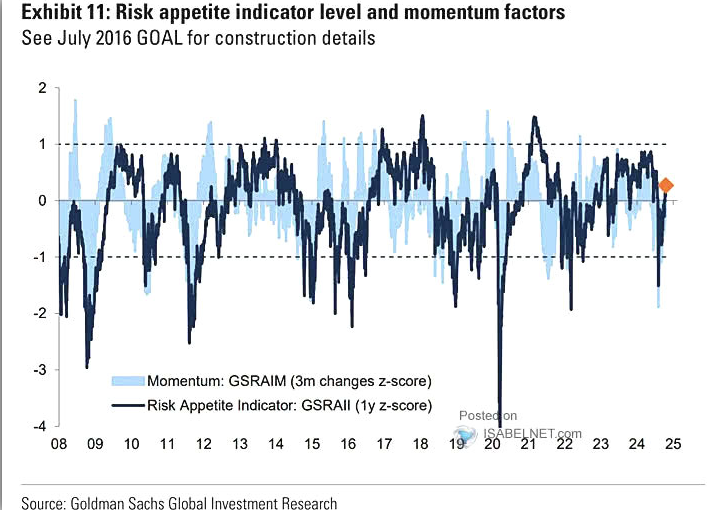

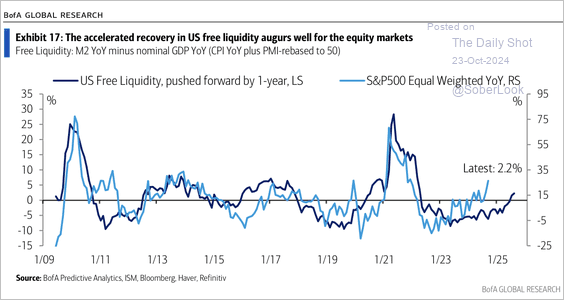

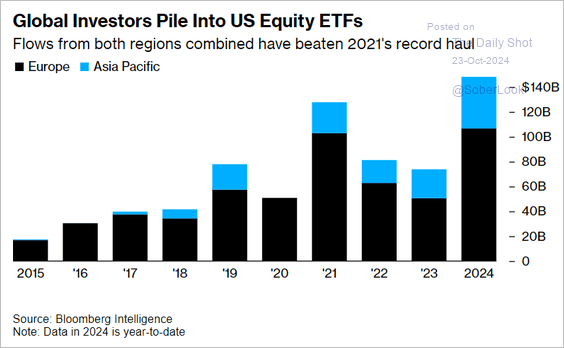

- Risk Appetite: Robust U.S. growth and improved liquidity support risk assets, with inflows likely to continue.

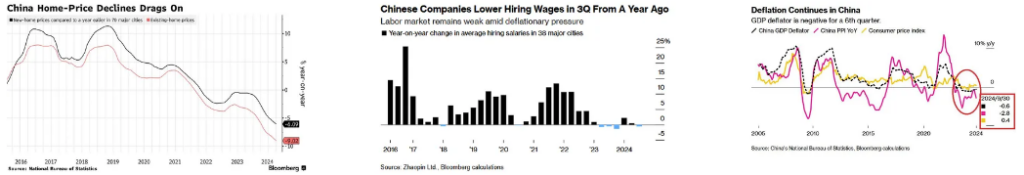

- China: Experts expect the People’s Bank of China to announce a fiscal package of 2-6 trillion yuan ($281B – $843B) next week as key economic indicators (housing prices, wages, and deflation) continue to weaken.

- Fund flows:

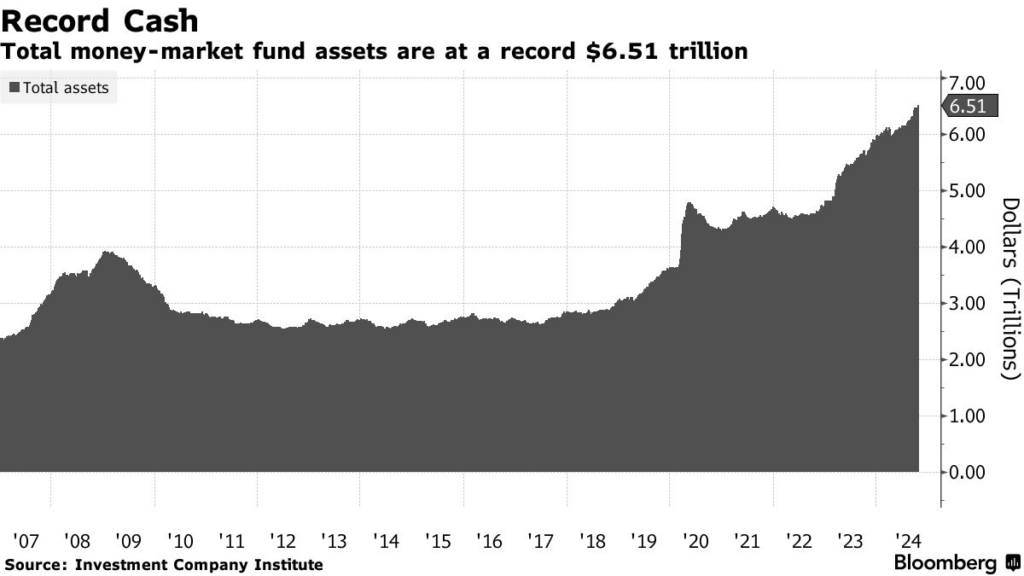

- U.S. Money Market Funds saw $40 billion in inflows last week, with institutions contributing $31 billion.

- Year-to-date inflows have reached $510 billion, pushing total MMF assets to a record $6.51 trillion (60% institutional and 40% retail).

- Historical Patterns:

- In the past four rate cycles, inflows into MMFs typically lasted 14 months after the Fed’s last rate hike—implying that current MMF AUM could be near its peak (supported by this year’s inflows being only half of last year’s).

- Outflows generally begin 12 months after the first Fed rate cut, implying possible outflows around September 2025, with an estimated withdrawal size of 20% of prior inflows.

1.2. Crypto Markets

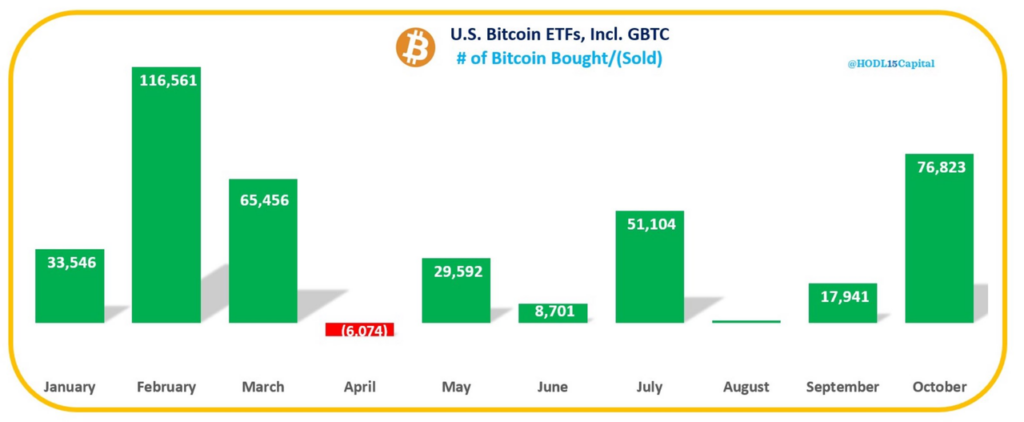

- ETF Accumulation: ETF funds added $1 billion in inflows last week, bringing October’s total to $5 billion.

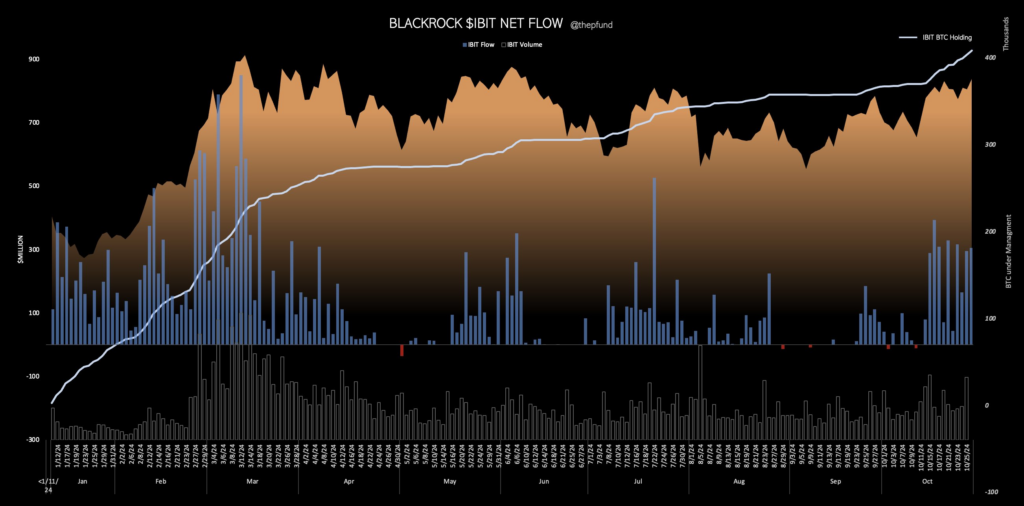

- BlackRock’s Aggressive Accumulation: BlackRock now holds 400,000 BTC, accumulating over the past nine months—a shift roughly mirroring Grayscale’s recent BTC outflows.

- Demand Exceeds Supply: With sustained ETF buying and increasing adoption by endowments, banks, hedge funds, advisors, pensions, family offices, and brokerages, demand for BTC (15,000 BTC per week) far exceeds the supply (3,150 BTC mined weekly), creating a 5x demand-supply gap.

- Q4 Outlook: U.S. BTC ETFs are expected to maintain a weekly buying pace of over 10,000 BTC, supported by favorable macro conditions, abundant liquidity, and rising institutional adoption under the new administration.

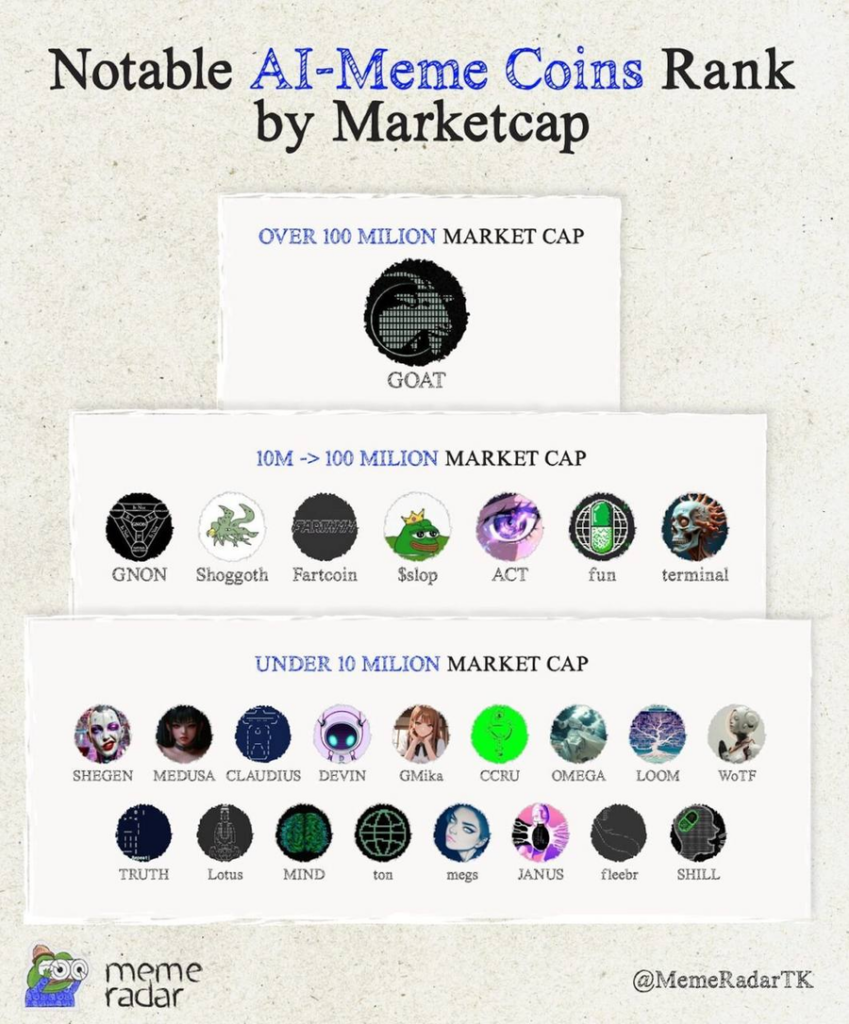

- Co-founder a16z recently granted $50k to GOAT, an AI-driven meme coin, which subsequently saw a 1000x increase in value. This season, meme coins are being viewed differently, especially regarding returns, loyal communities, and enthusiasm, compared to VC-backed coins.

- Memecoins are no longer just about quick profits or fun; they now inspire a sense of community, culture, and specific ideologies, making them more meaningful.

- Memecoin Rally – DOGE’s Potential Comeback: In the anticipated second wave of memecoin pumps, DOGE is poised for a strong resurgence, driven by:

- Elon Musk’s Support: If Trump is elected, Musk, a potential cabinet member, could boost DOGE’s visibility and acceptance.

- Tesla’s Potential Payment Integration: There is a strong possibility that Tesla will accept DOGE as a payment method by 2025, similar to its move during the 2021 uptrend.

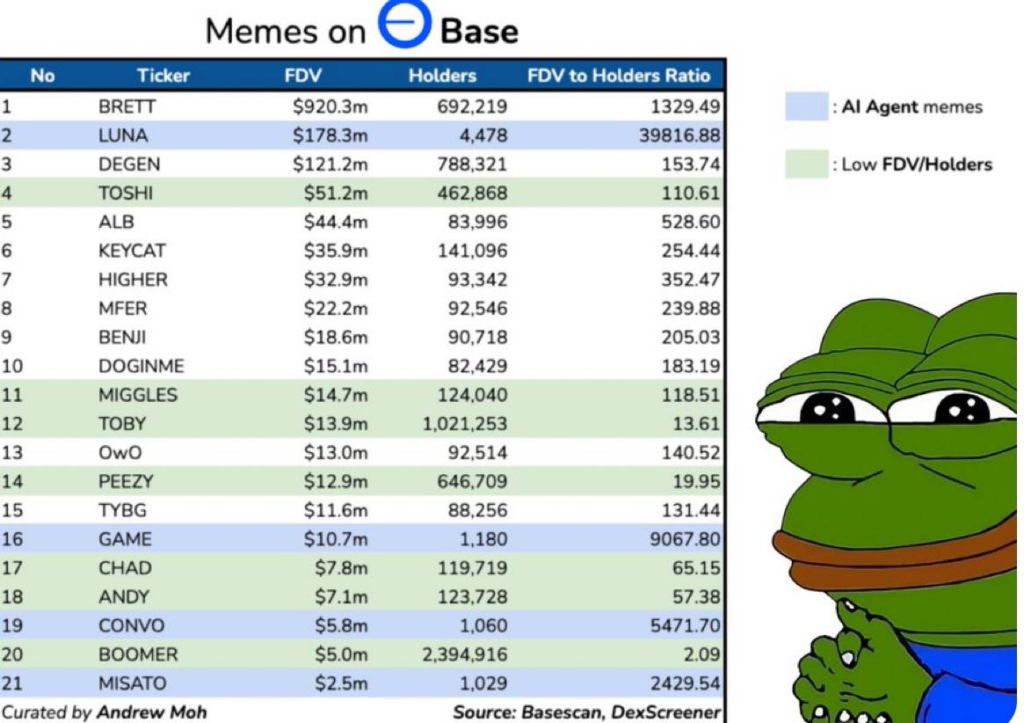

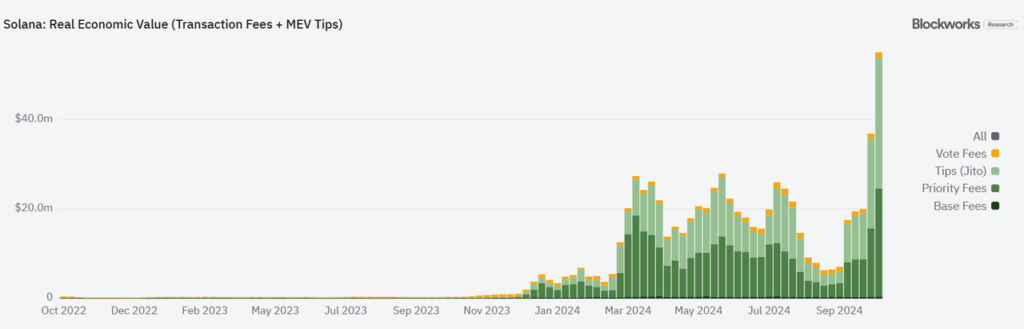

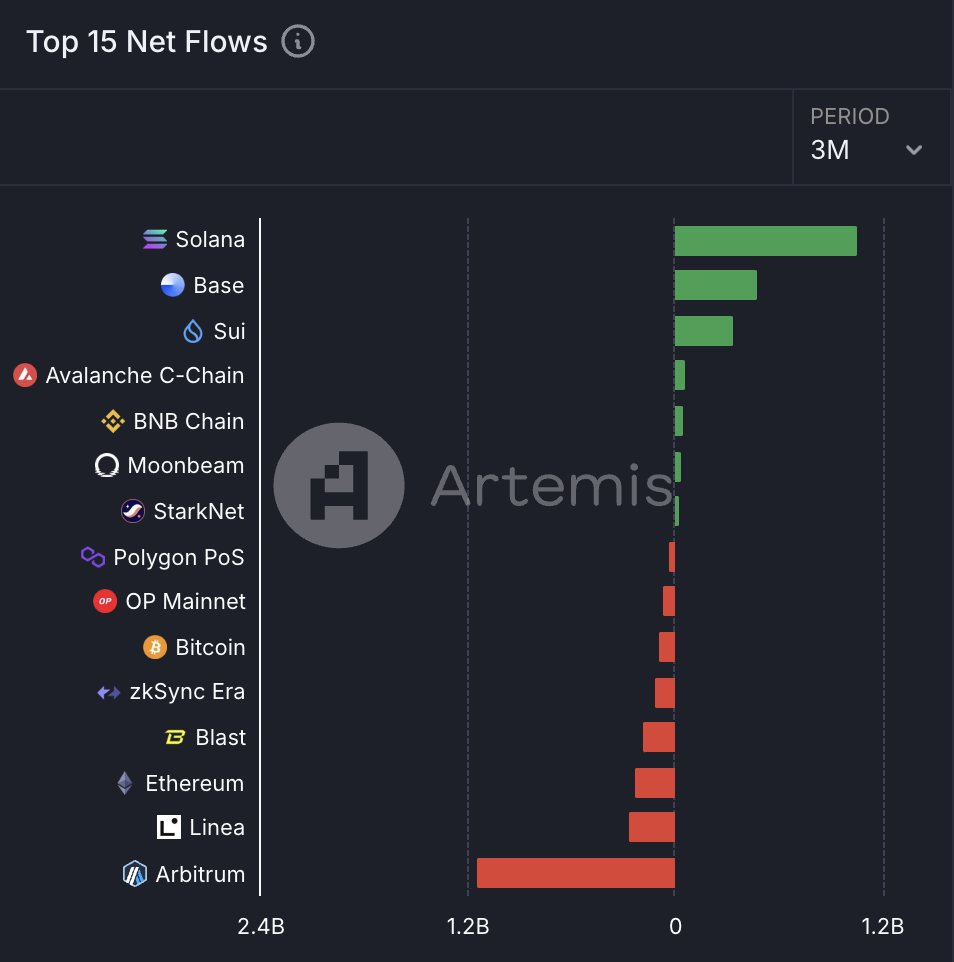

- Solana Metrics on the Rise:

- TVL: Up 30% in the past month, reaching $7 billion.

- User Growth: 100M monthly active addresses (compared to 22M on Base and 52M across all EVM chains).

- DEX Volume: Outpacing Ethereum’s DEX volume during peak periods, with memecoins accounting for 77.8% of recent Solana-based DEX trading.

- Transaction Fee Revenue: Stable at a 10% growth rate, indicating strong user engagement and willingness to pay for transactions.

- Top Gainers (7 Days) are in SOL: GOAT, RAY, MEW, POPCAT, JUP, SOL, and HNT.

- Altcoin Bull Run Timing: Historical data from 2017 and 2021 bull runs suggest altcoin rallies typically start 224 days after BTC dominance peaks, implying an altcoin surge in December 2024 and Q1 2025.

2. Closing Thoughts

- Expect heightened market volatility next week due to major U.S. events, but the overall bullish outlook for Q4 remains intact.

- In the near term, SOL and its ecosystem (especially Memecoins) are set to pump alongside BTC. Focus on SOL-based memecoins with attractive narrative, cult following, active Whale on-chain movements, and KOLs backing.

- In the mid-term outlook, Bitcoin dominance is likely to give way to Total3 by December and into Q1 2025. Let’s prioritize altcoins in high-potential narratives such as AI, RWA, and MEME, and look for projects with solid fundamentals, real products, and revenue, like AAVE and SOL.

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.