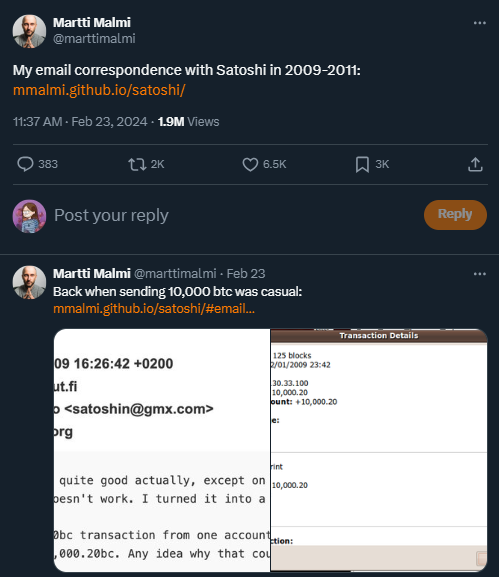

On 23/02/2023, a collection of new emails attributed to the pseudonymous Bitcoin creator, Satoshi Nakamoto (they), was publicly disclosed. These emails were released as part of the London court case initiated by the Crypto Open Patent Alliance (COPA) against Craig Wright, who has long claimed to be Satoshi Nakamoto without providing substantial evidence. The emails primarily involve conversations between Satoshi Nakamoto and Adam Back, a crypto pioneer, as well as with Martti Malmi, an early contributor to the Bitcoin code.

The release of these new emails, made public by Martti Malmi, not only contributes to the existing lore surrounding Bitcoin but also offers readers further insights into the humble origins of Bitcoin and the collaborative efforts undertaken by Satoshi to launch the network.

Following this intriguing event, enthusiasts of cryptocurrencies have expressed particular interest in two main aspects: the true identity of Satoshi and the initial purpose behind the creation of Bitcoin. This article focuses primarily on explaining the latter, shedding light on the early intentions of Bitcoin’s creator.

What is Bitcoin?

Satoshi Nakamoto held the view that Bitcoin should not be perceived as an investment. It appears that they recognized the potential consequences of categorizing Bitcoin as an asset, as it would likely draw scrutiny and oversight from regulatory bodies such as the SEC.

“Even so, I'm uncomfortable with explicitly saying "Consider it an investment". That's a dangerous thing to say and you should delete that bullet point.”

- Satoshi Nakamoto's email

Explaining the terms

The original statement in its whitepaper describes Bitcoin as a “P2P e-cash system,” consisting of two components: P2P and e-cash. Before delving into the details, let’s first clarify the meaning of the following concepts:

- Currency: “Currency is a medium of exchange for goods and services. In short, it’s money, in the form of paper and coins, usually issued by a government and generally accepted at its face value as a method of payment.” (Investopedia)

- Forms of currency: Currency can be embodied in the form of paper, coins, online banking, etc. We have this table mentioning the forms of each currency:

| Currency | Forms of currency |

| Commodity currency: gold, seashell, petroleum,…. | Physical commodities |

| Fiat currency: USD, EUR, CNY,… | – Physical cash, physical coin – e-cash (online banking, mobile payment…) |

| Cryptocurrency: BTC, ETH,… | P2P e-cash (BTC, ETH,…) |

From e-cash…

e-cash represents an online iteration of physical currency, whereby the funds within your bank account and Apple Wallet are also denoted as e-cash. However, there exist certain concerns about this particular modality. Diverging from tangible transactions involving cash or commodities, the balance figures exhibited on the digital interface are derived from a repository maintained by financial institutions or other intermediaries, thereby rendering them susceptible to facile tampering. In simpler terms, these entities possess the capacity to exercise unrestricted control over your monetary assets. Consequently, this arrangement necessitates trust in a third party (such as a financial institution or prominent technology corporation) to ensure the verification of the value attributed to one’s account, thereby safeguarding the integrity of the financial worth.

… to P2P e-cash…

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

- Bitcoin whitepaper

It is impossible to assert with absolute certainty that one possesses $60 million in their bank account, as ultimately, it consists solely of lines of code. Online transactions and payments, unlike physical cash, are reversible, necessitating the involvement of a third party to settle disputes. Consequently, this gives rise to additional costs for dispute resolution in the case of minor transactions or unwarranted information leakage. Bitcoin, however, seeks to establish a peer-to-peer (P2P) electronic cash system, enabling P2P transactions akin to physical cash. In this context, one can confidently affirm the ownership of 1000 BTC, as their immutable transaction history remains unalterable.

Is there a demand for a system that is entirely non-reversible and completely P2P? Bitcoin presents itself as an alternative payment option within the vast expanse of the internet. It is important to recognize that we are merely at the early stages of the internet era. Upon the emergence of Airbnb, for instance, traditional hotels did not undergo complete eradication.

“These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.”

- Bitcoin whitepaper

… and then a brand-new currency – cryptocurrency.

It is noteworthy that in the whitepaper, Satoshi explicitly expressed the intention to replace the existing payment systems of medium, without fundamentally undermining fiat currencies. Furthermore, when examining the calculation of Bitcoin’s supply, Satoshi envisioned its utilization within a relatively limited scope of global commerce.

Subsequently, in a series of leaked emails, Satoshi expressed his interest in the term “cryptocurrency.”:

“Someone came up with the word "cryptocurrency"... maybe it's a word we should use when describing Bitcoin, do you like it?”

- Satoshi Nakamoto's email

Martti Malmi responded:

“It sounds good. "The P2P Cryptocurrency" could be considered as the slogan, even if it's a bit more difficult to say than "The Digital P2P Cash". It still describes the system better and sounds more interesting, I think."

- Martti Malmi's email

To establish Bitcoin as a fully P2P system, it is necessary to separate it from all intermediaries, including governmental entities, thereby transforming it into a currency that can freely traverse the internet. The question of whether the Internet should possess sovereignty remains a subject of considerable debate. Nevertheless, as Bitcoin evolves into a currency, it introduces a new narrative. There is a heightened interest in deliberating the contentious aspects surrounding it. In terms of payment, Bitcoin serves as an additional alternative to transactions conducted through banks and other intermediaries. In the realm of currency, it introduces a non-fiat form of money, which traditionally falls under the purview of state control.

If we consider non-fiat cryptocurrencies, Bitcoin and Ethereum come to mind. However, when it comes to a cryptocurrency that still relies on fiat currency, it is referred to as a Central Bank Digital Currency (CBDC). In such cases, blockchain technology is employed primarily as a means to ensure security (immutability and resistance to hacking), rather than emphasizing decentralization. It is worth noting that many CBDCs even utilize centralized databases. From a governmental standpoint, it is understandable that they would seek to establish a monetary system where they can exercise control over all currency flows and monitor the compliance of banks with their directives.

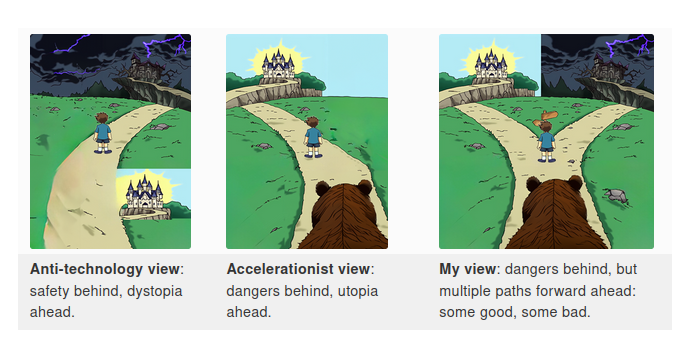

Dystopian or utopian?

However, the path towards achieving the lofty goals of Bitcoin is still unfolding. In reality, the value of Bitcoin continues to fluctuate based on market investment demand rather than reflecting payment needs. Currently, the price of Bitcoin has risen to such heights that it is not yet suitable to be considered as a currency. Whether Bitcoin resembles the distorted version of Karl Marx’s idea of communism transformed into totalitarianism or whether it falls into the realms of a dystopian or utopian concept remains unclear.

The matter is that Bitcoin, cryptocurrencies, and blockchain technology are certain to further elevate numerous real-world aspects into the digital realm. The initial impact will be felt in the realm of currency, followed by the integration of other digital assets through NFTs.

Economic factors likely play a crucial role in this process. As we recognize the potential certainty that exists on the internet, it becomes the responsibility of economists and individuals to leverage it effectively.

Bitcoin, alongside other cryptocurrencies sharing similar intentions, is poised to enhance the landscape of online commerce, thereby catalyzing transformations across various industries. Change is inevitable, and it is the only constant to place trust in. Humans possess the ingenuity to navigate through this evolving landscape.

Another discussion from a recently published email

The discourse extends beyond those aforementioned points, as email correspondence delves into various facets of Bitcoin.

- Energy consumption: Satoshi designated Proof of Work (PoW) as a pivotal element for network coordination, counteracting double spending, and providing the exclusive solution for peer-to-peer cryptocurrency without reliance on trusted third parties. Satoshi also envisions a future where Bitcoin mining and network ownership are accessible to all. While acknowledging the potential surge in energy consumption associated with Bitcoin’s scalability, Nakamoto posits that it would still be a more judicious employment of resources compared to conventional banking operations.

"If it did grow to consume significant energy, I think it would still be less wasteful than the labour and resource-intensive conventional banking activity it would replace. The cost would be an order of magnitude less than the billions in banking fees that pay for all those brick and mortar buildings, skyscrapers and junk mail credit card offers."

- Satoshi Nakamoto's email

- Non-financial Applications: In addition to Bitcoin’s utilization as a medium of exchange, Nakamoto perceives blockchain as an open-source notary, permitting users to securely timestamp their information by embedding it into Bitcoin blocks, thereby providing verifiable proof of its existence at a specific point in time.

- Anonymity: Regarding the matter of anonymity, Nakamoto advises against amplifying the privacy attributes of Bitcoin. He cautions that transaction histories have the potential to unveil the identities of users. The originator of Bitcoin comments:

"Also, anonymous sounds a bit shady. I think the people who want anonymous will still figure it out without us trumpeting it."

- Satoshi Nakamoto's email

The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.