I. Overview

The cryptocurrency market experienced significant gains yesterday. The highlights are as follows:

- Bitcoin saw a surge of over 9%, reaching a high of $72,000, while Ethereum increased by 20%, breaking above the $3,800 mark. Both BTC and ETH are nearing new all-time highs, signaling robust rebound trends.

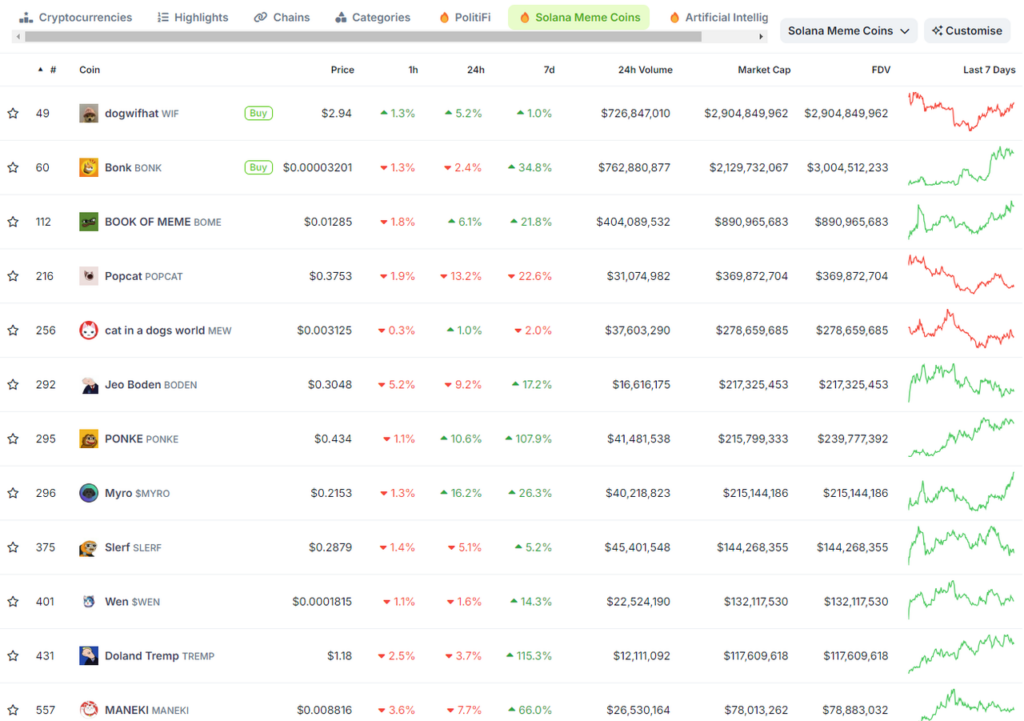

- Memecoins are one of the main drivers of the current market trend. The vibrant trading activity around Bitcoin and other major tokens has bolstered retail investor enthusiasm and market liquidity, which in turn supports the rising popularity of memecoins such as PEPE, BOME, BONK, and MANEKI.

II. Major Drivers Behind the Ascent of Crypto Assets

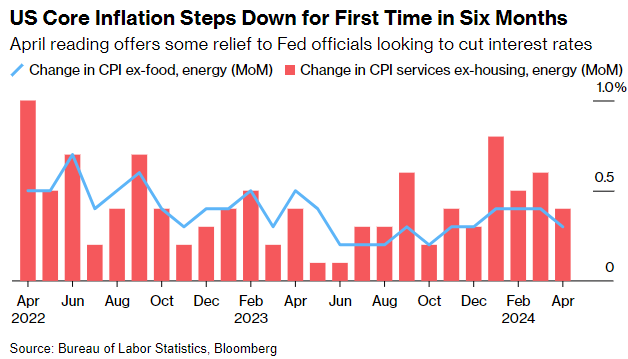

1. Softer U.S. Inflation

- Core CPI, closely monitored by the Federal Reserve, has shown a decrease for the first time in six months, which has significantly boosted the likelihood of a Fed interest rate cut. Futures markets now anticipate a 60% chance of a rate cut in September, with expectations of one to two cuts this year.

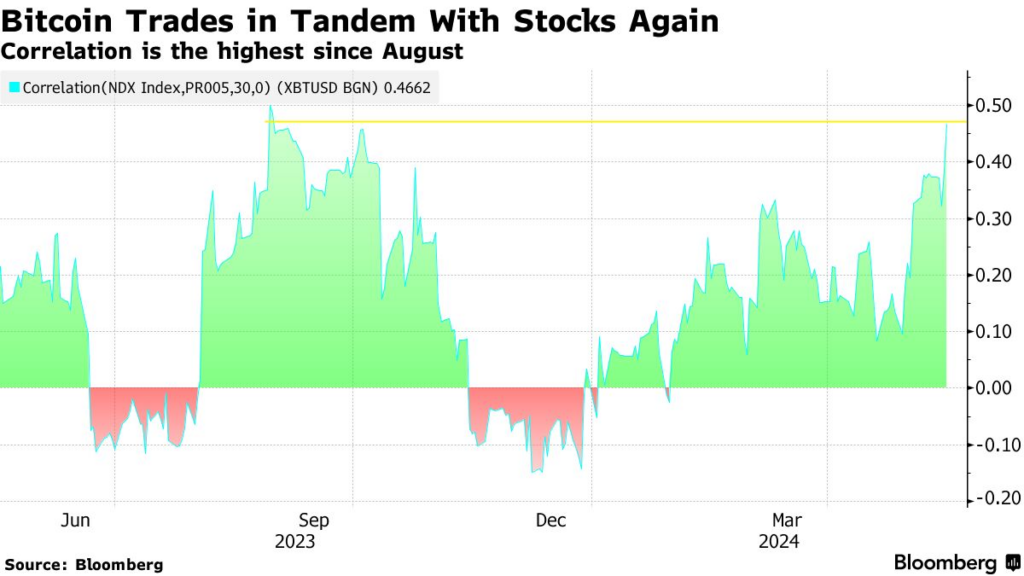

- This news has led to a decrease in U.S. Treasury yields and a weakening of the Dollar Index, benefiting the capital and risk markets. All three major U.S. stock indices have risen, with the Nasdaq reaching a new historical high. Mainstream cryptocurrencies mirrored this upward movement, with gains of about 10% in a single day, showing a positive correlation with tech stocks.

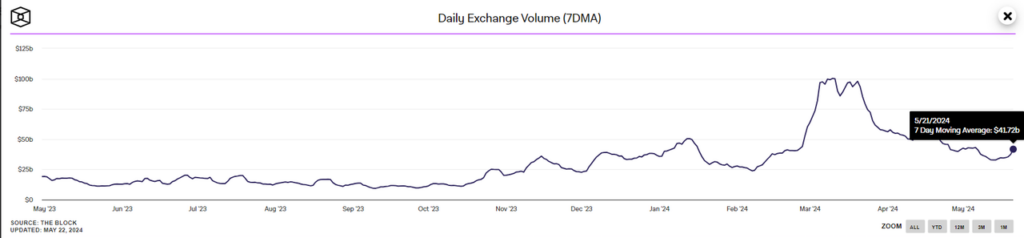

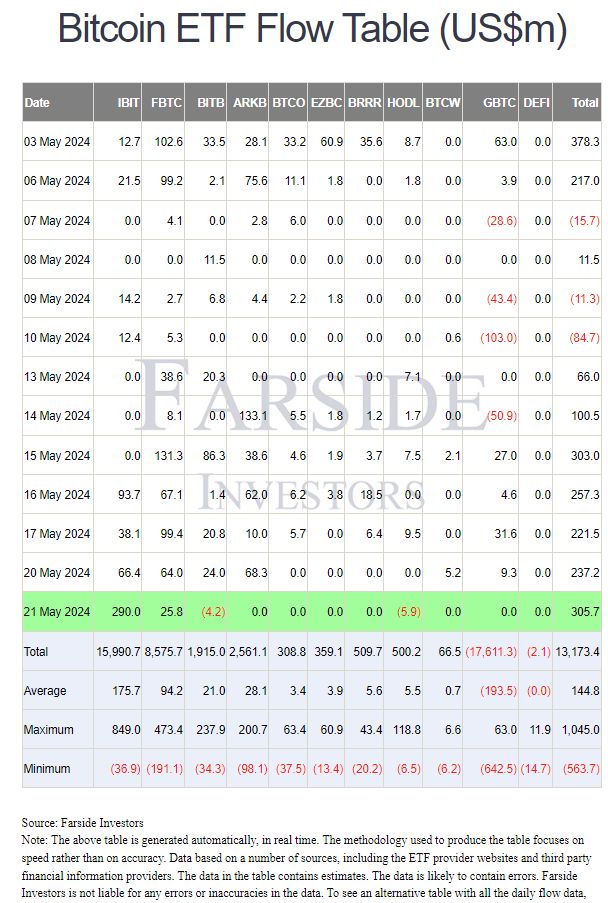

2. Positive Net Inflows into U.S. BTC ETFs

- Bitcoin ETFs have seen net inflows of $305 million, marking a week of sustained traditional capital entering the cryptocurrency market and contributing to its upward trend.

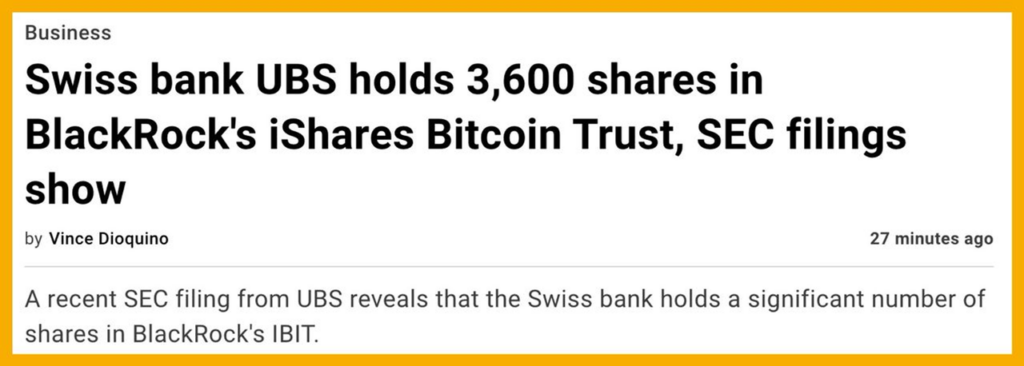

3. Growing Institutional Adoption

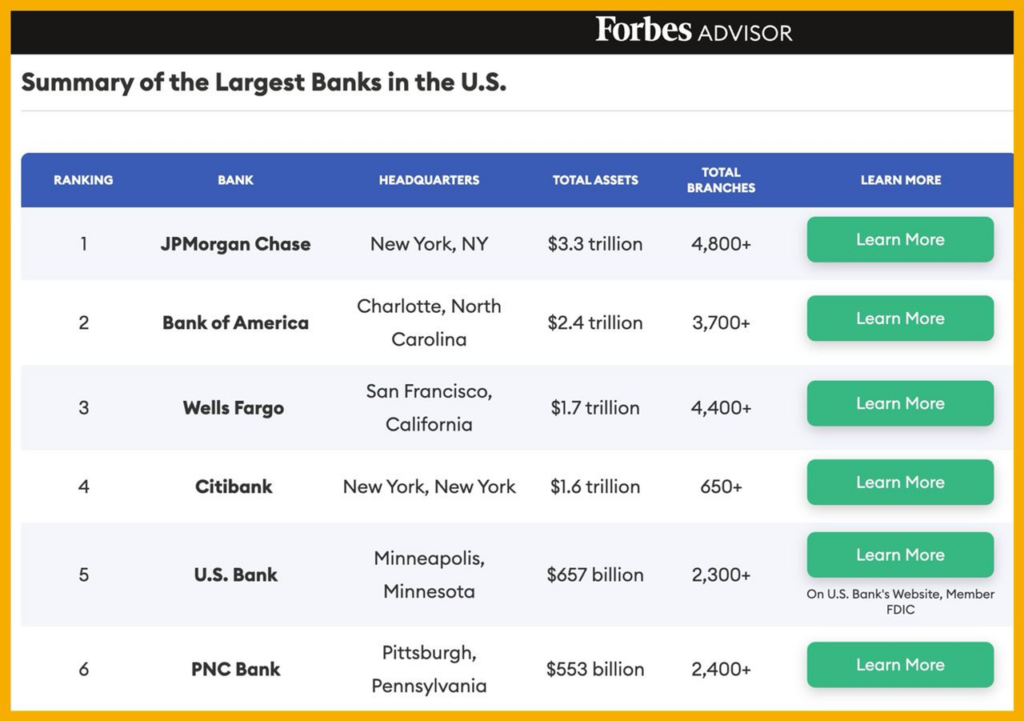

- Recent disclosures have revealed substantial holdings in Bitcoin ETFs by prominent financial institutions, including some of the largest U.S banks and hedge funds such as Millennium Management, which has invested approximately $2 billion across at least four Bitcoin ETFs. Significant positions are also held by Steven Cohen’s Point72 Asset Management and Elliott Investment Management.

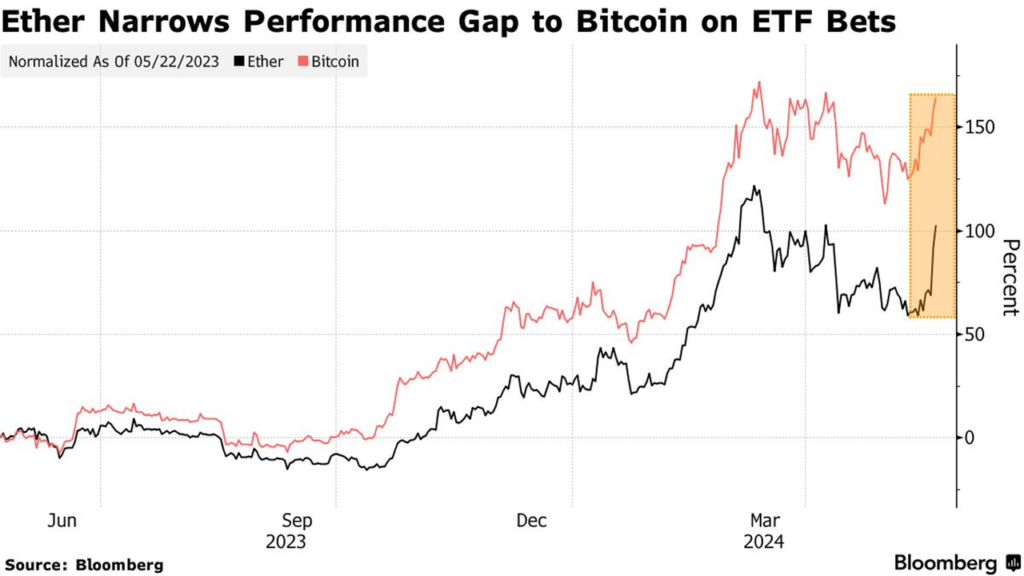

4. Prospects for Spot Ethereum ETF

- The U.S. SEC has urged exchanges to hasten updates to the 19B-4 form for the spot Ethereum ETF, significantly increasing the approval likelihood by May 31 to 75%. This contrasts with earlier Wall Street predictions of potential rejection.

III. Final Thoughts & Investment Opportunity

- Since the launch of U.S. ETFs, Bitcoin has demonstrated consistent growth and resilience. The increasing investment from pension funds, retirement funds, leading asset management firms, and banks into BTC ETFs indicates a likely continuation of robust buying power, supporting Bitcoin’s market strength.

- We anticipate that Bitcoin’s price may continue to oscillate near its recent highs, presenting the possibility of a ‘false breakout’ as it tests the previous resistance level. Should Bitcoin successfully surpass this threshold, it could trigger a substantial upward movement in its price trajectory.

- Market Wealth Effects and Strategic Sectors:

Ethereum Ecosystem: The ETH/BTC trading pair recently reached a three-year low at 0.045, suggesting Ethereum is relatively undervalued compared to Bitcoin. With ongoing ETF developments, Ethereum presents substantial growth potential. Investors might benefit from positioning early, especially if ETH consolidates after surpassing its previous high, as profits could flow back into the broader ETH ecosystem.

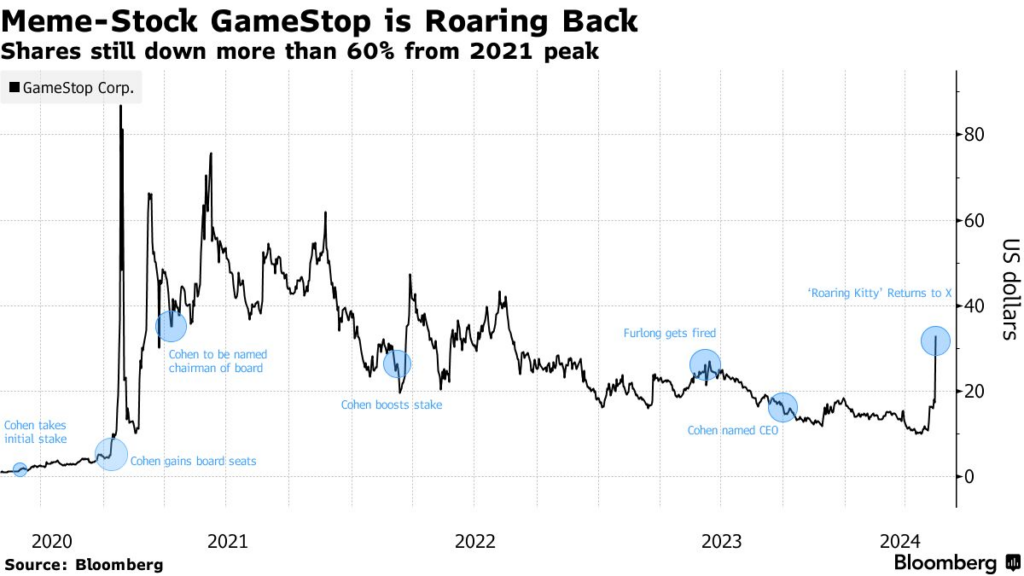

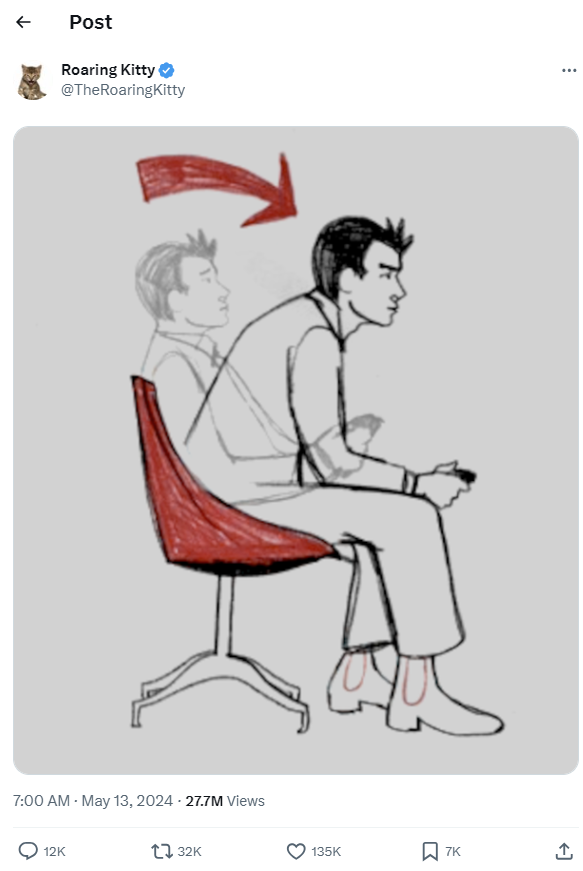

Memecoins: GameStop Trader ‘Roaring Kitty’ Return Drives Crypto Memecoin Frenzy. RoaringKitty’s influence among U.S. Stock retail investors is significant, as evidenced by the surge in stocks like GME and AMC following his tweets.

- The information provided in this article is for reference only and should not be taken as investment advice. All investment decisions should be based on thorough research and personal evaluation.