Written by Dustin

The NFT market witnesses its worst liquidity levels in the second and third quarters of 2023 as a series of Blue Chip NFT projects experience significant declines. A wave of negative news has emerged, causing investors to panic and question the legitimacy of NFTs as nothing more than a scam. These are the primary keywords reflecting the current state of the market.

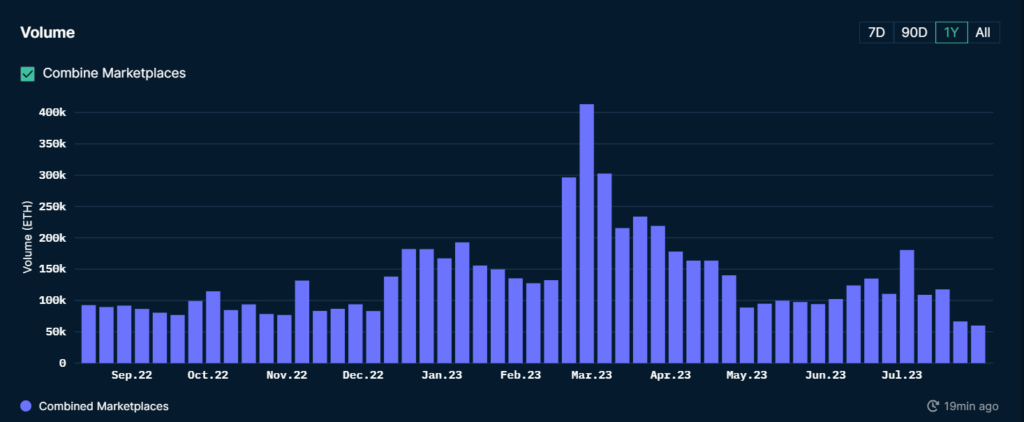

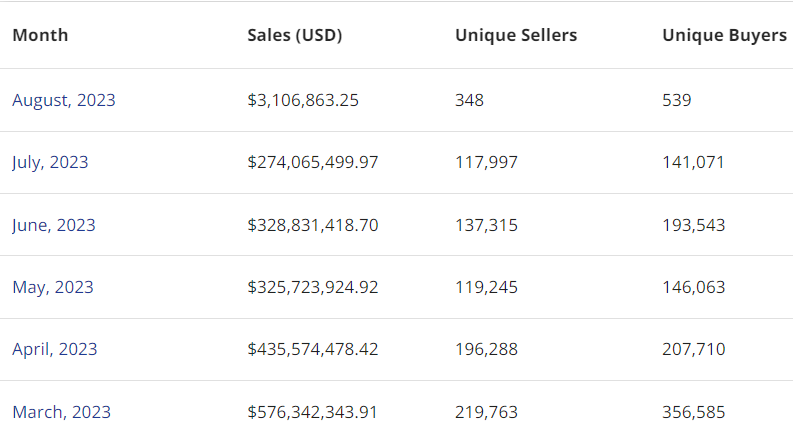

The data presented indicates that since Q1, when Blur initiated an airdrop campaign to compete with OpenSea for market share, the NFT market has entered a downward trend. Overall, there haven’t been any significant new developments, which has partly led to disillusionment among existing investors and a lack of enthusiasm among new investors to explore NFTs.

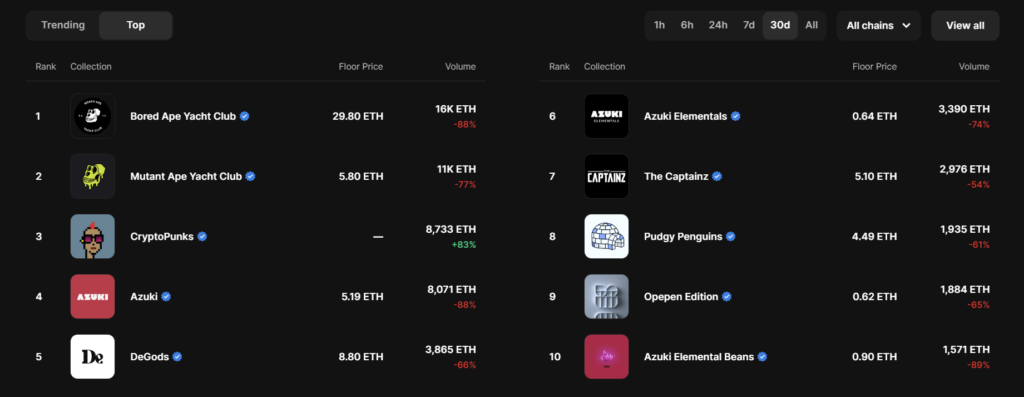

Most Blue Chip NFTs have seen a minimum decline of 60% over the past month, raising concerns about whether this severe downturn is a collective impact of the market or if there are issues within the projects’ own models that are no longer compatible with the market. The article below will examine some case studies to understand why these Blue Chips are experiencing a downward spiral.

1. Azuki

One of the largest IPs in Web3, Azuki, deserves to be mentioned first. It was first launched in January 2022 and has gradually built a brand image that has achieved the widest media coverage in the Web3 world. With a large and supportive fan base, Azuki has garnered a strong community. At one point, the project’s reach was so extensive that most OG crypto enthusiasts set Azuki as their profile picture on Twitter to express their affiliation.

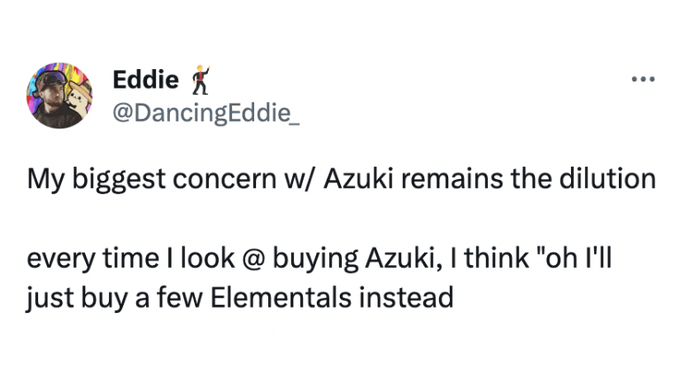

Since the launch of their second collection called Elementals, the project team has generated a profit of $38 million from the sales alone (excluding secondary market royalties). However, during the same period, the price of Azuki declined from its peak of 17 ETH to 5 ETH. It is believed that the primary reason for this decline is the similarity in the artwork between Elementals and Azuki, which has led users to sell their Azuki holdings in favor of acquiring Elementals at a much more affordable price.

Azuki holders believe that with a similar art style, it makes more sense to purchase Elementals at a lower price.

What’s even more significant is that Elementals had a supply of 20,000. This sale can be seen as the project team injecting an additional 20,000 NFTs into the market at a much lower price. In a market with limited liquidity, the demand was insufficient to absorb such a massive supply.

Another noteworthy aspect is that during the sale, the majority of those minting Elementals were Azuki holders at that time. Therefore, the $38 million earned by the project was solely based on the existing community and did not attract new users. This has resulted in significant disappointment for Azuki fans. As a natural consequence, the price of Azuki has experienced a sharp decline.

2. Yuga Labs

Considered one of the pioneering NFT collections that fueled the NFT craze in 2021, the story of selling monkey-themed profile picture (pfp) NFTs for hundreds of thousands, even millions of dollars, has become an iconic symbol of the industry.

Similar to Azuki, the Yuga Labs ecosystem has also been diluted with the release of a series of new collections. These include a total of 10,000 Bored Ape Yacht Club (BAYC) NFTs, 20,000 Mutant Ape Yacht Club (MAYC) NFTs, and other collections such as Otherdeeds by Otherside and The Sewer Pass.

However, Yuga Labs fueled the development of its ecosystem during the bull market phase of the overall market, not in 2023. During that time, people were willing to spend a significant amount of money to purchase any NFTs released by the project. Therefore, it could be considered a win-win case, at least in the past. Currently, due to the impact of the overall market and the dilution of the ecosystem, liquidity is spread thin, making it challenging to explain to new users what Yuga is focusing on and the role of each collection within that ecosystem. This is also the reason why the Yuga Labs community no longer has the same level of influence as before.

Conclusion

This is indeed a challenging time for a project to launch new collections and raise funds from the community when market liquidity is experiencing a significant decline.

It appears that the market is no longer vibrant for traditional models as most NFT projects lack sustainable revenue sources to survive during bear markets. Project teams have few alternatives to sustain their operational funds besides launching additional collections, which often struggle to deliver value to the products they sell, resulting in a loss of trust from the community.

NFT projects need to be even more creative, and the market requires a new narrative and a more sustainable operational model that is more appealing. This model should address three crucial factors to avoid repeating past mistakes, which are:

- Reward current holders.

- Onboard new holders.

- Generate revenue from external sources rather than solely relying on their community.